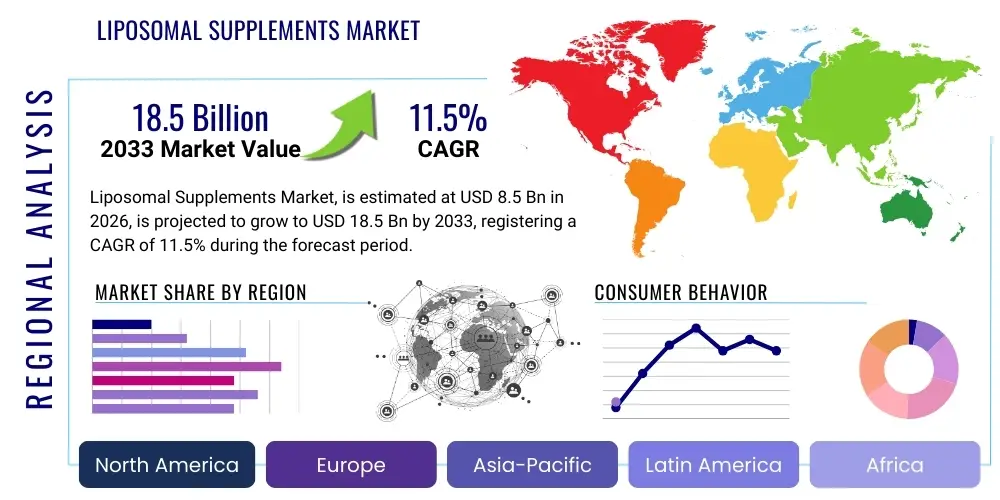

Liposomal Supplements Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437659 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Liposomal Supplements Market Size

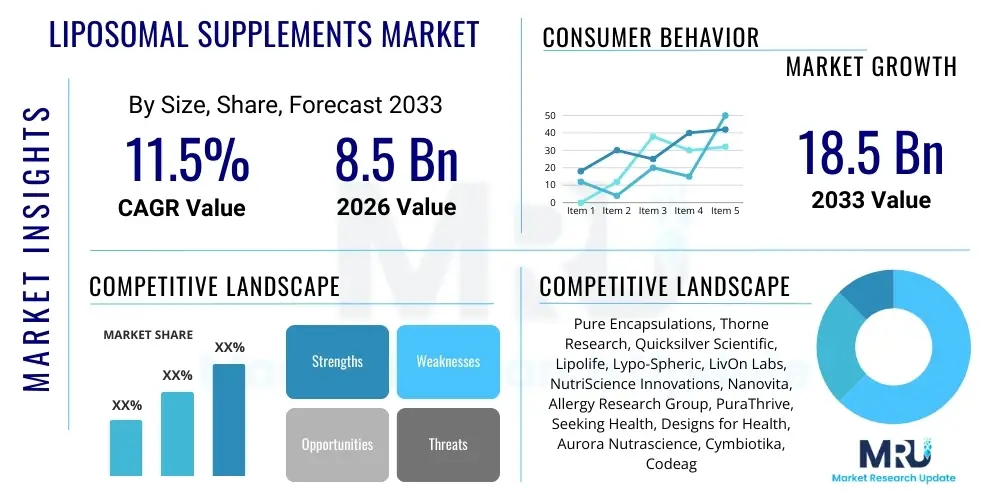

The Liposomal Supplements Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 18.5 Billion by the end of the forecast period in 2033.

Liposomal Supplements Market introduction

The Liposomal Supplements Market encompasses the production and sale of nutritional supplements where active ingredients, such as vitamins, minerals, and botanicals, are encapsulated within microscopic lipid bilayers known as liposomes. This advanced delivery system is designed to significantly enhance the bioavailability and absorption of nutrients into the bloodstream by protecting them from degradation in the harsh gastrointestinal environment. Liposomes are structurally similar to cell membranes, facilitating efficient transport across intestinal walls and directly into target cells, thereby maximizing efficacy compared to conventional supplement forms. Key products range from liposomal Vitamin C and Curcumin to Glutathione and CoQ10, catering to diverse health and wellness needs.

Major applications of liposomal supplements span chronic disease management, boosting immune function, enhancing athletic performance, and general wellness. Consumers increasingly seek these premium delivery systems as awareness of nutrient malabsorption and the limitations of traditional pills grows. The primary benefit driving market adoption is the superior absorption profile, which allows for lower effective dosing and faster onset of action. Furthermore, liposomal encapsulation can mask the unpleasant taste of certain active ingredients, improving patient compliance and overall user experience.

The market is primarily driven by the escalating consumer demand for highly effective nutraceuticals, technological advancements in nanoparticle formulation, and the rising prevalence of lifestyle diseases requiring precise nutrient intervention. Increased investment in research and development to stabilize liposomal formulations and scale up manufacturing processes further supports market growth. However, challenges related to the high manufacturing costs and stringent regulatory scrutiny for novel delivery systems present persistent constraints that require continuous innovation from market players.

Liposomal Supplements Market Executive Summary

The Liposomal Supplements Market is poised for substantial expansion, characterized by robust business trends focusing on innovation in formulation stability and targeted nutrient delivery. The trend towards preventative health and personalized nutrition heavily favors liposomal technology due to its proven efficacy in improving bioavailability, particularly for fat-soluble vitamins and sensitive compounds like glutathione. Key business dynamics include strategic mergers and acquisitions aimed at consolidating advanced nanotechnology expertise and expanding geographical footprints, particularly in fast-growing Asia Pacific markets. Furthermore, direct-to-consumer (DTC) sales channels, bolstered by educational content highlighting the scientific advantages of liposomal delivery, are becoming central to brand differentiation and revenue generation.

Regionally, North America maintains the dominant market share, driven by high consumer spending on premium health products and the presence of sophisticated biotechnological infrastructure. However, the Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by increasing health awareness, growing disposable incomes, and the rapid adoption of Western dietary supplement trends in countries like China and India. European growth remains steady, supported by strong regulatory frameworks ensuring product safety and quality, particularly concerning novel food ingredients and nutrient delivery systems. Companies are focusing on optimizing supply chains to meet global demand while navigating varied regional regulatory landscapes concerning nanoparticle size and excipient safety.

In terms of segmentation, the Vitamin C category currently holds a leading position due to widespread recognition of its immune-boosting properties and the significant bioavailability improvements offered by liposomal encapsulation compared to conventional ascorbic acid. The liquid form segment is witnessing rapid uptake, often preferred by consumers who seek easy administration and potentially faster absorption. The sports nutrition application segment is emerging as a critical growth area, capitalizing on the need for highly absorbed proteins and recovery compounds such as CoQ10 and B vitamins among athletes seeking performance optimization and rapid recovery. Investment in manufacturing processes that reduce particle size variability and enhance shelf stability remains paramount across all product segments.

AI Impact Analysis on Liposomal Supplements Market

Common user questions regarding AI's influence on the Liposomal Supplements Market center primarily on how Artificial Intelligence can optimize formulation design, enhance quality control, and personalize dosing strategies. Users frequently inquire about AI's role in predicting the stability and shelf-life of complex liposomal structures, given their inherent sensitivity to temperature and shear stress. Concerns also revolve around AI-driven personalized health platforms recommending specific liposomal products based on genetic data or microbiome analysis, prompting questions about data privacy and the ethical use of sophisticated predictive models in dietary advice. The general expectation is that AI will dramatically accelerate the discovery and validation of new, highly stable liposomal carriers and active ingredient combinations, moving the industry towards ultra-precise nutraceutical delivery.

AI is set to revolutionize the research and development pipeline for liposomal supplements by accelerating the modeling of lipid interactions, vesicle stability, and drug release kinetics. Machine learning algorithms can analyze vast datasets of chemical compositions and manufacturing parameters (e.g., homogenization pressure, temperature) to quickly identify optimal processing conditions that yield the smallest, most uniform, and most stable liposomes. This capability reduces the reliance on costly and time-consuming traditional trial-and-error laboratory methods, drastically cutting down the time-to-market for novel formulations. Furthermore, AI tools are essential in simulating the interaction of liposomes with biological barriers, providing predictive insights into in vivo performance before expensive clinical testing.

In the consumer-facing domain, AI is transforming marketing and personalized recommendations. AI-powered diagnostic tools analyze individual health metrics, dietary intake, and even wearable device data to suggest customized liposomal supplement stacks, ensuring consumers receive the exact nutrients they need, delivered optimally. On the operational side, AI enhances supply chain efficiency by predicting demand fluctuations, optimizing inventory management for temperature-sensitive products, and ensuring stringent quality assurance protocols through automated image recognition systems that detect structural anomalies in the manufactured vesicles. This integrated application of AI across the value chain guarantees higher product quality and a more personalized consumer experience, solidifying the market's premium positioning.

- Optimization of Liposome Formulation: AI algorithms predict ideal lipid ratios and manufacturing parameters for maximum stability and encapsulation efficiency.

- Personalized Nutrition Recommendations: Machine learning models analyze consumer data (genetics, lifestyle) to recommend specific liposomal nutrient profiles.

- Quality Control and Assurance: Automated systems use computer vision to monitor batch consistency, particle size distribution, and defect detection in real-time manufacturing.

- Accelerated R&D Cycle: AI simulates in vivo bioavailability and stability, reducing pre-clinical testing duration and cost.

- Supply Chain and Inventory Prediction: Predictive analytics forecasts demand for temperature-sensitive liposomal products, optimizing logistics and minimizing spoilage.

DRO & Impact Forces Of Liposomal Supplements Market

The Liposomal Supplements Market is significantly influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the competitive landscape and growth trajectory. The primary driver is the scientifically proven enhancement in nutrient bioavailability afforded by liposomal encapsulation, directly addressing consumer concerns over the efficacy of standard supplements. This is complemented by increasing consumer willingness to pay a premium for technologically advanced health products. However, the market faces significant restraints, chiefly the high cost associated with the specialized manufacturing processes (e.g., high-pressure homogenization or sonication) required to create stable, uniform liposomes, making end products expensive. Additionally, regulatory hurdles regarding nanoparticle safety and classification (food vs. drug) create complexity for manufacturers.

Opportunities for growth are vast, centered around expanding applications into therapeutic areas such as oncology support, targeted drug delivery, and enhanced functional foods, leveraging the liposome's ability to protect sensitive compounds. Furthermore, ongoing research into developing plant-derived, natural lipid carriers (e.g., using soy or sunflower lecithin) aims to address consumer demand for clean-label products, presenting a major strategic avenue. The integration of advanced diagnostics and personalized health services, allowing for bespoke liposomal formulations based on individual needs, represents a critical long-term opportunity for market differentiation and value creation.

The key impact forces influencing the market are strong consumer pull (high demand for efficacy), technological advancement (continuous improvement in liposome stability and shelf life), and competitive rivalry (companies aggressively investing in proprietary encapsulation technologies). Regulatory environment forces (increased scrutiny on claims and nanoparticle safety) act as a moderating factor, driving quality standards but potentially slowing market entry for smaller players. The combination of high efficacy perception (a strong positive force) and high manufacturing barriers (a strong negative force) determines the speed and direction of market penetration.

Segmentation Analysis

The Liposomal Supplements Market is segmented based on product type, application, form, and distribution channel, providing a granular view of consumer preferences and market dynamics. This detailed segmentation helps stakeholders identify high-growth niches, allocate resources effectively, and tailor product development strategies. The segmentation reveals that health-conscious consumers are increasingly moving away from generic multivitamins toward targeted nutrient delivery systems, driving specialized segments like liposomal antioxidants and specific micronutrients where absorption is historically challenging.

The segmentation by product highlights the dominance of high-demand vitamins such as Vitamin C and B Complex, followed closely by therapeutic compounds like Curcumin and Glutathione. Application segmentation demonstrates a strong focus on immunity and wellness, although segments related to age-related disease management and specialized sports recovery are showing the fastest expansion rates. Understanding these divisions is crucial for predicting future market needs, such as the increasing demand for plant-based liposome formulations and the shift toward specialized, condition-specific nutrient cocktails.

Form factor analysis confirms the continued importance of liquid supplements due to perceived rapid absorption and ease of swallowing, particularly for geriatric and pediatric populations. However, capsules and soft gels are gaining traction as manufacturers improve stability and address leakage issues, offering better portability and dose precision. The shift in distribution channels toward e-commerce platforms reflects the sophisticated consumer base seeking detailed product information and comparative analysis, driving online sales growth significantly faster than traditional retail channels.

- Product Type:

- Liposomal Vitamin C

- Liposomal B Complex

- Liposomal Glutathione

- Liposomal Curcumin/Turmeric

- Liposomal CoQ10

- Liposomal Iron

- Others (Melatonin, Resveratrol, CBD)

- Application:

- Immunity & Wellness

- Disease Management (Cardiovascular, Neurological)

- Sports Nutrition & Recovery

- Anti-Aging & Skin Health

- Weight Management

- Form:

- Liquid Supplements

- Capsules/Tablets

- Powders

- Distribution Channel:

- Online Retail (E-commerce, Company Websites)

- Retail Pharmacies & Drug Stores

- Health & Wellness Stores

- Others (Practitioner Channels)

Value Chain Analysis For Liposomal Supplements Market

The Value Chain for the Liposomal Supplements Market begins with upstream activities involving the sourcing and purification of high-grade raw materials, primarily phospholipids (lecithin from soy, sunflower, or egg) and the specific active nutritional ingredients (e.g., ascorbic acid, curcumin extract). Critical upstream analysis focuses on ensuring the purity, non-GMO status, and consistent quality of these inputs, as slight variations can drastically impact the stability and particle size of the final liposomal product. Suppliers specializing in pharmaceutical-grade lipids often hold a significant power position due to the technical requirements of the encapsulation process. Research and development activities, particularly those focused on optimizing proprietary encapsulation techniques and ensuring long-term shelf stability, represent the highest value-addition point in this segment.

The core manufacturing stage involves complex processing steps such as high-pressure homogenization, extrusion, or sonication, demanding specialized, high-capital equipment and rigorous quality control protocols. Direct manufacturing adds substantial value by transforming raw materials into premium, bioavailable finished products. The downstream segment involves robust marketing and distribution. Due to the high-tech nature and premium price point of liposomal products, effective marketing requires detailed educational content explaining the science of enhanced absorption, often relying on digital and scientific endorsement strategies. Distribution channels are bifurcated into direct sales and indirect channels.

Direct channels, primarily through branded e-commerce websites and direct practitioner dispensing, allow companies maximum control over branding, pricing, and consumer education, often resulting in higher margins. Indirect channels involve retail pharmacies, drug stores, and major online marketplaces (like Amazon or specialized supplement retailers). While indirect distribution offers broader market reach, it requires significant investment in supply chain management to maintain the integrity of temperature-sensitive liposomal liquids. The shift toward specialized online platforms enables detailed scientific comparison, directly influencing consumer purchasing decisions and making online retail a dominant distribution mechanism in this specialized market.

Liposomal Supplements Market Potential Customers

The primary end-users or buyers of liposomal supplements are highly health-conscious consumers who prioritize efficacy and are willing to invest in premium health solutions. This includes individuals dealing with specific absorption disorders, those undergoing chemotherapy or chronic disease management where maximizing nutrient uptake is crucial, and the elderly population whose digestive efficiency naturally declines with age. These customers are typically educated about nutraceutical science and actively seek research-backed products that offer verifiable advantages over conventional forms, making bioavailability data a critical purchase determinant.

Another significant customer segment includes professional athletes and active individuals who require rapid and maximum absorption of vitamins, antioxidants, and recovery compounds (like Vitamin C, CoQ10, and Glutathione) to enhance performance and accelerate muscle recovery. For this cohort, the efficiency and speed of nutrient delivery are paramount. Furthermore, practitioners, including naturopaths, functional medicine doctors, and dietitians, act as influential buyers, recommending specialized liposomal formulations to their patient base as part of comprehensive treatment protocols, viewing these products as pharmaceutical-grade dietary interventions.

The market also targets consumers engaged in preventative health and anti-aging regimens. These individuals seek liposomal supplements containing high-efficacy antioxidants and skin-supporting nutrients (such as Resveratrol or certain B vitamins) to maintain optimal cellular function and counteract oxidative stress. The perceived superior quality and reduced potential for gastrointestinal upset associated with traditional supplements further drive adoption across all these diverse, but uniformly discerning, end-user groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 18.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pure Encapsulations, Thorne Research, Quicksilver Scientific, Lipolife, Lypo-Spheric, LivOn Labs, NutriScience Innovations, Nanovita, Allergy Research Group, PuraThrive, Seeking Health, Designs for Health, Aurora Nutrascience, Cymbiotika, Codeage, SunLipid, Vital Nutrients, Micro-Sphere SA, NanoVeda, Swanson Health Products |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liposomal Supplements Market Key Technology Landscape

The technological landscape of the Liposomal Supplements Market is dominated by sophisticated lipid engineering and nanoscale manufacturing processes designed to create uniformly sized and stable vesicles. The foundational technology involves thin-film hydration followed by size reduction techniques. However, the most commercially viable and scalable methods currently utilized include High-Pressure Homogenization (HPH) and Microfluidization. HPH involves forcing the mixture of lipids and aqueous phase ingredients through a tiny gap under extremely high pressure, resulting in the breakdown of large vesicles into small, homogenous liposomes, typically under 200 nanometers. This mechanical method is highly valued for its ability to achieve consistent particle size distribution, which is crucial for optimal absorption and stability.

Another crucial technology is the use of specialized extrusion techniques, where pre-formed liposomes are forced through membranes with defined pore sizes, allowing for precise control over the final diameter of the vesicles. Furthermore, advanced stabilization techniques are paramount, focusing on modifying the lipid bilayer composition, often incorporating cholesterol or specific charged lipids to increase physical and chemical stability against factors like oxidation, temperature fluctuation, and pH changes encountered during digestion. These stabilization innovations are key to extending the shelf life and ensuring the efficacy of liquid formulations, which are inherently prone to particle aggregation and active ingredient leakage over time.

Emerging technologies include the application of supercritical fluid technology (SCF), which offers a solvent-free method for liposome production, appealing to clean-label consumers and reducing environmental impact. The development of 'pro-liposomes,' which are dry, powdered formulations that spontaneously form liposomes when exposed to an aqueous medium (e.g., in the stomach), is a significant advancement addressing shelf-life and portability constraints associated with liquid forms. Continuous innovation in these encapsulation methods, alongside robust quality control testing using techniques like Dynamic Light Scattering (DLS) to monitor particle size, dictates competitive advantage within the market.

Regional Highlights

- North America (Dominance in Consumption and Innovation): North America, particularly the United States, commands the largest share of the global liposomal supplements market. This dominance is attributed to high consumer awareness regarding nutrient absorption, strong disposable incomes supporting premium purchases, and the robust presence of key market innovators like Quicksilver Scientific and Thorne Research. The region also benefits from a mature regulatory framework (FDA) that, while strict, encourages sustained investment in high-quality, scientifically validated products. Demand is particularly high for liposomal Vitamin C and Glutathione, driven by the strong emphasis on immune support and detoxification.

- Europe (Regulatory Compliance and Quality Focus): Europe represents a significant market, characterized by stringent quality standards enforced by bodies like the European Food Safety Authority (EFSA). Growth is steady, focused heavily on clean-label products and sustainable sourcing of phospholipids. Germany, the UK, and France are the largest contributors, with consumers valuing pharmaceutical-grade supplements. The market focuses heavily on ensuring liposomal stability meets rigorous quality specifications for novel food classifications, which can sometimes slow product introduction but ensures high consumer trust.

- Asia Pacific (Highest Growth Potential): The Asia Pacific region is forecast to register the fastest CAGR during the forecast period. This accelerated growth is driven by rapidly expanding middle-class populations, increasing urbanization, rising awareness of preventative healthcare, and improving access to advanced supplement technology, particularly in countries like China, Japan, and South Korea. Local manufacturers are rapidly adopting Western encapsulation technologies, and the demand for traditional botanical ingredients delivered via liposomal systems (e.g., adaptogens) represents a major untapped opportunity.

- Latin America (Emerging Market Dynamics): Latin America is an emerging market with potential driven by growing health expenditure and increasing import volumes of premium supplements. Brazil and Mexico are the primary markets, exhibiting demand for general wellness and sports nutrition applications. Market penetration remains challenging due to price sensitivity compared to North America and Europe, requiring companies to focus on cost-efficient manufacturing and strong local distribution partnerships.

- Middle East and Africa (MEA) (Niche Demand and Infrastructure Gaps): The MEA region currently holds the smallest market share but presents specialized opportunities, particularly in health tourism and luxury wellness segments in the Gulf Cooperation Council (GCC) countries. Growth is hampered by inconsistent regulatory landscapes and logistical challenges related to maintaining the cold chain for temperature-sensitive liposomal products, limiting widespread consumer accessibility outside major metropolitan areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liposomal Supplements Market.- Pure Encapsulations (Nestlé Health Science)

- Thorne Research, Inc.

- Quicksilver Scientific, Inc.

- Lipolife Ltd.

- Lypo-Spheric (LivOn Labs)

- NutriScience Innovations, LLC

- Nanovita B.V.

- Allergy Research Group

- PuraThrive

- Seeking Health

- Designs for Health, Inc.

- Aurora Nutrascience Inc.

- Cymbiotika LLC

- Codeage LLC

- SunLipid Inc.

- Vital Nutrients

- Micro-Sphere SA

- NanoVeda

- Swanson Health Products

- NOW Foods

Frequently Asked Questions

Analyze common user questions about the Liposomal Supplements market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of liposomal supplements over traditional forms?

The primary advantage is significantly enhanced bioavailability. Liposomes protect active ingredients from degradation by stomach acids and enzymes, allowing for vastly improved absorption into the bloodstream, thus maximizing efficacy compared to standard tablets or powders.

How does the encapsulation process impact the cost of liposomal products?

Liposomal encapsulation utilizes complex, high-energy manufacturing techniques such as high-pressure homogenization or microfluidization, requiring specialized equipment and high-purity phospholipids. This technological intensity and strict quality control protocols contribute directly to the higher premium price point of liposomal supplements.

What role does nanotechnology play in the liposomal supplement industry?

Nanotechnology is fundamental, as liposomes are nanometer-sized vesicles (typically 50-200 nm). Nanotechnology ensures precise control over particle size, which is critical for vesicle stability, absorption kinetics, and targeted delivery to cells, defining the effectiveness of the entire product category.

Are liposomal supplements safe, and are they regulated by health authorities?

Liposomal supplements are generally considered safe, utilizing food-grade lipids (like lecithin). They are regulated as dietary supplements (nutraceuticals) in most major markets. However, due to the use of nanoparticles, specific regulations concerning safety documentation and novel food classifications are increasingly stringent, particularly in Europe and Asia.

Which liposomal product segments are currently experiencing the fastest growth?

The fastest-growing segments are centered around immunity support (Liposomal Vitamin C and Zinc), specialized antioxidants (Liposomal Glutathione and Curcumin), and supplements targeting brain health, capitalizing on the liposome's enhanced ability to potentially cross the blood-brain barrier for improved neurological support.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager