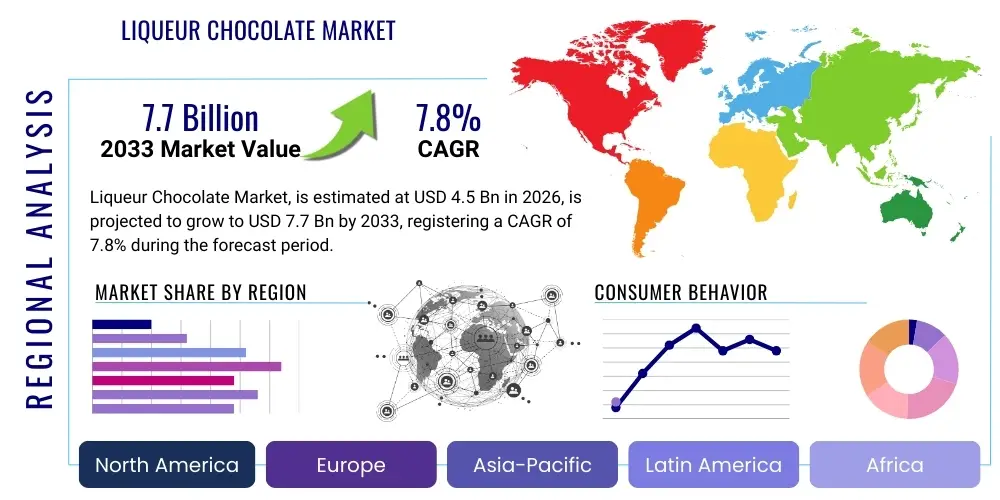

Liqueur Chocolate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438192 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Liqueur Chocolate Market Size

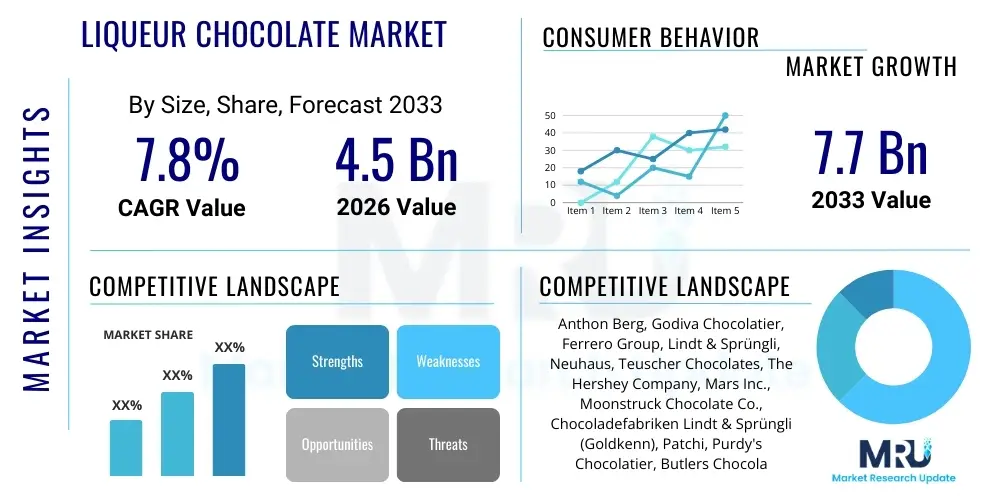

The Liqueur Chocolate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally supported by the increasing global demand for premium and specialized confectionery products, coupled with the enduring popularity of gifting culture, particularly in Western and increasingly in Asian markets.

Liqueur Chocolate Market introduction

The Liqueur Chocolate Market encompasses high-end confectionery where a chocolate shell, typically dark or milk chocolate, encases a filling that contains distilled spirits or liqueurs such as whiskey, rum, vodka, or specialty cordials. This niche sector differentiates itself through superior craftsmanship, complex flavor pairings, and premium packaging, positioning the product primarily within the luxury and gifting segments. The sophisticated nature of the product requires stringent quality control, especially concerning the alcohol content and ensuring structural integrity to prevent leakage or crystallization. Major applications of liqueur chocolates include celebratory gifting, high-end dessert consumption, and duty-free retail, catering predominantly to an adult consumer base seeking novel and indulgent experiences.

The primary driving factors propelling this market include the global trend of premiumization in food and beverages, where consumers are willing to pay a premium for perceived higher quality and unique flavor profiles. The integration of high-quality, recognizable alcohol brands into chocolate formulations enhances consumer appeal and brand value. Furthermore, the sustained growth of international tourism significantly boosts sales through airport retail and duty-free channels, segments where specialized luxury confectionery thrives. These products offer a blend of indulgence and sophistication, making them ideal luxury impulse purchases.

Key market benefits revolve around product differentiation, offering a unique sensory experience that combines the bitterness or sweetness of chocolate with the complexity and warmth of alcohol. The inherent luxury association supports higher profit margins compared to standard chocolate products. The challenge of regulatory compliance regarding alcohol content and labeling, however, necessitates specialized operational expertise, creating significant barriers to entry for smaller manufacturers, thereby stabilizing the competitive landscape among established, large-scale luxury confectionery houses.

Liqueur Chocolate Market Executive Summary

The Liqueur Chocolate Market is defined by robust business trends centered on strategic brand partnerships between global chocolate manufacturers and established distilleries, driving product innovation and market penetration, especially in the premium segment. Consumer preference is gradually shifting towards high-cacao content dark chocolate bases, which complement the complexity of aged spirits like whiskey and cognac, moving away from overly sweet milk chocolate varieties. The competitive landscape is intensely focused on sustainable sourcing and transparent labeling, addressing growing consumer scrutiny regarding ethical production practices, particularly concerning cocoa beans and alcohol provenance.

Regionally, Europe maintains its dominance due to deep-rooted confectionery traditions, the presence of major manufacturers (e.g., in Belgium and Switzerland), and strong cultural associations with specialized dessert consumption and gifting occasions. North America is experiencing accelerated growth, fueled by rising disposable incomes and a growing appetite for European-style luxury goods, prompting manufacturers to adapt product portfolios to include locally popular spirits. Asia Pacific, specifically high-growth economies like China and India, presents the highest future opportunity, driven by expanding middle-class populations, Westernization of gifting habits, and increased international travel, despite existing regulatory complexities concerning alcohol sales and consumption.

Segmentation analysis highlights the dominance of the Brandy/Cognac segment based on value, often utilized in traditionally packaged luxury boxes. However, the Whiskey segment is projected to exhibit the highest volume growth, capitalizing on its broad appeal and versatility in various chocolate formats. Distribution trends indicate a pivot towards specialized retail stores and e-commerce platforms, offering better temperature-controlled shipping and a tailored consumer experience, crucial for maintaining product quality, especially during seasonal peaks associated with major holidays such as Christmas and Valentine's Day.

AI Impact Analysis on Liqueur Chocolate Market

User inquiries regarding AI's impact frequently focus on how technology can maintain the artisanal quality and authenticity associated with luxury liqueur chocolates while simultaneously improving efficiency and addressing supply chain risks. Key themes include the potential for AI-driven predictive analytics to forecast precise consumer flavor preferences—analyzing geographic taste data and trend cycles to inform new liqueur and filling combinations—and concerns about how automation might compromise traditional hand-crafted elements crucial to the product’s luxury positioning. There is a strong expectation that AI systems will be implemented for enhanced quality assurance, especially in monitoring the consistency of alcohol content and the precise tempering of chocolate shells, minimizing batch variations and ensuring premium standards are consistently met across diverse production facilities globally. Furthermore, users are keenly interested in how AI can optimize highly complex logistics, particularly temperature-controlled storage and distribution, which is critical for perishable confectionery products containing liquid fillings.

The application of Artificial Intelligence within the Liqueur Chocolate Market extends significantly into optimizing raw material procurement and sustainable sourcing verification. AI-powered platforms can analyze vast datasets concerning cocoa farm conditions, ethical labor practices, and climate change effects, thereby allowing manufacturers to secure high-quality, ethically sourced cocoa and spirits with greater transparency. This not only mitigates reputational risks but also ensures the premium positioning of the final product aligns with conscious consumer values. By predicting yield fluctuations and price volatility, AI aids in strategic buying decisions, stabilizing the often volatile cost structure of luxury ingredients.

In marketing and consumer engagement, Generative AI tools are transforming how liqueur chocolate brands interact with their target demographic. These tools are used to create personalized product recommendations based on past purchase history and stated flavor profiles, streamlining the digital consumer journey. Additionally, AI assists in designing dynamic, appealing packaging visualizations and targeted advertising campaigns that resonate deeply with specific cultural gifting norms in various regional markets, thereby maximizing conversion rates, particularly during high-volume holiday seasons. This strategic application ensures that the luxury branding remains consistently relevant and highly personalized to the modern consumer.

- AI-driven predictive modeling for identifying novel liqueur-chocolate flavor combinations.

- Optimization of supply chain logistics and temperature control for delicate liquid fillings.

- Advanced image processing and sensor technology for precise quality control during molding and filling.

- Enhanced consumer personalization through AI analysis of gifting patterns and preference mapping.

- Implementation of AI in monitoring and verifying ethical and sustainable cocoa sourcing practices (farm-to-shelf traceability).

- Automated defect detection in packaging and structural integrity, reducing waste and ensuring premium presentation.

DRO & Impact Forces Of Liqueur Chocolate Market

The dynamics of the Liqueur Chocolate Market are shaped by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), exerting significant Impact Forces on strategic decision-making and market direction. Key drivers include the entrenched culture of luxury gifting globally, the continuous upward trajectory of disposable income in emerging economies, and the inherent allure of alcohol-infused novelty confectionery products that appeal to adult palates seeking indulgence and exclusivity. These forces collectively push manufacturers toward high-value production and premium pricing strategies.

However, the market faces notable restraints, primarily stemming from stringent governmental regulations on alcohol content, labeling requirements, and cross-border trade restrictions, which complicate global expansion and require substantial regulatory compliance investment. Furthermore, the rising awareness of health and wellness, including concerns over sugar and calorie intake, acts as a decelerating force, prompting manufacturers to explore smaller portion sizes or use darker, less sugar-intensive chocolate bases. The volatility in the price of premium cocoa and high-quality distilled spirits also poses a recurring operational challenge, impacting profitability and requiring sophisticated hedging strategies.

Opportunities for expansion are prominent in the development of low-sugar, diabetic-friendly, or vegan variants that maintain the luxurious texture and flavor profile, addressing broadening dietary trends. Furthermore, geographical expansion into underserved, high-growth APAC countries and strategic innovation in packaging to enhance shelf appeal and protect product integrity represent core avenues for sustained market growth. The most significant impact force is the necessity for continuous innovation in flavoring and formulation—specifically, mastering the integration of highly sought-after craft spirits (e.g., small-batch gin or tequila) into stable chocolate formats—to maintain product novelty and consumer interest.

Segmentation Analysis

The Liqueur Chocolate Market is intricately segmented based on core product characteristics, alcohol type, distribution channels, and regional consumption patterns, providing a granular view of consumer preferences and operational focus areas. Product type segmentation primarily involves the distinction between Dark Liqueur Chocolate and Milk Liqueur Chocolate, with Dark chocolate gaining significant traction due to its ability to better balance the strong flavor profiles of mature spirits, appealing to a mature and sophisticated consumer base. Segmentation by alcohol type is critical as it dictates branding and partnership strategies, with segments like Whiskey and Cognac driving high-value sales, while lighter spirits like Vodka and Fruit Liqueurs cater to broader, often seasonal, consumer markets.

The market’s profitability is heavily influenced by distribution channel segmentation, categorizing sales through Supermarkets/Hypermarkets, Specialized Retail Stores (e.g., confectionery boutiques, gourmet food halls), and the rapidly expanding E-commerce sector. Specialized retail and e-commerce platforms offer distinct advantages in handling premium, temperature-sensitive goods and providing the necessary brand storytelling and customer service expected in the luxury segment. This preference underscores a market dynamic where the buying experience is almost as important as the product itself, particularly for gifting purposes.

Further segmentation by flavor profile often includes the use of fruits, nuts, or spices in combination with the liqueur, creating limited-edition products that drive seasonal demand and consumer excitement. The sophisticated consumer base often exhibits strong loyalty to specific brands associated with high-quality ingredients and provenance, emphasizing the importance of transparent sourcing and heritage branding. Strategic market penetration requires manufacturers to prioritize robust cold chain logistics, especially when targeting warmer climates or utilizing high-volume indirect distribution channels that lack specialized handling capabilities.

- By Product Type:

- Dark Liqueur Chocolate

- Milk Liqueur Chocolate

- Assorted/Mixed Boxes

- By Alcohol Type:

- Whiskey/Bourbon

- Brandy/Cognac

- Rum

- Vodka

- Specialty Cordials and Liqueurs (e.g., Amaretto, Cointreau)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Specialized Retail Stores (Confectionery Boutiques)

- E-commerce and Online Retail

- Duty-Free and Travel Retail

- By Packaging Format:

- Boxed Gifting Sets

- Bulk/Individual Pieces

Value Chain Analysis For Liqueur Chocolate Market

The Value Chain for the Liqueur Chocolate Market is characterized by highly specialized procurement and manufacturing processes necessary to maintain the integrity and luxury positioning of the final product. The upstream segment involves the sourcing of two primary, high-value raw materials: premium cocoa beans (often single-origin or sustainably certified) and distilled spirits from established, often proprietary, distilleries. High dependency on quality raw material suppliers necessitates strong, long-term contractual agreements and rigorous auditing processes to ensure ingredient consistency and ethical provenance, directly impacting the final product's quality and brand story. Cocoa bean processing and preliminary alcohol maturation steps are key cost drivers in this upstream phase.

The core manufacturing and midstream activities focus on precision chocolate tempering, shell molding, and the critical step of specialized liquid filling. Unlike standard confectionery, liqueur chocolates require advanced techniques such as the sugar crust method or micro-encapsulation to prevent the alcohol from compromising the chocolate structure or evaporating prematurely. Efficiency and quality control are paramount here, demanding sophisticated, temperature-controlled machinery and skilled labor. The packaging stage, involving customized, often elaborate, and protective materials, adds significant value, transforming the product into a luxury gift item.

Downstream activities center on distribution, which is bifurcated into direct and indirect channels. Direct distribution involves sales through brand-owned boutiques and dedicated e-commerce platforms, offering maximum control over product handling and customer experience. Indirect channels, which form the majority of sales, rely on specialized retail, gourmet food retailers, and critical travel retail (duty-free). Due to the product’s sensitivity to temperature, efficient cold-chain logistics are a mandatory prerequisite for all distribution methods. This stringent requirement ensures that the delicate balance of the liqueur filling is maintained until the point of consumption, protecting the brand's reputation for quality.

Liqueur Chocolate Market Potential Customers

The primary customer base for the Liqueur Chocolate Market consists of affluent consumers (High Net Worth Individuals and the upper middle class) who possess strong disposable income and prioritize high-quality, indulgent food products. These consumers are typically aged 30 and above, appreciate artisanal craftsmanship, and are often discerning buyers who seek out brands that offer provenance, heritage, and unique flavor experiences, viewing the purchase not just as a treat but as a status symbol or a sophisticated gift. They are less price-sensitive and more value-driven, associating higher cost with superior ingredients and meticulous production standards.

A crucial segment comprises corporate and individual gift-givers, particularly during major holidays (Christmas, Easter) and professional events. Liqueur chocolates are highly favored for corporate gifting due to their universal appeal as a sophisticated, pre-packaged luxury item that reflects positively on the giver. The aesthetic appeal and premium packaging play a significant role in influencing purchasing decisions within this segment, making product presentation a central marketing component. This seasonal demand necessitates robust inventory planning and flexible packaging capabilities.

Furthermore, tourists and international travelers represent a substantial customer segment, heavily leveraging the duty-free and travel retail channels. These consumers purchase liqueur chocolates as souvenirs or easily transportable luxury gifts, benefiting from tax exemptions and the concentration of high-end brands in airport environments. This segment's purchasing behavior is often impulse-driven, relying on attractive, highly visible merchandising displays and exclusive travel-only editions to encourage immediate sales before departure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Anthon Berg, Godiva Chocolatier, Ferrero Group, Lindt & Sprüngli, Neuhaus, Teuscher Chocolates, The Hershey Company, Mars Inc., Moonstruck Chocolate Co., Chocoladefabriken Lindt & Sprüngli (Goldkenn), Patchi, Purdy's Chocolatier, Butlers Chocolates, Charbonnel et Walker, Hachez Chocolade, Valrhona, Storck (Werther's Original), Ghirardelli Chocolate Company, Russell Stover Chocolates, Leonidas S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liqueur Chocolate Market Key Technology Landscape

The manufacturing of high-quality liqueur chocolates relies heavily on precision engineering and specialized confectionery technology, primarily focused on maintaining the integrity of the liquid filling within the solid chocolate shell. A critical technological advancement is the use of micro-encapsulation and advanced shell molding techniques. Micro-encapsulation involves creating a micro-thin layer around the liquid center, preventing leakage, crystallization (sugar bloom), and premature alcohol evaporation, which is essential for extending shelf life and ensuring product stability during transport. Furthermore, advanced servo-driven depositors ensure precise dosing of the often high-viscosity liquid centers, minimizing waste and maintaining uniform product standards across high-volume production lines.

Temperature control technology is non-negotiable within this sector. Sophisticated tempering machines utilize real-time sensors and algorithmic controls to maintain cocoa butter crystallization at optimal points, resulting in a chocolate shell with the desired snap, gloss, and resistance to melting. Beyond manufacturing, the technological landscape includes the integration of smart sensors and IoT devices throughout the distribution cold chain. These systems monitor temperature and humidity variations in transit, providing manufacturers with immediate data feedback, which is crucial for mitigating risks associated with spoilage or structural damage, especially when shipping internationally to diverse climatic regions.

Moreover, modern manufacturers are increasingly leveraging blockchain technology to enhance transparency and address consumer demands for ethical sourcing. Blockchain implementation provides an immutable, verifiable ledger for tracking cocoa beans from the farm gate and spirits from the distillery, right through to the final packaging facility. This technological application not only assures quality and authenticity—a paramount factor in the luxury market—but also substantiates sustainability claims, providing a significant competitive advantage in markets increasingly focused on corporate social responsibility and product provenance.

Regional Highlights

The Liqueur Chocolate Market exhibits significant regional variations in terms of consumption patterns, regulatory environment, and competitive intensity. Europe stands as the mature epicenter of the market, driven by deeply ingrained traditions in luxury confectionery, high consumer spending power on gourmet goods, and the historical presence of globally recognized chocolate houses in countries like Belgium, Switzerland, and Germany. The high volume of intra-European tourism and the strong gifting culture surrounding holidays ensure sustained, stable growth. European manufacturers are also pioneers in flavor innovation and premium packaging design.

North America, particularly the United States, represents a high-potential growth region, characterized by a rapid increase in the consumption of premium, imported luxury goods. The demand here is often tied to major holidays and corporate gifting, driving sales primarily through specialized retail and online channels. Manufacturers must navigate complex state-level regulations regarding the sale of alcohol-infused products, which often requires specific labeling or limitations on alcohol by weight. The segment thrives on brand partnerships, integrating popular local spirits like Bourbon or high-end craft whiskeys into their portfolios to capture the domestic consumer base.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This acceleration is fueled by the burgeoning middle class in countries such as China, India, and South Korea, where Western gifting traditions are increasingly adopted. While regulatory hurdles regarding imported alcohol-containing food products exist, the high demand for exclusive and exotic luxury imports positions liqueur chocolates favorably. Market strategies in APAC heavily focus on tailored seasonal packaging for local holidays and leveraging e-commerce platforms to bypass traditional, fragmented retail infrastructure.

- Europe: Market leader and largest segment by value, supported by strong gifting traditions, high density of established luxury brands, and robust tourist consumption (especially duty-free sales).

- North America: Rapidly growing segment, focusing on premium imported goods and domestic spirit integrations; complex regulatory landscape requiring localized compliance strategies.

- Asia Pacific (APAC): Highest CAGR, driven by rising disposable income, urbanization, and adoption of Western consumption patterns; challenges include import duties and local restrictions on alcohol marketing.

- Latin America (LATAM): Emerging market with localized high-end demand; growth potential hindered by economic volatility and often high import taxation on luxury confectionery.

- Middle East and Africa (MEA): Niche market focused primarily on affluent consumers and international expatriates; demand is concentrated in travel retail channels and major metropolitan hubs like the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liqueur Chocolate Market.- Anthon Berg

- Godiva Chocolatier

- Ferrero Group

- Lindt & Sprüngli

- Neuhaus

- Teuscher Chocolates

- The Hershey Company

- Mars Inc.

- Moonstruck Chocolate Co.

- Chocoladefabriken Lindt & Sprüngli (Goldkenn)

- Patchi

- Purdy's Chocolatier

- Butlers Chocolates

- Charbonnel et Walker

- Hachez Chocolade

- Valrhona

- Storck (Werther's Original)

- Ghirardelli Chocolate Company

- Russell Stover Chocolates

- Leonidas S.A.

Frequently Asked Questions

Analyze common user questions about the Liqueur Chocolate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Liqueur Chocolate Market?

Market growth is primarily driven by the increasing global trend toward premiumization in confectionery, the enduring strength of the gifting culture, especially during holidays, and successful strategic collaborations between renowned chocolate houses and high-end distilled spirit brands which enhance product appeal and perceived value. The expansion of duty-free and travel retail channels also significantly contributes to volume sales.

Which alcohol segment holds the largest market share in liqueur chocolates?

The Brandy and Cognac segment traditionally holds the largest market share by value, particularly in European markets, owing to its long-standing association with luxury and formal gifting sets. However, the Whiskey/Bourbon segment is showing the fastest growth rate, fueled by its widespread popularity and versatility in both dark and milk chocolate formulations globally.

What major regulatory challenges impact the global distribution of liqueur chocolates?

Major regulatory challenges include varying national standards for maximum allowable alcohol content in food products, diverse labeling requirements (particularly regarding alcohol warnings and ingredients), and restrictive trade policies in certain regions, notably parts of Asia and the Middle East, necessitating product reformulation or specialized import licenses for cross-border sales.

How is technology being utilized to improve the quality and production of liqueur chocolates?

Technology is crucial for maintaining product quality, primarily through advanced tempering and shell molding machines to ensure chocolate structure stability, and specialized micro-encapsulation techniques that prevent liquid centers from leaking or crystallizing. Furthermore, blockchain technology is increasingly adopted for ensuring ingredient provenance and supporting ethical sourcing claims.

Which geographical region is anticipated to be the fastest-growing market?

The Asia Pacific (APAC) region is anticipated to be the fastest-growing market, driven by rapidly increasing urbanization, rising disposable incomes, and the growing consumer acceptance of Western luxury goods and sophisticated confectionery products, making it a key focus area for multinational manufacturers seeking future expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager