Liquid Argon Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438307 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Liquid Argon Market Size

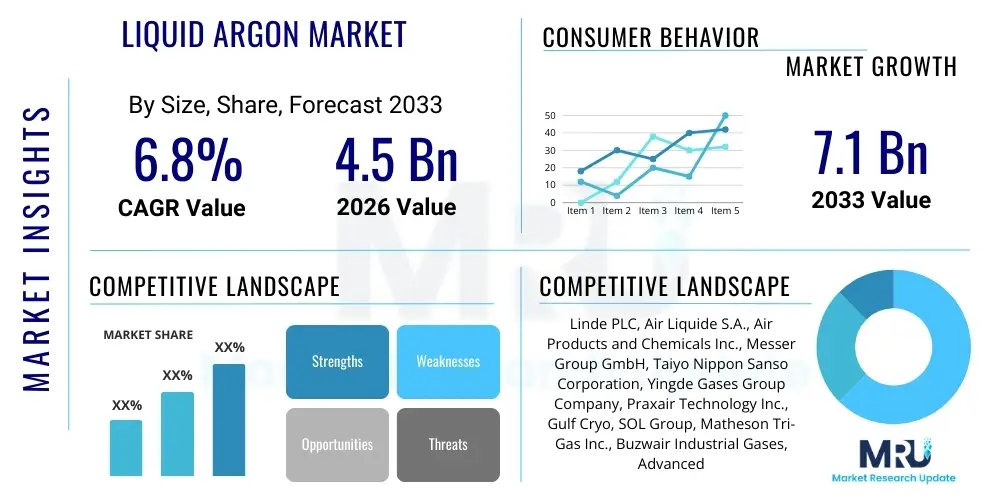

The Liquid Argon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033.

Liquid Argon Market introduction

Liquid Argon (LAR) is a colorless, odorless, non-flammable, and extremely inert noble gas that constitutes approximately 0.93% of the Earth's atmosphere by volume. It is primarily derived through the fractional distillation of liquid air using large-scale Air Separation Units (ASUs). Argon’s primary appeal lies in its chemical inertness, making it indispensable across various high-temperature industrial processes where reactivity with other elements must be strictly avoided. The cryogenic nature of Liquid Argon allows for efficient storage and transportation, facilitating its widespread use in industries ranging from metallurgy and welding to advanced electronics manufacturing and scientific research. High-purity argon is particularly crucial for semiconductor fabrication, ensuring a pristine environment for sensitive processes like sputtering and etching.

The major applications of Liquid Argon are concentrated in the industrial sector, predominantly serving as a protective atmosphere. In metal fabrication and welding, particularly Gas Tungsten Arc Welding (GTAW) and Gas Metal Arc Welding (GMAW), argon acts as an inert shield gas, preventing atmospheric contamination of the weld pool, thereby guaranteeing the structural integrity and quality of the final product. Furthermore, the steel industry relies heavily on argon in the process of Argon Oxygen Decarburization (AOD) for producing high-grade stainless steel, where it minimizes chromium oxidation losses. The rising demand for specialized alloys and high-precision manufacturing techniques globally continues to solidify argon's foundational role in these heavy and specialized industries.

Beyond traditional industrial uses, the expansion of the electronics sector, particularly the surge in semiconductor and flat panel display manufacturing, represents a significant driving factor for the Liquid Argon market. Ultra-high purity (UHP) argon, often 99.999% or purer, is mandated in cleanroom environments to purge processing equipment and serve as an atmospheric diluent during chemical vapor deposition (CVD) and epitaxy processes. The inherent benefits of argon, including its non-reactivity and density, coupled with the global acceleration in digitalization and infrastructure development, necessitate a stable and expanding supply of LAR. Investment in sophisticated cryogenic production and distribution infrastructure is paramount to supporting the diverse and stringent requirements across its highly demanding end-user segments.

Liquid Argon Market Executive Summary

The global Liquid Argon market trajectory is fundamentally shaped by macro-economic trends, notably the intensifying pace of industrialization in Asia Pacific and the increasing global emphasis on high-tech manufacturing, specifically semiconductors and advanced materials. Business trends indicate a shift towards long-term supply agreements and strategic vertical integration among major industrial gas producers to mitigate volatile energy costs and secure captive production capacity, particularly for ultra-high purity grades of argon. Capacity expansions in Air Separation Units (ASUs) are accelerating in regions experiencing rapid infrastructure development, reflecting the direct correlation between industrial output and argon demand. Furthermore, sustainability pressures are driving innovation in more energy-efficient cryogenic distillation technologies, aiming to lower the considerable energy footprint associated with LAR production.

Regionally, the Asia Pacific (APAC) stands as the undisputed leader in market consumption, driven overwhelmingly by China, South Korea, Taiwan, and Japan, which are the global hubs for steel production, electronics, and high-volume welding operations. The rapid deployment of 5G technology and corresponding expansions in data centers are further amplifying the regional demand for UHP argon used in semiconductor fabrication. Conversely, North America and Europe, while possessing mature markets, are focusing on high-value applications such as aerospace component manufacturing, specialized metallurgy, and advanced medical diagnostics, including cryo-ablation techniques. These regions are characterized by higher pricing power but slower volume growth compared to APAC, necessitating an optimized distribution network focused on reliability and purity assurance.

Segmentation analysis reveals that the high-purity Liquid Argon segment is exhibiting the fastest growth due to its critical use in the electronics industry, which mandates stringent quality controls and minimal contaminants. By end-use, the Metal Manufacturing and Fabrication segment retains the largest volume share, yet the Electronics segment is projected to deliver superior value growth over the forecast period. Distribution trends show a sustained reliance on bulk delivery via cryogenic tankers for large industrial customers (on-site or pipeline supply), while smaller users continue to rely on micro-bulk and cylinder delivery. The underlying trend across all segments is the increasing requirement for just-in-time delivery and sophisticated telemetric monitoring of storage tanks to optimize inventory management and prevent operational disruptions at customer sites.

AI Impact Analysis on Liquid Argon Market

Analysis of user inquiries concerning the influence of Artificial Intelligence (AI) on the Liquid Argon market reveals key themes centered around operational efficiency, predictive maintenance, and optimizing the capital-intensive production process. Users are commonly seeking information on how AI algorithms can minimize the substantial energy consumption required by Air Separation Units (ASUs), improve the precision of purity control for UHP argon, and enhance the logistical complexity of cryogenic supply chains. Primary concerns include the upfront investment required for integrating AI and IoT sensors into existing infrastructure and the potential displacement of traditional supply chain management methods. Expectations are high regarding AI’s capability to provide superior demand forecasting, which is critical for minimizing wasted production capacity and ensuring uninterrupted supply to sensitive end-users like chip manufacturers where supply failure is catastrophic.

AI is projected to revolutionize the operational economics of argon production by analyzing real-time data streams from cryogenic distillation columns. Machine learning models can predict and adjust temperature and pressure parameters dynamically, ensuring maximum argon yield while minimizing the massive power draw of compressors. This predictive optimization moves beyond static operational manuals, allowing ASUs to adapt instantly to fluctuating atmospheric conditions or power grid variances. Furthermore, in the realm of quality control, AI-driven spectroscopy and sensor fusion techniques are enhancing the ability to rapidly detect and categorize trace impurities, certifying ultra-high purity grades required for advanced semiconductor lithography and deposition processes with unprecedented accuracy and speed.

In terms of market logistics, AI integration focuses on optimizing the highly complex and costly transportation of Liquid Argon via specialized cryogenic tankers. Algorithms process variables such as real-time road conditions, customer consumption patterns (telemetry data), tanker capacity, and regional storage levels to generate optimized delivery routes and scheduling. This ensures that the cryogenic product, which is subject to unavoidable boil-off losses during transit, is delivered efficiently, minimizing operational expenditures and product loss. The predictive capabilities of AI in demand forecasting also allow producers to fine-tune production schedules months in advance, smoothing out demand volatility and improving asset utilization across the global network of production facilities.

- AI-driven optimization of Air Separation Unit (ASU) parameters for energy reduction and maximized argon yield.

- Predictive maintenance schedules implemented for critical cryogenic equipment, reducing unplanned downtime and enhancing reliability.

- Enhanced supply chain logistics through machine learning models optimizing cryogenic tanker routing and minimizing product boil-off losses.

- Real-time quality control using AI-assisted sensor technology to ensure ultra-high purity certification for electronics applications.

- Improved demand forecasting accuracy, aiding in efficient inventory management and capital expenditure planning for future ASU buildouts.

DRO & Impact Forces Of Liquid Argon Market

The Liquid Argon market is characterized by a unique balance of powerful industrial drivers and significant operational restraints, alongside substantial long-term opportunities that collectively define its impact forces. Primary drivers include the robust global expansion of the steel industry, particularly the demand for high-grade stainless steel using the Argon Oxygen Decarburization (AOD) process, and the unprecedented growth of the electronics sector, demanding ultra-high purity argon for semiconductor fabrication. These industrial demands are complemented by a growing medical application portfolio, including cryosurgery and specialized respiratory support, increasing the baseline need for high-quality argon supply. The impact forces are fundamentally tied to global industrial output indices and technological investment cycles.

Restraints predominantly revolve around the high capital intensity and energy consumption inherent in the production process. Air Separation Units require enormous initial investment, long lead times for construction, and continuous, substantial electrical input for compression and cryogenic cooling, making the cost structure highly sensitive to energy price fluctuations. Furthermore, the specialized nature of Liquid Argon transport—requiring insulated cryogenic trailers and regulated handling—adds significant logistical complexity and operational expense, particularly in remote areas. Regulatory hurdles concerning purity standards and the limited availability of atmospheric air separation sites suitable for high-volume production also pose continuous restraints on rapid market expansion.

Opportunities for market growth are primarily concentrated in emerging applications and geographical expansion. The burgeoning space exploration sector utilizes argon as a propellant or simulated environment gas in testing, representing a niche but high-value opportunity. Likewise, advancements in 3D printing (additive manufacturing) of reactive metals necessitate inert atmospheres provided by argon. Geographically, untapped potential in industrializing African and select Latin American nations, where infrastructure investment is accelerating, presents significant expansion opportunities for bulk gas supply networks. The ongoing global transition towards advanced materials and specialized manufacturing techniques ensures a persistent demand for the inert properties of Liquid Argon, bolstering long-term market resilience against cyclical economic downturns.

Segmentation Analysis

The segmentation of the Liquid Argon market is multifaceted, primarily structured around the required Purity Grade, the specific End-Use Industry, and the Distribution Method employed. Purity grade is the most critical differentiator, distinguishing standard industrial grade (99.9%) used primarily for welding and purging from the ultra-high purity (UHP) and research grades (99.999% and above) mandated by the highly sensitive electronics and photovoltaic industries. This distinction directly impacts pricing, production complexity, and handling protocols, as UHP argon requires specialized purification units and non-contaminating distribution systems. Understanding the shifting demand dynamics between these purity levels is essential for strategic market positioning.

The End-Use segmentation highlights the diversity of applications, with Metal Manufacturing and Fabrication historically dominating volume consumption, driven by high demand for steel, aluminum, and exotic alloys where inert shielding is vital. However, the fastest growth is emanating from the Electronics sector, specifically due to the accelerating global chip shortage resolution and investment in new fabrication plants (Fabs). Healthcare and R&D segments, while smaller in volume, represent high-value niches due to the use of argon in specialized surgical procedures, cryogenic preservation, and particle physics research, such as dark matter detection experiments which utilize large volumes of liquid argon as a detection medium.

Distribution methods are crucial given the cryogenic nature of the product. The market distinguishes between on-site production (via captive ASUs or direct pipeline supply to very large users like steel mills), bulk delivery via cryogenic trailers (for medium to large customers), and packaged gas (cylinders or dewars) for low-volume or remote users. The rising trend of micro-bulk delivery (small, vacuum-insulated tanks) is gaining traction, offering better efficiency and lower logistical costs for mid-sized users compared to traditional cylinder banks. Strategic investment in efficient cryogenic logistics and localized storage hubs is paramount to maintaining competitive advantage within this capital-intensive supply chain.

- By Purity Grade:

- Standard Industrial Grade (99.9%)

- High Purity Grade (99.99%)

- Ultra-High Purity Grade (UHP, 99.999% and above)

- By End-Use Industry:

- Metal Manufacturing and Fabrication (Welding, Steel Production, Aluminum Refining)

- Electronics (Semiconductors, Flat Panel Displays, Photovoltaics)

- Healthcare and Medical (Cryosurgery, Medical Gas Mixtures)

- Chemical and Petrochemical

- Energy and Power Generation

- Aerospace and Defense

- Research and Development

- By Distribution Mode:

- On-Site Production/Pipeline

- Bulk/Mini-Bulk Delivery (Cryogenic Tankers)

- Packaged Gas (Cylinders and Dewars)

Value Chain Analysis For Liquid Argon Market

The Liquid Argon value chain begins with the highly capital-intensive upstream segment, centered entirely on the efficient operation of Air Separation Units (ASUs). Raw material input is atmospheric air, which is free but requires substantial electrical energy and complex equipment (compressors, heat exchangers, distillation columns) for purification and liquefaction. The high barriers to entry in this stage, driven by the massive investment required for large-scale ASUs, concentrate production capacity among a few global industrial gas giants. Upstream activities focus on maximizing throughput, optimizing energy efficiency, and employing advanced cryogenic technology to separate argon (which exists in trace quantities) from oxygen and nitrogen at extremely low temperatures.

The midstream component involves the liquefaction, storage, and extensive distribution network. Once produced as Liquid Argon, the product must be stored in massive, super-insulated cryogenic tanks and transported using highly specialized bulk tankers. The distribution channel is crucial, as the product is continuously prone to boil-off, necessitating optimized logistics and routing. Distribution is segmented into direct sales (for large customers receiving bulk deliveries or pipeline supply) and indirect distribution through regional distributors or specialty gas suppliers who handle micro-bulk and cylinder filling operations, catering to smaller or geographically dispersed end-users. Purity maintenance during storage and transit is a critical midstream concern, particularly for UHP grades.

The downstream segment encompasses the final consumption by the end-users. Direct consumers, such as major integrated steel mills or large semiconductor fabrication plants, receive bulk deliveries and often utilize sophisticated on-site storage and gas management systems. The cost of argon is a significant factor in the total operational expenditure for these industries. Indirect consumption involves the use of smaller volumes in laboratories, specialized welding shops, and medical facilities, sourced through distributors. The profitability of the value chain is highly dependent on long-term contracts and the optimization of logistics to minimize transportation costs and maximize asset utilization (tanks and trailers). Technological advancements in insulation and monitoring systems are continuously targeted to enhance efficiency throughout this distribution network.

Liquid Argon Market Potential Customers

Potential customers for Liquid Argon span a diverse spectrum of heavy industry, advanced manufacturing, and specialized research institutions, unified by the requirement for an inert and stable gaseous environment. The largest volume consumers are traditionally found within the Metal Manufacturing sector, specifically steel producers utilizing AOD processes to refine high-quality stainless and specialty steels, and large-scale welding and fabrication shops involved in pipeline construction, bridge building, and machinery manufacturing. These customers demand consistent supply reliability, often achieved through on-site ASUs or dedicated pipeline connections, prioritizing volume and cost-effectiveness over ultra-high purity grades.

The highest growth and value-added customers are situated within the Electronics and Semiconductor industry. These entities, including major memory chip manufacturers (DRAM, NAND), microprocessor producers, and flat panel display fabricators, require Liquid Argon of exceptional purity (99.999% and higher). Argon serves crucial functions in purging cleanrooms, inerting process chambers during etching and deposition, and serving as a carrier gas, where even minute impurities can compromise product yield. These customers are highly sensitive to purity deviations and typically enter into long-term, high-assurance supply contracts with major gas vendors capable of meeting stringent quality standards globally.

Other vital customer segments include specialized Aerospace and Defense manufacturers who rely on argon shielding for welding reactive metals like titanium and specialized alloys used in jet engines and rockets. Furthermore, the Healthcare sector utilizes argon for cryo-ablation procedures and as a component in specialized gas mixtures for lung function testing. Research institutions, particularly those engaged in high-energy physics, dark matter detection experiments (requiring vast liquid argon reservoirs), and materials science, represent niche but essential customers. These diverse end-users collectively drive the demand for a flexible supply infrastructure capable of handling both massive bulk volumes and precise, highly purified smaller quantities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde PLC, Air Liquide S.A., Air Products and Chemicals Inc., Messer Group GmbH, Taiyo Nippon Sanso Corporation, Yingde Gases Group Company, Praxair Technology Inc., Gulf Cryo, SOL Group, Matheson Tri-Gas Inc., Buzwair Industrial Gases, Advanced Gas Technologies Inc., Universal Industrial Gases Inc., Chemix Gas, Sicgil Industrial Gases Limited, BASF SE, Iwatani Corporation, Showa Denko K.K., Cryotec Anlagenbau GmbH, Calgaz. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Argon Market Key Technology Landscape

The foundational technology underpinning the Liquid Argon market is Cryogenic Distillation, executed within Air Separation Units (ASUs). This process involves compressing atmospheric air, cooling it down to cryogenic temperatures (below -180°C) until it liquefies, and then separating the constituent gases (Nitrogen, Oxygen, and Argon) based on their differing boiling points through precise fractional distillation columns. Modern ASUs are characterized by advanced heat exchanger designs and highly efficient compressors to maximize energy utilization, which is the single largest operating cost factor. Technological advancements focus heavily on optimizing the internal column structure and control systems to enhance the purity extraction rate of argon (which has a boiling point close to oxygen) while minimizing power consumption and operational footprint. The continuous push toward modular and smaller-scale ASUs also allows industrial gas suppliers to establish localized production closer to key demand centers, mitigating high long-haul transportation costs.

A secondary, but increasingly critical, technological area involves Ultra-High Purity (UHP) Purification methods. While standard cryogenic distillation yields purity suitable for general industrial applications, the stringent demands of the semiconductor industry necessitate further processing. This is typically achieved through purification units utilizing catalytic converters, specialized adsorbents (such as molecular sieves or activated carbon beds), and sophisticated membrane separation techniques to remove minute traces of contaminants like hydrocarbons, moisture, and residual oxygen. The integrity of the UHP supply chain is maintained through advanced material science in piping and storage, using electro-polished stainless steel and specialized valves to prevent outgassing and contamination during final delivery. Innovation in real-time purity analyzers, often incorporating mass spectrometry, ensures continuous compliance with exacting customer specifications.

Furthermore, significant technological investments are directed toward cryogenic storage and distribution infrastructure. Advanced double-walled, vacuum-insulated storage tanks (Dewars) and bulk transport trailers are essential for maintaining the argon in its liquid state and minimizing the costly "boil-off" rate. Innovations include developing new super-insulation materials, integrating IoT sensors and telemetric devices for remote monitoring of pressure, temperature, and liquid levels, and designing high-efficiency pump systems for rapid and safe transfer. The implementation of advanced route optimization software, often leveraging AI and predictive modeling, represents a crucial technological refinement in the logistics domain, ensuring reliable, safe, and cost-effective delivery of bulk Liquid Argon to global industrial consumers.

Regional Highlights

Regional dynamics play a paramount role in shaping the Liquid Argon market, reflecting varying industrial concentrations, regulatory environments, and technological adoption rates. The market is broadly categorized into five major regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA). Each region presents a unique supply-demand landscape, dictating pricing, distribution strategies, and investment priorities for industrial gas producers. The vast differences in industrial maturity and economic growth rates necessitate tailored market approaches, particularly regarding long-term contractual agreements and infrastructure expansion.

Asia Pacific (APAC) currently dominates the global Liquid Argon market, both in terms of production capacity and consumption volume. This dominance is intrinsically linked to the region’s status as the global manufacturing hub, particularly for electronics, steel, and automotive production. Countries such as China, South Korea, Taiwan, and Japan host the world's largest semiconductor fabrication plants (Fabs), creating an enormous, sustained demand for Ultra-High Purity (UHP) argon. The rapid expansion of infrastructure, coupled with governmental support for high-tech industries, ensures that APAC will remain the fastest-growing region, driving significant investment in new, large-scale Air Separation Units and specialized UHP purification facilities throughout the forecast period.

North America and Europe represent mature, high-value markets characterized by demand for specialized, high-specification grades of argon used in aerospace, advanced metallurgy, and sophisticated R&D. While volume growth is slower compared to APAC, the high value of applications such as specialized metal 3D printing, advanced welding of complex materials, and particle physics research sustains steady revenue generation. The focus in these regions is less on massive capacity expansion and more on optimizing existing distribution networks, ensuring logistical efficiency, and implementing digitalization (telemetry and AI) to manage the demanding supply chains that service dispersed, high-specification manufacturing clusters.

- Asia Pacific (APAC): Market leader driven by immense demand from the semiconductor, steel, and electronics manufacturing sectors; focus on capacity expansion and UHP supply chain integrity in China, South Korea, and Taiwan.

- North America: Mature market concentrating on high-value applications in aerospace, defense, specialty chemicals, and advanced welding; emphasis on efficient logistics and technological optimization.

- Europe: Stable market supported by robust automotive, chemical, and metal fabrication industries; increasing focus on sustainable production methods and regulatory compliance for medical and food-grade applications.

- Latin America: Emerging market with increasing industrialization, particularly in Brazil and Mexico; growth tied to infrastructure development and localized steel production, relying primarily on imported or smaller regional ASUs.

- Middle East and Africa (MEA): Growth stimulated by large petrochemical projects and infrastructure development in the GCC countries; demand for industrial-grade argon for welding, oil and gas processing, and construction sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Argon Market.- Linde PLC

- Air Liquide S.A.

- Air Products and Chemicals Inc.

- Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- Yingde Gases Group Company

- Praxair Technology Inc. (now part of Linde)

- Gulf Cryo

- SOL Group

- Matheson Tri-Gas Inc.

- Buzwair Industrial Gases

- Advanced Gas Technologies Inc.

- Universal Industrial Gases Inc.

- Chemix Gas

- Sicgil Industrial Gases Limited

- BASF SE (select operations)

- Iwatani Corporation

- Showa Denko K.K.

- Cryotec Anlagenbau GmbH

- Calgaz

Frequently Asked Questions

Analyze common user questions about the Liquid Argon market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Ultra-High Purity (UHP) Liquid Argon?

The primary driver for UHP Liquid Argon demand is the rapid global expansion of the semiconductor and electronics manufacturing industries, where ultra-pure argon is essential for creating inert atmospheres during critical processes like etching, deposition, and cleanroom purging, ensuring device yield and quality.

How is Liquid Argon typically produced, and what is the main production challenge?

Liquid Argon is produced through the fractional distillation of liquid air in large-scale Air Separation Units (ASUs). The main production challenge is the significant energy consumption required for the compression and cryogenic cooling processes, making operational efficiency highly susceptible to fluctuations in energy prices.

Which end-use industry holds the largest volume share in the Liquid Argon market?

The Metal Manufacturing and Fabrication industry, including steel production (especially Argon Oxygen Decarburization or AOD) and general welding applications, currently consumes the largest volume share of industrial- grade Liquid Argon globally.

What distinguishes the Asia Pacific market from North America and Europe?

The Asia Pacific market is characterized by dominant volume consumption and rapid growth driven by high-volume steel and electronics production, focusing on capacity expansion. North America and Europe are mature markets, focusing instead on high-value, specialized applications like aerospace and advanced metallurgy.

What logistical challenges are associated with the transportation of Liquid Argon?

Liquid Argon must be maintained at cryogenic temperatures (approx. -186°C), requiring specialized, vacuum-insulated cryogenic tankers. Key challenges include minimizing costly product loss due to continuous boil-off during transit and optimizing routing for energy efficiency and timely, safe delivery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Liquid Argon Market Size Report By Type (Pure Grade, High Purity Grade, Ultra Pure Grade), By Application (Welding & Cutting, Semiconductor Industry, Photovoltaic Industry, Smelting, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Liquid Argon Market Statistics 2025 Analysis By Application (Welding & Cutting, Semiconductor Industry, Photovoltaic Industry, Smelting, Others), By Type (Pure Grade, High Purity Grade, Ultra Pure Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Liquid Argon Market Statistics 2025 Analysis By Application (Welding & Cutting, Semiconductor Industry, Photovoltaic Industry, Smelting), By Type (Pure Grade, High Purity Grade, Ultra Pure Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager