Liquid Biopsy Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436626 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Liquid Biopsy Services Market Size

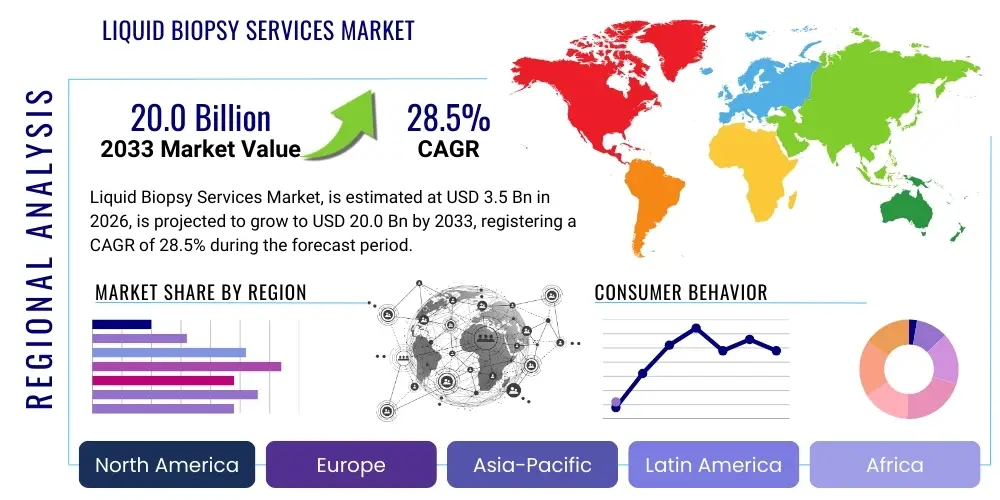

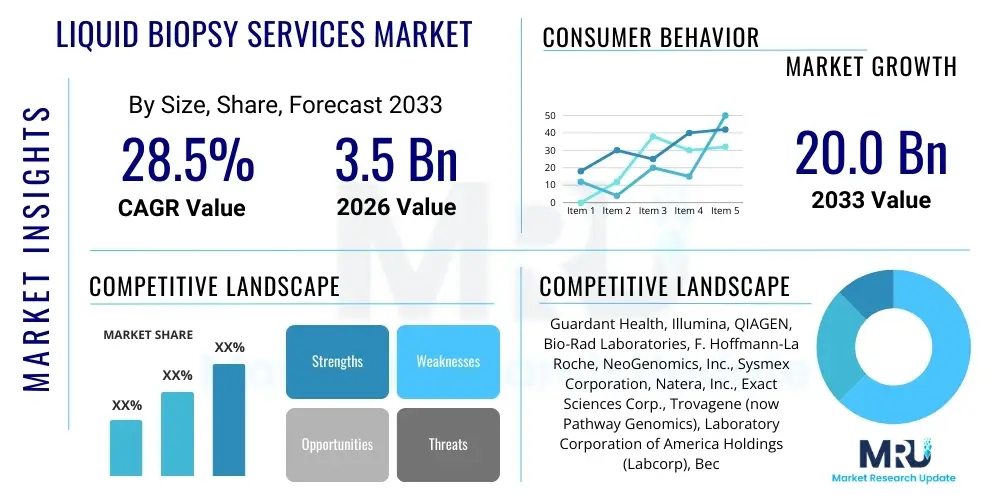

The Liquid Biopsy Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 20.0 Billion by the end of the forecast period in 2033.

Liquid Biopsy Services Market introduction

The Liquid Biopsy Services Market encompasses the provision of laboratory and clinical testing services utilizing non-invasive techniques to analyze biological fluids—primarily blood—for biomarkers such as circulating tumor cells (CTCs), circulating tumor DNA (ctDNA), exosomes, and proteins. These services are rapidly displacing traditional, invasive tissue biopsies, offering significant advantages in early disease detection, treatment monitoring, and recurrence surveillance, particularly within the oncology domain. The fundamental product description revolves around highly sensitive molecular diagnostics assays, underpinned by technologies like Next-Generation Sequencing (NGS) and digital PCR (dPCR), which allow for the detection of minute quantities of tumor-derived materials circulating in the periphery. This non-invasive approach reduces patient risk, provides a dynamic view of disease evolution, and facilitates precision medicine strategies, thereby accelerating the therapeutic decision-making process for oncologists worldwide.

Major applications for liquid biopsy services are concentrated heavily in cancer management, including screening high-risk populations, confirming diagnosis, guiding targeted therapy selection (companion diagnostics), and monitoring minimal residual disease (MRD) following definitive treatment. Beyond oncology, these services are increasingly applied in non-invasive prenatal testing (NIPT), infectious disease diagnostics, and transplantation monitoring, though cancer detection and management remain the primary revenue drivers. The central benefit derived from adopting liquid biopsy services is the capacity for real-time, repeated monitoring of disease heterogeneity and resistance mutations without the logistical complications and risks associated with surgical procedures. This capability ensures that treatment regimens can be rapidly adjusted based on evolving tumor characteristics, improving patient outcomes and reducing overall healthcare costs related to unnecessary or ineffective treatments.

The market expansion is principally driven by the accelerating global incidence of various cancers, coupled with substantial technological advancements that enhance the sensitivity and specificity of liquid biopsy assays. Increased research funding from both private and governmental organizations aimed at validating liquid biopsy biomarkers for diverse clinical uses further propels growth. Additionally, the increasing acceptance and integration of these non-invasive diagnostic tools into established clinical guidelines by professional societies are crucial driving factors. Furthermore, the global shift towards personalized medicine, demanding tailored therapeutic strategies based on individual genetic profiles, necessitates the high throughput, comprehensive genomic profiling offered by sophisticated liquid biopsy services, solidifying its pivotal role in future diagnostics.

Liquid Biopsy Services Market Executive Summary

The Liquid Biopsy Services Market is characterized by intense technological innovation, robust investment from venture capital, and strategic collaborations aimed at expanding assay coverage and clinical utility. Key business trends include the shift from single-gene testing to comprehensive genomic profiling (CGP) panels, driven by the need to identify multiple actionable mutations simultaneously. Major diagnostic companies are aggressively pursuing regulatory approvals (e.g., FDA clearance) to establish clinical validation and gain wider reimbursement coverage, which remains a critical barrier in several geographies. Furthermore, consolidation is observed, with larger pharmaceutical and diagnostics corporations acquiring specialized liquid biopsy startups to integrate novel intellectual property and enhance their services portfolio. The focus remains heavily on improving workflow integration, shortening turnaround times, and developing robust bioinformatics pipelines capable of managing and interpreting complex genomic data, ensuring scalability across clinical laboratory settings globally.

Regionally, North America maintains the leading position due to its advanced healthcare infrastructure, high awareness among oncologists, and favorable reimbursement landscape for innovative diagnostic tests, particularly in the United States. Europe is projected for steady growth, stimulated by national initiatives supporting early cancer detection and the adoption of centralized screening programs, although regulatory hurdles in certain countries persist. The Asia Pacific (APAC) region is emerging as the fastest-growing market segment, fueled by rising cancer prevalence, increasing healthcare expenditures, and the growing establishment of high-quality molecular testing laboratories in countries like China, Japan, and India. Investment in regional infrastructure and localized clinical trials is crucial for penetrating these diverse markets, often requiring tailored service offerings to meet local clinical needs and regulatory requirements.

Segment trends highlight the dominance of circulating tumor DNA (ctDNA) analysis within the market, recognized for its stability and suitability for NGS applications, making it the most frequently requested biomarker service. Application-wise, oncology remains overwhelmingly the largest segment, with specific attention directed towards treatment monitoring and MRD detection, areas where liquid biopsy offers maximal clinical utility and repeatability. Technology trends indicate a strong preference for Next-Generation Sequencing (NGS) platforms due to their capability to perform high-throughput, multiplexed analyses, essential for CGP. However, digital PCR (dPCR) continues to hold significance in specific high-sensitivity applications, such as post-treatment recurrence monitoring, where absolute quantification of minimal residual disease is paramount for clinical decision-making. The increasing acceptance of decentralized testing models, utilizing automation and standardization, is also shaping the service provision landscape.

AI Impact Analysis on Liquid Biopsy Services Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Liquid Biopsy Services Market frequently center on three critical areas: enhancing diagnostic accuracy, managing the complexity of genomic data, and accelerating clinical translation. Users often question how machine learning algorithms can differentiate true disease signals from background noise, particularly when dealing with extremely low concentrations of circulating biomarkers (e.g., ctDNA fractions below 0.1%). Furthermore, there is significant user interest in AI's role in interpreting the massive datasets generated by comprehensive genomic profiling (CGP) panels, querying whether AI can swiftly identify novel actionable mutations or predict therapeutic resistance patterns more effectively than traditional bioinformatics. Expectations are high that AI will optimize laboratory workflows, reduce human error in sample processing, and ultimately lower the cost of complex testing, thereby democratizing access to these advanced diagnostic services.

The integration of AI algorithms is fundamentally reshaping the interpretation phase of liquid biopsy services. Machine learning models, particularly deep learning networks, are being trained on vast repositories of genomic and clinical data to recognize subtle patterns indicative of cancer type, stage, or prognosis. This computational approach allows for improved specificity in classifying mutations and overcoming inherent biological and technical variability, which is critical for clinical robustness. For instance, AI aids in filtering out clonal hematopoiesis of indeterminate potential (CHIP) signals, ensuring that the detected ctDNA is genuinely tumor-derived, a common concern that previously limited the reliability of tests, particularly for early-stage disease detection. By automating this complex filtering and annotation process, AI significantly reduces the diagnostic uncertainty associated with low-allele fraction samples.

Beyond diagnostics, AI is instrumental in the clinical decision support systems integrated into liquid biopsy service platforms. These systems leverage AI to correlate detected molecular alterations with appropriate targeted therapies and clinical trial eligibility, providing oncologists with actionable insights instantly. This capability shortens the time from sample collection to treatment recommendation, drastically improving the efficiency of personalized medicine pathways. Moreover, AI contributes to quality control and optimization within the laboratory setting by predicting potential assay failures, automating image analysis (in the case of CTC detection), and streamlining sample tracking and processing, ensuring the provision of highly reliable, standardized liquid biopsy services across the global market. The future impact of AI will likely involve predictive modeling for disease recurrence, leveraging longitudinal liquid biopsy data points.

- AI enhances sensitivity and specificity in detecting ultra-low allele fraction circulating tumor DNA (ctDNA).

- Machine learning algorithms streamline the interpretation of comprehensive genomic profiling (CGP) data, identifying complex mutational signatures.

- AI facilitates the management of massive sequencing datasets, automating quality control and reducing bioinformatics turnaround time.

- Predictive analytics powered by AI assist in monitoring therapeutic response and forecasting potential drug resistance development.

- AI systems integrate clinical data with molecular findings to provide optimized, personalized clinical decision support for oncologists.

- Optimization of laboratory automation and robotic workflow management through AI reduces operational costs and potential human error.

DRO & Impact Forces Of Liquid Biopsy Services Market

The Liquid Biopsy Services Market is governed by a dynamic interplay of potent Drivers (D), significant Restraints (R), and compelling Opportunities (O), collectively shaping the direction and pace of market evolution. Key Drivers include the increasing global incidence of cancer, the inherent non-invasiveness and repeatability of the procedure compared to traditional tissue biopsies, and accelerated technological innovation yielding assays of superior sensitivity. These factors are heavily supported by growing clinical evidence demonstrating the utility of liquid biopsy across the entire spectrum of cancer care, from screening to surveillance. Conversely, Restraints primarily revolve around the high initial cost of advanced testing platforms, persistent challenges in achieving standardized assay protocols across different providers, and, most critically, limited reimbursement coverage in numerous key markets, hindering widespread clinical adoption despite proven efficacy. These opposing forces dictate the market's trajectory, emphasizing the necessity of robust clinical validation to overcome economic and logistical barriers.

Opportunities for market growth are abundant and center on expanding the application scope beyond core oncology into adjacent fields such as neurological disorders, cardiovascular health monitoring, and infectious disease diagnostics, particularly for pathogen detection and monitoring resistance. The development of multi-omics liquid biopsy platforms, which simultaneously analyze ctDNA, CTCs, and exosomes, presents a significant opportunity to provide a more holistic view of disease biology. Furthermore, a substantial opportunity lies in the development of highly accurate pan-cancer early screening tests for the asymptomatic population, which holds the potential to dramatically improve five-year survival rates by detecting cancer at its most treatable stages. Strategic partnerships between diagnostics providers, pharmaceutical companies, and technology developers are essential to capitalize on these opportunities, facilitating integrated service offerings and combined research efforts.

The Impact Forces are heavily skewed towards technological advancement and regulatory clarity. High clinical utility acts as a strong positive impact force, driving physician adoption once clear guidelines are established. However, the existing regulatory landscape, often requiring extensive and costly validation studies (particularly for FDA approval), remains a substantial hindering force. Moreover, ethical and data privacy concerns associated with managing sensitive genomic information exert pressure on service providers to maintain stringent security protocols, impacting trust and adoption rates. The transition from Research Use Only (RUO) to In Vitro Diagnostic (IVD) status for assays is a critical inflection point, determining market accessibility. Ultimately, the successful management of these impact forces—especially achieving favorable reimbursement through compelling health economic data—will be the defining factor in realizing the market’s projected potential and transitioning liquid biopsy from niche specialty testing to standard clinical practice.

Segmentation Analysis

The Liquid Biopsy Services Market is extensively segmented based on key parameters including the primary biomarker analyzed, the specific technology employed for detection, the clinical application area, and the type of end-user utilizing the service. This segmentation is crucial for understanding the diverse demands and technical capabilities driving specific market niches. The inherent complexity of circulating biomarkers necessitates high specificity in service offerings, leading to strong competition within specialized sub-segments, particularly between ctDNA analysis and circulating tumor cell (CTC) isolation methodologies. Geographically, the market landscape is segmented to reflect variances in regulatory environments, healthcare spending, and cancer prevalence across major regions, influencing pricing strategies and service deployment models for global providers.

The core of market segmentation lies in the technology used, where sophisticated molecular techniques like Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR) dominate the landscape, offering complementary capabilities suitable for different clinical contexts. NGS platforms are primarily used for comprehensive profiling and mutation discovery, while highly sensitive digital PCR (dPCR) is often preferred for monitoring known mutations and minimal residual disease (MRD) assessment. Furthermore, the services segment is frequently differentiated by the scope of offering, ranging from basic targeted panels to large-scale, complex pan-cancer screening services, impacting the value proposition for various healthcare systems and clinical settings, including academic research centers versus community oncology clinics.

Application-based segmentation confirms oncology as the major market category, driven by the immediate need for better recurrence monitoring and therapy selection tools. Within oncology, segmentation by cancer type, such as lung, breast, prostate, and colorectal cancer, helps service providers focus their assay development efforts based on clinical need and prevalence. The structure of the market, therefore, reflects a continuous effort to tailor high-sensitivity diagnostic solutions to specific clinical challenges, ensuring maximum utility and cost-effectiveness for end-users, ultimately accelerating the shift from centralized testing to potentially decentralized or near-patient testing models enabled by standardized service protocols and advanced instrumentation.

- By Sample Type:

- Blood (Plasma/Serum)

- Urine

- Cerebrospinal Fluid (CSF)

- Saliva

- Other Biological Fluids

- By Biomarker Type:

- Circulating Tumor Cells (CTCs)

- Circulating Tumor DNA (ctDNA) and Cell-Free DNA (cfDNA)

- Extracellular Vesicles (EVs) / Exosomes

- Circulating RNA (miRNA, lncRNA)

- Proteins and Metabolites

- By Technology:

- Next-Generation Sequencing (NGS)

- Targeted Sequencing

- Whole-Genome Sequencing (WGS)

- Whole-Exome Sequencing (WES)

- Polymerase Chain Reaction (PCR)-based Amplification

- Digital PCR (dPCR)

- Quantitative PCR (qPCR)

- Microarray

- Flow Cytometry (for CTCs)

- Others (e.g., Optical Detection, Mass Spectrometry)

- Next-Generation Sequencing (NGS)

- By Application:

- Oncology

- Early Screening and Detection

- Therapy Selection and Monitoring (Companion Diagnostics)

- Recurrence Monitoring (Minimal Residual Disease - MRD)

- Prognosis and Risk Assessment

- Non-Invasive Prenatal Testing (NIPT)

- Transplantation Diagnostics

- Infectious Disease Diagnostics

- Other Applications

- Oncology

- By End User:

- Hospitals and Clinics

- Reference Laboratories

- Academic & Research Institutions

- Pharmaceutical & Biotechnology Companies

Value Chain Analysis For Liquid Biopsy Services Market

The value chain for the Liquid Biopsy Services Market begins with the upstream segment, primarily focused on the development and manufacturing of specialized reagents, proprietary extraction kits, high-throughput sequencing instrumentation, and sophisticated bioinformatics software necessary for processing and interpreting biological samples. Key upstream participants include instrumentation providers (e.g., Illumina, Thermo Fisher Scientific), specialty chemical suppliers, and software developers specializing in genomic data analysis. Innovation and patent protection at this stage are critical, as the sensitivity and reliability of the service are fundamentally dependent on the quality of these core technological components. Establishing reliable supply chains for specialized reagents, which often require stringent quality control, is paramount for ensuring consistent service delivery across various clinical laboratories globally.

The midstream segment constitutes the core service provision, encompassing sample collection, preparation, high-complexity laboratory testing (e.g., NGS runs, dPCR quantification), and initial data processing. This is typically carried out by reference laboratories, centralized service providers, or specialized clinical diagnostics companies. This stage adds significant value through the implementation of standardized protocols, maintenance of necessary regulatory certifications (e.g., CLIA, CAP), and the application of proprietary algorithms for mutation calling and interpretation. Efficient workflow management and rapid turnaround times are crucial competitive differentiators in the midstream, directly impacting clinical utility and customer satisfaction, particularly when diagnostic results are urgently required for treatment decisions in oncology settings.

The downstream segment involves the delivery of the final comprehensive report to the end-users—primarily oncologists, clinicians, and pharmaceutical researchers—and subsequent utilization for clinical decision-making or research purposes. Distribution channels are varied, encompassing direct sales teams engaging with hospitals and oncology centers (direct channel), partnerships with large reference laboratory networks (indirect channel), and collaborations with pharmaceutical companies for companion diagnostics services. The commercial success in the downstream relies heavily on market access strategies, achieving widespread reimbursement, and providing extensive clinical education to ensure appropriate test utilization. Continuous feedback loops from clinicians to the laboratory service provider are essential for refining assay panels and improving report clarity and actionable content, thereby reinforcing the value proposition within the complex healthcare ecosystem.

Liquid Biopsy Services Market Potential Customers

The primary and largest potential customers for Liquid Biopsy Services are integrated healthcare systems, large hospitals, and specialized oncology clinics. These institutions are the direct purchasers and utilizers of these diagnostic services for managing their patient populations, particularly those diagnosed with, or suspected of having, various malignancies. Oncologists within these settings rely heavily on liquid biopsy results for crucial clinical applications, including confirming the stage of cancer, selecting personalized targeted therapies based on detected genetic mutations, and continuously monitoring for disease progression or resistance development during treatment. The value proposition for these clinical end-users centers on improving patient stratification, reducing the need for invasive procedures, and enabling timely adjustments to therapeutic regimens, directly translating to better clinical outcomes and operational efficiency within the hospital system.

Another significant segment of potential customers includes large reference laboratories and centralized diagnostic testing centers, which purchase the services or license the technology to expand their testing menus and offer specialized molecular diagnostics to smaller clinics or regional healthcare providers that lack the requisite specialized infrastructure. For these reference labs, the integration of liquid biopsy technology is driven by the necessity of remaining competitive in the rapidly evolving molecular diagnostics landscape and consolidating high-volume testing to achieve economies of scale. Furthermore, academic research institutions and university hospitals constitute a vital segment, utilizing these services not only for clinical care but also for translational research, biomarker discovery, and conducting investigator-initiated clinical trials aimed at validating new applications and improving the understanding of cancer biology through non-invasive sampling techniques.

Pharmaceutical and biotechnology companies represent a highly valuable customer base, particularly in the context of drug development and clinical trials. These companies leverage liquid biopsy services extensively as companion diagnostics (CDx) to identify patient cohorts suitable for specific targeted therapies, monitor drug efficacy, and evaluate resistance mechanisms during Phase I, II, and III trials. The ability of liquid biopsy to provide real-time, repeated molecular insights without impacting patient well-being significantly accelerates drug development timelines and enhances the precision of patient selection. Moreover, government health agencies and population health programs are emerging customers, particularly interested in utilizing liquid biopsy services for large-scale, cost-effective early cancer screening initiatives aimed at reducing mortality rates across large populations, positioning them as essential long-term strategic partners for service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 20.0 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Guardant Health, Illumina, QIAGEN, Bio-Rad Laboratories, F. Hoffmann-La Roche, NeoGenomics, Inc., Sysmex Corporation, Natera, Inc., Exact Sciences Corp., Trovagene (now Pathway Genomics), Laboratory Corporation of America Holdings (Labcorp), Becton, Dickinson and Company (BD), Menarini Silicon Biosystems, Myriad Genetics, Foundation Medicine (Roche), Epic Sciences, Angle plc, Thermo Fisher Scientific, Agilent Technologies, Precipio, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Biopsy Services Market Key Technology Landscape

The technological landscape of the Liquid Biopsy Services Market is dominated by sophisticated molecular profiling tools that enable the highly sensitive detection and analysis of trace biomarkers. Next-Generation Sequencing (NGS) platforms represent the foundational technology, providing the capability for comprehensive genomic profiling (CGP) required for identifying multiple concurrent mutations, structural variants, and fusion genes from circulating tumor DNA (ctDNA). Advances in NGS library preparation techniques, coupled with enhanced sequencing depth and targeted panel designs, have significantly improved the lower limit of detection (LOD), making NGS indispensable for both broad screening and detailed molecular characterization of tumors. Specialized bioinformatics pipelines are a critical component of the NGS service ecosystem, transforming complex raw data into clinically actionable reports, ensuring the accuracy and timely delivery required in oncology practice.

Complementary to NGS, digital Polymerase Chain Reaction (dPCR), including platforms such as Droplet Digital PCR (ddPCR), plays a crucial role, particularly in minimal residual disease (MRD) monitoring and tracking known resistance mutations. dPCR offers unparalleled sensitivity and absolute quantification capabilities, making it the preferred method when extremely low-frequency alleles need to be reliably quantified, often succeeding where conventional quantitative PCR (qPCR) fails due to lack of precision at trace levels. The integration of dPCR into service workflows allows for highly sensitive monitoring post-treatment, providing precise, longitudinal data on disease burden. Furthermore, advancements in microfluidics and automation are rapidly standardizing the upstream processes of sample preparation and biomarker isolation (e.g., CTC isolation and cfDNA extraction), which historically presented significant barriers to achieving robust, reproducible results across different laboratories.

Emerging technologies continue to refine the services available, notably the increasing utilization of mass spectrometry for protein biomarker analysis and advanced microscopic imaging combined with microfluidics for detailed characterization of circulating tumor cells (CTCs). Furthermore, the rise of multi-omics approaches, combining genomic, transcriptomic (RNA sequencing), and epigenetic analyses (methylation status), promises to provide a deeper biological understanding of the tumor microenvironment and disease progression, elevating the complexity and clinical value of liquid biopsy services. The drive towards decentralized, point-of-care liquid biopsy solutions, potentially leveraging portable sequencing devices or highly automated benchtop systems, represents a future technological frontier aimed at improving accessibility and shortening diagnostic timelines outside specialized reference laboratories, thereby driving the next phase of market expansion and widespread clinical utility.

Regional Highlights

- North America: Dominates the global market share, primarily driven by the United States, due to the high concentration of key market players, advanced healthcare infrastructure, high research expenditure in oncology, and favorable reimbursement policies for FDA-approved liquid biopsy assays. High awareness among physicians and patients regarding the benefits of non-invasive diagnostics ensures rapid adoption of new service offerings.

- Europe: Represents the second-largest market, characterized by increasing governmental support for cancer research, rising adoption of molecular diagnostics in clinical settings, and active clinical trial collaborations. Key growth countries include Germany, the UK, and France, focusing heavily on integrating liquid biopsy into national screening programs and standardizing laboratory procedures through organizations like the European Society for Medical Oncology (ESMO).

- Asia Pacific (APAC): Expected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is attributable to the large, aging population leading to increasing cancer prevalence, improving healthcare infrastructure, and rising disposable incomes coupled with increasing health insurance coverage in developing economies such as China and India. Localized service providers are focusing on tailoring assays to prevalent regional cancer types.

- Latin America (LATAM): A nascent but growing market, propelled by increasing investment in private healthcare facilities and a rising need for affordable, high-quality diagnostic alternatives in countries like Brazil and Mexico. Market growth is dependent on overcoming hurdles related to regulatory clarity and establishing sufficient training for clinical personnel to properly utilize and interpret advanced genomic reports.

- Middle East and Africa (MEA): Currently holds the smallest share but shows potential due to substantial government investments in healthcare diversification, particularly in Gulf Cooperation Council (GCC) countries. The market is slowly adopting advanced diagnostics, relying heavily on international service providers and specialized reference laboratories based in Europe and North America to fulfill complex testing requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Biopsy Services Market.- Guardant Health

- Illumina, Inc.

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd. (Genentech/Foundation Medicine)

- NeoGenomics, Inc.

- Sysmex Corporation

- Natera, Inc.

- Exact Sciences Corp.

- Laboratory Corporation of America Holdings (Labcorp)

- Becton, Dickinson and Company (BD)

- Menarini Silicon Biosystems (CellSearch)

- Myriad Genetics, Inc.

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Angle plc

- Epic Sciences, Inc.

- Trovagene (now Pathway Genomics)

- Veracyte, Inc.

- Personal Genome Diagnostics (acquired by Labcorp)

Frequently Asked Questions

Analyze common user questions about the Liquid Biopsy Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of liquid biopsy services over traditional tissue biopsy methods?

The primary advantage of liquid biopsy services is their non-invasive nature, requiring only a blood draw, which significantly reduces patient discomfort, risk of complications, and procedural time compared to invasive surgical tissue biopsies. Furthermore, liquid biopsy provides a real-time, comprehensive assessment of tumor heterogeneity and evolution, enabling repeated sampling to monitor therapeutic efficacy and detect drug resistance mutations earlier than imaging scans, crucial for timely treatment modification.

Which specific cancer applications are driving the highest demand for liquid biopsy services?

The highest demand is currently driven by advanced oncology applications, specifically Circulating Tumor DNA (ctDNA) analysis for treatment monitoring (identifying acquired resistance mutations) and Minimal Residual Disease (MRD) detection following surgery or definitive therapy. Additionally, comprehensive genomic profiling for therapy selection (companion diagnostics) in advanced non-small cell lung cancer, breast, and colorectal cancers is a critical revenue driver for specialized service providers.

What technological factors are essential for achieving high sensitivity in liquid biopsy tests?

Achieving high sensitivity relies on sophisticated molecular techniques such as Next-Generation Sequencing (NGS) with deep sequencing capabilities or highly accurate digital PCR (dPCR) platforms. Essential factors include optimized sample preparation for maximizing biomarker yield (e.g., cfDNA extraction efficiency), stringent bioinformatics algorithms to filter out background noise, and targeted enrichment panels capable of detecting ultra-low allele fraction mutations, often below 0.1% frequency.

What are the main obstacles hindering the widespread clinical adoption and reimbursement of liquid biopsy services?

Major obstacles include the lack of standardized regulatory guidelines across different international jurisdictions, the high cost of comprehensive genomic profiling services, and insufficient reimbursement coverage from public and private payers, particularly for tests lacking long-term health economic data validation. Demonstrating robust clinical utility across diverse cancer stages and achieving consistent results across various testing laboratories remain key hurdles for establishing universal clinical trust.

How is Artificial Intelligence (AI) expected to transform the future of liquid biopsy services?

AI is expected to transform liquid biopsy by dramatically improving data interpretation, enabling faster and more accurate analysis of complex NGS datasets, and enhancing the differentiation between malignant signals and biological background noise (like clonal hematopoiesis). AI models will increasingly be used for predictive prognostics, automating workflow quality control, and integrating molecular results with patient clinical data to generate precise, actionable treatment recommendations for oncologists.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager