Liquid Boron Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436648 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Liquid Boron Market Size

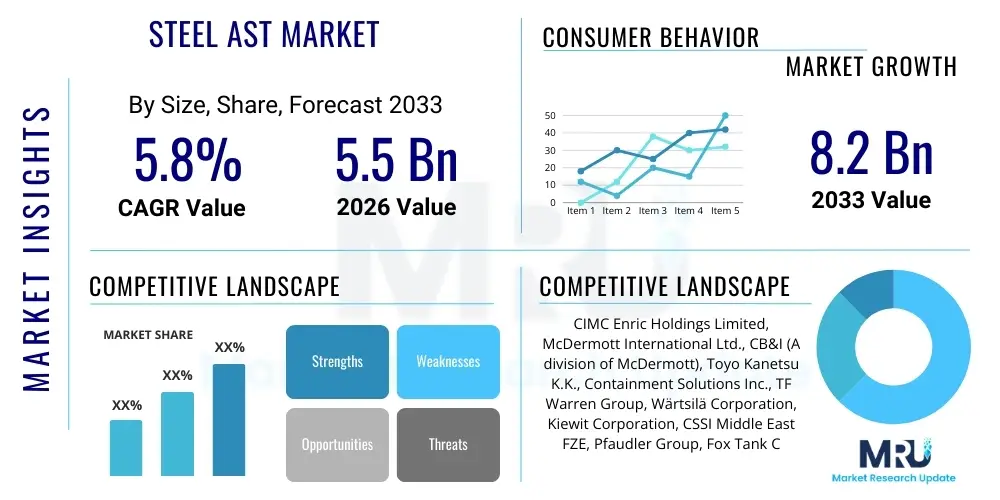

The Liquid Boron Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 980.5 Million in 2026 and is projected to reach USD 1,550.8 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing global emphasis on enhancing crop yield and quality through efficient micronutrient management, coupled with the rapid adoption of precision farming techniques that favor liquid fertilizer applications over conventional granular forms.

Liquid Boron Market introduction

Liquid Boron, typically formulated as sodium borate or boric acid solutions, serves as a critical micronutrient solution widely utilized across various industrial and agricultural sectors. In agriculture, its primary role is to enhance flowering, fruit set, and overall plant structural integrity, addressing boron deficiencies common in diverse soil types globally. The liquid form offers superior convenience, high bioavailability, and precise application capabilities compared to solid alternatives, making it highly favored in modern irrigation systems and foliar sprays. Beyond farming, Liquid Boron finds significant usage in industrial applications such as the manufacturing of ceramics, fiberglass, and specialized chemical intermediates, where its unique chemical properties, including fluxing capabilities and heat resistance, are essential.

The market growth is fundamentally propelled by the necessity for advanced agricultural inputs that maximize resource efficiency and sustainability. Global population increase necessitates higher food production yields from finite arable land, placing intense pressure on farmers to adopt high-efficacy fertilizers. Liquid Boron formulations address this need by ensuring even distribution and rapid uptake by plants, minimizing wastage and environmental runoff. Furthermore, its benefits extend to improving the resistance of crops against various environmental stresses, including drought and certain diseases, solidifying its position as an indispensable component in high-value crop production, such as fruits, vegetables, and oilseeds.

Key applications driving demand include its use in foliar feeding programs designed for instantaneous nutrient delivery during critical growth phases, and its integration into fertigation systems for continuous soil application. The ease of handling and compatibility with other agrochemicals, such as pesticides and growth regulators, further enhances its attractiveness. Major driving factors include government initiatives supporting agricultural modernization, the expansion of commercial greenhouse farming, and ongoing research demonstrating the crucial role of boron in cellular structure and carbohydrate transport within plants, assuring sustained market demand throughout the forecast period.

Liquid Boron Market Executive Summary

The Liquid Boron Market demonstrates strong upward momentum, characterized by significant investment in advanced chelation and formulation technologies aimed at improving nutrient stability and plant uptake. Business trends indicate a strategic shift among leading manufacturers toward developing tailored, region-specific liquid solutions catering to particular soil deficiencies and crop types. The competitive landscape is moderately fragmented, with intense focus on intellectual property surrounding high-concentration, low-salt-index formulations. Key business strategies observed include vertical integration, securing stable boron raw material sourcing, and expanding distribution networks, particularly in emerging economies where agricultural intensification is rapidly accelerating.

Regionally, Asia Pacific (APAC) stands as the dominant market, driven by its expansive agricultural base, the pervasive issue of micronutrient-deficient soils, and supportive governmental policies promoting the utilization of quality fertilizers in countries like India and China. North America and Europe, while mature, exhibit steady growth fueled by the widespread adoption of precision agriculture, which inherently favors liquid applications integrated through sophisticated sensor and drone technologies. Segment trends highlight the Agriculture sector as the primary consumer, specifically the 'Foliar Spray' application segment, which offers the quickest and most effective resolution for acute boron deficiencies, maximizing return on investment for farmers.

Overall, the market trajectory is highly correlated with global agricultural commodity prices and environmental regulations concerning fertilizer use. The increasing preference for bio-based and sustainable formulations represents a significant opportunity, driving product innovation. Companies focusing on developing biodegradable chelating agents and non-toxic delivery systems are expected to capture disproportionately higher market shares. Furthermore, the industrial application segment, though smaller, provides stable demand rooted in the sustained production of high-performance glass, enamels, and specialized alloys, contributing a steady revenue stream independent of seasonal agricultural fluctuations, thereby stabilizing overall market revenue.

AI Impact Analysis on Liquid Boron Market

User inquiries regarding the intersection of Artificial Intelligence and the Liquid Boron Market primarily revolve around how AI can optimize application rates, predict localized boron deficiencies, and enhance supply chain efficiency. Key themes include the use of machine learning algorithms to analyze satellite imagery and soil sensor data to generate precise variable rate prescriptions (VRT) for Liquid Boron application, ensuring maximum efficacy and minimizing waste. Concerns often focus on data privacy, the cost of implementing AI-driven precision agriculture hardware, and the reliability of predictive models in highly diverse microclimates. Expectations center on AI enabling demand forecasting with unprecedented accuracy, leading to reduced inventory holding costs for manufacturers and streamlined logistics for large-scale distributors.

The deployment of advanced AI and IoT sensors allows for real-time monitoring of crop health and nutrient uptake, enabling adaptive dosing strategies. For Liquid Boron manufacturers, this translates into developing products optimized for these digital application platforms. AI models can correlate factors such as soil moisture, temperature, pH levels, and historical crop performance to dynamically adjust the concentration of liquid boron needed, moving beyond static, generalized application recommendations. This predictive analytics capability not only improves yield but also strengthens the environmental profile of the product by reducing over-application and potential runoff.

Furthermore, AI-driven market analysis assists companies in identifying critical supply chain vulnerabilities, optimizing manufacturing schedules based on predicted regional agricultural cycles, and managing logistical bottlenecks related to the transport of concentrated liquid solutions. This enhancement in operational efficiency leads to lower costs and higher reliability, ultimately supporting better market penetration. The ability of AI to rapidly process vast datasets related to crop genetics and soil chemistry will expedite the development and validation of new, highly efficient liquid boron formulations.

- AI-driven Variable Rate Technology (VRT) optimizes precise liquid boron application, reducing input costs.

- Machine learning models enhance predictive accuracy for localized soil boron deficiencies.

- IoT sensor integration allows real-time monitoring of boron uptake and crop response.

- AI algorithms improve supply chain forecasting, minimizing inventory and logistics expenses for manufacturers.

- Automated quality control systems utilize AI for rapid testing of liquid boron formulation purity and stability.

- Robotics and autonomous vehicles, guided by AI, facilitate uniform and timely field application of liquid fertilizers.

DRO & Impact Forces Of Liquid Boron Market

The Liquid Boron Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), significantly influencing its growth trajectory. The primary Driver is the global mandate for increased food security coupled with the increasing prevalence of boron-deficient soils worldwide, compelling farmers to adopt high-efficiency micronutrient inputs. Opportunities are largely concentrated in developing advanced nano-formulations and sustainable, bio-based chelates that offer enhanced environmental compatibility and superior plant absorption. However, the market faces significant Restraints, including the stringent regulatory environment surrounding fertilizer registration and use, and the potential for boron toxicity if application rates are improperly managed, requiring meticulous education and precise product formulation by industry stakeholders. The cumulative impact of these forces shapes investment decisions, product innovation cycles, and overall market stability, pointing towards a necessity for technologically sophisticated and regulatory-compliant solutions.

Impact forces stemming from technological advancements play a pivotal role. The rapid integration of precision agriculture technologies, such as drones, remote sensing, and centralized farm management software, acts as a powerful accelerating force, as these systems are inherently optimized for handling and applying liquid inputs. Conversely, volatile raw material pricing, particularly for boric acid, introduces a significant restraining force, impacting the cost of manufacturing and the final price paid by end-users. Regulatory pressures, especially in developed markets, favoring reduced chemical runoff and environmental footprint, necessitate continuous innovation in product formulation to maintain market access. Manufacturers must strategically navigate these forces by investing in sustainable sourcing and high-efficiency formulations that provide superior environmental and economic benefits to secure long-term market competitiveness.

Segmentation Analysis

The Liquid Boron Market is broadly segmented based on Application, Type, and End-Use, providing granular insights into demand patterns across different sectors. The categorization by Application, primarily focusing on foliar spray and soil application (fertigation), reveals the preference for instantaneous nutrient correction methods over slower, traditional soil amendment techniques. Segmentation by Type differentiates between various chemical compounds such as Soluble Borates, Boric Acid derivatives, and Chelated Boron, reflecting the industry's shift towards high-performance chelated products offering improved stability and utilization rates in diverse pH conditions. Analyzing the market through End-Use segments, which include Agriculture, Industrial (e.g., Ceramics, Glass), and Pharmaceuticals, confirms the agricultural sector’s dominant consumption, while industrial segments provide niche, high-value, and consistent demand profiles.

- By Application:

- Foliar Application

- Soil Application (Fertigation/Drip Irrigation)

- By Type:

- Boric Acid-based Solutions

- Sodium Borate Solutions

- Chelated Liquid Boron

- Boron Ethanolamine Solutions

- By End-Use Industry:

- Agriculture (Cereals, Fruits & Vegetables, Oilseeds & Pulses, Turf & Ornamentals)

- Industrial (Ceramics, Glass & Fiberglass, Adhesives & Sealants)

- Pharmaceuticals and Cosmetics

- Chemical Manufacturing

Value Chain Analysis For Liquid Boron Market

The Liquid Boron Value Chain initiates with the Upstream analysis, focusing on the mining and refining of boron-containing ores, primarily colemanite and tincal, which are then processed into intermediate chemicals like boric acid or refined borax. This stage is highly capital-intensive and geographically concentrated, with a few major global players controlling the bulk of raw material supply, impacting pricing and market stability. Midstream activities involve the chemical formulation—converting raw boric acid or sodium borates into stable, concentrated liquid solutions, often incorporating chelating agents (e.g., EDTA, lignosulfonates) to enhance solubility and plant uptake. Formulation requires specialized chemical engineering expertise to ensure compatibility and shelf stability, especially when combined with other nutrients or pesticides.

The Downstream segment encompasses the distribution and sales network, which is critical for reaching the dispersed end-user base, particularly farmers. Distribution channels are bifurcated into Direct and Indirect models. Direct sales involve manufacturers supplying large agricultural cooperatives or key industrial consumers (e.g., major glass manufacturers). Indirect channels rely heavily on regional distributors, agricultural retailers, and specialized agronomist consultants who provide technical advice and small-scale product delivery to individual farmers. The complexity of the agricultural segment demands strong technical support in the downstream phase to ensure proper product usage and prevent boron toxicity issues in the field.

Efficient logistics are paramount due to the liquid nature and concentration levels, requiring specialized packaging and transport protocols. The indirect distribution network often necessitates strategic warehousing to manage seasonal demand peaks associated with planting and flowering cycles. Value addition occurs significantly at the formulation stage through advanced chelation technology and at the final distribution point through agronomic services and localized product customization. The integrity of the value chain relies heavily on maintaining rigorous quality control from raw ore extraction to the final application, ensuring compliance with global fertilizer standards and maximizing product efficacy for end-users.

Liquid Boron Market Potential Customers

The primary customer base for Liquid Boron is vast and diversified, predominantly centered around the agricultural sector. End-users in agriculture include large-scale commercial farm operations, high-tech greenhouse enterprises, small and medium-sized farming businesses, and regional agricultural cooperatives. These buyers utilize liquid boron solutions to correct localized soil deficiencies, implement preventive nutrient management programs, and boost the yield and quality of high-value crops such as grapes, almonds, citrus fruits, and cotton. Their purchasing decisions are highly influenced by agronomic efficacy data, product compatibility with existing irrigation infrastructure, and total cost of application, prioritizing formulations that offer the highest bioavailability and ease of use.

Beyond farming, a significant group of potential customers resides within the chemical and industrial manufacturing sectors. This includes major producers of fiberglass and high-performance glass (where boron acts as a fluxing agent, increasing heat resistance and mechanical strength), ceramic manufacturers (where it enhances glazes and improves firing properties), and producers of specialty adhesives and fire retardants. For these industrial buyers, product specifications such as purity, solubility, and stable concentration are paramount, and they often engage in long-term supply contracts directly with liquid boron formulators or upstream chemical producers to ensure a reliable supply of technical-grade solutions.

Furthermore, fertilizer compounders and blenders represent crucial intermediary customers. These companies purchase concentrated liquid boron solutions to integrate them into complex NPK (Nitrogen, Phosphorus, Potassium) liquid fertilizer blends, creating customized, multi-nutrient products tailored for specific crop requirements. The demand from these intermediaries is driven by the need for highly miscible and chemically stable boron sources that will not precipitate out of solution when mixed with other macro- and micro-nutrients, demanding superior formulation quality from suppliers. Thus, the customer landscape requires specialized sales and marketing approaches addressing technical specifications for industrial use and agronomic effectiveness for agricultural use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 980.5 Million |

| Market Forecast in 2033 | USD 1,550.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Mosaic Company, Compass Minerals, BASF SE, Yara International ASA, Akzo Nobel N.V., Syngenta AG, Kothari Group, Valagro S.p.A., SQM S.A., Borax Corporation, U.S. Borax Inc., Eti Maden, Nutrien Ltd., Haifa Group, Lallemand Inc., Brandt Consolidated, Inc., Sapec Agro Business, Coromandel International Limited, Agrium Advanced Technologies, EuroChem Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Boron Market Key Technology Landscape

The technological landscape of the Liquid Boron market is primarily focused on enhancing the bioavailability, stability, and application efficiency of the nutrient. A dominant trend is the use of advanced chelation technology, where boron ions are complexed with organic molecules such as ethanolamine, lignosulfonates, or polyols. This chelation process prevents the boron from reacting with antagonistic elements in the soil, such as calcium, and stabilizes the solution across various pH ranges, thereby drastically improving its uptake efficiency when applied via foliar or fertigation methods. Manufacturers continually invest in synthesizing novel, biodegradable chelating agents that offer superior stability compared to traditional synthetic chelates like EDTA, aligning with sustainability goals and regulatory preferences.

Another crucial technological advancement is the development of nano-boron delivery systems. By reducing the particle size of boron compounds to the nanoscale, formulators aim to maximize the surface area, facilitating easier and more rapid absorption through plant cuticles and cell walls, particularly in foliar applications. While still nascent, nano-boron technology holds significant promise for reducing the required application rates while achieving the same or superior physiological effects, addressing the restraint of potential boron toxicity associated with conventional high-concentration applications. Research focuses on creating stable nano-emulsions that prevent particle aggregation and ensure uniform application through standard spraying equipment.

Furthermore, the integration of smart formulation techniques designed for compatibility with complex liquid fertilizer blends is accelerating. This involves developing low-salt-index, high-purity solutions that are chemically inert when mixed with other concentrated macro- and micro-nutrients in commercial tanks. Technological efforts also include improving the shelf life and temperature tolerance of liquid products through sophisticated stabilizing agents, ensuring product efficacy remains consistent even after prolonged storage or exposure to environmental fluctuations during distribution. These technological breakthroughs are essential for meeting the demands of modern, highly efficient precision agriculture systems.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily driven by agricultural intensification and the sheer volume of arable land in China, India, and Southeast Asian countries. Boron deficiency is endemic in many parts of the region due to high rainfall and intensive farming practices, necessitating regular supplementation. Government subsidies and promotional schemes for micronutrient use, especially for high-yield crops like rice, cotton, and oilseeds, strongly propel the demand for readily available liquid formulations.

- North America: The North American market is characterized by high adoption rates of precision agriculture and advanced irrigation systems, making it highly receptive to liquid inputs like Liquid Boron. Demand is stable, focused on high-value crops such as corn, soybeans, and specialty fruits. Manufacturers here prioritize premium, chelated formulations and integration with sophisticated VRT (Variable Rate Technology) platforms to maximize efficacy and regulatory compliance.

- Europe: Europe exhibits moderate, steady growth, heavily influenced by stringent environmental regulations (e.g., EU Green Deal) that emphasize sustainable fertilizer use and minimized nutrient leaching. The focus is on developing highly efficient, low-dosage, and eco-friendly liquid boron products, often leveraging advanced organic chelating agents to ensure high utilization rates and minimal environmental impact, particularly in horticulture and intensive vegetable farming.

- Latin America (LATAM): LATAM presents a rapidly expanding market, especially in Brazil and Argentina, fueled by the massive expansion of soybean, sugar cane, and coffee plantations. Economic growth and the need to improve soil fertility in vast, nutrient-depleted regions drive significant uptake. The logistical advantages and efficiency of liquid products in large-scale mechanized farming operations make them the preferred choice for major agribusinesses across the continent.

- Middle East and Africa (MEA): Growth in MEA is concentrated in regions with large irrigation projects, particularly those focused on increasing food production in arid and semi-arid climates. The reliance on water-efficient fertigation systems in countries like Saudi Arabia, Turkey, and South Africa favors liquid fertilizers. The demand is often tied to large commercial farms and government-backed agricultural initiatives aimed at self-sufficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Boron Market.- The Mosaic Company

- Compass Minerals

- BASF SE

- Yara International ASA

- Akzo Nobel N.V.

- Syngenta AG

- Kothari Group

- Valagro S.p.A.

- SQM S.A.

- Borax Corporation

- U.S. Borax Inc.

- Eti Maden

- Nutrien Ltd.

- Haifa Group

- Lallemand Inc.

- Brandt Consolidated, Inc.

- Sapec Agro Business

- Coromandel International Limited

- Agrium Advanced Technologies

- EuroChem Group

Frequently Asked Questions

Analyze common user questions about the Liquid Boron market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the Liquid Boron Market growth?

The key driver is the globally increasing demand for high-efficiency micronutrient delivery systems necessitated by widespread boron deficiency in agricultural soils, coupled with the rapid adoption of precision farming techniques that optimize liquid fertilizer application via fertigation and foliar sprays for improved crop yields and quality.

Which application method dominates the consumption of Liquid Boron?

Foliar application dominates the consumption segment. This method allows for immediate correction of acute boron deficiencies and ensures high nutrient utilization efficiency by delivering the boron directly to the plant foliage during critical growth stages, such as flowering and fruit setting.

How does chelation technology enhance the effectiveness of Liquid Boron?

Chelation technology binds the boron ion with an organic ligand (e.g., ethanolamine or polyol), preventing the boron from precipitating or reacting with other soil elements. This process increases the solubility and stability of the liquid formulation, significantly boosting the bioavailability and uptake rate of boron by the plant roots or leaves across varying soil pH conditions.

What are the main industrial applications of Liquid Boron?

The main industrial applications include the manufacturing of high-performance specialty glass and fiberglass, where boron acts as a fluxing agent and improves heat resistance, and in the production of ceramics, enamels, specialized adhesives, and chemical intermediates requiring high purity and specific thermal properties.

What are the key risks associated with using Liquid Boron fertilizers?

The primary risk is boron toxicity, which can severely damage crops if the liquid application rates are inaccurately calculated or unevenly applied. This necessitates strict adherence to agronomic guidelines and the use of precision application technologies to ensure accurate dosing and prevent phytotoxicity in sensitive crops.

How do regulatory policies affect the Liquid Boron market?

Regulatory policies, particularly in mature markets like Europe, impose stringent limits on fertilizer composition and environmental impact. These regulations push manufacturers toward developing low-salt, highly concentrated, and environmentally friendly liquid formulations utilizing biodegradable chelating agents, significantly influencing product innovation and market entry strategies.

Why is the Asia Pacific region the leading market for Liquid Boron?

The Asia Pacific region leads the market due to its extensive agricultural land base, high population pressure driving demand for increased yields, widespread issue of soil micronutrient depletion, and supportive governmental initiatives in major economies like China and India promoting efficient fertilizer use in intensive farming systems.

What role does the Boron Ethanolamine segment play in the market?

Boron Ethanolamine is a dominant product type because it offers superior chemical stability and excellent compatibility when mixed with other agrochemicals. Its high water solubility and neutral pH make it a preferred choice for liquid fertilizer blending and effective foliar spray applications, leading to high consumer acceptance.

How are advancements in technology shaping the future of Liquid Boron delivery?

Technology is moving towards nano-boron delivery systems and encapsulated formulations designed for controlled release. These advancements aim to reduce the total amount of boron required, increase cellular absorption rates, and provide prolonged nutrient availability, thereby maximizing efficacy while minimizing environmental risks and application costs.

Who are the major upstream suppliers in the Liquid Boron value chain?

Major upstream suppliers include large mining and chemical companies like Eti Maden and U.S. Borax Inc., which control the extraction and initial refinement of boron ores (tincal and colemanite). Their output dictates the raw material costs and overall supply stability for the downstream liquid formulators.

What differentiates Liquid Boron from granular Boron fertilizers?

Liquid Boron offers superior homogeneity, ease of handling, and immediate nutrient availability compared to granular forms. It integrates seamlessly into fertigation and foliar application systems, providing precise and rapid nutrient correction, whereas granular boron requires soil moisture and time to dissolve and become plant-available, leading to variable uptake rates.

How does the volatile pricing of raw materials impact the market?

Volatile raw material pricing, primarily for upstream boric acid and refined borax, introduces significant cost uncertainty for liquid boron manufacturers. This volatility can compress profit margins and necessitate dynamic pricing strategies, potentially transferring higher costs to the end-users during periods of peak agricultural demand.

Which crops are major consumers of Liquid Boron solutions?

Major consumers include high-value and boron-sensitive crops such as fruits (e.g., grapes, apples, citrus), vegetables (e.g., tomatoes, potatoes), oilseeds (e.g., canola, sunflower), and specialty crops like cotton and almonds, where boron deficiency severely impairs pollination and fruit development.

What is the role of Liquid Boron in Biofortification?

Liquid Boron is used in biofortification programs to increase the boron content in edible parts of food crops. Proper boron fertilization improves human and animal nutrition by ensuring the essential micronutrient is present in sufficient levels in harvested grains and vegetables, addressing public health issues related to micronutrient deficiencies.

How does Liquid Boron production address sustainability concerns?

Sustainability is addressed through the development of highly concentrated formulas that reduce transportation energy needs and by employing eco-friendly delivery systems, such as biodegradable chelating agents. The high efficiency of liquid application minimizes nutrient waste and environmental runoff compared to less efficient soil treatments.

What is the market outlook for Chelated Liquid Boron?

The market outlook for Chelated Liquid Boron is exceptionally positive. Driven by the need for enhanced efficacy in complex soil environments and compatibility with modern farming equipment, the chelated segment is projected to grow faster than standard formulations, commanding a premium price due to its superior bioavailability and stability features.

Which type of distribution channel is most critical for reaching small-scale farmers?

The indirect distribution channel, relying on regional distributors, agricultural retailers, and local cooperatives, is most critical for reaching small-scale farmers. These intermediaries provide essential localized product access, agronomic consultation services, and credit facilities necessary for broader market penetration in developing regions.

How does the industrial demand for Liquid Boron differ from agricultural demand?

Industrial demand is generally steady, volume-based, and highly sensitive to technical specifications like purity and concentration for use in fixed manufacturing processes (e.g., glass making). Agricultural demand is highly seasonal, geographically dispersed, and focused on agronomic efficacy and compatibility with fluctuating environmental conditions.

What impact does the growth of protected cultivation (greenhouses) have on demand?

The growth of protected cultivation significantly boosts Liquid Boron demand because greenhouses almost exclusively utilize highly controlled fertigation systems. Liquid fertilizers are essential for these closed systems, allowing growers to precisely manage nutrient levels and maximize yield quality and cycles year-round.

Is there a trend toward utilizing Liquid Boron in organic farming?

Yes, there is a moderate trend. While conventional boric acid derivatives are generally restricted, the market is seeing the emergence of specific boron compounds derived from natural minerals or complexed with organic substances that comply with various organic certification standards, driven by increasing consumer preference for organic produce globally.

How does climate change influence the Liquid Boron market?

Climate change, leading to increased extreme weather events and altered precipitation patterns, exacerbates soil nutrient loss (including boron leaching). This heightened vulnerability compels farmers to rely more heavily on fast-acting, efficient liquid micronutrient inputs to stabilize yields in unpredictable growing environments, thereby increasing market demand.

What is the typical shelf life of commercial Liquid Boron products?

The typical shelf life for high-quality, stabilized Liquid Boron formulations ranges from 24 to 36 months when stored under recommended conditions (cool, dry environment). Formulators invest in stabilizing agents to prevent crystallization or chemical breakdown, ensuring product integrity throughout the distribution and usage period.

Are there substitutes for Liquid Boron in the agriculture sector?

The primary substitute is granular boron (e.g., granular borax). However, due to its low solubility and variable availability, its substitution is limited in precision agriculture, where high efficacy and uniform application are paramount. Alternative micronutrient sources do not generally substitute for boron, which is uniquely essential for cell wall formation and sugar transport.

What is the role of technical consultation in the Liquid Boron market?

Technical consultation is critical, especially in the agricultural segment. Agronomists provide essential services related to soil testing, diagnosis of boron deficiency symptoms, and prescription of the correct liquid boron formulation and application rate, which is vital for preventing toxicity and maximizing the economic return on fertilizer investment for the farmer.

How do leading companies achieve a competitive advantage in this market?

Leading companies gain competitive advantage through continuous innovation in formulation (especially high-efficacy chelated and nano-boron products), securing stable and cost-effective raw material supply through vertical integration, and building extensive technical support networks to educate end-users on safe and optimal application practices globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager