Liquid Candy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432561 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Liquid Candy Market Size

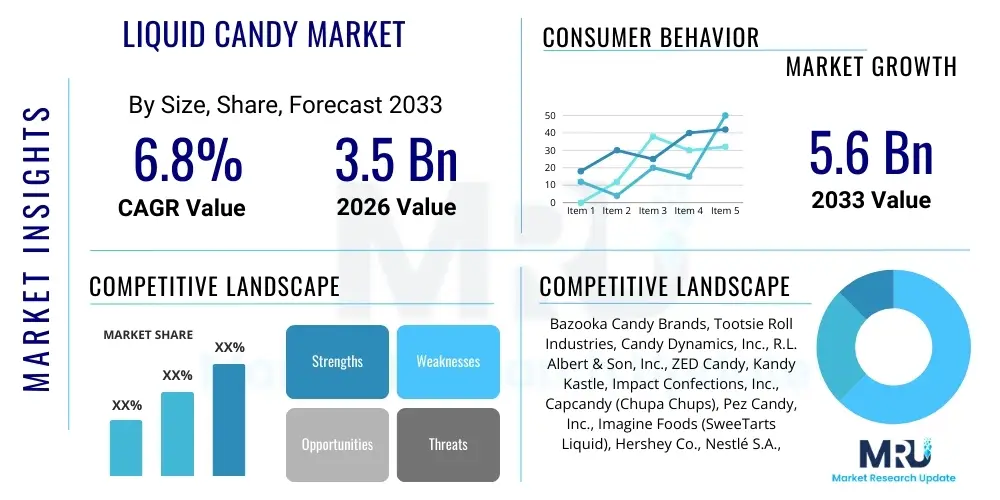

The Liquid Candy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily attributed to evolving consumer preferences favoring novelty confectionery products, coupled with significant innovation in flavor profiles, packaging designs, and delivery systems, particularly those targeting the youth demographic and seasonal consumption trends.

Liquid Candy Market introduction

The Liquid Candy Market encompasses a diverse range of confectionery products delivered in liquid, gel, or semi-liquid forms, often characterized by innovative, playful packaging such as spray bottles, pens, dipping sticks, or tubes. These products are fundamentally defined by their high novelty factor, intense flavor delivery, and interactive consumption experience, distinguishing them from traditional solid candies. Major applications span impulsive snack consumption, entertainment products for children, and increasingly, as components in cocktail mixers or dessert toppings, reflecting diversification beyond conventional confectionery aisles.

The primary benefits driving the market include convenience, unique sensory experiences, and strong emotional appeal, especially among younger consumers who seek exciting and interactive food experiences. Product innovation frequently focuses on sourness levels, vibrant colors, and thematic packaging tied to popular culture or media. Key driving factors accelerating market expansion involve rapid urbanization globally, increased disposable incomes in emerging economies, aggressive marketing by leading confectioners emphasizing seasonal and limited-edition releases, and advancements in food technology that improve shelf stability and ingredient integration without compromising sensory qualities.

Furthermore, the shift towards customizable and personalized food experiences has subtly influenced the liquid candy sector, encouraging manufacturers to introduce products where flavor intensity or mix-ins can be controlled by the consumer. This focus on engagement ensures sustained interest, positioning liquid candies not just as a treat but as a form of playful indulgence, thereby cementing their role within the broader novelty food and snack industries.

Liquid Candy Market Executive Summary

The Liquid Candy Market is undergoing a transformation driven by global business trends focused on premiumization and experiential branding, particularly in mature markets like North America and Europe where novelty and health-conscious formulations (such as natural coloring and reduced sugar options) are gaining traction. Regional trends indicate Asia Pacific leading in consumption volume, fueled by high population density and cultural acceptance of brightly colored, uniquely textured snacks, while Latin America is emerging as a critical growth hub due to increasing discretionary spending and a youthful demographic eager for new product experiences. Competitive intensity remains high, necessitating constant innovation in packaging, flavor profiles, and distribution channels to maintain market share against both established confectionery giants and localized niche players.

Segment trends highlight the dominance of the Spray/Squeeze segment, valued for its immediate consumption appeal and portability, though the Dipping Sticks and Gel Pens segments are showing above-average growth rates, appealing to consumers looking for extended enjoyment and interactive elements. Furthermore, the segmentation by distribution channel emphasizes the crucial role of convenience stores and hypermarkets, yet the growing influence of e-commerce platforms is providing new avenues for manufacturers to reach specialized consumer segments and launch direct-to-consumer limited editions. Ingredient segmentation is increasingly important, with a noticeable shift toward natural fruit flavors and away from artificial additives, especially in products marketed towards parents concerned with children's nutrition.

Overall, the market is characterized by short product lifecycles demanding responsive supply chain management and proactive trend forecasting. Successful market players are those who can swiftly introduce products that capture viral trends, maintain cost efficiencies in mass production, and effectively navigate complex regulatory environments related to food safety, coloring agents, and sugar content across diverse international markets. Strategic partnerships with entertainment brands (licensing agreements) represent a crucial tactic for driving visibility and impulse purchases globally, thereby ensuring sustained commercial relevance in a highly fragmented and dynamic industry landscape.

AI Impact Analysis on Liquid Candy Market

Common user questions regarding AI's impact on the Liquid Candy Market predominantly revolve around optimizing formulation complexity, predicting viral flavor trends, and enhancing supply chain efficiency in impulse purchasing environments. Users frequently inquire about how AI can assist in reducing product waste associated with short shelf-life novelty items, improving quality control in high-speed filling processes, and personalizing marketing campaigns to target narrow demographic niches based on real-time social media consumption data. Concerns often focus on the required investment in AI infrastructure, data privacy related to consumer purchase patterns, and the potential displacement of human roles in traditional flavor development and retail analytics.

The central themes emerging from this analysis include the expectation that AI will primarily revolutionize product development through predictive analytics—determining which unique combinations of sourness, sweetness, and texture will resonate most strongly with target groups before market launch. There is significant interest in using machine learning algorithms to optimize packaging materials and structural integrity, reducing leakage issues prevalent in liquid formats, thereby enhancing product reliability. Moreover, the implementation of AI-driven demand forecasting is expected to stabilize inventories across fast-moving consumer goods (FMCG) retailers, ensuring that seasonal and trend-driven products are available during peak demand cycles without resulting in burdensome post-season surplus.

Ultimately, users anticipate that AI will transition the Liquid Candy market from being purely reactive to trends to becoming proactively adaptive, using large datasets of regional consumption habits, weather patterns, and social media sentiment to guide flavor innovation and marketing spend. This shift promises higher precision in product launches, reduced time-to-market for novelty items, and a more sustainable operational footprint by minimizing material and inventory waste, fundamentally transforming competitive strategies within this highly impulse-driven sector.

- AI optimizes flavor formulation by analyzing consumer sensory data and ingredient interactions, reducing R&D cycles.

- Machine learning algorithms predict regional trends and demand spikes, leading to optimized inventory management and reduced stockouts.

- Robotics and computer vision systems enhance quality control for packaging integrity and precise liquid filling, minimizing leakage defects.

- AI-driven marketing personalization targets specific demographics with tailored advertisements based on consumption history and real-time behavioral data.

- Predictive maintenance for high-speed manufacturing lines reduces downtime associated with complex liquid processing equipment.

- Natural Language Processing (NLP) rapidly analyzes consumer feedback from social media platforms to identify emerging dissatisfaction or high praise related to new products.

DRO & Impact Forces Of Liquid Candy Market

The Liquid Candy Market is propelled by powerful drivers such as rapid product innovation centered on novelty and interactivity, significant marketing investments targeting children and adolescents through licensed characters and social media campaigns, and the inherent convenience and portability of liquid formats conducive to impulsive purchases. Restraints primarily involve increasing regulatory scrutiny over high sugar content and artificial ingredients, particularly in Western markets, leading to public health campaigns that discourage consumption. Operational challenges, specifically leakage and spoilage concerns associated with liquid packaging, also impose limitations on geographical expansion and shelf life. However, these challenges simultaneously pave the way for opportunities through the development of low-sugar or natural alternatives and the adoption of advanced, leak-proof packaging technologies.

Opportunities are abundant in emerging markets where disposable income growth directly translates to higher expenditure on non-essential confectionery items, coupled with the potential for premiumization through fortified liquid candies incorporating vitamins or functional ingredients appealing to health-conscious parents. Furthermore, expanding distribution capabilities in untapped rural and semi-urban areas using decentralized logistics models presents significant market penetration opportunities. The competitive landscape is intensely influenced by impact forces such as strong supplier bargaining power for specialized packaging materials and flavors, while buyer power remains moderate due to the low switching costs inherent in the impulse purchase category. The threat of substitutes is high, coming from traditional solid candies, gums, and other novelty snacks, forcing manufacturers to continuously raise the experiential value of their liquid offerings.

In essence, the market momentum is driven by consumer demand for sensory excitement and rapid gratification, constantly challenging manufacturers to balance highly appealing, often sugar-rich formulations with growing governmental and consumer pressure for healthier alternatives. Navigating this dichotomy requires sophisticated R&D capabilities and strategic market positioning, leveraging the unique format of liquid delivery to introduce functional benefits or utilize natural, plant-derived sweetening agents to mitigate regulatory risks and address evolving health perceptions without sacrificing the core novelty appeal of the product.

Segmentation Analysis

The Liquid Candy Market is broadly segmented based on product type, flavor, distribution channel, ingredient, and end-user. This structural categorization allows manufacturers to precisely target specific consumer groups and tailor marketing strategies based on purchase drivers. Product type segmentation, including sprays, squeezes, dipping sticks, and droppers, dictates the level of interactivity and consumption method, directly influencing target age groups. Flavor segmentation remains critical, with perennial favorites like cherry, blue raspberry, and sour apple driving core sales, while niche and tropical flavors cater to trend-sensitive consumers and regional tastes. Ingredient analysis increasingly focuses on the dichotomy between artificial coloring/sweeteners and their natural counterparts, reflecting the growing polarization between novelty and health attributes in consumer choice.

- By Product Type:

- Sprays/Squeezes

- Dipping Sticks

- Gel Pens/Tubes

- Droppers/Bottles

- By Flavor:

- Fruity (Berry, Citrus, Tropical)

- Sour

- Sweet

- Spicy/Novelty

- By Ingredient:

- Natural Ingredients (Natural Flavors, Natural Colors)

- Artificial Ingredients (Artificial Flavors, Artificial Colors)

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail (E-commerce)

- Specialty Stores/Confectionery Shops

- By End-User:

- Children (Ages 4-12)

- Teenagers (Ages 13-18)

- Adults (Novelty, Cocktails, Desserts)

Value Chain Analysis For Liquid Candy Market

The Liquid Candy market value chain initiates with upstream activities involving the sourcing of raw materials, primarily specialized flavorings (natural and synthetic), high-intensity sweeteners, coloring agents, and specific packaging components such as small plastic bottles, spray mechanisms, and custom-molded plastic tubes. Key challenges in this phase include maintaining consistent quality of high-purity ingredients and securing reliable suppliers for innovative, leak-proof packaging solutions that are fundamental to product integrity. Manufacturers must also invest heavily in blending and formulation R&D to ensure liquid stability and consistent texture, a process significantly more complex than producing solid confectionery.

Midstream activities center on manufacturing and packaging, involving specialized high-speed filling machinery capable of handling viscous liquids and gels with precise dosing. This stage is crucial for managing quality control, as packaging defects (leaks, seal failures) can lead to mass product recalls and significant financial losses. Downstream activities focus on distribution, predominantly leveraging established FMCG supply chains. Liquid candies rely heavily on dense, wide distribution networks, utilizing both direct sales teams contacting large retailers and indirect distribution through wholesalers and specialized confectionary distributors who facilitate access to smaller convenience stores and impulse-purchase locations.

The distribution channel split is heavily weighted towards physical retail—specifically convenience stores and hypermarkets—which capitalize on impulse buying. E-commerce, while growing rapidly, serves mainly for bulk purchases, gift packages, and accessing limited-edition novelty items not readily available in physical stores. Effective value chain management in this sector demands rapid response capabilities to market trends, efficient logistics to minimize damage during transit, and stringent inventory management to handle the seasonality and short shelf life typical of many liquid candy products, optimizing the flow from raw ingredient to the point of purchase.

Liquid Candy Market Potential Customers

The primary end-users and buyers of liquid candy products are fundamentally segmented into three main groups: children, teenagers, and, increasingly, adults seeking novelty or specialized ingredients. The core market, children aged 4 to 12, are driven purely by novelty, fun, vibrant colors, and intense sweet or sour flavors, with purchasing decisions often heavily influenced by packaging themes tied to popular media, character licensing, and playground trends. Parents act as the purchasing gatekeepers for this segment, driving demand for reduced-sugar or naturally colored variants, forcing manufacturers to dual-target both the child's desire and the parent's health concern.

Teenagers (13-18) constitute the second crucial segment, focusing on extreme flavor profiles (ultra-sour, spicy, or unusual blends) and social sharing appeal, often influenced by viral social media challenges and trends. This segment drives demand for innovative formats like spray candies used as props or interactive elements. Adult consumers represent a growing niche, utilizing liquid candies not only as nostalgic treats but also incorporating high-end, uniquely flavored liquid gels as dessert components, cocktail garnishes, or flavor enhancers, expanding the product's application beyond traditional snacking and into specialized food service channels and novelty gift markets.

The purchasing behavior across these segments is highly impulsive. Therefore, optimizing point-of-sale visibility, placing products near checkout counters in convenience stores, and leveraging online platforms for targeted advertising are paramount strategies. Potential buyers across all segments value convenience, portability, and the immediate gratification offered by the product's easy-to-consume liquid format, ensuring strong sales velocity when products are effectively merchandised and strategically priced for impulse purchase appeal.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bazooka Candy Brands, Tootsie Roll Industries, Candy Dynamics, Inc., R.L. Albert & Son, Inc., ZED Candy, Kandy Kastle, Impact Confections, Inc., Capcandy (Chupa Chups), Pez Candy, Inc., Imagine Foods (SweeTarts Liquid), Hershey Co., Nestlé S.A., Haribo GmbH & Co. KG, Jelly Belly Candy Company, Fini Golosinas Internacional S.L., Wonka (Liquid), Boston America Corp., PIM Brands Inc., Au'some Snacks & Candies, Mega Pops. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Candy Market Key Technology Landscape

The technology landscape for the Liquid Candy market is predominantly focused on advanced packaging, high-speed aseptic or semi-aseptic filling systems, and specialized flavor encapsulation techniques designed to maintain flavor integrity over extended periods. High-speed Rotary and In-line Fillers equipped with precise volumetric dosing mechanisms are essential for handling the varying viscosities of liquid and gel formulations while minimizing spillage and ensuring consistent product volume in small, often irregularly shaped containers. Leak-proof sealing technology, including induction sealing and ultrasonic welding for plastic components, is paramount to mitigating the high risk of product damage during distribution, which is a key technical challenge unique to the liquid confectionery segment.

Furthermore, ingredient technology plays a vital role, particularly concerning the integration of high-intensity natural sweeteners (like Stevia or Monk fruit) and natural coloring agents that must remain stable and vibrant within a low-pH liquid environment. Manufacturers increasingly utilize microencapsulation techniques to protect sensitive ingredients, such as natural flavors and functional additives (e.g., vitamins), ensuring they are released only upon consumption or under specific conditions, thereby improving both shelf life and sensory experience. The deployment of automated optical inspection systems using advanced sensor technology allows for real-time monitoring of filling levels and package integrity on fast-moving production lines, drastically improving quality assurance standards and compliance with global food safety regulations.

Beyond the manufacturing floor, digital technology is influencing market reach. E-commerce platforms and sophisticated digital inventory management systems allow for rapid restocking and dynamic pricing adjustments based on real-time sales velocity, crucial for managing the short, intense sales spikes typical of novelty items. The adoption of sustainable and biodegradable packaging solutions, often involving multilayered barrier films or innovative dispensing mechanisms that reduce plastic usage, represents a significant current focus area in technology investment, driven by consumer demand and regulatory pressures favoring environmental responsibility in the FMCG sector.

Regional Highlights

- North America: North America, particularly the United States, represents a mature but highly innovative market for liquid candy. Consumers here exhibit strong demand for both extreme novelty (super sour or highly unusual flavors) and premium, healthier formulations, driving the proliferation of reduced-sugar, naturally flavored, and organic liquid candy options. The market is characterized by high penetration in convenience store channels and a reliance on intellectual property licensing (movie characters, gaming franchises) to drive impulse purchases. The region serves as a trendsetter for marketing strategies, utilizing viral social media challenges and targeted digital advertising to engage the youthful demographic. The high disposable income ensures that premium novelty products maintain strong pricing power, even amidst competitive pressure.

- Europe: The European market displays heterogeneity, with strong historical confectionery traditions in countries like Germany and the UK. Growth is constrained by stringent regulations regarding artificial colorants (e.g., the EU's requirement for warning labels on certain azo dyes), pushing manufacturers toward natural alternatives faster than other regions. The focus is on smaller, portion-controlled packaging and sustainable sourcing. Western Europe prefers quality and ethical production, while Eastern Europe shows faster volume growth due to increasing retail modernization and rising consumption of convenience snacks, though sensitivity to price remains a critical factor across the continent.

- Asia Pacific (APAC): APAC is the fastest-growing region by volume, dominated by populous countries like China and India, where urbanization and growing middle-class populations fuel demand for Western-style convenience snacks and novelty items. The market benefits from cultural acceptance of vibrant colors and sweet flavors, leading to high consumption rates. Innovation is often tailored to local tastes (e.g., green tea or tropical fruit flavors) and local packaging formats. Distribution channels are rapidly expanding from traditional wet markets to modern hypermarkets and local e-commerce platforms, though logistical challenges in vast geographical areas persist.

- Latin America (LATAM): LATAM presents a high-potential growth market driven by a youthful population and increasing discretionary spending, particularly in Brazil and Mexico. The liquid candy segment aligns well with the local culture's appreciation for intense sweetness and vibrant packaging. While price sensitivity is high, leading to a dominance of value-oriented brands, there is a clear rising trend towards premiumization in urban centers. Local manufacturers often focus on leveraging strong regional brand recognition and efficient local supply chains to compete effectively against international players.

- Middle East and Africa (MEA): This region is characterized by fragmented market development. The Middle East shows moderate growth, heavily influenced by imported premium brands and high standards for food quality compliance. Africa remains nascent, with growth concentrated primarily in urban South Africa and Nigeria, where economic growth supports non-essential impulse purchases. Expansion is linked to the development of organized retail infrastructure, and local manufacturing is slowly increasing to offer more affordable, regionally tailored liquid candy options, often prioritizing long shelf life due to logistical complexities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Candy Market.- Bazooka Candy Brands

- Tootsie Roll Industries

- Candy Dynamics, Inc.

- R.L. Albert & Son, Inc.

- ZED Candy

- Kandy Kastle

- Impact Confections, Inc.

- Capcandy (Chupa Chups)

- Pez Candy, Inc.

- Imagine Foods (SweeTarts Liquid)

- The Hershey Company

- Nestlé S.A.

- Haribo GmbH & Co. KG

- Jelly Belly Candy Company

- Fini Golosinas Internacional S.L.

- Wonka (Liquid Products)

- Boston America Corp.

- PIM Brands Inc.

- Au'some Snacks & Candies

- Mega Pops

Frequently Asked Questions

Analyze common user questions about the Liquid Candy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Liquid Candy Market?

The Liquid Candy Market is projected to exhibit a CAGR of 6.8% between the forecast years of 2026 and 2033. This growth is driven primarily by continuous product innovation, particularly in interactive packaging and novelty flavor profiles, coupled with strong demand from impulsive purchasing behaviors across key global markets.

What are the primary factors restraining growth in the Liquid Candy Market?

Key restraints include increasing governmental and consumer scrutiny regarding high sugar content and the use of artificial colorings, leading to regulatory pressures and public health initiatives discouraging consumption. Operational constraints related to the complexity of liquid packaging, such such as potential leakage and spoilage, also pose significant technical and logistical challenges for manufacturers and distributors globally.

Which product type segment dominates the Liquid Candy Market?

The Sprays/Squeezes product type segment currently holds the dominant market share. This dominance is attributed to their high convenience, immediate consumption appeal, and the interactive nature of their dispensing mechanism, which strongly appeals to the primary target demographic of children and teenagers.

How is the adoption of AI impacting the formulation and production of liquid candies?

AI is significantly impacting the market by enabling predictive analytics for flavor trend forecasting, reducing R&D cycles for new formulations, and optimizing supply chain logistics to match short product lifecycle demand. In production, AI-powered robotics enhance quality control, ensuring precise filling and minimizing packaging defects like leaks essential for maintaining product integrity.

Which geographical region is expected to show the fastest growth in consumption volume?

The Asia Pacific (APAC) region is projected to demonstrate the fastest growth in consumption volume. This accelerated expansion is fueled by rapid urbanization, substantial growth in the middle-class population, increasing disposable incomes, and the modernization of retail and distribution channels across high-density markets like India and China, creating vast new consumer base opportunities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager