Liquid Chemical Shipping Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433055 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Liquid Chemical Shipping Market Size

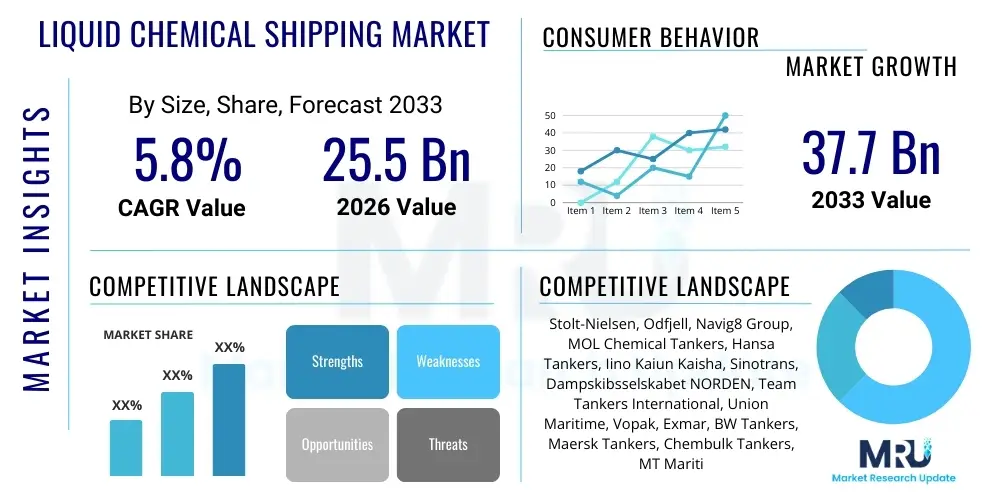

The Liquid Chemical Shipping Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $25.5 Billion USD in 2026 and is projected to reach $37.7 Billion USD by the end of the forecast period in 2033.

Liquid Chemical Shipping Market introduction

The Liquid Chemical Shipping Market encompasses the global transportation of bulk liquid chemicals using specialized tanker vessels, adhering to rigorous safety and environmental standards dictated by international maritime organizations. This critical logistical sector facilitates the movement of thousands of different chemical commodities, ranging from basic petrochemicals (methanol, caustic soda, styrene) to sophisticated specialty chemicals (pharmaceutical intermediates, vegetable oils, and polymers). The robust growth in this market is intrinsically linked to industrialization trends, particularly in Asia Pacific, and the expanding global supply chain complexity, necessitating efficient and safe intercontinental transport solutions for essential manufacturing inputs. Chemical tanker fleets are engineered for specific cargo types, classified based on tank material, coating, and containment systems, ensuring product integrity and preventing contamination or hazardous reactions during transit.

The product description for this market centers around the specialized fleet of chemical tankers, generally categorized by size (from small coastal vessels to large deep-sea tankers) and capability (IMO Type 1, 2, or 3, depending on the hazard level of the cargo they are permitted to carry). Major applications span various end-use industries, including polymers and plastics production, agriculture (fertilizers), textiles, pharmaceuticals, and consumer goods manufacturing. The efficiency and reliability of chemical shipping directly impact global production costs and supply chain resilience for these critical sectors. The specialized design of these vessels, incorporating sophisticated heating, cooling, and pumping systems, ensures that even sensitive cargoes maintain their necessary state throughout long voyages.

Key driving factors accelerating market expansion include the substantial growth in global chemical production capacity, particularly in the Middle East and East Asia, creating long-haul trade routes. Furthermore, the increasing global reliance on specialized and intermediate chemicals, which require dedicated handling and storage solutions, boosts demand for high-specification chemical tankers. The inherent benefits of chemical shipping lie in its economies of scale, allowing for the cost-effective bulk movement of massive quantities of liquids over vast distances, far surpassing the logistical capacity of alternative modes like rail or road for international trade. Regulatory compliance, though a cost factor, also drives quality and safety standards, enhancing the long-term viability and trustworthiness of established market players, thereby consolidating market expertise and investment towards newer, more environmentally compliant fleets.

Liquid Chemical Shipping Market Executive Summary

The Liquid Chemical Shipping Market demonstrates robust growth driven primarily by shifting global chemical manufacturing hubs, heightened focus on digitalization for operational efficiency, and strict environmental compliance mandates necessitating fleet modernization. Business trends indicate a strong move toward consolidation among major carriers to leverage economies of scale and better manage capital expenditure required for sophisticated newbuilds compliant with IMO sulfur limits and greenhouse gas reduction strategies. Investment is heavily concentrated in sophisticated stainless steel tankers, which offer maximum cargo flexibility and command premium freight rates compared to coated vessels, catering to the growing demand for specialty and high-purity chemicals. Supply chain resilience, following recent global disruptions, is a major focus, prompting charterers to seek long-term, reliable partnerships with carriers that exhibit strong safety records and advanced tracking capabilities, emphasizing risk mitigation across complex voyages.

Regional trends highlight the Asia Pacific (APAC) region as the undisputed epicenter of demand growth, fueled by massive industrial expansion, consumer goods production, and the relocation of manufacturing facilities. This region not only consumes vast quantities of imported base chemicals but is also rapidly becoming a significant exporter of refined chemical products, driving intra-Asia trade and long-haul routes connecting the Middle East and North America to Asian ports. In contrast, mature markets like North America and Europe are focusing intensely on regulatory enforcement and technological integration, utilizing advanced logistics software and port infrastructure upgrades to enhance efficiency and reduce emissions. Latin America and the Middle East continue to play critical roles as key supply regions, exporting feedstocks and primary chemicals, benefiting from competitive production costs driven by abundant natural gas resources, thereby anchoring significant global trade flows.

Segment trends reveal that the cargo type segmentation is undergoing significant evolution, with specialty chemicals exhibiting the highest growth rate, surpassing the more cyclical bulk organic chemicals segment. This is attributed to sustained demand across high-value sectors such as agrochemicals and pharmaceuticals, which require highly specialized handling and transportation protocols, driving demand for smaller, more versatile parcel tankers. Vessel size segmentation shows consistent investment in Medium Range (MR) and Handysize tankers, preferred for their versatility in accessing diverse ports and serving complex, multi-port discharge schedules typical in the specialty chemical trades. Furthermore, the operational segmentation is strongly leaning toward advanced coating technologies and dual-fuel propulsion systems (LNG or methanol), as operators strive to future-proof their assets against escalating environmental legislation and increasing bunker costs, viewing sustainability as both a regulatory necessity and a competitive differentiator in attracting high-profile clients.

AI Impact Analysis on Liquid Chemical Shipping Market

Common user questions regarding AI's impact on the Liquid Chemical Shipping Market typically revolve around how artificial intelligence can enhance operational safety, optimize fleet deployment, and predict supply chain disruptions caused by geopolitical or environmental factors. Users are keenly interested in AI’s capability to automate complex scheduling, thereby minimizing port congestion and maximizing vessel utilization, a critical concern given the high capital cost of chemical tankers. Key concerns often center on data security, the reliability of AI-driven navigation systems in high-traffic zones, and the requirement for specialized skill sets to manage and interpret predictive maintenance outputs. Users anticipate that AI will fundamentally transform chartering and pricing models by offering greater transparency and real-time risk assessment, ultimately driving down unnecessary operational costs and improving regulatory reporting accuracy, particularly concerning emissions monitoring.

- AI-driven Predictive Maintenance: Reduces equipment failure rates (pumps, engines, and tank heating systems) through real-time sensor data analysis, minimizing unplanned downtime and associated operational risks.

- Optimized Voyage Planning: Utilizes machine learning algorithms to calculate the most fuel-efficient routes, considering complex variables such as weather, currents, port delays, and specific cargo handling requirements (e.g., maintaining specific temperatures).

- Enhanced Safety and Risk Management: AI analyzes historical incident data and real-time operational parameters to predict potential hazardous conditions, significantly improving crew and cargo safety protocols.

- Automated Chartering and Pricing: Machine learning models forecast freight rates, optimize cargo parcel matching, and automate contract negotiation parameters, leading to faster and more profitable booking decisions.

- Supply Chain Visibility and Traceability: AI integrates data across the logistics chain, offering charterers and owners transparent, real-time tracking of sensitive chemical shipments, ensuring compliance and quality control from loading to discharge.

- Regulatory Compliance Monitoring: Automated tracking and reporting of emissions (e.g., carbon intensity indicators - CII), ballast water management, and port State Control readiness, significantly simplifying burdensome regulatory documentation.

- Port Congestion Prediction: AI algorithms analyze global port operational data to forecast congestion levels, allowing vessels to adjust speeds or routing proactively, saving time and fuel consumption.

DRO & Impact Forces Of Liquid Chemical Shipping Market

The market dynamics of the Liquid Chemical Shipping industry are shaped by a complex interplay of increasing global trade requirements (Drivers), significant capital investment hurdles and regulatory constraints (Restraints), and the transition toward sustainable energy sources and digital integration (Opportunities). The primary driving force remains the sustained growth in global chemical production, driven by industrialization and population growth, particularly demanding bulk movements of basic organics, fertilizers, and specialty intermediates necessary for modern manufacturing. This demand is further amplified by the ongoing shift in chemical manufacturing capacity toward cost-advantaged regions like the Middle East and North America, necessitating long-haul deep-sea shipping to consuming markets in Asia and Europe. The increasing complexity of chemical formulations also necessitates higher quality tankers, acting as a persistent driver for new vessel orders and technological upgrades, thereby stimulating market activity and pushing freight rates for sophisticated tonnage upwards.

Restraints impose structural limitations on the market's expansive potential. Chief among these is the extreme volatility in global energy prices, which directly affects bunker fuel costs, often the largest operational expenditure for shipping lines, making profitability unpredictable despite rising freight rates. Furthermore, the industry is highly capital-intensive; newbuild costs for specialized stainless steel chemical tankers are substantial, presenting significant financial barriers to entry and expansion, particularly for smaller operators. Stringent and ever-evolving environmental regulations, such as the IMO’s Carbon Intensity Indicator (CII) and Energy Efficiency Existing Ship Index (EEXI), mandate costly modifications or accelerated scrapping of older vessels, straining cash flows and occasionally creating short-term capacity shocks. Geopolitical instability in key shipping lanes, such as the Suez Canal and Strait of Hormuz, also represents a major operational restraint, adding risk premiums, security costs, and significant delays.

Opportunities are largely centered around sustainability and digitalization, offering pathways for differentiation and long-term cost savings. The global push toward decarbonization presents a massive opportunity for early movers in adopting alternative fuels (like methanol, ammonia, or LNG) and installing energy-saving devices, aligning with corporate sustainability goals of major chemical producers who prefer environmentally responsible transport partners. Digitalization, especially the deployment of AI, provides an opportunity to optimize performance, enhance predictive maintenance, and automate commercial processes, promising substantial efficiency gains over traditional operations. Moreover, the growth in specialized chemical sectors, like biochemicals and high-ppurity solvents, provides market participants with the chance to diversify their fleet capabilities and secure long-term contracts in resilient, high-margin niches, thereby mitigating exposure to the more cyclical bulk commodity shipping segments.

Segmentation Analysis

The Liquid Chemical Shipping Market is comprehensively segmented based on three primary categories: the type of cargo being transported, which dictates the complexity and requirements of the vessel; the vessel size, influencing trade routes and port access; and the type of material used for the cargo tanks, which determines the chemical compatibility and resistance. Analyzing these segments provides a clear understanding of market dynamics, revealing that the specialty chemicals segment is the fastest growing due to increasing demand from pharmaceutical and high-tech manufacturing, favoring stainless steel tanks and smaller parcel sizes. The interdependence of these segments, where high-value specialty cargoes require specialized stainless steel tanks, drives premium pricing and investment in smaller, flexible Handysize and Intermediate tonnage capable of multi-port discharge schedules necessary for complex supply chains.

- By Cargo Type:

- Bulk Organic Chemicals (e.g., Methanol, Styrene, Benzene)

- Bulk Inorganic Chemicals (e.g., Caustic Soda, Sulfuric Acid)

- Specialty Chemicals (e.g., Solvents, Lubricants, Pharmaceutical Intermediates)

- Vegetable Oils and Fats

- By Vessel Size:

- Small Tankers (less than 10,000 DWT)

- Handysize (10,000 – 39,999 DWT)

- Intermediate/Medium Range (MR) (40,000 – 60,000 DWT)

- Large/Long Range (LR) (60,000 DWT and above)

- By Tank Material:

- Stainless Steel Tanks

- Coated Steel Tanks (e.g., Zinc Silicate, Epoxy)

- By Trade Route:

- Deep-Sea Shipping (Intercontinental)

- Regional and Coastal Shipping (Intra-regional)

Value Chain Analysis For Liquid Chemical Shipping Market

The value chain in the Liquid Chemical Shipping Market is sophisticated, beginning with upstream activities focused on chemical production and the complex infrastructure required for safe storage and loading. Upstream analysis involves the major chemical manufacturers and producers (e.g., petrochemical giants, agricultural chemical companies), who generate the initial bulk liquid cargo. Their location, production capacity, and contractual requirements heavily influence the demand for specific tanker types and trade routes. Furthermore, the construction and financing of specialized chemical tankers form a crucial part of the upstream segment, involving shipyards, marine finance institutions, and technology providers developing highly technical containment and propulsion systems, often driving high capital costs into the market structure. Reliability and safety certifications, issued by classification societies and regulatory bodies, are also integral upstream components that determine the vessel’s utility and market access.

Midstream activities encompass the core transport and logistics function—the actual shipping process. This involves vessel owners and operators (tanker companies), charterers (who hire the vessels), and ship brokers who facilitate transactions. This stage is characterized by high operational complexity, including voyage optimization, risk management, insurance provision, and ensuring strict adherence to IMO regulations (such as MARPOL and the IBC Code). The operational efficiency achieved here, often through route optimization software and sophisticated cargo handling management, directly determines the profitability of the entire shipping leg. Distribution channels are highly structured, predominantly favoring direct contracts between large chemical producers and reputable tanker operators, particularly for long-term carriage of specialized or sensitive products, ensuring consistency and accountability throughout the supply process.

Downstream analysis focuses on the final destination, encompassing port and terminal operations, storage facilities, and the ultimate end-users/buyers of the chemical product. Efficient port infrastructure for handling liquid bulk chemicals, including dedicated jetties and high-capacity loading/unloading systems, is crucial for minimizing turnaround time. The end-users, ranging from plastics manufacturers to pharmaceutical companies, rely on the punctual and contaminant-free delivery of their raw materials. The indirect channel, though less dominant than direct contracts, involves third-party logistics (3PL) providers and freight forwarders who manage fragmented loads or specialized regional distribution, adding layers of consolidation and specialized handling required for smaller volume movements or complex multi-modal transfers post-shipping.

Liquid Chemical Shipping Market Potential Customers

The primary potential customers and end-users of the Liquid Chemical Shipping Market are large-scale industrial entities and multinational corporations that rely heavily on bulk liquid chemicals as primary inputs for their manufacturing processes. This core customer base includes major petrochemical companies requiring transport of monomers, feedstocks, and basic organic chemicals; agricultural conglomerates necessitating the shipment of liquid fertilizers and pesticides; and diversified manufacturing groups involved in textiles and consumer goods. The customer base places an extremely high value on safety records, compliance adherence, and the specific technical capability of the tanker fleet (e.g., stainless steel availability, heating coil efficiency) to handle their unique product requirements without degradation or contamination during transit, making carrier selection a highly scrutinized procurement decision.

A significant segment of the customer base consists of specialty chemical manufacturers, particularly those in the pharmaceutical and high-end electronics sectors, who demand tailored logistical solutions for high-value, sensitive intermediates and solvents. These buyers often require smaller, highly flexible parcel tankers capable of calling at multiple minor ports and maintaining stringent temperature and purity controls. Their procurement focus often shifts away from simple price considerations towards reliability, detailed traceability, and the carrier's demonstrated ability to navigate complex global regulatory environments, ensuring seamless delivery into highly regulated end-markets. Long-term contracts are frequently preferred by these customers to secure reliable capacity and stable pricing in volatile shipping markets, emphasizing partnership over transactional engagements.

Furthermore, major trading houses and commodity brokers constitute a secondary, yet vital, potential customer group, acting as intermediaries between producers and multiple smaller end-users across different geographies. These traders manage the global flow of standardized chemicals, using sophisticated hedging and spot market strategies, and require carriers that offer high operational flexibility and global coverage. Their demand fluctuates based on arbitrage opportunities and regional inventory levels, contributing significantly to the spot market volume within the chemical shipping sector. Ensuring safe handling and adherence to international standards is paramount for all customer types, as chemical spills or product damage can result in catastrophic financial and reputational damage, underscoring the necessity for world-class operational excellence from the shipping service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.5 Billion USD |

| Market Forecast in 2033 | $37.7 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stolt-Nielsen, Odfjell, Navig8 Group, MOL Chemical Tankers, Hansa Tankers, Iino Kaiun Kaisha, Sinotrans, Dampskibsselskabet NORDEN, Team Tankers International, Union Maritime, Vopak, Exmar, BW Tankers, Maersk Tankers, Chembulk Tankers, MT Maritime Management (MTMM), Seatankers Management, Grieg Star, Hapag-Lloyd, Jo Tankers (part of Stolt). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Chemical Shipping Market Key Technology Landscape

The technology landscape in the Liquid Chemical Shipping Market is rapidly evolving, driven primarily by the need for enhanced environmental performance, operational safety, and maximizing fuel efficiency in the face of escalating regulatory pressure. A core technological advancement is the widespread adoption of dual-fuel propulsion systems, specifically engines capable of running on Liquefied Natural Gas (LNG) or being future-proofed for methanol and ammonia. This transition is essential for meeting IMO 2030 and 2050 decarbonization targets and offers a significant competitive advantage in chartering agreements. Furthermore, advanced hull coatings designed to reduce frictional resistance (e.g., silicone-based foul-release coatings) and optimized propeller designs are becoming standard, directly contributing to lower bunker consumption and improved Carbon Intensity Indicator (CII) ratings, crucial metrics for vessel viability in the mid-term future. Investment in these technologies requires significant upfront capital but yields substantial long-term operational cost savings and regulatory compliance assurance.

In terms of operational technology, the market is embracing sophisticated digital platforms for fleet management and cargo surveillance. These systems utilize Integrated Ship Management Software (ISMS) that connects various vessel data points—from engine performance and fuel consumption to tank pressure and temperature monitoring—into a centralized dashboard. Remote monitoring capabilities allow shore-based teams to optimize vessel performance in real-time, intervening to adjust routing or speed based on predictive analytics and weather modeling. This level of digitalization is paramount for handling sensitive chemical cargoes, as it ensures immediate detection and mitigation of potential problems, maintaining cargo integrity and adherence to stringent quality specifications, particularly for high-purity specialty chemicals where even minor deviations are unacceptable. These digital twins of the vessel operation are redefining transparency.

Another crucial technological area involves enhanced safety and handling equipment, specifically related to inerting systems and cargo pump designs. The use of nitrogen generation plants onboard chemical tankers is expanding to ensure optimal tank atmosphere for volatile cargoes, significantly reducing the risk of explosion or combustion during transit and transfer. Furthermore, innovative stainless steel technologies, including advanced welding techniques and material treatments, ensure tanks maintain high resistance to corrosion from aggressive chemical products, extending the lifespan and versatility of the vessel. The integration of sensors for real-time monitoring of tank cleaning processes and residual chemical detection is also becoming standard, satisfying the extremely high cleanliness requirements mandated by shippers of food-grade oils and pharmaceutical intermediates, thereby reducing contamination risks and optimizing vessel turnaround time between different chemical grades.

Regional Highlights

The global Liquid Chemical Shipping Market exhibits distinct regional dynamics, fundamentally shaped by regional chemical production capacity, industrial demand structure, and regulatory environments. Asia Pacific (APAC) is the dominant and fastest-growing region, driven by immense population growth, rapid industrialization, and high levels of infrastructure investment across China, India, and Southeast Asia. APAC serves both as a massive consumer market, importing large volumes of basic petrochemical feedstocks from the Middle East and North America, and increasingly, as a significant exporter of refined chemical products, driving robust intra-regional shipping activity. The sheer volume of manufacturing output in this region creates high demand for consistent, high-capacity chemical shipping services, consolidating its position as the primary market engine, necessitating continuous fleet expansion and modernization focused on regional trade routes.

North America and Europe represent mature markets characterized by higher regulatory scrutiny, advanced port infrastructure, and a strong focus on high-value specialty chemical production and consumption. North America, benefiting from abundant, low-cost shale gas feedstocks, has become a major exporter of basic chemicals (like methanol and ethylene derivatives), creating strong outbound trade lanes, particularly across the Atlantic and Pacific to Asia. European demand is sophisticated, leaning heavily toward specialty chemicals, requiring complex parcel services. Both regions prioritize environmental compliance, driving high charter rates for new, compliant vessels (particularly those utilizing dual-fuel technologies) and accelerating the retirement of older, less efficient tonnage, thereby influencing global vessel supply and quality standards significantly.

The Middle East and Africa (MEA) play a pivotal role as a primary supply hub. The Middle Eastern Gulf States, leveraging low-cost hydrocarbon resources, are world leaders in petrochemical production, driving massive export volumes of bulk inorganic and organic chemicals, which form the backbone of the global deep-sea trade routes to APAC and Europe. Investment in new chemical production plants across Saudi Arabia and Qatar ensures sustained demand for outward bulk shipping capacity. Africa, while a smaller consumer, presents emerging opportunities for coastal and regional distribution of refined fuels and agricultural chemicals, though trade remains complex due to infrastructure limitations and geopolitical stability concerns, necessitating adaptable and robust shipping solutions capable of navigating diverse logistical challenges across numerous smaller ports.

- Asia Pacific (APAC): Dominant market share and highest growth rate; driven by petrochemical expansion in China, industrial demand in India, and strong intra-regional specialty chemical trade. Focus on MR and Handysize stainless steel tankers.

- North America: Major exporter of basic chemicals (petrochemicals) fueled by shale gas; high regulatory standards emphasizing environmental compliance and technologically advanced fleet operations.

- Europe: Mature, high-value market focused on specialty chemicals and pharmaceuticals; stringent decarbonization mandates driving demand for alternative fuel ships and localized coastal distribution networks.

- Middle East: Crucial supply region for global bulk chemicals; anchors major intercontinental trade routes supplying Asia and Europe with essential feedstocks, leading to sustained demand for large-capacity tankers.

- Latin America & Africa (LAMEA): Emerging markets with reliance on imports of refined chemicals and fuels; potential for growth in agricultural chemical shipping, contingent on infrastructure development and economic stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Chemical Shipping Market.- Stolt-Nielsen

- Odfjell

- Navig8 Group

- MOL Chemical Tankers

- Hansa Tankers

- Iino Kaiun Kaisha

- Sinotrans

- Dampskibsselskabet NORDEN

- Team Tankers International

- Union Maritime

- Vopak (Focus on terminal operations, influencing the shipping market)

- Exmar

- BW Tankers

- Maersk Tankers

- Chembulk Tankers

- MT Maritime Management (MTMM)

- Seatankers Management

- Grieg Star

- Hapag-Lloyd (Expanding container liquid bulk logistics influence)

- Jo Tankers (part of Stolt)

Frequently Asked Questions

Analyze common user questions about the Liquid Chemical Shipping market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Liquid Chemical Shipping Market?

The primary driver is the sustained, significant growth in global chemical manufacturing and production, particularly in Asia Pacific and the Middle East, necessitating the long-distance, safe, and cost-effective bulk transport of essential petrochemical feedstocks and specialty chemical intermediates across continents.

How do IMO environmental regulations impact the cost structure of chemical shipping?

IMO regulations (such as CII and EEXI) mandate the adoption of low-sulfur fuels and investment in energy-efficient technologies, significantly increasing both operational costs (due to expensive compliant fuels or technology installation) and capital expenditure for new, modernized vessels, indirectly raising freight rates.

Which segment is experiencing the fastest growth in the Liquid Chemical Shipping Market?

The Specialty Chemicals segment is demonstrating the highest growth rate. This is due to rising global demand from high-value industries like pharmaceuticals, agrochemicals, and electronics, which require smaller, high-specification tankers (often stainless steel) for safe, contamination-free parcel delivery.

What are the typical risks associated with transporting volatile liquid chemicals by sea?

Major risks include cargo contamination, tank corrosion, fire or explosion hazards (due to volatility or flammability), and potential environmental damage from spills. Mitigation requires specialized vessel design (IMO classification), strict operational protocols, and mandatory inerting systems (e.g., nitrogen blankets).

What role does digitalization and AI play in optimizing chemical tanker operations?

Digitalization optimizes operations by utilizing AI for predictive maintenance, resulting in fewer unplanned breakdowns, and sophisticated algorithms for real-time voyage planning, which significantly reduces fuel consumption, enhances scheduling efficiency, and improves overall safety compliance reporting.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager