Liquid Co2 Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436908 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Liquid Co2 Market Size

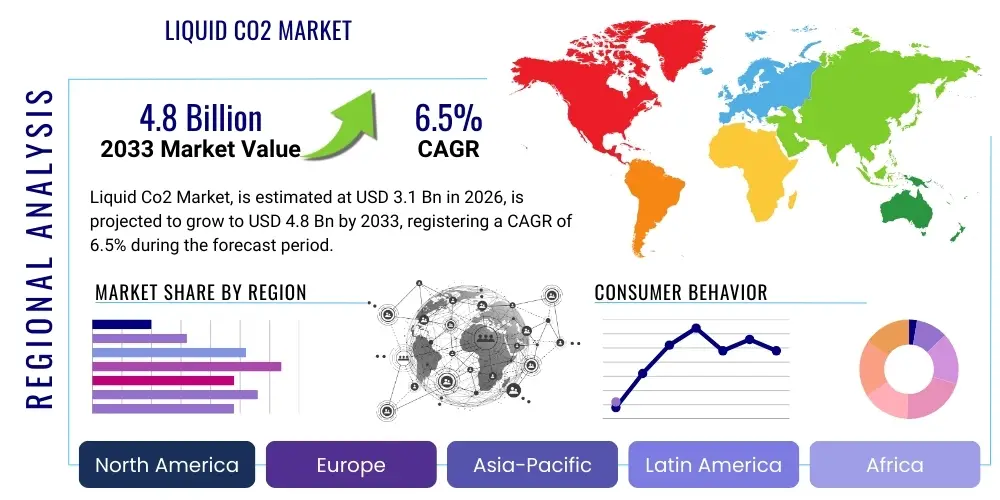

The Liquid Co2 Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.8 Billion by the end of the forecast period in 2033.

Liquid Co2 Market introduction

Liquid Carbon Dioxide (LCO2) is an odorless, colorless gas that is condensed and stored under high pressure at low temperatures. It is characterized by its high purity and ease of transport and storage, making it essential across diverse industrial applications. LCO2 is primarily derived as a byproduct of industrial processes such as hydrogen and ammonia production, ethanol fermentation, and natural gas processing, although direct air capture (DAC) technologies are emerging as supplementary sources. Its physical properties—especially its ability to transition directly from solid (dry ice) to gas (sublimation)—make it invaluable in processes requiring inert atmospheres, precise temperature control, and carbonation.

The product’s versatility spans major sectors including food and beverage, where it is critical for carbonation, preservation, and chilling; industrial manufacturing, where it is used for welding, fire suppression, and inerting; and medical applications, utilized in cryotherapy and laparoscopic surgery. Furthermore, the burgeoning application of LCO2 in enhanced oil recovery (EOR) and carbon capture and storage (CCS) initiatives is fundamentally reshaping market dynamics, positioning it not just as an industrial input but as a critical component of environmental sustainability infrastructure. The high solubility and non-flammable nature of LCO2 contribute significantly to its broad appeal and safety profile in regulated environments.

Key market benefits of LCO2 include efficient cryogenic cooling capabilities, superior quality control in food processing, and crucial contributions to cleaner energy technologies through carbon sequestration. The driving factors behind market expansion are multifaceted, anchored by the consistent demand from the packaged food and beverage sector globally, increasing stringency in food safety regulations necessitating controlled atmospheric storage, and the substantial governmental and private investment flowing into large-scale decarbonization projects requiring reliable LCO2 supply chains. This intersection of industrial necessity and environmental solutions underpins the robust growth trajectory anticipated over the forecast period.

Liquid Co2 Market Executive Summary

The global Liquid CO2 market is experiencing robust expansion, driven primarily by sustained high demand from the food and beverage industry for carbonation and refrigeration, coupled with accelerating adoption in energy and environmental applications, particularly Enhanced Oil Recovery (EOR) and Carbon Capture and Storage (CCS). Current business trends indicate a strong move toward supply chain integration, where major industrial gas producers are strategically investing in large-scale purification and liquefaction plants near high-output industrial sources (like ethanol production facilities) to minimize logistical costs and ensure purity standards. Furthermore, strategic alliances focused on infrastructure development for pipeline transportation of CO2 are becoming common, optimizing the distribution network and reducing reliance on traditional tanker logistics, thereby enhancing efficiency and scalability for environmental projects.

Regionally, North America maintains market leadership, heavily influenced by its mature EOR market and established infrastructure for CO2 pipeline transport, particularly across the Permian Basin. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid industrialization, burgeoning demand for packaged and carbonated beverages among a growing middle class, and increasing governmental mandates supporting industrial decarbonization efforts in countries like China and India. European regional dynamics are distinct, focusing intensely on regulatory compliance and the implementation of large-scale CCS projects aimed at meeting ambitious climate neutrality targets, with significant investments directed towards cross-border CO2 transport networks.

Segment trends reveal that the application of LCO2 in the food and beverage sector remains the largest volume consumer, demanding exceptionally high purity levels. However, the EOR segment is set to generate the most dynamic revenue growth due to fluctuating crude oil prices making enhanced recovery methods economically viable, and regulatory pressures favoring carbon utilization techniques. The purity grade segmentation highlights a noticeable shift toward ultra-high purity LCO2 grades, necessitated by sensitive applications in semiconductor manufacturing and advanced pharmaceutical processes, pushing technological innovation in purification and quality assurance among market players.

AI Impact Analysis on Liquid Co2 Market

User queries regarding AI's influence on the Liquid CO2 market frequently center on optimizing the complex capture, purification, and logistical processes associated with large-volume industrial gases. Users are keenly interested in how Artificial Intelligence can enhance the efficiency of Carbon Capture Utilization and Storage (CCUS) facilities, particularly in predictive maintenance for liquefaction equipment and maximizing yields from byproduct sources. Key themes emerging from these questions involve utilizing AI for real-time monitoring of CO2 purity levels, optimizing transportation routes (especially for cryogenic tanks) to minimize energy consumption and transit time, and developing sophisticated demand forecasting models that can seamlessly integrate highly variable supply (e.g., byproduct CO2 streams) with fluctuating industrial and seasonal demands (e.g., beverage carbonation). Expectations are high that AI will be the pivotal factor in scaling up CCUS infrastructure affordably and safely, ensuring long-term supply stability for critical industrial consumers.

- AI-driven optimization of CO2 capture efficiency and purity refinement processes, reducing energy intensity.

- Implementation of predictive maintenance analytics for high-pressure compressors and liquefaction equipment, minimizing unplanned downtime.

- Advanced logistics and routing algorithms enhancing the efficiency of cryogenic tanker distribution networks.

- Real-time monitoring and control systems for large-scale carbon sequestration sites, ensuring structural integrity and preventing leakage.

- Development of sophisticated demand forecasting models integrating seasonal variation and industrial production cycles for improved supply chain stability.

- AI utilization in simulating and optimizing membrane separation and cryogenic distillation processes for ultra-high purity LCO2 production.

DRO & Impact Forces Of Liquid Co2 Market

The market for Liquid CO2 is influenced by a powerful combination of driving forces related to industrial demand and sustainability imperatives, coupled with significant restraints concerning infrastructure and source variability, creating substantial opportunities for technological innovation. The core driver remains the persistent and increasing demand from the food and beverage industry, where LCO2 is indispensable for preserving freshness and carbonating beverages, an inelastic consumer demand driven by global population growth and urbanization. Simultaneously, regulatory shifts toward climate mitigation, manifesting as carbon taxation and mandated emission reductions, accelerate the adoption of CCUS technologies, establishing LCO2 as a critical commodity for environmental compliance rather than just an industrial input. These two pillars—consumer packaged goods necessity and environmental regulatory urgency—create a resilient demand structure.

However, the market faces inherent restraints, most notably the high capital expenditure required for establishing and maintaining CO2 liquefaction, storage, and specialized transportation infrastructure, particularly in developing economies. The supply of LCO2 is heavily dependent on the output and operational stability of its primary sources (e.g., ammonia, hydrogen, and ethanol plants), meaning that market stability can be vulnerable to shutdowns or changes in feedstock prices in those upstream industries. Furthermore, concerns regarding the safety and perceived risk of large-scale CO2 pipeline transport and subterranean storage, while mitigated by strict standards, still present a societal hurdle that requires ongoing educational and regulatory efforts to overcome and secure public acceptance for widespread CCUS deployment.

These challenges concurrently open up substantial opportunities, particularly in leveraging novel CO2 capture technologies, such as Direct Air Capture (DAC), which promises to decouple LCO2 supply from traditional industrial byproduct streams, offering a cleaner and more diversified supply source. The expanding use of LCO2 in emerging sectors like supercritical fluid extraction (SFE) in pharmaceuticals and cannabis extraction, coupled with innovations in sustainable cooling methods and fire suppression systems, represent high-value, niche growth areas. The most impactful opportunity lies in governmental incentives and tax credits for carbon capture projects, which fundamentally improve the financial viability of large-scale LCO2 supply infrastructure, ensuring sustained future growth and cementing LCO2’s role in the global transition to net-zero emissions.

Segmentation Analysis

The Liquid CO2 market is extensively segmented based on its source of origin, the purity grade required by end-users, and its diverse applications across major industries. Understanding these segments is crucial as they directly dictate the necessary infrastructure for capture, purification, and distribution. While source segmentation helps analyze supply chain stability and geographic concentration, application segmentation reveals key demand drivers, with the food and beverage industry historically dominating volume, and enhanced oil recovery driving significant revenue growth due to scale and utilized volumes. Purity grade categorization reflects the strict quality control standards necessary for specialized markets such as pharmaceuticals and electronics manufacturing.

- By Source:

- Hydrogen Production

- Ammonia Production

- Ethanol Fermentation

- Natural Gas Processing

- Direct Air Capture (DAC)

- By Grade:

- Industrial Grade

- Food Grade

- Medical Grade

- Ultra-High Purity Grade

- By Application:

- Food and Beverage (Carbonation, Freezing, Packaging)

- Enhanced Oil Recovery (EOR)

- Chemicals and Pharmaceuticals

- Metal Fabrication (Welding and Cutting)

- Water Treatment

- Fire Fighting Systems

- Cryogenics and Refrigeration

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Liquid Co2 Market

The Liquid CO2 value chain is inherently complex, starting with the upstream sourcing of CO2 gas, which is typically a byproduct of high-volume industrial processes. Upstream activities are dominated by large chemical and biofuel producers (such as ammonia and ethanol manufacturers) who generate raw, impure CO2 streams. The crucial step here involves the initial separation and collection, followed by purification technologies—including scrubbing and dehydration—to remove contaminants like sulfur compounds and moisture. The efficiency of the upstream sector dictates the cost of the raw material, with highly concentrated and predictable CO2 streams offering the most attractive economics for liquefaction plants, thus emphasizing the importance of securing long-term supply contracts with these industrial emitters.

Midstream activities involve the energy-intensive process of liquefaction, where purified CO2 is compressed and cooled to cryogenic temperatures (-56.6°C at 5.1 atmospheres) to convert it into its liquid form (LCO2). This segment is capital-intensive and requires sophisticated, reliable infrastructure. Following liquefaction, distribution becomes critical; LCO2 is transported via specialized cryogenic tankers (trucks, rail, or ships) for smaller, localized deliveries, or through large-diameter pipelines for continuous, high-volume requirements, particularly serving EOR and major CCS hubs. The distribution channel is characterized by its dual nature: highly optimized direct sales to large industrial customers (e.g., breweries or chemical plants) and indirect sales through vast regional gas distributors who manage smaller accounts and geographically dispersed end-users.

The downstream segment focuses on the storage and ultimate application of the LCO2 by the end-user. This includes maintaining the LCO2 in insulated storage tanks at the client site and ensuring safe delivery through specialized delivery systems for carbonation, inerting, or injection. Direct distribution dominates high-volume, continuous supply contracts (e.g., large industrial facilities and EOR projects), where the supplier directly manages the logistics and tank maintenance. Indirect distribution through regional dealers and resellers serves the fragmented market of smaller users, providing localized inventory management, technical support, and managing the cyclical demand fluctuations common in the food and hospitality sectors. The reliability and safety performance of both direct and indirect delivery methods are paramount to maintaining customer relationships and regulatory compliance.

Liquid Co2 Market Potential Customers

The primary customer base for Liquid CO2 is extraordinarily diverse, spanning nearly every major industrial sector that requires gas for process control, environmental compliance, or product formulation. The largest traditional buyers are within the Food and Beverage industry, comprising major soft drink manufacturers, breweries, fast-food chains utilizing beverage dispensers, and meat processing facilities relying on LCO2 for cryogenic freezing and inert atmosphere packaging to extend shelf life. These consumers prioritize food-grade purity and reliable, just-in-time delivery schedules, viewing LCO2 as a non-negotiable input for product quality and consumer safety.

A rapidly expanding segment of high-volume buyers comes from the Energy sector, specifically companies engaged in Enhanced Oil Recovery (EOR). These operators inject substantial volumes of LCO2 into mature oil reservoirs to increase hydrocarbon yield, often requiring dedicated pipeline infrastructure rather than traditional tanker delivery. Furthermore, large industrial emitters (e.g., cement manufacturers, steel mills, and power generators) pursuing Carbon Capture and Storage (CCS) initiatives represent the fastest-growing and potentially the largest future end-users, shifting the buyer profile from consumer-goods focused to heavy industrial and utility-scale infrastructure clients.

Niche but high-value buyers include pharmaceutical and biotechnology companies utilizing LCO2 for sterile environments, supercritical fluid extraction (SFE) in natural product purification, and medical facilities requiring medical-grade LCO2 for surgical procedures. The semiconductor and electronics manufacturing industries also represent premium customers, demanding ultra-high purity grades of LCO2 for cleaning processes where trace contaminants could compromise sensitive microchips. This diversity of application means that potential customers range from small, independent craft breweries requiring intermittent deliveries to multinational energy corporations needing continuous, million-ton annual supplies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde PLC, Air Liquide S.A., Air Products and Chemicals Inc., Nippon Sanso Holdings Corporation (Taiyo Nippon Sanso), Messer Group GmbH, Continental Carbonic Products Inc., Matheson Tri-Gas Inc., PurityPlus Specialty Gases, Praxair Technology Inc., Gulf Cryo, Reliable Purity Solutions, Sichuan Meifeng Chemical Industry Co. Ltd., Mitsubishi Chemical Corporation, White Martins Gases Industriais Ltda., Buzwair Industrial Gases, SOL Group, ACP, ASCO Group, Inox Air Products, TNSC Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Co2 Market Key Technology Landscape

The technology landscape governing the Liquid CO2 market is primarily focused on two critical areas: optimizing the efficiency and scalability of CO2 capture and purification processes, and ensuring safe, high-volume handling through advanced cryogenic systems and specialized transportation infrastructure. In the capture segment, established technologies like amine scrubbing remain dominant for post-combustion capture at industrial sources. However, newer, more energy-efficient technologies are rapidly gaining traction, including membrane separation, physical absorption methods, and the innovative integration of cryogenic separation techniques, especially where high CO2 concentration streams are available. These capture innovations are crucial as they directly address the significant energy penalty historically associated with generating LCO2 from industrial flue gases, thereby improving the overall economic viability of large-scale supply chains.

A significant technological breakthrough driving future market dynamics is Direct Air Capture (DAC) technology. DAC systems, though currently capital-intensive, are vital because they provide an entirely synthetic source of CO2, decoupling supply from traditional industrial emission points. Technologies such as solid sorbents or liquid solvents are utilized in DAC to filter CO2 directly from the ambient air. While the captured CO2 initially requires substantial energy for concentration and liquefaction to meet commercial specifications, continued advancements in solvent regeneration and waste heat utilization are expected to dramatically reduce the operational costs of DAC over the forecast period, providing a geographically flexible and potentially unlimited supply source for LCO2 consumers, especially those focused on genuine carbon negativity.

Furthermore, technology related to purity verification and logistics is central to market competitiveness. Advanced analytical instrumentation, including gas chromatography and mass spectrometry, is mandatory to meet the ultra-high purity specifications required by the medical and electronics sectors. On the infrastructure side, materials science advancements are leading to lighter, more durable cryogenic tanks and improved insulation techniques that minimize boil-off losses during long-distance transport. For pipeline applications, sophisticated sensor networks and digital twins are increasingly deployed to monitor pipeline integrity, density, and flow characteristics in real-time, ensuring safe and efficient transfer of pressurized LCO2 over hundreds of kilometers for EOR and dedicated sequestration projects.

Regional Highlights

- North America: North America commands a leading share of the global Liquid CO2 market, primarily due to the expansive and mature Enhanced Oil Recovery (EOR) industry in the United States, particularly across Texas, Oklahoma, and the Permian Basin. This region possesses significant, well-established CO2 pipeline infrastructure, facilitating the transfer of multi-million tons of LCO2 annually from capture sources (like natural gas processing plants and large ethanol facilities) to injection sites. The robust regulatory frameworks and tax incentives, such as the 45Q federal tax credit, strongly incentivize Carbon Capture, Utilization, and Storage (CCUS) projects, driving major investments by energy companies and industrial gas suppliers. Furthermore, the high consumption rate of carbonated beverages in the US and Canada provides a stable baseline demand for food-grade LCO2, solidifying the region's market dominance and strategic importance in LCO2 supply.

- Europe: The European market is characterized by stringent environmental mandates and ambitious decarbonization targets, driving intense focus on developing industrial clusters for CCUS. Key initiatives are concentrated in the North Sea region (Norway, Netherlands, UK) where large-scale geological storage sites are being developed (e.g., Northern Lights project). Demand for LCO2 here is strongly influenced by the industrial sector's need to comply with the European Union Emission Trading System (EU ETS). While the food and beverage market provides steady demand, the significant growth driver is the mandated transition away from high-emission processes, creating opportunities for cross-border LCO2 pipeline networks and shared storage infrastructure.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market, propelled by rapid industrial expansion, urbanization, and rising disposable incomes leading to booming demand for packaged and carbonated consumer goods, especially in China, India, and Southeast Asia. The region’s reliance on coal-fired power and heavy industries also means it has the highest concentration of potential CO2 emission sources. Governments in countries like Japan, South Korea, and Australia are initiating significant policy support and pilot projects for large-scale CCS to manage their massive industrial emissions. Infrastructure development remains a challenge compared to North America, but substantial foreign direct investment into industrial gas infrastructure is rapidly closing this gap, positioning APAC as the primary volume growth engine.

- Latin America (LATAM): The LATAM market, while smaller, presents focused opportunities, particularly in Brazil and Mexico. Brazil’s ethanol production industry is a major global source of byproduct CO2, providing a localized and pure stream for liquefaction, serving both industrial gas markets and the large domestic beverage industry. EOR activities in the pre-salt deepwater oil fields off Brazil are gaining momentum, potentially creating significant demand for LCO2 injection methods. Market growth is heavily contingent upon stabilizing economic conditions and securing foreign investment to build sophisticated cryogenic logistics and distribution capabilities beyond localized urban centers.

- Middle East & Africa (MEA): The MEA region is strongly dominated by EOR application, particularly in the Gulf Cooperation Council (GCC) countries such as the UAE and Saudi Arabia, which utilize LCO2 to enhance hydrocarbon recovery from mature fields. Given the region’s massive oil and gas production infrastructure, there is an inherent capability for large-scale CO2 capture and utilization. Furthermore, the development of mega-projects and large industrial complexes drives continuous demand for industrial-grade LCO2 for welding, metal fabrication, and fire suppression systems. The future growth here is tied directly to sustained investments in upstream EOR projects and the regulatory adoption of CCUS as part of national diversification and sustainability visions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Co2 Market.- Linde PLC

- Air Liquide S.A.

- Air Products and Chemicals Inc.

- Nippon Sanso Holdings Corporation (Taiyo Nippon Sanso)

- Messer Group GmbH

- Continental Carbonic Products Inc.

- Matheson Tri-Gas Inc.

- PurityPlus Specialty Gases

- Gulf Cryo Industrial Gases

- Reliable Purity Solutions LLC

- Sichuan Meifeng Chemical Industry Co. Ltd.

- Mitsubishi Chemical Corporation

- White Martins Gases Industriais Ltda.

- Buzwair Industrial Gases W.L.L.

- SOL Group S.p.A.

- ACP (CO2 supply)

- ASCO Group

- Inox Air Products Ltd.

- Norco Inc.

- Praxair Technology Inc. (Part of Linde)

Frequently Asked Questions

Analyze common user questions about the Liquid Co2 market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the significant growth in the Liquid CO2 Market?

The most significant growth drivers are the dual demands originating from the food and beverage industry for carbonation and freezing, combined with massive global investment and regulatory incentives supporting Carbon Capture, Utilization, and Storage (CCUS) projects, especially for Enhanced Oil Recovery (EOR) and mandated industrial decarbonization efforts worldwide.

How do the different purity grades of Liquid CO2 impact its industrial applications?

Purity grade is critical, as applications vary significantly. Industrial-grade LCO2 is suitable for welding and fire suppression. Food-grade LCO2 requires strict quality control for direct consumer contact (carbonation, packaging). Medical and Ultra-High Purity grades are essential for sensitive processes like supercritical fluid extraction in pharmaceuticals and precision cleaning in semiconductor manufacturing, demanding rigorous purification steps and higher pricing.

Which geographic region currently holds the largest market share for Liquid CO2 and why?

North America holds the largest market share, predominantly driven by the maturity and scale of its Enhanced Oil Recovery (EOR) operations, particularly in the US. The region benefits from established pipeline networks for CO2 transport and substantial governmental incentives (like the 45Q tax credit) that make large-scale CCUS infrastructure deployment economically viable for energy companies.

What technological advancements are expected to stabilize the supply of Liquid CO2 in the future?

The key stabilizing technology is Direct Air Capture (DAC). While currently expensive, DAC promises to decouple LCO2 supply from volatile industrial byproduct streams (like ethanol or ammonia production). Ongoing research focused on improving the energy efficiency of solid sorbents and solvent regeneration in DAC systems will ensure a clean, reliable, and scalable source of CO2, independent of traditional industrial emissions, thus stabilizing long-term supply.

What are the main logistical and infrastructural challenges facing the expansion of the Liquid CO2 market?

Major challenges include the high upfront capital expenditure necessary for building and maintaining large-scale cryogenic liquefaction plants and specialized distribution infrastructure (cryogenic tankers and pipelines). Additionally, securing public acceptance and navigating complex cross-jurisdictional regulatory frameworks for long-distance CO2 pipeline construction and subterranean storage sites present substantial logistical and political hurdles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager