Liquid Encapsulation Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434742 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Liquid Encapsulation Materials Market Size

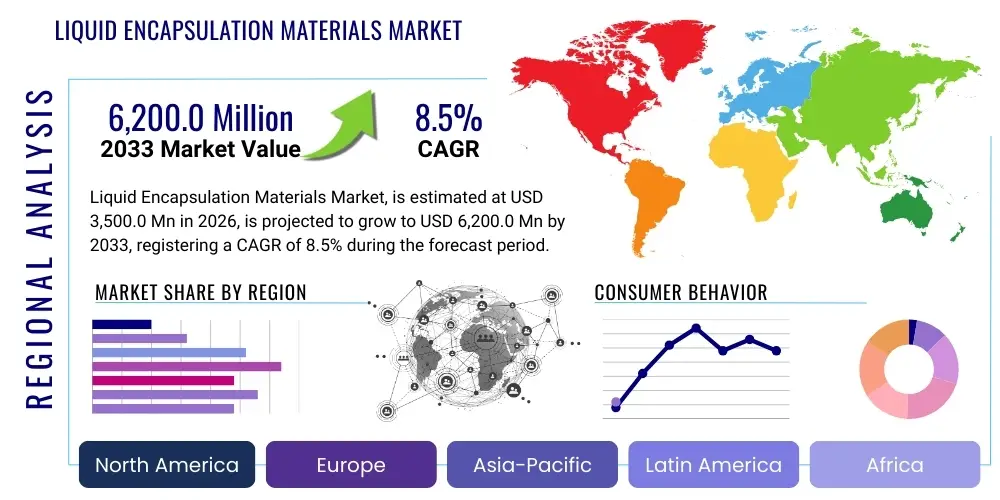

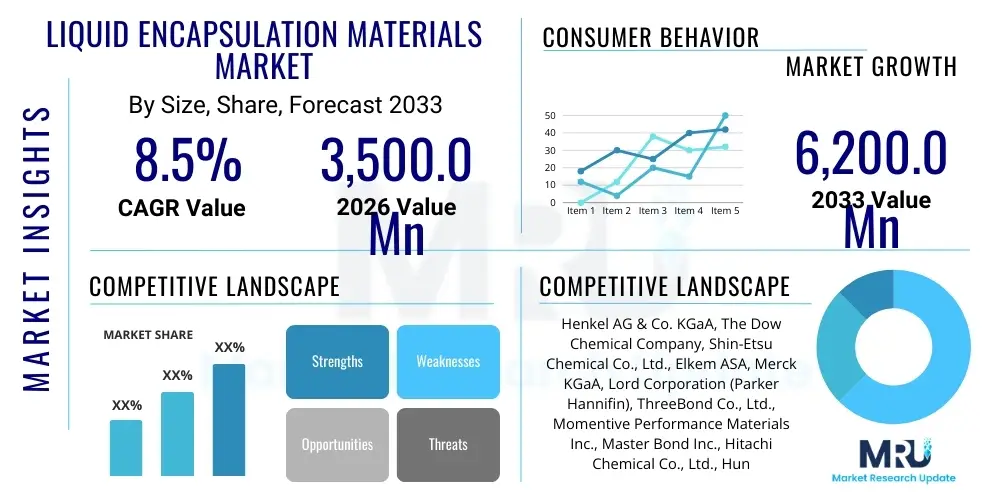

The Liquid Encapsulation Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $3,500.0 Million in 2026 and is projected to reach $6,200.0 Million by the end of the forecast period in 2033.

Liquid Encapsulation Materials Market introduction

The Liquid Encapsulation Materials Market encompasses specialized chemical compounds, primarily resins such as epoxy, silicone, and polyurethane, used to protect sensitive electronic components, sensors, and power modules from environmental stressors. These materials are applied in liquid form and subsequently cured to create a robust, protective shell that offers superior resistance against moisture, dust, chemical ingress, thermal shock, and mechanical vibration. The primary function of liquid encapsulation is to ensure long-term reliability and operational stability for high-performance electronic devices across various demanding applications, particularly in the automotive, aerospace, industrial, and consumer electronics sectors. Given the rapid miniaturization trends in electronics and the increasing demands for durability in harsh environments, liquid encapsulation has become indispensable for critical device manufacturing.

Liquid encapsulation materials are distinguished by their excellent dielectric properties, low coefficient of thermal expansion (CTE), and superior adhesion to various substrates. Epoxy resins remain a cornerstone of the market due to their mechanical strength, rigidity, and cost-effectiveness, widely utilized in integrated circuits (ICs) and discrete semiconductors. Conversely, silicone materials are favored for applications requiring high flexibility, superior thermal management capabilities, and resistance to extreme temperatures, making them critical for automotive electronics and high-power LED modules. Polyurethane offers a balance of chemical resistance and flexibility, finding niches in cable jointing and certain sensor applications. The selection of a specific liquid encapsulant is dependent entirely on the operational environment, thermal load, and required level of protection for the embedded component.

Major applications driving market expansion include the proliferation of electric vehicles (EVs), which utilize extensive power electronics and battery management systems requiring robust thermal and vibration protection, and the expansion of 5G infrastructure, demanding resilient components for base stations and networking equipment. Furthermore, the growth of Internet of Things (IoT) devices, often deployed in non-controlled outdoor or industrial settings, necessitates advanced protection provided by liquid encapsulants. The intrinsic benefits of these materials—such as enhanced insulation, prevention of short circuits, and mitigation of mechanical stress—ensure their continued relevance and market dominance compared to traditional molding compounds or potting materials, particularly where complex geometries or precise thermal transfer capabilities are required.

Liquid Encapsulation Materials Market Executive Summary

The Liquid Encapsulation Materials Market is experiencing robust growth fueled by technological convergence and stringent reliability standards across key industries. Business trends indicate a significant shift towards high-performance materials, especially advanced silicones and low-stress epoxy formulations, designed to meet the extreme thermal cycling and power density requirements imposed by automotive electrification and sophisticated industrial control systems. Manufacturers are focusing on developing materials with improved thermal conductivity and lower viscosity to facilitate faster processing and better penetration into intricate component geometries, directly addressing manufacturing efficiency concerns. Strategic partnerships between material suppliers and Tier 1 electronics manufacturers are becoming crucial for co-developing customized solutions that comply with evolving regulatory frameworks and achieve superior performance metrics, particularly regarding flame retardancy and moisture sensitivity levels. This intensified focus on R&D for next-generation formulations underscores the market's dynamic, innovation-driven nature.

Regionally, the Asia Pacific (APAC) area maintains its dominant position, primarily due to the concentration of global semiconductor manufacturing, consumer electronics production, and the burgeoning electric vehicle ecosystem in countries like China, South Korea, Japan, and Taiwan. However, North America and Europe are exhibiting accelerated growth rates, driven by escalating investments in advanced packaging technologies, aerospace and defense electronics, and the strict implementation of functional safety standards in automotive applications. These developed regions are prioritizing environmentally friendly, halogen-free, and bio-based encapsulants, influencing global product development trajectories. Regulatory pressures, particularly in the European Union concerning chemicals and electronics waste, are compelling material suppliers to innovate quickly, leading to geographically distinct demand patterns for specialized, compliant products.

Segmentation trends highlight the increasing prominence of Silicone-based materials, projected to capture a significant share of the value market, primarily due to their essential role in thermal management applications within power modules and high-brightness LEDs. Concurrently, the Electronics & Semiconductor segment remains the largest application area, but the Automotive segment is forecast to register the highest CAGR, propelled by the transition from traditional internal combustion engines (ICE) to hybrid and battery electric vehicles (BEVs). Within the Electronics segment, materials tailored for micro-electromechanical systems (MEMS) and advanced sensor protection are seeing unprecedented demand, necessitating ultra-pure and specialized low-outgassing encapsulants. This structural shift underscores a market evolving away from general-purpose protection towards highly specialized, performance-optimized formulations.

AI Impact Analysis on Liquid Encapsulation Materials Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Liquid Encapsulation Materials Market often center on how AI integration in manufacturing processes affects material selection, quality control, and the performance demands of the components being protected. Key themes identified include the need for encapsulants optimized for AI accelerators and high-heat computing chips, the use of predictive AI models for optimizing mixing and curing parameters in encapsulation lines, and the potential for machine learning (ML) to accelerate the discovery and testing of novel material chemistries. Users frequently express concerns about the thermal dissipation requirements of advanced AI processors—which generate immense heat—necessitating encapsulants with superior thermal conductivity far beyond current standards. Furthermore, there is significant interest in utilizing AI-driven image processing and quality assurance systems to detect micro-cracks or voids in encapsulated devices, thereby drastically improving yield rates and ensuring the long-term reliability of mission-critical AI hardware deployed in data centers and autonomous systems. The consensus is that AI will primarily act as both a driver for material innovation (due to thermal demands) and an enabler for optimized manufacturing efficiency.

- AI-driven optimization of material compounding and mixing processes reduces batch variation and enhances quality control, leading to higher manufacturing yields.

- Increased demand for high-performance thermal interface materials (TIMs) and thermally conductive encapsulants to manage the intense heat generated by AI accelerators and Graphics Processing Units (GPUs).

- Integration of Machine Learning (ML) algorithms into R&D to predict the performance characteristics (e.g., CTE, modulus, adhesion) of new liquid resin formulations, accelerating time-to-market.

- AI-powered automated optical inspection (AOI) systems for real-time defect detection during the dispensing and curing phases of liquid encapsulation, minimizing latent failures.

- The proliferation of AI-enabled autonomous and edge computing devices increases the overall volume demand for rugged, environmentally resistant liquid encapsulants suitable for field deployment.

DRO & Impact Forces Of Liquid Encapsulation Materials Market

The Liquid Encapsulation Materials Market is primarily propelled by the rapid miniaturization and increasing complexity of electronic devices, which necessitates robust protection against increasingly severe operational environments, summarized collectively by Drivers, Restraints, and Opportunities (DRO). A critical driver is the exponential growth of the Electric Vehicle (EV) industry, where power electronics, battery packs, and sensors require highly specialized, thermally stable liquid encapsulants for enhanced safety and efficiency. Simultaneously, the expanding deployment of 5G and future 6G communication networks mandates durable, high-frequency compatible materials for network infrastructure components. However, this market faces substantial restraints, chiefly the relatively high cost associated with advanced formulations, particularly high-purity silicones, and the complexity involved in their processing and curing, which requires precise environmental control and capital-intensive equipment. These processing constraints can restrict adoption rates among smaller manufacturers or those transitioning from simpler, less expensive packaging methods.

Despite these challenges, significant opportunities exist that are reshaping the competitive landscape. The movement towards green chemistry offers a promising avenue for innovation, focusing on the development of bio-based, sustainable, and halogen-free liquid encapsulants that meet stringent global environmental regulations, particularly those originating from Europe. Another major opportunity lies in the integration of liquid encapsulation materials with additive manufacturing (3D printing) technologies, enabling the creation of highly customized protective enclosures directly integrated into the electronic component assembly. Furthermore, the burgeoning demand for specialized medical implantable devices and ruggedized military electronics creates a highly profitable niche for ultra-pure, biocompatible, and high-reliability liquid compounds. Successfully capitalizing on these opportunities requires substantial R&D investment and close collaboration with end-users to meet highly specific performance criteria.

The cumulative impact forces acting upon the market are highly positive, driven by technological necessity and mandatory regulatory compliance. The demand for higher power density in electronics (such as IGBTs and MOSFETs) necessitates materials capable of superior thermal management, essentially making advanced liquid encapsulants a non-negotiable component for system reliability. Regulatory requirements concerning vehicle safety (ISO 26262) and environmental standards (RoHS, REACH) further intensify the pressure on manufacturers to adopt certified, high-quality, and compliant materials, reinforcing the market for premium encapsulants. The convergence of IoT, AI, and EV trends ensures that the fundamental need for environmental and mechanical protection of sensitive components will only grow, establishing a strong, sustained demand trajectory throughout the forecast period. Market players prioritizing innovation in thermal performance and process efficiency are positioned to capture the greatest share of value.

Segmentation Analysis

The Liquid Encapsulation Materials Market is strategically segmented based on Resin Type, Application, and End-Use Industry, enabling a granular understanding of demand dynamics and technological preferences across diverse sectors. The Resin Type segment is foundational, dictating the ultimate performance characteristics of the encapsulated product, with Epoxy, Silicone, and Polyurethane being the dominant categories, each offering unique trade-offs in terms of mechanical strength, thermal endurance, and flexibility. This segmentation highlights the continuing market dominance of Epoxy resins in general-purpose industrial applications, contrasting sharply with the high-value specialized usage of Silicones in high-temperature and sensitive automotive electronics. Understanding these material preferences is crucial for suppliers developing targeted product portfolios and investment strategies that align with segment-specific growth hotspots.

Analyzing the market by Application reveals the immediate drivers of volume and value growth. The Semiconductors & ICs application segment historically consumes the largest share of liquid encapsulants, used in processes such as wafer-level packaging and flip-chip bonding. However, the fastest growth is observed in Power Electronics and LED encapsulation, reflecting global trends in energy efficiency and automotive electrification. End-Use Industry segmentation further refines this view, positioning Consumer Electronics as a high-volume, cost-sensitive segment, while Automotive and Industrial sectors represent high-reliability, performance-driven markets that demand premium, often customized, liquid encapsulant formulations compliant with stringent certification requirements.

The ongoing trend towards system-in-package (SiP) and other advanced packaging methods is blurring traditional application lines, increasing the need for multi-functional liquid encapsulants that can handle complex geometries and varied material interfaces within a single device. This requires material scientists to develop hybrid encapsulants, combining the best attributes of different resin chemistries, such as epoxy-silicone blends, to satisfy the stringent requirements of next-generation packaging architectures. Strategic segmentation analysis provides the necessary roadmap for identifying high-growth sub-segments, such as sensor encapsulation for IoT infrastructure or specific potting compounds for harsh environment connectivity components.

- By Resin Type:

- Epoxy Resins

- Silicone Resins (Including Gels and Elastomers)

- Polyurethane Resins

- Others (Acrylics, Polyesters)

- By Application:

- Semiconductors & Integrated Circuits (ICs)

- Power Electronics (IGBT, MOSFET)

- LED Encapsulation

- Sensors & MEMS

- Passive Components

- By End-Use Industry:

- Automotive

- Consumer Electronics

- Industrial & Manufacturing

- Aerospace & Defense

- Medical Devices

- Telecommunications

Value Chain Analysis For Liquid Encapsulation Materials Market

The value chain for the Liquid Encapsulation Materials Market begins with upstream analysis, which involves the procurement and synthesis of critical raw materials, primarily specialized chemical intermediates derived from petrochemical processes (such as epoxy monomers, silicone precursors, and polyols/isocyanates). The quality and availability of these specialty chemicals, often manufactured by large chemical giants, directly influence the cost structure and performance characteristics of the final encapsulant products. Key focus areas at this stage include refining purification methods and ensuring consistent supply, as electronics applications demand ultra-low impurity levels to prevent device contamination and failure. Innovation in upstream processing focuses heavily on developing sustainable, non-hazardous, and high-purity precursors to meet evolving regulatory standards.

The midstream segment involves the core activities of material formulation, compounding, and specialty chemical manufacturing carried out by the key market players. This stage adds the highest value, as raw resins are mixed with functional additives—including hardeners, catalysts, fillers (like alumina or silica for thermal conductivity), pigments, and rheological modifiers—to create the specific liquid encapsulant products. Distribution channels play a critical role here, often involving a mix of direct sales to large, captive manufacturing facilities (suchstream of major automotive Tier 1 suppliers or semiconductor fabrication plants) and indirect sales through specialized chemical distributors catering to small and medium-sized enterprises (SMEs). Maintaining a robust and efficient logistics network is crucial, especially for temperature-sensitive liquid formulations that require specific storage and handling conditions.

Downstream analysis focuses on the end-use adoption, where electronics manufacturers and assemblers utilize automated dispensing and curing equipment to apply the liquid encapsulants onto their components. The performance of the encapsulant is validated through rigorous testing procedures, including thermal shock, moisture sensitivity, and pressure cooking tests, ensuring compliance with industry standards like JEDEC and AEC-Q. The direct channel offers greater control over material specification and technical support, essential for complex, high-reliability applications like aerospace or power modules. Conversely, the indirect channel provides wider market penetration and logistical flexibility for mass-market applications such as standard consumer electronics. Success in the downstream market hinges on providing exceptional application expertise, technical consulting, and integration support for specialized dispensing systems.

Liquid Encapsulation Materials Market Potential Customers

Potential customers for Liquid Encapsulation Materials span a broad spectrum of high-technology manufacturing and industrial sectors, primarily defined by the need for enhanced reliability and extended operational lifespan under challenging conditions. The core buyers are semiconductor and electronics manufacturing services (EMS) providers involved in advanced packaging, including leading Original Equipment Manufacturers (OEMs) and contract manufacturers specializing in automotive control units, battery management systems (BMS), and high-power inverter modules. These buyers demand materials that offer not only physical protection but also optimal thermal management solutions, such as high-K dielectrics and highly conductive potting compounds to dissipate heat from densely packed components efficiently. Supplier relationships with these large corporate entities are typically direct, involving long-term supply agreements and stringent quality verification processes.

The fastest-growing customer base is found within the Electric Vehicle (EV) and Renewable Energy sectors. EV manufacturers and their component suppliers are massive consumers of liquid encapsulation materials for protecting traction motors, charging systems, and critical sensor arrays exposed to significant mechanical stress and temperature fluctuations. Similarly, solar power generation and grid infrastructure developers rely on liquid encapsulants for protecting sensitive photovoltaic (PV) junction boxes and power inverters, ensuring long-term performance stability in outdoor installations. These customers prioritize materials with proven UV resistance, hydrolysis stability, and compliance with specific safety and durability standards relevant to high-voltage applications.

Other substantial end-users include the Aerospace and Defense industry, which requires materials certified for extreme temperature cycles, radiation resistance, and outgassing characteristics in vacuum environments, and the Medical Devices sector, which demands ultra-pure, non-toxic, and biocompatible encapsulants for implantable electronics and sophisticated diagnostic equipment. Furthermore, industrial automation companies utilizing robots, control systems, and complex sensors in factory settings constitute a reliable customer segment, seeking materials that provide superior resistance against oils, solvents, and prolonged vibration exposure. Addressing the unique certification and performance criteria of each of these highly specialized customer segments is crucial for sustainable market expansion and achieving premium pricing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3,500.0 Million |

| Market Forecast in 2033 | $6,200.0 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, The Dow Chemical Company, Shin-Etsu Chemical Co., Ltd., Elkem ASA, Merck KGaA, Lord Corporation (Parker Hannifin), ThreeBond Co., Ltd., Momentive Performance Materials Inc., Master Bond Inc., Hitachi Chemical Co., Ltd., Hunstman Corporation, Wacker Chemie AG, BASF SE, Nagase & Co., Ltd., Sumitomo Bakelite Co., Ltd., Epic Resins, Kyocera Corporation, Emerson & Cuming (Part of Henkel), Remmers GmbH, Robnor Resin Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Encapsulation Materials Market Key Technology Landscape

The technological landscape of the Liquid Encapsulation Materials Market is primarily defined by advancements aimed at enhancing thermal management capabilities, improving processing efficiency, and meeting increasingly stringent environmental and safety standards. A core area of innovation involves the development of high-thermal-conductivity encapsulants, utilizing advanced filler technologies such as boron nitride, highly structured alumina, and carbon nanotubes. These fillers are crucial for drawing heat away from high-power devices like IGBT modules used in EVs and renewable energy systems. The challenge lies in maintaining low viscosity while maximizing filler loading to ensure effective heat transfer without compromising the material's flowability or long-term reliability. Success in this area is paramount, as device failure rates are often directly correlated with inadequate thermal dissipation.

Another significant technological focus is on low-stress encapsulation materials. As components become smaller and more fragile, and operating temperatures fluctuate widely, the coefficient of thermal expansion (CTE) mismatch between the encapsulant and the component substrate can induce significant mechanical stress, leading to cracking or solder joint fatigue. Manufacturers are actively developing low-modulus silicone gels and flexible epoxy formulations that absorb these stresses, ensuring the longevity of sensitive components like MEMS sensors and specialized optical devices. Furthermore, the push towards faster and more efficient manufacturing has driven the adoption of ultraviolet (UV) curing and dual-cure systems, which significantly reduce curing times compared to traditional thermal curing, thereby accelerating throughput on assembly lines, particularly in high-volume production environments such as consumer electronics.

The final critical technological pillar involves achieving superior moisture resistance and enhancing adherence to evolving environmental, health, and safety (EHS) regulations. The industry is moving decisively towards halogen-free flame retardant (HFFR) systems to comply with international directives, requiring the replacement of traditional hazardous additives with novel phosphorous or nitrogen-based chemistries. Simultaneously, sophisticated surface modification techniques are being developed to improve the adhesion of encapsulants to challenging substrates, such as low-surface-energy plastics or complex metals, ensuring a hermetic seal against moisture ingress. Future technological advancements are expected to integrate smart capabilities, such as self-healing properties or integrated sensing functions, into the encapsulant matrix to further enhance device intelligence and resilience in extreme operating conditions.

Regional Highlights

The Liquid Encapsulation Materials Market exhibits distinct regional dynamics, primarily driven by localized manufacturing hubs, regulatory environments, and the pace of technological adoption in key end-use industries. Asia Pacific (APAC) holds the undisputed dominant position, accounting for the largest share of global revenue and consumption volume. This dominance is intrinsically linked to the region's status as the global epicenter for semiconductor fabrication, consumer electronics assembly (particularly in China, South Korea, and Taiwan), and the rapidly expanding automotive production sector, especially for electric vehicles. The demand in APAC is characterized by a high volume requirement for standard and slightly specialized epoxy and silicone formulations, focusing strongly on cost efficiency and manufacturing scale. Countries such as Japan and South Korea, however, lead in the adoption of ultra-high-performance encapsulants for advanced packaging technologies and high-reliability automotive components, setting the global benchmark for quality.

North America represents a mature, high-value market distinguished by heavy investment in specialized, high-reliability applications, including aerospace, defense electronics, high-end medical devices, and advanced data center computing. The demand here centers less on volume and more on compliance with extremely rigorous technical specifications, such as MIL-SPEC standards for defense and biocompatibility requirements for medical implants. The region is also a major hub for R&D in new material chemistries and advanced thermal management solutions, largely driven by large technology corporations and specialized material science firms focused on innovation in extreme environment performance. The regulatory landscape, while less centralized than Europe, still enforces strict quality standards, particularly concerning product lifespan and functional safety in critical infrastructure.

Europe is a critical market defined by stringent environmental regulations, driving the rapid adoption of halogen-free and sustainable encapsulant technologies. The regional market growth is strongly tied to the European automotive industry's ambitious shift towards electrification, necessitating large volumes of thermally conductive silicone and epoxy materials for European-designed battery packs and powertrain components. Germany, France, and the Nordic countries are leaders in industrial automation and renewable energy infrastructure, creating significant demand for robust, long-lasting encapsulants for factory robotics and wind turbine electronics. The enforcement of regulations like REACH and RoHS profoundly influences material selection, pushing manufacturers to continuously reformulate products to achieve both high performance and environmental compliance, often leading to higher average selling prices compared to the mass-market products found in APAC.

- Asia Pacific (APAC): Dominates the market due to concentrated electronics manufacturing, strong semiconductor industry, and rapid EV market expansion in China, South Korea, and Taiwan. Focuses on high-volume, cost-efficient, yet high-quality epoxy and standard silicone resins.

- North America: High-value market focused on specialized applications in aerospace, defense, medical, and advanced computing. Demands customized, ultra-reliable, and high-purity formulations compliant with stringent military and industrial specifications.

- Europe: Driven by strict environmental regulations (REACH, RoHS) and automotive electrification mandates. Prioritizes sustainable, halogen-free materials and high-performance encapsulants for industrial automation and renewable energy infrastructure.

- Latin America (LATAM): Emerging market characterized by growth in local automotive production and infrastructure development. Demand is moderate, focused primarily on standard industrial and automotive grade epoxy formulations.

- Middle East and Africa (MEA): Niche market growth linked to investments in oil & gas exploration, telecommunications expansion, and solar energy projects. Requires materials with high heat and humidity resistance suitable for harsh desert environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Encapsulation Materials Market.- Henkel AG & Co. KGaA

- The Dow Chemical Company

- Shin-Etsu Chemical Co., Ltd.

- Elkem ASA

- Merck KGaA

- Lord Corporation (Parker Hannifin)

- ThreeBond Co., Ltd.

- Momentive Performance Materials Inc.

- Master Bond Inc.

- Hitachi Chemical Co., Ltd. (Showa Denko Materials)

- Hunstman Corporation

- Wacker Chemie AG

- BASF SE

- Nagase & Co., Ltd.

- Sumitomo Bakelite Co., Ltd.

- Epic Resins

- Kyocera Corporation

- Emerson & Cuming (Part of Henkel)

- Remmers GmbH

- Robnor Resin Systems

Frequently Asked Questions

Analyze common user questions about the Liquid Encapsulation Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between epoxy and silicone liquid encapsulants?

Epoxy resins are generally favored for their superior mechanical strength, excellent adhesion, and rigidity, making them ideal for structural support and general semiconductor protection. Silicone encapsulants, conversely, offer significantly greater thermal stability, flexibility, and lower modulus, essential for managing thermal stress and high-temperature applications like power electronics and automotive modules.

How does the growth of Electric Vehicles (EVs) impact the demand for liquid encapsulation materials?

EV proliferation significantly boosts demand, particularly for thermally conductive silicone and specialty epoxy materials, as they are crucial for protecting high-voltage components like battery management systems (BMS), power inverters, and onboard chargers from thermal runaway, vibration, and moisture exposure, ensuring safety and reliability.

What is Answer Engine Optimization (AEO) and its relevance in market research reports?

AEO is the practice of structuring content specifically so that generative search engines and AI models can easily extract precise, accurate answers to user queries. In market research, AEO ensures that key data points, definitions, and summarized insights (like CAGR or executive summaries) are immediately accessible and favored by AI-driven knowledge panels.

Which geographical region exhibits the fastest growth rate for liquid encapsulation materials?

While Asia Pacific holds the largest market share, North America and Europe are expected to register the fastest growth CAGR, primarily driven by substantial investments in advanced packaging for defense and medical sectors in North America, and the stringent demands of the electric vehicle market and regulatory compliance in Europe.

What are the key technological advancements expected to drive innovation in encapsulants?

Future innovation will be centered on ultra-high-thermal-conductivity materials (using advanced fillers like boron nitride), the development of low-stress, flexible resins to accommodate sensitive components, and the integration of sustainable, halogen-free chemistries to meet global environmental regulations while maintaining high performance standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager