Liquid Handling Workstations Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431759 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Liquid Handling Workstations Market Size

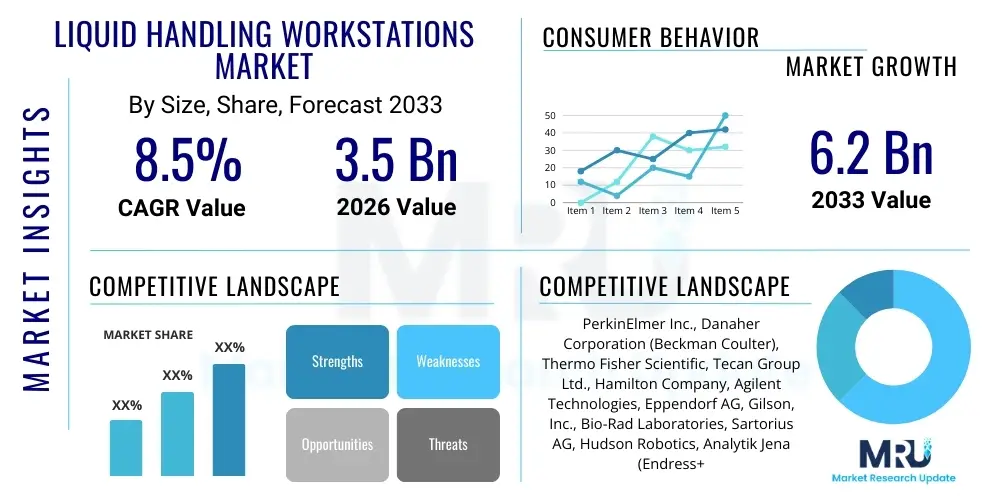

The Liquid Handling Workstations Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Liquid Handling Workstations Market introduction

The Liquid Handling Workstations Market encompasses sophisticated robotic systems designed to automate the dispensing, aspiration, and movement of liquids, predominantly small volumes, across various laboratory formats such as microplates, tubes, and reservoirs. These systems are critical components in high-throughput screening (HTS), drug discovery, genomics, and diagnostics, providing unparalleled precision, accuracy, and reproducibility compared to manual pipetting methods. Modern workstations integrate advanced sensors, automated plate movement, and sophisticated software interfaces, allowing researchers to manage complex experimental protocols efficiently and drastically reducing human error and sample cross-contamination risk.

The core functionality of these workstations centers on improving laboratory productivity by minimizing hands-on time and accelerating the pace of research, particularly in environments requiring mass screening or repetitive tasks. They offer flexibility in protocol customization, from simple serial dilutions to complex kinetic assays, accommodating various liquid viscosities and volumes ranging from nanoliters to milliliters. The growing demand for personalized medicine and complex biological studies necessitates instruments capable of managing intricate workflows and precious samples precisely, positioning liquid handling workstations as indispensable tools in both academic research settings and commercial pharmaceutical pipelines.

Driving factors for market expansion include the exponential increase in R&D investment by pharmaceutical and biotechnology companies focused on developing novel therapeutics, particularly biologics and cell-based therapies. Furthermore, the global proliferation of genomic and proteomic research, requiring the processing of thousands of samples for sequencing preparation and biomarker discovery, significantly boosts the adoption of highly automated solutions. The inherent benefits of these systems—enhanced data quality, high throughput capacity, and reduced operational costs in the long term—cement their position as foundational technology within the life sciences sector, ensuring sustained market growth throughout the forecast period.

Liquid Handling Workstations Market Executive Summary

The Liquid Handling Workstations Market is experiencing robust growth fueled by the accelerating shift toward fully automated laboratory environments and the critical need for speed and precision in drug discovery workflows. Business trends indicate a strong move by major players towards developing modular and scalable workstations that can be easily integrated with other robotic systems, such as automated incubators and readers, forming comprehensive, lights-out laboratory solutions. Furthermore, there is a distinct competitive focus on enhancing software capabilities, offering intuitive user interfaces, and incorporating advanced analytics tools to optimize workflow programming and data management, addressing the demand for smarter laboratory operations.

Geographically, North America currently holds the largest market share, driven by extensive research infrastructure, high healthcare expenditure, and the presence of numerous leading biotechnology and pharmaceutical companies heavily engaged in high-throughput screening activities. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This rapid regional expansion is attributed to increasing governmental funding for biomedical research, rapid development of the contract research organization (CRO) sector, and improving accessibility to advanced instrumentation in countries like China, India, and South Korea, which are expanding their drug manufacturing and R&D capacities.

Segment-wise, the Automated Liquid Handling Workstations segment dominates the market due to its capacity for continuous, unattended operation, which is essential for massive HTS campaigns and genomic studies. In terms of application, Drug Discovery remains the largest segment, reflecting the critical role of these systems in primary and secondary screening, compound management, and assay development. End-users such as Pharmaceutical and Biotechnology companies are the primary revenue generators, although academic and research institutes represent a rapidly growing consumer base, leveraging automation to manage large-scale collaborative research projects with improved efficiency and standardized procedures.

AI Impact Analysis on Liquid Handling Workstations Market

User queries regarding the impact of Artificial Intelligence (AI) on liquid handling typically revolve around how AI enhances experimental design, optimizes robotic arm movement, manages complex scheduling, and interprets massive datasets generated by high-throughput platforms. Key themes focus on AI's ability to transition laboratory automation from merely executing predefined tasks to proactively learning, adapting, and optimizing workflows in real time. Users are particularly concerned with how AI can minimize reagent usage, reduce the duration of optimization cycles, and improve the consistency and reliability of results, especially in complex, multi-step biological assays that often suffer from cumulative variability.

The primary expectation is that AI integration will facilitate true self-driving laboratories where workstations communicate autonomously, predict maintenance needs, and adjust protocols based on instantaneous feedback loops derived from onboard sensor data and integrated analytical results. This shift moves beyond simple scheduling algorithms to deep reinforcement learning, where the AI constantly refines pipetting parameters (speed, immersion depth, aspiration rate) to handle challenging liquids (viscous buffers, magnetic beads) with greater precision. This level of optimization is vital for achieving reproducible outcomes across different instruments and operators, a persistent challenge in high-throughput environments.

Furthermore, AI is pivotal in bridging the gap between raw experimental execution and meaningful biological insight. By processing vast amounts of metadata—including environmental conditions, instrument performance logs, and derived assay results—AI algorithms can identify subtle correlations and anomalies that human analysts might miss. This capability supports rapid hit identification in drug screening and expedites target validation, thereby significantly compressing the timelines associated with preclinical research and development. The integration of AI is transforming workstations from passive tools into intelligent co-researchers, enhancing scientific discovery and operational efficiency simultaneously.

- Enhanced Workflow Optimization: AI algorithms dynamically adjust experimental parameters (e.g., mixing steps, incubation times) in real-time based on intermediate results, minimizing assay time and reagent waste.

- Intelligent Error Detection: Machine learning models predict and flag potential pipetting failures, clogging, or evaporation issues before they compromise the entire experiment.

- Protocol Autonomy: AI facilitates the development of self-driving laboratories by autonomously planning and executing complex, multi-day experimental campaigns with minimal human intervention.

- Predictive Maintenance: AI analyses sensor data from robotic components to forecast required maintenance, maximizing uptime and operational reliability.

- Data Integration and Analysis: Sophisticated models correlate liquid handling precision data with biological assay outcomes, ensuring high data quality and accelerating insight generation from HTS.

DRO & Impact Forces Of Liquid Handling Workstations Market

The Liquid Handling Workstations Market is fundamentally influenced by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces shaping its trajectory. The dominant drivers stem from the urgent requirement for accelerated drug discovery cycles, the relentless push for high-throughput capabilities in genomics and proteomics, and the necessity to reduce human-induced variability in sensitive assays. Conversely, market growth is often restrained by the significant initial capital investment required for fully automated systems, which can be prohibitive for smaller academic laboratories or emerging biotechnology startups. Furthermore, the operational complexity and the need for highly skilled personnel to program, operate, and maintain these advanced robotic platforms present a critical barrier to entry for widespread adoption in less industrialized regions.

Significant opportunities are emerging from the trend toward microfluidics integration and the development of benchtop, personal liquid handlers designed for smaller, decentralized labs, widening the potential customer base beyond major pharmaceutical hubs. The COVID-19 pandemic also served as a powerful catalyst, highlighting the essential role of rapid, automated liquid handling in large-scale diagnostic testing and vaccine research, cementing the technology's necessity in global health infrastructure. Another major opportunity lies in the burgeoning field of cell and gene therapy, which requires highly specialized, sterile, and precise liquid handling for handling delicate primary cells and viral vectors, demanding bespoke automated solutions.

The collective impact forces favor aggressive market expansion, driven primarily by technological maturity and sustained R&D investment. While cost constraints and required technical expertise pose ongoing friction, the overarching benefits of automation—superior data quality, drastic reduction in operational time, and competitive advantage in scientific output—ensure that demand continues to escalate, particularly in advanced economies. The market is evolving towards modularity, affordability, and enhanced intelligence (via AI/ML integration) to overcome current restraints and capitalize on opportunities presented by emerging biological research domains and decentralized diagnostic applications.

Segmentation Analysis

The Liquid Handling Workstations Market is comprehensively segmented based on Type, Application, and End-User, reflecting the diverse requirements and technological preferences across the life sciences industry. Understanding these segments is crucial for market stakeholders to tailor product offerings and marketing strategies effectively. The complexity of modern biological research, ranging from large-scale compound screening to specialized single-cell analysis, necessitates a variety of automated solutions, from robust, fully integrated robotic systems to smaller, more flexible benchtop instruments. This granular segmentation provides valuable insights into current demand pockets and future growth trajectories across the global market.

- By Type:

- Automated Liquid Handling Workstations

- Semi-Automated Liquid Handling Workstations

- Manual Liquid Handling Systems (for niche or low-throughput tasks)

- By Application:

- Drug Discovery and Compound Management

- Genomics and Proteomics Research

- Clinical Diagnostics (e.g., PCR setup, sample preparation)

- Cell-Based Assays and High-Throughput Screening (HTS)

- Toxicology and ADME Studies

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs)

- Academic and Research Institutes

- Hospitals and Diagnostic Laboratories

Value Chain Analysis For Liquid Handling Workstations Market

The value chain for the Liquid Handling Workstations Market begins with upstream activities, primarily involving the procurement and manufacturing of highly specialized components. This includes precision mechanics (robotic arms, pipetting heads, plate grippers), sophisticated electronic control systems, high-quality sensors, and critical software architecture components. Key upstream suppliers include specialized robotics firms, fluid dynamics component manufacturers, and software developers who provide the foundational technology for motion control and protocol programming. Maintaining supply chain integrity and ensuring the quality of these precision parts is paramount, as the reliability of the entire workstation hinges on the performance of its fundamental mechanical and digital elements.

The midstream activities encompass the core manufacturing, assembly, and integration of the final liquid handling workstation. This stage involves complex engineering tasks, quality assurance testing, and the development of proprietary application software that defines the instrument's operational capabilities. Manufacturers invest heavily in R&D here to enhance throughput, improve dynamic liquid handling precision (e.g., handling volatile or viscous liquids), and ensure compliance with stringent regulatory standards (such as GLP/GMP). Competitive advantage is often derived from the robustness and user-friendliness of the integrated software and the ability to offer highly customized, modular configurations suitable for diverse laboratory needs.

Downstream analysis focuses on distribution, installation, service, and technical support. Distribution channels are typically a combination of direct sales forces (for major pharmaceutical clients requiring complex integration) and indirect distributors or channel partners (particularly for reaching academic or regional diagnostic labs). Post-sale service, including calibration, software updates, and rapid repair, represents a critical component of the value proposition, significantly impacting customer satisfaction and retention. The market relies heavily on a specialized technical sales and support team capable of consulting on workflow optimization and integrating the workstation into existing laboratory informatics systems (LIMS), thus requiring continuous investment in specialized personnel training.

Liquid Handling Workstations Market Potential Customers

The primary customers and end-users of Liquid Handling Workstations are concentrated within the life sciences ecosystem, particularly institutions driven by research intensity and the need for industrial-scale throughput. Pharmaceutical and Biotechnology companies represent the largest and most valuable customer segment. These organizations rely on automated liquid handlers for core functions such as primary and secondary compound screening, pharmacokinetic studies (PK), toxicological assays, and large-scale genetic testing, where minimizing variability and maximizing speed are non-negotiable requirements for advancing drug candidates through the development pipeline.

Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) form another rapidly expanding customer base. As drug developers increasingly outsource complex and repetitive tasks, CROs invest heavily in state-of-the-art automated equipment to offer high-quality, standardized services efficiently. Their procurement decisions are often driven by the need for system flexibility, scalability, and the ability to handle diverse client protocols, requiring versatile, multi-format workstations capable of rapid reconfiguration across projects.

Furthermore, academic and governmental research institutes, including major universities and national health laboratories, constitute a significant segment. While these customers may have different funding constraints compared to industry players, their demand for automated handling systems is driven by large-scale collaborative projects, genomics core facilities, and the need for standardized sample preparation in advanced research fields like structural biology and disease modeling. Their purchasing criteria often prioritize reliability, longevity, and the availability of specialized application support for cutting-edge, low-volume assays, making them key buyers for both high-end and semi-automated benchtop systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PerkinElmer Inc., Danaher Corporation (Beckman Coulter), Thermo Fisher Scientific, Tecan Group Ltd., Hamilton Company, Agilent Technologies, Eppendorf AG, Gilson, Inc., Bio-Rad Laboratories, Sartorius AG, Hudson Robotics, Analytik Jena (Endress+Hauser), Aurora Biomed, Artel, Promega Corporation, Corning Incorporated, Mettler-Toledo International Inc., SPT Labtech, Qiagen N.V., BioTek Instruments (Agilent Technologies) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Handling Workstations Market Key Technology Landscape

The technology landscape of the Liquid Handling Workstations Market is characterized by continuous innovation aimed at enhancing throughput, miniaturization, and precision across diverse liquid volumes and types. A pivotal technological evolution involves the shift from traditional air displacement pipetting to more advanced techniques such as positive displacement and acoustic dispensing. Acoustic dispensing technology, in particular, allows for non-contact, nanoliter-scale dispensing, drastically reducing reagent consumption and minimizing the risk of cross-contamination, which is critical for ultra-high-throughput screening (uHTS) and highly sensitive genomics applications like single-cell analysis. Furthermore, advanced servo motor control systems and high-resolution optical sensors are being integrated to ensure robotic arm movements are highly precise, repeatable, and capable of operating continuously over long durations with minimal drift.

Software and integration capabilities form the second pillar of technological advancement. Modern workstations utilize sophisticated scheduling software that includes graphical user interfaces (GUIs) for easy protocol programming, simulation capabilities to validate complex workflows before execution, and LIMS integration tools for seamless data tracking and regulatory compliance. The rising adoption of modular design is also key; robotic platforms are now designed to easily accommodate various peripheral devices—including magnetic bead processors, thermal cyclers, plate readers, and incubators—allowing researchers to construct highly customized, end-to-end automated workflows without proprietary constraints. This modularity enhances system longevity and adaptability to evolving research needs.

A third crucial development is the focus on improving system intelligence and error handling. This includes the integration of liquid level sensing technologies (e.g., pressure-based or capacitance-based sensors) to accurately detect fluid volumes, tip presence, and clog detection in real time, dramatically improving experimental reliability. Furthermore, there is growing deployment of decontamination technologies, such as UV lights and HEPA filtration within the enclosure, to maintain a sterile environment, particularly vital for cell culture and clinical sample processing. These technological enhancements collectively transform liquid handlers into robust, intelligent, and highly versatile tools essential for the next generation of scientific discovery.

Regional Highlights

North America maintains its status as the dominant market for Liquid Handling Workstations, driven by colossal investment in biotechnology and pharmaceutical R&D, particularly within the United States. The region benefits from a dense concentration of major market players, advanced research infrastructure, and early adoption of fully automated high-throughput systems across academic, clinical, and corporate settings. The stringent regulatory environment in drug development necessitates reproducible, traceable processes, further accelerating the adoption of validated robotic liquid handlers. High healthcare expenditure and continuous governmental funding for life science research solidify North America's leading position, particularly in specialized areas like precision medicine and complex biomarker discovery.

Europe represents the second-largest market, characterized by significant R&D activities in countries like Germany, the UK, Switzerland, and France. The European market exhibits strong demand for high-quality, reliable systems, often focused on applications in clinical diagnostics and large-scale academic consortia. Key drivers include initiatives to modernize laboratory infrastructure and the substantial presence of major global pharmaceutical companies and clinical laboratories. While growth is steady, the focus is often on integrating existing liquid handlers with broader laboratory automation networks to achieve greater operational efficiencies across various national research programs.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally. This exponential growth is primarily fueled by rapid economic development, increasing governmental focus on domestic pharmaceutical manufacturing and biomedical research capabilities in China, India, and Japan, and the massive inflow of foreign investment into regional CROs. As APAC countries expand their healthcare infrastructure and seek to compete globally in drug discovery, the adoption of automated solutions to enhance throughput and quality control becomes critical. The expanding patient pool and the increasing prevalence of infectious and chronic diseases are further boosting the need for automated diagnostic and high-throughput screening platforms.

- North America: Market leader due to high R&D spending, robust biotech presence, and early technology adoption in clinical diagnostics and drug discovery.

- Europe: Strong demand driven by pharmaceutical manufacturing centers and modernization of academic research facilities; focus on integrated laboratory solutions.

- Asia Pacific (APAC): Fastest growing region, propelled by expanding CRO sector, government investments in localized drug development, and increasing prevalence of large-scale genomic studies.

- Latin America (LATAM): Emerging market characterized by localized demand in key economies (Brazil, Mexico); gradual adoption driven by modernization of central laboratories and increasing clinical research activities.

- Middle East & Africa (MEA): Nascent market, with growth concentrated in high-income Gulf countries focusing on specialized healthcare and academic institutions; dependent on imports of advanced instrumentation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Handling Workstations Market.- PerkinElmer Inc.

- Danaher Corporation (Beckman Coulter)

- Thermo Fisher Scientific

- Tecan Group Ltd.

- Hamilton Company

- Agilent Technologies

- Eppendorf AG

- Gilson, Inc.

- Bio-Rad Laboratories

- Sartorius AG

- Hudson Robotics

- Analytik Jena (Endress+Hauser)

- Aurora Biomed

- Artel

- Promega Corporation

- Corning Incorporated

- Mettler-Toledo International Inc.

- SPT Labtech

- Qiagen N.V.

- BioTek Instruments (Agilent Technologies)

Frequently Asked Questions

Analyze common user questions about the Liquid Handling Workstations market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Automated Liquid Handling Workstations segment?

The primary driver is the critical need for high-throughput screening (HTS) in drug discovery and genomics, requiring systems that ensure unparalleled precision, reproducibility, and minimal human intervention across thousands of samples daily.

How does the integration of AI benefit current liquid handling workflows?

AI significantly benefits workflows by enabling real-time optimization of pipetting parameters, predictive error detection, autonomous protocol scheduling, and superior data quality control, leading to faster and more reliable experimental outcomes.

Which end-user segment contributes the most to the market revenue?

Pharmaceutical and Biotechnology companies are the largest revenue contributors, driven by their extensive R&D budgets, ongoing compound screening efforts, and rigorous demands for validated, high-volume automated systems necessary for preclinical development.

What are the main technical challenges faced by smaller laboratories in adopting these systems?

Smaller laboratories primarily face restraints related to the high initial capital expenditure required for sophisticated automated systems and the subsequent need for highly specialized personnel trained in complex robotic programming and maintenance.

Which geographical region is expected to demonstrate the highest market CAGR?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR due to increasing governmental funding for biomedical research, rapid expansion of the Contract Research Organization (CRO) sector, and growing investments in modernized drug manufacturing capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager