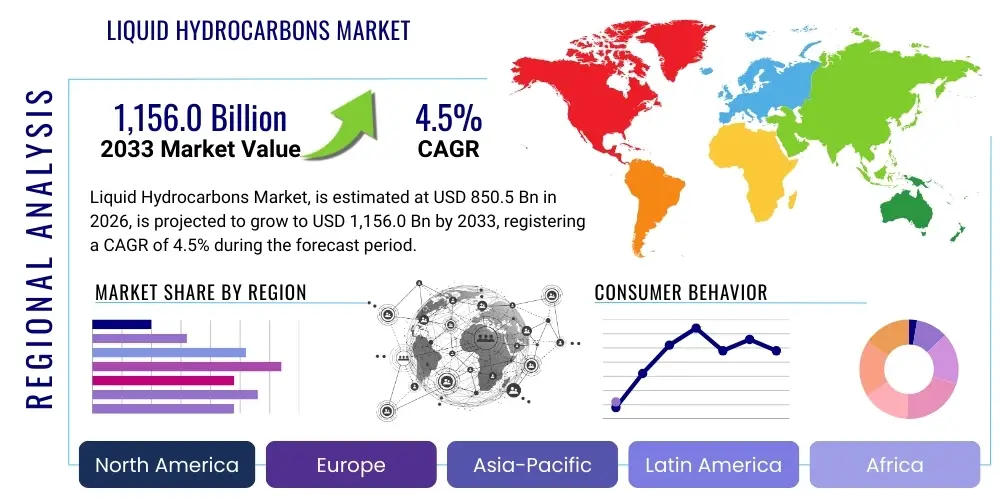

Liquid Hydrocarbons Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438272 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Liquid Hydrocarbons Market Size

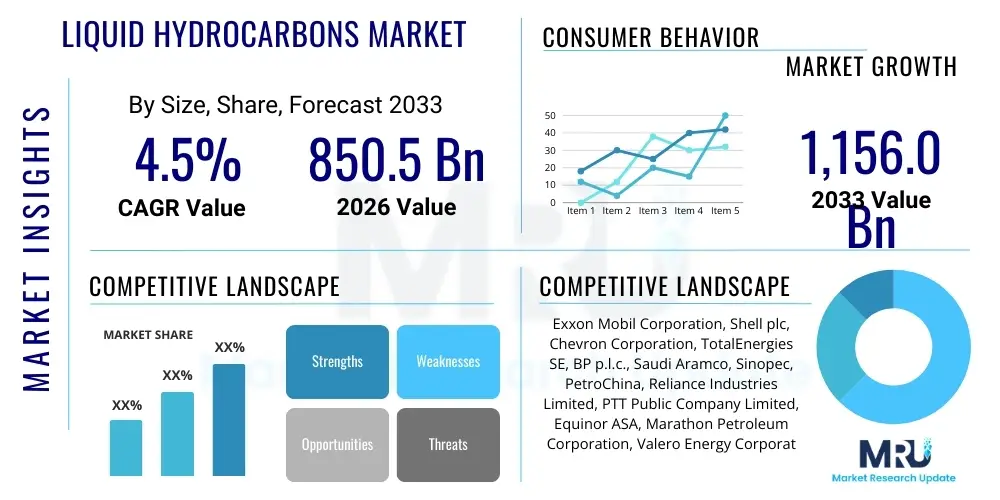

The Liquid Hydrocarbons Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $850.5 Billion USD in 2026 and is projected to reach $1,156.0 Billion USD by the end of the forecast period in 2033.

Liquid Hydrocarbons Market introduction

Liquid hydrocarbons represent a fundamental energy and chemical feedstock class derived primarily from crude oil and natural gas, supplemented by increasingly important sources such as biofuels and synthesized liquid fuels (GTL/CTL). These substances are defined by their molecular structure, containing hydrogen and carbon atoms, existing in a liquid state under standard temperature and pressure. Their versatility makes them indispensable across the global economy, serving as the primary energy carrier for transportation, a key element in industrial heat and power generation, and the foundational building block for the petrochemical industry, which manufactures plastics, fertilizers, and countless consumer goods. The market dynamics are complex, heavily influenced by global geopolitical stability, evolving energy regulations, technological advancements in refining, and the transition toward sustainable energy sources.

The product scope within the market is extensive, encompassing traditional fuels like gasoline, diesel, and jet fuel, as well as lighter fractions such as naptha and heavier lubricating oils. Gasoline and diesel dominate the transportation sector, while naptha is crucial for steam cracking processes in chemical manufacturing. The market's significance stems from its high energy density and ease of transport, which have historically powered industrial expansion and global logistics. Key applications span road transport, aviation, maritime shipping, and base material provision for the polymers and chemical sectors. Major market benefits include reliable energy supply, established infrastructure, and cost-effectiveness compared to many alternative energy sources, though these benefits are increasingly challenged by environmental mandates and volatility in raw material pricing.

The market is predominantly driven by sustained global energy demand, especially in developing economies undergoing rapid industrialization and urbanization. Furthermore, the persistent reliance on liquid fuels in heavy-duty and long-distance transport sectors—where electrification remains challenging—ensures continued demand. Technological drivers include advancements in deep-sea drilling and hydraulic fracturing, which enhance supply security, alongside efficiency improvements in refinery operations. However, the regulatory environment, particularly mandates related to carbon reduction and fuel quality standards (e.g., Euro 6 or IMO 2020), acts as a strong modifier, pushing manufacturers toward cleaner, lower-sulfur products and stimulating investment in advanced conversion technologies.

Liquid Hydrocarbons Market Executive Summary

The Liquid Hydrocarbons Market is experiencing a fundamental shift driven by the dual pressures of increasing energy demand and global climate mitigation targets. Business trends show major integrated oil companies pivoting towards portfolio optimization, emphasizing high-value product streams and petrochemical integration to hedge against fluctuating crude prices and declining long-term fuel demand in developed regions. There is a noticeable increase in mergers and acquisitions aimed at securing specialized assets, such as advanced refining capacities or strategic access to unconventional reserves, facilitating cleaner fuel production. Furthermore, the strategic implementation of digitalization and automation across the value chain, from exploration to distribution, is enhancing operational efficiency and margin capture, positioning companies to better respond to market volatility. The integration of biofuels and renewable hydrocarbon sources is emerging as a critical growth vector, supported by governmental incentives and corporate sustainability mandates.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by burgeoning populations, infrastructural development, and escalating demand for transportation fuels and chemical feedstocks, particularly in China and India. North America remains a crucial supply hub due to robust shale gas and oil production, influencing global pricing and supply stability, while also leading innovation in gas-to-liquid (GTL) and advanced refining technologies. Conversely, European markets are characterized by stringent environmental policies and aggressive decarbonization roadmaps, focusing investment on premium, low-carbon fuels and decommissioning older, less efficient refinery assets. The Middle East continues its role as a core producer, leveraging vast reserves and investing heavily in downstream capabilities to diversify its revenue base away from volatile crude exports, thereby securing market share in refined products and high-demand petrochemical derivatives.

Segment trends highlight the sustained dominance of gasoline and diesel fuels, although their growth trajectory is flattening in OECD countries due to electric vehicle penetration and efficiency gains. Jet fuel demand shows robust recovery and expected long-term growth driven by increased global air travel and cargo transport. Crucially, the petrochemical feedstock segment, primarily naptha and ethane, is witnessing the fastest expansion, reflecting the global boom in plastics and polymers production, especially in regions with cheap natural gas sources. The shift toward natural gas liquids (NGLs) as feedstocks is displacing traditional crude-based naptha in many regions, emphasizing feedstock flexibility as a key competitive advantage. Technological segmentation sees increased adoption of catalytic reforming and hydrocracking processes necessary for meeting tighter environmental specifications and maximizing middle distillate yields.

AI Impact Analysis on Liquid Hydrocarbons Market

Common user questions regarding AI's impact on the Liquid Hydrocarbons Market typically center on optimization capabilities, safety improvements, and predictive maintenance effectiveness. Users frequently ask how AI can stabilize supply chains amidst volatility, whether predictive analytics can truly forecast geopolitical risks impacting prices, and the extent to which AI-driven refining process control can improve yields and energy efficiency. Key concerns revolve around data security, the high upfront investment required for integration, and the shortage of skilled personnel capable of managing advanced AI models in complex operational environments. The prevailing expectation is that AI will primarily serve as a powerful tool to maximize existing asset performance, reduce operational expenditures, and enhance safety protocols, rather than fundamentally altering the liquid hydrocarbons product base itself.

Artificial Intelligence (AI) and machine learning (ML) are rapidly transforming the operations of the Liquid Hydrocarbons Market, particularly within exploration, refining, and distribution logistics. In the upstream sector, AI algorithms are significantly accelerating seismic data interpretation and reservoir modeling, leading to improved drilling precision, higher success rates, and reduced non-productive time. This optimization capability allows companies to maximize recovery rates from complex, mature fields and accurately target new reserves. Downstream, AI is being deployed for highly complex predictive maintenance (PdM) across refineries, anticipating equipment failures weeks or months in advance, thereby minimizing unplanned downtime and associated colossal repair costs. This preventative approach enhances operational reliability and safety, addressing major industry pain points.

Furthermore, AI-powered systems are revolutionizing the trading and logistics aspects of the market. ML models are capable of analyzing vast datasets—including weather patterns, geopolitical events, inventory levels, and macroeconomic indicators—to generate highly accurate demand forecasts and optimal routing solutions for tankers and pipelines. This predictive capability is vital for managing inventory buffers effectively, reducing demurrage charges, and ensuring timely delivery of products, particularly critical for time-sensitive commodities like jet fuel and specialty chemicals. In the refining process itself, advanced process control (APC) systems, often utilizing deep learning, fine-tune operational parameters in real-time, resulting in optimized energy consumption, improved product quality consistency, and higher conversion yields of valuable middle distillates, directly impacting profitability.

- AI enhances seismic interpretation, increasing exploration success rates and reducing exploratory risk.

- Predictive Maintenance (PdM) models using ML minimize unplanned refinery shutdowns and optimize asset lifecycles.

- AI-driven Advanced Process Control (APC) systems optimize refining parameters for maximum yield and energy efficiency.

- Machine learning models improve supply chain logistics, optimizing transportation routes and minimizing inventory holding costs.

- AI supports compliance and emissions monitoring by processing continuous sensor data to detect and correct deviations rapidly.

- Chatbots and smart interfaces improve knowledge management and support decision-making for field operators and control room personnel.

DRO & Impact Forces Of Liquid Hydrocarbons Market

The Liquid Hydrocarbons Market is influenced by a dynamic interplay of powerful drivers, structural restraints, and emerging opportunities, collectively shaped by geopolitical instability and the accelerated global energy transition. Key drivers include unwavering demand from heavy-duty and non-road transport sectors, coupled with the reliance of the vast global petrochemical industry on these feedstocks. Restraints are primarily regulatory, centered on carbon pricing mechanisms, stringent emissions standards, and competition from rapidly scaling renewables and electric vehicles (EVs). Significant opportunities lie in capitalizing on the energy transition through the production of low-carbon intensity fuels (e.g., sustainable aviation fuels - SAFs), investing in Carbon Capture, Utilization, and Storage (CCUS) technologies to decarbonize production, and optimizing existing assets through digital transformation. These forces dictate investment decisions, technological priorities, and long-term market sustainability.

Primary drivers sustaining market growth include the industrialization and urbanization wave in emerging economies, particularly across Asia and Africa, which necessitates immense amounts of energy for construction, manufacturing, and transport infrastructure. Furthermore, the inherent energy density advantage of liquid fuels keeps them irreplaceable for long-haul trucking, commercial shipping, and aviation in the near to medium term. The cyclical nature of the global economy also plays a role; periods of strong GDP growth typically correlate directly with higher consumption of gasoline, diesel, and industrial heating oils. On the supply side, continuous innovation in extraction technologies, such as enhanced oil recovery (EOR) and unconventional resource development, maintains supply stability, keeping prices competitive relative to other energy carriers.

Restraints pose major structural challenges. Global policy shifts aimed at combating climate change, exemplified by net-zero commitments, necessitate a reduction in fossil fuel consumption, dampening long-term demand growth in developed nations. Regulatory frameworks, such as strict fuel economy standards (CAFE in the US) and the EU’s Fit for 55 package, compel consumers and manufacturers toward alternatives. Additionally, price volatility, influenced by OPEC+ decisions and geopolitical conflicts, introduces significant market risk for refiners and distributors. Opportunities, however, present pathways for resilience. The push for cleaner products opens doors for companies specializing in Sustainable Aviation Fuel (SAF) and renewable diesel derived from biomass. Furthermore, the strategic expansion into petrochemicals, transforming liquid hydrocarbons into higher-value plastics and specialty chemicals, offers a robust growth trajectory, decoupling revenue streams from purely energy-based demand cycles.

Impact Forces Summary:

- Drivers: Continuous demand from global transportation (especially aviation and marine), robust petrochemical feedstock requirements, and strong energy demand in developing nations.

- Restraints: Aggressive global climate policies (carbon taxes, net-zero goals), rapid adoption of electric vehicles in passenger transport, and fluctuating crude oil price volatility.

- Opportunities: Development and commercialization of Sustainable Aviation Fuels (SAF) and renewable diesel, integration of advanced digital technologies for operational efficiency, and expansion into high-value petrochemical derivatives.

- Impact Forces: Geopolitical tensions causing supply disruptions; regulatory standards accelerating the shift to low-sulfur fuels; technological improvements maximizing resource extraction and refining yields.

Segmentation Analysis

The Liquid Hydrocarbons Market segmentation provides a granular view of diverse product applications and source materials, crucial for understanding specific market dynamics, supply chain intricacies, and regulatory influences. The market is primarily segmented by Product Type, identifying key fuel and feedstock streams such as gasoline, diesel, and naptha, each serving distinct end-uses and possessing unique quality specifications. Segmentation by Source is vital for assessing supply risks and sustainability compliance, differentiating between conventional crude oil, natural gas liquids (NGLs), and renewable inputs like bio-crude. The Application segmentation dictates the ultimate demand drivers, highlighting the critical sectors of transportation, energy generation, and petrochemical manufacturing, providing insight into which industries are most exposed to energy transition risks or growth opportunities.

Analysis of the Product Type segment reveals distinct supply and demand characteristics. Middle distillates, which include diesel and jet fuel, often command a premium due to high demand in freight, logistics, and aviation sectors, industries less susceptible to immediate electrification than light-duty vehicles. Conversely, the Gasoline segment is facing intense pressure in mature markets but remains robust in emerging economies. Naptha is primarily governed by the cyclical investments and operational capacities of steam crackers globally, serving as a direct barometer of the petrochemical industry's health. The Source segmentation is gaining importance, as Biofuels and GTL/CTL derived hydrocarbons offer strategic advantages in terms of energy security and potentially lower lifecycle emissions, attracting significant investment and policy support in North America and Europe. This diversification minimizes reliance on volatile crude sources and hedges against carbon transition risks.

The Application segmentation underscores the market's entrenched role in global infrastructure. The Transportation segment remains the largest consumer, although internal dynamics are rapidly changing; marine and aviation fuels demonstrate relative resilience, while road fuel is rapidly transitioning. The Petrochemicals segment is forecast for the highest growth rate, driven by relentless demand for polymers used in packaging, construction, and textiles. Understanding these segments is crucial for strategic positioning, allowing refiners and producers to optimize their product mix to maximize margins. For instance, companies heavily invested in complex refining capabilities can maximize high-demand products like low-sulfur marine fuel or jet fuel, catering to stringent specialized market needs, thereby achieving differentiation in an increasingly commoditized environment.

- By Product Type:

- Gasoline (Motor Spirit)

- Diesel Fuel (Gas Oil)

- Jet Fuel (Kerosene)

- Liquefied Petroleum Gas (LPG)

- Naphtha

- Fuel Oil (Heavy & Residual)

- Lubricants and Waxes

- By Source:

- Crude Oil

- Natural Gas Liquids (NGLs)

- Biofuels (Renewable Diesel, Bio-Jet Fuel)

- Coal-to-Liquid (CTL)

- Gas-to-Liquid (GTL)

- By Application:

- Transportation (Road, Rail, Aviation, Marine)

- Energy and Power Generation

- Petrochemical Feedstocks (Chemical Manufacturing)

- Industrial and Residential Heating

- Others (Solvents, Specialty Products)

- By Process Technology (Refining):

- Cracking (Fluid Catalytic Cracking, Hydrocracking)

- Reforming and Alkylation

- Hydrotreating

- Blending and Fractionation

Value Chain Analysis For Liquid Hydrocarbons Market

The Liquid Hydrocarbons value chain is a complex, integrated system spanning upstream exploration and production, midstream transportation and storage, and downstream refining and marketing. Upstream activities involve locating, extracting, and treating crude oil and natural gas, defining the initial cost structure and supply geography. Midstream logistics are crucial for market efficiency, relying heavily on vast networks of pipelines, maritime tankers, and storage facilities to move raw materials to refining centers, where price hedging and risk management are paramount. Downstream operations, including complex refining processes and integrated petrochemical manufacturing, are where the value is significantly added, transforming crude into finished, specification-grade products like gasoline, diesel, and specialty chemicals. The direct channel involves major integrated companies selling directly to large industrial consumers or specialized distributors, while indirect channels utilize extensive networks of wholesalers and retail fueling stations, making brand recognition and service reliability key competitive factors.

Upstream analysis highlights the high capital intensity and significant geological risk associated with exploration and production. Success in this segment relies on technological prowess (e.g., 3D/4D seismic imaging, deep-water drilling) and favorable regulatory environments. The cost of crude oil extraction heavily influences the entire downstream market profitability. Recent trends show a shift towards optimizing brownfield sites and utilizing enhanced oil recovery techniques, focusing on maximizing existing asset returns rather than purely high-risk greenfield exploration. Midstream functions are characterized by high barriers to entry due to massive infrastructure investment requirements. Efficiency in midstream operations—reducing throughput losses and minimizing transportation costs—is critical, as these costs are ultimately passed onto the refiners and end consumers. Geopolitical risk often manifests most acutely in the midstream, impacting global shipping routes and pipeline security.

The downstream sector is characterized by fierce competition and thin margins, requiring continuous technological upgrades to meet evolving product specifications (e.g., lower sulfur content). Refiners invest heavily in conversion units (hydrocracking, coking) to maximize high-value yields from lower-cost heavy crude feedstocks. The distribution channel is bifurcated: direct sales serve major customers like airlines, power plants, and chemical manufacturers, where volume and long-term contracts secure supply. The indirect channel, serving vehicle owners and smaller industrial users, relies on highly optimized retail networks and aggressive marketing. Companies that achieve strong vertical integration, effectively linking profitable upstream production with high-efficiency downstream processing and reliable distribution networks, typically capture the highest margins and maintain resilience during market fluctuations.

Liquid Hydrocarbons Market Potential Customers

The Liquid Hydrocarbons Market serves a diverse yet concentrated set of industrial and commercial end-users whose operations fundamentally depend on the energy density and chemical versatility of these products. Potential customers are categorized primarily across four major sectors: transportation, petrochemicals, industrial manufacturing, and residential/commercial energy use. The largest customer base resides within the global transportation infrastructure, encompassing airlines (for jet fuel), marine operators (for bunker fuel), freight trucking companies, and the vast network of individual motorists who rely on gasoline and diesel. These buyers prioritize cost efficiency, reliability of supply, and compliance with stringent emissions standards, making fuel quality a non-negotiable requirement for purchase.

Another crucial customer segment is the petrochemical industry, which consumes naptha, LPG, and other lighter fractions as foundational feedstocks for steam cracking and polymerization processes. Companies in this segment, including global polymer manufacturers and specialty chemical producers, are highly sensitive to feedstock price volatility and require massive, continuous supplies of specified hydrocarbon grades to maintain high utilization rates of their plants. Their purchasing decisions are driven by long-term strategic contracts, integrated supply relationships, and guaranteed product purity. Furthermore, large-scale industrial customers, such as cement producers, mining operations, and large power generation facilities (particularly those in regions without established natural gas grids), constitute a stable demand pool for fuel oils and other heavy distillates used for heat and steam generation.

Finally, the residential and commercial sector remains a significant, though regionally variable, customer for heating oil and LPG, particularly in regions with cold climates where it is used for space heating. For these customers, factors like seasonal pricing, local distribution network reliability, and fuel efficiency are key considerations. Major airlines, integrated chemical companies, national power utilities, and global shipping conglomerates represent the highest volume buyers, often negotiating contracts directly with major oil producers or refiners. The future customer landscape is expected to shift, with aviation and petrochemicals retaining strong demand, while the road transport customer base slowly erodes due to widespread electrification efforts, forcing suppliers to adapt their marketing and product mix strategies toward more resilient sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850.5 Billion USD |

| Market Forecast in 2033 | $1,156.0 Billion USD |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Exxon Mobil Corporation, Shell plc, Chevron Corporation, TotalEnergies SE, BP p.l.c., Saudi Aramco, Sinopec, PetroChina, Reliance Industries Limited, PTT Public Company Limited, Equinor ASA, Marathon Petroleum Corporation, Valero Energy Corporation, Phillips 66, ENEOS Holdings, Inc., Indian Oil Corporation Ltd., Repsol S.A., ENI S.p.A., ConocoPhillips, Rosneft. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Hydrocarbons Market Key Technology Landscape

The technological landscape of the Liquid Hydrocarbons Market is dominated by advanced refining processes and new feedstock conversion technologies designed to maximize yields of high-value products while simultaneously meeting increasingly strict environmental specifications. Key refining technologies include hydrocracking and fluid catalytic cracking (FCC), which are essential for converting heavy, lower-value crude fractions into profitable middle distillates (diesel, jet fuel) and gasoline. Continuous process optimization through digitalization, utilizing sensors, IIoT (Industrial Internet of Things), and AI-driven control systems, is enhancing throughput and energy efficiency across legacy refinery complexes. Furthermore, catalytic reforming processes are critical for improving gasoline octane ratings, ensuring performance requirements are met without reliance on harmful additives. These foundational technologies are constantly being refined to handle heavier, sourer crudes and reduce operational carbon intensity.

A major technological focus is the development and commercialization of pathways for alternative liquid hydrocarbons. Gas-to-Liquid (GTL) and Coal-to-Liquid (CTL) technologies, though capital intensive, allow resource-rich regions to monetize stranded natural gas or coal reserves by converting them into cleaner, synthetic liquid fuels (Fischer-Tropsch synthesis). These synthetic fuels often possess superior characteristics, such as ultra-low sulfur content, making them highly desirable for specialty applications. Equally critical is the burgeoning technology around Sustainable Aviation Fuel (SAF) and renewable diesel production, primarily relying on hydrotreating vegetable oils (HVO) or utilizing advanced fermentation and catalytic processes to convert biomass or municipal waste into drop-in fuels. Investment in these renewable fuel pathways is accelerating, driven by global aviation industry commitments and government blending mandates, representing a major diversification avenue for traditional refiners.

Beyond conversion, supply chain technologies are integral to maximizing market value. Advanced tank gauging systems, integrated pipeline monitoring (using robotics and sensor arrays for leak detection), and sophisticated inventory management software ensure product integrity and minimize losses. Digital twin technology is increasingly deployed to simulate refinery operations under various scenarios, allowing engineers to test optimization strategies safely and efficiently before deployment. Moreover, the integration of Carbon Capture, Utilization, and and Storage (CCUS) technologies within refinery and petrochemical complexes is becoming a necessary technological step to maintain long-term license to operate, addressing the massive carbon footprint associated with liquid hydrocarbon production. These technological advancements collectively aim to reduce risk, increase efficiency, and enable compliance in a rapidly evolving regulatory environment.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of demand growth, fueled by massive infrastructure development, increasing vehicle ownership, and burgeoning middle-class consumption across nations like China, India, and Southeast Asian countries. The region is characterized by high refining capacity expansion, focused on meeting rapidly rising demand for gasoline, diesel, and critically, petrochemical feedstocks (naptha, LPG). Investment strategies often prioritize integrated refinery-petrochemical complexes to capture maximum value. Supply security remains a core strategic concern, driving major economies to secure long-term import contracts from the Middle East and develop domestic strategic reserves.

- North America: North America is defined by its role as a major global producer of both crude oil and Natural Gas Liquids (NGLs), primarily due to the shale revolution. The region possesses high-complexity refining capabilities optimized to handle domestically sourced light, tight oil. The market is mature, characterized by stringent environmental regulations and a rapidly advancing energy transition, leading to substantial investment in renewable fuels (renewable diesel, ethanol) and export capacity expansion, particularly for LNG and refined products targeting international markets, making it a critical balancing point in global supply.

- Europe: Europe is characterized by the most aggressive policy drive toward decarbonization, significantly restraining long-term domestic demand for traditional liquid fuels. The region is a net importer of crude oil but maintains strong, technologically advanced refining centers. The focus is strictly on producing ultra-low-sulfur and specialized products required for Euro 6 standards and IMO 2020 compliance. Investment is heavily directed towards optimizing existing refineries for co-processing sustainable feedstocks (biomass) and pioneering innovative fuel standards, such as sustainable aviation fuel (SAF) mandates, leading the way in premium, compliant fuel production.

- Middle East & Africa (MEA): The Middle East remains the cornerstone of global crude oil supply, possessing the lowest cost of production. The strategic regional shift involves massive investment in downstream integration (refining and petrochemicals) to diversify revenue streams away from raw crude exports. Key nations are building mega-refineries designed for export dominance, transforming themselves into global hubs for refined products and polymers. Africa represents a future growth market, driven by expanding energy access needs and rapid industrialization, though hindered by insufficient refining capacity and reliance on imported products.

- Latin America: This region presents a mixed market scenario, characterized by significant domestic oil reserves (e.g., Brazil, Mexico) but often hampered by underinvestment in refining infrastructure and state-owned company inefficiencies. Demand is driven by expanding road transportation and industrial needs. Major regional players are focused on modernizing outdated refineries, reducing reliance on expensive fuel imports, and capitalizing on abundant regional resources, although economic and political instability frequently introduces high market risk.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Hydrocarbons Market.- Exxon Mobil Corporation

- Shell plc

- Chevron Corporation

- TotalEnergies SE

- BP p.l.c.

- Saudi Aramco

- Sinopec

- PetroChina

- Reliance Industries Limited

- PTT Public Company Limited

- Equinor ASA

- Marathon Petroleum Corporation

- Valero Energy Corporation

- Phillips 66

- ENEOS Holdings, Inc.

- Indian Oil Corporation Ltd.

- Repsol S.A.

- ENI S.p.A.

- ConocoPhillips

- Rosneft

Frequently Asked Questions

Analyze common user questions about the Liquid Hydrocarbons market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the long-term demand for liquid hydrocarbons despite the energy transition?

Long-term demand is primarily sustained by hard-to-abate sectors, specifically global aviation, marine transport, and heavy-duty logistics, where alternative energy solutions lack the required energy density or mature infrastructure. Additionally, the rapid expansion of the petrochemical sector requires liquid hydrocarbons (like naptha) as indispensable chemical feedstocks for plastics and polymers.

How are environmental regulations impacting refining profitability in the liquid hydrocarbons market?

Environmental regulations, particularly lower sulfur mandates (e.g., IMO 2020), increase capital expenditure for refiners needing to install complex hydrotreating units. While raising operating costs, these mandates also create margin opportunities for refiners capable of producing premium, compliant, low-carbon intensity fuels, driving differentiation and competitive advantage.

Which geographic region will dominate future market growth for liquid hydrocarbons?

The Asia Pacific (APAC) region, driven by populous emerging economies such as China, India, and Indonesia, is projected to dominate market growth. This expansion is fueled by accelerating urbanization, industrialization, and sustained demand for transportation fuels and base petrochemical materials essential for economic development.

What role do renewable liquid hydrocarbons, such as SAF, play in the market?

Renewable liquid hydrocarbons, including Sustainable Aviation Fuel (SAF) and renewable diesel (HVO), represent a critical future growth segment. Their role is to provide 'drop-in' fuels that meet established technical specifications while significantly reducing lifecycle carbon emissions, allowing heavy-emitting sectors like aviation to comply with decarbonization targets without requiring massive fleet overhauls.

How does technological innovation impact the upstream segment of the liquid hydrocarbons market?

Upstream technological innovation, especially utilizing advanced seismic imaging, hydraulic fracturing, and AI-driven data analytics, significantly lowers the cost of extraction and improves resource recovery rates. These technologies unlock unconventional reserves and optimize production from mature fields, ensuring sustained supply and operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager