Liquid Lenses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431536 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Liquid Lenses Market Size

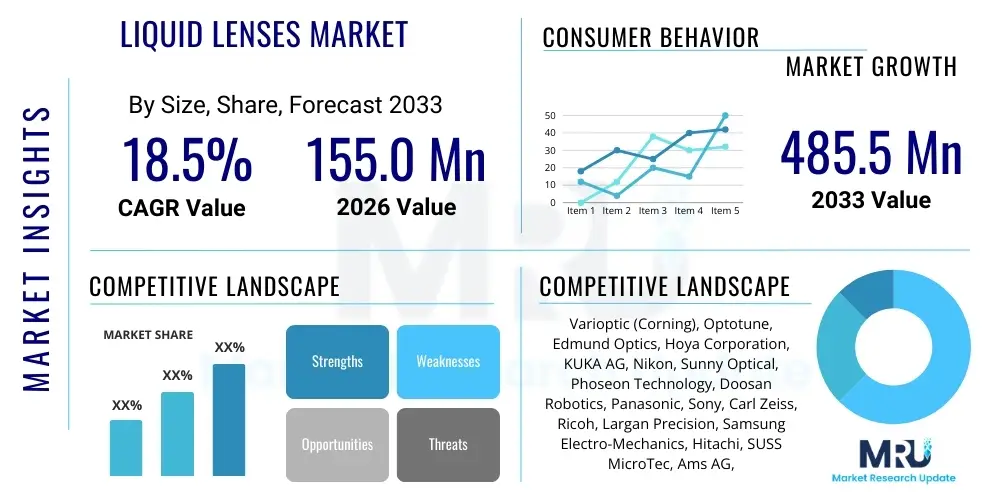

The Liquid Lenses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $155.0 Million in 2026 and is projected to reach $485.5 Million by the end of the forecast period in 2033.

Liquid Lenses Market introduction

The Liquid Lenses Market encompasses advanced optical components that utilize liquids or fluidic materials to achieve variable focus, unlike traditional mechanical lenses which rely on moving solid glass elements. These innovative lenses offer rapid focus adjustments, high shock resistance, and compact form factors, making them highly desirable for miniaturized and high-speed imaging systems. Liquid lenses function primarily through electrowetting, acoustic actuation, or liquid crystal technology, allowing for dynamic changes in focal length without mechanical movement. This capability significantly reduces latency and power consumption while enhancing the durability of imaging systems, positioning them as a critical technology for the future of optics.

The core product description revolves around lenses that modify their shape or internal refractive index via electrical signals, mimicking the accommodation process of the human eye. Major applications span industrial automation, medical diagnostics, consumer electronics, and automotive imaging. In industrial settings, they enable high-speed machine vision for quality control and sorting processes, providing unparalleled flexibility in handling objects at varying distances. The inherent benefits of liquid lenses include silent operation, robustness against vibrations, minimal maintenance requirements, and the ability to operate effectively in harsh environments where traditional optics might fail due to dust or moisture ingress.

Key driving factors accelerating market adoption include the increasing demand for high-speed autofocus and z-stacking capabilities in advanced microscopy and inspection equipment. Furthermore, the relentless trend toward miniaturization in smartphone cameras, wearables, and augmented reality (AR) devices necessitates compact and robust optical solutions. The convergence of these technological demands, coupled with continuous advancements in fluidic material science and actuator integration, is cementing the liquid lens as a foundational element in next-generation imaging and optical systems globally, offering distinct competitive advantages over conventional lens technologies.

Liquid Lenses Market Executive Summary

The Liquid Lenses Market is poised for substantial growth, driven by pervasive digitalization across manufacturing, healthcare, and consumer sectors, necessitating superior optical performance in highly constrained spaces. Key business trends indicate a strong move toward strategic partnerships between optical component manufacturers and automation integrators, particularly in regions specializing in advanced manufacturing like Asia Pacific and Europe. Companies are heavily investing in developing hybrid lens solutions that combine the stability of solid optics with the dynamic focusing capabilities of liquid elements, thereby expanding their addressable market beyond niche high-speed applications into mainstream consumer electronics and automotive safety systems.

Regional trends highlight the Asia Pacific (APAC) as the primary growth engine, fueled by its dominance in electronics manufacturing and the rapid expansion of industrial automation infrastructure, especially in China, South Korea, and Japan. North America and Europe, while possessing mature markets, demonstrate strong demand driven by high-value applications such as advanced medical imaging (e.g., endoscopy, ophthalmology) and complex machine vision systems used in pharmaceutical and semiconductor industries. The regulatory environment in these Western regions, demanding higher precision and traceability, further encourages the adoption of error-reducing liquid lens technology.

Segment trends reveal that the Electrowetting segment dominates the technology landscape due to its speed, low power consumption, and proven reliability in mass-market applications. However, the Polymer/Fluidic Lenses segment is expected to show the highest CAGR, propelled by innovations improving durability and resistance to thermal variation. Applications are increasingly diversified, with Machine Vision remaining the largest segment due to the immediate return on investment provided by enhanced inspection speed, while the Medical and Scientific Instrumentation segment is emerging rapidly, driven by the demand for minimally invasive surgical tools and flexible, high-resolution diagnostic equipment that benefits significantly from variable focus capabilities.

AI Impact Analysis on Liquid Lenses Market

Common user questions regarding AI's impact on the Liquid Lenses Market frequently center on how machine learning enhances focusing precision, reduces image processing time, and facilitates dynamic adaptation in complex environments. Users are particularly concerned with whether AI algorithms can predict and pre-adjust focal lengths in high-speed applications like robotics and automated inspection, thereby maximizing the inherent speed advantage of liquid lenses. They also inquire about the integration of neural networks for real-time defect detection, which requires instantaneous and perfect focus changes based on system demands. Key themes revolve around the transformation of liquid lenses from simple dynamic optics into integrated, intelligent vision systems capable of autonomous operation and predictive maintenance.

The symbiotic relationship between Artificial Intelligence and liquid lens technology significantly elevates the performance ceiling of modern imaging systems. AI algorithms, particularly deep learning models, are now employed to optimize the control signals sent to liquid lenses, enabling microsecond-level adjustments based on contextual data rather than simple distance metrics. This predictive focusing dramatically reduces motion blur in high-throughput applications, critical for quality assurance in complex manufacturing lines. Moreover, AI integration allows liquid lenses to become core components of 'smart' cameras, where the focusing mechanism learns environmental variations, compensating for temperature drift, vibration, and object variability autonomously, thereby ensuring consistently high image quality without manual intervention or excessive post-processing.

Furthermore, the integration of AI models allows for sophisticated calibration and aberration correction unique to fluidic optics. Liquid lenses, being inherently sensitive to external factors like gravity and temperature, benefit immensely from continuous, AI-driven calibration loops. These systems analyze image feedback in real-time, instantly adjusting the lens parameters (e.g., voltage, frequency) to counteract performance degradation, leading to superior long-term reliability and consistency, which is vital for industries such as clinical diagnostics and aerospace inspection. This synergy not only maximizes the speed and precision of liquid lenses but fundamentally transforms imaging systems into adaptive, highly efficient visual sensing platforms.

- AI drives predictive autofocus optimization, minimizing latency in robotic vision systems.

- Machine learning enhances real-time aberration correction, ensuring consistent optical performance across environmental changes.

- Deep learning models facilitate instant Z-stacking (depth mapping) by autonomously controlling liquid lens focus through multiple planes.

- AI integration enables autonomous calibration and long-term stability monitoring for industrial liquid lens modules.

- Contextual awareness provided by AI allows liquid lenses to dynamically adjust focus based on object recognition and tracking.

DRO & Impact Forces Of Liquid Lenses Market

The Liquid Lenses Market dynamics are fundamentally shaped by a confluence of technological drivers emphasizing speed and miniaturization, restrained by high initial integration costs and complexity, yet brimming with opportunities in emerging smart infrastructure. The primary driver is the pervasive demand for high-speed, flexible automation systems, especially in Industry 4.0 environments, where liquid lenses offer millisecond-level focus changes impossible with traditional mechanical systems. This is counterbalanced by significant restraints, chiefly the limited availability of highly durable, specialized liquid materials that can withstand extreme temperature fluctuations and maintain performance over billions of cycles, leading to concerns regarding longevity and reliability in harsh industrial settings. Opportunities arise distinctly in the burgeoning fields of biometric security, medical endoscopy, and advanced augmented reality devices where the compact, robust nature of liquid lenses provides an essential enabling technology that addresses space limitations.

Impact forces within the market are predominantly technological and competitive. On the technological front, continuous improvement in power efficiency and the development of new actuation methods (beyond electrowetting) are exerting upward pressure on market adoption, lowering the overall energy footprint of smart devices. Competitively, the market faces strong resistance from traditional optical suppliers who are aggressively optimizing miniaturized mechanical autofocus modules, creating pricing and performance competition, especially in the high-volume smartphone sector. However, the unique advantages of liquid lenses—silent operation and extreme resistance to mechanical shock—create distinct competitive buffers in specialized applications like defense and ruggedized industrial cameras, ensuring a sustainable niche market presence and continuous innovation.

The regulatory landscape, especially concerning medical device standards and automotive safety mandates, also acts as a critical impact force. Compliance with stringent imaging requirements for clinical diagnostics or advanced driver-assistance systems (ADAS) pushes manufacturers toward the precision offered by liquid lenses. Furthermore, supply chain disruptions, particularly affecting specialized fluidic components and micro-actuators, represent a substantial operational restraint. Mitigating these risks through vertical integration and localized material sourcing is becoming a strategic imperative for market leaders to capitalize on the increasing opportunities in consumer electronics integration and high-resolution microscopy applications.

Key Market Dynamics:

- Drivers: Growing adoption of machine vision systems; demand for miniaturized and fast autofocus cameras in consumer electronics; shift towards non-mechanical, durable optical solutions.

- Restraints: Sensitivity of fluidic elements to extreme temperatures and gravity effects; complexity and high cost of integration for small-volume applications; limited choice of proprietary fluidic materials.

- Opportunity: Expansion into advanced medical devices (endoscopes, surgical robotics); proliferation in Augmented Reality (AR) and Virtual Reality (VR) headsets requiring variable focus; implementation in automotive lidar and interior monitoring systems.

- Impact Forces: Technological advancements in fluidic actuation methods (driving adoption); competitive pricing from traditional VCM modules (restraining growth in mass market); stringent industrial quality control standards (enforcing precision requirements).

Segmentation Analysis

The Liquid Lenses Market is primarily segmented based on the type of actuation technology, the specific application areas, and the geographical regions. Understanding these segments is crucial for strategic positioning, as different technologies cater to varied performance requirements and cost sensitivities. The technology segmentation, encompassing Electrowetting, Fluidic Lenses, and Polymer Lenses, dictates speed, durability, and integration complexity. Electrowetting technology remains dominant due to its high speed and low power consumption, making it suitable for compact, battery-operated devices and rapid industrial inspection systems, whereas polymer-based solutions are gaining traction due to lower manufacturing complexity and improved robustness against mechanical stress.

Application segmentation reveals a landscape heavily skewed toward industrial utilization, specifically Machine Vision, which relies on the lens’s ability to change focus instantaneously for inspecting diverse objects on an assembly line. However, the fastest-growing segment is anticipated to be Consumer Electronics, driven by the need for superior camera performance in smartphones, drones, and wearable technologies, where space constraints are paramount. The Medical and Scientific Instrumentation segment, though smaller in volume, represents a high-value market requiring extremely reliable and precise optical performance for diagnostics, microscopy, and surgical robotics. The specific needs of each application—whether it is high volume/low cost (Consumer Electronics) or low volume/high reliability (Medical)—define the required technological trade-offs and market penetration strategies.

Geographically, market concentration follows global manufacturing footprints. Asia Pacific dominates due to its status as the world’s manufacturing hub for electronics and automotive components, offering high-volume potential. Conversely, North America and Europe lead in research and development and high-precision applications, securing significant shares in the Medical and Scientific segments. Strategic analysis must differentiate between high-volume manufacturing hubs driving unit sales and advanced technology hubs driving innovation and high-margin product adoption, ensuring tailored marketing and distribution efforts across these diverse segments.

- By Technology: Electrowetting Lenses, Fluidic Lenses (Pressure/Acoustic Actuated), Polymer/Elastomer Lenses, Liquid Crystal Lenses.

- By Application: Machine Vision and Industrial Automation, Consumer Electronics (Smartphones, Cameras), Medical and Scientific Instrumentation (Endoscopy, Microscopy), Automotive (ADAS, Interior Monitoring), Defense and Security, Robotics and Drones.

- By End-User: Original Equipment Manufacturers (OEMs), System Integrators, Research and Development Institutions.

- By Industry Vertical: Electronics Manufacturing, Automotive, Healthcare, Aerospace & Defense, Consumer Goods.

Value Chain Analysis For Liquid Lenses Market

The Liquid Lenses value chain commences with the upstream analysis, focusing on the specialized procurement and processing of critical raw materials. This includes highly pure, immiscible dielectric fluids, conductive liquids, advanced polymer membranes, and micro-electromechanical systems (MEMS) components necessary for actuation mechanisms. A key characteristic of the upstream market is the specialized and often proprietary nature of these materials, leading to high dependency on a few specialized chemical and material suppliers. Research and development activities, which involve material science innovation to improve thermal stability and optical clarity, constitute a significant portion of the upstream value addition. Companies must invest heavily in ensuring the long-term chemical compatibility and reliability of fluidic interfaces to prevent material degradation.

Midstream activities involve the complex processes of manufacturing, assembly, and integration. Fabrication requires highly precise micro-assembly techniques in cleanroom environments to encapsulate the fluidics and integrate the micro-actuators (often MEMS-based). This stage includes critical steps like lens molding, fluid filling, and calibration, which demand specialized capital equipment and expertise. Downstream analysis focuses on the integration of these finished liquid lens modules into end-user products. This involves collaboration with Original Equipment Manufacturers (OEMs) in consumer electronics, industrial camera manufacturers, and medical device developers, requiring tailored solutions regarding mechanical interface, software drivers, and calibration protocols specific to the final system.

The distribution channel landscape is bifurcated into direct and indirect routes. Direct distribution is prevalent for high-volume OEMs and highly specialized industrial or medical integrators, where technical consultation and customized supply agreements are essential. This direct approach allows manufacturers to maintain tight quality control and offer bespoke technical support. Indirect channels utilize specialized optics distributors and value-added resellers (VARs) who cater to smaller system integrators, academic institutions, and niche robotics companies. These indirect partners offer localized support, inventory management, and integration services. Success in distribution hinges on developing robust technical partnerships that can adequately educate the market on the unique benefits and integration nuances of liquid lens technology compared to conventional optical components.

Liquid Lenses Market Potential Customers

The primary customers for liquid lens technology are highly concentrated within industries requiring ultra-fast, non-mechanical focusing capabilities in space-constrained or ruggedized environments. End-users fall mainly into two broad categories: large-scale Original Equipment Manufacturers (OEMs) integrating the technology into their mass-produced products (e.g., smartphone companies, automotive tier-1 suppliers), and specialized System Integrators (SIs) and design houses that build bespoke high-precision systems (e.g., machine vision setup developers, medical device manufacturers). These customers value liquid lenses not just for speed, but for their ability to significantly reduce the total system size and complexity by eliminating mechanical motors, thereby offering a crucial competitive advantage in miniaturization and durability.

In the industrial domain, potential buyers include factory automation companies implementing high-speed inspection and quality control lines, where the rapid focus adjustment of liquid lenses enables the processing of objects at much faster rates than traditional cameras. These customers seek improved throughput and reduced inspection errors, directly translating to enhanced profitability. The second key customer group resides in the medical and scientific community, including manufacturers of advanced endoscopes, surgical robots, and high-resolution microscopes. These applications demand perfect focusing in highly restricted operational spaces, making the compact form factor and robustness of liquid lenses indispensable for achieving precise diagnostic or surgical outcomes.

Furthermore, the rapidly expanding consumer electronics market represents a massive potential customer base. Smartphone manufacturers are constantly seeking innovative ways to improve mobile photography performance, particularly in terms of autofocus speed and depth-of-field control, making liquid lenses an attractive alternative to traditional voice coil motor (VCM) actuators. Similarly, developers of head-mounted displays (HMDs) for Augmented Reality (AR) and Virtual Reality (VR) are crucial future buyers, as liquid lenses are essential for resolving the vergence-accommodation conflict, thus enhancing user comfort and immersion. Therefore, liquid lens manufacturers must strategically target these high-volume and high-value niche segments by ensuring scalability, cost-effectiveness, and compliance with stringent quality requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $155.0 Million |

| Market Forecast in 2033 | $485.5 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Varioptic (Corning), Optotune, Edmund Optics, Hoya Corporation, KUKA AG, Nikon, Sunny Optical, Phoseon Technology, Doosan Robotics, Panasonic, Sony, Carl Zeiss, Ricoh, Largan Precision, Samsung Electro-Mechanics, Hitachi, SUSS MicroTec, Ams AG, TDK Corporation, CSEM |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Lenses Market Key Technology Landscape

The technological landscape of the Liquid Lenses Market is highly dynamic, centered around three primary actuation methods: electrowetting, acoustic/pressure actuation (fluidic lenses), and liquid crystal technology. Electrowetting stands as the most mature and widely commercialized technology, utilizing electrical voltage to change the contact angle between two immiscible liquids, thereby altering the curvature of the fluidic interface and, consequently, the focal length. This method is highly valued for its speed, achieving focus changes in milliseconds, and its low power consumption, making it ideal for portable devices. However, electrowetting requires highly specialized, chemically stable fluids and sophisticated encapsulation techniques to ensure long-term reliability and prevent fluid leakage or contamination, driving continuous material science research.

Fluidic Lenses, often actuated via pressure or acoustic waves, represent another significant technological stream. These lenses typically involve a flexible membrane enclosing a transparent liquid, where an external force (pressure pump or actuator) deforms the membrane to achieve variable focus. While offering potentially larger aperture sizes and better resistance to gravity effects compared to electrowetting, they generally suffer from slower response times and require auxiliary pumps or mechanical components, limiting their integration into highly miniaturized consumer devices. Ongoing innovation in this sector focuses on integrating microfluidic pumps and developing highly elastic, transparent polymers to improve response speed and reduce the overall system footprint and energy requirements.

Furthermore, the emerging field of Liquid Crystal (LC) Lenses and Polymer/Elastomer Lenses is expanding the landscape. LC lenses use layers of liquid crystals to vary the refractive index profile based on an applied electric field, creating a lens effect without physically moving materials. These lenses are incredibly flat and energy-efficient but often have limitations regarding the total range of diopter change and sensitivity to polarization. Polymer and Elastomer Lenses, conversely, focus on mechanical deformation of elastic materials filled with liquid, emphasizing robustness and ease of manufacturing. The future trajectory involves hybrid solutions, combining the speed of electrowetting with the stability of polymers, often integrating MEMS control circuitry directly onto the lens structure to achieve smarter, fully integrated optical modules optimized for high-performance applications like holographic displays and complex machine vision.

Regional Highlights

The global demand for liquid lenses demonstrates significant regional variation, heavily influenced by local manufacturing capabilities, technological adoption rates, and regulatory environments. Asia Pacific (APAC) dominates the market, primarily driven by its massive electronics and semiconductor manufacturing industries. Countries like China, South Korea, and Japan are high-volume consumers of liquid lenses for integration into smartphone cameras, industrial inspection systems, and automated assembly lines. The region’s cost-competitive manufacturing environment and rapid technological scaling provide fertile ground for the mass production and adoption of liquid lens modules, securing its position as the leading revenue contributor and growth driver globally.

North America is characterized by high investment in advanced research, development, and sophisticated high-value applications. The market here is predominantly driven by specialized fields such as medical instrumentation (advanced surgical robotics, high-resolution diagnostics), defense technology, and complex aerospace imaging systems. North American companies often adopt liquid lenses for performance superiority and compliance with stringent operational standards, prioritizing precision and reliability over volume cost considerations. The robust presence of tech giants and innovative start-ups focused on AR/VR technologies further fuels demand, positioning North America as a leader in high-margin, niche liquid lens applications.

Europe represents a crucial market, distinguished by its strong emphasis on industrial automation (Industry 4.0) and automotive innovation. Countries like Germany and the Netherlands are major consumers of liquid lenses for precision machine vision systems used in quality control and automated manufacturing processes. Furthermore, European regulatory pushes for autonomous vehicle technology necessitate advanced, reliable imaging sensors, driving the adoption of robust liquid lens systems in lidar and driver-monitoring cameras. The focus on high-quality, long-life industrial components ensures steady, reliable growth within the region, emphasizing performance stability in demanding manufacturing environments.

- Asia Pacific (APAC): Market leader due to dominance in consumer electronics manufacturing (smartphones, cameras) and rapid industrial automation adoption in China and South Korea.

- North America: High demand from specialized sectors like Medical Imaging (endoscopy, diagnostics), Defense, and high-tech AR/VR development.

- Europe: Strong growth driven by Industry 4.0 initiatives, requiring precision machine vision, and the expanding automotive sector (ADAS and in-cabin sensing).

- Latin America (LATAM): Emerging market characterized by gradual adoption in industrial automation and entry-level security systems, focusing on cost-effective solutions.

- Middle East and Africa (MEA): Limited but growing usage in specialized oil & gas inspection and smart city surveillance projects, dependent on international technology imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Lenses Market.- Varioptic (Corning)

- Optotune

- Edmund Optics

- Hoya Corporation

- KUKA AG

- Nikon

- Sunny Optical

- Phoseon Technology

- Doosan Robotics

- Panasonic

- Sony

- Carl Zeiss

- Ricoh

- Largan Precision

- Samsung Electro-Mechanics

- Hitachi

- SUSS MicroTec

- Ams AG

- TDK Corporation

- CSEM

Frequently Asked Questions

Analyze common user questions about the Liquid Lenses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of liquid lenses over traditional mechanical lenses?

Liquid lenses offer key advantages including ultra-fast (millisecond) focus adjustments, non-mechanical operation leading to high durability and shock resistance, reduced form factor for miniaturization, and significantly lower power consumption compared to voice coil motors (VCMs).

In which industries are liquid lenses most commonly utilized?

The most common application areas are Machine Vision and Industrial Automation for high-speed quality inspection, Consumer Electronics (smartphones and cameras) for rapid autofocus, and advanced Medical and Scientific Instrumentation (endoscopy and microscopy).

What is the main constraint hindering the mass adoption of liquid lenses in consumer products?

The primary constraint is the higher initial unit cost compared to established VCM autofocus modules and the sensitivity of some fluidic technologies to extreme temperatures and gravity effects, which can complicate integration into high-volume, cost-sensitive consumer electronics.

How does Electrowetting technology work in liquid lenses?

Electrowetting utilizes an applied voltage to change the contact angle between two immiscible liquids (one conductive, one insulating dielectric) contained within a cell. This voltage alters the surface tension, causing the fluid interface to curve, thereby changing the focal length of the optical system rapidly.

What role does AI play in improving liquid lens performance?

AI, through machine learning, optimizes liquid lens performance by enabling predictive autofocus, where the system anticipates required focus changes based on object movement or contextual data. This integration maximizes speed, ensures continuous precision, and facilitates real-time compensation for environmental variations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager