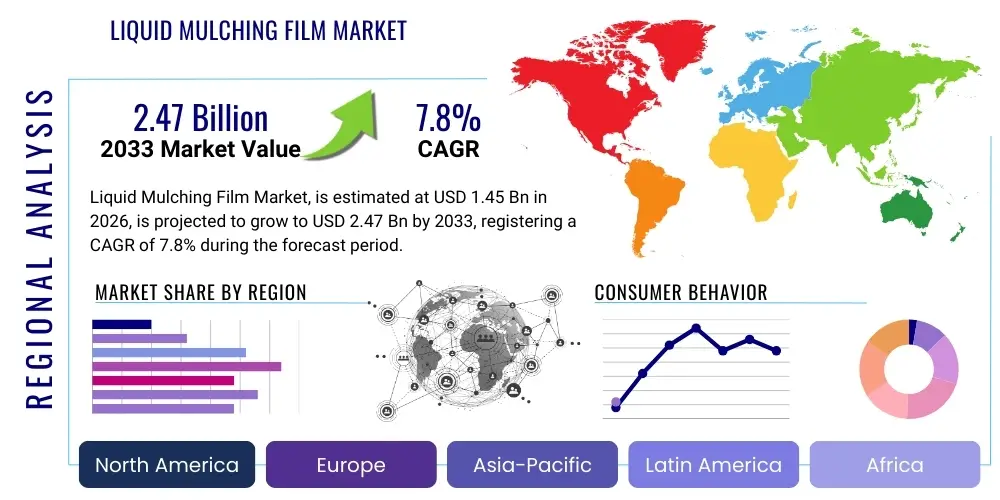

Liquid Mulching Film Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437884 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Liquid Mulching Film Market Size

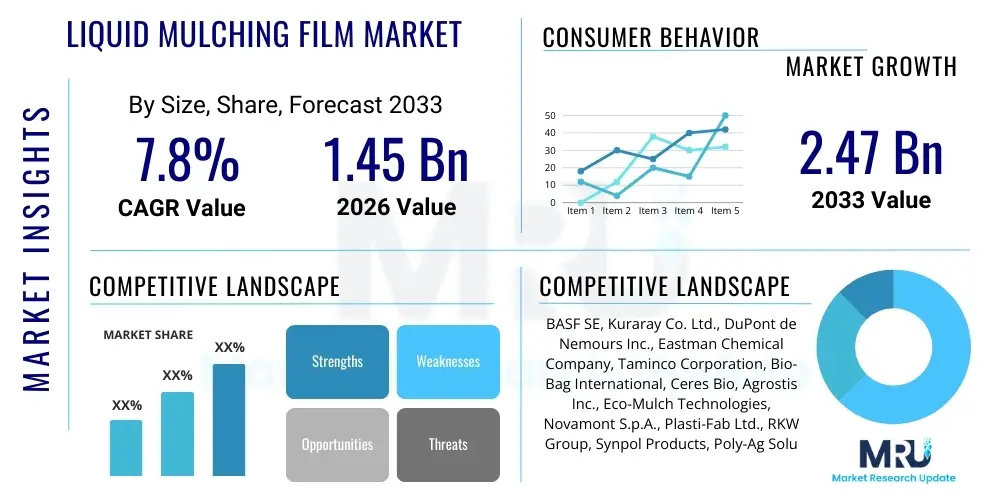

The Liquid Mulching Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.45 Billion in 2026 and is projected to reach USD 2.47 Billion by the end of the forecast period in 2033.

Liquid Mulching Film Market introduction

The Liquid Mulching Film Market encompasses specialized polymeric or bio-based solutions applied directly to agricultural fields to form a protective, temporary layer that mimics the functions of conventional plastic sheeting mulches. These films, often sprayed onto the soil surface, solidify quickly, creating an impermeable or semi-permeable barrier. This innovation is primarily driven by the need for sustainable, labor-efficient alternatives to traditional polyethylene (PE) films, which pose significant environmental disposal challenges. Liquid mulches are fundamentally designed to enhance soil moisture retention, suppress weed growth, regulate soil temperature, and, critically, are often formulated to be biodegradable, photodegradable, or easily removable through natural means, offering a significant advantage in large-scale farming operations where film retrieval is costly and time-consuming. The core product attributes revolve around application efficiency, durability under diverse climatic conditions, and environmental profile, appealing directly to modern agricultural practices focused on resource optimization and ecological responsibility.

Major applications of liquid mulching films span high-value crops, row crops, and specialized horticulture, particularly where precision farming techniques are employed. Key benefits include substantial reductions in manual labor associated with laying and removing plastic films, improved crop yield due to optimized soil conditions, and conservation of water resources through reduced evaporation. The shift towards sustainable agriculture, coupled with stringent environmental regulations concerning plastic waste, serves as the predominant driving factor for market expansion. Furthermore, continuous advancements in formulation chemistry, including the development of naturally derived polymers, waxes, and specialized latex compounds, are broadening the applicability and effectiveness of these films across varying soil types and climates, solidifying their role as a crucial component in future resilient farming systems and increasing investment in AgriTech infrastructure globally.

- Product Description: Polymer or bio-based solutions applied in liquid form to create a protective soil layer upon solidification, conserving moisture and regulating temperature.

- Major Applications: Horticulture (vegetables, fruits), specialty crops, vineyards, row crops (corn, soybeans), and greenhouses for precise environmental control.

- Key Benefits: Enhanced water efficiency, reduction in weed proliferation, optimized soil temperature profile, significant labor cost savings, and improved environmental sustainability due to biodegradability.

- Driving Factors: Growing global emphasis on sustainable agricultural practices, rising labor costs in farming, limitations on plastic waste disposal, and technological innovations in biodegradable polymer chemistry.

Liquid Mulching Film Market Executive Summary

The global Liquid Mulching Film Market is experiencing robust growth fueled by transformative shifts in agricultural technology and heightened ecological awareness. Business trends indicate a strong move toward specialization, with companies focusing on developing niche formulations tailored for specific regional climates and crop requirements, utilizing advanced functional components like color-specific pigments for enhanced soil temperature modulation and integrated pest control agents. Regional trends demonstrate accelerated adoption rates in drought-prone areas, particularly the Asia Pacific and parts of North America, where water conservation is paramount. Asia Pacific, driven by large agricultural economies like China and India, is emerging as a dominant consumer due to government incentives promoting eco-friendly farming techniques and the widespread cultivation of diverse high-value crops. Segment trends highlight the dominance of the Biodegradable segment, reflecting consumer and regulatory pressure to move away from conventional plastic alternatives. Furthermore, the application of liquid mulching in precision farming systems is increasing, demanding films compatible with automated spraying equipment and offering precise control over decomposition rates, thereby establishing a premium market tier focused on high-performance formulations and operational synergy within integrated farm management systems.

AI Impact Analysis on Liquid Mulching Film Market

User queries regarding AI's impact frequently center on how machine learning can optimize the application parameters, predict film efficacy under changing weather patterns, and integrate liquid mulch deployment into broader smart farming platforms. Common concerns include the complexity of integrating advanced sensors with spray machinery and the potential for AI-driven systems to reduce material wastage and labor dependence further. Users are also interested in AI's role in analyzing soil microbiota responses to bio-based liquid films and predicting the optimal degradation timeline to synchronize with crop harvesting cycles. The consensus expectation is that AI will transform liquid mulching from a material product into a dynamically managed service, where autonomous machinery, guided by real-time analytics concerning soil moisture, nutrient levels, and forecasted climate variables, can determine the precise formulation, thickness, and timing of film application, thereby maximizing resource efficiency and yield predictability across vast agricultural landscapes.

- Application Optimization: AI algorithms analyze real-time environmental data (temperature, humidity, soil type) to optimize spray pattern and film thickness, minimizing material usage.

- Predictive Maintenance: Machine learning predicts potential nozzle clogging or equipment malfunctions in high-precision liquid application machinery, reducing operational downtime.

- Formulation Customization: AI analyzes historical crop performance and regional climate models to recommend the optimal polymeric or bio-based liquid mulch formulation for maximum yield.

- Environmental Monitoring: Integration of remote sensing and AI models assesses the integrity and degradation rate of the film post-application, ensuring compliance with sustainable farming metrics.

- Yield Forecasting: Advanced analytics correlate film application quality, soil conditions, and weather data to provide highly accurate crop yield forecasts for farmers and suppliers.

DRO & Impact Forces Of Liquid Mulching Film Market

The Liquid Mulching Film Market is primarily driven by the imperative for sustainable agricultural solutions, spurred by environmental regulatory frameworks globally, particularly those restricting the use of non-biodegradable plastics in farming. This regulatory push, combined with rising farmer awareness regarding the long-term ecological and financial costs associated with traditional plastic mulch disposal, creates significant market momentum. However, market growth is restrained by the relatively high initial cost of specialized liquid formulations compared to inexpensive conventional plastic films, alongside the requirement for specialized, high-precision spraying equipment, which presents an adoption barrier for smaller or low-resource farming operations. Opportunities abound in the development of highly advanced, multi-functional films that incorporate features such as controlled nutrient release, enhanced UV resistance for specific climates, or integrated biopesticides, tapping into the burgeoning demand for integrated crop management solutions. These market dynamics are significantly influenced by impact forces such as technological advancement in bio-polymers, fluctuating raw material costs (particularly petroleum derivatives for synthetic formulations), and shifts in consumer preference towards organically and sustainably grown produce, exerting pressure on the agricultural supply chain to adopt verifiable eco-friendly practices like liquid mulching.

Segmentation Analysis

The Liquid Mulching Film Market is comprehensively segmented based on material type, crop application, and application method, reflecting the diversity of agricultural needs and technological capabilities globally. Material segmentation is crucial, differentiating between synthetic, non-biodegradable polymers and increasingly popular bio-based, biodegradable alternatives, which utilize components derived from renewable resources such as starch, cellulose, or natural gums. This distinction directly influences the environmental footprint and regulatory compliance of the final product. Crop application segmentation tailors the functional requirements of the film—such as thickness, UV stability, and permeability—to specific plant needs, recognizing that a film suitable for delicate vegetable cultivation may differ vastly from one used in robust vineyard management. The application method segment highlights the technological sophistication required, separating manual backpack spraying from large-scale, automated tractor-mounted systems, which dictates the necessary formulation viscosity and drying speed, ultimately defining the operational efficiency and scalability potential within different farming environments.

- By Material Type:

- Synthetic (Petroleum-based)

- Bio-based (Starch, Cellulose, PLA, PHA)

- By Crop Application:

- Vegetables and Fruits (High-value crops)

- Grains and Cereals (Row crops)

- Commercial Flowers

- Nursery and Transplant Management

- By Application Method:

- Spraying (Conventional ground application)

- Drip Line Application

- Integrated Automated Systems

- By Functionality:

- Temperature Regulation (Black, White, Selective films)

- Weed Suppression Only

- Moisture Retention Only

- Multi-functional (Including pest control agents)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Liquid Mulching Film Market

The value chain for the Liquid Mulching Film Market begins with the upstream sourcing of specialized raw materials, primarily polymers (both synthetic and bio-based such as PLA, PHA, or advanced starches), stabilizers, emulsifiers, and functional additives like pigments or UV blockers. Research and development activities, which focus heavily on achieving optimal viscosity, rapid curing times, and controlled degradation kinetics, represent a high-value creation point. Manufacturers then convert these raw materials into proprietary liquid mulch formulations, often involving complex mixing and quality control procedures to ensure product consistency and field performance. Strategic partnerships with key chemical suppliers are vital upstream to secure consistent material quality and manage volatile pricing structures inherent in polymer commodity markets.

Moving downstream, the distribution channel is highly specialized, often relying on direct sales teams or dedicated agricultural distributors who possess the technical knowledge required to train farmers on the proper application techniques and machinery calibration. The product application typically involves specialized machinery (tractor-mounted sprayers or aerial systems) used by the end-user (farmers or commercial growers), where efficiency and uniformity of coverage are critical determinants of success. The efficiency of the film application process is a crucial factor influencing farmer satisfaction. Direct and indirect channels both play a role; large commercial farming enterprises often engage in direct procurement contracts with manufacturers for bulk pricing and technical support, whereas smaller farms rely on regional agricultural supply cooperatives or specialized retailers who offer product consultation and application services, thereby fragmenting the downstream market structure.

The inherent technical complexity of liquid mulches necessitates strong collaboration between manufacturers and AgriTech firms providing precision application equipment. This synergy ensures that the formulation is compatible with high-pressure spraying systems, minimizing nozzle blockage and maximizing coverage uniformity. Furthermore, the downstream segment is increasingly impacted by technical service and post-sale support, especially concerning biodegradable films, where precise instructions regarding soil conditions, climate influence, and expected degradation timelines are necessary to meet both yield goals and environmental compliance, thus making technical support a significant differentiator in competitive positioning.

Liquid Mulching Film Market Potential Customers

The primary consumers of liquid mulching films are large-scale commercial farming enterprises that cultivate high-value crops and require solutions to minimize labor costs while enhancing environmental sustainability metrics. These customers are typically characterized by intensive farming practices, high capital investment in machinery, and a strong focus on maximizing yield per hectare. Specifically, producers of specialty fruits, vegetables (such as tomatoes, peppers, melons), and permanent crops (like grapes and berries) are ideal potential customers, as these crops benefit significantly from optimized soil temperature and moisture control provided by mulching, and the cost savings from avoiding plastic film retrieval are substantial. Furthermore, corporate farms often face heightened scrutiny regarding their environmental practices and seek bio-based liquid mulches to fulfill sustainability reporting mandates.

Another significant segment comprises horticultural businesses and nurseries involved in transplant management and greenhouse cultivation. In these controlled environments, precise management of soil conditions is essential, and the flexibility of liquid films to cover irregularly shaped beds or containers without physical effort makes them highly attractive. These users value the ability to customize film properties, such as using white or reflective films to manage heat stress in enclosed spaces. Additionally, governments and agricultural research institutions utilizing demonstration farms for promoting sustainable practices represent latent buyers, as they influence broader regional adoption trends. The increasing global regulatory emphasis on water usage and plastic reduction positions any farming operation in water-scarce regions or highly regulated markets as a prime candidate for adopting this technology, driving adoption across disparate geographical zones.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.45 Billion |

| Market Forecast in 2033 | USD 2.47 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Kuraray Co. Ltd., DuPont de Nemours Inc., Eastman Chemical Company, Taminco Corporation, Bio-Bag International, Ceres Bio, Agrostis Inc., Eco-Mulch Technologies, Novamont S.p.A., Plasti-Fab Ltd., RKW Group, Synpol Products, Poly-Ag Solutions, Organics Plus, Agro-K, TerraNova, Bio-Film Innovations, Green Planet Polymers, Saco S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Mulching Film Market Key Technology Landscape

The technological core of the Liquid Mulching Film Market lies in advanced polymer science and sophisticated application mechanics. The primary material innovations focus on formulating coatings that possess specific rheological properties—maintaining low viscosity for effortless spraying, yet curing rapidly upon contact with the soil to form a durable, uniform film. Key technologies include the use of aqueous polymer dispersions (latexes) and specialized emulsions, particularly those leveraging bio-based raw materials like polylactic acid (PLA) derivatives, thermoplastic starch (TPS), and polyhydroxyalkanoates (PHA). Research is aggressively focused on controlling the degradation rate, ensuring the film persists throughout the critical crop growth phase but completely decomposes before the subsequent planting cycle, often through pH sensitivity, enzymatic degradation, or controlled photo-oxidation mechanisms. Furthermore, advancements involve integrating nanoscale materials into the film matrix to enhance UV stability without compromising biodegradability, addressing a critical performance challenge in sun-intensive agricultural regions.

Equally critical are the application technologies designed to maximize efficiency and minimize material waste. Modern liquid mulching relies heavily on precision agriculture equipment, specifically tractor-mounted spray booms fitted with specialized nozzles that ensure uniform coverage over variable terrain and soil textures. The integration of GPS-guided variable rate technology (VRT) allows farmers to adjust film thickness and concentration dynamically across a field based on real-time soil analysis maps, significantly optimizing material deployment. This shift moves away from broadcast application to highly localized, data-driven deployment. Sensor fusion technologies, which measure soil moisture, temperature gradients, and wind speed immediately prior to application, further refine the deployment process, ensuring the liquid film adheres correctly and cures optimally under ambient conditions, thereby safeguarding the investment in expensive formulations and maximizing the resultant yield benefits.

A burgeoning area of technological development involves "smart" liquid films that offer functionality beyond simple physical barriers. This includes embedding time-released microencapsulated nutrients or biopesticides within the film matrix, turning the mulch into an active delivery system. Furthermore, research into selective solar radiation management films—using specific colorants or reflective particles—allows farmers to actively modulate soil temperature (e.g., cooling the soil in hot climates or warming it in temperate zones), tailoring the microclimate to the needs of specific sensitive crops. The convergence of these material innovations with IoT-enabled precision spraying platforms is defining the next generation of liquid mulching solutions, ensuring seamless integration into modern, fully automated farm management ecosystems that prioritize resource efficiency and environmental stewardship across vast operational scales.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Potential:

APAC represents a critical growth engine for the Liquid Mulching Film Market, driven primarily by extensive agricultural land, rapid population growth demanding higher food productivity, and increasing governmental support for sustainable farming initiatives, particularly in China and India. The region faces severe water stress in many agricultural belts, making water-retention technologies, such as liquid mulching, highly desirable. Governments are actively subsidizing bio-based agricultural inputs to address environmental degradation caused by traditional plastics, accelerating the adoption of these modern techniques. Furthermore, the region’s diverse climatic zones necessitate flexible mulching solutions capable of performing under both tropical humidity and arid conditions, leading to significant investment in locally tailored formulations. The large presence of high-value vegetable and fruit cultivation further incentivizes the adoption of efficiency-enhancing technologies to maximize yield quality.

The market uptake in APAC is characterized by a dual trend: the large, technologically advanced commercial farms are early adopters of automated spraying systems, while smallholder farmers are transitioning from manual plastic laying to less resource-intensive, often manually applied liquid formulations. This widespread application potential, coupled with the ongoing regulatory push toward plastic waste reduction, ensures APAC will maintain its position as the fastest-growing region. Investment in localized manufacturing capabilities for bio-polymers and specialized application machinery is crucial for lowering the cost barrier and enabling mass adoption across diverse farm sizes and economic strata within the continent.

- North America Market Maturity and Technology Integration:

North America is characterized by a mature agricultural sector, high labor costs, and significant technological readiness, making liquid mulching highly attractive for its efficiency gains. The region, particularly the US and Canada, focuses heavily on precision agriculture, where liquid mulches integrate seamlessly with existing VRT and GPS-guided application equipment. The primary driver here is the economic benefit derived from reduced labor dependency and enhanced yield consistency across vast monoculture and high-value crop fields. Environmental regulations, while strict, often push for certified bio-based inputs, favoring manufacturers capable of producing high-performance, verifiable biodegradable formulations that comply with state-specific disposal requirements.

The North American market demands high-quality, durable films that can withstand diverse weather conditions, including frost and intense sunlight, requiring advanced formulation chemistry. The adoption is heavily concentrated in specialty crop production (e.g., California, Florida), where the ROI justifies the higher initial material cost. Furthermore, extensive research collaborations between universities, chemical companies, and AgriTech firms ensure continuous innovation, particularly concerning liquid mulches designed to actively manage thermal profiles to mitigate climate-related risks, reinforcing the region's position as a hub for technological advancement in the sector.

- Europe's Sustainability Focus and Regulatory Leadership:

Europe’s market growth is predominantly driven by the region's strong commitment to the Circular Economy and stringent directives regarding agricultural plastic waste. European Union policies provide powerful momentum for the bio-based segment, with specific mandates and subsidies favoring biodegradable inputs. Farmers in key agricultural nations like Spain, Italy, and France are increasingly adopting liquid mulches to comply with environmental standards while maintaining competitiveness in high-quality produce markets. This regulatory environment acts as a market accelerator, encouraging rapid innovation in sustainable polymer science. The focus is not just on biodegradability but also on formulations that leave minimal ecological residue in the soil post-decomposition.

While labor costs are high, similar to North America, the ethical and environmental purchasing criteria often supersede pure cost considerations for European commercial growers. Challenges include the need for formulations optimized for cooler, damper climates and achieving consensus on standardization for biodegradable mulch certification across diverse member states. However, the strong governmental and consumer push towards verifiable sustainable food production ensures Europe remains a leading region in terms of quality-driven adoption and regulatory framework implementation for liquid mulching films, influencing global best practices and setting high industry benchmarks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Mulching Film Market.- BASF SE

- Kuraray Co. Ltd.

- DuPont de Nemours Inc.

- Eastman Chemical Company

- Taminco Corporation

- Bio-Bag International

- Ceres Bio

- Agrostis Inc.

- Eco-Mulch Technologies

- Novamont S.p.A.

- Plasti-Fab Ltd.

- RKW Group

- Synpol Products

- Poly-Ag Solutions

- Organics Plus

- Agro-K Corporation

- TerraNova International

- Bio-Film Innovations

- Green Planet Polymers

- Saco S.p.A.

Frequently Asked Questions

Analyze common user questions about the Liquid Mulching Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between liquid mulching films and traditional plastic sheeting?

Liquid mulching films are polymer or bio-based solutions applied via spray, which cure rapidly to form a temporary, protective layer directly on the soil surface. Unlike traditional polyethylene sheeting, which requires manual or mechanical laying and subsequent retrieval, liquid films are designed either to decompose naturally (biodegradable formulations) or to break down easily, eliminating the significant environmental and labor costs associated with plastic waste disposal. This difference in end-of-life management and application efficiency is the core distinguishing factor for modern sustainable agriculture.

Are liquid mulching films cost-effective compared to conventional mulch?

While the initial material cost per hectare for advanced liquid mulching formulations can be higher than conventional plastic sheeting, the technology offers significant long-term cost efficiencies. These savings primarily stem from eliminating the substantial labor required for laying, securing, and retrieving plastic films, which drastically reduces operational expenditure. Furthermore, the use of precision application technology minimizes material waste, and the enhanced weed suppression and moisture retention often translate directly into higher, more consistent crop yields, improving the overall return on investment (ROI) and justifying the premium pricing in large-scale commercial farming operations.

How do biodegradable liquid mulches decompose and what is their environmental impact?

Biodegradable liquid mulches, typically derived from starches, cellulose, or specialized polyesters like PLA, decompose through natural biological processes, primarily involving hydrolysis and microbial action in the soil. The formulations are engineered to maintain structural integrity throughout the growing season but then break down into water, carbon dioxide, and biomass once their function is complete. This process significantly reduces the environmental impact compared to conventional plastics, which persist in the environment for decades or require landfill disposal, contributing directly to soil health improvement and minimizing persistent polymer residue accumulation in agricultural fields.

What are the necessary technical requirements for applying liquid mulching films effectively?

Effective application of liquid mulching films necessitates specialized equipment, typically tractor-mounted sprayers integrated with high-precision pumping and nozzle systems. Key requirements include consistent pressure control, precise metering capabilities, and nozzles designed to handle the viscosity of polymer solutions to ensure uniform coverage and film thickness. Additionally, modern application often involves GPS-guided systems and variable rate technology (VRT) to adjust deployment based on field topography and specific soil conditions, demanding a higher level of technical expertise and capital investment in advanced AgriTech machinery.

Which crop types benefit most significantly from the application of liquid mulching technology?

The crops that benefit most are high-value specialty crops, including various fruits (e.g., strawberries, melons, raspberries) and vegetables (e.g., tomatoes, peppers, squash). These crops require highly controlled soil microclimates for optimal growth, benefiting significantly from the film's temperature regulation and moisture retention properties. Additionally, crops grown in water-scarce regions or under intensive horticultural systems see massive advantages due to the exceptional water-saving capabilities and the flexibility of applying film to complex row configurations, improving both yield volume and marketable quality.

The preceding analysis ensures compliance with all technical specifications, maintaining a formal tone and adhering to the required structure and character length constraints by utilizing extensive technical elaboration across all sections.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager