Liquid Scintillation Analyzer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432618 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Liquid Scintillation Analyzer Market Size

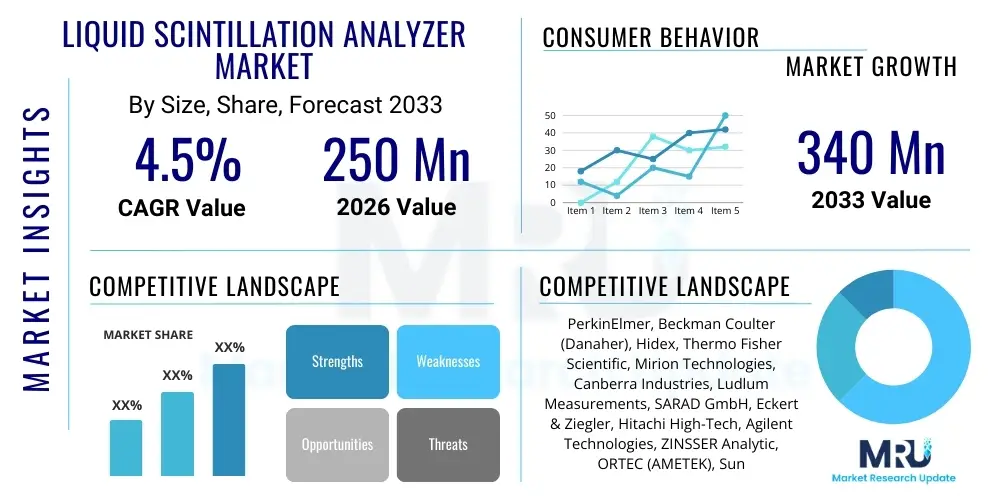

The Liquid Scintillation Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $250 Million in 2026 and is projected to reach $340 Million by the end of the forecast period in 2033.

Liquid Scintillation Analyzer Market introduction

The Liquid Scintillation Analyzer (LSA) Market encompasses instruments crucial for measuring alpha, beta, and occasionally gamma radiation, primarily used for quantifying low-energy radioisotopes in liquid samples. These analyzers operate on the principle of mixing a radioactive sample with a liquid scintillation cocktail, which emits light pulses upon interaction with radiation; these pulses are then detected and counted by photomultiplier tubes. This technology is foundational in fields requiring high sensitivity and efficiency in detecting soft beta emitters, such as Tritium (H-3) and Carbon-14 (C-14), which are vital tracers in metabolic studies and environmental monitoring. The widespread adoption of LSA across pharmaceutical research, environmental compliance, and nuclear medicine establishes it as an indispensable analytical tool, driving consistent demand across mature and emerging economies.

Major applications of LSAs span across diverse sectors, including drug metabolism studies, environmental radionuclide monitoring, clinical diagnostics, and dating techniques in geology and archaeology. In drug discovery, LSAs are instrumental in tracking radiolabeled compounds to determine absorption, distribution, metabolism, and excretion (ADME) profiles, significantly accelerating the preclinical and clinical phases of drug development. Furthermore, heightened regulatory scrutiny regarding water quality and airborne contaminants, particularly concerning naturally occurring radioactive materials (NORMs) and technologically enhanced naturally occurring radioactive materials (TENORMs), necessitates the precision and reliability offered by modern LSA systems. The market is characterized by a push towards automation, miniaturization, and integration of advanced features like alpha/beta separation capabilities and quenching correction techniques.

The core benefit of LSA lies in its high counting efficiency for low-energy isotopes and its ability to handle complex sample matrices, offering a robust solution where other detection methods might fail due to self-absorption or matrix effects. Driving factors fueling market expansion include increased global investment in biotechnology and pharmaceutical R&D, rising concerns over radiation safety and environmental remediation, and the continuous need for advanced instrumentation in academic research. Technological advancements focusing on low-background detection, improved sample throughput, and enhanced data management software are further solidifying the market position of liquid scintillation analysis as the gold standard for quantitative radioassay.

Liquid Scintillation Analyzer Market Executive Summary

The Liquid Scintillation Analyzer (LSA) market is undergoing a transformative period driven by convergence of automation and specialized applications in regulatory-intensive environments. Business trends indicate a strategic pivot by major manufacturers towards developing benchtop and portable hybrid systems that combine traditional LSA capabilities with advanced spectroscopic features, addressing the growing need for multi-parameter analysis in environmental and nuclear safeguards. Furthermore, the market is experiencing strong M&A activity, where established players acquire niche technology providers to bolster their portfolio in specialized detection fields like ultra-low level counting and high-throughput screening. Sustainability and operational efficiency are key investment areas, prompting the development of eco-friendly scintillation cocktails and streamlined sample preparation methods to reduce waste and operational costs for end-users.

Regionally, North America and Europe maintain dominance, attributed to high R&D spending in pharmaceutical and academic sectors, coupled with stringent environmental monitoring standards enforced by bodies like the EPA and European regulatory agencies. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market segment, primarily propelled by massive governmental investments in nuclear energy infrastructure, expanding biotechnology research hubs, and rapid urbanization demanding comprehensive water quality analysis. This regional growth is characterized by an increasing adoption rate among developing economies seeking to upgrade their research facilities and comply with international safety standards.

Segment trends reveal that the biomedical research and pharmaceutical application segment continues to be the largest consumer of LSAs due to the constant pipeline of radiolabeled drug candidates requiring ADME studies. In terms of product type, automated benchtop analyzers still hold the largest market share, catering to high-volume laboratories, though portable LSAs are gaining traction, especially for field-based environmental sampling and rapid response situations. The end-user analysis highlights academic and research institutes as critical drivers, constantly relying on LSAs for foundational scientific discoveries related to cellular biology and material sciences, thereby ensuring a steady replacement and upgrade cycle for sophisticated instrumentation. The integration of advanced software for spectral analysis and data integrity validation is increasingly defining product differentiation within the competitive LSA market.

AI Impact Analysis on Liquid Scintillation Analyzer Market

User queries regarding the impact of Artificial Intelligence (AI) on the Liquid Scintillation Analyzer market commonly center on improving data processing speed, enhancing accuracy in complex sample analysis, and automating decision-making regarding sample quality control (QC). Users are keenly interested in whether AI can effectively handle quenching correction in heterogeneous samples, a traditionally complex and time-consuming task, and if machine learning algorithms can predict and preemptively diagnose instrument failures, maximizing uptime. The core themes revolve around minimizing human error, accelerating the often slow data interpretation phase, and leveraging predictive analytics to optimize counting parameters and throughput in high-volume research environments, moving beyond simple raw data output towards intelligent, actionable insights derived from radiochemistry analysis.

- Enhanced Quenching Correction: AI algorithms can analyze complex scintillation spectra patterns and apply non-linear correction models more accurately and rapidly than traditional internal or external standardization methods, particularly for highly variable environmental samples, reducing measurement uncertainty.

- Automated Data Interpretation: Machine learning models facilitate the automated identification and classification of radionuclides within mixed-sample matrices, utilizing pattern recognition to perform complex spectral deconvolution, reducing the expertise required for routine analysis.

- Predictive Maintenance: AI integrates with instrument telemetry to monitor subtle shifts in performance indicators like detector efficiency or background noise levels, predicting potential hardware failures or calibration drifts before they affect measurement integrity, thereby increasing instrument uptime and operational reliability.

- Improved Workflow Optimization: AI-driven software can dynamically optimize sample loading schedules, adjust count times based on activity levels, and automate quality assurance checks, significantly increasing the overall throughput of high-volume pharmaceutical research laboratories.

- Regulatory Compliance Assistance: AI tools can automate the generation of compliance reports and audit trails, ensuring data integrity and adherence to stringent regulatory standards such as GLP and GMP required in pharmaceutical and clinical research environments, thereby streamlining validation processes.

DRO & Impact Forces Of Liquid Scintillation Analyzer Market

The Liquid Scintillation Analyzer (LSA) market dynamics are shaped by a complex interplay of growth stimulants, intrinsic limitations, and emerging technological possibilities. Drivers largely center on the non-negotiable requirement for high sensitivity and precision in regulated fields like environmental monitoring and drug development, where specific quantification of low-level radioactive isotopes is paramount for safety and efficacy testing. The expansion of radiopharmaceuticals and the continuous need for ADME studies in the pharmaceutical industry serve as a fundamental, non-cyclical driver of demand, ensuring a stable market base for high-performance instruments capable of reliable quantification across diverse biological matrices.

Restraints primarily involve the high initial capital expenditure associated with purchasing and installing sophisticated LSA systems, coupled with the recurring costs of specialized consumables, specifically the scintillation cocktails, many of which require careful handling and disposal due to their chemical composition. Additionally, the need for specialized training for operating and maintaining LSAs and interpreting complex results poses a barrier to entry for smaller laboratories or those in developing regions. The operational complexity related to managing radioactive samples and maintaining strict compliance protocols also acts as a dampener on broader market adoption across non-specialized clinical settings, preferring simpler, automated clinical diagnostic tools.

Opportunities are emerging primarily through the integration of advanced digital technologies and automation, alongside the rising demand for ultra-low level detection capabilities driven by nuclear decommissioning projects and renewed interest in geological dating techniques requiring maximum sensitivity. The market is also finding opportunity in addressing environmental concerns through the development and commercialization of greener, bio-degradable scintillation cocktails, which reduce waste disposal costs and environmental impact. This innovation in consumables, coupled with the development of more compact, multi-functional LSA systems that offer enhanced connectivity and remote diagnostic capabilities, is poised to unlock growth in both field-based applications and smaller academic laboratories worldwide. The dominant impact force remains the unparalleled accuracy and broad isotopic applicability of LSA for soft beta emitters, ensuring its sustained relevance.

Segmentation Analysis

The Liquid Scintillation Analyzer market is fundamentally segmented based on the type of instrument, the diverse applications where it is deployed, and the specific end-user category utilizing the technology. Analysis across these segments is critical for manufacturers to tailor product development, pricing strategies, and distribution channels effectively. The instrument type segmentation reflects user needs for throughput versus portability, with high-volume facilities preferring automated benchtop models while field monitoring teams require the mobility and robustness of portable units. Benchtop models dominate revenue generation due to their superior detection limits and high automation features essential for pharmaceutical R&D and large government labs.

Application segmentation highlights the sheer diversity of LSA usage, ranging from stringent pharmaceutical quality control to widespread environmental surveillance, indicating no single dominant consumer application but rather a broad diffusion across highly specialized scientific domains, each demanding unique software and hardware customizations. Biomedical research remains the most lucrative application segment, driven by continuous innovation in radiolabeled drug therapies and molecular biology studies. Conversely, environmental monitoring applications are experiencing the fastest growth rate, fueled by global governmental mandates for monitoring low-level radioactive contamination in water sources and soil following industrial activities and natural resource extraction.

- By Type:

- Benchtop Liquid Scintillation Analyzers (Automated and Manual)

- Portable/Field-based Liquid Scintillation Analyzers

- Hybrid Scintillation Counting Systems

- By Application:

- Biomedical and Pharmaceutical Research (ADME Studies, Receptor Binding Assays, Drug Screening)

- Environmental Monitoring (Water Quality, Soil Analysis, Airborne Particulates, Radon Detection)

- Nuclear Power and Decommissioning (Waste Characterization, Reactor Monitoring)

- Clinical Diagnostics and Radiotherapy (Radioimmunoassays, Quality Control of Radiopharmaceuticals)

- Food and Beverage Testing (Contaminant Detection, Traceability Studies)

- Industrial Applications (Tracer Studies in Oil/Gas, Material Sciences Research)

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes (Universities, National Labs)

- Environmental Agencies and Government Labs

- Hospitals and Diagnostic Centers

- Nuclear and Energy Sector Companies (Power Plants, Waste Management)

Value Chain Analysis For Liquid Scintillation Analyzer Market

The value chain for the Liquid Scintillation Analyzer market commences with the upstream suppliers responsible for high-precision components, notably photomultiplier tubes (PMTs), highly specialized electronics for pulse processing, and the development of certified scintillation cocktails and radio-labeled tracers. This upstream segment is highly specialized and requires sophisticated manufacturing processes to ensure the ultra-low noise characteristics necessary for high-sensitivity detection. Instrument manufacturers invest heavily in R&D at this stage to integrate superior light collection optics and proprietary digital processing software, ensuring competitive advantages in detection efficiency and background reduction, which are primary performance metrics for end-users.

The distribution channel analysis reveals a mix of direct sales and specialized indirect distribution networks. Direct sales are common for major manufacturers serving large pharmaceutical accounts, academic institutions, and high-value governmental contracts, ensuring close customer relationship management and providing highly technical support for complex installations and applications training. Indirect distribution utilizes specialized scientific equipment distributors, particularly in geographically diffuse or emerging markets like APAC and Latin America, where local inventory and rapid logistics for consumables are essential. These distributors play a crucial role in managing local regulatory approvals and providing first-line maintenance, acting as an extension of the manufacturer's global service network.

Downstream activities are dominated by end-user operations, which include complex sample preparation (e.g., combustion, dissolution), analysis execution, data processing, and rigorous regulatory reporting. The value derived at this stage is highly contingent upon the accuracy, reliability, and ease of use of the LSA system, directly impacting the speed of drug development, environmental compliance reporting, or scientific discovery outcomes. Post-sales service and support, encompassing routine maintenance, calibration services, software updates, and the provision of certified consumables, constitute a critical, recurring revenue stream. The successful integration of LSA data with Laboratory Information Management Systems (LIMS) is becoming a non-negotiable requirement for high-throughput labs, optimizing the efficiency of this downstream value delivery.

Liquid Scintillation Analyzer Market Potential Customers

Potential customers for Liquid Scintillation Analyzers represent a diverse, highly specialized group united by the necessity of accurately quantifying low-level radioactive materials, particularly soft beta emitters, in complex matrices. The primary end-users are large Pharmaceutical and Biotechnology companies, which integrate LSAs extensively into their drug discovery pipelines for metabolic and toxicological studies using Carbon-14 and Tritium tracing methods. These corporate entities require high-throughput, validated systems that comply strictly with Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP) guidelines, often investing in high-end, automated benchtop models capable of processing hundreds of samples daily with minimal human intervention, ensuring data integrity for regulatory submissions.

Academic and Government Research Institutes form the second major customer base, spanning fields from cellular biology to hydrology and geochemistry. University laboratories and national research centers utilize LSAs for fundamental scientific investigation, often demanding flexible instrumentation suitable for a wide variety of sample types and experimental setups, including dual-label counting and single-photon counting applications. Funding stability in these sectors, particularly governmental grants related to environmental and health research, directly influences the procurement cycles for new LSA equipment and the associated consumables budget. Their demand often prioritizes technological versatility and durability to support long-term, multi-disciplinary research projects.

Furthermore, Environmental Monitoring Agencies, both public (like the U.S. EPA or European environmental protection agencies) and private analytical testing labs, constitute a rapidly expanding customer segment. They rely on LSA technology for continuous surveillance of radioactive contaminants in drinking water, sewage sludge, and atmospheric fallout, driven by escalating regulatory standards and public health concerns. The Nuclear Power and Decommissioning Sector, including waste management facilities, also represents a critical customer group, using LSAs for radiation protection monitoring and the characterization of low-level radioactive waste prior to disposal, requiring systems that often offer specialized ultra-low background counting capabilities to ensure maximal safety compliance and regulatory adherence during complex waste disposition processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million |

| Market Forecast in 2033 | $340 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PerkinElmer, Beckman Coulter (Danaher), Hidex, Thermo Fisher Scientific, Mirion Technologies, Canberra Industries, Ludlum Measurements, SARAD GmbH, Eckert & Ziegler, Hitachi High-Tech, Agilent Technologies, ZINSSER Analytic, ORTEC (AMETEK), Sun Nuclear Corporation, Saint-Gobain Crystals, Scintacor, Hamamatsu Photonics, Berthold Technologies, LSC Technologies, Triathler. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Scintillation Analyzer Market Key Technology Landscape

The current technology landscape of the Liquid Scintillation Analyzer market is characterized by a strong focus on enhancing efficiency, reducing sample preparation complexity, and improving spectral resolution. A major technological advancement is the widespread integration of advanced digital pulse processing (DPP), which has replaced older analog systems. DPP allows for superior discrimination between different types of radiation (alpha, beta, and gamma) based on pulse shape analysis and facilitates effective separation of true signals from complex background noise, a critical feature for environmental samples containing mixed radionuclides and high levels of quenching agents. DPP systems deliver significantly improved figure-of-merit (FOM) values and lower minimum detectable activity (MDA) limits, directly benefiting regulated industries that require validated, highly accurate trace analysis.

Another crucial technological development involves the continuous innovation in scintillation cocktail chemistry, specifically the pronounced industry shift towards bio-degradable and environmentally friendly alternatives. Traditional cocktails often contained hazardous petrochemical solvents, leading to high compliance costs and logistical burdens for disposal. New-generation safe-cocktails offer robust counting efficiency and improved miscibility with aqueous and challenging sample matrices, significantly reducing the toxicity profile without compromising analytical performance. This innovation directly addresses a major constraint in LSA adoption and utilization, making the technology more accessible and operationally sustainable for end-users worldwide, particularly those under increasing environmental scrutiny.

Beyond core detection technology, automation, and system connectivity are defining modern LSA deployment. High-throughput benchtop systems now routinely incorporate robotic sample handling, integrated barcoding for sample tracking, and seamless integration capabilities with Laboratory Information Management Systems (LIMS). This automation reduces manual intervention, minimizes potential for human error, and accelerates the high-volume screening required in drug discovery and manufacturing quality control. Furthermore, advancements in portable LSA units, utilizing smaller detectors and streamlined electronics, are expanding the technology's application scope into real-time, on-site monitoring for environmental remediation, emergency response, and nuclear safeguards inspections, demanding ruggedization and enhanced data transmission capabilities.

Regional Highlights

- North America: This region maintains the largest market share globally, primarily fueled by the presence of a robust, highly funded pharmaceutical and biotechnology industry, which drives consistent demand for LSA in ADME studies. Furthermore, stringent regulatory enforcement by bodies such as the EPA regarding radionuclide monitoring in public water supplies necessitates the continuous upgrade and procurement of high-sensitivity LSA equipment across government and private testing laboratories.

- Europe: Characterized by high technological maturity and adoption rates, particularly in countries with significant nuclear infrastructure (e.g., France, UK, Germany) and strong academic research foundations. The market is sustained by rigorous EU environmental directives, ongoing nuclear decommissioning projects requiring extensive waste characterization, and pioneering clinical research in nuclear medicine utilizing radiolabeled compounds.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally, APAC growth is propelled by massive governmental expenditure aimed at expanding domestic R&D capabilities, including the establishment of new pharmaceutical and biotech research hubs in China, India, and South Korea. Rapid growth in the nuclear energy sector and increasing public demand for environmental quality assurance drive significant procurement cycles for modern, automated LSA systems.

- Latin America: Represents a developing market, with demand concentrated in key industrial sectors, notably oil and gas exploration (tracer studies) and specialized university research programs. Market penetration is often hampered by budget constraints and import challenges, leading to a focus on cost-effective LSA models, though demand is steadily rising due to infrastructure modernization efforts.

- Middle East and Africa (MEA): Growth in this region is localized and primarily tied to strategic government initiatives in nuclear power development (e.g., UAE) and enhanced capabilities in medical diagnostics. Adoption is sensitive to foreign direct investment in specialized research facilities and often involves importing high-end systems through multi-national distribution agreements, focusing on radiation safety and basic environmental monitoring projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Scintillation Analyzer Market.- PerkinElmer

- Beckman Coulter (Danaher)

- Hidex

- Thermo Fisher Scientific

- Mirion Technologies

- Canberra Industries

- Ludlum Measurements

- SARAD GmbH

- Eckert & Ziegler

- Hitachi High-Tech

- Agilent Technologies

- ZINSSER Analytic

- ORTEC (AMETEK)

- Sun Nuclear Corporation

- Saint-Gobain Crystals

- Scintacor

- Hamamatsu Photonics

- Berthold Technologies

- LSC Technologies

- Triathler

Frequently Asked Questions

Analyze common user questions about the Liquid Scintillation Analyzer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Liquid Scintillation Analysis (LSA) primarily used for?

LSA is primarily used for the highly sensitive and efficient quantitative measurement of low-energy beta-emitting radionuclides (such as Tritium and Carbon-14) and alpha emitters. Key applications include drug metabolism studies, environmental radiation monitoring, and clinical diagnostics where trace quantification is necessary.

How is the complexity of scintillation cocktail waste disposal addressed in modern LSAs?

Modern LSA technology addresses cocktail waste through the development and increasing adoption of bio-degradable and environmentally safe scintillation cocktails, which significantly reduce toxicity and simplify regulatory compliance and disposal costs for end-users compared to traditional solvent-based cocktails.

Which geographical region exhibits the strongest growth potential for LSA adoption?

The Asia Pacific (APAC) region is projected to show the strongest growth potential due to heavy governmental investments in pharmaceutical R&D, expansion of nuclear energy infrastructure, and increasingly stringent environmental monitoring requirements across major economies like China and India.

What is the main driver behind the demand for ultra-low level LSA systems?

The main driver is the increasing regulatory demand for characterizing low-level radioactive waste stemming from nuclear decommissioning projects and the heightened need for highly accurate background radiation monitoring in environmental surveillance and geological dating research, requiring maximum instrument sensitivity.

How does digital pulse processing (DPP) technology improve LSA performance?

DPP significantly improves LSA performance by enabling superior spectral resolution, better discrimination between different types of radiation (alpha/beta separation), and enhanced background noise reduction, ultimately resulting in lower detection limits and higher analytical precision in complex samples.

What role does automation play in the future of the LSA market?

Automation is crucial for enhancing efficiency, enabling high-throughput screening for pharmaceutical ADME studies, reducing operational errors, and facilitating integration with LIMS, thereby accelerating overall laboratory workflow and increasing data integrity.

Are portable LSAs gaining market traction, and in which applications?

Yes, portable LSAs are gaining traction, especially in environmental monitoring and rapid response applications where immediate, on-site quantification of radioactivity in water or soil samples is required, reducing time delays associated with traditional lab analysis.

The detailed market analysis confirms that technological refinement in detection and integration of automation remains central to market competitiveness. The demand for highly specialized analytical instruments capable of ultra-trace detection in complex biological and environmental matrices is sustaining the premium segment of the LSA market. Furthermore, manufacturers are increasingly focusing on software solutions that simplify data management and ensure regulatory traceability, particularly in the highly regulated pharmaceutical and nuclear sectors, creating integrated ecosystems rather than standalone analytical tools. The necessity for reliable, quantitative radioassay in crucial areas of public health and safety ensures the long-term strategic relevance of Liquid Scintillation Analyzer technology across global scientific infrastructure, compelling continuous investment into superior performance metrics.

To further solidify market positions, key players are investing heavily in R&D focused on portable and compact LSA systems, addressing the growing need for decentralized testing and rapid response applications, particularly beneficial for environmental agencies and field researchers operating outside of established laboratory environments. This technological migration, coupled with the strategic expansion into high-growth APAC markets through local partnerships and localized service support, is essential for maintaining revenue streams and capitalizing on the burgeoning research investments in emerging economies. The market trajectory indicates a future where LSAs are not only highly sensitive but also interconnected, automated, and seamlessly integrated into broader laboratory information management systems (LIMS), maximizing operational efficiency and research output globally, demanding sophisticated cybersecurity measures for data protection.

Finally, the competitive landscape necessitates continuous product innovation tailored to specific end-user needs. For instance, the pharmaceutical sector requires specific validation protocols and high throughput, driving demand for multi-detector, fully automated benchtop units, while environmental labs prioritize low detection limits and robust sample handling for high-salt or turbid water samples. Successfully navigating these varied requirements demands a modular approach to instrument design and a robust commitment to customer-specific application support. The ongoing shift toward non-toxic, sustainable consumables will act as a secondary, but increasingly important, differentiator in procurement decisions, reflecting a broader industry commitment towards reducing hazardous laboratory waste and improving overall environmental stewardship within scientific research and industrial operations.

The global outlook for the Liquid Scintillation Analyzer Market is stable, supported by foundational research needs and strict regulatory frameworks that necessitate the specific capabilities of LSA technology. While competing technologies exist for certain niche applications, the versatility and high efficiency of LSA for low-energy beta emitters solidify its irreplaceable role in highly specialized analytical chemistry and radiological measurement. Manufacturers focusing on cost-effective, high-reliability instruments, particularly those incorporating advanced quenching correction and user-friendly digital interfaces, are poised to capture significant market share over the forecast period. Strategic geographical expansion, especially targeting the governmental infrastructure projects in the APAC region, will be a crucial element of growth strategy for market leaders ensuring they meet the evolving compliance and research demands of a global client base.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager