Liquid Source Vaporization System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431510 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Liquid Source Vaporization System Market Size

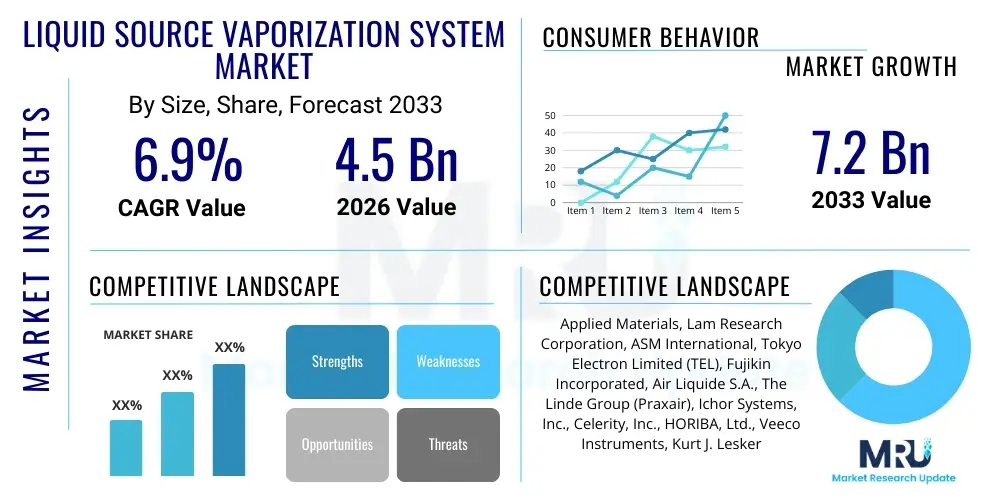

The Liquid Source Vaporization System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $7.2 Billion by the end of the forecast period in 2033.

Liquid Source Vaporization System Market introduction

The Liquid Source Vaporization System (LSVS) Market encompasses advanced equipment designed to precisely deliver and vaporize high-purity liquid chemical precursors into a gaseous state, which are then utilized in sophisticated manufacturing processes such as Chemical Vapor Deposition (CVD), Atomic Layer Deposition (ALD), and Epitaxy. These systems are crucial components in semiconductor fabrication, photovoltaic manufacturing, and the production of LEDs, where the precise control of gas stoichiometry and deposition rate is paramount for achieving ultra-thin, high-quality films. The fundamental role of LSVS technology is to ensure the consistent and contamination-free delivery of metalorganic or liquid hydride precursors necessary for creating complex integrated circuits and advanced material structures.

LSVS technology offers significant advantages over traditional solid or gaseous source delivery methods, particularly when dealing with precursors that have low vapor pressure or are thermally sensitive. By controlling temperature, pressure, and flow rates with exceptional accuracy, modern vaporization systems minimize precursor waste, improve process repeatability, and enhance the overall yield of high-value manufacturing steps. Major applications driving market growth include the production of advanced logic and memory chips (e.g., DRAM, NAND flash), specialized compound semiconductors for 5G and wireless applications, and the increasing demand for high-efficiency solar cells that utilize advanced thin-film coatings.

The market is primarily driven by the relentless trend towards device miniaturization and the subsequent shift to three-dimensional device architectures, which necessitate novel materials and ultra-precise deposition techniques. As semiconductor nodes shrink below 7nm and 5nm, the performance requirements for vaporization equipment—specifically regarding temperature stability, pulse control, and non-particle generation—become increasingly stringent. The need to handle complex, specialized precursors, such as those used for high-k dielectrics or advanced metal interconnects, further fuels the demand for high-performance Direct Liquid Injection (DLI) and Mass Flow Control (MFC) vaporization systems.

Liquid Source Vaporization System Market Executive Summary

The Liquid Source Vaporization System market is characterized by robust growth, primarily fueled by massive capital expenditure in the global semiconductor industry, particularly across Asia Pacific. Business trends indicate a strong move away from conventional bubbler systems toward sophisticated Direct Liquid Injection (DLI) systems and advanced thermally controlled vaporization units, which provide superior stability and responsiveness required for next-generation deposition processes like ALD and pulsed CVD. Key technological advancements center on optimizing heating elements, designing inert flow paths to prevent precursor decomposition, and integrating sophisticated process monitoring tools to ensure ultra-high purity delivery, thereby directly impacting manufacturing yield and operational efficiency.

Regionally, the market exhibits a concentrated landscape, with Asia Pacific maintaining overwhelming dominance due to the presence of major foundry operations and Integrated Device Manufacturers (IDMs) in Taiwan, South Korea, China, and Japan. This region is witnessing rapid establishment of new fabrication plants (fabs), often subsidized by government initiatives aimed at achieving self-sufficiency in semiconductor production. North America and Europe, while smaller in volume, contribute significantly to innovation, focusing on R&D for compound semiconductors, advanced materials for automotive electronics, and specialized equipment manufacturing, thereby influencing global technology standards.

Segment trends highlight the Semiconductor application segment as the largest revenue contributor, driven by ongoing technological transitions in memory (e.g., transitioning from planar to 3D NAND) and logic device manufacturing. Within technology types, DLI systems are expected to register the highest growth rate, displacing traditional technologies in high-precision environments due to their ability to handle low-volatility, high-viscosity precursors with unmatched accuracy. Furthermore, there is an increasing demand for modular and customizable LSVS solutions that can be easily integrated into existing or new fabrication platforms, allowing end-users flexibility in scaling production and adapting to evolving material requirements.

AI Impact Analysis on Liquid Source Vaporization System Market

User queries regarding AI's impact on Liquid Source Vaporization Systems frequently center on predictive maintenance capabilities, optimization of precursor usage, and the enhancement of real-time process control in highly complex manufacturing environments. Users are primarily concerned with how AI can mitigate the risks associated with precursor decomposition, vaporizer clogging, and flow instabilities—issues that severely compromise yield in high-value processes like ALD. The consensus expectation is that AI algorithms, leveraging massive datasets collected from MFCs, pressure sensors, and thermal controllers within the LSVS, will transition process control from reactive adjustments to proactive, model-based predictions, ensuring unprecedented stability in precursor delivery and deposition thickness.

The integration of Artificial Intelligence transforms LSVS operational paradigms by enabling self-diagnosis and anomaly detection with high sensitivity. Traditional monitoring systems often rely on threshold alarms, whereas AI-driven models can detect subtle deviations in heating element performance or flow dynamics indicative of impending failure or quality drift. This capability is crucial because even minor variations in vaporization temperature or pressure translate directly into non-uniform film deposition or material contamination at the wafer level. By continuously learning the optimal operating conditions for specific precursors and recipes, AI systems optimize vaporization efficiency, ensuring maximum utilization of expensive source materials and minimizing waste, which is a major operational concern for semiconductor fabs.

Furthermore, AI facilitates advanced recipe management and rapid process tuning. In environments where hundreds of distinct precursors and processing recipes are used, AI assists engineers in dynamically adjusting vaporization parameters in response to real-time feedback from downstream reactors (e.g., plasma state, deposition rate measured via ellipsometry). This closed-loop optimization dramatically reduces the time required for process qualification for new materials or device nodes. The ability of AI to correlate LSVS performance metrics with final device yield data allows manufacturers to pinpoint the exact source of variability, positioning these smart vaporization systems as critical enablers for Industry 4.0 standards within highly automated semiconductor foundries.

- AI enables predictive maintenance by analyzing sensor data to forecast vaporizer component failure or precursor degradation.

- Optimization of precursor flow and temperature parameters through machine learning models, enhancing deposition uniformity and utilization efficiency.

- Real-time anomaly detection in flow rates and pressure, preventing catastrophic process failures and reducing scrap rates.

- Automated tuning and recipe generation for new material stacks, accelerating R&D cycles and qualification times.

- Improved process traceability by linking LSVS operational data directly to final wafer yield statistics for quality control.

DRO & Impact Forces Of Liquid Source Vaporization System Market

The Liquid Source Vaporization System market is powerfully influenced by a confluence of accelerating drivers related to technological innovation in end-user industries, offset by significant restraints concerning operational complexity and high costs, while capitalizing on emerging opportunities arising from advanced material science. The primary driver is the pervasive demand for high-performance semiconductor components across critical sectors like 5G infrastructure, artificial intelligence processing, high-density data storage, and the proliferation of IoT devices. These applications mandate the use of advanced deposition techniques (such as ALD) that are inherently dependent on ultra-stable, highly controllable liquid precursor delivery provided by state-of-the-art vaporization systems, acting as a crucial impact force.

Key restraints include the extremely high capital investment required for high-precision LSVS equipment, coupled with the specialized maintenance and operating expertise needed to handle pyrophoric, toxic, or air-sensitive precursors. Furthermore, the limited supply chain for certain ultra-high purity precursors and specialized components poses challenges, increasing lead times and operational costs. Impact forces related to regulation and industry standards, particularly around safety and environmental handling of hazardous chemicals, require continuous engineering efforts to ensure compliance, potentially slowing down technology adoption for smaller manufacturers.

Opportunities in the market are centered around the transition to novel material chemistries, including those used in EUV lithography processing and the development of next-generation memories (MRAM, ReRAM). The market stands to benefit significantly from the trend toward localized manufacturing and supply chain resilience, prompting investments in regional fab capacity that inherently require new vaporization systems. Furthermore, the opportunity to integrate advanced diagnostic capabilities and closed-loop control systems leveraging AI offers pathways for vendors to provide higher value-added solutions, moving beyond hardware sales into comprehensive process solutions.

| Category | Description |

|---|---|

| Drivers (D) | Rapid advancement in semiconductor nodes requiring ALD/CVD techniques; Growth of 3D device architecture (3D NAND, FinFET); Expansion of 5G, AI, and IoT infrastructure demanding specialized materials. |

| Restraints (R) | High system complexity and integration challenges; Significant capital expenditure required for sophisticated DLI systems; Volatility and specialized handling requirements of ultra-high purity precursors. |

| Opportunities (O) | Emergence of new materials (e.g., Gallium Nitride, Silicon Carbide) for power electronics; Integration of AI and machine learning for predictive maintenance and process optimization; Growth in flexible electronics and advanced display technologies. |

| Impact Forces | Technological advancements (Shift to DLI); Economic factors (Semiconductor capital investment cycles); Regulatory pressures (Safety and environmental compliance). |

Segmentation Analysis

The Liquid Source Vaporization System market is segmented based on the type of technology employed, the specific application areas, and the type of precursor material being delivered. This segmentation is essential for understanding the diverse requirements of end-user industries, ranging from the high-volume manufacturing needs of major semiconductor foundries to the specialized, small-scale demands of research laboratories. Technological segmentation primarily distinguishes between systems based on Mass Flow Control (MFC) and sophisticated Direct Liquid Injection (DLI) technologies, reflecting different levels of precision and suitability for precursors with varying physical properties. DLI systems, which atomize the liquid source directly before heating, are increasingly preferred for low-volatility or highly viscous precursors critical for sub-10nm logic and advanced memory fabrication.

Application-based segmentation reveals that the Semiconductor sector dominates the market, driving the most significant revenue and technological evolution due to the stringent demands of microchip manufacturing processes like ALD and specialized CVD. The Photovoltaic and Solar segment represents a steady growth area, utilizing LSVS for depositing functional layers to enhance cell efficiency, although typically requiring higher throughput and less stringent purity than semiconductor applications. The third major segment, Research and Development, includes universities and corporate labs focused on material science and compound semiconductors, demanding highly flexible and versatile vaporization systems capable of rapid changeovers between different precursor chemistries.

Further analysis of the market by component reveals distinct segments for the vaporization chamber/head, the liquid flow control unit (pump/MFC), and the integrated control electronics. The performance and reliability of the vaporization chamber are critical differentiators, especially its thermal homogeneity and resistance to corrosion or particle generation. The continuous development of specialized, inert materials for system components is necessary to ensure the purity of complex organometallic precursors, driving continuous innovation within component manufacturing.

- By Technology

- Direct Liquid Injection (DLI) System

- Mass Flow Control (MFC) Based System

- Bubbler Systems (Declining Share)

- By Component

- Vaporization Unit/Chamber

- Liquid Flow Controller (LFC)

- Integrated Control Module

- Precursor Handling and Delivery Subsystems

- By Application

- Semiconductor Manufacturing (Memory, Logic, Analog)

- Photovoltaic (Solar Cell) Manufacturing

- LED and Display Technology

- Research and Development (R&D)

- Compound Semiconductor Fabrication (e.g., GaN, SiC)

- By Precursor Type

- Metalorganic Precursors (MOCVD)

- Hydride Precursors

- Halide Precursors

- Organosilicon Precursors

Value Chain Analysis For Liquid Source Vaporization System Market

The value chain of the Liquid Source Vaporization System market begins with the upstream sourcing and manufacturing of ultra-high purity chemical precursors, often involving specialized chemical companies. This initial stage dictates the complexity and design requirements for the downstream vaporization equipment, as the physical and chemical properties of the precursor (e.g., viscosity, thermal stability, vapor pressure) directly influence the necessary LSVS technology (DLI versus MFC). Key activities in this upstream segment include chemical synthesis, purification, and specialized packaging to maintain precursor integrity. Competition at this stage is high, driven by intellectual property related to proprietary precursor chemistries essential for advanced deposition processes.

The midstream component involves the core manufacturing of the vaporization systems, dominated by highly specialized equipment vendors. These manufacturers focus heavily on precision engineering, materials science (to ensure compatibility with corrosive precursors), and system integration. Distribution channels for these high-value systems are primarily direct, involving close collaboration between the equipment vendor and the end-user (fabrication plants). This direct sales model ensures that complex customization and integration services, including factory acceptance testing (FAT) and site acceptance testing (SAT), are managed efficiently, reflecting the mission-critical nature of the equipment.

The downstream segment consists of the end-users—primarily semiconductor foundries, IDMs, and PV manufacturers. These buyers integrate the LSVS into larger deposition tools (CVD/ALD reactors). The aftermarket services, including maintenance, calibration, and spare parts supply for vaporization units, form a crucial revenue stream for equipment manufacturers. Indirect channels, such as regional distributors or system integrators, sometimes play a role in smaller regional markets or for R&D equipment, but the majority of high-volume, high-value sales are handled directly to ensure optimal performance and technical support for highly sensitive fabrication processes.

Liquid Source Vaporization System Market Potential Customers

The primary consumers and buyers of Liquid Source Vaporization Systems are organizations involved in the high-precision manufacture of electronic components and advanced materials, where thin-film deposition techniques are indispensable. The largest customer base resides within the semiconductor industry, including captive Integrated Device Manufacturers (IDMs) like Samsung and Intel, as well as pure-play semiconductor foundries such as TSMC and GlobalFoundries. These companies continually invest in state-of-the-art vaporization equipment to support process scaling, new product introductions (NPI), and volume production of advanced logic and memory chips, which demand absolute control over film quality and thickness down to the atomic level.

Another significant customer segment is the Photovoltaic industry, particularly large-scale solar cell manufacturers utilizing thin-film technologies (like CIGS or cadmium telluride) that rely on LSVS for depositing critical functional layers, although their volume requirements and cost sensitivity often differ from the semiconductor sector. Furthermore, companies involved in manufacturing advanced displays (OLED, MicroLED) and compound semiconductors (Gallium Nitride, Silicon Carbide for power electronics) are growing consumers, as these high-performance materials require specialized MOCVD processes enabled by precise liquid source delivery.

Finally, academic and industrial research institutions constitute a crucial customer segment, purchasing smaller, highly flexible LSVS units for exploratory material science, process development, and prototyping new thin-film applications. While their individual purchase volumes are low, these institutions often set the stage for future high-volume manufacturing adoption, focusing on next-generation precursors and deposition techniques. The purchasing decision across all segments is heavily influenced by factors such as system reliability, compatibility with a wide range of precursors, and the vendor’s reputation for providing responsive and highly specialized technical support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.2 Billion |

| Growth Rate | 6.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials, Lam Research Corporation, ASM International, Tokyo Electron Limited (TEL), Fujikin Incorporated, Air Liquide S.A., The Linde Group (Praxair), Ichor Systems, Inc., Celerity, Inc., HORIBA, Ltd., Veeco Instruments, Kurt J. Lesker Company, AIXTRON SE, CVD Equipment Corporation, MKS Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Source Vaporization System Market Key Technology Landscape

The technological landscape of the Liquid Source Vaporization System market is dominated by the sophisticated refinement of Direct Liquid Injection (DLI) systems, which represent the cutting edge for handling complex, low-vapor-pressure precursors essential for advanced semiconductor nodes. DLI technology involves pumping the liquid precursor with ultra-high precision directly into a heated vaporization chamber, where flash vaporization occurs. Key technological advancements here include the optimization of injector design to minimize droplet size variability and the development of specialized, corrosion-resistant heating elements (often utilizing ceramic or exotic alloys) that ensure instantaneous and uniform heating without causing thermal decomposition or premature precursor cracking, which would lead to particle generation and contamination.

Parallel to DLI, Mass Flow Control (MFC) based liquid vaporization systems continue to evolve, particularly for precursors with moderately high vapor pressure. The latest generation of Liquid Mass Flow Controllers (L-MFCs) integrates advanced sensors and algorithms to compensate for changes in fluid viscosity and density due to temperature fluctuations, ensuring highly accurate mass delivery. Furthermore, there is a pervasive industry focus on developing modularity and standardization. Modular LSVS components allow fabrication plants to rapidly swap out vaporization units to accommodate different precursors or maintenance needs, thereby maximizing tool uptime and flexibility—a critical requirement in high-volume, multi-product foundry environments.

A major emphasis across all LSVS technologies is the implementation of ultra-clean and vacuum-compatible designs. This involves the utilization of specialized, low-outgassing sealing materials, meticulous surface finishes for all wetted components, and integrated particle monitoring systems. The incorporation of advanced diagnostic tools, often employing spectroscopic or acoustic sensing methods, allows for real-time monitoring of the vaporization efficiency and detection of precursor degradation products. These integrated diagnostic capabilities are foundational for the next phase of smart manufacturing, where vaporization systems communicate their health and performance status directly to upstream and downstream process controllers to achieve unprecedented levels of stability and yield optimization.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC, particularly regions including Taiwan, South Korea, China, and Japan, commands the largest share of the global LSVS market. This dominance is attributable to the concentration of the world’s leading semiconductor manufacturers (foundries and IDMs) and aggressive governmental strategies supporting domestic chip production capacity expansion. Massive ongoing investment in building new mega-fabs across China and Taiwan, coupled with technological leadership in memory (DRAM, NAND) production in South Korea, ensures continued high demand for high-precision DLI systems and associated infrastructure.

- North America (NA) Innovation Hub: North America maintains a strong position driven by leading equipment manufacturers and a robust ecosystem for high-tech research and development. While high-volume manufacturing capacity is lower compared to APAC, the region is pivotal for developing next-generation LSVS technology, advanced precursor chemistries, and integrating AI/ML capabilities into process control. Significant investment in compound semiconductors (SiC, GaN) and quantum computing research also generates specialized demand for highly customizable vaporization solutions.

- Europe’s Specialized Growth: The European market, while moderate in size, focuses on specialized applications, particularly in the automotive electronics sector, power devices (based on SiC and GaN), and advanced R&D related to materials for More than Moore applications. The presence of key European equipment suppliers and materials science institutes drives demand for advanced MOCVD and ALD systems that require precise liquid source delivery, contributing specialized expertise and high-end technological solutions to the global market.

- Emerging Markets (MEA & LATAM): The Middle East & Africa and Latin America currently hold minor shares, primarily driven by investments in academic research centers and initial stages of localized electronic assembly and repair. Future growth potential relies on governmental initiatives to establish localized semiconductor supply chains or investments in renewable energy infrastructure requiring photovoltaic components. Demand remains highly specific and often satisfied through imported systems from established global vendors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Source Vaporization System Market.- Applied Materials

- Lam Research Corporation

- ASM International

- Tokyo Electron Limited (TEL)

- Fujikin Incorporated

- Air Liquide S.A.

- The Linde Group (Praxair)

- Ichor Systems, Inc.

- Celerity, Inc.

- HORIBA, Ltd.

- Veeco Instruments

- Kurt J. Lesker Company

- AIXTRON SE

- CVD Equipment Corporation

- MKS Instruments

- SAES Getters S.p.A.

- RECIF Technologies

- VAT Group AG

Frequently Asked Questions

Analyze common user questions about the Liquid Source Vaporization System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Liquid Source Vaporization System (LSVS) in semiconductor manufacturing?

The primary function of an LSVS is to precisely convert high-purity liquid chemical precursors, often metalorganics or hydrides, into a stable, gaseous vapor stream required for thin-film deposition processes such as Atomic Layer Deposition (ALD) and Chemical Vapor Deposition (CVD). This precise delivery ensures film uniformity and optimal material composition critical for advanced microchip fabrication.

How do Direct Liquid Injection (DLI) systems differ from traditional bubbler or MFC-based vaporization methods?

DLI systems offer superior control and stability, especially for low-volatility and thermally sensitive precursors. Unlike bubblers, which rely on carrier gas flow over the liquid surface, DLI systems pump the liquid precursor directly into a flash vaporization chamber, ensuring instantaneous conversion and eliminating issues related to carrier gas saturation limitations, thus supporting high-speed ALD and advanced deposition recipes.

Which application segment drives the highest demand in the Liquid Source Vaporization System market?

The Semiconductor Manufacturing segment drives the highest demand. This sector utilizes LSVS extensively for critical steps in producing advanced logic (e.g., FinFETs, Gate-All-Around) and memory devices (3D NAND, High-Bandwidth Memory), where the requirements for ultra-high purity and precise film thickness are most stringent and demanding of sophisticated vaporization technology.

What major challenges restrict the adoption and performance of LSVS technology?

Major challenges include the high capital cost and complexity of DLI systems, the need for specialized maintenance to prevent precursor decomposition or clogging, and ensuring the absolute thermal stability and corrosion resistance of components when handling highly reactive or hazardous liquid precursors necessary for sub-10nm processing.

What is the impact of AI and Machine Learning on LSVS operations?

AI significantly enhances LSVS operations by enabling predictive maintenance for vaporization components, optimizing precursor usage through dynamic flow control, and providing real-time anomaly detection. This transition from static control to dynamic, predictive management improves system uptime, reduces material waste, and enhances overall deposition yield in highly automated production environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager