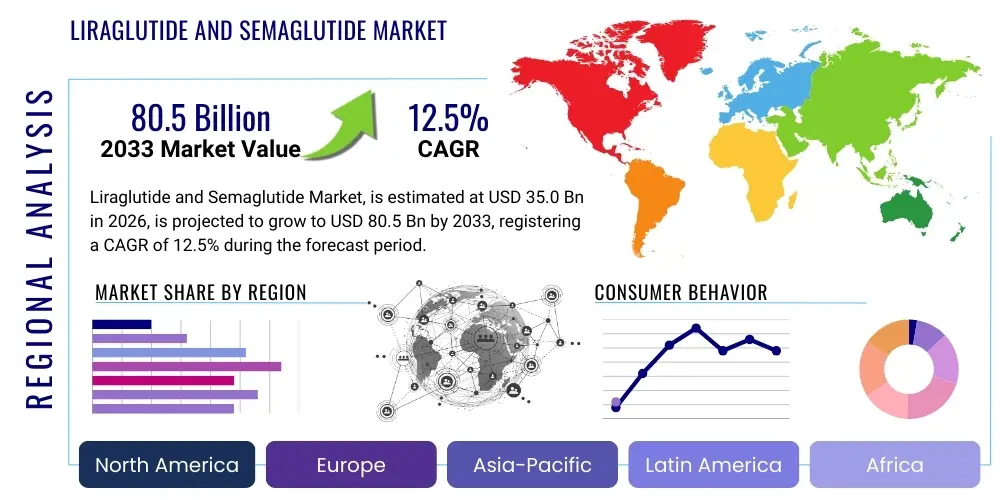

Liraglutide and Semaglutide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438982 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Liraglutide and Semaglutide Market Size

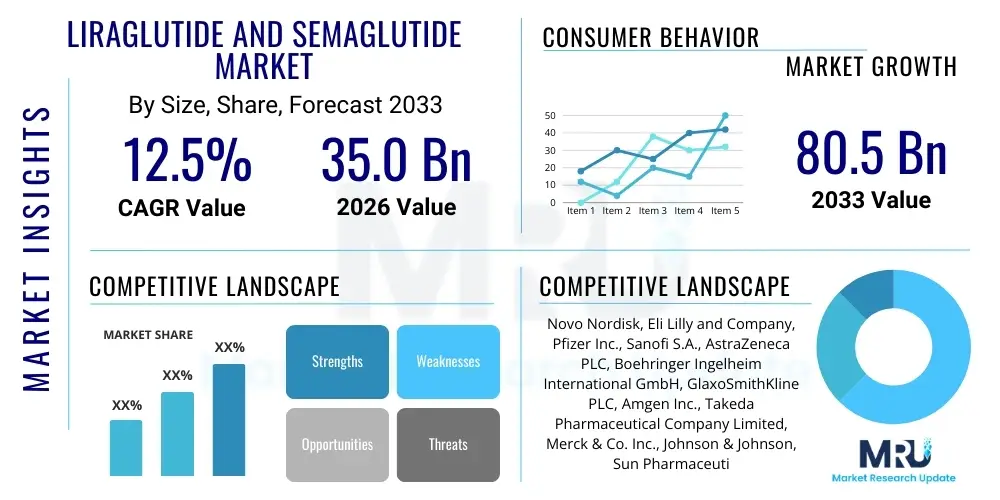

The Liraglutide and Semaglutide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 35.0 Billion in 2026 and is projected to reach USD 80.5 Billion by the end of the forecast period in 2033.

Liraglutide and Semaglutide Market introduction

The Liraglutide and Semaglutide market encompasses pharmaceutical products based on Glucagon-like Peptide-1 (GLP-1) receptor agonists, primarily developed for the management of Type 2 Diabetes Mellitus (T2DM), chronic weight management (obesity), and cardiovascular risk reduction. These drugs operate by mimicking the actions of the natural GLP-1 hormone, which stimulates insulin secretion, suppresses glucagon release, slows gastric emptying, and increases satiety. Liraglutide (daily injection) and Semaglutide (weekly injection, and newer oral formulations) have become cornerstone therapies, significantly improving glycemic control and offering substantial weight loss benefits, thereby addressing two of the most prevalent global health crises: diabetes and obesity.

The core mechanism involves enhancing endogenous glucose-dependent insulin secretion, which minimizes the risk of hypoglycemia, a common concern with older diabetes medications. Furthermore, the demonstrated efficacy in reducing major adverse cardiovascular events (MACE) in high-risk patients has expanded their application beyond endocrinology into cardiology, establishing them as vital therapeutic agents for holistic metabolic health management. The market introduction of long-acting formulations and novel delivery systems, particularly the transition toward oral bioavailability for Semaglutide, represents a paradigm shift, improving patient compliance and broadening accessibility to these high-efficacy treatments. This combination of superior clinical outcomes, multi-indication approvals, and convenient dosing schedules positions these therapies for sustained commercial success.

Driving factors underpinning market expansion include the escalating global prevalence of T2DM and obesity, demographic shifts toward aging populations often grappling with comorbid metabolic conditions, and heightened awareness among healthcare providers regarding the long-term benefits, including sustained weight reduction and profound cardiovascular protection offered by GLP-1 agonists. The continuous investment in research and development to explore new indications, such as non-alcoholic steatohepatitis (NASH) and obstructive sleep apnea, alongside efforts to reduce manufacturing costs and enhance supply chain resilience, further solidifies the market's robust growth trajectory over the forecast period. Regulatory approvals for broader patient populations, including adolescents, also contribute significantly to the expanding patient pool requiring these treatments.

Liraglutide and Semaglutide Market Executive Summary

The Liraglutide and Semaglutide market is characterized by intense innovation and explosive growth, driven primarily by the blockbuster success of Semaglutide across both diabetes and weight management applications, setting unprecedented commercial milestones in the biopharmaceutical sector. Key business trends include aggressive capacity expansion by leading manufacturers to address severe global demand shortages, strategic mergers and acquisitions focused on securing novel delivery technologies, and substantial pipeline investments exploring next-generation multi-agonist therapies (e.g., GLP-1/GIP/Glucagon combinations) designed to offer even greater metabolic benefits. Pricing and reimbursement strategies remain central, particularly in highly competitive markets like North America and Europe, as payers grapple with the high utilization and cost associated with chronic lifetime treatment.

Regionally, North America maintains its dominance due to high disease prevalence, advanced healthcare infrastructure, and favorable reimbursement policies for branded, high-cost biological treatments, accounting for the largest share of market revenue. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapidly increasing rates of urbanization, sedentary lifestyles leading to surging diabetes and obesity rates, and improving access to specialty pharmaceuticals in developing economies like China and India. European markets exhibit steady growth, balancing stringent cost-containment policies with the recognized clinical necessity of these high-efficacy treatments, focusing regulatory efforts on achieving value-based pricing agreements. Latin America and MEA are gaining traction as pharmaceutical companies expand their geographic footprint to tap into relatively underserved populations.

Segment-wise, the Semaglutide segment is overwhelmingly dominant, largely attributable to its superior convenience (once-weekly dosing) and the successful commercialization of both injectable and oral forms, which drastically improves patient adherence compared to daily alternatives like Liraglutide. Application trends show a critical pivot: while diabetes treatment historically constituted the major revenue stream, the market for dedicated obesity management has exploded, becoming the primary growth engine, particularly following clear clinical evidence linking weight loss with long-term cardiovascular benefits. Distribution channels are shifting, with specialized retail pharmacies playing an increasingly vital role in patient counseling and prescription fulfillment, complementing the historical reliance on hospital settings for initial diagnosis and treatment initiation.

AI Impact Analysis on Liraglutide and Semaglutide Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are accelerating the identification of novel GLP-1 related molecular targets, optimizing personalized dosing regimens, and improving clinical trial efficiency for next-generation metabolic drugs. The key themes revolve around AI's ability to interpret vast datasets derived from metabolomics, genomics, and electronic health records (EHRs) to predict patient response to Liraglutide or Semaglutide, potentially minimizing ineffective treatment periods and adverse events. There is a strong expectation that AI will streamline the complex synthesis and quality control processes required for peptide manufacturing, addressing current supply chain bottlenecks and quality assurance concerns, ultimately leading to faster market access for enhanced formulations and reduced production costs.

Furthermore, concerns often center on AI's role in pharmacovigilance and real-world data analysis. Users are interested in how ML algorithms can continuously monitor large patient populations using Semaglutide or Liraglutide to rapidly detect rare or subtle adverse effects not apparent in initial clinical trials, enhancing overall drug safety profiles. AI is also anticipated to revolutionize treatment protocols by integrating continuous glucose monitoring (CGM) data and patient lifestyle inputs to recommend highly personalized therapeutic adjustments, optimizing the synergistic effects of the medication with individualized behavioral changes. This shift towards data-driven, precision medicine is crucial for maintaining the long-term effectiveness of these GLP-1 agonists.

The integration of AI in drug discovery for adjacent therapies, focusing on combination treatments that maximize both GLP-1 action and other complementary mechanisms (such as GIP or Glucagon), is a major area of public and research interest. AI models can simulate millions of molecular interactions to rapidly screen candidates for optimal efficacy and minimized off-target effects, significantly shortening the pre-clinical development timeline. This predictive power is vital for staying ahead in the highly competitive metabolic drug pipeline, ensuring that companies can swiftly bring to market improved formulations, potentially surpassing current once-weekly standards with even longer-acting or more effective molecules tailored to specific patient genotypes and phenotypes.

- AI optimizes target identification for next-generation GLP-1 mimetics, accelerating R&D.

- Machine learning algorithms enhance personalized dosing, predicting patient response and minimizing side effects.

- AI improves clinical trial design efficiency, identifying ideal patient cohorts for metabolic studies.

- Predictive analytics stabilize and optimize complex peptide manufacturing supply chains.

- AI-driven pharmacovigilance systems continuously monitor real-world data for rapid safety signal detection.

- Generative AI supports the development of novel oral delivery systems with enhanced bioavailability.

DRO & Impact Forces Of Liraglutide and Semaglutide Market

The market for Liraglutide and Semaglutide is primarily driven by the catastrophic global rise in obesity and Type 2 Diabetes prevalence, coupled with compelling clinical trial data demonstrating significant efficacy not only in glycemic control and weight reduction but critically in cardiovascular risk mitigation. These drugs represent a pivotal shift from managing symptoms to modifying disease progression, securing their position as standard-of-care treatments worldwide. However, key restraints include the substantial cost of therapy, which strains healthcare budgets and limits patient access in lower-income regions, alongside persistent patient adherence challenges related to injectable administration (though mitigated by weekly and oral options) and common gastrointestinal side effects such as nausea and vomiting, which can lead to treatment discontinuation.

Opportunities for market expansion are vast, centered on exploring novel indications beyond T2DM and obesity, most notably in treating conditions like Non-Alcoholic Steatohepatitis (NASH), Polycystic Ovary Syndrome (PCOS), and Alzheimer’s disease, where early preclinical data suggests potential benefit. The continuous development of improved delivery systems, including ultra-long-acting formulations (e.g., monthly injections or implantable devices) and further enhancing the bioavailability of oral formulations, represents a major commercial opportunity to maximize patient convenience and compliance. Moreover, the increasing adoption of combination therapies, integrating GLP-1 agonists with other hormonal pathways (e.g., GIP, Glucagon), promises superior efficacy profiles, capturing patients who require more aggressive metabolic control than current monotherapies can provide.

The impact forces currently shaping the market are exceptionally strong, characterized by high barriers to entry due to complex manufacturing and entrenched intellectual property, allowing only a few major pharmaceutical players to dominate. Regulatory momentum is highly positive, with fast-track designations granted for new formulations and indications reflecting the unmet medical need. Furthermore, public perception and media attention surrounding the weight loss benefits of Semaglutide have generated massive consumer demand, often outpacing manufacturer supply capabilities. The imminent threat of biosimilars post-patent expiry (though still several years away for Semaglutide) compels current market leaders to aggressively innovate and differentiate their offerings to maintain market share dominance against future generic competition.

Segmentation Analysis

The Liraglutide and Semaglutide market is meticulously segmented based on Drug Type, Route of Administration, Application, and Distribution Channel to provide granular insights into market dynamics and growth potential across various therapeutic and commercial vectors. Understanding these segments is crucial for manufacturers, payers, and healthcare providers to tailor strategies, optimize resource allocation, and address specific patient needs effectively. The dominance of Semaglutide highlights the market's preference for convenience and efficacy, while the dual segmentation by application (Diabetes vs. Obesity) reveals rapidly shifting utilization patterns and revenue sources, particularly the exponential growth in the obesity segment.

The Route of Administration segmentation clearly indicates a strategic shift towards non-injectable formats. While injectable formulations remain the gold standard for clinical efficacy, the introduction and rapid adoption of oral Semaglutide (Rybelsus) signal a transformative movement towards maximizing patient comfort and adherence, especially for long-term chronic management. Analyzing the Distribution Channel segment emphasizes the critical role of specialized retail pharmacies, which manage the cold chain requirements and patient education necessary for these sensitive biological products, often facilitating greater access compared to restrictive hospital-only dispensing models.

These segmentations collectively highlight the market's maturity and its response to patient preference and clinical need. The forecasted growth is heavily dependent on the performance within the Semaglutide and the Obesity application segments. Companies prioritizing R&D in long-acting injectable and enhanced oral bioavailability technologies are expected to capture the highest market share, capitalizing on the high demand spurred by the global metabolic health crisis. Future segmentation analysis will likely focus more intently on combination therapies and personalized medicine approaches based on patient genotype.

- By Drug Type:

- Liraglutide

- Semaglutide

- By Route of Administration:

- Injectable (Subcutaneous)

- Oral

- By Application:

- Type 2 Diabetes Mellitus

- Obesity/Weight Management

- Cardiovascular Risk Reduction

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Liraglutide and Semaglutide Market

The value chain for Liraglutide and Semaglutide is characterized by high upfront investment in research and development (R&D) and complex, specialized manufacturing processes for these large peptide molecules. The upstream segment is dominated by highly technical API (Active Pharmaceutical Ingredient) synthesis, requiring advanced recombinant DNA technology and stringent quality control protocols to ensure purity and stability. This phase accounts for a significant portion of the cost structure, driven by intellectual property protection and the need for proprietary formulation techniques to achieve extended half-lives and enhanced bioavailability, such as fatty acid modifications crucial for weekly dosing regimens. Key activities include advanced peptide synthesis, large-scale fermentation, and purification.

The midstream segment involves formulation, fill-and-finish, and packaging, necessitating highly regulated and sterile environments compliant with global Good Manufacturing Practices (GMP). The development of sophisticated pen injector devices for subcutaneous delivery or specialized coating technology for oral bioavailability (e.g., SNAC absorption enhancers) adds considerable complexity and cost here. Distribution channels form the core of the downstream activities, requiring robust cold chain logistics due to the temperature sensitivity of these biological products. The distribution network is complex, involving direct sales forces targeting endocrinologists and cardiologists, indirect sales through wholesalers, and specialized handling by retail and hospital pharmacies.

Direct channels, involving communication and contracts directly with large institutional buyers (e.g., government health systems, large hospital networks), are critical for volume sales and formulary inclusion. Indirect channels, relying on pharmaceutical wholesalers and distributors, ensure broad geographical reach and inventory management across thousands of retail dispensing points. Specialized distribution models are emerging, particularly with the rise of online pharmacies offering discreet and convenient prescription fulfillment, albeit requiring certified cold-chain monitoring throughout delivery. The high R&D intensity and complex proprietary manufacturing methods ensure significant barriers to entry, maintaining the oligopolistic structure of the value chain.

Liraglutide and Semaglutide Market Potential Customers

The primary end-users and buyers of Liraglutide and Semaglutide products span across multiple layers of the healthcare system, reflecting the broad therapeutic applicability of these GLP-1 agonists. At the clinical level, key prescribing professionals include endocrinologists, who manage the intricate details of Type 2 Diabetes; cardiologists, focused on cardiovascular risk reduction in high-risk patients; and bariatric specialists or primary care physicians specializing in chronic weight management. These professionals drive demand by initiating therapy, responding to clinical guidelines, and managing patient adherence. The rapidly growing recognition of obesity as a chronic disease requiring pharmacological intervention has broadened the prescribing base significantly beyond traditional diabetes specialists.

Institutional buyers represent the major purchasing power, particularly large integrated healthcare systems, hospital pharmacies, and governmental or private insurance payers (PBMs). Health insurance companies and pharmacy benefit managers (PBMs) are crucial potential customers as they make formulary decisions regarding which drugs are covered and at what tier, fundamentally influencing patient access and overall market size. These entities analyze comparative effectiveness and cost-effectiveness data rigorously to manage budget impact, given the high price point and long-term nature of treatment required for metabolic diseases.

Ultimately, the individual patient suffering from T2DM, obesity, or comorbid cardiovascular risk is the end consumer, although their purchasing decision is mediated by prescription and payer coverage. The high consumer demand generated by social awareness regarding the efficacy of these drugs, particularly for weight loss, means that patients often actively seek out these treatments. Therefore, manufacturers must target educational efforts not only toward prescribers but also directly to consumers to drive patient-initiated discussions with their doctors. The expanding indications and successful marketing campaigns ensure a continuously growing pool of potential customers across all age groups requiring chronic metabolic and weight management therapy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.0 Billion |

| Market Forecast in 2033 | USD 80.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novo Nordisk, Eli Lilly and Company, Pfizer Inc., Sanofi S.A., AstraZeneca PLC, Boehringer Ingelheim International GmbH, GlaxoSmithKline PLC, Amgen Inc., Takeda Pharmaceutical Company Limited, Merck & Co. Inc., Johnson & Johnson, Sun Pharmaceutical Industries Ltd., Alkem Laboratories Ltd., Teva Pharmaceutical Industries Ltd., Mylan N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liraglutide and Semaglutide Market Key Technology Landscape

The technological landscape supporting the Liraglutide and Semaglutide market is centered on enhancing the pharmacological properties and improving patient delivery of these GLP-1 receptor agonists. A critical advancement involves lipid acylation and albumin binding technology, which significantly extends the half-life of the peptide, enabling once-weekly dosing for Semaglutide compared to the once-daily requirement for Liraglutide. This modification, often involving attaching a fatty acid side chain, allows the molecule to evade rapid enzymatic degradation and excretion, providing steady therapeutic concentrations over a prolonged period and revolutionizing patient compliance and clinical outcomes.

Another pivotal technological area is the development of non-parenteral (non-injectable) delivery systems. The successful commercialization of oral Semaglutide relies heavily on absorption enhancer technology, specifically the utilization of Salcaprozate Sodium (SNAC), which protects the delicate peptide from gastric degradation and facilitates its absorption across the stomach lining into the bloodstream. This advancement represents a significant biological and pharmacological breakthrough, overcoming the historical challenge of oral administration for large peptide molecules. Continuous refinement of this technology is expected to drive the development of other oral peptide therapies.

Furthermore, the market heavily relies on advanced engineering and manufacturing technologies related to the delivery devices themselves. High-precision, pre-filled pen injectors are standard, incorporating mechanisms for easy, accurate self-administration and often integrating features for dosage memory and connectivity for better patient tracking. In the upstream segment, sophisticated recombinant DNA and fermentation technologies are essential for the high-yield, high-purity production of the Liraglutide and Semaglutide peptides at the massive scale required to meet escalating global demand, ensuring robust supply chain stability and quality control for these blockbuster drugs.

Regional Highlights

North America, particularly the United States, represents the dominant region in the Liraglutide and Semaglutide market, primarily driven by the exceptionally high prevalence rates of diabetes and obesity, coupled with the established cultural acceptance of early pharmacological intervention for chronic diseases. The region benefits from a robust regulatory framework (FDA), extensive insurance coverage (both private and government-funded), and high patient awareness, leading to rapid and widespread adoption of innovative, high-cost branded therapies. Aggressive marketing and substantial investment in Phase IV clinical trials and real-world evidence gathering further cement North America’s leadership, accounting for the largest revenue share and driving global pricing trends.

Europe constitutes the second-largest market, characterized by varied national healthcare systems and pricing structures. While Western European countries (Germany, UK, France) exhibit high adoption rates, market access often involves complex negotiations with national reimbursement bodies (e.g., NICE, IQWiG) demanding rigorous cost-effectiveness data. This emphasis on health technology assessment (HTA) means adoption rates, though high, can be slower than in the US, but the integration of these drugs into standardized clinical guidelines ensures steady long-term usage. Eastern European markets show increasing potential as economic conditions improve and healthcare expenditure rises.

The Asia Pacific (APAC) region is projected to register the fastest growth, fueled by urbanization, dietary shifts, and a significant, rapidly expanding population base facing metabolic challenges. Countries like China, India, and Japan offer immense untapped market potential. While affordability and access remain constraints, increasing disposable income, improving healthcare infrastructure, and rising chronic disease awareness are accelerating the uptake of GLP-1 agonists. Local manufacturing expansion and strategic partnerships are key to navigating diverse regulatory environments and intellectual property enforcement across this vast and heterogeneous geographic area.

- North America: Market dominance due to high disease burden, favorable reimbursement policies, and established biopharmaceutical presence, driving massive commercial revenue.

- Europe: Steady growth mandated by structured HTA evaluations, strong clinical guideline adherence, and increasing adoption in major economies like Germany and the UK.

- Asia Pacific (APAC): Highest CAGR forecast, propelled by surging obesity rates, expanding middle class access to specialty drugs, and improving healthcare investment in China and India.

- Latin America: Emerging market characterized by growing awareness and rising incidence of T2DM, requiring manufacturers to tailor strategies to diverse economic conditions and public procurement systems.

- Middle East & Africa (MEA): High prevalence of diabetes and metabolic syndrome in affluent GCC nations drives demand, though market penetration remains low in sub-Saharan Africa due to cost barriers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liraglutide and Semaglutide Market.- Novo Nordisk A/S

- Eli Lilly and Company

- Pfizer Inc.

- Sanofi S.A.

- AstraZeneca PLC

- Boehringer Ingelheim International GmbH

- GlaxoSmithKline PLC

- Amgen Inc.

- Takeda Pharmaceutical Company Limited

- Merck & Co. Inc.

- Johnson & Johnson

- Sun Pharmaceutical Industries Ltd.

- Alkem Laboratories Ltd.

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V.

- Dr. Reddy's Laboratories Ltd.

- Cipla Limited

- Bayer AG

- Oramed Pharmaceuticals Inc.

- Intarcia Therapeutics, Inc.

Frequently Asked Questions

Analyze common user questions about the Liraglutide and Semaglutide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Semaglutide market?

The primary driver is the extraordinary efficacy of Semaglutide in chronic weight management (obesity), coupled with the convenience of its once-weekly injectable dosing and the availability of an oral formulation, significantly expanding its market reach beyond Type 2 Diabetes treatment.

How do Liraglutide and Semaglutide compare in terms of dosing frequency and efficacy?

Semaglutide generally offers superior efficacy in terms of blood glucose control and weight loss compared to Liraglutide, and is typically administered as a once-weekly injection or once-daily oral tablet, whereas Liraglutide requires daily injection, making Semaglutide more favorable for patient adherence.

What are the major challenges facing the market for GLP-1 agonists?

Major challenges include the high cost of therapy, which restricts patient access and strains healthcare budgets; supply chain limitations struggling to meet soaring global demand; and managing common gastrointestinal side effects experienced by patients.

Which geographical region dominates the Liraglutide and Semaglutide market?

North America, led by the United States, dominates the market due to the high prevalence of metabolic diseases, extensive insurance coverage, and rapid adoption of novel, high-value branded pharmaceuticals in the specialty therapeutics sector.

What role does the oral formulation play in future market development?

The oral formulation (Rybelsus) is crucial for future expansion as it lowers the barrier to entry for needle-averse patients, drastically improving adherence and allowing these medications to compete more effectively with non-injectable standard diabetes and weight loss therapies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager