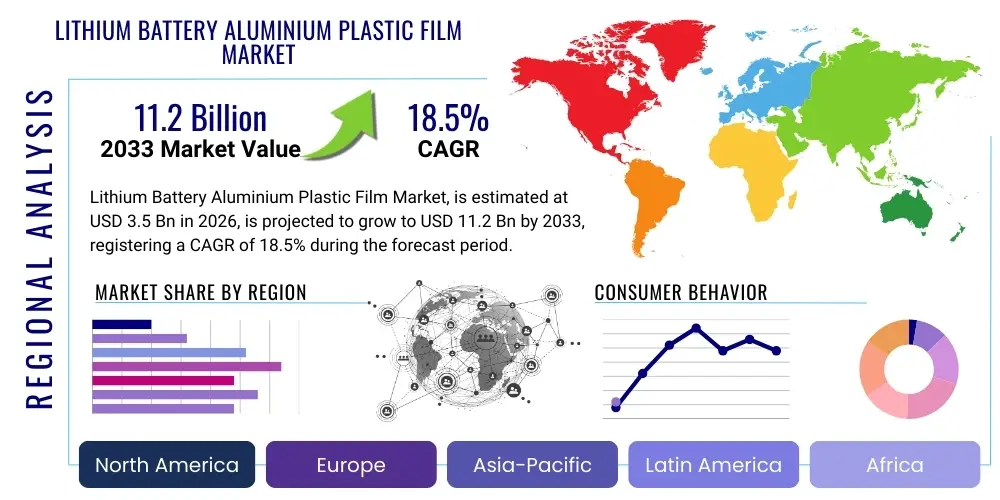

Lithium Battery Aluminium Plastic Film Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438293 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Lithium Battery Aluminium Plastic Film Market Size

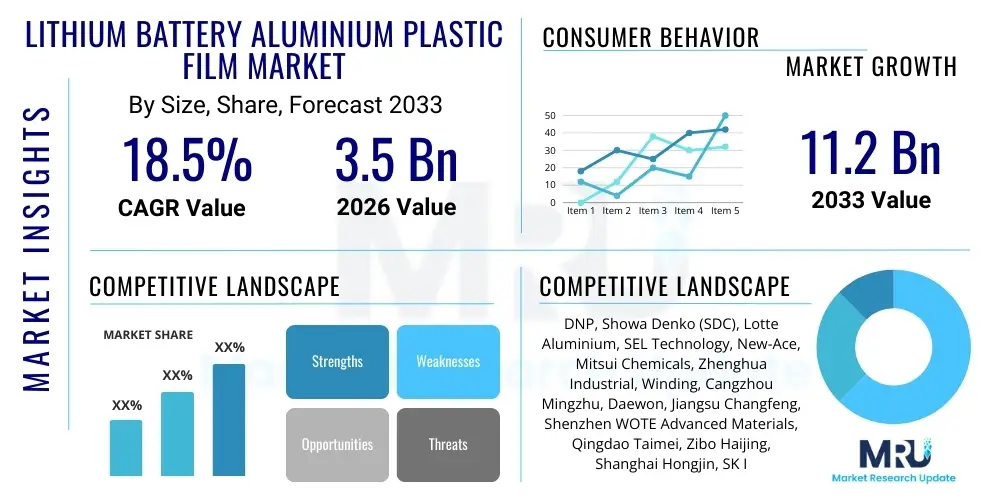

The Lithium Battery Aluminium Plastic Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

Lithium Battery Aluminium Plastic Film Market introduction

The Lithium Battery Aluminium Plastic Film Market encompasses the specialized material critical for packaging prismatic and pouch-type lithium-ion battery cells. This film, often referred to as 'aluminum laminate film' or 'pouch film,' serves as the primary external barrier, protecting the internal components—such as the cathode, anode, separator, and electrolyte—from external moisture and oxygen while providing necessary thermal and chemical insulation. Its multilayer structure, typically comprising an outer polyamide layer for mechanical strength, an aluminum layer for barrier performance, and an inner polypropylene/polyethylene layer for heat sealing and insulation, makes it indispensable for maintaining cell integrity and ensuring safety and longevity.

Product Description: Aluminium plastic film is characterized by its high barrier properties against water vapor transmission rate (WVTR) and oxygen transmission rate (OTR), exceptional puncture resistance, and superior deep drawing performance required for shaping the pouch around the internal cell structure. The functionality of this film directly impacts the overall energy density and lifespan of the battery. Major Applications include electric vehicles (EVs), where pouch cells are increasingly favored for their flexibility in design and high energy density; consumer electronics, particularly smartphones, tablets, and wearable devices; and stationary energy storage systems (ESS), which require robust, long-lasting containment solutions for grid stabilization and renewable energy integration.

The primary benefit of utilizing this material is enhanced safety and reduced weight compared to traditional rigid metal casings, which is crucial for maximizing the driving range in EVs. Driving factors propelling market expansion include the exponential growth in global EV adoption, aggressive government incentives promoting renewable energy storage solutions, and significant technological advancements aimed at improving film durability, thermal management, and cost-effectiveness. Furthermore, the global push toward lighter and higher energy density batteries inherently increases the demand for high-quality, defect-free aluminum plastic film.

Lithium Battery Aluminium Plastic Film Market Executive Summary

The Lithium Battery Aluminium Plastic Film Market is experiencing robust growth driven predominantly by the paradigm shift in the automotive industry toward electrification, focusing heavily on pouch cell formats due to their efficiency in space utilization and superior thermal dissipation capabilities compared to cylindrical cells. Business trends show a critical focus on localization and supply chain resilience, particularly outside of Asia, as battery manufacturers (Gigafactories) in North America and Europe seek local supply chains to mitigate geopolitical risks and high logistics costs. Strategic mergers, acquisitions, and joint ventures between material science specialists and established battery component suppliers are increasing, aiming to vertically integrate production processes and secure proprietary lamination and surface treatment technologies, thereby enhancing market competitiveness.

Regional trends highlight the continued dominance of the Asia Pacific (APAC) region, spearheaded by China, South Korea, and Japan, which serve as the major production hubs for both the film and the finished lithium-ion batteries. However, Europe and North America are projected to exhibit the fastest growth rates during the forecast period due to massive investments in regional battery manufacturing capacity (Gigafactories). This geographical dispersion is stimulating increased competition and necessitating adherence to diverse regulatory standards regarding environmental and safety compliance. Furthermore, government policies, such as the Inflation Reduction Act (IRA) in the US and the European Green Deal, are actively shaping trade flows and manufacturing site selection, rewarding localized production.

Segment trends underscore the rising demand for thicker, more resilient films (113µm and 152µm) tailored specifically for high-capacity EV batteries and large-scale ESS applications, which require enhanced protection against internal pressures and external stresses over extended cycles. Simultaneously, the market is seeing innovation in ultra-thin films (below 85µm) for compact consumer electronics and flexible battery designs. The EV application segment maintains the largest market share and is expected to drive the highest absolute growth, reflecting the sustained, large-volume production requirements necessary for mass-market electric vehicles globally. Quality control and minimizing defect rates remain paramount across all segments, given the high cost associated with cell failure.

AI Impact Analysis on Lithium Battery Aluminium Plastic Film Market

Analysis of common user questions regarding AI's impact on the Lithium Battery Aluminium Plastic Film Market reveals strong interest in how automation and predictive intelligence can address the core challenges of quality assurance, material wastage, and complex supply chain management. Key concerns revolve around leveraging AI to detect microscopic defects in multi-layer films during high-speed production (roll-to-roll processes), optimize lamination parameters to ensure superior adhesion and barrier integrity, and accurately forecast demand volatility tied to the highly cyclical EV market. Users expect AI to reduce the extremely low tolerance for defects characteristic of battery materials manufacturing, thereby enhancing overall yield and reducing operational costs. The summary indicates that AI is viewed primarily as an enabling technology for achieving Industry 4.0 standards, critical for maintaining competitive advantage against established Asian material science giants, particularly concerning material traceability and reducing energy consumption during manufacturing.

- AI-driven Predictive Quality Control: Utilization of machine vision and deep learning algorithms to identify microscopic pinholes, layer defects, or inconsistent coating thicknesses in real-time during production, significantly reducing defect rates and scrap material.

- Manufacturing Process Optimization: Implementation of AI and machine learning (ML) models to dynamically adjust drying temperatures, tension control, and lamination pressures, optimizing energy use and ensuring consistent barrier performance across large production batches.

- Supply Chain Resilience and Forecasting: AI integration for analyzing raw material (aluminum, polymers) price volatility and demand fluctuations from downstream battery manufacturers, leading to smarter inventory management and risk mitigation strategies.

- Automated Inspection and Testing: Deployment of robotics and AI in laboratories for accelerated lifecycle testing and material characterization, speeding up R&D cycles for next-generation films with improved thermal and chemical resistance.

- Equipment Health Monitoring: Predictive maintenance using sensor data and AI to anticipate equipment failures in complex coating and laminating machinery, minimizing downtime and maximizing production efficiency (OEE).

DRO & Impact Forces Of Lithium Battery Aluminium Plastic Film Market

The market dynamics are fundamentally shaped by a complex interplay of demand-side drivers emanating from the electric mobility revolution, supply-side constraints tied to specialized manufacturing capabilities, and significant technological opportunities related to next-generation battery architectures. Drivers primarily include the escalating global demand for high-performance lithium-ion batteries, particularly in the automotive sector, which favors the lightweight and thermally efficient pouch cell design, directly increasing the consumption of aluminum plastic film. Restraints largely center on the highly technical nature of film production, requiring extremely stringent quality control and high capital investment, coupled with inherent difficulties in securing consistent, low-defect raw material inputs (e.g., specific grades of aluminum foil and functional polymers). Opportunities emerge from the potential integration of these films into rapidly developing solid-state battery technology, which may require different but equally high-specification flexible packaging solutions, and the push for domestic production in non-Asian regions to diversify the supply base.

Impact forces currently exerting the strongest influence include governmental policies, particularly vehicle emission standards and subsidies for EV adoption, which accelerate the demand curve significantly. Regulatory scrutiny regarding battery safety and fire prevention standards necessitates continuous material innovation to improve the film’s thermal stability and burst pressure resistance. Furthermore, the market structure is heavily influenced by the high entry barriers, resulting in a concentrated market dominated by a few established Asian giants, making it challenging for new entrants to gain traction without proprietary technology or significant investment backing. These forces ensure that technological superiority and manufacturing precision remain the key determinants of market leadership and growth trajectory.

The interdependence of the battery cell market and the film market creates a strong ripple effect; any significant shift in battery chemistry or packaging format, such as a major breakthrough favoring cylindrical cells (like 4680 format) over pouch cells, could pose a substantial long-term risk to demand for aluminum plastic film. Conversely, continued technological successes in increasing the energy density of pouch cells, making them the preferred format for premium EVs, will solidify the market’s expansion. Therefore, navigating this market requires astute forecasting of EV manufacturing trends and robust intellectual property protection in lamination and polymer science.

Segmentation Analysis

The Lithium Battery Aluminium Plastic Film Market is strategically segmented based primarily on the film's thickness, which correlates directly with its intended application and required mechanical robustness, and by the end-user application, determining the volume and specific performance requirements. Segmentation by thickness is crucial as films used in small consumer electronics demand extreme thinness (e.g., 85µm) for high volume energy density, while those utilized in large-format EV battery packs and stationary ESS typically require enhanced puncture resistance and mechanical integrity provided by thicker films (e.g., 113µm and 152µm). The application segmentation differentiates market growth drivers, where the EV segment provides high volume demand and ESS requires long-term reliability and chemical stability, influencing material formulation choices.

The detailed market analysis confirms that the primary growth driver resides within the Electric Vehicle sector, necessitating specialized films capable of managing higher operating temperatures and pressures associated with fast charging and deep discharge cycles characteristic of automotive use. This has pushed manufacturers to innovate in the inner polymer layers, improving heat seal strength and chemical compatibility with advanced electrolytes. Furthermore, segmentation by structure (e.g., dry lamination vs. wet lamination) reflects the varying degrees of manufacturing maturity and cost structures, though dry lamination is gaining preference due to environmental and efficiency advantages. Understanding these nuanced segments is essential for material producers to align their product portfolios with the distinct performance specifications and volume demands of diverse battery manufacturers globally.

- By Thickness

- 85 µm

- 113 µm

- 152 µm

- Other Thicknesses (e.g., specialized ultra-thin or thick films)

- By Application

- Electric Vehicles (EVs) & Plug-in Hybrid Electric Vehicles (PHEVs)

- Consumer Electronics (Smartphones, Laptops, Wearables)

- Energy Storage Systems (ESS)

- Industrial & Others (e.g., Medical Devices, Power Tools)

- By Sealing Technology

- Heat Sealing

- Other Sealing Methods

Value Chain Analysis For Lithium Battery Aluminium Plastic Film Market

The value chain for Lithium Battery Aluminium Plastic Film is highly specialized and capital-intensive, starting with the upstream sourcing of critical raw materials. Upstream analysis focuses on the suppliers of high-purity aluminum foil, typically 20-40 microns thick, which forms the core barrier layer, alongside suppliers of functional polymers such as oriented polyamide (Nylon), polyethylene (PE), and cast polypropylene (CPP). Quality control at this stage is crucial, as any pinholes or impurities in the aluminum foil or inconsistencies in the polymer films directly translate to defects in the final product, potentially compromising battery safety. The processing stage involves complex multi-layer lamination processes (either wet or dry) where proprietary adhesive formulations and precise temperature and pressure controls are essential to achieving superior bond strength and minimal residual solvent content.

Midstream activities involve the specialized film converters, primarily based in East Asia, who possess the proprietary technology and equipment necessary for consistent, large-volume production of the finished aluminum plastic film. These converters differentiate themselves based on their deep-drawing performance capabilities—a critical metric reflecting how well the film can be stretched and shaped without tearing or delaminating when formed into the pouch structure by the battery manufacturer. Distribution channels are typically direct, given the high value and strict technical requirements of the product. Major film manufacturers engage directly with Tier 1 battery cell producers (e.g., CATL, LG Energy Solution, Samsung SDI) through long-term supply agreements and rigorous qualification processes that often span years.

Downstream analysis centers on the battery cell manufacturing industry, where the aluminium plastic film is utilized in the cell assembly process to encapsulate the electrode stack and electrolyte. The direct channel minimizes logistical risk and facilitates immediate technical feedback necessary for product iteration. Indirect distribution via specialized chemical or materials distributors is less common but sometimes used for smaller-volume applications or regional emerging markets. The efficiency and reliability of the film directly influence the final battery's cost, performance, and safety certifications, positioning the film manufacturers as critical strategic partners rather than mere component suppliers in the rapidly expanding energy storage ecosystem.

Lithium Battery Aluminium Plastic Film Market Potential Customers

The primary potential customers and end-users of Lithium Battery Aluminium Plastic Film are global manufacturers of lithium-ion battery cells that employ the pouch cell format. This group constitutes the Tier 1 battery producers who supply cells to major automotive OEMs and large-scale energy storage integrators. Specifically, electric vehicle manufacturers represent the fastest-growing and largest volume buyer segment, as the push for longer range and lightweight design favors the energy-dense pouch cell format, requiring high volumes of the film tailored for durability and thermal resilience in dynamic driving environments. Automobile manufacturers like Tesla (for specific models), Hyundai, Kia, and various European OEMs often source batteries containing this film.

A secondary, yet highly critical, customer segment is the consumer electronics industry, encompassing manufacturers of smartphones, laptops, and wearable devices. These buyers demand ultra-thin, flexible films that maximize internal space utilization while maintaining safety standards. Companies such as Apple, Samsung Electronics, and other major portable device makers utilize batteries packaged in these films, prioritizing compact design and high-cycle life performance. Finally, developers and integrators of Energy Storage Systems (ESS), including utility-scale grid stabilization projects and residential storage solutions, represent a significant, long-term customer base. These applications require large-format batteries packaged in films optimized for extended operational lifespan and resistance to harsh environmental conditions, providing stable, high-volume demand outside of the cyclical automotive market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DNP, Showa Denko (SDC), Lotte Aluminium, SEL Technology, New-Ace, Mitsui Chemicals, Zhenghua Industrial, Winding, Cangzhou Mingzhu, Daewon, Jiangsu Changfeng, Shenzhen WOTE Advanced Materials, Qingdao Taimei, Zibo Haijing, Shanghai Hongjin, SK Innovation, Sumitomo Chemical, Toray Industries, Kureha Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Battery Aluminium Plastic Film Market Key Technology Landscape

The technological landscape of the Lithium Battery Aluminium Plastic Film market is highly competitive and centered around achieving superior barrier performance, enhanced deep drawing capabilities, and consistent thermal stability. A core technology is the proprietary multi-layer structure, which typically involves five or more distinct layers precision-bonded together. Key focus areas include optimizing the inner polypropylene (PP) or modified polyethylene (PE) layer to improve adhesion to the electrolyte and enhance resistance to highly corrosive LiPF6-based electrolytes, a critical factor for extending battery lifespan. Furthermore, advancements in the outer Polyamide (Nylon) layer are focusing on maximizing mechanical strength and puncture resistance without compromising overall film flexibility or weight, crucial for rugged automotive applications.

Manufacturing process innovation is another vital component, specifically the shift towards and refinement of dry lamination techniques. Unlike wet lamination, which uses solvent-based adhesives and requires extensive drying processes, dry lamination offers environmental benefits, significantly lower energy consumption, and faster production speeds, while eliminating the risk of residual solvents impacting cell performance. Leading manufacturers are investing heavily in high-precision coating and curing equipment necessary for dry lamination. Furthermore, surface treatment technologies applied to the aluminum foil, such as specific chemical etching or polymer priming layers, are continuously being developed to ensure consistent, defect-free bonding across vast surface areas, mitigating the risk of delamination under internal battery stress.

The emerging technological frontier involves developing films compatible with next-generation high-voltage and high-nickel cathode chemistries, and eventually, solid-state batteries (SSBs). High-voltage applications put extreme stress on the inner sealing layer, demanding materials with enhanced chemical resistance and thermal stability up to 90°C and beyond during charging cycles. For SSBs, the packaging requirements may pivot towards ultra-flexible, high-thermal-resistant films capable of accommodating volume expansion without micro-cracks, necessitating entirely new polymer combinations or composite materials. Patent activity in specialized functional coatings for improved heat dissipation and fire retardancy is high, reflecting the industry's commitment to safety and performance gains.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for both production and consumption of Lithium Battery Aluminium Plastic Film, largely driven by the dominance of China, South Korea, and Japan in global battery manufacturing. China, hosting the world's largest EV market and significant capacity for ESS, dictates global demand trends. South Korean and Japanese material science companies (like DNP, Showa Denko, Lotte Aluminium) hold leading positions in high-quality, high-performance film manufacturing, often supplying multinational Tier 1 battery manufacturers. Robust governmental support for EV production and comprehensive supply chain infrastructure ensure APAC’s sustained dominance.

- Europe: Europe is designated as the fastest-growing market in percentage terms, driven by the massive influx of Gigafactories across Germany, Poland, Hungary, and Sweden. The European Union's regulatory push towards localizing the battery value chain, stimulated by initiatives like the European Battery Alliance, is generating substantial demand for regional film supply, currently met predominantly by imports but rapidly shifting towards local production ventures or strategic partnerships. The focus here is on sustainable manufacturing practices and compliance with strict EU safety standards.

- North America (NA): Driven significantly by the US Inflation Reduction Act (IRA), North America is rapidly accelerating its own battery and component manufacturing base. While currently a net importer of the film, major battery manufacturers expanding in the US are demanding local sourcing to qualify for federal incentives. This region is witnessing substantial greenfield investments in lamination facilities, primarily focused on supplying the domestic EV industry. Market growth is strong, characterized by intense efforts to establish a resilient, localized supply chain for high-quality pouch cells.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently hold smaller market shares but are projected to see moderate growth, primarily tied to local grid-scale ESS projects and emerging domestic automotive manufacturing centers. Growth is dependent on the pace of infrastructure development, adoption of renewable energy technologies, and stabilization of local economies to support large-scale EV adoption and manufacturing investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Battery Aluminium Plastic Film Market.- Dai Nippon Printing Co., Ltd. (DNP)

- Showa Denko Materials Co., Ltd. (SDC) - Now a part of Resonac Group

- Lotte Aluminium Co., Ltd.

- SEL Technology Co., Ltd.

- New-Ace Co., Ltd.

- Mitsui Chemicals, Inc.

- Zhenghua Industrial Co., Ltd.

- Winding Industrial Co., Ltd.

- Cangzhou Mingzhu Plastic Co., Ltd.

- Daewon Chemical Co., Ltd.

- Jiangsu Changfeng Composite Material Co., Ltd.

- Shenzhen WOTE Advanced Materials Co., Ltd.

- Qingdao Taimei Film Products Co., Ltd.

- Zibo Haijing New Material Co., Ltd.

- Shanghai Hongjin Material Technology Co., Ltd.

- SK Innovation Co., Ltd. (SK IE Technology)

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- Kureha Corporation

- UACJ Corporation

Frequently Asked Questions

Analyze common user questions about the Lithium Battery Aluminium Plastic Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of aluminum plastic film in lithium batteries?

The primary function is to serve as a robust, flexible, and lightweight outer packaging (pouch) for the battery cell, providing a critical barrier against moisture, oxygen, and external contamination, which is essential for maintaining the stability and safety of the reactive internal components, thereby extending the battery’s cycle life.

Why is the quality control for aluminum plastic film so stringent?

Quality control is stringent because even microscopic defects, such as pinholes or layer delaminations, can compromise the hermetic seal, allowing moisture infiltration. This contamination leads to irreversible degradation of the electrolyte and rapid battery failure, making zero-defect manufacturing critical for high-performance and safety standards, especially in EVs.

Which application segment drives the highest demand for the film?

The Electric Vehicle (EV) segment currently drives the highest volume and value demand for aluminum plastic film. Pouch cell formats, which rely exclusively on this film for containment, are favored in many high-performance EVs due to their superior energy density and thermal management characteristics compared to traditional metal-cased cylindrical or prismatic cells.

How does the thickness of the film relate to its application?

Film thickness correlates directly with required mechanical robustness and capacity. Thinner films (e.g., 85 µm) are used for space-constrained consumer electronics, maximizing energy density. Thicker films (e.g., 113 µm and 152 µm) are required for large-format EV and ESS batteries to withstand greater internal pressure, physical stress, and chemical degradation over long service cycles.

What key technological trends are influencing the film market?

Key technological trends include the development of advanced dry lamination processes for improved sustainability and efficiency, proprietary surface treatments for superior adhesion, and innovation in inner-layer polymer materials to enhance chemical compatibility with next-generation electrolytes and accommodate the higher operating temperatures associated with fast-charging EV batteries.

What are the main advantages of pouch cells over cylindrical cells regarding packaging?

Pouch cells, packaged using aluminum plastic film, offer greater flexibility in design, superior volumetric efficiency, and better thermal dissipation compared to rigid cylindrical cells. This allows vehicle manufacturers to optimize battery pack layout, leading to improved overall vehicle performance and range, crucial factors driving EV market adoption.

How are geopolitical factors impacting the market supply chain?

Geopolitical tensions and trade policies, particularly in North America (IRA) and Europe (EBA), are forcing manufacturers to localize production closer to major Gigafactories outside of traditional Asian hubs. This localization effort is transforming supply chains, increasing the demand for new production facilities in Western regions to mitigate logistics risks and secure regulatory compliance benefits.

What role does the aluminum layer play in the film structure?

The central aluminum foil layer is crucial as it provides the primary, near-perfect barrier against moisture (Water Vapor Transmission Rate - WVTR) and oxygen (Oxygen Transmission Rate - OTR). This metallic layer ensures the long-term chemical stability of the sensitive lithium battery electrolyte, preventing rapid degradation and potential thermal runaway events.

Is the market exposed to raw material price volatility?

Yes, the market is significantly exposed to price volatility, particularly for high-purity battery-grade aluminum foil and functional polymers (Nylon/PP). Since these raw materials constitute a substantial portion of the film’s manufacturing cost, fluctuations directly impact the profitability and pricing strategies of film converters and, subsequently, the cost structure of battery manufacturers.

What are the key differences between wet and dry lamination processes?

Wet lamination utilizes solvent-based adhesives, which require extensive drying stages and pose environmental concerns related to solvent emissions. Dry lamination, the newer technique, uses solvent-free or minimal-solvent adhesives, offering faster production, lower energy consumption, and eliminates the risk of residual solvents interfering with cell chemistry, leading to higher quality films.

How is the need for enhanced safety driving innovation in film materials?

The need for enhanced safety drives innovation in materials with superior thermal stability and higher burst pressure resistance. Manufacturers are developing polymer layers that can withstand higher internal pressures generated during thermal events and are introducing fire-retardant additives and coatings to minimize the risk of fire propagation in large battery packs.

Which region dominates the current market for aluminum plastic film?

Asia Pacific (APAC) currently dominates the market both in terms of production capacity and consumption. This dominance is attributed to the concentration of the world’s largest lithium-ion battery manufacturers (China, South Korea, Japan) and the established regional material science expertise and integrated supply chains necessary for complex film manufacturing.

How will solid-state battery adoption affect the demand for these films?

While solid-state batteries (SSBs) eliminate liquid electrolytes, they still require specialized flexible packaging to manage mechanical stresses from volume expansion and maintain structural integrity. The demand for highly specialized, flexible, and thermally stable aluminum plastic film packaging, potentially with enhanced stress resistance properties, is expected to continue or even grow, shifting requirements rather than eliminating the need.

What constitutes the primary cost factor in aluminum plastic film production?

The primary cost factor is the raw material input, predominantly the specialized high-grade aluminum foil and high-performance polymer resins (like Nylon and PP). Additionally, the high capital expenditure required for precision multi-layer lamination equipment and the strict quality control processes contribute significantly to the overall manufacturing cost structure.

What is the significance of deep drawing performance in the industry?

Deep drawing performance is crucial; it measures the film’s ability to be deeply stretched and formed into the battery pouch shape around the electrode stack without cracking, tearing, or suffering layer delamination. Superior deep drawing capability is essential for maximizing the volumetric energy density of the final pouch cell, particularly in EV applications.

Which specific polymers are commonly used in the film's structure?

The structure typically includes an outer layer of oriented polyamide (Nylon) for mechanical protection, and an inner sealing layer, usually cast polypropylene (CPP) or modified polyethylene (PE), which is directly in contact with the electrolyte and is heat-sealed to close the pouch, while adhesives bond the aluminum barrier layer between them.

How is AI specifically being utilized in the manufacturing process?

AI and machine vision systems are utilized for continuous, real-time quality inspection during the high-speed roll-to-roll lamination process. These systems detect microscopic pinholes, coating inconsistencies, and potential delamination defects with greater accuracy and speed than human inspectors, thereby optimizing yield and material utilization.

What are the main market restraints related to manufacturing technology?

The main technological restraints include the extremely high capital investment required for establishing high-precision, clean-room lamination facilities, the inherent complexity of maintaining consistent multi-layer bonding at high speeds, and the scarcity of skilled labor capable of managing highly technical lamination and coating processes efficiently.

Do stringent environmental regulations impact the choice of lamination technique?

Yes, increasingly stringent environmental regulations, particularly in Europe and North America, are driving manufacturers away from traditional wet lamination techniques that use volatile organic compounds (VOCs) in solvent-based adhesives. This regulatory pressure accelerates the adoption of cleaner, more efficient dry lamination processes.

What distinguishes pouch cells from prismatic cells in terms of film usage?

While both prismatic and pouch cells may use aluminum plastic film, prismatic cells often use rigid metal casings, whereas pouch cells rely entirely on the flexible aluminum plastic film for containment. The film in pouch cells must therefore meet stringent deep drawing and sealing requirements that are less critical for standard prismatic casings.

How does the growth of grid energy storage systems (ESS) affect demand?

The proliferation of grid-scale ESS, driven by renewable energy integration, is creating a stable, high-volume market for large-format pouch batteries. This translates into sustained, long-term demand for durable aluminum plastic film optimized for longevity and resistance to degradation in stationary, long-cycle applications, diversifying demand away from only automotive cycles.

What is the role of proprietary adhesives in film performance?

Proprietary adhesive formulations are vital for bonding the different layers (polyamide, aluminum, polyethylene/polypropylene) securely. The adhesive must maintain strong adhesion under extreme temperatures, internal pressure, and chemical exposure throughout the battery's lifespan, preventing catastrophic failure from delamination.

Which countries in APAC are key producers of the film?

Japan, South Korea, and China are the key producing nations in APAC. Japanese and South Korean firms are known for high-quality, high-performance films primarily supplied to major global battery manufacturers, while Chinese producers are rapidly expanding capacity, focusing on cost-effective, high-volume output catering mainly to the domestic market and emerging global competitors.

How is film thickness typically measured in the industry?

Film thickness is typically measured in micrometers (µm). Standard thicknesses used across the industry include 85 µm (consumer electronics), 113 µm (mid-range EVs), and 152 µm (heavy-duty EVs and high-capacity ESS), with precision measurement critical to ensuring uniform material properties and barrier integrity.

Why are non-Asian manufacturers struggling to enter this market?

Non-Asian manufacturers face high entry barriers primarily due to the intense capital requirements for ultra-clean production facilities, the dominance of established Asian players with decades of proprietary technical expertise (especially in lamination and deep drawing), and the time-consuming, rigorous qualification process required by Tier 1 battery manufacturers.

What is the long-term impact of the IRA on regional film manufacturing?

The Inflation Reduction Act (IRA) encourages battery component manufacturing within North America by offering substantial tax credits. This policy mandates localization, spurring unprecedented investment in regional film lamination facilities, creating a parallel, geographically distinct supply chain designed to serve the rapidly expanding US EV battery market exclusively.

How does the film contribute to the lightweighting trend in EVs?

Aluminum plastic film is substantially lighter than rigid metal battery casings, offering an improved weight-to-energy ratio. By using this lightweight material for cell packaging, EV manufacturers can decrease the overall weight of the battery pack, directly enhancing the vehicle's efficiency, acceleration, and driving range.

What are the chemical compatibility requirements for the inner layer?

The inner sealing layer (typically PP/PE) must exhibit excellent chemical compatibility with the highly volatile and corrosive organic carbonate-based electrolytes (e.g., containing LiPF6). Any degradation or leaching of the inner layer into the electrolyte can impair cell performance, leading to premature capacity fade and safety issues, hence specialized modifications are often required.

How do manufacturers ensure consistency across large production rolls?

Manufacturers utilize advanced, closed-loop process control systems, leveraging precise tension controls, automated visual inspection systems (AI/machine vision), and continuous real-time monitoring of lamination parameters (temperature, pressure, curing time) across the vast length of the roll to guarantee uniform thickness and defect-free barrier performance.

What is the primary technical challenge when dealing with high-voltage battery chemistries?

High-voltage battery chemistries increase the internal stress and operating temperature of the cell, challenging the thermal stability and chemical resistance of the aluminum plastic film, particularly the inner sealing layer. The film must resist increased oxidation and maintain its structural integrity at elevated temperatures without compromising the seal.

Define the Compound Annual Growth Rate (CAGR) for this market.

The market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033, reflecting the exponential increase in global lithium-ion battery production capacity, particularly the expansion of pouch cell adoption in the automotive and energy storage sectors worldwide.

***End of Report***

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager