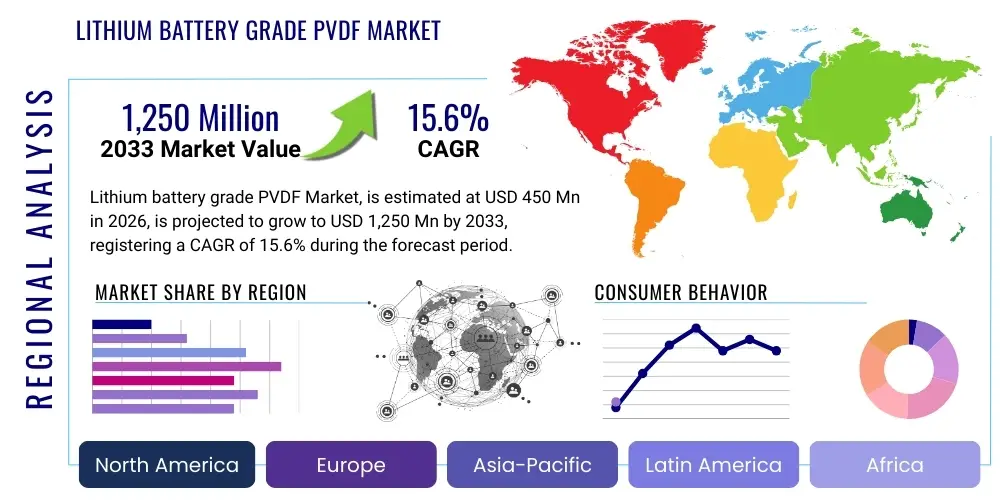

Lithium battery grade PVDF Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437428 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Lithium battery grade PVDF Market Size

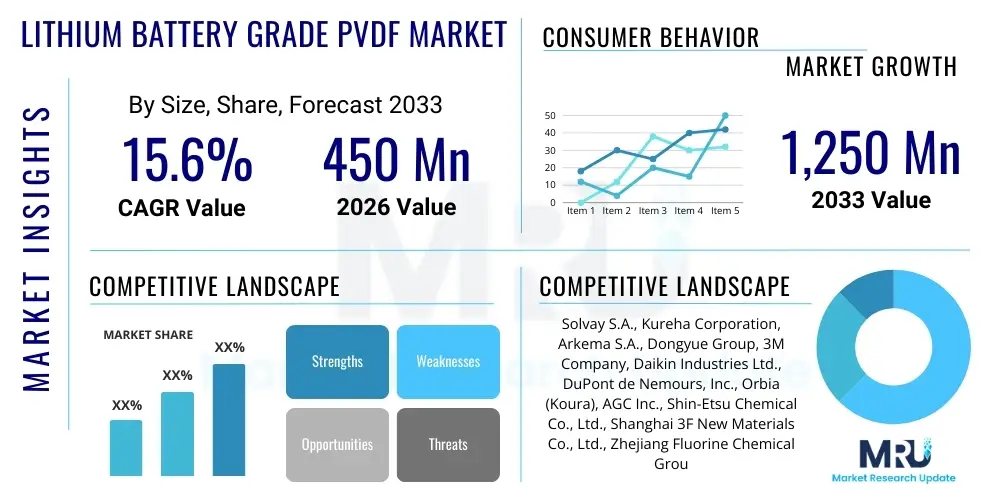

The Lithium battery grade PVDF Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.6% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,250 Million by the end of the forecast period in 2033.

Lithium battery grade PVDF Market introduction

The Lithium battery grade Polyvinylidene Fluoride (PVDF) Market encompasses high-purity, specialized fluoropolymers essential for manufacturing high-performance lithium-ion batteries (LiBs). PVDF serves critically as a binder, primarily stabilizing the cathode material—such as NMC (Nickel Manganese Cobalt) or NCA (Nickel Cobalt Aluminum)—to the current collector foil (aluminum) and ensuring mechanical integrity within the electrode structure. Its superior chemical stability, excellent electrochemical resistance against common LiB electrolytes, and reliable thermal performance make it the preferred choice over alternative binders like carboxymethyl cellulose (CMC) or styrene-butadiene rubber (SBR), particularly in high-energy density and large-format power batteries used in electric vehicles (EVs) and grid storage systems. The exacting purity requirements for battery applications demand strict control over molecular weight distribution and residual volatile impurities, differentiating battery-grade PVDF from standard industrial grades.

The market growth is intrinsically linked to the global acceleration of electric vehicle adoption and the expanding need for efficient stationary energy storage solutions. Key applications beyond cathode binding include use as a component in separator coatings to enhance thermal stability and reduce the risk of internal short circuits, contributing significantly to overall battery safety and longevity. Benefits derived from using high-quality PVDF include improved adhesion, resulting in lower impedance, better rate capability, and prolonged cycle life of the LiBs. Furthermore, PVDF’s ability to withstand harsh electrochemical environments ensures sustained performance under continuous charge and discharge cycles, which is critical for demanding EV applications.

Driving factors for this market include supportive governmental policies promoting e-mobility, substantial investments by major automotive OEMs and battery Gigafactories globally, and ongoing technological advancements focused on increasing the energy density of LiBs. The shift towards solid-state battery technology, while potentially disruptive in the long term, still utilizes PVDF or related fluoropolymers in current developmental stages for specific interface engineering or composite construction. Supply chain resilience and achieving self-sufficiency in PVDF production, particularly in regions like North America and Europe, are becoming increasingly important strategic considerations due to geopolitical shifts and the concentration of current production capacity predominantly in the Asia Pacific region, specifically China.

Lithium battery grade PVDF Market Executive Summary

The Lithium battery grade PVDF market is characterized by robust business trends driven by capacity expansion and technological optimization. Major chemical manufacturers are focusing heavily on establishing localized production facilities outside traditional manufacturing hubs in APAC to mitigate supply chain risks and meet stringent regional content requirements, especially those imposed by regulations like the US Inflation Reduction Act (IRA) and similar European directives. Consolidation within the battery manufacturing sector is creating significant procurement power, placing pressure on PVDF suppliers to maintain high quality standards while optimizing cost structures. Furthermore, there is an increasing R&D focus on developing lower viscosity, higher molecular weight PVDF variants, and exploring water-based PVDF dispersions to align with sustainability goals and move away from traditional N-Methyl-2-pyrrolidone (NMP) solvent processing, which is facing environmental scrutiny.

Regionally, the Asia Pacific (APAC) region currently dominates the market, primarily due to the overwhelming presence of major LiB cell manufacturers in China, South Korea, and Japan, which account for the majority of global battery production capacity. However, North America and Europe are exhibiting the fastest growth rates, catalyzed by massive planned investments in Gigafactories designed to support local EV supply chains. Governments in these Western regions are actively incentivizing domestic PVDF production to ensure secure access to critical materials, transforming these areas from net importers to nascent production hubs. This geographical shift in manufacturing capacity will significantly rebalance the global distribution of PVDF consumption and production over the forecast period, leading to potentially complex regional pricing dynamics.

In terms of segmentation trends, the Cathode Binder application segment remains the largest volume consumer, directly correlating with the increasing demand for high-nickel cathode materials where PVDF’s binding strength is crucial. While powder PVDF still represents the conventional format, the liquid PVDF dispersion segment is experiencing accelerated growth due to its alignment with environmentally friendly, solvent-free electrode manufacturing processes and improved coatability characteristics. Within the competitive landscape, there is intense focus on proprietary polymerization techniques to achieve ultra-high purity necessary for next-generation, high-voltage batteries, leading to strategic alliances and joint ventures between PVDF producers and major battery cathode material suppliers to secure future supply agreements and optimize material formulation.

AI Impact Analysis on Lithium battery grade PVDF Market

User queries regarding the impact of Artificial Intelligence (AI) on the Lithium battery grade PVDF market generally center on how advanced analytics and machine learning (ML) can optimize PVDF production quality, accelerate material discovery for next-generation binders, and enhance manufacturing efficiency within LiB Gigafactories that are the primary consumers of PVDF. Users frequently inquire about the feasibility of using AI models to predict the correlation between PVDF molecular structure (e.g., crystallinity, molecular weight distribution) and final battery performance (cycle life, capacity retention), which traditionally relies on time-consuming laboratory tests. Key concerns revolve around the integration cost of such sophisticated systems and whether AI-driven quality control can effectively detect subtle, sub-parts-per-million impurities that degrade battery performance, thereby demanding a higher premium for AI-validated materials.

The core expectation is that AI will introduce unprecedented precision into the entire PVDF lifecycle. In manufacturing, AI algorithms can monitor polymerization reactors in real-time, adjusting parameters (temperature, pressure, monomer feed rates) to ensure highly consistent material properties, minimizing batch-to-batch variation—a critical factor for battery reliability. Furthermore, in R&D, generative AI and ML models are being utilized for virtual screening of thousands of potential fluoropolymer chemistries, drastically speeding up the identification of novel binder materials that might outperform PVDF in specific high-voltage or fast-charging applications. This optimization reduces raw material waste, lowers energy consumption during processing, and potentially unlocks new fluoropolymer architectures specifically tailored for anode or specialized electrolyte interface needs, thus ensuring PVDF maintains its competitive edge or finds replacement materials more efficiently.

Finally, within battery manufacturing itself, predictive maintenance enabled by AI on coating lines and slurry mixing equipment directly consuming PVDF improves throughput and reduces defects caused by inconsistencies in the binder delivery or drying process. Smart quality control systems use image processing and sensor data, optimized by ML, to verify the uniformity of the PVDF coating on electrodes. The adoption of AI is not about replacing PVDF but about enhancing the efficiency, quality, and customization of the material, solidifying its position as a strategic component by ensuring that material specifications consistently meet the increasingly stringent requirements of Tier 1 battery manufacturers focusing on zero-defect production strategies.

- AI optimizes polymerization process parameters, ensuring high batch-to-batch consistency and purity levels crucial for battery performance.

- Machine Learning accelerates material discovery for new high-performance binders, potentially challenging or enhancing existing PVDF formulations.

- Predictive analytics minimizes manufacturing defects in electrode coating processes, leading to higher yield rates for PVDF consumers (Gigafactories).

- AI-driven quality control verifies ultra-low impurity levels in battery-grade PVDF powder or dispersion in real-time.

- Optimization of PVDF usage reduces waste and enhances sustainability by improving solvent recovery and minimizing NMP reliance through process efficiency.

DRO & Impact Forces Of Lithium battery grade PVDF Market

The Lithium battery grade PVDF market is subject to dynamic drivers (D), significant restraints (R), compelling opportunities (O), and pervasive impact forces. The primary driver is the explosive growth in the global Electric Vehicle (EV) sector, mandating massive increases in LiB production, which directly correlates with the demand for high-purity PVDF as an indispensable cathode binder. Complementary drivers include rapid expansion in renewable energy integration, requiring large-scale battery energy storage systems (BESS), and continuous regulatory support from governments globally, such as tax credits and emission standards that favor electrification. Technological improvements in battery chemistry, particularly the shift towards high-nickel cathodes (e.g., NMC 811, NCA), necessitate binders with superior chemical resilience and thermal stability, thereby reinforcing the specialized need for PVDF.

Major restraints include the complex and capital-intensive nature of high-purity PVDF manufacturing, leading to high entry barriers and limited competitive supply, particularly outside of Asian markets. Volatility in the price of key raw materials, especially vinylidene fluoride (VDF) monomer, introduces cost unpredictability for manufacturers. Furthermore, growing environmental regulations targeting the use of N-Methyl-2-pyrrolidone (NMP)—the standard solvent used in PVDF processing for electrode slurry preparation—pose a significant challenge, forcing manufacturers to invest heavily in solvent recovery systems or transition to less established, potentially higher-cost water-based PVDF dispersion technologies. The emergence and development of alternative binder chemistries, such as specialized acrylics or modified polymers, also present a long-term substitution threat, although these currently lack the proven electrochemical stability of PVDF.

Opportunities abound in localizing PVDF production in North America and Europe to cater to the burgeoning local Gigafactories and comply with domestic content mandates, significantly reducing logistical bottlenecks and geopolitical risks associated with Asian dependency. Furthermore, advancements in specialized PVDF applications beyond the cathode binder, such as in solid-state battery electrolytes (as polymer components) or specialized separator coatings, open up new high-value market segments. The continuous drive towards higher battery performance creates an opportunity for premium, ultra-high-molecular-weight PVDF grades designed for specific high-voltage applications. Impact forces include intense competition in pricing driven by large Asian producers, stringent quality standards imposed by Tier 1 battery manufacturers, and the geopolitical imperative to secure strategic material supply chains through vertical integration or mandated domestic sourcing.

Segmentation Analysis

The Lithium battery grade PVDF market is segmented primarily based on product form and application, providing granular insights into consumption patterns and technological trends. The segmentation by form distinguishes between the traditional Powder PVDF and the increasingly utilized Liquid PVDF Dispersion, reflecting the industry's gradual shift towards more sustainable and efficient manufacturing processes. Application segmentation highlights the critical role of PVDF in various battery components, with cathode binding remaining the dominant revenue and volume driver. Understanding these segments is crucial for suppliers to tailor product specifications—such as molecular weight, particle size, and solution viscosity—to meet the precise requirements of different battery cell designs (e.g., pouch, prismatic, cylindrical) and chemistries (LFP, NMC, NCA).

The dominance of the cathode binder application is rooted in PVDF's unparalleled electrochemical stability required to maintain electrode integrity under high potential. However, the rapidly evolving segment of separator coatings, where PVDF enhances thermal shutdown properties and electrolyte wettability, represents a key area of future growth. Geographically, segmentation analysis emphasizes the crucial role of the Asia Pacific region as the current manufacturing heartland, while projecting significant growth acceleration in North America and Europe driven by massive greenfield Gigafactory investments. The competitive structure within these segments varies; high-purity powder manufacturing is dominated by established global chemical giants, while the localized dispersion market often sees regional specialty chemical players innovating to meet local solvent regulation needs.

Strategic analysis must consider the increasing differentiation required within the PVDF market. For instance, high-voltage battery designs (often exceeding 4.2V) necessitate specialized, higher-purity PVDF grades with minimal residual impurities to prevent undesirable side reactions, leading to sub-segmentation based on quality tiers. Furthermore, the adoption rate of water-based dispersions is highly dependent on regional environmental legislation and the willingness of battery manufacturers to modify their established slurry processing lines. This intricate segmentation confirms that while the overall market driver is LiB growth, success requires niche focus and technological superiority in specific product grades and regional supply chain responsiveness.

- Segmentation by Type:

- Powder PVDF (Conventional, High-Purity Grade)

- Liquid PVDF Dispersion (Aqueous/Water-Based, NMP-Based Solutions)

- Segmentation by Application:

- Cathode Binder (Major Segment)

- Separator Coating

- Electrolyte Additives/Components

- Anode Protection Layers

- Segmentation by Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, UK, Italy, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Lithium battery grade PVDF Market

The value chain for Lithium battery grade PVDF begins with the upstream sourcing of crucial fluorine-based raw materials, primarily Fluorspar (CaF2), which is converted through several highly technical processes into the Vinylidene Fluoride (VDF) monomer. The upstream analysis is critical because the purity of the VDF monomer directly dictates the quality of the final PVDF polymer, impacting its electrochemical performance. This stage is characterized by high capital expenditure and energy consumption, with reliance concentrated in a few global regions holding significant fluorspar reserves. Key players at this stage include integrated chemical companies that manage the complex fluorochemical synthesis from mining to monomer production. Supply chain vulnerabilities often exist at this upstream level due to geopolitical restrictions or environmental compliance challenges associated with fluorochemical manufacturing.

The midstream process involves the specialized polymerization of VDF monomer under controlled conditions to produce the high-molecular-weight PVDF resin suitable for battery applications. This is a highly technical barrier-to-entry stage, requiring proprietary know-how to achieve the necessary molecular structure, crystallinity, and, most importantly, ultra-low residual impurity levels. The specialized nature of battery-grade specifications distinguishes these manufacturers. The PVDF is then processed into the final usable form: high-purity powder or solvent-based/aqueous dispersions. Downstream analysis focuses on the end-users—the LiB cell manufacturers, particularly Gigafactories. These manufacturers formulate the PVDF into electrode slurries, which are coated onto current collectors. The quality and uniformity of this coating step are paramount to battery performance, making the PVDF supplier a critical partner in the manufacturing process.

Distribution channels for battery-grade PVDF are predominantly direct or utilize specialized, technical distributors due to the necessity of strict quality assurance, technical support, and timely delivery to high-volume battery clients. Direct channels are favored by major integrated suppliers engaging with Tier 1 battery manufacturers, allowing for customized specifications and long-term contracts (off-take agreements). Indirect channels, involving specialty chemical distributors, are often used for smaller regional players or for supplying smaller niche battery manufacturers. The crucial element in the distribution is maintaining the integrity of the material, especially for liquid dispersions, which have specific storage and handling requirements. The entire value chain is characterized by strong vertical integration attempts, particularly as major battery players look to secure long-term, high-quality material supply chains against increasing global competition and regulatory pressures for localized sourcing.

Lithium battery grade PVDF Market Potential Customers

The primary and largest segment of potential customers for Lithium battery grade PVDF are Lithium-ion Battery Cell Manufacturers, commonly referred to as Gigafactories, which produce cells across various formats (prismatic, pouch, cylindrical) for mass market applications. These manufacturers, including major entities in Asia, Europe, and North America, have exacting quality standards and volume demands for PVDF, as it is a non-substitutable material in most commercial high-energy cathode formulations. Their purchasing decisions are driven by PVDF's performance metrics—specifically its binding capability, resistance to electrolyte degradation, and consistency—alongside supply security and adherence to stringent environmental, social, and governance (ESG) criteria, particularly regarding NMP solvent use.

A secondary, yet rapidly growing, customer base includes Electric Vehicle (EV) Manufacturers and Energy Storage System (ESS) Integrators that are moving towards backward integration by establishing their own captive cell manufacturing facilities or engaging in highly collaborative joint ventures. These captive manufacturers prioritize supply chain visibility and material customization, often demanding specific PVDF grades tailored to their proprietary cell designs and expected vehicle performance profiles. This segment seeks long-term, highly stable supply partnerships that can scale rapidly with EV production targets, often negotiating multi-year procurement contracts directly with PVDF producers to lock in volume and pricing.

Finally, specialized customers include Research and Development Institutions, Pilot Battery Production Facilities, and Suppliers of High-End Specialty Batteries (e.g., for aerospace, defense, medical devices). These customers purchase smaller, highly specialized quantities of PVDF for prototyping next-generation battery designs, including solid-state and high-silicon anode applications. Their focus is less on volume and more on technical expertise, material availability in niche formats (like ultra-fine powders or experimental dispersions), and collaboration on formulation science to push the boundaries of energy density and safety performance beyond current commercial limits. The evolving nature of battery technology ensures this segment remains a vital driver for PVDF product innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,250 Million |

| Growth Rate | 15.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Solvay S.A., Kureha Corporation, Arkema S.A., Dongyue Group, 3M Company, Daikin Industries Ltd., DuPont de Nemours, Inc., Orbia (Koura), AGC Inc., Shin-Etsu Chemical Co., Ltd., Shanghai 3F New Materials Co., Ltd., Zhejiang Fluorine Chemical Group, Shandong Huaxia Shenzhou New Material Co., Ltd., Gujrat Fluorochemicals (GFL), Halopolymer JSC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium battery grade PVDF Market Key Technology Landscape

The technological landscape of the Lithium battery grade PVDF market is highly focused on optimizing polymerization processes to achieve ultra-high purity and tailored molecular weights, which are essential for electrochemical performance. The predominant manufacturing technology involves specialized emulsion or suspension polymerization of Vinylidene Fluoride (VDF) monomers. Key technological advancements center on minimizing residual catalysts, cross-linking agents, and low-molecular-weight fractions, as even trace impurities can lead to parasitic reactions within the battery cell, compromising cycle life and safety. Manufacturers are increasingly utilizing advanced spectroscopic and chromatographic techniques for quality control to ensure batch consistency, pushing the limits of material purity well beyond conventional industrial standards to meet Tier 1 battery producer specifications.

A pivotal technological shift involves the transition from traditional solvent-based PVDF processing to environmentally friendlier alternatives, primarily focusing on developing stable, high-performance Aqueous PVDF Dispersions. This technology utilizes surfactants and specialized polymerization techniques to create water-processable PVDF formulations, aiming to eliminate the need for NMP, a toxic solvent facing mounting regulatory pressure globally, especially in Europe. While water-based dispersions offer substantial environmental benefits and simplified solvent recovery, their successful implementation requires overcoming challenges related to electrode processing, such as slurry stability, drying speeds, and maintaining strong adhesion comparable to NMP-processed electrodes. Significant R&D expenditure is currently directed towards improving the dispersion stability and coatability of these aqueous systems.

Beyond binding, technology is evolving to utilize PVDF derivatives in next-generation battery components. For instance, high-purity PVDF is being investigated as a base material for polymer electrolytes in solid-state batteries, where its high dielectric constant and mechanical strength can be leveraged. Furthermore, advanced coating technologies using modified PVDF are being applied to separators to enhance thermal runaway resistance, employing thinner, high-density layers to improve cell safety without sacrificing energy density. The application of nanotechnology and surface modification techniques allows PVDF suppliers to functionalize the polymer surface, enhancing its compatibility with complex cathode materials like high-nickel compounds, ensuring optimal electronic and ionic conductivity at the electrode interface for superior overall battery performance.

Regional Highlights

- Asia Pacific (APAC): Dominates the global PVDF market due to the high concentration of major LiB cell manufacturing giants in China, South Korea (e.g., LG Energy Solution, Samsung SDI, SK On), and Japan (e.g., Panasonic). China specifically holds the largest production and consumption capacity, driven by supportive domestic policies for EV adoption and vertically integrated supply chains. The region is characterized by intense price competition and continuous capacity expansion, though it faces increasing pressure from Western regions aiming for localized production.

- North America: Emerging as the fastest-growing market, primarily fueled by the establishment of numerous Gigafactories (catalyzed by the IRA) and substantial investments from major automotive OEMs (Ford, GM, Tesla) moving into captive cell production. The demand here is highly focused on securing localized, high-purity supply chains, creating significant opportunities for new domestic PVDF production facilities and joint ventures aimed at meeting stringent domestic content requirements and reducing reliance on Asian imports.

- Europe: Exhibits robust growth driven by ambitious European Green Deal mandates and the rapid construction of European Battery Alliances and Gigafactories across countries like Germany, Hungary, Poland, and the UK. Environmental regulations (especially REACH concerning NMP) are a critical market driver, pushing demand towards advanced, high-performance PVDF grades and accelerating the adoption of water-based PVDF dispersions. European buyers prioritize sustainability, traceability, and localized technical support.

- Latin America, Middle East, and Africa (MEA): These regions represent nascent markets for LiB-grade PVDF, with demand largely tied to localized EV pilot projects and small-scale renewable energy storage deployments. Growth is anticipated in the medium to long term, potentially driven by resource-rich countries in LATAM (lithium and raw materials) or infrastructure development in MEA, though production remains negligible. These regions primarily rely on imports from APAC and, increasingly, from European and North American suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium battery grade PVDF Market.- Solvay S.A.

- Kureha Corporation

- Arkema S.A.

- Dongyue Group

- 3M Company

- Daikin Industries Ltd.

- DuPont de Nemours, Inc.

- Orbia (Koura)

- AGC Inc.

- Shin-Etsu Chemical Co., Ltd.

- Shanghai 3F New Materials Co., Ltd.

- Zhejiang Fluorine Chemical Group

- Shandong Huaxia Shenzhou New Material Co., Ltd.

- Gujrat Fluorochemicals (GFL)

- Halopolymer JSC

- Chemours Company

- Wuxi Hongyi Chemical Co., Ltd.

- Guangzhou Liheng Fluorine Chemical Co., Ltd.

- Suzhou Sanfu New Materials Co., Ltd.

- Jingxin Fluorine Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Lithium battery grade PVDF market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of PVDF in a lithium-ion battery?

PVDF (Polyvinylidene Fluoride) serves primarily as a cathode binder, crucial for adhering active materials (like NMC or LFP) to the current collector and maintaining the structural integrity of the electrode throughout numerous charge and discharge cycles, ensuring optimal electrochemical performance and longevity.

Why is battery grade PVDF considered superior to standard PVDF grades?

Battery grade PVDF possesses ultra-high purity, extremely low moisture content, and strictly controlled molecular weight distribution. These characteristics minimize parasitic side reactions with the electrolyte at high voltages, preventing degradation and ensuring long cycle life, which standard PVDF cannot guarantee.

How are environmental regulations impacting the PVDF market, particularly regarding NMP?

Stringent environmental and health regulations, especially the EU’s REACH initiative, are pushing manufacturers to shift away from the NMP solvent traditionally used in PVDF slurry preparation. This drives R&D and market adoption of water-based (aqueous) PVDF dispersions as a more sustainable alternative for electrode production.

Which regions are leading the growth in demand for Lithium battery grade PVDF?

While the Asia Pacific region currently holds the largest market share due to existing Gigafactory concentration, North America and Europe are projected to exhibit the fastest growth rates. This acceleration is driven by massive domestic capacity build-out, localization mandates, and supportive EV policies like the US Inflation Reduction Act (IRA).

Are there viable alternatives to PVDF used as binders in lithium-ion batteries?

Yes, alternatives include SBR/CMC (Styrene-Butadiene Rubber combined with Carboxymethyl Cellulose), particularly favored for low-cost LFP cathodes and graphite anodes. However, for high-voltage and high-nickel cathode applications requiring superior electrochemical stability, PVDF currently remains the dominant and preferred industry standard.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager