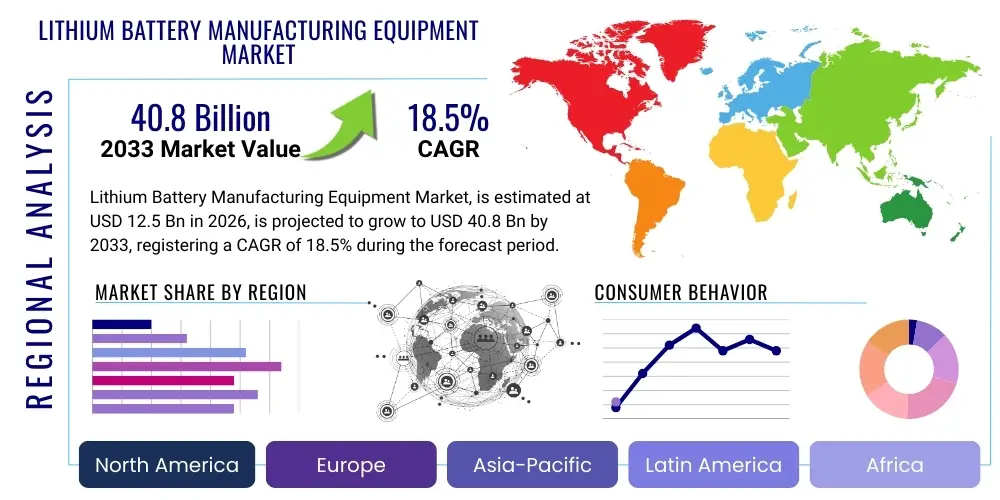

Lithium Battery Manufacturing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436797 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Lithium Battery Manufacturing Equipment Market Size

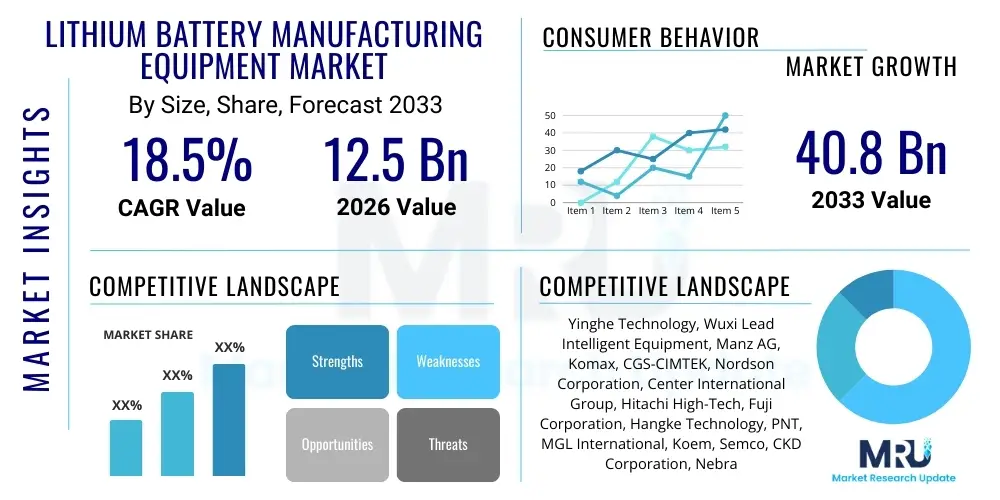

The Lithium Battery Manufacturing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 40.8 Billion by the end of the forecast period in 2033.

Lithium Battery Manufacturing Equipment Market introduction

The Lithium Battery Manufacturing Equipment Market encompasses the specialized machinery, tools, and integrated systems necessary for the complete production cycle of various lithium-ion battery chemistries, including LFP (Lithium Iron Phosphate), NMC (Nickel Manganese Cobalt), NCA (Nickel Cobalt Aluminum), and next-generation solid-state batteries. This equipment is critical for executing three primary stages: electrode preparation (mixing, coating, calendering, slitting), cell assembly (winding/stacking, electrolyte injection, sealing), and formation and testing. The sophistication of this machinery directly impacts battery energy density, cycle life, safety profile, and overall manufacturing cost efficiency. Advanced equipment includes high-precision vacuum mixers, slot-die coaters for uniform electrode coating, high-speed automated stacking machines, and complex formation systems that activate the battery chemistry through controlled charging cycles.

Major applications driving the demand for this specialized equipment are predominantly centered in the electric vehicle (EV) sector, energy storage systems (ESS) for grid stabilization and renewable integration, and high-performance consumer electronics. The proliferation of electric mobility globally, fueled by stringent emission regulations and consumer preference shifts, necessitates massive investments in gigafactories, consequently accelerating the procurement of high-throughput manufacturing lines. Furthermore, the rising adoption of renewable energy sources demands large-scale, reliable battery storage solutions, opening significant downstream opportunities for equipment suppliers.

The primary benefits associated with modern lithium battery manufacturing equipment include enhanced production scalability, improved product quality consistency through automation, reduced waste material generation, and the capability to handle complex next-generation materials like silicon anodes or solid electrolytes. Driving factors for market growth include global commitments to decarbonization, substantial government subsidies for EV and battery production (e.g., Inflation Reduction Act in the U.S., European Green Deal), rapid advancements in battery technology requiring new precision machinery (e.g., dry electrode processing), and the ongoing trend toward large-format battery cells (pouch and prismatic) which demand larger, more robust equipment configurations.

Lithium Battery Manufacturing Equipment Market Executive Summary

The Lithium Battery Manufacturing Equipment Market is experiencing unprecedented expansion, fundamentally driven by the global transition towards electrification and sustainable energy infrastructure. Business trends indicate a strong move toward high-speed, fully automated manufacturing lines to meet the exponential increase in demand from global gigafactories, necessitating original equipment manufacturers (OEMs) to focus heavily on integrating Industry 4.0 principles, including predictive maintenance, real-time quality control, and data analytics. Furthermore, the competitive landscape is shifting towards regionalization, with major battery manufacturers establishing localized supply chains in North America and Europe, which previously relied heavily on Asian equipment suppliers. This geographical realignment is creating significant opportunities for localized equipment service and customization.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, South Korea, and Japan, remains the largest consumer and innovation hub for battery manufacturing equipment due to its long-established dominance in battery production capacity. However, North America and Europe are exhibiting the highest Compound Annual Growth Rates (CAGR), primarily due to aggressive capacity build-up incentivized by governmental policies aimed at establishing domestic battery supply sovereignty. The European market, particularly Germany and Hungary, is witnessing immense investment in equipment procurement for new large-scale battery plants, aiming to supply the rapidly expanding European EV market. Meanwhile, the U.S. market is capitalizing on tax credits and incentives to draw investment for localized equipment assembly and supply.

Segment trends highlight the dominance of electrode manufacturing equipment, specifically high-precision coating and calendering machines, due to their critical role in determining cell performance and energy density. Within cell assembly, automated stacking and winding equipment segments are growing rapidly, driven by the shift from traditional cylindrical cells to large-format prismatic and pouch cells preferred in high-capacity EV batteries. Technology-wise, the formation and testing segment is seeing innovation focused on fast-formation techniques and high-accuracy end-of-line testing systems to ensure product reliability and shorten manufacturing lead times, crucial for economies of scale. The solid-state battery equipment segment, though nascent, is projected to show exponential growth as pilot lines transition towards mass production capacity by the end of the forecast period.

AI Impact Analysis on Lithium Battery Manufacturing Equipment Market

User queries regarding AI’s influence on the Lithium Battery Manufacturing Equipment Market frequently revolve around how artificial intelligence can enhance production efficiency, minimize defects, and accelerate the transition to advanced battery chemistries. Key themes include the implementation of AI-driven predictive maintenance on complex machinery like coaters and calenders to reduce costly downtime; the use of machine learning algorithms for real-time quality control based on visual inspection data during stacking and winding processes; and the optimization of resource-intensive processes such as electrolyte filling and battery formation cycles. Users also express interest in AI’s role in material science, particularly in optimizing electrode slurry formulation and ensuring homogeneity during mixing, which are critical upstream processes. The consensus expectation is that AI will move battery production from statistical quality control to deterministic, inline process optimization, thereby increasing yield and lowering capital expenditure over time.

- AI-Powered Predictive Maintenance: Utilizing sensor data to forecast equipment failures, minimizing unexpected downtime of high-cost machinery such as vacuum dryers and calenders.

- Real-Time Quality Assurance: Employing machine vision and deep learning algorithms for 100% inline defect detection during electrode cutting, stacking, and welding processes, far surpassing human capabilities.

- Slurry Mixing Optimization: AI algorithms analyzing material properties and adjusting mixing parameters (speed, duration, temperature) automatically to ensure optimal electrode slurry homogeneity and dispersion.

- Formation Process Acceleration: Using machine learning to optimize the highly time-consuming battery formation step, reducing the cycle time while maximizing long-term battery performance and longevity.

- Energy Consumption Optimization: Deploying AI to manage the energy load of high-power equipment, such as vacuum ovens and drying kilns, reducing operational energy costs in gigafactories.

- Autonomous Factory Management: Implementation of AI-driven systems to autonomously manage material flow, scheduling, and resource allocation across highly complex, multi-stage production lines.

DRO & Impact Forces Of Lithium Battery Manufacturing Equipment Market

The market is predominantly driven by aggressive global expansion plans for EV production and corresponding governmental support through subsidies and regulatory mandates promoting zero-emission vehicles. This massive demand surge necessitates new gigafactory construction globally, directly translating into equipment procurement volume. However, the market faces significant restraints, chiefly the exceedingly high capital expenditure required for sophisticated, high-precision manufacturing equipment, which creates substantial entry barriers for new battery producers. Furthermore, the specialized technological expertise needed for operating and maintaining these complex lines, particularly in new regions without established supply chains, poses a persistent challenge. Opportunities abound in the development of next-generation equipment catering to solid-state batteries and dry electrode manufacturing techniques, which promise higher energy density and reduced manufacturing footprints.

Key drivers include the technological push toward higher energy density batteries (requiring more precise coating and calendering), the necessity for increased production speed and automation to achieve economic scale, and continuous innovation in battery chemistry that mandates flexible and modular equipment designs. Restraints also encompass intense competition among equipment suppliers, leading to pricing pressures, and the global geopolitical instability affecting the secure supply chain of critical components used in the machinery itself (e.g., high-precision tooling, specialized sensors). The long lead times associated with procuring and installing these capital-intensive machines further restricts rapid capacity expansion.

Impact forces are predominantly high and positive. The primary force is the unprecedented speed of battery manufacturing capacity expansion globally, driven by EV adoption. This demand force compels equipment manufacturers to innovate rapidly, offering faster, more precise, and more reliable systems. Another significant impact force is technological convergence, where equipment must now seamlessly integrate data analytics, robotics, and automation to maintain competitiveness. The overall net effect is rapid market growth but also immense pressure on manufacturers to deliver proven, scalable solutions quickly to secure long-term contracts with major battery producers like CATL, LG Energy Solution, and Panasonic.

Segmentation Analysis

The Lithium Battery Manufacturing Equipment Market is comprehensively segmented based on the type of equipment utilized across the production lifecycle, the battery chemistry supported, and the final application of the battery cells. Segmentation by equipment type is crucial as it reflects the distinct technological requirements of each manufacturing phase: electrode production, cell assembly, and post-assembly processing. The chemistry-based segmentation, differentiating between liquid electrolyte (Li-ion) and emerging solid-state battery requirements, is essential for tracking technological shifts in machinery demand. Furthermore, the application segmentation highlights the varying scale and throughput requirements dictated by the end-user sector, such as high-volume automotive production versus specialized, lower-volume consumer electronics or niche medical device applications.

- By Equipment Type:

- Electrode Manufacturing Equipment (Mixers, Coaters, Calenders, Slitters, Vacuum Drying Ovens)

- Cell Assembly Equipment (Winding Machines, Stacking Machines, Welding Systems, Notching Machines, Electrolyte Filling Machines, Sealing Equipment)

- Formation and Testing Equipment (Formation Systems, Capacity Sorting Systems, End-of-Line Inspection Systems)

- By Battery Type/Chemistry:

- Lithium-ion Batteries (NMC, LFP, NCA)

- Solid-State Batteries (Emerging market segment requiring specialized handling and pressing equipment)

- By Application:

- Electric Vehicles (EVs, including BEV, PHEV)

- Energy Storage Systems (ESS)

- Consumer Electronics

- Industrial and Others (E.g., Medical Devices, Power Tools)

- By Operation Mode:

- Semi-Automatic

- Fully Automatic (Dominant segment due to scaling needs)

Value Chain Analysis For Lithium Battery Manufacturing Equipment Market

The value chain for Lithium Battery Manufacturing Equipment starts upstream with the raw material suppliers, predominantly providing specialized components such as high-precision motors, vacuum systems, advanced laser components, custom robotics, and industrial automation control systems. These suppliers often operate in highly specialized engineering niches, providing critical components that determine the precision and reliability of the final equipment. The core of the value chain involves the Original Equipment Manufacturers (OEMs), who design, assemble, integrate, and test the complex machinery. These OEMs often engage in intense research and development to tailor their equipment to the specific chemistry and format requirements of major battery producers, focusing on achieving high throughput and minimal tolerance levels, particularly in the electrode coating and calendering phases.

Downstream, the manufactured equipment is primarily purchased by Battery Cell Producers, often referred to as Gigafactories (e.g., Tesla, LG Energy Solution, CATL, Northvolt). These buyers conduct rigorous vendor selection processes based on equipment reliability, maintenance requirements, maximum throughput capacity, and the ability to service the equipment globally. The distribution channel is heavily skewed towards direct sales, given the high value, customization, and complex installation process involved. Direct interaction ensures seamless integration of the equipment into the battery producer’s specific factory layout and operational protocols, often involving long-term service and support contracts. Indirect channels, such as local distributors or agents, are utilized in smaller, emerging regional markets or for simpler ancillary equipment, but the core manufacturing lines are almost exclusively handled via direct negotiation.

The interplay between equipment suppliers and major battery producers dictates technological development. Battery producers demand equipment that can handle new, often sensitive, materials and processes (like dry coating), pushing equipment manufacturers to innovate rapidly. This collaboration forms a tight feedback loop, wherein OEMs often co-develop machinery tailored for specific battery formats (e.g., large format prismatic cells for ESS or 4680 cylindrical cells for high-performance EVs). This tight integration makes the service and maintenance component a critical part of the long-term value generated by the equipment supplier, ensuring high operational uptime for the capital-intensive gigafactories.

Lithium Battery Manufacturing Equipment Market Potential Customers

The primary purchasers and end-users of lithium battery manufacturing equipment are large-scale industrial entities deeply invested in the energy transition. These include established global battery manufacturers aiming to expand capacity (e.g., CATL, Samsung SDI, SK Innovation), automotive OEMs that have adopted vertically integrated battery production strategies (e.g., Volkswagen, Tesla, Ford), and emerging regional battery startups, especially in North America and Europe, focused on regionalizing the supply chain. These customers are characterized by their need for highly automated, scalable, and high-precision systems capable of running 24/7 operations, often requiring modular equipment to adapt to evolving battery chemistries and formats.

Another significant segment comprises manufacturers focused on specialized battery applications, such as high-end medical device batteries, defense technology power sources, and niche industrial robotics. While their volume demand is lower than the EV sector, their requirements for ultra-high precision and stringent quality control often drive demand for specialized, smaller-scale, high-accuracy equipment. Additionally, research institutions and pilot line facilities, often associated with major universities or corporate R&D departments, act as crucial early adopters for cutting-edge equipment, particularly machinery designed for solid-state electrolyte handling and next-generation electrode preparation techniques.

The investment cycle for these potential customers is typically long-term, involving multi-million or billion-dollar capital commitments over several years. Purchase decisions are heavily influenced not just by the initial cost of the machinery but, critically, by the proven track record of the equipment OEM, the guaranteed yield rates, energy efficiency, and the geographic proximity and responsiveness of the after-sales service and support network. As global capacity for batteries continues to double year over year, the pool of potential customers is rapidly expanding, necessitating equipment suppliers to scale their production and technical support capabilities commensurately.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 40.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yinghe Technology, Wuxi Lead Intelligent Equipment, Manz AG, Komax, CGS-CIMTEK, Nordson Corporation, Center International Group, Hitachi High-Tech, Fuji Corporation, Hangke Technology, PNT, MGL International, Koem, Semco, CKD Corporation, Nebra Solutions, VDL Groep, Bühler Group, Dürr Group, Shenzhen DADI Automation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Battery Manufacturing Equipment Market Key Technology Landscape

The technology landscape in lithium battery manufacturing equipment is rapidly evolving, driven by the need for enhanced energy density, faster charging capabilities, and improved safety. A critical technological focus is precision coating equipment, particularly slot-die coating technology, which offers highly uniform electrode material distribution, essential for maximizing cell performance and minimizing defects. The shift toward higher loading of active materials and thicker electrodes necessitates robust, high-speed, and extremely accurate calendering systems capable of achieving tight thickness tolerances across vast electrode areas. Furthermore, advanced laser welding techniques are replacing traditional methods in cell assembly to ensure stronger, cleaner internal connections, enhancing reliability and reducing internal resistance.

One of the most disruptive emerging technologies is Dry Electrode Manufacturing, often associated with companies like Tesla (who acquired Maxwell) and certain German firms. This process eliminates the highly energy-intensive and volatile solvent drying stage, significantly reducing the manufacturing footprint, capital costs, and energy consumption. Equipment required for this dry process, such as dry powder handling systems, specialized bonding equipment, and roll-to-roll processing machinery, represents a major future investment area. Manufacturers are intensely focused on developing production lines that can seamlessly integrate both traditional wet and novel dry processes, offering flexibility to battery producers.

Moreover, the integration of Industry 4.0 elements, including Internet of Things (IoT) sensors, advanced robotics, and comprehensive Manufacturing Execution Systems (MES), is defining the modern factory floor. These technologies enable sophisticated process control, real-time data collection, and predictive analytics, ensuring unprecedented levels of operational efficiency and quality traceability from raw materials to the finished cell. For instance, the formation and testing segment now utilizes high-accuracy, multi-channel testing systems equipped with sophisticated software capable of diagnosing minute variations in cell performance, further enhancing the technological complexity and value proposition of the equipment market.

Regional Highlights

The regional dynamics of the Lithium Battery Manufacturing Equipment market are characterized by high production concentration in APAC and aggressive localization efforts in North America and Europe. Asia Pacific, particularly China, maintains undisputed leadership due to its vast installed battery capacity, robust supply chain infrastructure, and historical dominance in both battery cell production and equipment manufacturing. Chinese equipment suppliers benefit from immediate proximity to the world's largest battery producers and favorable governmental policies supporting industrial capacity expansion. South Korea and Japan continue to be critical hubs for high-end, precision-focused machinery.

North America is rapidly emerging as a high-growth region, primarily fueled by the U.S. Inflation Reduction Act (IRA), which provides substantial incentives for domestic battery production. This has led to a flurry of gigafactory announcements and construction projects, directly translating into high-volume equipment demand. North American battery manufacturers often prioritize automated, highly customized equipment from established global leaders, sometimes demanding local assembly or supply chain commitments from Asian equipment vendors to meet regulatory content requirements. The regional focus is on large-scale EV battery production.

Europe mirrors the North American trend, driven by the European Green Deal and national strategies focused on energy sovereignty. Countries like Germany, Sweden, and Hungary are key battlegrounds for new gigafactories (e.g., Northvolt, CATL, ACC). The European market exhibits a strong preference for sustainable and energy-efficient equipment, often emphasizing advanced digital integration and modularity to handle diverse cell formats and support potential transitions to solid-state technologies. The high demand across both North America and Europe is creating a dual-sourcing strategy for major battery producers, benefiting equipment suppliers capable of supporting global deployments.

- Asia Pacific (APAC): Dominant market share; driven by China, South Korea, and Japan; focus on high-volume production and cost efficiency; epicenter of technological innovation in traditional Li-ion equipment.

- North America: Highest CAGR; accelerated growth driven by IRA incentives and localized EV production; strong demand for high-automation electrode and assembly equipment; preference for high-throughput, integrated systems.

- Europe: High growth rate; motivated by decarbonization goals and domestic supply chain security; emphasis on sustainable manufacturing practices, modular equipment, and technologies supporting high-performance European EV platforms.

- Latin America & MEA: Nascent but growing market; focused on initial domestic EV and ESS projects; procurement often tied to partnerships with established global battery players expanding into these resource-rich regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Battery Manufacturing Equipment Market.- Wuxi Lead Intelligent Equipment Co., Ltd.

- Yinghe Technology Co., Ltd.

- Manz AG

- Center International Group (CIG)

- Hangke Technology Co., Ltd.

- PNT Co., Ltd.

- Hitachi High-Tech Corporation

- Fuji Corporation

- Komax Group

- Nordson Corporation

- CKD Corporation

- Dürr Group (e.g., Dürr Assembly Products)

- Shenzhen DADI Automation Co., Ltd.

- Koem Co., Ltd.

- MGL International

- Bühler Group

- Semco (Samsung Engineering)

- VDL Groep

- Nebula Solutions Co., Ltd.

- Teijin Limited

Frequently Asked Questions

Analyze common user questions about the Lithium Battery Manufacturing Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for new lithium battery manufacturing equipment?

The central driver is the explosive global demand for Electric Vehicles (EVs) and large-scale Energy Storage Systems (ESS). This necessitates continuous construction and expansion of gigafactories globally, requiring high-volume, automated production lines, particularly for electrode and cell assembly processes.

How is the manufacturing equipment market adapting to solid-state battery technology?

Equipment manufacturers are focusing on developing specialized machinery for solid-state battery production, which requires precise dry handling systems, high-pressure stacking/pressing equipment, and vacuum deposition tools, moving away from traditional liquid electrolyte filling methods.

Which geographical region dominates the global market for this equipment?

The Asia Pacific (APAC) region, specifically driven by China, holds the largest market share due to its established, massive battery production capacity. However, North America and Europe are exhibiting the fastest growth rates due to government incentives and rapid domestic gigafactory construction.

What role does automation play in modern battery equipment?

Automation is critical for achieving high throughput, ensuring product quality consistency, and managing the highly sensitive components of the battery cell. Industry 4.0 integration, AI-driven process control, and high-speed robotics are standard requirements for all capital-intensive manufacturing stages.

What are the greatest technological challenges faced by equipment suppliers?

Key challenges include maintaining ultra-high precision (micrometer level) at extremely high production speeds, ensuring equipment flexibility to handle diverse battery chemistries (NMC, LFP, next-gen materials), and reducing the cost and complexity associated with dry electrode processing technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Lithium Battery Manufacturing Equipment Market Size Report By Type (Pretreatment, Cell Assembly, Post Processing), By Application (Consumer Electronics, Power Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Lithium Battery Manufacturing Equipment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Pretreatment, Cell Assembly, Post Processing, Others), By Application (Consumer Electronics, Power Industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager