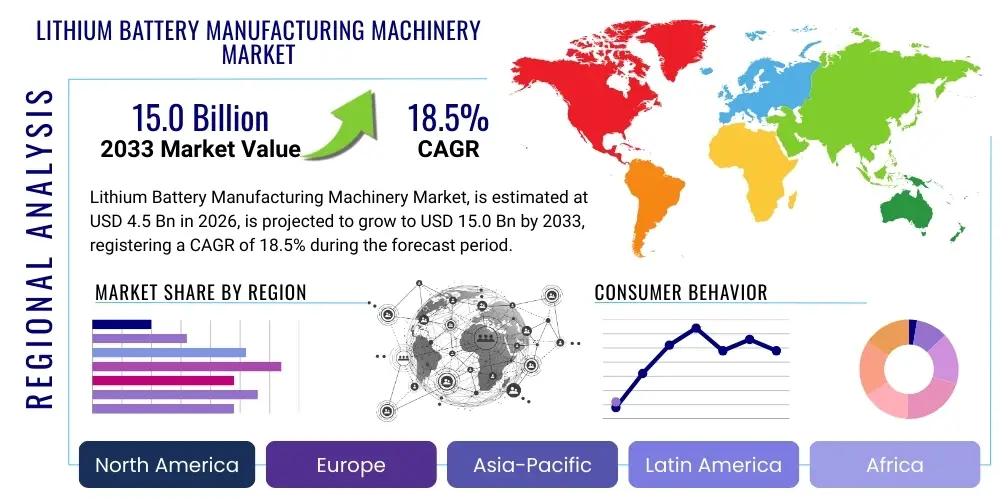

Lithium Battery Manufacturing Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437420 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Lithium Battery Manufacturing Machinery Market Size

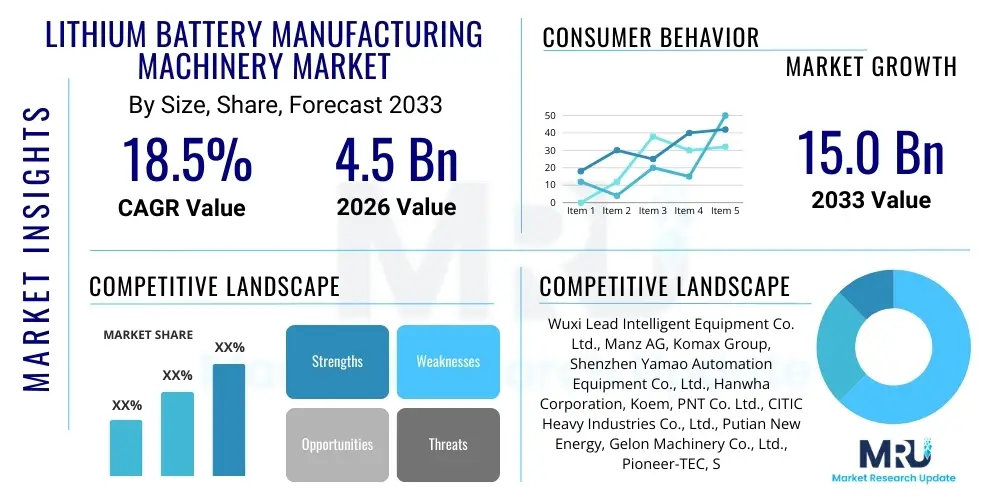

The Lithium Battery Manufacturing Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 15.0 Billion by the end of the forecast period in 2033.

Lithium Battery Manufacturing Machinery Market introduction

The Lithium Battery Manufacturing Machinery Market encompasses specialized industrial equipment essential for producing various lithium-ion battery chemistries (LCO, NMC, NCA, LFP) across the entire production lifecycle, from raw material handling to final cell testing and formation. This machinery includes high-precision mixers, advanced coaters and dryers, slitting and cutting systems, high-speed winding and stacking machines, electrolyte filling apparatus, and sophisticated formation and grading equipment. The machinery market is fundamentally driven by the exponential global demand for Electric Vehicles (EVs), grid energy storage systems (ESS), and high-performance consumer electronics, which necessitates the rapid scaling and modernization of Gigafactories worldwide.

Product complexity is a defining feature of this market, as the machinery must handle highly sensitive, thin-film materials with extreme accuracy (often measured in micrometers) to ensure battery safety, energy density, and longevity. Major applications span automotive battery packs, utility-scale storage solutions, and specialized industrial tools. The core benefit derived from investing in advanced machinery is the maximization of throughput, minimization of waste (reject rates), and the achievement of highly consistent quality standards essential for automotive Original Equipment Manufacturers (OEMs). Furthermore, modern machinery incorporates advanced automation and digitalization to manage complex manufacturing environments and comply with stringent safety regulations related to volatile materials.

Driving factors propelling this market forward include substantial government incentives and regulatory mandates promoting electrification, particularly in major automotive markets like North America, Europe, and Asia Pacific. Technological advancements, such as the transition toward solid-state batteries and dry electrode processes, are forcing machinery manufacturers to innovate and provide adaptable, next-generation equipment capable of handling these novel material formulations and assembly techniques. The intense global race to secure battery supply chains further accelerates capital expenditure in high-capacity, efficient manufacturing lines, making the machinery market a critical bottleneck and enabler for the energy transition.

Lithium Battery Manufacturing Machinery Market Executive Summary

The global Lithium Battery Manufacturing Machinery Market is characterized by intense capital investment cycles and rapid technological obsolescence, primarily fueled by the Gigafactory construction boom across North America and Europe, shifting the manufacturing center of gravity traditionally dominated by Asia. Business trends highlight a movement towards full-line integration, where key machinery providers are transitioning from selling individual units to offering complete, turnkey production solutions, thereby increasing complexity and project value. Strategic partnerships between machinery suppliers and major battery manufacturers (Cell makers) are becoming crucial for co-developing customized equipment optimized for specific cell designs and chemistries, such as large format prismatic cells preferred in certain EV segments. Moreover, the emphasis on sustainability and energy efficiency in production lines is driving the adoption of specialized drying equipment (e.g., vacuum drying) to reduce energy consumption during critical manufacturing steps.

Regionally, Asia Pacific, specifically China and South Korea, maintains its leadership due to established supply chains and high production volumes, but North America and Europe are experiencing the highest growth rates, supported by massive governmental funding (e.g., the Inflation Reduction Act in the US) aimed at localizing battery production. This localization trend mandates that machinery suppliers establish localized service and maintenance capabilities to support newly established facilities. Segment trends indicate that the formation and testing segment is growing rapidly, driven by the need for meticulous quality control and grading processes as battery cell capacities increase, directly impacting the final battery reliability and lifespan.

In essence, the market overview confirms a high-growth environment defined by scalability, precision, and automation. Key challenges revolve around managing long lead times for complex machinery and rapidly training the workforce to operate advanced, integrated production lines. Successful market players are those that can offer modular, high-throughput solutions combined with robust after-sales service and rapid adaptation to emerging battery technologies like silicon anodes and solid-state electrolytes. The machinery market acts as a critical enabler, directly dictating the speed and quality at which global battery capacity can expand to meet decarbonization goals and automotive OEM quality requirements.

AI Impact Analysis on Lithium Battery Manufacturing Machinery Market

User inquiries regarding AI's influence predominantly center on three themes: predictive maintenance effectiveness, optimization of complex process parameters (like coating thickness and drying temperature), and the enhancement of quality control through computer vision. Users are keenly interested in how AI can move machinery from reactive fault management to true preventative failure prediction, minimizing costly downtime in high-volume production lines where an hour of downtime can represent significant lost revenue. There is also significant curiosity about utilizing AI/Machine Learning (ML) algorithms to fine-tune the highly sensitive chemical and physical processes inherent in battery production, ensuring uniform cell quality across billions of units, which is essential for automotive warranty compliance. The general expectation is that AI integration will lead to higher yield rates, reduced operational expenditure (OpEx), and acceleration toward fully autonomous Gigafactories capable of continuous self-correction and optimization.

The application of Artificial Intelligence within battery manufacturing machinery transcends simple data collection; it involves complex pattern recognition to correlate input material variations with final cell performance metrics. For instance, AI systems analyze hundreds of variables during the mixing and coating stages—including temperature, pressure, humidity, and material flow rates—to predict potential defects hours before they occur, allowing for micro-adjustments to maintain optimal quality. This proactive, data-driven manufacturing approach is vital as tolerances for high-energy density cells become increasingly strict. Furthermore, AI enhances equipment flexibility, allowing the same production line to quickly switch between different electrode chemistries (e.g., LFP to NMC) with minimal physical retooling, relying instead on software-based parameter adjustments calibrated through ML models.

- AI-Driven Predictive Maintenance: Utilizing sensor data (vibration, temperature, power draw) from mixers, coaters, and winding machines to forecast component failure before performance degradation occurs, maximizing machine uptime and extending equipment lifecycle.

- Real-time Process Optimization: Applying ML algorithms to dynamically adjust manufacturing parameters (e.g., slurry viscosity, drying ramp rates, roll-to-roll tension) based on real-time feedback loops to optimize energy density and structural integrity of the electrodes.

- Enhanced Quality Control (Computer Vision): Implementing sophisticated AI-powered vision systems for rapid, high-resolution defect detection during electrode coating, slitting, and stacking processes, minimizing scrap material and improving yield rates significantly.

- Autonomous Handling Systems: Integrating AI for robotic path planning and material handling within the cleanroom environment, enabling faster and safer transport of intermediate products (e.g., electrode rolls) between different machinery stations, reducing potential damage from human error.

- Digital Twin Simulation: Using AI to create virtual models of the manufacturing line, allowing engineers to simulate process changes, test new materials, and optimize throughput without disrupting actual production, thereby accelerating R&D to mass production timelines.

- Supply Chain Optimization: Utilizing AI to predict demand fluctuations for machinery components and raw materials (steel, specialized alloys) needed for equipment manufacturing, improving lead time management for global deployment and reducing procurement risks.

- Energy Consumption Management: Deploying AI systems to manage power utilization across energy-intensive processes like drying ovens and formation chambers, optimizing heating and cooling schedules based on external factors and production load, contributing to lower carbon footprint manufacturing goals.

DRO & Impact Forces Of Lithium Battery Manufacturing Machinery Market

The market is primarily driven by massive capital expenditure stemming from global Gigafactory proliferation, technological demand for higher precision equipment required for next-generation cells, and enabling regulatory environments pushing for rapid electrification. The transition to high-nickel cathodes and silicon anodes necessitates machinery with unprecedented handling precision and sophisticated cleanroom technology, directly increasing machinery value. Furthermore, global geopolitical efforts to localize battery supply chains (IRA in the US, Green Deal in the EU) accelerate investments in new production facilities, ensuring sustained demand for manufacturing equipment over the next decade. These macro-drivers create a strong upward pressure on market valuation.

However, significant restraints include the long lead times required for sophisticated machinery, often stretching 12 to 24 months for customized lines, which hinders the speed at which new Gigafactories can ramp up production. The high initial investment costs for fully automated, high-precision lines pose barriers to entry for new battery manufacturers and smaller startups. Additionally, the complexity of integrating diverse equipment from multiple specialized suppliers (e.g., mixers from one vendor, coaters from another, testers from a third) into a cohesive, high-speed line requires extensive engineering efforts, introducing integration risks and potential bottlenecks.

Opportunities are concentrated in the development of specialized machinery for next-generation chemistries (Solid-State, Sodium-Ion) and the increasing requirement for localized service centers in North America and Europe to support the installed base and minimize downtime. The shift towards dry electrode manufacturing presents a massive opportunity for equipment vendors who can successfully commercialize the necessary powder handling and compression machinery. These factors exert high impact forces, particularly the intense pressure from EV manufacturers demanding faster capacity ramp-up and flawless quality control, making equipment reliability, speed, and adaptability paramount to market success.

Segmentation Analysis

The Lithium Battery Manufacturing Machinery Market is comprehensively segmented based on the stages of the battery production process: Electrode Manufacturing, Cell Assembly, and Post-Assembly Process. Electrode Manufacturing, which includes critical steps like mixing, coating, and slitting, currently dominates the market value due to the high cost and complexity of the equipment required to ensure electrode homogeneity and precision—factors that directly influence cell performance. Precision coaters, capable of applying ultra-thin layers with micron-level consistency, are among the most expensive and technically demanding machines in the entire production line.

The Cell Assembly segment involves winding or stacking the electrodes and preparing the cell for activation, primarily serving the cylindrical and prismatic/pouch cell markets, respectively. High-speed stacking machinery, necessary for large format cells favored by most EV manufacturers, is undergoing rapid technological advancements to improve alignment speed and accuracy. The Post-Assembly Process, including electrolyte filling, cell formation, aging, and testing, is emerging as the fastest-growing segment, driven by the escalating necessity for meticulous quality validation of high-capacity cells before deployment, with the formation process being highly energy-intensive and requiring sophisticated power management equipment.

Further analysis reveals critical sub-segmentation within the machinery type. For instance, in the coating process, machinery is bifurcated into slot-die coating and extrusion coating technologies, with slot-die becoming the preferred method for its high precision and consistency, particularly for high-energy density materials. In assembly, the shift from conventional winding to stacking technology, crucial for large format prismatic and pouch cells, is demanding entirely new classes of highly automated stacking machinery capable of extremely precise alignment over large surface areas. This technological transition ensures machinery providers must continuously adapt their product portfolios to align with the dominant cell formats chosen by tier-one battery manufacturers globally to remain competitive.

- By Process:

- Electrode Manufacturing Machinery (Mixing, Coating, Drying, Calendering, Slitting)

- Cell Assembly Machinery (Winding/Stacking, Notching, Tab Welding, Sealing)

- Post-Assembly Process Machinery (Electrolyte Filling, Formation, Degassing, Testing, Grading)

- By Battery Format:

- Prismatic Cell Machinery

- Cylindrical Cell Machinery

- Pouch Cell Machinery

- By Automation Level:

- Semi-Automated Machinery

- Fully Automated Machinery

- By Application:

- Electric Vehicles (EVs)

- Energy Storage Systems (ESS)

- Consumer Electronics

- Industrial and Medical Devices

Value Chain Analysis For Lithium Battery Manufacturing Machinery Market

The value chain for Lithium Battery Manufacturing Machinery is complex, starting with the upstream suppliers of core components such as precision engineering materials (high-grade steel, specialized ceramics), advanced robotics, sophisticated sensor technology, and high-performance servo motors. These upstream activities are crucial as the quality and precision of the final machinery heavily rely on the integrity of these foundational components, which must withstand continuous, high-speed operation in demanding environments. Specialized component sourcing, often involving vendors from the aerospace or semiconductor industries, is essential to meet the micron-level tolerance requirements of battery production machinery. The capital expenditure required at this stage is high, favoring established component suppliers with robust quality control protocols.

The middle tier consists of the machinery manufacturers themselves, who specialize in design, integration, and assembly. This stage demands intensive R&D, particularly in areas like cleanroom compatibility, high-vacuum technology (for drying and filling systems), and high-speed motion control, transforming components into complex, integrated production lines. Due to the highly specialized nature of the equipment, technological expertise and proprietary designs—especially in coating and stacking methodologies—constitute a major source of competitive advantage. Leading players differentiate themselves through the development of proprietary control software (MES/MOM systems) that ensures seamless integration and data management across the entire production sequence, addressing the increasing industry demand for turnkey solutions.

The downstream flow involves the deployment and operation of the machinery. Direct distribution is common, where major machinery vendors engage directly with Tier 1 battery manufacturers (e.g., CATL, LGES) through long-term procurement contracts and customization agreements, often requiring extensive factory acceptance tests (FAT) and site acceptance tests (SAT) before final payment. Indirect distribution is less prevalent but includes system integrators or localized agents who handle sales, installation, and initial training in smaller, emerging markets, particularly in regions where the machinery manufacturer does not maintain a direct physical presence. Post-sales service, maintenance, and periodic software and hardware upgrades form a significant and growing revenue stream in the downstream segment, critical for ensuring the longevity and continuous performance of the multi-million dollar production lines and managing warranty commitments for the final battery cells. The relationship between the machinery manufacturer and the cell producer is highly symbiotic, demanding close collaboration during R&D to optimize the equipment for new battery chemistries and formats.

Lithium Battery Manufacturing Machinery Market Potential Customers

The primary customers in the Lithium Battery Manufacturing Machinery Market are the global producers of lithium-ion cells, ranging from established Tier 1 entities with multi-gigawatt-hour production capacities to new entrants or automotive OEMs establishing captive cell manufacturing facilities (Gigafactories). These end-users require machinery that offers maximum throughput, minimal tolerance deviation (to prevent costly field failures), and high levels of automation to achieve economies of scale necessary for competitive battery production. Their goal is minimizing the cost per kWh while maximizing quality consistency, making equipment reliability paramount. The substantial global investment into EV platforms means that automotive players, either directly or through joint ventures, represent the largest segment of potential customers.

Secondary potential customers include specialized entities such as grid energy storage providers who might invest in dedicated lines for LFP cells, research institutions and governmental laboratories who need small-scale, highly flexible R&D machinery to test novel electrode materials and electrolyte compositions before scaling up production, and manufacturers of high-end consumer electronics or specialized industrial batteries who require equipment tailored for smaller batch sizes but extremely high quality. These customers often prioritize flexibility and customization over sheer speed.

The purchasing decisions of these large customers are driven by several key factors: proven reliability and uptime statistics (often requiring documented mean time between failures - MTBF), the supplier’s capability to deliver and install machinery within stringent construction timelines, and the ability of the machinery to adapt to future battery chemistry changes (e.g., a shift from liquid to semi-solid electrolytes). Automobile manufacturers, in particular, prioritize suppliers who can guarantee the security of the supply chain, offer localized maintenance and support in new geographic hubs, and adhere to globally recognized safety and data security standards, often leading to dual-sourcing strategies for critical equipment like coaters and formation systems to mitigate production risk.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 15.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wuxi Lead Intelligent Equipment Co. Ltd., Manz AG, Komax Group, Shenzhen Yamao Automation Equipment Co., Ltd., Hanwha Corporation, Koem, PNT Co. Ltd., CITIC Heavy Industries Co., Ltd., Putian New Energy, Gelon Machinery Co., Ltd., Pioneer-TEC, Shenzhen Kejing Star Technology, Suzhou Victory Precision, Techno Smart, Vitzro Cell. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Battery Manufacturing Machinery Market Key Technology Landscape

The current technology landscape in the Lithium Battery Manufacturing Machinery market is defined by a relentless push towards higher precision, faster throughput, and increased flexibility to accommodate evolving battery chemistries. Slot-die coating technology remains paramount for electrode production due to its ability to achieve uniform thickness and mass loading crucial for high-performance cells, often integrating advanced laser cutting for precision slitting instead of mechanical methods to minimize material distortion. Furthermore, the adoption of Industry 4.0 principles, including integrated sensor networks, real-time data analytics, and cloud connectivity, is essential for enabling the complex automation and predictive maintenance features demanded by modern Gigafactories. This focus on digitalization allows battery manufacturers to maintain stringent quality control while operating at extremely high production speeds, measured in meters per minute, facilitating fully traceable manufacturing records for every cell produced.

A significant technological shift is the transition in cell assembly from traditional high-speed winding (primarily for cylindrical cells) to complex high-precision stacking machinery, which is necessary for the large-format prismatic and pouch cells dominating the EV market. Stacking machinery must manage multiple layers of ultra-thin electrode and separator films with sub-millimeter accuracy, often utilizing sophisticated pick-and-place robotics and specialized vacuum suction systems to prevent damage or misalignment, which could lead to internal short circuits. Simultaneously, innovations in the formation and testing segment involve high-efficiency, multi-channel testing equipment and advanced cooling solutions to safely manage the heat generated during the critical initial charge and discharge cycles, which permanently set the cell’s performance parameters and are essential for determining the cell's final grade and application suitability.

Looking ahead, the development of machinery capable of handling new processes, such as Dry Electrode Manufacturing (pioneered by companies like Tesla/Maxwell), represents a disruptive technological challenge. Dry processing equipment significantly simplifies the manufacturing flow by eliminating solvent handling, drying ovens, and associated energy consumption, demanding entirely new equipment designs for powder handling, mixing, and high-force compression machinery capable of creating self-supporting electrodes. Similarly, machinery suppliers are heavily investing in R&D for specialized equipment necessary for solid-state battery production, focusing on minimizing atmospheric contamination, integrating high-temperature sintering processes necessary for solid electrolyte membranes, and developing novel stacking methods for solid components, marking a significant departure from current liquid electrolyte handling and vacuum filling systems.

Regional Highlights

The global Lithium Battery Manufacturing Machinery Market demonstrates heterogeneous growth influenced heavily by regional investment strategies and electrification mandates. Asia Pacific currently holds the largest market share, anchored by China, South Korea, and Japan, which possess the most mature and extensive supply chains, dominating both cell production and machinery manufacturing. Chinese suppliers, in particular, lead in offering cost-effective, high-throughput solutions, driving global competition and setting benchmarks for scalability. South Korea and Japan maintain technological superiority in specific high-precision areas, providing equipment often preferred for high-end automotive applications.

North America is projected to exhibit the highest growth rate during the forecast period, driven by the supportive policy landscape (e.g., Inflation Reduction Act - IRA) and significant investments by automotive OEMs (e.g., Ford, GM, Stellantis) establishing large-scale battery production hubs, particularly in the US Sunbelt region. This regional growth is characterized by a "greenfield" approach, necessitating full line installation from scratch. The region demands robust, highly automated machinery, often prioritizing established European and Japanese precision vendors alongside domestic integration firms to ensure quality and compliance with regional content requirements.

Europe is similarly undergoing rapid expansion, particularly in Germany, Hungary, and Scandinavia, supporting both domestic champions (like Northvolt) and Asian investment, focusing heavily on sustainable manufacturing practices and energy-efficient machinery. European procurement emphasizes energy efficiency (e.g., lower power consumption during drying) and strict adherence to environmental regulations. The Middle East and Africa, alongside Latin America, remain nascent but emerging markets, with demand primarily tied to localized small-scale assembly or research facilities and future renewable energy storage projects, showing increasing potential as battery demand extends beyond the core automotive markets.

- Asia Pacific (APAC): Dominant market share due to established Gigafactory infrastructure in China, South Korea, and Japan. Focus on optimization, cost efficiency, and handling massive production volumes. Key growth driver: Domestic EV market scale and exports to Western markets.

- North America: Fastest-growing region, fueled by government incentives (IRA) and localization efforts. High demand for fully integrated, high-precision machinery and specialized dry-electrode equipment. Key focus: Supply chain security, quality control for automotive applications, and establishment of local service capabilities.

- Europe: Strong growth driven by EU regulations favoring electrification and sustainability. High demand for energy-efficient machinery (especially advanced vacuum drying systems) and flexible manufacturing lines to support diverse cell chemistries and formats. Key hub: Germany, Nordic countries, and Eastern European investment zones.

- Latin America, Middle East, and Africa (MEA): Emerging markets with growth tied to renewable energy deployment and localized battery material processing. Demand is generally for smaller, modular production lines or machinery capable of handling specialized industrial battery production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Battery Manufacturing Machinery Market.- Wuxi Lead Intelligent Equipment Co. Ltd.

- Manz AG

- Komax Group

- Shenzhen Yamao Automation Equipment Co., Ltd.

- Hanwha Corporation

- Koem

- PNT Co. Ltd.

- CITIC Heavy Industries Co., Ltd.

- Putian New Energy

- Gelon Machinery Co., Ltd.

- Pioneer-TEC

- Shenzhen Kejing Star Technology

- Suzhou Victory Precision

- Techno Smart

- Vitzro Cell

- Hirano Tecseed Co., Ltd.

- Guangdong Hongtu Technology Co., Ltd.

- Nagoya Electric Works Co., Ltd.

- Teijin Ltd. (related coating technologies)

- Buhler Group (mixing and grinding solutions)

Frequently Asked Questions

Analyze common user questions about the Lithium Battery Manufacturing Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Lithium Battery Manufacturing Machinery?

The primary driver is the unprecedented global expansion of Electric Vehicle (EV) production and the associated construction of multi-gigawatt-hour battery Gigafactories across North America, Europe, and Asia, necessitating massive capital expenditure on high-throughput, precision equipment to secure localized battery supply chains.

How is the market adapting to the rise of Solid-State Battery technology?

Machinery manufacturers are actively investing in R&D to develop specialized equipment for solid-state production, focusing on high-temperature processing, vacuum handling, and assembly machinery that can manage brittle, solid electrolyte materials with extreme precision, fundamentally differentiating from current liquid-handling systems used in conventional lithium-ion production.

Which segment of the manufacturing process requires the most specialized machinery investment?

Electrode Manufacturing, particularly precision coating and slitting machinery, requires the highest initial capital investment due to the critical nature of these steps in determining battery performance and energy density, demanding ultra-high precision, cleanroom conditions, and sophisticated material handling capabilities for thin films.

What role does automation play in modern battery machinery production lines?

Automation (Industry 4.0 integration) is crucial for achieving high yield rates, reducing human error, and ensuring cost efficiency. It includes advanced robotics, integrated sensor networks, and AI-driven quality control and predictive maintenance, ensuring continuous, high-speed operation with strict parameter adherence in demanding cleanroom environments.

What are the main risks associated with procuring new battery manufacturing equipment?

The main risks include high initial capital expenditure, extremely long lead times (up to 24 months for fully customized lines), and the risk of technological obsolescence if the equipment cannot be easily adapted to new cell chemistries or formats, potentially undermining long-term operational efficiency and profitability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager