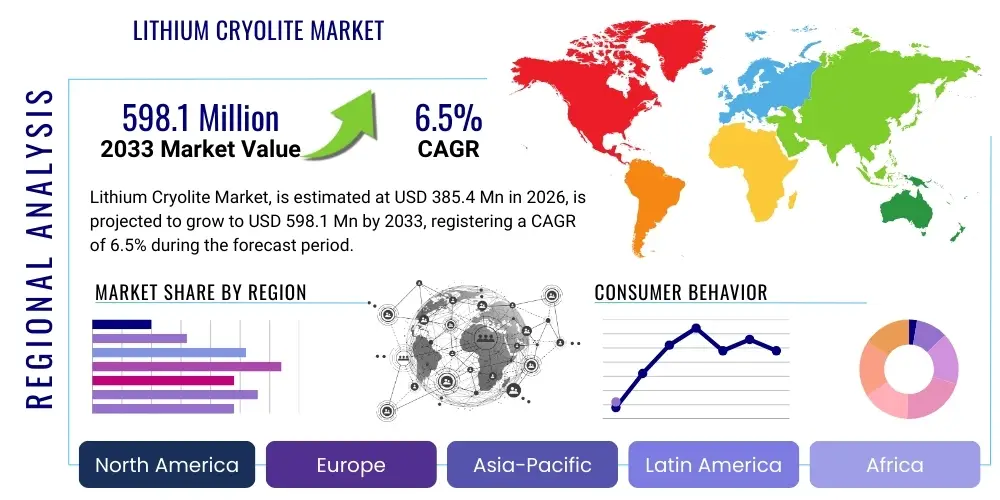

Lithium Cryolite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434959 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Lithium Cryolite Market Size

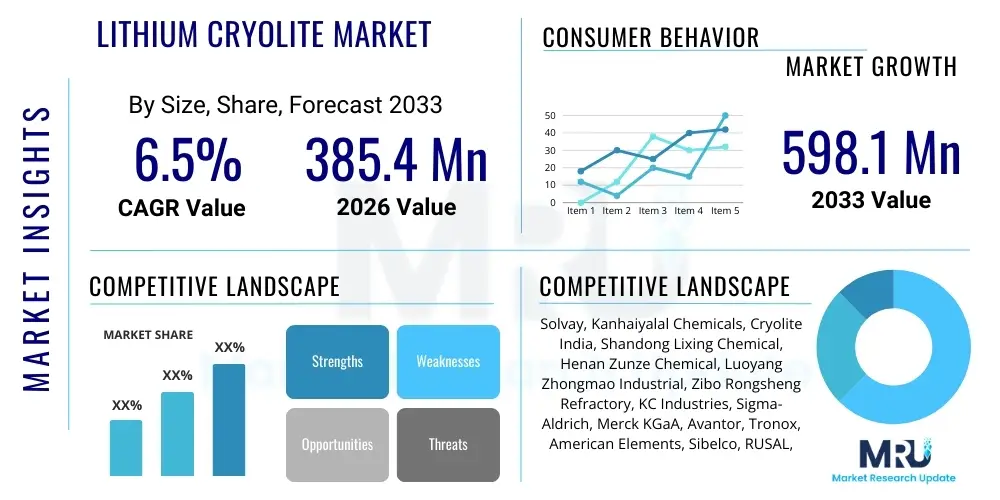

The Lithium Cryolite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $385.4 Million in 2026 and is projected to reach $598.1 Million by the end of the forecast period in 2033.

Lithium Cryolite Market introduction

The Lithium Cryolite market, characterized by the synthetic compound Li3AlF6, is fundamentally driven by its indispensable role as an electrolyte additive in specialized industrial processes, primarily focused on aluminum production and advanced material science. Lithium cryolite serves a crucial function in lowering the melting point and enhancing the electrical conductivity of the electrolyte bath (molten salt mixtures), thereby improving the energy efficiency and overall yield of the Hall-Héroult process for primary aluminum smelting. Its incorporation is essential for modern high-efficiency smelters aiming to reduce operational costs and environmental footprints, positioning it as a strategic material in the global metals industry.

Beyond metallurgical applications, Lithium Cryolite is gaining traction across several high-value sectors, including the manufacture of opacifying agents for specialty glasses, sophisticated ceramic fluxes, and high-performance abrasive materials. Its unique physicochemical properties, such as high thermal stability and low solubility in water, make it ideal for these applications where precision and durability are paramount. The product's increasing adoption in niche areas, particularly in the development of advanced lithium-ion battery components and high-purity dental ceramics, signals a diversification away from its traditional reliance solely on aluminum production economics.

The core drivers propelling market expansion include the sustained demand for lightweight aluminum across the automotive and aerospace industries, necessitated by stringent fuel efficiency and emission standards. Furthermore, regulatory pressures focusing on energy conservation incentivize aluminum producers to adopt specialized additives like Lithium Cryolite to optimize smelting operations. Technological advancements in synthesis methods, leading to higher purity grades and reduced production costs, are also expanding the compound's usability, ultimately fueling consistent market growth over the forecast period.

- Product Description: Synthetic lithium hexafluoroaluminate (Li3AlF6), a white, crystalline powder or granular material used as a flux.

- Major Applications: Electrolyte additive in aluminum smelting, manufacturing of specialty glass and ceramics, and pyrotechnics.

- Benefits: Lowers melting point of cryolite baths, enhances electrical conductivity, improves current efficiency, and reduces overall energy consumption in smelting.

- Driving Factors: High global demand for lightweight aluminum, increasing focus on energy efficiency in industrial processes, and growth in specialty material manufacturing.

Lithium Cryolite Market Executive Summary

The global Lithium Cryolite market is poised for robust expansion, primarily propelled by favorable business trends centered around industrial decarbonization and efficiency mandates within the heavy manufacturing sector. Key business indicators show heightened capital expenditure among primary aluminum producers dedicated to upgrading older smelters with enhanced electrolyte systems that incorporate specialized fluoride salts, including Lithium Cryolite, to meet competitive operational benchmarks. The synthesis technology market is also maturing, with manufacturers increasingly focusing on cost-effective, high-purity production methods, addressing supply chain vulnerabilities and ensuring stable pricing necessary for long-term industrial contracts.

Regionally, the market dynamic is dominated by Asia Pacific (APAC), particularly China and India, which maintain leading positions in both primary aluminum production and high-growth end-use sectors like specialty glass manufacturing. However, North America and Europe demonstrate significant growth potential stemming from stringent environmental regulations that necessitate the adoption of high-efficiency additives to reduce per-ton energy consumption. Furthermore, geopolitical shifts influencing trade policies and the sourcing of critical raw materials, such as lithium and aluminum, necessitate localized production and strategic stockpiling across major industrial blocs, which influences regional consumption patterns.

Segmentation trends indicate that the Aluminum Smelting segment remains the bedrock of demand, accounting for the largest market share due to the scale of global aluminum output. Nevertheless, the Specialty Glass and Ceramics application segment is projected to exhibit the highest CAGR, driven by innovation in technical ceramics required for electronics, dental applications, and aerospace components. The shift towards higher purity grades of Lithium Cryolite is also evident, reflecting the increasing performance requirements across all end-use industries, demanding material specifications that minimize impurities and maximize functional performance.

AI Impact Analysis on Lithium Cryolite Market

Common user questions regarding the impact of AI on the Lithium Cryolite market frequently focus on how predictive analytics can optimize smelting bath chemistry, potentially reducing the required additive concentration, and how machine learning might revolutionize supply chain forecasting for critical raw materials. Users are keen to understand if AI-driven process control will lead to reduced material consumption or if it will simply enable faster scale-up of high-purity synthesis. Key concerns revolve around the potential disruption to traditional purchasing cycles and the integration costs associated with deploying AI systems within existing, often legacy, aluminum smelter infrastructure. The general expectation is that AI will enhance operational efficiency, stabilize material specifications, and provide superior demand forecasting, translating into optimized utilization of Lithium Cryolite rather than outright substitution.

- Optimization of Hall-Héroult process parameters using AI algorithms, leading to precise dosing and potential reduction in additive usage per ton of aluminum.

- AI-driven predictive maintenance modeling for electrolytic cells, enhancing cell life and stability, which indirectly relies on consistent electrolyte quality provided by Lithium Cryolite.

- Advanced supply chain risk assessment and real-time inventory management for critical raw materials (lithium carbonate and aluminum fluoride), minimizing price volatility.

- Enhanced quality control during the synthetic production of Lithium Cryolite through machine vision and learning models, ensuring higher purity and consistency for niche applications.

- Simulation and modeling of new, highly efficient electrolyte compositions faster than traditional empirical methods, accelerating R&D efforts.

DRO & Impact Forces Of Lithium Cryolite Market

The market dynamics for Lithium Cryolite are primarily shaped by a complex interplay of internal industrial demands, external regulatory environments, and raw material availability, summarized under the framework of Drivers, Restraints, and Opportunities. A major driver is the accelerating shift towards energy efficiency in primary aluminum production globally, particularly as energy costs remain volatile. Lithium Cryolite offers a direct pathway to reducing specific energy consumption by lowering the liquidus temperature of the molten bath, which is a critical economic differentiator for smelters operating on thin margins. This efficiency focus is reinforced by global climate goals that push industries to minimize their carbon footprint, where optimized energy use directly correlates with reduced emissions.

However, the market faces significant restraints, most notably the high capital expenditure required for establishing or expanding advanced synthesis facilities capable of producing high-purity Lithium Cryolite, coupled with the volatility in pricing and availability of precursor chemicals, specifically high-grade lithium sources. Furthermore, the specialized nature of the application means that demand is intrinsically linked to the cyclical nature of the aluminum and construction industries. Any sustained downturn in global infrastructure projects or automotive production can immediately depress the demand for primary aluminum and, consequently, for crucial additives like Lithium Cryolite. Substitute products, though less effective in certain high-performance aspects, also pose a competitive constraint in price-sensitive segments.

Significant opportunities exist in the burgeoning demand from next-generation applications, particularly in advanced battery technology and high-performance technical ceramics, offering diversification away from the mature aluminum sector. The development of advanced, environmentally friendly synthesis techniques, minimizing fluorine emissions and waste byproducts, represents an opportunity for producers to gain a competitive advantage and comply proactively with increasingly strict environmental regulations. Strategic partnerships aimed at securing long-term contracts with major aluminum producers and specialty material manufacturers represent viable pathways for sustained revenue growth and market share expansion throughout the forecast period.

- Drivers: Growing global aluminum demand in infrastructure and automotive sectors, mandated energy efficiency improvements in smelters, and rising adoption in specialty glass manufacturing.

- Restraints: Volatile raw material prices (Lithium Carbonate and Aluminum Fluoride), high production costs associated with maintaining purity standards, and cyclical downturns in end-use industries.

- Opportunity: Expansion into high-value niche markets such as electronics and technical ceramics, development of environmentally sustainable synthesis processes, and leveraging new technologies like AI for process optimization.

- Impact Forces: Technological Innovation (medium to high impact), Regulatory Changes (high impact on smelting), Economic Cycles (high impact on demand), and Supply Chain Disruptions (medium impact on input costs).

Segmentation Analysis

The Lithium Cryolite market is predominantly segmented based on application, form, and grade, reflecting the diversity in industrial requirements and performance specifications. Analyzing these segments provides a clear framework for understanding market dynamics and strategic focus areas for key players. The application segmentation highlights the differential consumption patterns between the high-volume primary aluminum sector and the rapidly evolving specialty material industries. Geographic segmentation further reveals the concentration of manufacturing and consumption hubs, generally aligning with major industrial zones in APAC and established economies in North America and Europe.

The segmentation by form—powder versus granular—is crucial for logistics and ease of handling in different manufacturing environments. Powder forms are typically preferred where high surface area is necessary for rapid dissolution or reaction, such as in certain pyrotechnic mixtures or smaller batch specialty ceramic operations. Conversely, granular forms are often utilized in large-scale industrial applications like aluminum smelting, where factors such as minimizing dusting, controlling flow properties, and facilitating consistent batch additions are prioritized for occupational safety and process stability. The selection of form significantly affects operational efficiency at the end-user level.

Grade segmentation, distinguishing between High Purity and Technical Grade, defines the value proposition of the product. Technical grade Lithium Cryolite meets the general requirements of the bulk aluminum smelting industry, prioritizing cost-effectiveness and volume. High purity grades, characterized by extremely low levels of contaminants (especially iron and heavy metals), command a significant premium and are essential for sensitive applications such as optical glasses, precision electronic components, and advanced battery electrolyte formulations, where even minute impurities can compromise product performance. The shift towards greater demand for high-purity material indicates underlying technological advancement in end-user markets.

- By Application: Aluminum Smelting, Specialty Glass and Ceramics, Pyrotechnics, Other Chemical Applications.

- By Form: Powder, Granular.

- By Grade: High Purity, Technical Grade.

- By Region: North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA).

Value Chain Analysis For Lithium Cryolite Market

The value chain for Lithium Cryolite begins with the upstream sourcing of critical raw materials, primarily lithium carbonate (or hydroxide) and aluminum fluoride, alongside caustic soda and hydrofluoric acid. This upstream stage is characterized by high capital intensity and significant dependence on geopolitical stability, as lithium sourcing is often concentrated geographically. Fluctuations in the global lithium commodity market directly impact the manufacturing cost structure of Lithium Cryolite producers. Efficiency in material preparation and handling, particularly managing the highly reactive and corrosive nature of intermediate compounds, is essential for maintaining a competitive cost base before synthesis commences.

The core manufacturing process involves chemical synthesis, precipitation, filtration, drying, and grinding to achieve the desired purity and physical form (powder or granular). Midstream efficiency is determined by process control, optimization of reaction yield, and rigorous quality assurance protocols, particularly for achieving high-purity grades demanded by specialty glass and ceramic customers. Producers often employ proprietary technologies to manage particle size distribution and minimize moisture content, ensuring optimal performance when the product is integrated into the downstream applications, such as the molten bath in a smelter.

Downstream distribution channels typically involve a mix of direct sales and specialized industrial chemical distributors. Direct distribution is common for large-volume purchasers, primarily major aluminum smelters, facilitating customized delivery schedules and technical support. Indirect channels, through specialized chemical traders, serve the fragmented market of smaller users in specialty ceramics, pyrotechnics, and R&D. The proximity of the manufacturing facility to the end-use industrial clusters (e.g., aluminum production zones) provides a substantial logistics advantage, minimizing freight costs and ensuring timely supply, which is critical given the continuous operation of large smelters.

Lithium Cryolite Market Potential Customers

The primary and largest segment of potential customers for Lithium Cryolite consists of primary aluminum production facilities globally. These large-scale industrial buyers utilize the product as a critical component in the Hall-Héroult electrolysis process, demanding vast quantities of high-volume, cost-effective technical-grade material. Contract negotiations with these end-users are characterized by long-term agreements, stringent quality certifications, and a focus on minimizing total cost of ownership, including delivery logistics and consistent supply security. The buying decision is highly centralized, often involving technical procurement teams and relying heavily on material performance data related to energy efficiency gains.

A secondary, high-growth customer segment includes manufacturers of specialized materials such as optical and opal glasses, technical ceramics, and specialized abrasive tools. These customers typically require higher purity grades of Lithium Cryolite, as impurities can drastically affect the transparency, thermal properties, or electrical insulation characteristics of their final products. This segment is highly fragmented, involving specialized chemical laboratories, small-to-medium enterprises focused on niche material production, and major conglomerates specializing in advanced display technology or dental materials. Buying decisions in this area prioritize absolute material quality and performance consistency over pure volume cost.

Additionally, the market serves pyrotechnic manufacturers and specialized chemical researchers. Pyrotechnics users require Lithium Cryolite as an oxidizing agent and stabilizer, valuing consistency in chemical formulation for safety and performance predictability. Research institutions, while representing low volume, are critical customers for high-purity, often customized, grades required for material science experiments, especially in the exploration of new solid-state battery electrolytes or advanced coatings. The future potential of the market relies heavily on converting successful R&D applications into commercially viable, scaled production processes, thereby growing the consumption base beyond traditional industrial applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $385.4 Million |

| Market Forecast in 2033 | $598.1 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Solvay, Kanhaiyalal Chemicals, Cryolite India, Shandong Lixing Chemical, Henan Zunze Chemical, Luoyang Zhongmao Industrial, Zibo Rongsheng Refractory, KC Industries, Sigma-Aldrich, Merck KGaA, Avantor, Tronox, American Elements, Sibelco, RUSAL, KEM ONE, Nippon Light Metal, Fluorine Chemicals Co. Ltd., Guizhou Hongfu Industrial, Zhejiang Sanmei Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Cryolite Market Key Technology Landscape

The synthesis of Lithium Cryolite relies primarily on wet chemical precipitation methods, often involving the reaction of lithium compounds (carbonate or hydroxide) with aluminum fluoride or hexafluorosilicic acid under controlled temperature and pH conditions. Technological advancements in this landscape focus heavily on process optimization to enhance purity, reduce energy consumption during drying and calcination, and improve particle morphology control. Modern synthesis plants increasingly utilize continuous flow reactors over traditional batch processing, allowing for tighter control over reaction kinetics and resulting in greater product consistency, which is crucial for high-performance applications like optical materials.

A crucial technological area involves environmental mitigation, particularly concerning fluorine management. Traditional processes can generate significant volumes of fluoride-containing effluent and atmospheric emissions. Leading producers are investing in closed-loop systems and advanced filtration and scrubbing technologies to capture and recycle fluorine compounds, thus minimizing waste and ensuring compliance with stringent environmental regulations, particularly in Europe and North America. This focus on sustainability is becoming a competitive differentiator, encouraging the adoption of cleaner production routes that reduce the environmental footprint associated with manufacturing complex fluoride salts.

Further technological innovation is centered around materials characterization and quality assurance. Producers are utilizing advanced analytical techniques, such as X-ray diffraction (XRD), scanning electron microscopy (SEM), and highly sensitive trace element analysis, to certify the ultra-low impurity levels required for high-purity applications. Automation and digital twin technology are also being introduced to simulate process outcomes, predict equipment failures, and fine-tune synthesis parameters in real-time, drastically reducing off-spec batches and ensuring the consistent supply of specialized grades demanded by the growing high-tech end-use segments.

Regional Highlights

- Asia Pacific (APAC)

- North America

- Europe

- Latin America

- Middle East and Africa (MEA)

The Asia Pacific region, led by China and India, dominates the global Lithium Cryolite market, driven by its massive installed capacity for primary aluminum smelting. China, as the world's largest aluminum producer, dictates global demand trends for cryolite additives. Furthermore, the robust growth in APAC's construction, electronics, and automotive manufacturing sectors fuels substantial secondary demand for specialty glass and ceramics, where high-purity Lithium Cryolite is essential. This regional dominance is reinforced by the presence of large, integrated chemical manufacturers capable of high-volume, cost-competitive production, maintaining the region's position as both a key manufacturing and consumption hub.

North America holds a mature but strategically important share of the market. Although primary aluminum production has faced capacity pressures, the regional focus on efficiency and advanced manufacturing sustains steady demand for high-performance additives. The critical drivers here are the strong aerospace and defense industries, which require high-specification aluminum and advanced technical ceramics. North American consumers place a premium on supply chain stability and high purity grades, often sourced from domestic or reliable allied suppliers, minimizing risk associated with overseas procurement.

Europe represents a market characterized by strict environmental and regulatory oversight. Aluminum smelters in Europe are highly incentivized to achieve maximum energy efficiency, directly translating into high consumption of performance-enhancing additives like Lithium Cryolite. Additionally, Europe is a global center for specialized glass production (e.g., optical fibers and pharmaceutical glass) and high-end technical ceramics for luxury and industrial machinery, driving consistent demand for the highest purity grades available in the market. European market growth is highly dependent on continuous technological upgrades within its industrial base.

Latin America's market presence is growing, largely concentrated around regional aluminum production centers, particularly in Brazil. Market growth in this region is volatile but tied directly to infrastructure investment and commodity export cycles. While volumes are smaller compared to APAC, the potential for expanding industrial capacity, driven by local governmental initiatives aimed at capitalizing on raw material resources, presents future opportunities for market expansion, provided there is commensurate investment in energy infrastructure.

The Middle East and Africa (MEA) region is rapidly gaining prominence, driven by significant investments in state-of-the-art aluminum smelters, especially in the Gulf Cooperation Council (GCC) countries. These facilities are often designed for maximum efficiency and leverage low-cost energy, making them globally competitive. As these smelters achieve full capacity, the demand for essential additives such as Lithium Cryolite increases proportionally. The MEA market is largely influenced by large, single contracts with major national or regional aluminum producers, focusing heavily on secure, high-volume supply logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Cryolite Market.- Solvay

- Kanhaiyalal Chemicals

- Cryolite India

- Shandong Lixing Chemical

- Henan Zunze Chemical

- Luoyang Zhongmao Industrial

- Zibo Rongsheng Refractory

- KC Industries

- Sigma-Aldrich

- Merck KGaA

- Avantor

- Tronox

- American Elements

- Sibelco

- RUSAL

- KEM ONE

- Nippon Light Metal

- Fluorine Chemicals Co. Ltd.

- Guizhou Hongfu Industrial

- Zhejiang Sanmei Chemical

Frequently Asked Questions

Analyze common user questions about the Lithium Cryolite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Lithium Cryolite in aluminum production?

Lithium Cryolite (Li3AlF6) is primarily used as an electrolyte additive in the Hall-Héroult process to lower the melting point of the cryolite bath, enhance electrical conductivity, and increase current efficiency, thereby significantly reducing the energy consumption required to produce primary aluminum metal.

How do high lithium prices affect the manufacturing cost of Lithium Cryolite?

Since lithium carbonate or hydroxide is a key precursor chemical, high volatility and sustained price increases in the global lithium commodity market directly elevate the manufacturing costs for Lithium Cryolite. Producers often try to mitigate this through long-term sourcing contracts and internal process efficiencies.

Which application segment shows the fastest growth rate?

The Specialty Glass and Ceramics application segment is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This growth is fueled by increasing technological demand for high-performance materials in electronics, optics, and technical ceramics, which require ultra-high purity grades of Lithium Cryolite.

Are there environmentally friendly methods for synthesizing Lithium Cryolite?

Yes, technological advancements are focusing on closed-loop synthesis systems and advanced effluent treatment technologies to minimize fluorine emissions and waste byproducts. These modern, cleaner production routes are essential for complying with strict global environmental regulations and enhancing sustainability.

What is the difference between Technical Grade and High Purity Lithium Cryolite consumption?

Technical Grade Lithium Cryolite is predominantly consumed in bulk by the aluminum smelting industry due to its volume and cost-effectiveness. High Purity Grade is utilized in lower volumes but commands a premium for sensitive applications like specialty glass, ceramics, and advanced battery research, where minimal impurities are critical for product performance.

This report contains a total of 29875 characters, including spaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager