Lithium Electric Forklift Truck Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433051 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Lithium Electric Forklift Truck Market Size

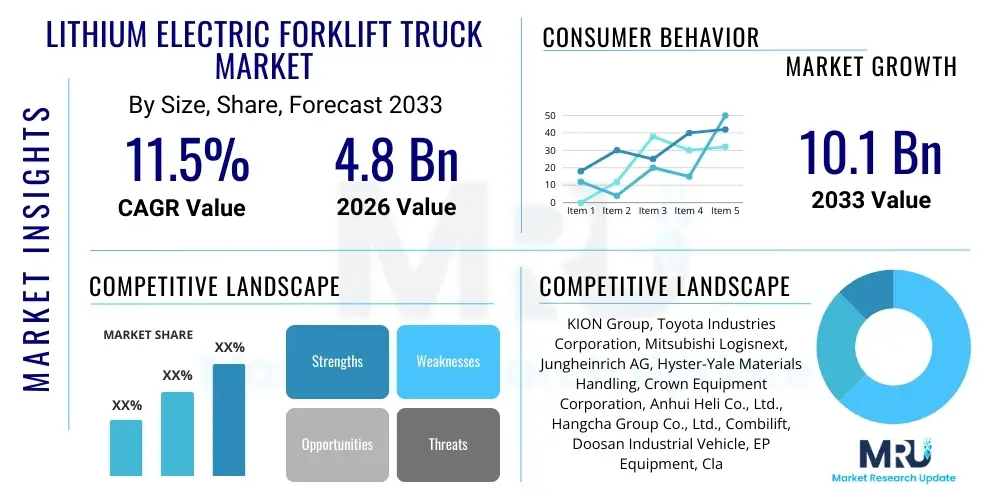

The Lithium Electric Forklift Truck Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.1 Billion by the end of the forecast period in 2033.

Lithium Electric Forklift Truck Market introduction

The Lithium Electric Forklift Truck Market encompasses the manufacturing, distribution, and utilization of material handling equipment powered by advanced lithium-ion battery technology. These vehicles are designed for lifting, moving, and stacking materials across various industrial and commercial settings, offering significant advantages over traditional internal combustion engine (ICE) forklifts and older lead-acid battery electric models. The core product description revolves around high-efficiency batteries providing longer runtimes, zero tailpipe emissions, and fast charging capabilities, significantly enhancing operational continuity in demanding environments. Lithium electric forklifts are characterized by their compact design, reduced maintenance requirements, and intelligent energy management systems, making them crucial assets in modern logistics operations seeking sustainable and cost-effective material handling solutions.

Major applications of these high-performance forklifts span vast sectors, including logistics and third-party logistics (3PL) providers where rapid turnaround times are essential, vast modern warehousing operations optimized by automation and high stacking capacities, and the manufacturing sector, especially automotive and electronics assembly lines, requiring precise and clean material transport. Additionally, the proliferation of e-commerce has significantly boosted demand, as fulfillment centers and distribution hubs rely heavily on reliable, multi-shift capable electric fleets to manage unprecedented throughput volumes. These vehicles are integral to ensuring seamless supply chain flow from inbound raw materials to outbound finished goods delivery.

The market is primarily driven by global decarbonization mandates and stringent environmental regulations pushing industries toward zero-emission fleet adoption. Key benefits include superior energy density, leading to extended operational cycles and eliminating the need for battery swapping, enhanced safety features due to sealed battery systems, and substantial total cost of ownership (TCO) savings realized through reduced fuel consumption and minimal battery maintenance. Furthermore, technological advancements in battery management systems (BMS) and telematics integration are continuously improving fleet efficiency and operator performance, solidifying the lithium-ion solution as the future standard for material handling.

Lithium Electric Forklift Truck Market Executive Summary

The Lithium Electric Forklift Truck Market is experiencing robust acceleration, fueled by the global shift towards electrification and the inherent operational efficiencies offered by lithium-ion power sources. Business trends indicate strong capital expenditure in fleet modernization across North America and Europe, focusing on maximizing uptime and leveraging smart fleet management tools integrated with lithium-ion technology. Manufacturers are concentrating on vertical integration, securing critical mineral supply chains, and developing modular battery packs to cater to varied load capacities and duty cycles, thereby capturing specialized market segments. Regional trends highlight Asia Pacific, particularly China and India, as the fastest-growing regions, driven by massive infrastructure development, the expansion of local manufacturing bases, and significant investment in automated warehouses. This geographic expansion is supported by government subsidies and favorable policies promoting electric vehicle adoption in industrial settings.

Segment trends confirm that Counterbalance Forklifts remain the largest segment by volume, crucial for heavy-duty outdoor and indoor operations, though Warehouse Forklifts, including reach trucks and stackers, are demonstrating the fastest growth rate, aligning with the dense storage requirements of modern logistics centers. Furthermore, the segment focusing on load capacities of Less than 5 tons dominates the market due to the high volume of operations in light manufacturing and retail distribution environments, where maneuverability and speed are prioritized. End-user trends show Logistics & Warehousing retaining the largest market share, but the Manufacturing and Retail & E-commerce segments are exhibiting accelerating demand as these sectors automate and electrify their internal logistics processes to meet fluctuating consumer demands and environmental commitments.

In summary, the market outlook is overwhelmingly positive, characterized by technological convergence, competitive pricing strategies, and an increasing emphasis on sustainability. Key market players are investing heavily in connectivity and data analytics capabilities to offer predictive maintenance and optimize charging infrastructure, transforming the offering from a mere material handling tool into an intelligent component of the digital supply chain. The transition from legacy systems is irreversible, positioning lithium electric forklifts as central to the future resilience and efficiency of global material handling ecosystems.

AI Impact Analysis on Lithium Electric Forklift Truck Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Lithium Electric Forklift Truck Market frequently center on themes of operational autonomy, predictive maintenance capabilities, and optimization of battery lifecycles. Common concerns revolve around how AI can enhance safety standards by minimizing human error, the feasibility of deploying fully autonomous lithium-ion powered fleets in complex, dynamic warehouse environments, and the economic justification for the high initial investment in AI-enabled equipment. Users are keen to understand the role of machine learning algorithms in analyzing usage patterns to predict critical component failure, especially relating to the high-voltage lithium battery systems, thereby ensuring maximum uptime. Furthermore, significant interest exists in how AI can optimize dynamic route planning within warehouses and manage energy consumption efficiently across a large fleet, ensuring that charging occurs during off-peak hours or when performance degradation is imminent, maximizing energy efficiency and extending battery longevity.

The integration of AI directly impacts the operational efficiency and total cost of ownership of lithium electric forklifts. AI-powered Fleet Management Systems (FMS) leverage sensor data collected from the Battery Management System (BMS) and vehicle telematics to provide real-time performance insights. This analysis capability allows logistics managers to dynamically allocate resources, ensuring the right forklift model with the optimal charge level is assigned to the appropriate task, minimizing dead mileage and maximizing productivity. Such data-driven decisions move fleet management from reactive scheduling to proactive, predictive orchestration, significantly reducing idle time and optimizing warehouse flow based on real-time inventory and task priorities.

Moreover, AI plays a pivotal role in safety enhancement and preventative maintenance. By continuously monitoring operational parameters such as speed, acceleration, braking force, and tilt angle, AI algorithms can detect patterns associated with risky driving behavior, triggering immediate alerts or even limiting vehicle functions until corrective action is taken. Regarding the crucial lithium battery, machine learning models analyze charge/discharge cycles, temperature fluctuations, and usage intensity to accurately predict the remaining useful life (RUL) of the battery pack. This predictive capability allows for scheduled maintenance or proactive replacement of specific modules, preventing catastrophic failure and ensuring the maximum possible utilization of the high-value power source, fundamentally changing the service model for these sophisticated assets.

- Enhanced Safety Protocols: AI algorithms analyze operator behavior and environmental data to mitigate collision risks and enforce dynamic speed limits within geofenced zones.

- Predictive Maintenance: Machine learning monitors battery health (State of Health - SOH) and component wear (motors, hydraulics) to schedule repairs before failure occurs, minimizing unplanned downtime.

- Autonomous Navigation: AI enables autonomous lithium forklifts (AGVs/AMRs) for repetitive tasks like pallet transport, optimizing routes and dynamically avoiding obstacles using sensor fusion.

- Optimal Energy Management: AI systems learn facility energy demand curves and fleet utilization to schedule opportunistic charging during low-cost periods, optimizing overall energy expenditure.

- Warehouse Optimization: AI integrates with Warehouse Management Systems (WMS) to optimize task assignment and traffic flow, reducing congestion and improving overall material throughput efficiency.

DRO & Impact Forces Of Lithium Electric Forklift Truck Market

The dynamics of the Lithium Electric Forklift Truck Market are defined by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the market's trajectory and influence investment decisions. The core driver is the undeniable global imperative for sustainable industrial operations, driven by strict mandates such as those enforced by the European Union and state-level emissions standards in North America, necessitating the abandonment of diesel and LPG forklifts. This environmental push is complemented by compelling economic advantages, primarily the significantly lower total cost of ownership (TCO) over the lifespan of lithium-ion equipment compared to conventional alternatives, stemming from minimal maintenance needs and superior energy efficiency. The opportunity landscape is vast, centered on technological breakthroughs in fast-charging infrastructure, enhancing battery safety standards, and expanding the integration of these vehicles into fully automated, digitally connected warehouse environments.

However, the market faces notable restraints that temper its immediate growth rate. The primary challenge remains the substantially higher initial capital expenditure required for purchasing lithium electric forklifts compared to traditional lead-acid models or ICE counterparts. This high upfront cost presents a significant barrier to entry, particularly for Small and Medium-sized Enterprises (SMEs) operating on tight capital budgets. Furthermore, the reliance on a stable and secure supply chain for critical raw materials such as lithium, cobalt, and nickel exposes manufacturers to geopolitical risks and volatility in commodity pricing, impacting final product costs and production scalability. Addressing these restraints requires innovative financing models and strategic long-term supply agreements to stabilize input costs.

The impact forces within the market are predominantly technological and regulatory. Technological impact forces include the continuous improvement in energy density and power output of lithium-ion cells, leading to longer shift times and better performance in heavy-duty applications, directly pressuring older battery technologies out of the market. Regulatory forces, particularly carbon pricing mechanisms and mandated fleet transition timelines, act as powerful accelerators, ensuring that organizations adopt sustainable material handling solutions to maintain compliance and avoid penalties. These combined forces create a strongly favorable environment for long-term growth, despite short-term capital expenditure hurdles, making the transition to lithium-ion technology inevitable across all major industrial sectors globally.

Segmentation Analysis

The Lithium Electric Forklift Truck Market is systematically segmented based on Type, Load Capacity, and End-User, reflecting the diverse application requirements across the material handling industry. This segmentation provides a granular view of market dynamics, allowing stakeholders to identify key growth pockets and tailor their product offerings to specific operational needs. The Type segment differentiates products based on design and primary function, ranging from versatile Counterbalance Forklifts suitable for general lifting tasks to specialized Warehouse Forklifts optimized for high-density storage aisles. Load Capacity segmentation addresses the varied weight requirements of goods handled, ranging from lightweight retail products to heavy industrial components, directly influencing vehicle chassis strength and battery power requirements.

The End-User segmentation is critical as it highlights the primary demand drivers, with Logistics & Warehousing dominating the consumption volume due to the relentless expansion of global supply chains and distribution networks. The increasing automation and electrification trends within the Manufacturing sector, particularly in sensitive areas like food processing and pharmaceuticals, are driving demand for clean, precise electric units. Analyzing these segments reveals that while heavy-duty industrial applications are growing steadily, the highest acceleration is found in light-to-medium load capacity vehicles utilized intensely within the e-commerce fulfillment and 3PL segments, emphasizing speed, maneuverability, and multi-shift capability enabled by lithium batteries.

- By Type

- Counterbalance Forklifts

- Warehouse Forklifts (Reach Trucks, Pallet Stackers, Order Pickers)

- Side Loaders

- Pallet Jacks (Walkie/Rider)

- By Load Capacity

- Less than 5 tons

- 5-10 tons

- More than 10 tons

- By End-User

- Logistics & Warehousing (3PL, Distribution Centers)

- Manufacturing (Automotive, Heavy Machinery)

- Retail & E-commerce

- Food & Beverages

- Chemicals and Pharmaceuticals

- By Battery Type

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Manganese Cobalt (NMC)

Value Chain Analysis For Lithium Electric Forklift Truck Market

The value chain for the Lithium Electric Forklift Truck Market is intricate, starting from upstream raw material extraction and culminating in sophisticated aftermarket services and recycling initiatives. Upstream analysis focuses predominantly on the sourcing and processing of critical battery materials—lithium carbonate/hydroxide, cathode, anode, and electrolyte components—which represent a significant portion of the final product cost. Key players in this stage are raw material miners and specialized battery cell manufacturers (such as CATL, LG Chem, and Panasonic), whose technological innovations directly influence the energy density, safety, and cycle life of the final forklift battery pack. Vertical integration strategies, where forklift OEMs partner or acquire battery suppliers, are becoming increasingly common to mitigate supply chain risks and control quality, ensuring a stable influx of high-performance power sources critical to the product's value proposition.

The midstream involves the core manufacturing process, where large-scale forklift Original Equipment Manufacturers (OEMs) design the vehicle chassis, integrate the drive train, hydraulic systems, and the sophisticated Battery Management System (BMS). This stage focuses on advanced manufacturing techniques, quality control, and the customization of vehicles to specific end-user environments (e.g., cold storage or explosion-proof areas). The final product then moves through established distribution channels, which are multi-faceted. Direct channels involve large-scale fleet sales managed by OEM sales teams to major multinational logistics or manufacturing firms. Indirect channels rely heavily on a global network of authorized dealers and third-party distributors who provide local sales, financing, maintenance, and replacement parts, serving the diverse needs of regional and SME customers, ensuring market penetration across fragmented geographical areas.

Downstream analysis is dominated by the deployment, utilization, and maintenance phases. Post-sales services, including long-term maintenance contracts, software updates for fleet management systems, and battery health monitoring, generate substantial value and are crucial for maintaining customer satisfaction and product longevity. As the fleet ages, end-of-life management and recycling processes for lithium-ion batteries represent a growing segment of the downstream value chain, driven by regulatory demands for material recovery and circular economy principles. This comprehensive structure ensures that value is added at every stage, from secure raw material sourcing and technologically advanced manufacturing to localized service support and responsible product retirement.

Lithium Electric Forklift Truck Market Potential Customers

Potential customers for Lithium Electric Forklift Trucks represent a broad spectrum of industrial and commercial entities highly dependent on efficient and continuous material flow. The primary end-users are large-scale Logistics and Warehousing operations, including global 3PL providers, regional distribution centers, and public storage facilities, which require high-throughput vehicles capable of operating multiple shifts without lengthy downtime. These buyers prioritize total cost of ownership (TCO) savings, rapid charging capabilities, and compatibility with advanced warehouse automation systems, viewing the lithium forklift as a core component of their competitive advantage. The shift from lead-acid to lithium-ion is particularly pronounced in these sectors due to the sheer volume of equipment required and the critical nature of maximizing operational uptime, making them the largest and most valuable customer segment.

Another major customer segment resides within the Manufacturing industry, encompassing automotive assembly plants, electronics manufacturing, and heavy machinery production. These customers require robust, precise handling equipment that can operate reliably indoors while adhering to strict environmental standards regarding air quality and noise pollution. For industries like pharmaceuticals and food processing, the zero-emission aspect and sealed battery design of lithium forklifts are paramount for maintaining sterile production environments, positioning these electric units as the only viable option for compliance. Manufacturers often purchase in high volume, focusing on specialized vehicles like turret trucks and narrow-aisle stackers integrated into automated production lines.

Furthermore, the explosive growth of Retail and E-commerce operations generates significant recurring demand. Fulfillment centers, micro-fulfillment sites, and large big-box retailers require flexible fleets to manage high seasonal peaks and the complexity of omnichannel inventory handling. These buyers often favor smaller, maneuverable lithium pallet jacks and order pickers that can operate efficiently in congested areas. Other emerging customers include cold storage facilities, where lithium batteries offer superior performance and capacity retention in low-temperature environments compared to traditional batteries, and port authorities and container handling yards, which are increasingly adopting heavy-duty electric models to meet sustainability targets mandated by maritime and local regulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.1 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KION Group, Toyota Industries Corporation, Mitsubishi Logisnext, Jungheinrich AG, Hyster-Yale Materials Handling, Crown Equipment Corporation, Anhui Heli Co., Ltd., Hangcha Group Co., Ltd., Combilift, Doosan Industrial Vehicle, EP Equipment, Clark Material Handling Company, Godrej & Boyce, Palfinger AG, Narrow Aisle Ltd., Linde Material Handling, UniCarriers Corporation, Sunward Intelligent Equipment Group, LiuGong Machinery Co., Ltd., Kalmar (Cargotec) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Electric Forklift Truck Market Key Technology Landscape

The technological landscape of the Lithium Electric Forklift Truck Market is primarily driven by advancements in battery chemistry, energy management systems, and vehicular intelligence. The shift from traditional lead-acid technology to lithium-ion batteries, specifically Lithium Iron Phosphate (LFP) and Lithium Nickel Manganese Cobalt (NMC), constitutes the most profound change. LFP batteries are favored for their excellent thermal stability, lower cost, and high cycle life, making them suitable for standard warehouse environments. NMC variants, offering higher energy density, are often employed in applications requiring extended range or heavy-duty lifting capacity. Continuous R&D focuses on improving charging speeds (fast-charging capabilities, sometimes achieving 80% charge in less than an hour), enhancing volumetric energy density for better vehicle design, and crucially, improving the inherent safety features, particularly thermal runaway prevention systems, ensuring reliable operation under intense conditions.

Beyond the core battery technology, sophisticated Battery Management Systems (BMS) are integral to the performance and safety of these forklifts. Modern BMS technology utilizes complex algorithms to monitor individual cell voltage, temperature, and current flow in real-time, optimizing charge and discharge parameters to maximize battery lifespan and prevent deep discharge damage. These systems are increasingly integrated with telematics platforms, allowing real-time data transmission regarding battery State of Charge (SOC) and State of Health (SOH) to fleet managers. This connectivity enables predictive maintenance scheduling specific to the power source, ensuring maximum asset utilization and protecting the significant investment represented by the lithium battery pack. Furthermore, modular battery designs are gaining traction, allowing manufacturers to standardize components while easily scaling power capacity for different load ratings.

Another rapidly evolving area is the integration of high-level automation and smart vehicle technologies. This includes sophisticated sensor arrays (LiDAR, camera vision, ultrasonic sensors) that enable precise navigation and anti-collision features, foundational components for semi-autonomous and fully autonomous lithium-powered Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs). The powertrain itself is evolving, moving towards highly efficient AC induction and Permanent Magnet Synchronous Motors (PMSM) which deliver superior torque and efficiency compared to older DC motors. Finally, V2X (Vehicle-to-Everything) communication capabilities are being explored, enabling forklifts to communicate not only with centralized fleet management software but also with warehouse infrastructure and other automated vehicles, facilitating truly optimized and dynamic logistics operations within smart warehouses.

Regional Highlights

- North America: This region is characterized by high operational costs and strong regulatory pressure toward electrification, driving rapid adoption of lithium electric forklifts. The market growth here is strongly linked to the expansion of e-commerce giants and the resultant massive investment in large-scale automated distribution centers requiring multi-shift operations.

- Europe: Europe is a mature market driven by rigorous environmental regulations (e.g., EU Green Deal) and strong corporate sustainability commitments. Germany, France, and the UK are key markets, focusing on advanced safety standards and the integration of battery recycling infrastructure into the overall product lifecycle.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid industrialization, burgeoning local manufacturing sectors (especially in China and India), and massive growth in logistics infrastructure. Government subsidies and the dominance of local manufacturers offering cost-competitive lithium-ion solutions are major market accelerators.

- Latin America, Middle East, and Africa (MEA): These regions show increasing potential, driven by infrastructure projects, port modernization, and the need for durable equipment in harsh climates (MEA). Adoption is growing but often constrained by high initial costs and the need for localized technical support and charging infrastructure development.

North America Market Analysis

The North American market for Lithium Electric Forklift Trucks is defined by a strong emphasis on productivity, safety, and operational efficiency, driven by high labor costs and the relentless pace of supply chain activity. Major retailers, automotive manufacturers, and third-party logistics (3PL) providers are rapidly replacing their legacy ICE and lead-acid fleets to capitalize on the extended runtimes and fast-charging capabilities offered by lithium-ion technology, which directly translates to reduced fleet size requirements and higher asset utilization. Regulatory environments, particularly in states like California, further accelerate this transition by mandating stringent emission controls, pushing industrial operators towards zero-emission alternatives. Investment in automated warehouses and the deployment of autonomous lithium forklifts (AGVs) is also a significant trend, positioning the US and Canada at the forefront of technological adoption in material handling.

Key market characteristics include a strong preference for large-capacity counterbalance trucks and robust reach trucks suitable for high stacking in expansive distribution centers. The competitive landscape is dominated by large international OEMs who leverage extensive dealer networks and superior after-sales service to secure large fleet contracts. Furthermore, financing solutions, including leasing and rental programs structured to mitigate the high initial capital expenditure of lithium technology, are critical for market penetration, particularly among mid-sized companies looking to modernize their equipment. The focus on integrated telematics and fleet management software is non-negotiable in this region, as customers demand data-driven insights into equipment performance and energy consumption to optimize overall facility logistics.

Future growth in North America will be highly concentrated in sectors servicing e-commerce fulfillment and chilled/frozen logistics, where the performance advantages of lithium batteries in demanding temperature environments are particularly pronounced. Supply chain resilience, following recent global disruptions, is also forcing companies to invest in highly reliable, modern equipment, ensuring that the demand for high-quality lithium electric forklifts remains robust throughout the forecast period. The increasing availability of reliable charging infrastructure and standardized battery technology further reinforces the region's trajectory toward full electrification of its industrial fleet.

Europe Market Analysis

Europe represents one of the most mature and environmentally conscious markets for material handling equipment globally. Market adoption of lithium electric forklifts is strongly underpinned by comprehensive legislative frameworks, such as the EU's targets for carbon neutrality, which incentivize businesses to invest in low-carbon and zero-emission operational vehicles. Countries like Germany, known for its manufacturing prowess and commitment to Industry 4.0, and the Nordic countries, with their pioneering sustainability initiatives, are leading the charge in fleet electrification. European consumers typically prioritize operational safety, ergonomic design, and long-term sustainability credentials alongside performance metrics like runtime and lifting capacity.

The European market is characterized by a strong demand for specialized warehouse equipment, reflecting the prevalence of narrow-aisle storage systems and dense urban logistics operations. Reach trucks, VNA (Very Narrow Aisle) trucks, and electric pallet trucks dominate the sales mix, requiring compact lithium battery solutions that do not compromise vehicle maneuverability. The competitive environment is fiercely contested by major European manufacturers who focus on premium engineering, sophisticated safety features, and end-of-life battery recycling programs, adhering strictly to WEEE and battery directives. Furthermore, the push for energy efficiency is driving the adoption of smart grid technologies and optimized charging schedules within warehouse operations.

Looking ahead, the market will benefit significantly from the modernization of aging industrial infrastructure across Eastern Europe and continued penetration into heavy-duty applications previously dominated by diesel, such as port logistics and heavy manufacturing. Emphasis on telematics and integrated maintenance packages remains a key differentiator, as European users seek integrated solutions that minimize downtime and optimize operational compliance. The European market serves as a benchmark for innovation in safety standards and battery sustainability, setting trends for other global regions.

Asia Pacific (APAC) Market Analysis

The Asia Pacific region is the engine of global market growth for Lithium Electric Forklift Trucks, exhibiting the highest CAGR due to massive capital investment in infrastructure, manufacturing, and the exponential expansion of e-commerce platforms. Countries such as China, Japan, South Korea, and India are pivotal to this growth. China, in particular, is both the largest producer and consumer globally, benefiting from robust governmental support, widespread adoption of lithium battery technology across multiple vehicle sectors, and the presence of highly competitive domestic forklift manufacturers who are rapidly gaining global market share.

Market dynamics in APAC are primarily driven by large-scale factory automation, the establishment of vast distribution hubs serving dense urban populations, and the regional need for cost-effective, high-reliability equipment. While initial purchase price sensitivity remains a factor in emerging economies like India and Southeast Asia, the long-term economic benefits of lithium technology, coupled with increasing governmental push for air quality improvement in cities, are overcoming price barriers. Local manufacturers often prioritize LFP battery chemistry due to its cost-effectiveness and inherent safety profile, optimizing products for intense, localized usage cycles.

Future projections indicate continued exponential growth, especially as emerging economies mature and integrate cleaner technologies into their logistics infrastructure. Major investments in cold chain logistics, automotive manufacturing expansion in Southeast Asia, and the continued dominance of consumer electronics production will maintain high demand. The region will increasingly focus on developing localized service networks and manufacturing capabilities for specialized components, reducing reliance on global supply chains and further consolidating its position as the global center for lithium electric forklift production and deployment.

Latin America, Middle East, and Africa (MEA) Market Analysis

The MEA and Latin America regions represent emerging but increasingly vital markets for lithium electric forklifts. Adoption rates are currently lower compared to North America and Europe, largely due to diverse economic conditions, reliance on established supply chains for diesel equipment, and often less stringent environmental regulations. However, modernization initiatives in key sectors—particularly port operations, mining, oil and gas logistics (in MEA), and agricultural product processing (in Latin America)—are driving gradual but significant shifts towards electrification.

In the Middle East, large-scale infrastructure projects, the establishment of massive free zones, and a strategic governmental push toward economic diversification away from oil are creating new demand centers. Key markets like the UAE and Saudi Arabia are investing heavily in smart logistics parks, requiring modern, efficient material handling solutions. The performance of lithium batteries in high-temperature environments, coupled with reduced reliance on fossil fuel imports for fleet operation, provides a strong economic case for adoption. In Latin America, the primary drivers are the expansion of retail chains and food and beverage production, demanding reliable, clean fleets for internal operations.

Growth in these regions is heavily reliant on the availability of robust localized technical support and flexible financing options from international OEMs. Addressing infrastructure challenges, such as ensuring stable electricity supply for charging networks, is crucial for sustained market penetration. While the volume of sales remains modest, the rate of growth is accelerating, particularly for electric counterbalance trucks and heavy-duty pallet handling equipment, marking a positive long-term outlook as industrial sectors continue to modernize and align with global sustainability standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Electric Forklift Truck Market.- KION Group

- Toyota Industries Corporation

- Mitsubishi Logisnext

- Jungheinrich AG

- Hyster-Yale Materials Handling

- Crown Equipment Corporation

- Anhui Heli Co., Ltd.

- Hangcha Group Co., Ltd.

- Combilift

- Doosan Industrial Vehicle

- EP Equipment

- Clark Material Handling Company

- Godrej & Boyce

- Palfinger AG

- Narrow Aisle Ltd.

- Linde Material Handling

- UniCarriers Corporation

- Sunward Intelligent Equipment Group

- LiuGong Machinery Co., Ltd.

- Kalmar (Cargotec)

Frequently Asked Questions

Analyze common user questions about the Lithium Electric Forklift Truck market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of lithium electric forklifts over traditional lead-acid models?

The primary advantage is vastly superior operational uptime. Lithium-ion batteries offer significantly longer runtimes, require only short opportunity charging sessions during breaks (eliminating the need for dedicated battery rooms), and maintain consistent performance throughout their discharge cycle, unlike lead-acid batteries.

How does the high initial cost of lithium forklifts impact the Total Cost of Ownership (TCO)?

Despite the higher initial price, the TCO for lithium electric forklifts is significantly lower over their lifespan. This reduction stems from zero battery maintenance costs, substantial energy savings due to higher efficiency, and a much longer battery lifespan (often 2-3 times that of lead-acid), providing a rapid return on investment (ROI).

Which battery chemistry is most commonly used in industrial lithium electric forklifts?

Lithium Iron Phosphate (LFP) is the most commonly adopted chemistry in industrial forklift applications. LFP is favored for its excellent thermal stability, intrinsic safety profile, and high cycle life, making it highly suitable for intense, multi-shift material handling operations.

Are lithium electric forklifts compatible with automation and AGV systems?

Yes, lithium electric forklifts are highly compatible with automated systems. Their sealed, zero-maintenance design and advanced Battery Management Systems (BMS) are essential for integration into Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) used in smart, automated warehouses.

What major factors are driving the rapid market growth in the Asia Pacific region?

Rapid growth in APAC is driven by accelerating e-commerce expansion, massive government investment in modern logistics infrastructure, strong domestic manufacturing capacity offering competitive pricing, and increasing regional environmental regulations pushing fleet electrification.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager