Lithium Iodide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437260 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Lithium Iodide Market Size

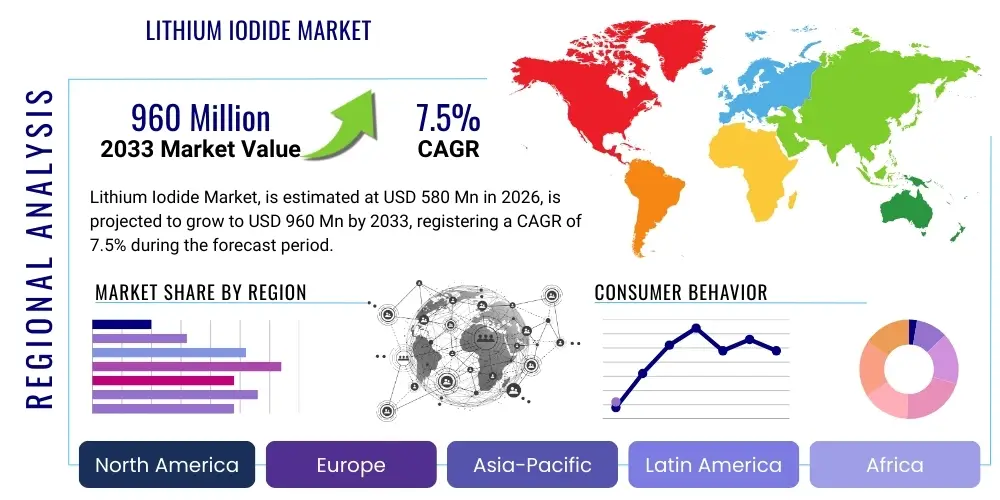

The Lithium Iodide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $960 Million by the end of the forecast period in 2033.

Lithium Iodide Market introduction

Lithium iodide (LiI) is a crucial inorganic compound characterized by its high solubility in polar solvents and exceptional ionic conductivity, making it indispensable across several high-growth industrial sectors. The market is primarily driven by its widespread application as an electrolyte component in high-performance battery systems, particularly in primary lithium batteries utilized in medical devices like pacemakers and specialized sensors. Furthermore, the emerging demand for advanced solid-state battery technology, where LiI derivatives often serve as essential solid electrolytes, is significantly fueling market expansion. The chemical stability and effectiveness of lithium iodide as a catalyst and precursor in various organic synthesis reactions also contribute substantially to its utility profile.

The core product is offered in various grades, including technical and high-purity, with the high-purity segment seeing rapid growth due to stringent quality requirements in battery and pharmaceutical manufacturing. Beyond batteries, lithium iodide finds notable application in the pharmaceutical industry for synthesizing specific thyroid medications and as a stabilizing agent in certain chemical processes. Its properties, such as being highly hygroscopic and demonstrating efficient charge transfer, solidify its position as a critical specialty chemical ingredient. Market dynamics are closely tied to global energy storage trends, regulatory frameworks governing medical device manufacturing, and advancements in iodine chemistry.

Key benefits driving adoption include enhanced energy density and stability in power sources, improved catalytic efficiency in industrial processes, and reliability in medical applications where consistent performance is paramount. Major driving factors involve the exponential growth of the Internet of Things (IoT) devices necessitating compact and reliable primary batteries, the accelerating electric vehicle (EV) sector pushing solid-state battery research, and sustained demand from established pharmaceutical manufacturing hubs globally. The versatility and technical superiority of Lithium Iodide ensure its sustained relevance across diversified end-user markets.

Lithium Iodide Market Executive Summary

The Lithium Iodide market is currently experiencing robust momentum, predominantly steered by technological advancements in energy storage solutions. Business trends indicate a strong shift towards vertical integration among key manufacturers aiming to secure raw material supply chains (primarily lithium and iodine sources) to mitigate price volatility and enhance operational efficiencies. A critical strategic focus involves scaling up production capacities for high-purity grades required by tier-one battery manufacturers developing solid-state architectures. Mergers and acquisitions focusing on specialized purification technologies and electrolyte formulation expertise are prevalent, signaling a competitive drive for product differentiation and intellectual property dominance in the specialized chemicals segment. Sustainability concerns are also beginning to influence procurement, pushing suppliers toward cleaner synthesis methods and better waste management protocols.

Regional trends highlight Asia Pacific (APAC), led by China, South Korea, and Japan, as the undisputed leader in consumption and manufacturing capacity, directly correlating with the region's dominance in global battery production (both primary and rechargeable). North America and Europe are significant consumers, driven by stringent pharmaceutical regulations and increasing investments in localized high-tech battery and medical device manufacturing. These Western markets prioritize supply chain security and high specifications, often relying on specialized, high-cost suppliers. Investment in R&D, particularly in Europe, targets optimizing LiI integration into next-generation sodium-ion and potassium-ion battery systems, diversifying its future application potential beyond traditional lithium chemistries.

Segmentation trends reveal that the Battery Manufacturing application segment holds the largest market share and is expected to exhibit the highest CAGR through 2033, driven specifically by the growing adoption of primary lithium iodide batteries in critical implantable medical devices. Within product grade segmentation, the High Purity Lithium Iodide segment is projected to grow faster than the Technical Grade, reflecting the industry-wide imperative for zero-defect materials in high-sensitivity applications. The Technical Grade segment, while slower growing, maintains stable demand in non-critical industrial catalysis and air purification sectors. The competitive landscape is moderately consolidated, with strong differentiation maintained through purity levels and customized physical forms (anhydrous vs. trihydrate).

AI Impact Analysis on Lithium Iodide Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Lithium Iodide market predominantly revolve around three key themes: optimization of synthesis and purification processes, enhancement of battery design and material testing, and predictive supply chain management. Users frequently ask how AI-driven material informatics can accelerate the discovery and validation of novel LiI-based solid electrolytes, thereby shortening the time-to-market for next-generation batteries. There is also significant concern regarding how AI could optimize manufacturing yield rates, especially for ultra-high purity grades, which are currently characterized by complex and expensive purification steps. Furthermore, questions address the role of machine learning algorithms in predicting demand fluctuations in the fast-paced battery sector, enabling better inventory management and mitigating price spikes resulting from sudden material shortages. The underlying expectation is that AI will introduce unprecedented levels of efficiency and predictability across the value chain.

The primary impact of AI is transforming the R&D lifecycle for new lithium iodide derivatives. AI-powered simulation tools and generative chemistry platforms are being utilized to model the crystalline structure and ionic transport properties of LiI in various polymer or ceramic matrices, drastically reducing the need for extensive, physical trial-and-error experiments. This acceleration allows material scientists to quickly screen thousands of potential solid-state electrolyte compositions incorporating LiI, identifying optimal candidates that offer superior conductivity and interface stability. This predictive capability translates directly into faster innovation cycles and cost reduction in formulation development, positioning LiI as a versatile component in future energy storage solutions.

In manufacturing and supply chain operations, AI’s influence focuses on process control and demand forecasting. Machine learning models analyze real-time sensor data from reactors and crystallizers to maintain optimal temperature, pressure, and concentration parameters, ensuring consistent yield and purity levels, critical for battery-grade materials. On the logistical front, advanced analytics platforms utilize historical sales data, geopolitical indicators, and end-user market projections (e.g., EV sales forecasts) to provide highly accurate demand predictions for lithium iodide precursors. This enhanced foresight allows manufacturers to optimize raw material sourcing (lithium carbonate/hydroxide and iodine) and production scheduling, minimizing inventory holding costs while preventing costly disruptions caused by unforeseen supply bottlenecks. Consequently, AI integration enhances both the technical performance and the economic efficiency of the Lithium Iodide market ecosystem.

- AI accelerates the discovery of novel LiI-based solid electrolytes through computational material screening and molecular dynamics simulations.

- Machine learning optimizes synthesis parameters (temperature, reaction time, stoichiometry) to achieve ultra-high purity grades required for solid-state batteries.

- Predictive analytics enhance supply chain resilience by forecasting regional demand spikes and optimizing inventory levels of lithium and iodine precursors.

- AI-driven quality control systems implement real-time spectral analysis to ensure zero-defect material batches for sensitive medical and battery applications.

- Robotics and automation, governed by AI algorithms, reduce human error and exposure in hazardous LiI handling and packaging environments.

DRO & Impact Forces Of Lithium Iodide Market

The market for Lithium Iodide is significantly influenced by a confluence of accelerating drivers, structural restraints, and strategic opportunities, which collectively define the impact forces shaping its trajectory. The primary driver remains the indispensable role of LiI in primary lithium batteries used in critical, long-life applications such as cardiac pacemakers and other implantable medical devices, where reliability is non-negotiable and substitutes are scarce. Furthermore, the global research surge in solid-state battery technology, aiming for safer and higher energy density cells, presents a massive growth opportunity, as many leading solid electrolyte compositions rely on or are derivatives of lithium iodide chemistry. However, market growth is restrained by the high cost and price volatility of key raw materials, particularly elemental iodine, and the complex, energy-intensive process required to achieve the necessary ultra-high purity required for battery and pharmaceutical applications. Geopolitical risks associated with lithium sourcing also pose a persistent restraint.

Impact forces are heavily skewed towards demand-side dynamics, particularly the increasing globalization of advanced healthcare technologies and the aggressive push towards electrification across transport and grid storage. The increasing prevalence of chronic diseases requiring advanced monitoring and therapeutic devices ensures sustained growth in the medical segment. The opportunity landscape is broadened by the potential integration of LiI into new, non-traditional applications such as smart window technology and radiation detection sensors, leveraging its unique physicochemical properties. Successful capitalization on these opportunities requires substantial investment in advanced chemical processing and material handling technologies to manage the corrosive and hygroscopic nature of LiI efficiently.

Strategic maneuvering around restraints involves securing long-term supply contracts for iodine and developing proprietary closed-loop recycling processes for lithium from spent primary batteries. The environmental impact and sustainability profile are becoming increasingly potent impact forces, influencing regulatory scrutiny and corporate social responsibility goals, pushing manufacturers toward more environmentally benign synthesis routes. Overall, while technical performance demands drive higher purity standards and complexity, the overwhelming demand from crucial, high-value sectors ensures positive growth potential, provided supply chain vulnerabilities and purification costs are effectively managed through innovation and strategic sourcing.

Segmentation Analysis

The Lithium Iodide market segmentation provides a granular view of market dynamics, classified primarily by application, distinguishing between the high-growth battery segment and stable pharmaceutical/catalysis sectors, and by grade, which reflects the purity required by end-users. The Application segment analysis is critical as it reveals that energy storage solutions are the central pillar of market expansion, demanding rigorous purity standards and reliable high-volume supply. Conversely, the Pharmaceutical segment, while smaller in volume, commands the highest prices due to extremely strict regulatory requirements and specialized handling protocols.

Analyzing the market by Grade highlights the divergence in manufacturing complexity and pricing structures. The High Purity Grade, which caters to sensitive electronics and medical applications, requires advanced multi-stage purification techniques and is disproportionately responsible for driving innovation in processing technology. The Technical Grade, suitable for broader industrial uses like heat transfer and catalysis, focuses more on cost efficiency and large-scale synthesis. Understanding these segment dynamics is essential for market participants to tailor their investment strategies, focusing either on high-margin, specialized purity niches or high-volume, cost-competitive industrial applications.

- By Application:

- Battery Manufacturing (Primary Lithium Batteries, Solid-State Batteries)

- Pharmaceuticals (Thyroid Treatments, Antiseptics)

- Catalysis (Organic Synthesis Reactions)

- Others (Air Purification, Heat Transfer Fluids, Photovoltaics)

- By Grade:

- High Purity Grade (99.9%+)

- Technical Grade

- By Form:

- Anhydrous

- Trihydrate

Value Chain Analysis For Lithium Iodide Market

The Lithium Iodide value chain commences with the upstream extraction and refining of foundational raw materials: lithium sources (typically lithium carbonate or hydroxide) and iodine sources (often iodine brine or caliche ore). Upstream analysis reveals that price stability and geopolitical security of these materials are paramount, as both lithium and iodine markets are characterized by oligopolistic supplier structures and concentrated geographical sourcing. Manufacturers of Lithium Iodide, specialized chemical companies, rely on energy-intensive chemical synthesis processes, typically involving the reaction of lithium compounds with hydriodic acid or other iodine precursors, followed by rigorous purification and crystallization steps to meet the stringent purity demands of the battery and pharmaceutical industries. Efficiency in resource utilization and waste minimization at this stage are key competitive differentiators.

The midstream involves the manufacturing, purification, and formulation of the final product, including converting it into anhydrous or trihydrate forms based on customer specifications. Distribution channels for Lithium Iodide are bifurcated: Direct channels are utilized for high-volume, strategic customers (such as major battery cell manufacturers and large pharmaceutical companies) requiring customized purity levels and secure supply logistics. Indirect channels involve specialized chemical distributors who manage inventory, repackaging, and delivery to smaller end-users in academia, R&D labs, and lower-volume industrial applications. The complexity of handling LiI, given its hygroscopic nature, necessitates specialized packaging and storage, adding to the distribution costs.

Downstream analysis focuses on the end-use sectors. The battery segment requires integration into complex electrolyte systems, often involving dissolution in organic solvents or incorporation into polymer matrices. Pharmaceutical companies utilize LiI as a high-value reactant in synthetic processes. The effectiveness and consistency of the final Lithium Iodide product directly impact the performance and certification (e.g., FDA approval for medical devices) of the downstream products. Therefore, strict quality control and certification throughout the value chain are essential, linking upstream material quality directly to downstream market acceptance and regulatory compliance.

Lithium Iodide Market Potential Customers

The primary consumers of Lithium Iodide are sophisticated manufacturing entities requiring specialty chemical inputs for high-performance products, dominated by the energy storage and medical device sectors. End-users in the Battery Manufacturing sector, particularly those specializing in primary (non-rechargeable) lithium cells, represent the largest and most critical customer base. These customers utilize Lithium Iodide as the vital electrolyte component in batteries designed for long-duration, low-power applications such as military sensors, utility meters, and, most importantly, implantable cardiac rhythm management devices (pacemakers and defibrillators), where product lifecycle often exceeds a decade and reliability failure is unacceptable. Consequently, these customers demand ultra-high purity, certified batches, and redundant supply chain guarantees.

A rapidly emerging customer segment involves companies engaged in advanced solid-state battery R&D and eventual commercial manufacturing. These buyers are looking for custom formulations of Lithium Iodide, often combined with other compounds like Lithium Sulfide (Li2S) or Lithium Phosphate, to create superior solid electrolytes. These customers prioritize collaboration with suppliers capable of delivering materials tailored to novel crystalline structures and surface treatments. The shift towards electrification in vehicles and grid storage is rapidly expanding this buyer base from specialized R&D institutes to massive automotive and industrial conglomerates planning gigafactory operations globally.

Beyond energy, the Pharmaceutical Industry constitutes a high-value customer group. These companies procure Lithium Iodide for use as a precursor in the synthesis of radiopharmaceuticals, treatments for thyroid disorders, and as a component in certain diagnostic reagents. Their purchasing decisions are driven almost exclusively by compliance with Good Manufacturing Practice (GMP) standards, traceability, and batch consistency, rather than volume pricing. Furthermore, smaller, stable customer bases exist in industrial catalysis (using LiI as a catalyst in polymerization or organic synthesis) and specialized chemical laboratories requiring the compound for its unique thermal and electrical properties in niche academic or industrial research projects, contributing to sustained, albeit lower, volume, demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $960 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FMC Corporation, Albemarle Corporation, American Elements, ICL Group, Honeywell International Inc., Sigma-Aldrich (Merck KGaA), Qingdao Zhongsen Group, Binhai Chemical, Suzhou High-Purity Chemical, Shanghai Zikang, Shenzhen B&K, Gansu Dongfeng, Jiangxi Nanle, Hunan Chuangda, Hebei Yanxi, Nippon Chemical Industrial, Gelest Inc., Alfa Aesar (Thermo Fisher). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Iodide Market Key Technology Landscape

The technological landscape of the Lithium Iodide market is characterized by continuous advancements focused on two primary goals: achieving higher purity levels required by advanced applications and developing novel synthesis routes that are more cost-effective and environmentally benign. Traditional synthesis involves the reaction of lithium compounds with hydriodic acid, which, while effective, is often challenged by the corrosive nature of the reactants and the complexity of removing trace metallic impurities essential for battery-grade material. Current technological innovation centers on advanced crystallization techniques, such as fractional crystallization and zone refining, which are implemented post-synthesis to systematically enhance purity to levels exceeding 99.99%. These sophisticated purification methods are critical in mitigating the risk of side reactions or degradation in sensitive electrochemical cells, driving up both the capital expenditure and operational complexity for specialized manufacturers.

A significant technological focus is directed toward optimizing Lithium Iodide’s performance in solid-state electrolytes (SSEs). Researchers are employing nanotechnology and surface engineering techniques to stabilize the interface between the LiI-based solid electrolyte and the lithium metal anode, a notoriously challenging hurdle in SSB commercialization. This involves incorporating ceramic fillers or polymer matrices (forming hybrid electrolytes) to enhance mechanical strength, suppress dendrite growth, and maximize ionic conductivity at room temperature. The development of anhydrous lithium iodide, essential for these non-aqueous battery systems, requires specialized vacuum drying and inert atmosphere handling technologies to prevent hydration, a factor that significantly degrades performance. Manufacturers capable of consistently supplying stable, anhydrous LiI are positioning themselves at the forefront of the next-generation battery market.

Furthermore, automation and process analytical technology (PAT) are transforming the manufacturing facilities. PAT tools, including real-time spectroscopy and chromatography, are deployed throughout the production line to monitor impurity profiles instantaneously, allowing for immediate process adjustments and minimizing batch waste. This integration of digital control systems ensures the stringent quality requirements of the pharmaceutical and medical device industries are met consistently. Innovations in material handling, particularly specialized packaging that utilizes desiccants and hermetic sealing under controlled atmosphere conditions, are equally important technological advancements, ensuring product integrity from the factory gate through to the highly sensitive cleanroom environments of end-users.

Regional Highlights

- Asia Pacific (APAC): Dominance in Manufacturing and Consumption

APAC is the largest market for Lithium Iodide, driven by the colossal battery manufacturing ecosystem concentrated in China, South Korea, and Japan. China acts as both the largest producer of raw materials (lithium chemicals and iodine derivatives) and the largest consumer, primarily due to its dominance in primary lithium battery production for consumer electronics and its rapidly expanding research and development efforts in solid-state battery technology. South Korea and Japan represent high-value markets, focusing on ultra-high purity LiI for premium medical devices and advanced automotive battery prototypes. The region benefits from robust government support for new energy vehicles and associated material research, ensuring sustained demand growth exceeding global averages. Regional competition is intense, focusing heavily on cost leadership and high-volume consistency.

- North America: Focus on Medical and High-Tech Energy Storage

North America is a mature market characterized by extremely high demand for medical-grade Lithium Iodide, critical for its leading biomedical device industry (e.g., Medtronic, Boston Scientific). Strict FDA regulations mandate the highest purity and traceability standards, commanding premium pricing. The region is also witnessing significant investment in localizing the battery supply chain, especially concerning R&D into solid-state battery architectures supported by substantial government grants and private sector funding. Demand here is driven more by technological sophistication and security of supply rather than sheer volume, positioning it as a key region for future technological breakthroughs and high-margin product sales.

- Europe: Strategic R&D Hub and Diversification Efforts

The European market is robustly growing, propelled by the European Green Deal and associated initiatives aimed at creating a self-sufficient battery value chain (European Battery Alliance). While relying heavily on imports for raw LiI, Europe is a major center for advanced material research, especially in Germany and Scandinavia, focusing on high-efficiency catalysis and the integration of LiI into novel electrochemical systems. The pharmaceutical segment maintains stable demand, supported by stringent EU regulatory frameworks. Strategic investments are currently targeting refining capabilities to reduce reliance on external suppliers, enhancing the region’s resilience against geopolitical supply shocks and optimizing its use of Lithium Iodide in advanced industrial processes.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Markets

LATAM plays a crucial role primarily upstream, as countries like Chile are major global sources of iodine, influencing global LiI input costs. However, downstream consumption is relatively small, focusing mainly on imported pharmaceutical products and basic industrial applications. The MEA region represents a burgeoning opportunity, particularly in the UAE and Saudi Arabia, driven by diversification efforts into high-tech manufacturing and renewable energy projects. As these regions increase investment in domestic battery assembly and localized healthcare infrastructure, demand for imported Lithium Iodide, particularly technical and pharmaceutical grades, is expected to see moderate, consistent growth over the forecast period, albeit from a low base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Iodide Market.- FMC Corporation

- Albemarle Corporation

- American Elements

- ICL Group

- Honeywell International Inc.

- Sigma-Aldrich (Merck KGaA)

- Qingdao Zhongsen Group

- Binhai Chemical

- Suzhou High-Purity Chemical

- Shanghai Zikang Industrial Co., Ltd.

- Shenzhen B&K Lithium Ion Battery Co., Ltd. (Supplier/Consumer Integration)

- Gansu Dongfeng Chemical Technology Co., Ltd.

- Jiangxi Nanle Chemicals Co., Ltd.

- Hunan Chuangda New Material Co., Ltd.

- Hebei Yanxi Chemical Co., Ltd.

- Nippon Chemical Industrial Co., Ltd.

- Gelest Inc. (A subsidiary of Mitsubishi Chemical Group)

- Alfa Aesar (Thermo Fisher Scientific)

- Toshima Manufacturing Co., Ltd.

- Shandong Sinocera Functional Material Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Lithium Iodide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for High Purity Lithium Iodide?

The primary driver is the manufacturing of primary (non-rechargeable) lithium batteries essential for life-critical medical devices like pacemakers and implantable defibrillators, where ultra-high purity ensures long life and reliability. Secondary drivers include advanced solid-state battery research and high-grade pharmaceutical synthesis.

How does the volatility of iodine prices impact the Lithium Iodide market?

Iodine is a critical and geographically concentrated raw material for Lithium Iodide synthesis. Price volatility in the global iodine market directly increases the manufacturing cost of LiI. Producers often enter long-term supply agreements or pursue vertical integration strategies to mitigate this price risk and stabilize production costs.

Which geographical region dominates the consumption and manufacturing of Lithium Iodide?

The Asia Pacific (APAC) region, particularly China, dominates both the consumption and manufacturing capacity of Lithium Iodide. This regional leadership is directly linked to APAC’s extensive control over the global lithium battery supply chain and major investment in associated chemical precursor production.

What role does Lithium Iodide play in next-generation solid-state batteries (SSBs)?

Lithium Iodide is a crucial component or precursor used to formulate high-performance solid electrolytes. Its exceptional ionic conductivity makes it invaluable in ceramic or polymer-based solid electrolytes, helping to overcome current challenges related to energy density, safety, and operational stability in SSBs.

What are the main technical challenges in manufacturing battery-grade Lithium Iodide?

The main technical challenges involve achieving and maintaining ultra-high purity (99.9% or higher) by effectively removing metallic trace impurities, managing the highly hygroscopic nature of the compound (requiring specialized anhydrous processing), and mitigating the corrosive effects of reactants during synthesis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Lithium Iodide Market Size Report By Type (Lithium Iodide Trihydrate, Lithium Iodide Anhydrous), By Application (Chemical, Pharmaceutical, Electrolyte, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Lithium Iodide Market Statistics 2025 Analysis By Application (Chemical, Pharmaceuticals, Electrolyte), By Type (Lithium Iodide Trihydrate, Lithium Iodide Anhydrous), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager