Lithium-Ion Battery Electrolyte Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439173 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Lithium-Ion Battery Electrolyte Market Size

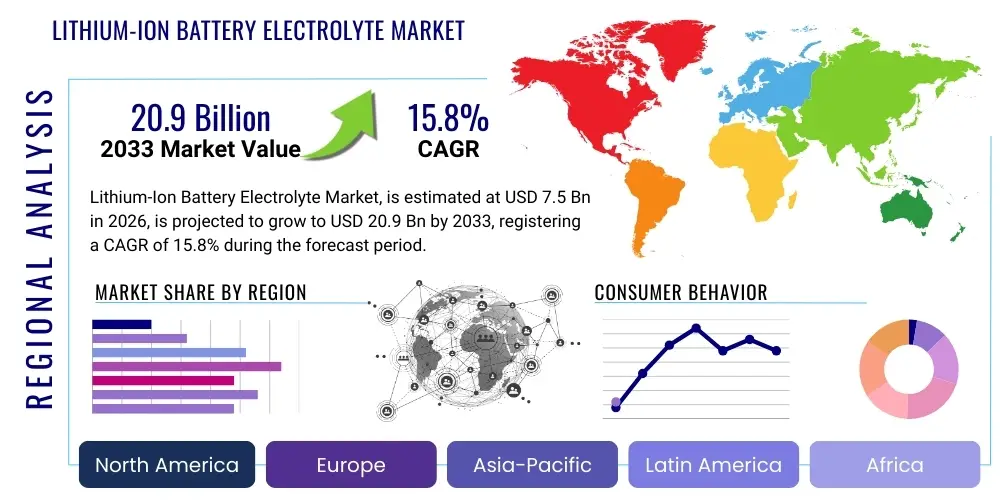

The Lithium-Ion Battery Electrolyte Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 20.9 Billion by the end of the forecast period in 2033.

Lithium-Ion Battery Electrolyte Market introduction

The Lithium-Ion Battery Electrolyte Market forms the crucial backbone of the rapidly expanding energy storage and electric mobility sectors. Electrolytes are fundamental components in Li-ion batteries, serving as the medium for the transport of lithium ions between the anode and cathode during charging and discharging cycles. Typically composed of lithium salts (such as LiPF6), organic solvents (like ethylene carbonate, diethyl carbonate, and dimethyl carbonate), and various additives, the electrolyte dictates key battery performance metrics, including power density, cycle life, operational temperature range, and, most critically, safety. Innovations in electrolyte chemistry, particularly the shift towards solid-state electrolytes and high-voltage liquid electrolytes, are driving the next generation of battery technology necessary for widespread electric vehicle adoption and grid storage solutions. The increasing global regulatory push toward decarbonization and the subsequent governmental support for EV manufacturing infrastructure are accelerating the demand trajectory for high-performance electrolyte formulations globally.

Major applications for lithium-ion battery electrolytes span across consumer electronics, where small-form factor and high energy density are paramount, to large-scale stationary storage systems designed for grid stabilization and renewable energy integration. However, the most significant driver remains the automotive sector, specifically the production of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs). The unique demands of the EV market necessitate electrolytes capable of operating reliably under extreme conditions, offering faster charging capabilities, and ensuring long-term thermal stability. Furthermore, specialized electrolyte solutions are critical for aerospace and medical devices, where reliability and weight minimization are non-negotiable performance parameters. The market is highly sensitive to raw material sourcing, particularly the availability and price volatility of lithium salts and high-purity solvents, which influences overall production costs and market competitiveness.

The primary benefits derived from advanced electrolytes include enhanced battery safety through improved thermal runaway resistance and increased cell longevity, directly impacting the total cost of ownership for end-users. Driving factors for market growth are multifaceted, encompassing continuous cost reduction in battery pack manufacturing due to economies of scale, substantial governmental investments in sustainable transportation, and rapid technological advancements in anode materials (e.g., silicon and lithium metal) which require compatible, often bespoke, electrolyte systems. The pursuit of higher energy density batteries, essential for extending EV driving ranges, perpetually pushes researchers and manufacturers to develop novel electrolyte formulations that can withstand higher operating voltages without degradation or decomposition, thereby solidifying the electrolyte's pivotal role in the future of energy storage.

Lithium-Ion Battery Electrolyte Market Executive Summary

The Lithium-Ion Battery Electrolyte Market is experiencing robust growth fueled primarily by the exponential expansion of the electric vehicle (EV) sector and corresponding investments in gigafactories worldwide. Key business trends indicate a strong focus on strategic vertical integration among battery manufacturers and electrolyte suppliers to secure supply chains and stabilize raw material pricing, particularly lithium hexafluorophosphate (LiPF6) and emerging alternatives. Technological innovation is heavily weighted toward developing non-flammable, solid-state electrolytes and specialized additives that enhance the stability of high-nickel cathode materials and silicon anodes, crucial for boosting energy density and overall battery safety. Regulatory standards, especially in Europe and North America focusing on battery performance and end-of-life management, are compelling rapid market evolution and fostering localized production capabilities to mitigate geopolitical supply chain risks, thus shifting manufacturing concentration away from traditional Asia-Pacific strongholds. Furthermore, sustainability requirements are driving research into bio-derived or more environmentally benign electrolyte solvents.

Regionally, Asia Pacific (APAC), particularly China, South Korea, and Japan, currently dominates the consumption and manufacturing landscape, driven by massive domestic EV markets and established battery manufacturing ecosystems. However, North America and Europe are exhibiting the highest growth rates, supported by aggressive government incentives (like the US Inflation Reduction Act and EU Green Deal) aimed at building localized, resilient battery value chains. These Western regions are becoming hotspots for new capital investment in advanced electrolyte manufacturing facilities and R&D centers dedicated to next-generation chemistries, reflecting a strategic effort to decrease reliance on Asian supply for critical battery components. The deployment of large-scale stationary energy storage systems, especially in regions transitioning rapidly to renewable energy sources, is also contributing significantly to regional demand diversification beyond the primary EV segment.

Segment trends reveal that the liquid electrolyte segment, based on conventional organic solvents, still holds the dominant market share due to its proven reliability and cost-effectiveness in current-generation lithium-ion batteries. However, the solid electrolyte segment is poised for the most rapid growth, though from a smaller base, driven by anticipated breakthroughs in solid-state battery commercialization offering superior safety and energy characteristics. By application, the Electric Vehicle segment remains overwhelmingly the largest and fastest-growing consumer of electrolytes, dictating the volume and quality requirements across the industry. Within material components, LiPF6 remains the standard lithium salt, but intense research into salts like LiFSI (Lithium bis(fluorosulfonyl)imide) is gaining traction due to superior thermal and electrochemical stability at higher voltages, signaling a gradual, though complex, material substitution trend in high-performance applications. Pricing pressure in standard electrolyte formulations persists, emphasizing efficiency and scale in production processes.

AI Impact Analysis on Lithium-Ion Battery Electrolyte Market

User queries regarding the impact of Artificial Intelligence (AI) on the Lithium-Ion Battery Electrolyte Market predominantly revolve around three critical themes: accelerating materials discovery, optimizing manufacturing processes, and predicting battery performance/lifespan using advanced data analytics. Consumers and industry professionals frequently ask if AI can rapidly screen millions of potential electrolyte combinations (salts, solvents, additives) far faster than traditional lab methods, seeking affirmation of AI's role in reducing the R&D cycle time for next-generation chemistries, especially solid-state formulations. There is significant interest in how machine learning models are used to simulate complex electrochemical reactions and degradation pathways, predicting electrolyte compatibility with novel high-voltage electrodes, thereby minimizing costly and time-consuming physical testing. Furthermore, questions address the integration of AI-driven process control in electrolyte mixing and purification to maintain ultra-high quality and consistency required for high-performance batteries, ensuring zero defects in large-scale production facilities (gigafactories).

AI's primary influence is recognized in transforming the R&D paradigm from empirical trial-and-error to rational, data-driven design. Machine learning algorithms, trained on vast datasets of electrochemical properties, thermodynamic stability, and degradation mechanisms, are proving exceptionally capable of identifying promising electrolyte candidates that meet stringent safety and performance criteria, far outpacing conventional synthesis methods. This capability is crucial for unlocking the potential of high-energy-density chemistries that are currently limited by traditional electrolyte instability. For example, generative AI is used to design new additive molecules that specifically target passivation layer formation (Solid Electrolyte Interphase or SEI) to enhance interface stability and charge transfer kinetics, moving the industry closer to commercially viable lithium metal anodes and 5V cathodes.

In manufacturing, AI and predictive analytics platforms are deployed for real-time quality control and process optimization in highly sensitive electrolyte production environments. Sensors monitor factors such as purity, moisture content, and composition during mixing and purification stages. AI algorithms process this data instantaneously to detect minute deviations and autonomously adjust process parameters, ensuring homogeneity and stability across batches. This not only boosts production efficiency and reduces waste but is critical given that even trace impurities can drastically reduce battery lifespan and safety. Consequently, the adoption of AI is viewed not just as an efficiency tool but as an enabler for achieving the necessary quality standards demanded by the automotive industry, thereby lowering manufacturing costs while improving product reliability.

- AI accelerates the discovery of novel electrolyte materials, especially complex formulations for solid-state batteries, using high-throughput virtual screening.

- Machine learning models predict long-term electrolyte stability and compatibility with advanced electrode materials (e.g., silicon, lithium metal) under operational stress.

- Predictive maintenance and real-time process control (RPC) in gigafactories utilize AI to optimize mixing, purification, and filling processes, enhancing electrolyte quality and reducing defects.

- Data analytics driven by AI optimizes the composition of electrolyte additives, improving the formation and stability of the Solid Electrolyte Interphase (SEI).

- AI aids in simulating complex electrochemical phenomena, reducing the reliance on extensive physical laboratory testing cycles, saving time and cost in R&D.

DRO & Impact Forces Of Lithium-Ion Battery Electrolyte Market

The dynamics of the Lithium-Ion Battery Electrolyte Market are heavily shaped by a robust set of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces influencing future trajectory. The primary driver is the unparalleled global growth of the Electric Vehicle (EV) sector, mandating massive increases in battery production capacity, which inherently translates to higher demand for electrolytes. Complementary to this is the significant growth in renewable energy integration and the resulting need for scalable grid-level energy storage solutions (ESS). Opportunities lie significantly in the technological transition toward solid-state batteries, which promise superior safety and energy density, opening new avenues for specialized solid electrolytes and creating high-value market segments. However, the market faces critical restraints, chief among them being the supply chain fragility and price volatility of key raw materials, especially lithium salts like LiPF6, coupled with inherent safety concerns regarding the flammability of traditional organic liquid electrolytes, which regulatory bodies are keen to mitigate. These forces dictate strategic investments, R&D priorities, and regional manufacturing strategies across the entire battery value chain.

Specific market drivers include supportive government policies, such as emission reduction targets, subsidies, and tax credits for EV adoption across major economies like the U.S., EU, and China, which directly stimulate battery demand. The continual decline in battery production costs due to manufacturing scale-up, known as Wright's Law, makes electric mobility more economically viable, further increasing adoption rates and electrolyte consumption. Technological advancements focused on increasing energy density are also driving demand for complex, specialized electrolyte formulations that can handle higher voltages and aggressive electrode materials. These advancements require bespoke additives and highly pure solvents, demanding stringent quality control from electrolyte suppliers.

Restraints center on the manufacturing challenges associated with maintaining the ultra-high purity required for high-performance electrolytes, where even minimal moisture or impurity levels can severely compromise battery performance and safety. Geopolitical concentration of raw material sourcing and processing, particularly in specific regions of Asia, poses a supply chain risk that compels multinational corporations to seek diversification. Opportunities are abundant in sustainable solutions, including the development of recycling processes for recovering electrolyte components, minimizing environmental impact, and creating a circular economy for battery materials. Furthermore, the development and commercialization of new, safer salt chemistries (like LiFSI) and polymer or ceramic-based solid electrolytes represent high-growth opportunities that could fundamentally reshape the market landscape and overcome current safety limitations of liquid systems.

Segmentation Analysis

The Lithium-Ion Battery Electrolyte Market is comprehensively segmented based on material composition, type, application, and end-use, allowing for precise market sizing and strategic targeting. Material composition segmentation focuses on the key components—lithium salts, solvents, and additives—as each dictates specific performance characteristics and supply chain requirements. The type segmentation distinguishes between liquid, solid, and semi-solid electrolytes, reflecting the current technology readiness levels and future development paths. Liquid electrolytes dominate today but face challenges from solid and polymer electrolytes aiming for enhanced safety. Application segmentation clearly highlights the dominance of the electric vehicle segment, while consumer electronics and stationary storage provide important, albeit different, growth vectors. Understanding these segments is crucial for manufacturers to tailor product specifications, secure supply agreements, and align R&D investment with future industry needs, particularly the requirements of high-performance EV batteries.

Segmentation by type reveals a critical market transition. While traditional liquid electrolytes benefit from established infrastructure and lower costs, they are inherently limited by flammability. This limitation is driving intensive research into solid-state batteries, positioning solid electrolytes as the primary growth area over the forecast period, despite current manufacturing complexities and interface resistance challenges. The solvent segment is also undergoing innovation, with efforts to replace traditional cyclic and linear carbonates with non-flammable alternatives or ionic liquids, particularly for high-voltage applications where conventional solvents decompose rapidly. These shifts necessitate careful portfolio management by suppliers to maintain relevance across both mature and emerging battery chemistries.

The granular analysis of the application segments underscores the divergence in required electrolyte specifications. Electric vehicles demand electrolytes optimized for high power output, rapid charging capability, and exceptional long-term cycling stability over thousands of charging cycles. Conversely, grid storage applications prioritize cost-effectiveness and calendar life over maximum energy density. Consumer electronics require electrolytes optimized for rapid discharge rates in smaller form factors. This divergence means electrolyte manufacturers must manage complex product lines catering to vastly different performance specifications, requiring specialized expertise in chemical formulation and blending for specific end-use requirements, which further drives specialization across the market value chain.

- By Type:

- Liquid Electrolyte

- Solid Electrolyte (Polymer, Ceramic)

- Semi-Solid/Gel Electrolyte

- By Material/Component:

- Lithium Salts (LiPF6, LiClO4, LiBF4, LiFSI, LiTFSI)

- Solvents (Ethylene Carbonate (EC), Dimethyl Carbonate (DMC), Diethyl Carbonate (DEC), Ethyl Methyl Carbonate (EMC))

- Additives (Flame retardants, SEI-forming agents, Gassing suppressants)

- By Application:

- Electric Vehicles (BEVs, PHEVs)

- Consumer Electronics (Smartphones, Laptops, Wearables)

- Energy Storage Systems (ESS/Grid Storage)

- Industrial & Others (Aerospace, Medical Devices)

- By End-Use Capacity:

- High Capacity (ESS, EV)

- Low Capacity (Consumer Electronics)

Value Chain Analysis For Lithium-Ion Battery Electrolyte Market

The value chain for the Lithium-Ion Battery Electrolyte Market is complex and highly specialized, beginning with the upstream sourcing and refinement of ultra-high-purity raw materials. Upstream activities involve the extraction and purification of lithium compounds to produce high-grade lithium salts (primarily LiPF6), alongside the synthesis and meticulous purification of organic solvents and specialized chemical additives. Maintaining extreme purity is non-negotiable, as trace amounts of moisture or metallic ions severely degrade battery performance. This stage is capital-intensive and often geographically concentrated, providing significant leverage to a few key raw material suppliers and intermediate chemical manufacturers. Efficiency and robust quality control in this upstream segment are crucial determinants of the final electrolyte performance and cost.

Midstream activities involve the formulation and blending of these components into the finished electrolyte product. Electrolyte manufacturers take the highly purified salts, solvents, and additives and mix them under stringent anhydrous and inert atmosphere conditions. The formulation process is proprietary and tailored to specific battery cell chemistries (e.g., LFP, NMC, NCA), voltages, and intended applications. These manufacturers often work closely with battery cell producers to meet bespoke specifications. The distribution channel is predominantly direct, especially in the context of large-scale EV battery production. Electrolyte suppliers typically establish long-term, direct supply contracts with major battery cell manufacturers (such as CATL, LG Energy Solution, Samsung SDI, and Panasonic), ensuring just-in-time delivery of this volatile and sensitive material.

Downstream analysis focuses on the end-users, primarily the battery cell assembly plants and subsequent integration into consumer devices, vehicles, or grid storage systems. Direct distribution ensures quality control and minimizes handling risks. Indirect distribution channels are minimal, primarily limited to small volumes sold to R&D institutions or specialized battery pack integrators. The relationship between the electrolyte manufacturer and the battery cell producer is highly symbiotic; changes in electrode technology immediately necessitate changes in electrolyte formulation. Therefore, successful market players are those that maintain strong collaborative ties throughout the downstream integration process, often co-developing new electrolyte solutions tailored for next-generation cell designs, thereby reinforcing a tightly knit and technically interdependent value chain.

Lithium-Ion Battery Electrolyte Market Potential Customers

Potential customers, or end-users/buyers, of lithium-ion battery electrolytes are overwhelmingly concentrated in the battery cell manufacturing sector, which serves as the direct purchaser and processor of these chemical compounds. These manufacturers are broadly categorized based on their scale and primary market focus. Tier 1 global battery producers—often referred to as 'Gigafactory operators'—constitute the largest volume buyers, driven by massive production demands for the automotive and grid storage sectors. Their purchasing decisions are driven by factors like volume pricing, stability of supply, and the electrolyte's compatibility with proprietary high-performance cathode and anode materials, making long-term strategic supply agreements essential. These customers require highly specialized formulations, impeccable quality consistency, and robust certifications demonstrating superior thermal stability.

Beyond the major EV battery producers, a significant customer segment exists within the consumer electronics sphere. Companies manufacturing small-format batteries for smartphones, laptops, and specialized IoT devices require electrolytes optimized for rapid charging and miniaturization. Although the volume requirement per unit is smaller than in EVs, the sheer quantity of consumer devices makes this a stable and high-value segment demanding excellent energy density performance. Furthermore, specialized customers, including aerospace and defense contractors, purchase electrolytes for highly specific, mission-critical applications where failure is unacceptable, prioritizing extreme thermal resilience and custom formulation over cost considerations.

Emerging customers include companies specializing in stationary energy storage systems (ESS), which are increasingly significant due to the proliferation of solar and wind power. These ESS customers prioritize long cycle life (calendar life) and safety over aggressive energy density metrics. Another growing customer segment involves R&D labs, academic institutions, and start-ups focused on next-generation battery technologies, such as all-solid-state cells. While these buyers purchase lower volumes, they are critical partners for electrolyte manufacturers looking to validate and commercialize new chemical components, representing future market opportunities and technological leadership. Thus, the customer base is segmented by volume, performance requirements, and willingness to adopt emerging, high-cost chemistries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 20.9 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ube Industries, Mitsubishi Chemical Corporation, Central Glass Co., Ltd., BASF SE, Kanto Chemical Co., Inc., Soulbrain Co., Ltd., Stella Chemifa Corporation, Dongwha Electrolyte, Guangzhou Tinci Materials Technology Co., Ltd., Capchem Technology Co., Ltd., Formosa Plastics Corporation, Dangsheng Material Technology Co., Ltd., Tomiyama Pure Chemical Industries, Ltd., Lixian New Material Technology Co., Ltd., Beijing Chemical Industry Group Co., Ltd., Shenzhen Capchem Technology Co., Ltd., Gelon LIB, Guotai Huarong New Chemical Materials Co., Ltd., Shantou Jinhui Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium-Ion Battery Electrolyte Market Key Technology Landscape

The technology landscape of the Lithium-Ion Battery Electrolyte Market is characterized by intense research focused on overcoming the inherent trade-offs between energy density, safety, and cycle life, especially as battery operating voltages increase beyond 4.2V. Current mainstream technology relies on conventional liquid electrolytes, typically composed of LiPF6 salt dissolved in a blend of organic carbonate solvents (EC, DMC, DEC, EMC). The primary technological challenge here is the continuous development of performance additives. These additives, used in small percentages (usually less than 5%), are crucial for forming a stable, highly ionically conductive, yet electronically insulating Solid Electrolyte Interphase (SEI) layer on the anode surface, especially when using advanced materials like silicon or lithium metal. Novel additive chemistries are being developed to prevent solvent co-intercalation, suppress gas generation, and inhibit dissolution of transition metals from high-nickel cathodes, thereby extending battery lifespan and enhancing thermal stability.

The most disruptive technological trend is the pivot toward solid-state electrolytes (SSEs). SSE technology replaces the flammable liquid solvent medium with a solid material—either polymers (e.g., poly(ethylene oxide) or PEO-based), ceramics (e.g., LiPON, LLZO), or sulfide-based glasses. This fundamental shift eliminates the risk of thermal runaway associated with solvent evaporation and combustion, promising significantly enhanced safety and enabling the use of high-capacity lithium metal anodes, which could dramatically boost energy density (up to 500 Wh/kg). Current technological barriers for SSEs primarily involve achieving high ionic conductivity comparable to liquids at room temperature and, crucially, managing the interfacial contact resistance between the rigid solid electrolyte and the electrode particles, particularly during cycling which involves volumetric changes.

Another major area of technological focus involves the substitution of LiPF6 with alternative lithium salts, such as Lithium bis(fluorosulfonyl)imide (LiFSI) or Lithium bis(oxalate)borate (LiBOB). LiFSI offers superior thermal stability and wider electrochemical window, making it suitable for high-voltage cells, although its corrosive nature towards current collectors (aluminum) and higher cost currently limit its full-scale adoption. Furthermore, researchers are exploring non-flammable solvents like ionic liquids or fluorinated carbonates to enhance the safety profile of semi-solid or gel electrolytes, serving as an intermediate step between conventional liquids and true solid-state systems. Advanced manufacturing technologies, including highly controlled atmosphere synthesis and purification equipment, are also critical to ensure the necessary ultra-high purity levels of these sophisticated chemical formulations demanded by leading battery cell producers globally.

Regional Highlights

- Asia Pacific (APAC): APAC is the global hub for both manufacturing and consumption, led predominantly by China, South Korea, and Japan. China holds the largest market share due to its massive domestic EV market, unparalleled battery production capacity (gigafactories), and integrated supply chain for electrolyte components, including key lithium salt and solvent producers. South Korea and Japan are leaders in high-performance electrolyte R&D, focusing on solutions for premium EV and next-generation solid-state batteries. The regional market is characterized by intense competition and vertical integration, with suppliers often co-located with major battery assemblers like CATL, LG Energy Solution, and Panasonic.

- North America: This region is projected to exhibit the highest CAGR, driven by ambitious governmental support through initiatives like the Inflation Reduction Act (IRA), aimed at establishing a localized, resilient battery supply chain. Significant capital investment is flowing into new electrolyte manufacturing plants in the U.S. and Canada, often spurred by partnerships between domestic chemical companies and established Asian market players. The primary demand driver is the rapidly expanding electric vehicle production base (Tesla, Ford, GM), which requires high-quality, regionally sourced electrolytes to qualify for tax credits and fulfill local content requirements.

- Europe: Europe is rapidly catching up in battery cell production, positioning itself as a key growth market. The EU's push for sustainability (Green Deal) and localized manufacturing standards is stimulating the construction of 'Battery Valleys' across countries like Germany, Hungary, and Poland. Demand is focused not only on automotive applications but also substantially on large-scale energy storage systems for grid balancing in renewables-rich countries. The emphasis in Europe is strongly placed on safety and sustainability, driving technological preference toward non-flammable and recyclable electrolyte formulations.

- Latin America, Middle East, and Africa (LAMEA): While smaller in market size, LAMEA presents significant long-term potential, particularly due to the abundance of lithium resources in Latin America (the "Lithium Triangle"). This region is increasingly focused on establishing localized battery production and processing facilities to leverage raw material proximity. Demand for electrolytes primarily stems from nascent EV assembly and, notably, from remote energy access and telecommunications infrastructure requiring reliable off-grid storage batteries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium-Ion Battery Electrolyte Market.- Mitsubishi Chemical Corporation

- Ube Industries

- Central Glass Co., Ltd.

- Guangzhou Tinci Materials Technology Co., Ltd.

- Soulbrain Co., Ltd.

- BASF SE

- Kanto Chemical Co., Inc.

- Stella Chemifa Corporation

- Dongwha Electrolyte

- Capchem Technology Co., Ltd.

- Formosa Plastics Corporation

- Dangsheng Material Technology Co., Ltd.

- Tomiyama Pure Chemical Industries, Ltd.

- Lixian New Material Technology Co., Ltd.

- Beijing Chemical Industry Group Co., Ltd.

- Shenzhen Capchem Technology Co., Ltd.

- Gelon LIB

- Guotai Huarong New Chemical Materials Co., Ltd.

- Shantou Jinhui Chemical Co., Ltd.

- Suzhou Fluoride New Materials Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Lithium-Ion Battery Electrolyte market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of the electrolyte in a lithium-ion battery?

The electrolyte acts as a critical medium for transporting lithium ions (Li+) between the cathode and anode during the charge and discharge cycles, enabling the flow of electrical current. It significantly influences battery performance parameters, including capacity, stability, safety, and operating temperature range.

How is the shift towards electric vehicles impacting electrolyte demand and technology?

The explosive growth of the Electric Vehicle (EV) sector is the single largest driver of electrolyte market expansion, demanding higher volumes and pushing R&D towards formulations that support fast charging, high voltage (up to 4.4V+), and superior thermal stability to ensure passenger safety and extended range.

What are solid-state electrolytes, and what are their main advantages?

Solid-state electrolytes (SSEs) are non-liquid materials (e.g., polymers or ceramics) that replace conventional flammable liquid electrolytes. Their main advantages are dramatically enhanced safety by eliminating fire risk and the ability to use high-energy-density lithium metal anodes, potentially doubling battery capacity.

Which raw material components are critical and pose the biggest supply chain risk?

Lithium salts, primarily Lithium Hexafluorophosphate (LiPF6), are critical components. The supply chain risk stems from the high purity required for these salts and the geographic concentration of their manufacturing, mostly located in the Asia Pacific region, leading to price volatility and geopolitical dependency.

What role do additives play in modern lithium-ion battery electrolytes?

Additives are essential minor components that drastically improve battery performance and lifespan. They primarily function to stabilize the Solid Electrolyte Interphase (SEI) layer on the anode, protect the cathode from decomposition at high voltages, and prevent gas generation, which is crucial for long-term cell health.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager