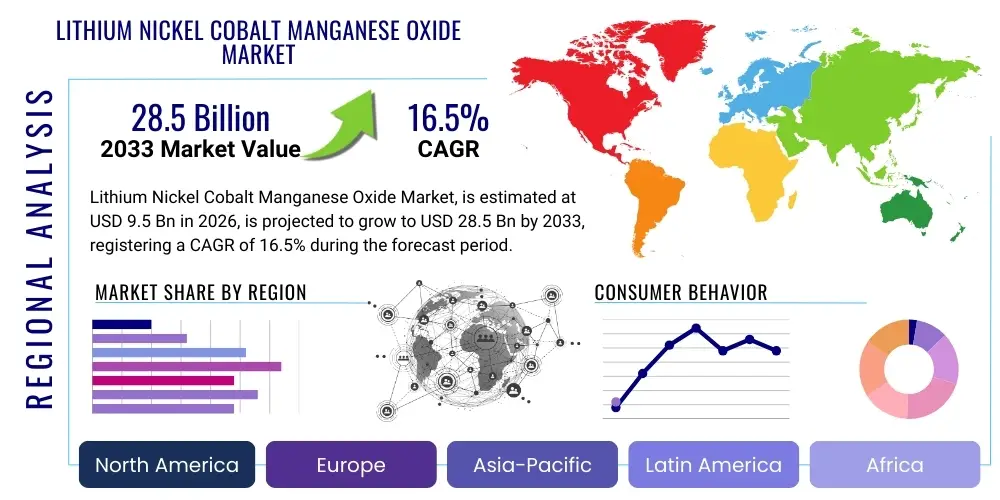

Lithium Nickel Cobalt Manganese Oxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438821 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Lithium Nickel Cobalt Manganese Oxide Market Size

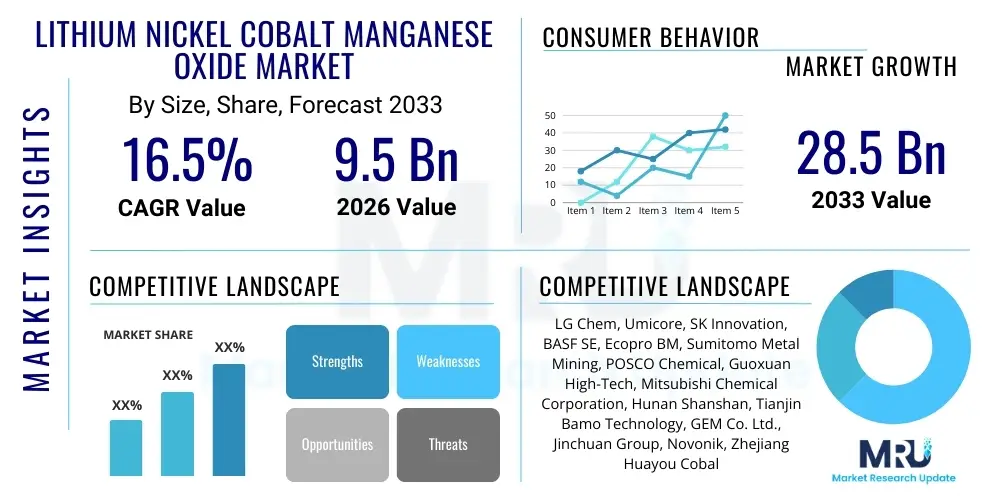

The Lithium Nickel Cobalt Manganese Oxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 28.5 Billion by the end of the forecast period in 2033.

Lithium Nickel Cobalt Manganese Oxide Market introduction

Lithium Nickel Cobalt Manganese Oxide (LiNixCoyMnzO2), commonly known as NMC or NCM, is a crucial cathode material utilized in lithium-ion batteries, recognized for its superior energy density, extended cycle life, and inherent safety profile compared to earlier chemistries like Lithium Cobalt Oxide (LCO). This ternary cathode material balances the high capacity contribution of nickel, the structural stability provided by manganese, and the improved rate capability and cycling performance offered by cobalt. Its versatility makes it the preferred choice for high-performance applications where maximizing the energy stored per unit weight (gravimetric energy density) is paramount, particularly in the burgeoning electric vehicle (EV) sector.

The primary applications driving the NCM market are electric vehicles, ranging from passenger cars to heavy-duty trucks, followed closely by large-scale grid energy storage systems (ESS). NCM cathodes enable longer driving ranges for EVs and provide the reliability required for grid stabilization and renewable energy integration. The continuous evolution of NCM chemistry towards higher nickel content, such as NCM 811 (80% nickel), signifies a strategic shift aimed at reducing reliance on expensive and geopolitically sensitive cobalt while simultaneously boosting the energy density necessary to meet demanding consumer expectations regarding EV range and charging speed.

Key market drivers include stringent global emissions regulations pushing for rapid EV adoption, substantial governmental subsidies supporting the establishment of Gigafactories worldwide, and technological advancements focusing on improved thermal stability and faster charging kinetics. The inherent chemical advantages of NCM, combining high volumetric energy density with acceptable safety standards, position it as the dominant high-performance cathode chemistry in the foreseeable future, solidifying its essential role in the global transition to electrified transportation and decentralized power infrastructure.

Lithium Nickel Cobalt Manganese Oxide Market Executive Summary

The Lithium Nickel Cobalt Manganese Oxide market is characterized by intense innovation centered on high-nickel compositions and significant geopolitical strategic maneuvering concerning raw material supply chains. Current business trends indicate a strong vertical integration strategy, where leading chemical and battery manufacturers are securing long-term contracts with mining and refining operations, especially in key resource areas like Indonesia (Nickel) and the Democratic Republic of Congo (Cobalt). This vertical alignment is critical for mitigating the volatility in precursor material pricing. Furthermore, there is a distinct trend towards the development of single-crystal NCM particles, which offer superior structural integrity and longevity, addressing key limitations of early generation poly-crystalline materials and improving overall battery longevity in demanding EV applications.

Regionally, the market is overwhelmingly dominated by the Asia Pacific (APAC), particularly China, which controls the vast majority of NCM precursor manufacturing and cathode material production capacity. However, aggressive expansion in Europe and North America, fueled by initiatives like the European Green Deal and the US Inflation Reduction Act (IRA), is reshaping the manufacturing landscape. These Western regions are focusing on establishing localized, sustainable supply chains to reduce reliance on Asian suppliers and achieve energy independence, driving substantial investment in domestic battery cell and cathode manufacturing plants, thereby diversifying the geographical distribution of manufacturing capabilities over the forecast period.

Segmentation trends highlight the increasing dominance of high-energy density variants, specifically NCM 811 and next-generation ultra-high nickel chemistries, which are gaining traction across premium and long-range EV models due to their unparalleled capacity. While NCM 523 and 622 continue to hold significant share in stationary storage and specific mid-range vehicle applications where safety and cost-efficiency are prioritized over maximum density, the overwhelming volume growth is channeled through the high-nickel segment. This shift mandates substantial R&D investment in thermal management systems and advanced electrolyte formulations to safely manage the increased reactivity associated with high nickel content.

AI Impact Analysis on Lithium Nickel Cobalt Manganese Oxide Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can accelerate the notoriously slow process of discovering and optimizing novel NCM compositions, particularly those that minimize cobalt usage while maximizing thermal safety. Key concerns revolve around AI's ability to predict synthesis parameters for large-scale, high-quality production, ensuring consistent particle morphology, distribution, and doping uniformity necessary for high-performance EV batteries. Users expect AI tools to significantly reduce the time required for precursor formulation and process optimization, ultimately lowering manufacturing costs and improving the reliability and safety of advanced NCM cathodes, transitioning from empirical trial-and-error to data-driven material engineering.

- Accelerated discovery of novel NCM chemical compositions, potentially identifying stable, low-cobalt variants.

- Optimization of cathode material synthesis processes, including temperature profiles, reaction times, and atmosphere control using predictive ML models.

- Enhanced quality control through real-time monitoring of particle size distribution and morphology during precursor production using computer vision and sensor data.

- Prediction of battery degradation rates and cycle life performance based on cathode microstructure, enabling tailored material specifications for specific applications.

- Supply chain risk management and predictive logistics planning for critical raw materials like nickel and cobalt using AI-driven forecasting models.

DRO & Impact Forces Of Lithium Nickel Cobalt Manganese Oxide Market

The market dynamics for Lithium Nickel Cobalt Manganese Oxide are heavily influenced by a potent blend of powerful external drivers, significant material constraints, and promising technological avenues. The primary driving force is the global regulatory mandate toward decarbonization, exemplified by phase-out dates for internal combustion engine vehicles, which creates unparalleled demand certainty for EV battery materials. Restraints predominantly stem from the complex supply chain, specifically the geopolitical risks and price volatility associated with sourcing cobalt, which necessitates continued innovation to minimize its percentage in cathode recipes. Opportunities lie primarily in advancing recycling technologies to create a truly circular material economy, mitigating dependency on primary mining, and the exploration of dry electrode processing techniques to lower manufacturing energy consumption and costs.

Impact forces are currently concentrated around three major areas: governmental policy intervention (subsidies and mandates), rapid technological advancement (shift to NCM 811 and beyond), and environmental, social, and governance (ESG) pressures. Governmental policies provide the initial financial impetus and market scale required for infrastructure investment. Technological shifts determine competitive positioning based on energy density and cost efficiency. ESG concerns are increasingly powerful, forcing manufacturers to focus on responsible sourcing of minerals, transparency in the supply chain, and reducing the carbon footprint of battery production, influencing purchasing decisions by major automotive OEMs.

The interplay of these factors suggests a market characterized by high growth but persistent instability. While demand is robust, manufacturers must navigate intense pressure from raw material cost fluctuations and the continuous need for R&D to maintain a technological edge. Successfully managing these constraints, particularly through strategic sourcing and investing heavily in next-generation chemistries and manufacturing efficiency, will determine market leadership.

Segmentation Analysis

The Lithium Nickel Cobalt Manganese Oxide market is extensively segmented based on the specific chemical composition, the end-use application, and the physical form of the cathode material. Segmentation by composition is critical as it directly correlates with energy density, cost structure, and thermal safety profile; higher nickel content dictates higher energy density but also higher cost and greater safety considerations. Application-based segmentation reflects the primary demand drivers, with the Electric Vehicle sector dominating consumption volumes, while the Energy Storage System segment requires specific NCM variants optimized for long cycle life and stability. Understanding these segments is vital for material producers tailoring their offerings to meet distinct performance criteria required by different battery manufacturers and end-users.

- By Composition:

- NCM 111 (Lithium Nickel Manganese Cobalt Oxide)

- NCM 523 (Lithium Nickel Cobalt Manganese Oxide)

- NCM 622 (Lithium Nickel Cobalt Manganese Oxide)

- NCM 811 (Lithium Nickel Cobalt Manganese Oxide)

- High-Nickel Variants (e.g., NCM 9xx/Low Cobalt)

- By Application:

- Electric Vehicles (BEVs, PHEVs)

- Energy Storage Systems (Grid & Residential Storage)

- Consumer Electronics (Smartphones, Laptops, Power Tools)

- Industrial Applications (Uninterruptible Power Supplies, Forklifts)

- By Form:

- Powder Form (Precursor and Finished Cathode Material)

- Composite Electrode Material

Value Chain Analysis For Lithium Nickel Cobalt Manganese Oxide Market

The NCM value chain is intricate, beginning with the highly capital-intensive upstream segment involving the extraction and refinement of key minerals—lithium, nickel, cobalt, and manganese. Upstream security is currently the most critical bottleneck, characterized by high geographical concentration of resources (e.g., cobalt in DRC, nickel in Indonesia) and complex ethical sourcing challenges. Key players in this segment are global mining giants and specialized chemical refiners who convert raw ores into battery-grade chemical sulfates (precursors) that meet rigorous purity specifications essential for high-performance cathode manufacturing.

The midstream process is where the proprietary intellectual property lies, encompassing the production of NCM precursor (P-NCM) and the final cathode active material (CAM). P-NCM is synthesized through co-precipitation, determining the final particle morphology and distribution. CAM production involves mixing P-NCM with lithium sources and heat treatment (calcination). This segment is dominated by specialized Asian chemical companies that possess decades of experience and scale, requiring high energy inputs and stringent process control to ensure consistent electrochemical performance and safety characteristics required by downstream battery manufacturers.

Downstream activities include the production of lithium-ion cells by major battery manufacturers (e.g., CATL, LG Energy Solution, Samsung SDI) who purchase the NCM cathode material. These cells are then integrated into battery packs by automotive OEMs (Original Equipment Manufacturers) or ESS integrators. Distribution channels are largely direct, with long-term, high-volume supply contracts established between CAM producers and Tier 1 cell manufacturers, ensuring security of supply and customized product specifications. Indirect distribution, through specialized material brokers or regional distributors, accounts for a smaller share, typically serving the consumer electronics or smaller specialized ESS markets.

Lithium Nickel Cobalt Manganese Oxide Market Potential Customers

The primary customers for Lithium Nickel Cobalt Manganese Oxide are Tier 1 and Tier 2 battery cell manufacturers who convert the cathode material into functional lithium-ion cells. These manufacturers, such as those supplying major automotive brands, demand high volumes, stringent quality controls, and tailored chemistries (e.g., NCM 811) to meet performance targets for electric vehicles. Their purchasing decisions are heavily influenced by long-term supply stability, pricing competitiveness, and the ability of the material supplier to innovate in tandem with evolving battery technology requirements.

The secondary major customer base comprises automotive Original Equipment Manufacturers (OEMs) who, while they may not purchase the cathode material directly, exert significant control over the entire supply chain. OEMs often specify the exact battery chemistry, performance metrics, and sourcing ethics required from their cell suppliers. Companies focused on stationary grid storage and utility-scale projects also represent a critical and growing customer segment, valuing NCM for its density in space-constrained installations and its reliability over thousands of deep cycles in grid applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 28.5 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LG Chem, Umicore, SK Innovation, BASF SE, Ecopro BM, Sumitomo Metal Mining, POSCO Chemical, Guoxuan High-Tech, Mitsubishi Chemical Corporation, Hunan Shanshan, Tianjin Bamo Technology, GEM Co. Ltd., Jinchuan Group, Novonik, Zhejiang Huayou Cobalt. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Nickel Cobalt Manganese Oxide Market Key Technology Landscape

The technological landscape of the NCM market is rapidly evolving, driven primarily by the need to achieve higher energy density, reduce cobalt reliance, and enhance safety characteristics. A key advancement is the mass adoption of high-nickel NCM variants, moving from NCM 523 and 622 to NCM 811 and increasingly towards NCM 9xx chemistries. This shift requires sophisticated doping techniques, where trace elements like Aluminum or Magnesium are incorporated to stabilize the crystal structure, mitigating the structural degradation and thermal instability that inherently accompany higher nickel content, thereby ensuring practical commercial viability in demanding EV applications.

Another crucial innovation involves particle engineering, specifically the transition from poly-crystalline NCM to single-crystal NCM particles. Single-crystal materials exhibit dramatically improved stability and resistance to microcracking during repeated charging and discharging cycles, leading to significantly longer battery life, especially under high-voltage operation. This technology is essential for realizing the full potential of high-nickel cathode materials by addressing structural integrity issues, particularly grain boundary corrosion caused by electrolyte interaction and volume change during cycling.

Furthermore, manufacturing process innovation is accelerating, focusing on energy and cost reduction. Advanced techniques like dry coating or solid-state electrolyte integration are being heavily researched. Dry coating processes eliminate the need for significant amounts of toxic solvents used in traditional slurry casting, reducing energy consumption and environmental impact. For future integration, NCM materials must also be optimized for compatibility with upcoming solid-state electrolytes, requiring specific surface modifications and processing routes to ensure low interfacial resistance and high ion conductivity in these next-generation battery architectures.

Regional Highlights

The global Lithium Nickel Cobalt Manganese Oxide market exhibits strong regional disparities in terms of production, consumption, and policy influence. Asia Pacific (APAC), led predominantly by China, remains the undisputed global hub for NCM cathode material manufacturing, commanding over 80% of global production capacity. This dominance is supported by established infrastructure, deep expertise in chemical processing, and substantial government support, positioning APAC as the critical supplier to global battery manufacturers.

North America and Europe are rapidly expanding their footprint, driven not by existing capacity but by unprecedented strategic policy efforts designed to localize the supply chain. The U.S. Inflation Reduction Act (IRA) and similar European directives mandate domestic content percentages, creating powerful incentives for the construction of precursor and cathode active material plants within these regions. This localization effort is crucial for reducing supply chain vulnerability and ensuring resilient access to key battery components necessary for the massive planned Gigafactory expansions across both continents.

Latin America, particularly nations with significant lithium and nickel reserves, is emerging as a critical upstream supplier, focusing on raw material extraction and basic refinement. The Middle East and Africa (MEA) play a pivotal role in resource supply, especially cobalt and manganese, though downstream manufacturing capacity remains negligible. The future market structure will likely feature a multi-polar production system, with APAC continuing to lead but North America and Europe achieving greater self-sufficiency in the midstream production of NCM materials by the end of the forecast period.

- Asia Pacific (APAC): Dominates global production capacity (especially China, South Korea, Japan). Strongest R&D base; primary exporter of finished NCM cathode materials to the world.

- North America: Experiencing explosive growth in localization due to the Inflation Reduction Act (IRA); focusing on securing nickel and lithium supply and establishing domestic cathode plants.

- Europe: High demand driven by massive regional Gigafactory construction (Germany, Hungary, Poland); substantial governmental backing for sustainable, localized supply chains under the European Green Deal.

- Latin America: Key region for upstream mineral sourcing (lithium from the Lithium Triangle, nickel from Brazil); focus on value addition through local refining operations.

- Middle East and Africa (MEA): Critical source of raw materials, particularly Cobalt (DRC) and Manganese; crucial for global supply stability but minimal downstream processing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Nickel Cobalt Manganese Oxide Market.- LG Chem

- Umicore

- SK Innovation

- BASF SE

- Ecopro BM

- Sumitomo Metal Mining

- POSCO Chemical

- Guoxuan High-Tech

- Mitsubishi Chemical Corporation

- Hunan Shanshan

- Tianjin Bamo Technology

- GEM Co. Ltd.

- Jinchuan Group

- Novonik

- Zhejiang Huayou Cobalt

Frequently Asked Questions

Analyze common user questions about the Lithium Nickel Cobalt Manganese Oxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the NCM market?

The primary driver is the accelerating global transition to Electric Vehicles (EVs), mandated by stringent governmental emission regulations and supported by significant consumer demand for high-range, high-performance battery systems that utilize NCM's superior energy density.

How does NCM 811 differ from earlier NCM chemistries?

NCM 811 features a composition ratio of 8 parts Nickel, 1 part Cobalt, and 1 part Manganese. The high nickel content significantly boosts energy density and lowers the cost compared to NCM 523 (5:2:3), but it requires advanced engineering to manage resulting thermal stability and structural degradation challenges.

What are the main supply chain challenges facing NCM producers?

The main challenges include the reliance on Cobalt, which is subject to geopolitical risks and price volatility, and securing long-term, ethically sourced battery-grade Nickel supply amidst rapid demand growth, necessitating strategic long-term contracts and vertical integration.

Is the market transitioning towards alternative cathode materials to replace NCM?

While Lithium Iron Phosphate (LFP) is gaining traction in cost-sensitive applications like urban EVs and some stationary storage, NCM remains the dominant chemistry for high-performance and long-range EVs due to its superior energy density, making it irreplaceable in that segment currently.

How is sustainability impacting the Lithium Nickel Cobalt Manganese Oxide production process?

Sustainability is driving major investment into hydro-metallurgical and pyro-metallurgical recycling processes to recover high-value elements like nickel and cobalt from spent batteries. Additionally, new production facilities in Western markets are emphasizing responsible sourcing and low-carbon manufacturing to meet stringent ESG criteria.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager