Lithium Primary Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431382 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Lithium Primary Battery Market Size

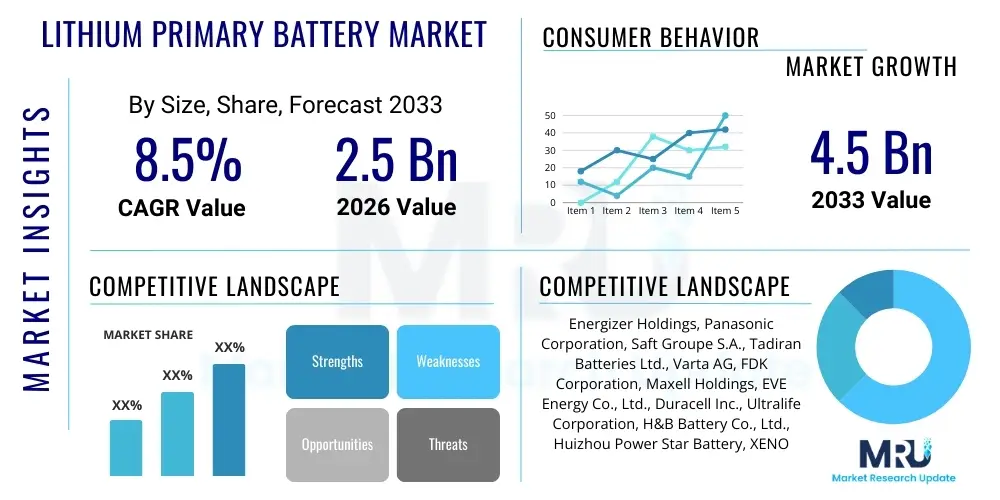

The Lithium Primary Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.5 Billion by the end of the forecast period in 2033.

Lithium Primary Battery Market introduction

The Lithium Primary Battery Market encompasses non-rechargeable electrochemical cells utilizing lithium metal or lithium compounds as the anode material. These batteries are highly valued for their exceptional energy density, long shelf life, and superior performance across a wide temperature range, making them indispensable for critical and long-duration applications where frequent replacement is impractical or costly. The primary function of these batteries is to provide reliable, sustained power in devices requiring immediate operational capability without the need for recharging infrastructure. The inherent characteristics of lithium primary batteries, such as stable voltage output and low self-discharge rate, differentiate them significantly from their secondary (rechargeable) counterparts.

Key products within this market segment include Lithium-Manganese Dioxide (Li-MnO2), widely used in consumer electronics and medical devices due to its safety and cost-effectiveness; Lithium-Thionyl Chloride (Li-SOCl2), favored in high-temperature industrial settings and military applications for its extremely high energy density and longevity; and Lithium-Sulfur Dioxide (Li-SO2), often used in demanding military communication equipment. Major applications span critical infrastructure monitoring, smart metering, remote sensing, security systems, implantable medical devices (like pacemakers), and various industrial Internet of Things (IIoT) sensors. The market growth is fundamentally driven by the accelerating global deployment of connected devices requiring reliable, long-term power solutions.

The primary benefit of adopting lithium primary batteries lies in their reliability and minimal maintenance requirements over extended operational lifetimes, often exceeding 10 years in certain specialized applications. Driving factors include the ongoing miniaturization of electronic components, the increasing demand for long-life power sources in utility meters and asset tracking devices, and stringent regulatory requirements in military and medical sectors demanding proven power integrity. Furthermore, advancements in battery encapsulation and safety features are continually expanding the range of permissible use cases, reinforcing their foundational role in the modern infrastructure landscape.

Lithium Primary Battery Market Executive Summary

The Lithium Primary Battery Market is characterized by robust growth, primarily fueled by the pervasive adoption of the Internet of Things (IoT) across industrial and consumer landscapes. Business trends indicate a strong focus on enhancing battery safety, increasing energy density, and optimizing cell design for specific demanding environments, such as deep-sea exploration and high-altitude surveillance. Specialized chemistries like Li-SOCl2 are witnessing heightened demand from oil and gas exploration sectors and smart grid infrastructure, while the Li-MnO2 segment maintains dominance in high-volume applications like smart cards and portable medical sensors. Strategic alliances between battery manufacturers and end-device integrators are common, aimed at co-developing customized power solutions tailored to stringent performance specifications.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of market expansion, driven by massive manufacturing capacities for IoT components, rapid industrialization, and high penetration of smart city projects, particularly in countries like China, Japan, and South Korea. North America and Europe maintain significant market share, characterized by high adoption rates in premium, regulatory-intensive sectors such as healthcare, defense, and advanced smart metering systems. Regional trends also show increasing investment in localized recycling infrastructure and sustainable disposal methods, responding to growing environmental concerns associated with non-rechargeable battery disposal and aiming to mitigate geopolitical risks associated with raw material sourcing.

Segment trends underscore the criticality of the Lithium-Thionyl Chloride segment due to its exceptional performance metrics required for defense and deep-well drilling applications, commanding premium pricing. Conversely, the high-volume nature and standardized form factors of the Li-MnO2 segment ensure its substantial market volume dominance. The industrial application segment is projected to experience the fastest growth, underpinned by the deployment of wireless sensors for predictive maintenance, remote asset monitoring, and environmental controls within manufacturing plants and large-scale infrastructure projects. Market evolution also includes a subtle shift towards solid-state primary battery development, promising even greater stability and energy retention characteristics in the long term, although commercialization remains constrained to niche, ultra-high-performance applications currently.

AI Impact Analysis on Lithium Primary Battery Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Lithium Primary Battery Market primarily center on three core themes: optimization of manufacturing efficiency, predictive performance modeling, and supply chain resilience. Users are keen to understand how AI-driven analytics can reduce defects in complex manufacturing processes, especially concerning electrolyte formulation and cell sealing, which are critical for the longevity and safety of primary cells. Furthermore, there is significant interest in using AI algorithms to predict the remaining useful life (RUL) of batteries embedded in inaccessible remote sensors or medical implants, ensuring proactive replacement schedules and preventing system failures. The consensus expectation is that AI will primarily serve as an enabler for enhanced quality control and extended product life optimization, rather than directly influencing the core electrochemical reaction itself.

AI's influence is transforming the production floor by integrating machine learning into quality control systems. Advanced computer vision and data processing algorithms analyze high-throughput manufacturing data (such as electrode coating consistency, separator integrity, and sealing parameters) in real-time. This capability significantly improves yield rates and reduces the variability inherent in traditional battery production, which is crucial given the non-rechargeable nature where failure prevention is paramount. Furthermore, AI models are now being used to design optimal battery management systems for end-devices, even if the battery itself is primary, ensuring the device draws power efficiently over the entire discharge curve, thereby maximizing the total operational life.

Beyond manufacturing, AI contributes significantly to raw material sourcing and supply chain management, particularly important for lithium, thionyl chloride, and manganese compounds. Predictive analytics help forecast supply bottlenecks and price volatility, allowing manufacturers to optimize inventory levels and hedge procurement risks. This robust, data-driven approach enhances the overall security and cost-effectiveness of production. Additionally, AI-enhanced simulations accelerate the research and development cycle for new, higher-energy primary battery chemistries, analyzing vast datasets related to material stability and electrochemical performance under extreme conditions, thus shortening the time-to-market for next-generation products required by military and aerospace clients.

- AI optimizes manufacturing processes, leading to higher production yields and reduced defect rates in cell assembly.

- Machine learning algorithms enhance quality control through real-time analysis of material integrity and sealing processes.

- Predictive analytics models estimate remaining useful life (RUL) for embedded batteries in remote or critical applications.

- AI improves supply chain resilience by forecasting raw material volatility and optimizing inventory management.

- Computational chemistry driven by AI accelerates the research and development of new, high-density primary cell chemistries.

- AI facilitates efficient power consumption management in end-devices, extending the overall operational duration of the primary battery.

DRO & Impact Forces Of Lithium Primary Battery Market

The dynamics of the Lithium Primary Battery Market are shaped by a complex interplay of drivers, restraints, and opportunities, collectively forming the critical impact forces governing investment and strategic direction. Key drivers include the exponential growth of the global IoT ecosystem, necessitating reliable, maintenance-free power sources for billions of sensors and connected devices. Furthermore, the stringent demands of the medical sector, particularly for implantable devices requiring unquestionable power integrity over decades, reinforce the market for high-quality lithium primaries. However, substantial restraints exist, primarily revolving around the environmental challenge of disposal, as primary batteries contain toxic components and are difficult to recycle effectively on a mass scale compared to secondary lithium-ion batteries. Additionally, the inherent safety risks associated with lithium metal, specifically thermal runaway potential if improperly manufactured or abused, imposes strict regulatory hurdles and drives up manufacturing complexity and cost.

Opportunities for market expansion are significant, particularly in the domain of solid-state primary batteries, which promise enhanced safety, higher energy density, and greater operational stability across temperature extremes, positioning them favorably for high-end aerospace and deep-sea monitoring applications. Another major opportunity lies in expanding market penetration within emerging economies undergoing rapid digitalization and implementing widespread smart grid infrastructure, demanding enormous volumes of smart meter batteries. The drive towards miniaturization, creating increasingly small and powerful coin cells and thin-film batteries for wearables and micro-sensors, also presents a lucrative niche for specialized manufacturers capable of precision engineering. The combination of these forces dictates a market direction focused on technological refinement, safety assurance, and sustainable end-of-life management.

Impact forces are centered on the regulatory environment, particularly the upcoming European Union Battery Regulation, which will significantly influence battery labeling, disposal, and mandated recycled content, compelling manufacturers to adapt their entire lifecycle strategy. Technological innovation remains a profound impact force, where breakthroughs in anode and cathode materials could drastically improve capacity or reduce material cost, potentially challenging established chemistries. Economic forces, specifically the volatile cost of raw materials (lithium, copper, cobalt, nickel—though less critical than in secondary batteries, still relevant for component costs), necessitate robust supply chain risk mitigation strategies. Ultimately, the imperative for reliable, long-duration power in mission-critical applications—from military surveillance to remote medical devices—ensures that despite disposal challenges, the market for superior, high-performance primary lithium batteries will continue its upward trajectory, underpinned by continuous safety and density enhancements.

Segmentation Analysis

The Lithium Primary Battery Market is systematically segmented based on chemistry (Type) and end-use application, reflecting the specialized requirements inherent in different sectors. Segmentation by type is crucial as the choice of chemistry dictates performance parameters such as energy density, operating temperature range, nominal voltage, and shelf life, which directly correlate with suitability for specific high-demand applications. The Li-MnO2 segment, known for its cost-effectiveness and relatively safe operation, dominates the volume market, while the high-power, high-density Li-SOCl2 segment commands superior value in industrial and defense niche markets. Understanding these distinct segments allows manufacturers to tailor their product offerings and marketing strategies to match the precise needs of diverse industrial consumers requiring reliability over capacity or capacity over cost.

The Application segmentation highlights the key end-user verticals that are driving demand. Historically, consumer electronics drove early adoption, but modern growth is overwhelmingly concentrated in industrial and medical applications. The industrial segment includes utility metering (smart gas, water, and electricity meters), asset tracking, and wireless sensor networks (WSN) used in environmental monitoring and infrastructure health checks. The medical segment is particularly stringent, demanding batteries with multi-decade reliability for life-sustaining devices such as cardiac monitors and drug delivery systems. The rapid evolution of the IoT necessitates increasingly robust and long-lasting batteries, positioning the Industrial segment as the fastest-growing market area, demanding robust operational characteristics across harsh conditions.

Further granularity in segmentation includes examining factors like size (e.g., coin cells, cylindrical cells) and specific features (e.g., high pulse capability vs. low continuous drain). This detailed analysis reveals emerging trends, such as the increased demand for high-pulse primary batteries capable of delivering short bursts of high current required by cellular communication modules in smart meters or military radios. Manufacturers leverage this segmentation intelligence to focus R&D investments, for instance, targeting high-rate capabilities within the Li-SOCl2 chemistry, or focusing on high-volume, low-cost production optimization for standard-sized Li-MnO2 cells used in pervasive consumer devices and general-purpose IoT sensors. This intricate segmentation confirms the market's maturity and specialization.

- By Type:

- Lithium-Manganese Dioxide (Li-MnO2)

- Lithium-Thionyl Chloride (Li-SOCl2)

- Lithium-Sulfur Dioxide (Li-SO2)

- Others (e.g., Lithium-Poly Carbon Monofluoride (Li-CFx))

- By Application:

- Consumer Electronics

- Industrial (Smart Meters, IIoT Sensors, Remote Monitoring)

- Medical (Implantable Devices, Diagnostic Equipment)

- Military & Aerospace

- Automotive (TPMS, Key Fobs)

- Others (Security Systems, Data Loggers)

- By Form Factor:

- Cylindrical Cells

- Coin Cells (Button Cells)

- Prismatic Cells

Value Chain Analysis For Lithium Primary Battery Market

The value chain for the Lithium Primary Battery Market begins with complex upstream activities, focusing heavily on the extraction and refinement of critical raw materials, primarily lithium compounds, manganese dioxide, and specialty chemicals like thionyl chloride. Procurement stability is essential, as the quality and purity of these materials directly dictate the performance, longevity, and safety of the finished cell. High-grade materials are required, often sourced globally, making manufacturers susceptible to geopolitical and logistical risks. Due to the specialized nature of primary lithium chemistries, stringent quality checks are implemented early in the supply chain. Key suppliers typically include specialized chemical and mining companies that adhere to strict material specification standards necessary for electrochemically stable components.

Midstream activities involve sophisticated manufacturing processes, including electrode preparation, electrolyte formulation, cell assembly (which often occurs in controlled dry rooms to prevent moisture contamination), and meticulous sealing. Given the high toxicity and reactivity of lithium metal and certain electrolytes, manufacturing requires capital-intensive facilities and adherence to strict safety protocols, acting as a high barrier to entry. Quality assurance and rigorous testing, including accelerated aging and abuse tests, are vital before products proceed to the downstream segments. Manufacturers typically focus on optimizing throughput while maintaining extremely high consistency, which is critical for achieving the promised shelf life and reliability required by end-users like the medical or military sectors.

Downstream distribution channels are bifurcated into direct sales and indirect routes. Direct distribution is favored for large industrial, military, and key medical Original Equipment Manufacturers (OEMs) that require customized form factors, guaranteed supply contracts, and detailed technical support. Indirect channels utilize specialized industrial distributors, electronics component distributors, and regional resellers to reach smaller industrial consumers, general IoT integrators, and the consumer retail market. The choice of channel is dictated by the complexity and volume of the order; for instance, high-volume coin cells are efficiently moved through electronics distribution networks, while specialized Li-SOCl2 batteries often require direct engineering consultation between the manufacturer and the end-user. The supply chain emphasizes specialized logistics for hazardous materials handling during transportation and storage, adding another layer of complexity and cost.

Lithium Primary Battery Market Potential Customers

The primary consumers (end-users/buyers) in the Lithium Primary Battery Market are diverse, spanning multiple high-reliability sectors, but they are chiefly distinguished by their absolute need for guaranteed, long-term power without maintenance. Industrial customers, particularly utility companies deploying advanced metering infrastructure (AMI), represent a massive segment. These meters often require battery life exceeding 15 years, making primary lithium cells, especially Li-SOCl2, the only viable option. Other significant industrial buyers include energy sector companies (oil and gas exploration) using downhole logging tools and environmental monitoring systems in remote, harsh conditions where battery replacement is prohibitively expensive or impossible, demanding extreme temperature tolerance and vibration resistance.

The medical technology sector is another crucial customer base, characterized by extremely high entry barriers and uncompromising quality demands. Buyers include manufacturers of implantable cardiac devices (pacemakers, defibrillators), neurostimulators, and sophisticated medical sensors and drug delivery patches. For these applications, battery failure is life-critical, necessitating the highest level of component traceability, manufacturing quality, and multi-decade shelf life certification. The decision-making process for these customers is driven entirely by regulatory compliance, certified reliability, and proven longevity under body temperature conditions, often leading to long-term sole-source contracts with highly reputable battery manufacturers.

Additionally, the military and aerospace sectors are significant buyers, purchasing highly specialized primary lithium batteries for missile systems, tactical communication radios, emergency beacons, and remote surveillance equipment. These customers prioritize performance under extreme environmental stress (high altitude, rapid temperature changes, intense shock) and require batteries with high pulse capability. The procurement process in this sector is heavily influenced by defense standards and national security requirements, favoring domestic or trusted international suppliers. Finally, the broader segment of Internet of Things (IoT) integrators, particularly those designing security systems, smart home peripherals, and asset trackers, represents the high-volume, cost-sensitive component of the customer landscape, generally preferring standardized Li-MnO2 or Li-CFx chemistries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Energizer Holdings, Panasonic Corporation, Saft Groupe S.A., Tadiran Batteries Ltd., Varta AG, FDK Corporation, Maxell Holdings, EVE Energy Co., Ltd., Duracell Inc., Ultralife Corporation, H&B Battery Co., Ltd., Huizhou Power Star Battery, XENO Energy Co., Ltd., Renata SA, Great Power Energy Co., Ltd., Wuhan Fanshine, Hitachi Maxell, Shenzhen Gezond, Guangzhou Maiyi, EaglePicher Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Primary Battery Market Key Technology Landscape

The technological landscape of the Lithium Primary Battery Market is intensely focused on achieving the optimal balance between high energy density, intrinsic safety, and extended shelf life, often measured in decades. While the fundamental chemistries (Li-MnO2, Li-SOCl2) have been established for years, ongoing innovations primarily target incremental but critical improvements in material science and cell engineering. A significant area of focus involves enhancing the purity and microstructure of the lithium metal anode and refining the cathode materials to maximize lithium intercalation and minimize irreversible capacity loss over time. Techniques such as advanced surface coating on active materials and optimization of electrolyte composition, including the use of non-aqueous solvents, are critical for improving performance across extreme temperatures, particularly relevant for military and oil-field applications.

A major technological frontier is the development and commercialization of solid-state primary batteries. These batteries replace the traditional liquid or gel electrolyte with a solid conductive material, such as specific polymers or ceramics. This transition offers profound safety advantages by eliminating the flammable liquid electrolyte, thereby mitigating the risk of thermal runaway. Furthermore, solid-state designs often enable higher volumetric energy density and significantly greater stability, making them ideal candidates for next-generation implantable medical devices and high-precision micro-sensors where space is severely constrained and reliability is paramount. Although still a niche technology due to manufacturing complexity and cost, solid-state primaries represent the long-term technological trajectory for the high-end market segments.

Another crucial technological advancement involves sophisticated cell sealing and venting mechanisms. Given that many primary batteries are pressurized or contain highly reactive materials, the integrity of the cell casing is non-negotiable for long-term reliability. Innovations in laser welding, glass-to-metal sealing, and the integration of highly reliable safety vent structures ensure that the batteries can withstand internal pressure buildup under fault conditions without catastrophic failure. Furthermore, the development of intelligent pulse batteries, which integrate a high-capacity Li-SOCl2 cell with a capacitor or hybrid layer capacitor (HLC), is essential for modern IoT devices that require high current pulses for data transmission, ensuring long operational life for the main battery while meeting peak power demands effectively. The continuous integration of these engineering improvements solidifies the market's technological sophistication.

Regional Highlights

The global Lithium Primary Battery Market exhibits strong regional disparities driven by differential rates of industrialization, technological adoption, regulatory frameworks, and manufacturing capabilities. These regions contribute uniquely to market demand and innovation, necessitating tailored market strategies for global players. The regional analysis below underscores the core drivers and competitive advantages within major geographies.

- Asia Pacific (APAC): APAC is the largest and fastest-growing region in the Lithium Primary Battery Market. This dominance is attributed to several factors: the presence of major electronics manufacturing hubs in China, South Korea, and Japan; vast deployment of smart metering infrastructure across developing economies like India and Southeast Asia; and substantial investment in industrial automation and IoT sensor production. Countries like China not only serve as massive manufacturing centers for battery components and finished cells but also represent a huge captive market for consumer electronics and industrial sensors. The competitive landscape is intense, favoring cost-efficient, high-volume producers, particularly for Li-MnO2 coin cells and small cylindrical formats used widely in consumer goods and low-end industrial sensors.

- North America: North America is characterized by high adoption rates in premium, high-reliability sectors, notably defense, medical devices, and high-end smart grid projects. The region demands specialized chemistries like high-rate Li-SOCl2 and Li-SO2 for military communications, as well as ultra-reliable cells for FDA-regulated implantable devices. Regulatory standards are extremely strict, favoring manufacturers that demonstrate superior quality control and robust safety certifications. Innovation often focuses on achieving greater power density and reliability under extreme environmental conditions, driven by demands from aerospace and deep-sea exploration applications. The market is mature, emphasizing value over volume, with a strong focus on strategic partnerships with OEMs.

- Europe: Europe maintains a strong market position, driven largely by rigorous environmental and energy efficiency targets, leading to widespread rollout of smart electricity and gas meters across the continent. This infrastructure roll-out is a primary demand driver for long-life primary lithium batteries. Furthermore, Europe is a major center for advanced industrial manufacturing (Industry 4.0), fueling demand for IIoT sensors and remote monitoring devices. Upcoming legislative changes, such as the new EU Battery Regulation, are significantly impacting the market by imposing strict rules on sustainability, material sourcing, and end-of-life management, pushing manufacturers toward more environmentally conscious production methods and potentially restricting certain chemistries unless disposal protocols are enhanced.

- Latin America, Middle East, and Africa (LAMEA): LAMEA represents an emerging growth opportunity, albeit from a smaller base. Growth is tied to infrastructure modernization, particularly in the Middle East's energy sector and the burgeoning smart city initiatives in certain Latin American countries. The demand often focuses on batteries resilient to high temperatures, required for remote monitoring in oil and gas fields (MEA) and utility services in high-heat climates. Market penetration is gradual, reliant on government spending on large-scale utility and communication projects, and heavily influenced by price-sensitivity compared to highly regulated markets like North America and Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Primary Battery Market.- Energizer Holdings Inc.

- Panasonic Corporation

- Saft Groupe S.A.

- Tadiran Batteries Ltd.

- Varta AG

- FDK Corporation

- Maxell Holdings, Ltd.

- EVE Energy Co., Ltd.

- Duracell Inc.

- Ultralife Corporation

- H&B Battery Co., Ltd.

- Huizhou Power Star Battery Co., Ltd.

- XENO Energy Co., Ltd.

- Renata SA

- Great Power Energy Co., Ltd.

- Wuhan Fanshine Power Technology Co., Ltd.

- Hitachi Maxell (now Maxell Holdings)

- Shenzhen Gezond Technology Co., Ltd.

- Guangzhou Maiyi Battery Co., Ltd.

- EaglePicher Technologies, LLC

Frequently Asked Questions

Analyze common user questions about the Lithium Primary Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Lithium Primary Battery Market?

The exponential growth and widespread proliferation of the Industrial Internet of Things (IIoT) and smart infrastructure (like smart metering) are the primary market drivers, requiring reliable, maintenance-free power sources with multi-year operational lifespans for remote sensors and connected devices.

How do Lithium-Thionyl Chloride (Li-SOCl2) batteries differ from Lithium-Manganese Dioxide (Li-MnO2) batteries?

Li-SOCl2 batteries offer significantly higher energy density, a wider operating temperature range, and a longer shelf life (up to 20 years), making them ideal for specialized industrial and military applications. Li-MnO2 batteries are lower cost, safer, and dominate the high-volume consumer electronics and general IoT sensor market.

What are the main restraints impacting the future expansion of the Lithium Primary Battery Market?

The primary restraints include the environmental challenges related to the safe disposal and recycling of non-rechargeable cells containing toxic materials. High manufacturing costs and stringent safety regulations regarding lithium metal handling also pose significant commercial hurdles for market participants.

Which geographical region is expected to lead the market in terms of growth and consumption?

The Asia Pacific (APAC) region is projected to lead the market due to its massive electronic manufacturing base, rapid industrialization, extensive deployment of smart city technologies, and high consumer penetration of connected devices.

Is AI being used to enhance the performance or manufacturing of primary lithium batteries?

Yes, AI is critically used to optimize manufacturing quality control through real-time defect detection, enhance supply chain resilience, and accelerate R&D efforts in computational chemistry to design safer and higher-density solid-state primary cell structures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager