Lithium Sulphide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431694 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Lithium Sulphide Market Size

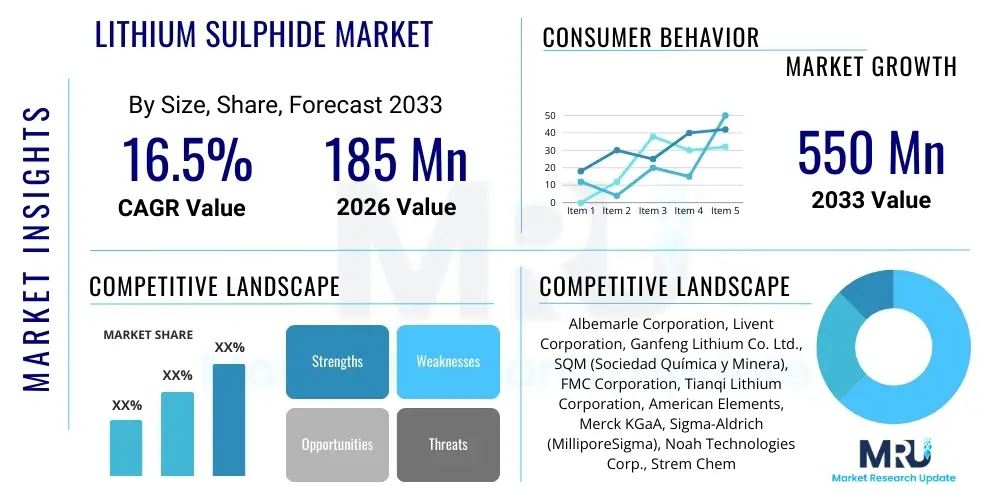

The Lithium Sulphide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at $185 Million in 2026 and is projected to reach $550 Million by the end of the forecast period in 2033.

Lithium Sulphide Market introduction

Lithium Sulphide (Li2S) is a high-purity inorganic chemical compound increasingly recognized as a foundational material for the next generation of energy storage solutions, primarily solid-state batteries (SSBs). It serves as a crucial precursor material, offering a high lithium content and inherent stability necessary for the fabrication of solid electrolytes, such as argyrodites and thiophosphates. Unlike traditional liquid electrolytes used in conventional lithium-ion batteries, solid electrolytes based on Li2S significantly enhance safety, energy density, and cycle life, addressing some of the most critical limitations facing mass Electric Vehicle (EV) adoption and large-scale grid storage deployment. The market's rapid expansion is intrinsically linked to global decarbonization efforts and the massive investments being funneled into advanced battery research and commercialization efforts across Asia and North America. The specialized nature of its synthesis, requiring ultra-high purity to prevent degradation within the battery cell, results in a highly complex and specialized supply chain.

The primary applications driving demand for Lithium Sulphide include its use in manufacturing advanced solid-state electrolytes, specifically those utilized in high-performance power cells intended for the automotive sector. When coupled with high-capacity electrode materials, Li2S enables the creation of batteries that can operate efficiently across a wider temperature range and offer superior intrinsic safety due to the elimination of flammable organic solvents present in liquid lithium-ion counterparts. A secondary, yet significant, application area involves advanced Lithium-Sulfur (Li-S) batteries, where Li2S serves as a cathode material precursor or additive to mitigate the notorious polysulfide shuttle effect, thereby improving overall performance metrics and extending the cycle life of Li-S technology, which inherently possesses very high theoretical energy density.

The fundamental driving factors propelling the Lithium Sulphide market include aggressive research and development spending by major automotive Original Equipment Manufacturers (OEMs) rapidly shifting their long-term production strategies towards SSBs, favorable governmental regulations globally promoting zero-emission vehicles (ZEVs), and substantial venture capital funding directed toward solid-state battery startups. The technological imperative for faster charging times, extended driving ranges in EVs, and safer operation necessitates a material solution that moves beyond current battery limitations, positioning high-purity Li2S compounds at the forefront of contemporary material innovation. Securing supply chain integrity, optimizing processes for achieving consistent material purity, and successfully scaling production capacity from early-stage laboratory setups to multi-ton industrial volumes are the immediate operational challenges that the industry is collectively addressing to meet the anticipated exponential growth in demand projected throughout the forecast period from 2026 to 2033.

Lithium Sulphide Market Executive Summary

The Lithium Sulphide market is characterized by intense technological convergence, driven primarily by the global race to commercialize solid-state battery technology. Current business trends indicate a strong move toward strategic partnerships and joint ventures between specialized chemical manufacturers, often based in APAC, and major automotive and electronics firms in North America and Europe. This collaboration aims to localize the supply chain and expedite the transition of Li2S synthesis from pilot-scale to mass production, reflecting the compound's critical status as a bottleneck material. Regional trends show Asia Pacific, led by South Korea, China, and Japan, maintaining dominance in both manufacturing capacity and technological patents related to solid electrolyte synthesis, capitalizing on established expertise in advanced chemical processing and battery fabrication. North America and Europe are rapidly increasing their investments, focusing on developing domestic supply capabilities to reduce reliance on foreign imports and meet stringent local content requirements for EV subsidies.

Segment trends reveal that the Battery Grade segment, specifically materials exceeding 99.9% purity, commands the highest revenue share and fastest growth rate, directly tied to the exponential increase in pilot and prototype production of SSBs. The Application segment is overwhelmingly dominated by solid-state battery development, overshadowing its use as a chemical reagent or in other specialty chemical applications, although research interest in Lithium-Sulfur technologies provides a robust secondary growth avenue. Geographically, while APAC currently dominates production volume, the fastest growth in consumption is expected in North America and Europe as gigafactories focused on next-generation batteries become operational. The transition from powder form to customized particle shapes and sizes optimized for specific electrolyte compositions represents a major product specialization trend influencing pricing and market differentiation among core competitors.

Overall, the market dynamic is shifting from academic curiosity and niche chemical supply to industrial strategic material sourcing. High entry barriers exist due to the required expertise in handling highly reactive precursors and maintaining ultra-high purity levels in oxygen and moisture-free environments, limiting competition primarily to established specialty chemical giants and well-funded material science startups. Success in the Lithium Sulphide market over the next decade will be dictated by the ability of companies to efficiently scale production volumes while maintaining uncompromising quality standards essential for automotive-grade battery reliability and longevity, thereby stabilizing the supply chain for key solid-state electrolyte materials.

AI Impact Analysis on Lithium Sulphide Market

Common user inquiries concerning AI's role in the Lithium Sulphide market frequently revolve around how artificial intelligence can accelerate material discovery, optimize synthesis processes, and improve quality control essential for high-performance solid-state battery applications. Users are primarily concerned with questions like: "Can AI reduce the cost of high-purity Li2S synthesis?" "How does machine learning predict optimal Li2S particle morphology?" and "Is AI being used to model interface stability in solid-state batteries using Li2S precursors?" This user interest highlights a central theme: the application of AI, particularly machine learning (ML) and deep learning (DL), is viewed as the necessary technological accelerator to overcome the current empirical and time-intensive nature of material science R&D and scale-up, directly impacting the availability and cost-effectiveness of this crucial battery precursor.

The impact of AI is profound in two critical areas: accelerating the materials discovery phase and significantly enhancing manufacturing process optimization. In research, AI models can rapidly screen thousands of potential dopants or composite structures involving Li2S, identifying candidates for solid electrolytes that possess superior ionic conductivity and stability, dramatically cutting down traditional lab testing time from years to months. For manufacturing, AI algorithms analyze vast datasets generated during the synthesis process—monitoring temperature, pressure, reaction time, and impurity levels—to pinpoint optimal operating windows, ensuring batch-to-batch consistency and minimizing waste. This precision is vital, as even trace impurities in Li2S can severely compromise battery performance and safety, making AI-driven predictive maintenance and quality assurance indispensable tools for producers.

Furthermore, AI is instrumental in simulating complex interfacial chemistries within the battery cell. Understanding the degradation mechanisms at the Li metal/solid electrolyte interface, which often involves Li2S derivatives, is key to achieving long cycle life. Machine learning models can predict the long-term stability and degradation pathways under various operational conditions (e.g., fast charging, extreme temperatures), allowing manufacturers to design more robust Li2S-based solid electrolytes. This integration of computational analysis driven by AI ensures that the resulting Lithium Sulphide material meets the rigorous purity, morphology, and stability requirements necessary for reliable automotive-grade solid-state battery commercialization.

- AI models accelerate the identification of novel Li2S-based solid electrolyte compositions, speeding up R&D cycles.

- Machine Learning optimizes complex synthesis parameters (temperature, stoichiometry, environment) to maximize Li2S yield and purity, reducing operational costs.

- Predictive analytics monitors real-time manufacturing data to ensure ultra-high Purity Grade consistency essential for automotive battery performance.

- Computational chemistry using AI simulates long-term electrochemical stability of Li2S derivatives at the electrode interface, improving battery lifespan prediction.

- AI-driven automated quality control systems enhance detection of microscopic impurities or morphological defects in Li2S powders.

- Logistics optimization uses AI to manage the complex and temperature-sensitive supply chain of highly reactive Li2S precursors.

DRO & Impact Forces Of Lithium Sulphide Market

The dynamics of the Lithium Sulphide market are fundamentally shaped by the interplay between the massive potential of solid-state battery technology and the inherent technical difficulties associated with synthesizing and handling ultra-pure materials. The primary driver is the critical need for safer, higher-energy-density batteries, making Li2S, as the key precursor for sulfide-based solid electrolytes, an indispensable material. However, the extreme reactivity of Li2S with moisture and oxygen acts as a major restraint, demanding high capital investment in dry room facilities, specialized handling equipment, and inert atmosphere processing, significantly escalating production costs compared to traditional chemicals. The opportunity lies in developing novel, less sensitive synthesis routes and establishing regionalized supply chains that bypass geopolitical vulnerabilities, particularly in North America and Europe, where aggressive domestic battery production goals are set. The impact forces are currently high, primarily fueled by technological breakthroughs in SSB performance validation and major automotive OEM commitments, which exert immediate pressure on the specialized chemical industry to rapidly increase both capacity and quality standards.

Specific market drivers include unprecedented global investments in gigafactories capable of manufacturing SSBs, robust regulatory support mandating zero-emission vehicles, and intense consumer demand for higher performance characteristics—longer driving range and quicker charging capabilities—which existing lithium-ion technology struggles to meet without compromising safety. Conversely, restraints involve the significant time and financial investment required for intellectual property development in solid electrolyte formulation, the limited availability of highly specialized technical talent capable of managing reactive materials at scale, and the inherent volatility in the pricing and supply of raw lithium feedstock, which impacts the final cost structure of Li2S. Overcoming these restraints requires a concerted effort across the value chain, from mining and refining through to final material processing.

Opportunities are extensive and center on technological differentiation, such as developing surface-modified Lithium Sulphide particles that enhance compatibility with polymer binders in composite electrolytes, or perfecting continuous manufacturing processes (rather than batch processes) to drastically lower unit costs. Furthermore, the expansion into adjacent markets, such as high-purity Li2S application in advanced sensor technology or catalyst development, provides diversification potential beyond the core battery market, though this is currently minor. The net impact force is overwhelmingly positive, projecting strong, sustained growth, but this growth remains highly sensitive to the success of key SSB commercialization timelines. If solid-state battery technology faces unforeseen delays or scalability issues, the forecast growth trajectory for the high-purity segment of the Lithium Sulphide market could be negatively revised, underscoring the market's high dependence on adjacent technological advancements.

Segmentation Analysis

The Lithium Sulphide market segmentation provides a comprehensive view of how the material is classified and utilized across various industrial verticals, primarily based on required purity levels, end application, and the final end-use sector. The fundamental differentiation hinges on purity, which directly correlates with the material's suitability for high-performance electrochemical applications versus basic chemical synthesis. Battery Grade Li2S, requiring minimal impurities, represents the highest value segment and drives technological innovation. Application segmentation focuses heavily on solid-state electrolyte precursors, which dominate current and projected demand due to the material's unique ionic conductivity properties when processed into sulfide ceramics or glasses. Regional segmentation emphasizes the geographical disparity between production capabilities, mainly centered in APAC, and the rapidly growing consumption base across all major economic zones.

Segmentation by Form is also critical, distinguishing between Powder Form, which is standard for initial synthesis and bulk transport, and Customized Morphology, where particles are engineered (e.g., nanosized, specific surface area treated) to optimize electrolyte performance, providing higher margins. The end-user analysis clearly indicates the automotive sector as the overwhelmingly dominant consumer, fueled by the global electrification movement and the push for performance differentiation in electric vehicles. Consumer electronics and stationary energy storage systems, while smaller, represent steady, diversified demand streams, especially as Li2S-based technologies mature and cost points decline, allowing broader adoption outside of the premium EV sector.

Understanding these segments is essential for strategic planning, allowing market participants to target investments effectively—whether focusing on high-volume, cost-efficient Industrial Grade production, or prioritizing R&D and quality control necessary to supply the stringent Battery Grade segment. The rapid technological evolution in solid-state electrolytes ensures that purity and morphology requirements will become increasingly rigorous, necessitating ongoing investment in advanced purification and characterization techniques across the supply chain to maintain competitiveness.

- By Purity Grade:

- Battery Grade (99.9% and above)

- Industrial Grade (Below 99.0%)

- By Application:

- Solid-State Electrolyte Precursor (Dominant Segment)

- Lithium-Sulfur Battery Components

- Chemical Reagents and Catalysts

- By Form:

- Powder

- Customized Morphology (Nanoparticles, Surface-Treated)

- By End-User Industry:

- Automotive (Electric Vehicles)

- Consumer Electronics

- Energy Storage Systems (Grid and Residential)

- Aerospace and Defense

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LAMEA)

- Middle East and Africa (MEA)

Value Chain Analysis For Lithium Sulphide Market

The value chain for the Lithium Sulphide market is characterized by high levels of specialization and risk, reflecting the complex chemical processes involved and the critical purity requirements of the end product. The upstream segment involves the mining and refining of raw lithium sources (spodumene, brine) and sulfur, transforming them into high-purity feedstock chemicals such as lithium hydroxide or carbonate and sulfur compounds. This initial phase is capital-intensive and subject to commodity price volatility and geopolitical influences, primarily centered in Australia, Chile, and China. Specialized chemical processing companies then utilize these feedstocks to synthesize Li2S, often employing proprietary high-temperature or solution-based methods in highly controlled inert environments to ensure the critical Battery Grade purity, representing the highest value-add stage in the entire chain.

The midstream sector involves the formulation and modification of the produced Li2S, where it is often treated, milled, and characterized to achieve the specific particle morphology and size distribution required by solid-state battery developers for optimal performance in solid electrolyte manufacturing. This stage includes specialized material handlers and distributors who manage the complex logistics, requiring inert gas packaging and temperature control due to the material's reactivity. Distribution channels are predominantly direct, involving close, long-term contractual relationships between the few established Li2S producers and major battery manufacturers (Tier 1 suppliers and automotive OEMs). Indirect channels are generally limited to small-scale R&D institutions or niche chemical buyers utilizing Li2S as a standard reagent, relying on specialized chemical catalog distributors.

Downstream, the manufactured Li2S is utilized by battery component producers to synthesize the final solid electrolytes (e.g., LGPS, argyrodites, etc.). These electrolytes are then integrated into battery cells by global cell manufacturers, which subsequently supply the final product to the dominant end-users: automotive companies, major consumer electronics brands, and utility-scale energy storage integrators. The high degree of direct distribution ensures strict quality traceability, which is non-negotiable for automotive applications. The integration of high-purity Li2S is crucial for the successful commercialization of solid-state batteries, making the upstream synthesis companies strategic partners rather than mere suppliers within the global battery ecosystem.

Lithium Sulphide Market Potential Customers

The potential customer base for the Lithium Sulphide market is highly focused and strategic, revolving predominantly around entities heavily invested in the next generation of high-performance energy storage technologies. The primary end-users are major global automotive Original Equipment Manufacturers (OEMs) such as Toyota, Volkswagen, BMW, Ford, and Hyundai, who are either developing SSBs internally or collaborating extensively with battery startups like QuantumScape, Solid Power, and ProLogium. These companies are the ultimate beneficiaries of Li2S-based technology, using the resulting solid-state cells to power their future electric vehicle fleets, where safety, range, and charge speed are paramount market differentiators. Their purchasing criteria are extremely strict, demanding not just high purity but also reliable high-volume supply guarantees that span several years.

Beyond the direct automotive sector, another critical customer segment includes Tier 1 battery manufacturers, such as Samsung SDI, LG Energy Solution, and Panasonic, who are positioning themselves to transition their production lines to accommodate solid-state technology. These companies act as significant bulk purchasers of high-purity Li2S and solid electrolyte precursors, driving demand for industrial-scale supply. Additionally, grid-scale energy storage providers and utilities represent a burgeoning customer segment, seeking the enhanced safety and long-term stability offered by SSBs, especially for deployment in sensitive urban environments or remote infrastructure projects, although their volume requirements are currently lower than the automotive segment.

Finally, specialized chemical and material science research institutions, universities, and small-to-medium enterprises (SMEs) focused on advanced battery R&D constitute the third tier of customers. While these entities purchase smaller quantities, they often drive demand for niche, ultra-high-purity, or customized Li2S forms for experimentation and developing next-generation applications, including innovative Lithium-Sulfur configurations. For suppliers, serving these R&D customers allows early access to emerging technological trends and potential long-term commercial partners, sustaining the ecosystem necessary for material refinement and application expansion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Million |

| Market Forecast in 2033 | $550 Million |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albemarle Corporation, Livent Corporation, Ganfeng Lithium Co. Ltd., SQM (Sociedad Química y Minera), FMC Corporation, Tianqi Lithium Corporation, American Elements, Merck KGaA, Sigma-Aldrich (MilliporeSigma), Noah Technologies Corp., Strem Chemicals Inc., Alfa Aesar (Thermo Fisher Scientific), Gelest Inc., EMD Performance Materials, Solvay S.A., BASF SE, POSCO Holdings, LG Chem Ltd., Samsung SDI Co., Ltd., Sumitomo Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Sulphide Market Key Technology Landscape

The technology landscape for the Lithium Sulphide market is intensely focused on achieving higher purity and better control over particle morphology, both critical factors for manufacturing stable and highly conductive sulfide-based solid electrolytes. Current synthesis methods predominantly fall into two categories: high-temperature solid-state reactions utilizing elemental lithium and sulfur or lithium precursors, and solution-based synthesis, often involving organic solvents or liquid ammonia, followed by complex precipitation and drying steps. The solid-state method is favored for producing larger volumes, but the resultant material often requires extensive post-processing to remove undesired contaminants and achieve the required fine particle size. Conversely, solution-based routes offer better control over particle size and morphology, often resulting in higher purity, but these methods are generally more expensive and pose significant challenges related to solvent recycling and handling highly reactive intermediates.

A major technological trend involves the transition from batch processing to continuous flow chemistry, particularly in solution-based synthesis. This shift aims to enhance scalability, reduce processing time, and improve batch-to-batch consistency, which is vital for automotive supply chains requiring stringent quality metrics. Furthermore, there is significant R&D dedicated to developing specialized protective coatings for Li2S particles. Since Li2S is highly sensitive to moisture and oxygen, leading to the formation of detrimental lithium hydroxide and polysulfides that decrease electrolyte performance, innovative surface modification techniques (e.g., atomic layer deposition or proprietary coating layers) are being explored to stabilize the material during handling, storage, and eventual integration into the solid electrolyte matrix, thereby extending the shelf life and operational lifespan of the final battery.

The market also relies heavily on advanced analytical technology to ensure material quality. Techniques such as X-ray diffraction (XRD), Scanning Electron Microscopy (SEM), and specialized inert atmosphere thermal analysis are indispensable for characterizing crystal structure, particle size distribution, and impurity levels. Innovations in spectroscopic techniques, particularly in-situ monitoring during synthesis, are helping producers achieve faster feedback loops, enabling real-time process adjustments essential for maintaining ultra-high purity (>99.9%). The convergence of advanced chemical engineering, material science, and data-driven process control defines the competitive edge in the Lithium Sulphide production landscape, demanding continuous investment in both specialized equipment and intellectual property protection related to synthesis protocols.

Regional Highlights

The global Lithium Sulphide market exhibits distinct regional dynamics, driven by localized production capabilities, governmental policies supporting electrification, and the presence of major end-user industries.

- Asia Pacific (APAC): APAC is the global hub for both production and consumption, dominating the market due to established leadership in battery manufacturing (China, South Korea, Japan). China possesses extensive expertise in chemical processing and raw material supply chain management, making it a critical source for precursor materials, although quality control standards for Battery Grade material vary. South Korea and Japan, home to leading battery innovators (LG Chem, Samsung SDI, Panasonic), represent the largest current consumers of high-purity Li2S for advanced solid-state battery development and pilot production, driving stringent quality demands.

- North America: North America is poised for the fastest growth in consumption, fueled by massive domestic investment under initiatives like the Inflation Reduction Act (IRA), which incentivizes local sourcing and production of EV components. The region is rapidly building gigafactories and partnering with material science startups (e.g., Solid Power, QuantumScape) to secure domestic supply of high-purity Li2S, reducing dependence on Asian imports and mitigating supply chain risks. The focus here is on securing high-volume, long-term contracts.

- Europe: Europe represents a highly attractive growth market, characterized by stringent environmental regulations and aggressive targets for EV adoption. Nations like Germany and France are investing heavily in localized battery value chains (European Battery Alliance), pushing R&D into solid-state technology. While European production capacity for high-purity Li2S is currently catching up, the region's strong automotive manufacturing base ensures high anticipated consumption, necessitating strong cross-regional partnerships with specialized chemical suppliers.

- Latin America and Middle East & Africa (LAMEA): These regions currently hold minor market shares in both production and consumption of Li2S. However, Latin America, particularly countries like Chile and Argentina (the Lithium Triangle), plays a crucial upstream role as a source of raw lithium carbonate and hydroxide, indirectly influencing the entire Li2S value chain through commodity pricing and supply stability. Consumption in LAMEA is nascent, primarily driven by small-scale academic research and specialized energy storage projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Sulphide Market.- Albemarle Corporation

- Livent Corporation

- Ganfeng Lithium Co. Ltd.

- SQM (Sociedad Química y Minera)

- FMC Corporation

- Tianqi Lithium Corporation

- American Elements

- Merck KGaA

- Sigma-Aldrich (MilliporeSigma)

- Noah Technologies Corp.

- Strem Chemicals Inc.

- Alfa Aesar (Thermo Fisher Scientific)

- Gelest Inc.

- EMD Performance Materials

- Solvay S.A.

- BASF SE

- POSCO Holdings

- LG Chem Ltd.

- Samsung SDI Co., Ltd.

- Sumitomo Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Lithium Sulphide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving demand for Lithium Sulphide?

The primary application driving demand for Lithium Sulphide is its use as a crucial precursor material for manufacturing sulfide-based solid electrolytes, which are essential components in next-generation solid-state batteries (SSBs) intended for electric vehicles.

Why is high purity Lithium Sulphide critical for battery performance?

Ultra-high purity (Battery Grade, >99.9%) Lithium Sulphide is critical because trace impurities, especially oxygen or moisture residues, significantly degrade the ionic conductivity and electrochemical stability of the final solid electrolyte, leading to premature battery failure and reduced cycle life.

Which geographical region dominates the Lithium Sulphide market production?

The Asia Pacific (APAC) region, particularly China, South Korea, and Japan, dominates the global production and technological development of high-purity Lithium Sulphide due to established chemical manufacturing infrastructure and significant investments in advanced battery technology.

What are the main technical challenges in synthesizing and handling Lithium Sulphide?

The main technical challenges include the highly reactive nature of Lithium Sulphide with moisture and oxygen, necessitating expensive, specialized inert atmosphere (dry room) processing and handling equipment, and the difficulty in achieving consistent ultra-high purity at industrial scale.

How is AI influencing the future production of Li2S?

AI is influencing Li2S production by accelerating material discovery, optimizing complex synthesis parameters through machine learning to ensure high yield and purity consistency, and simulating interfacial stability to improve the reliability of the resulting solid-state battery component.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager