Lithium Tantalate Crystal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432967 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Lithium Tantalate Crystal Market Size

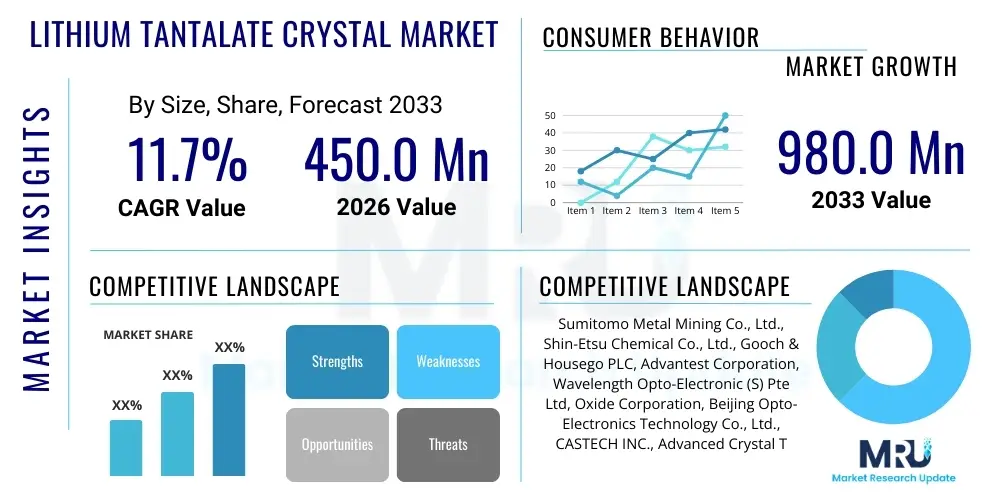

The Lithium Tantalate Crystal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.7% between 2026 and 2033. The market is estimated at USD 450.0 Million in 2026 and is projected to reach USD 980.0 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for high-performance Surface Acoustic Wave (SAW) filters essential for modern 5G telecommunications infrastructure and advanced radio frequency (RF) front-end modules utilized in consumer electronics. The unique piezoelectric and electro-optical properties of Lithium Tantalate (LiTaO3) crystals position them as indispensable materials in critical high-frequency applications where stability and precision are paramount for system reliability and efficiency. Furthermore, the increasing complexity of wireless devices necessitates materials that can handle broader bandwidths and higher data transmission rates, directly benefiting the LiTaO3 market.

Lithium Tantalate Crystal Market introduction

The Lithium Tantalate Crystal Market encompasses the global production, distribution, and utilization of synthetic single crystals of Lithium Tantalate (LiTaO3), a synthetic material known for its exceptional piezoelectric, pyroelectric, and electro-optical characteristics. LiTaO3 crystals are manufactured predominantly using the Czochralski growth method, ensuring high purity, structural perfection, and precise orientation necessary for specialized electronic and optical device fabrication. These crystals exhibit a high Curie temperature and strong electromechanical coupling coefficients, making them superior alternatives to materials like quartz or lithium niobate in specific high-demand applications, particularly within stringent operating environments requiring thermal stability and robust performance under varying conditions. The material's inherent properties enable miniaturization and performance enhancement across numerous electronic platforms.

The major applications of Lithium Tantalate crystals span several high-technology sectors, most notably in telecommunications where they form the active substrate for SAW filters used in smartphones, base stations, and other wireless communication systems operating across various frequency bands including 5G. Additionally, LiTaO3 is critical in integrated photonics, acting as a substrate for waveguides and modulators due to its high electro-optic coefficient, which allows for efficient conversion and manipulation of optical signals. In infrared detection, the strong pyroelectric effect of LiTaO3 is harnessed in uncooled thermal sensors and detectors, providing high sensitivity for applications in industrial monitoring, security, and defense. Its utility extends into high-precision timing devices and acoustic transducers.

Key driving factors propelling the expansion of this market include the relentless global deployment of 5G and subsequent 6G networks, which mandates exponentially greater numbers of high-frequency filters per device and per base station to manage complex spectral allocations. The rapid proliferation of advanced consumer electronics, particularly the continuous upgrades in smartphone technology demanding more robust and thermally stable RF components, further fuels demand. Moreover, advancements in material processing techniques leading to thinner wafers and improved crystal yield contribute to cost-effectiveness and broader applicability across sophisticated medical imaging equipment, industrial control systems, and complex aerospace communication systems, collectively establishing a robust growth trajectory for LiTaO3 derived products.

Lithium Tantalate Crystal Market Executive Summary

The Lithium Tantalate Crystal Market is characterized by intense technological competition and a strong correlation with the cyclical nature of the global telecommunications and consumer electronics industries. Current business trends indicate a significant shift towards high-grade, thin-film Lithium Tantalate wafers optimized for ultra-high-frequency (UHF) and super-high-frequency (SHF) applications, driven by the escalating integration of advanced connectivity features in IoT devices and automotive systems. Companies are heavily investing in proprietary crystal growth techniques to enhance purity and reduce defect density, thereby improving the yield and performance of complex acoustic components such as temperature-compensated SAW (TC-SAW) filters and bulk acoustic wave (BAW) filters utilizing thin films. Strategic partnerships between crystal manufacturers and major RF component integrators are becoming prevalent to secure supply chains and tailor material specifications precisely to next-generation device requirements, ensuring material availability for mass production phases.

Regionally, Asia Pacific (APAC) stands as the undisputed epicenter of both demand and production, primarily due to the concentration of major consumer electronics manufacturers, telecommunication equipment providers, and advanced crystal growth facilities located in countries such as Japan, China, South Korea, and Taiwan. This region not only consumes the majority of LiTaO3 wafers for consumer devices but also dominates the supply chain for precursor materials and post-processing services. North America and Europe demonstrate robust growth, particularly driven by investments in high-end industrial, defense, and specialized aerospace applications that require stringent material specifications and assured supply security, alongside burgeoning research into photonics and quantum technologies utilizing LiTaO3 waveguides. Regulatory compliance related to specialized defense applications also dictates certain manufacturing requirements in these Western markets, focusing on traceability and certified quality.

Segmentation trends highlight the increasing dominance of the Surface Acoustic Wave (SAW) filter segment, which accounts for the largest market share by application, fundamentally underpinning modern wireless communication. Within this segment, the transition from traditional SAW to high-performance TC-SAW structures utilizing specific cuts of LiTaO3 to mitigate temperature drift is a key growth area. Furthermore, the Optical Grade segment, while smaller in volume, exhibits higher value growth driven by the demand for integrated electro-optic modulators used in high-speed fiber optic networks and complex laser systems. The shift towards 6-inch wafers from traditional 4-inch wafers is also a notable segment trend, allowing for increased throughput and economies of scale in high-volume production lines catering to Tier 1 component suppliers, thus influencing pricing dynamics and competitive strategies across the market.

AI Impact Analysis on Lithium Tantalate Crystal Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Lithium Tantalate Crystal Market primarily revolve around optimizing manufacturing efficiency, improving material quality prediction, and enabling new applications in advanced computing infrastructure. Key themes frequently addressed include whether AI can lower the notoriously high costs associated with Czochralski crystal growth by minimizing defects; how machine learning can accelerate the design of new LiTaO3-based devices, particularly complex RF filters; and the potential role of LiTaO3 components in future AI-driven hardware, such as integrated photonics for high-speed AI data centers or advanced sensors for autonomous systems. Users are keenly interested in the potential for AI-powered simulation tools to predict optimum growth parameters, thereby enhancing yield, throughput, and consistency, which are critical metrics in the fiercely competitive semiconductor supply chain. This reflects an expectation that AI will transition LiTaO3 production from an experience-based art to a data-driven, highly controlled industrial process.

- AI-driven optimization of crystal growth: Machine learning algorithms analyze real-time temperature, flow, and rotation data in Czochralski furnaces to predict and adjust parameters, minimizing defect formation and maximizing crystal yield and purity.

- Accelerated device design and simulation: AI tools enable rapid virtual prototyping and performance simulation of complex SAW and TC-SAW filter designs based on LiTaO3 substrates, drastically reducing physical iteration cycles.

- Enhanced quality control and defect detection: Computer vision and deep learning models are deployed for automated, high-throughput inspection of LiTaO3 wafers, identifying sub-micron defects far faster and more reliably than manual or standard optical methods.

- Market forecasting and supply chain efficiency: Predictive analytics driven by AI helps manufacturers anticipate fluctuating demand in the volatile consumer electronics sector, optimizing inventory levels and strategic procurement of raw materials (tantalum and lithium compounds).

- Enabling AI infrastructure hardware: High-speed LiTaO3 electro-optic modulators are crucial components in photonics integrated circuits (PICs) used within advanced AI data centers for ultra-low latency, high-bandwidth signal processing.

- Development of smart sensors: AI integration facilitates the creation of smarter, more sensitive LiTaO3-based pyroelectric detectors used in autonomous vehicles and industrial IoT, where data processing occurs closer to the sensor element.

DRO & Impact Forces Of Lithium Tantalate Crystal Market

The market for Lithium Tantalate Crystals is shaped by a powerful interplay of technological drivers, structural restraints, and emerging opportunities, collectively defining the impact forces on market trajectory over the forecast period. The primary driver is the accelerating global transition to 5G and future 6G communication standards, which fundamentally requires the high thermal stability and superior electromechanical coupling offered by LiTaO3 for high-performance radio frequency filtering. Concurrent growth in complex consumer electronics, including sophisticated filtering architectures in smartphones, further solidifies this demand. However, the market faces significant structural restraints, notably the inherently high capital investment and technical complexity associated with single-crystal growth processes, leading to high production costs and sensitivity to supply chain disruptions for high-purity tantalum oxide, a critical precursor material. These counteracting forces necessitate continuous innovation in manufacturing yield and material substitution research.

Opportunity abounds in several rapidly evolving high-technology fields. The burgeoning integrated photonics sector presents a lucrative avenue, where LiTaO3 thin film technology is poised to replace traditional silicon photonics in certain high-speed modulation applications due to superior stability and electro-optic performance, particularly relevant for quantum computing and ultra-fast optical networking. Furthermore, the application of LiTaO3 in high-sensitivity pyroelectric detectors for uncooled infrared imaging, crucial for automotive night vision systems and industrial thermal monitoring, represents a significant growth vector. Exploiting these opportunities requires substantial R&D expenditure focused on wafer thinning, bonding techniques, and achieving large-diameter crystal growth standards (e.g., 8-inch wafers) to gain economies of scale necessary for commercial viability in competitive end-markets.

The primary impact forces acting on the market are centered around technological disruption and geopolitical stability. Technologically, the evolution of competing filter technologies, such as advanced BAW or Film Bulk Acoustic Resonator (FBAR) filters utilizing alternative materials, poses a continuous threat of substitution, pressuring LiTaO3 manufacturers to maintain a performance and cost advantage in the high-frequency domain. Geopolitically, the stability of the tantalum supply chain, which is often concentrated in specific regions, introduces significant risk related to sourcing and pricing volatility, requiring strategic inventory management and diversification efforts by key crystal growers. The confluence of these forces dictates a market environment where innovation in material purity and processing efficiency, rather than just raw volume production, determines competitive success and long-term market leadership.

Segmentation Analysis

The Lithium Tantalate Crystal Market is comprehensively segmented based on its structural form (Grade), its functional use in devices (Application), and the ultimate purchasing industry (End-Use Industry). This segmentation is crucial for understanding specific growth pockets, demand elasticity, and technological requirements across diverse industrial landscapes. The Electronic Grade, characterized by stringent surface flatness and structural perfection, dominates the volume segment, primarily driven by mass applications in telecommunications requiring high-volume wafer supply for SAW filter manufacturing. Conversely, the Optical Grade segment, demanding exceptionally low defects and high homogeneity, represents a higher-value, lower-volume segment critical for advanced laser systems and sophisticated modulators used in research and high-speed communication infrastructure. Analyzing these segments helps in resource allocation, investment prioritization, and developing tailored marketing strategies targeting specific industrial needs, recognizing the distinct quality standards for acoustic vs. optical functionalities.

- By Grade:

- Electronic Grade

- Optical Grade

- By Application:

- Surface Acoustic Wave (SAW) Filters

- Standard SAW Filters

- Temperature Compensated SAW (TC-SAW) Filters

- Piezoelectric Devices (Resonators, Transducers)

- Electro-Optical Devices (Waveguides, Modulators)

- Pyroelectric Sensors (Infrared Detectors)

- Other Specialized Applications

- Surface Acoustic Wave (SAW) Filters

- By End-Use Industry:

- Telecommunications (5G Infrastructure, Mobile Devices)

- Consumer Electronics (Smartphones, Tablets)

- Automotive (ADAS, Sensors, Connectivity)

- Industrial (Thermal Imaging, Process Control)

- Defense and Aerospace (Radar, Specialized Communications)

- Healthcare (Medical Imaging, Diagnostic Equipment)

Value Chain Analysis For Lithium Tantalate Crystal Market

The value chain for the Lithium Tantalate Crystal Market is highly specialized and spans from the extraction and processing of raw materials to the final integration of components into complex electronic and optical systems. The upstream segment involves the mining and purification of precursor materials, primarily tantalum (in the form of Tantalum Oxide, Ta2O5) and high-purity lithium carbonate/oxide (Li2CO3/Li2O). Tantalum sourcing presents a critical bottleneck due to its concentration in specific geographical locations and the stringent purity requirements needed for single-crystal growth, where trace impurities can severely compromise device performance. Upstream activities require high capital expenditure in chemical processing and purification facilities, establishing the initial cost structure and quality benchmark for the entire supply chain. Stability and ethical sourcing of tantalum are increasingly crucial concerns for downstream players, driving due diligence protocols.

The core manufacturing stage, centered on crystal growth and wafer processing, represents the highest value-addition point. This stage involves the complex Czochralski method to grow large, defect-free single crystals, followed by precision slicing, lapping, polishing, and orientation-specific wafer preparation. Major crystal growers, typically highly specialized companies such as Sumitomo or Shin-Etsu, dominate this middle segment, utilizing proprietary technology and decades of expertise to achieve the necessary crystalline quality (Electronic Grade or Optical Grade). Distribution channels for these wafers are generally characterized by direct sales and highly managed relationships with Tier 1 RF component manufacturers (e.g., Qorvo, Broadcom) or specialized electro-optic device fabricators. These direct channels facilitate technical collaboration essential for customizing wafer specifications to meet unique device architecture needs.

The downstream segment encompasses the manufacturing of final devices, where LiTaO3 wafers are patterned, metallized, and packaged into SAW filters, optical modulators, or pyroelectric detectors. This downstream processing is dominated by large semiconductor and component firms, primarily in Asia. The distinction between direct and indirect distribution is defined by the end-user: direct sales occur between crystal growers and component manufacturers, while indirect sales involve distributors supplying smaller fabrication houses or research institutions. The final products (e.g., smartphones, 5G base stations) constitute the furthest downstream market, where the performance advantage conferred by the LiTaO3 component translates into market competitiveness. Efficiency and yield improvements in the midstream crystal growth process directly impact the profitability and scalability of the entire downstream device market, creating a strong interdependence across the value chain segments.

Lithium Tantalate Crystal Market Potential Customers

The primary consumers and buyers of Lithium Tantalate Crystal wafers are large-scale component manufacturers specializing in high-frequency radio frequency (RF) devices and integrated optical systems. The Telecommunications sector, particularly companies involved in 5G and wireless infrastructure development, represents the largest customer base, purchasing LiTaO3 wafers for their unparalleled performance in Surface Acoustic Wave (SAW) and Temperature Compensated SAW (TC-SAW) filters essential for frequency selectivity and signal integrity in mobile devices and network equipment. These customers require high volumes of Electronic Grade wafers with exacting specifications regarding orientation (e.g., 36° Y-cut or 42° Y-cut) and thermal stability, often necessitating long-term supply contracts and joint development agreements with crystal suppliers to ensure material availability and quality consistency during rapid product cycles.

Another significant customer segment is the Consumer Electronics industry, dominated by global smartphone and tablet manufacturers, which indirectly drive demand through their Tier 1 component suppliers. As mobile devices integrate more frequency bands and advanced features like high-resolution cameras and low-power sensors, the need for miniature, high-performance filters and pyroelectric sensors based on LiTaO3 substrates escalates. These customers prioritize cost-effective high-volume production and quick response times from the supply chain. Furthermore, the Automotive sector is emerging as a critical growth customer, specifically for advanced driver-assistance systems (ADAS), in-vehicle connectivity modules, and integrated thermal detection systems, requiring LiTaO3-based components that meet stringent durability and reliability standards typical of automotive grade certifications.

Specialized industrial and defense contractors form the third major customer group, focusing heavily on Optical Grade LiTaO3 wafers and components. Customers in these sectors utilize the material’s electro-optic and pyroelectric properties for applications such as high-power laser Q-switches, complex guided-wave modulators for defense communication systems, and high-precision uncooled thermal imaging cameras used in surveillance and industrial monitoring. These end-users demand ultra-high material purity, low light scattering, and customized geometric specifications, often engaging in highly confidential supply arrangements due to the strategic nature of the technology involved. The demand characteristics here emphasize performance, longevity, and customization over pure volume, supporting a premium pricing structure for the specialized optical variants of Lithium Tantalate crystals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.0 Million |

| Market Forecast in 2033 | USD 980.0 Million |

| Growth Rate | 11.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Metal Mining Co., Ltd., Shin-Etsu Chemical Co., Ltd., Gooch & Housego PLC, Advantest Corporation, Wavelength Opto-Electronic (S) Pte Ltd, Oxide Corporation, Beijing Opto-Electronics Technology Co., Ltd., CASTECH INC., Advanced Crystal Technology Inc., Crystech Inc., Schott AG, Fujian Castech Crystals Inc., RIKEN CRYSTAL, Coherent Corp., Photonic Solutions PLC, Roditi International, Korth Kristalle GmbH, Alkor Technologies, Hellma GmbH & Co. KG, Mitsui Kinzoku. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Tantalate Crystal Market Key Technology Landscape

The technological landscape of the Lithium Tantalate Crystal Market is fundamentally defined by the highly sophisticated methods required for single-crystal growth and subsequent thin-film processing. The predominant technology remains the Czochralski (CZ) method, utilized for growing large-diameter, high-purity LiTaO3 boules. Continuous technological advancements focus on refining the CZ process to minimize thermal gradients, stabilize the melt interface, and achieve higher boule homogeneity, which directly impacts the yield of usable Electronic Grade wafers. Critical innovations include advanced thermal shielding designs and real-time process monitoring systems, often incorporating AI and machine learning to predict and correct growth irregularities, thereby reducing material defects that degrade high-frequency device performance and increasing the achievable diameter to 6-inch or potentially 8-inch wafers for economies of scale.

Beyond bulk crystal growth, a significant technological frontier involves the development of thin-film LiTaO3 on insulator (LTOI) technology. This utilizes techniques like crystal ion slicing (CIS) or smart-cut technologies to transfer extremely thin (sub-micron) layers of single-crystal LiTaO3 onto a passive substrate, such as silicon or silica. LTOI technology is revolutionizing the electro-optics segment, allowing for the creation of ultra-compact, highly efficient integrated photonic circuits, including high-speed modulators and frequency converters with superior performance metrics compared to traditional bulk LiTaO3 devices. The thin film architecture significantly enhances light confinement and manipulation, leading to lower insertion loss and higher power efficiency, which is critical for future applications in quantum and high-performance classical computing.

Furthermore, the material science of Surface Acoustic Wave (SAW) filter fabrication relies heavily on advanced photolithography, etching, and metallization techniques optimized for LiTaO3 substrates. The market is seeing a critical technological shift towards temperature-compensated structures (TC-SAW), which employ specialized passivation layers and bonding techniques to stabilize the filter performance against temperature fluctuations prevalent in mobile devices. Innovations in these backend processes, particularly in achieving high precision in electrode patterning and managing internal stresses during packaging, ensure that LiTaO3 continues to hold a competitive edge in the crowded RF filter market, especially as communication frequencies climb higher towards the demanding bands utilized by 5G ultra-wideband services. Ongoing research into alternative doping and crystal cuts aims to tailor piezoelectric properties for even greater efficiency and bandwidth.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC constitutes the largest market share globally for Lithium Tantalate Crystals, driven by massive domestic production capabilities in Japan (led by key players like Sumitomo and Shin-Etsu) and the unprecedented consumption from the world's leading consumer electronics and telecommunications manufacturing hubs in China, South Korea, and Taiwan. The region benefits from a well-established, integrated semiconductor supply chain, robust government support for high-tech manufacturing, and continuous investment in 5G infrastructure deployment, ensuring persistent, high-volume demand for Electronic Grade LiTaO3 wafers, particularly for mobile RF front ends.

- North American Growth in Specialized Applications: North America demonstrates strong growth momentum, primarily concentrated in high-value, low-volume segments such as defense, aerospace, advanced medical imaging, and burgeoning quantum technology research. The presence of major defense contractors and R&D centers drives demand for highly precise Optical Grade LiTaO3 components, including integrated modulators and high-performance acoustic sensors. Investments here are focused on securing supply chains for critical national infrastructure and leading innovation in thin-film LiTaO3 on silicon platforms for next-generation computing hardware.

- European Focus on Automotive and Industrial Sensors: Europe represents a mature market with increasing focus on industrial and automotive applications. The stringent European automotive safety standards and the push for industrial automation necessitate high-reliability, thermally stable components. Demand for LiTaO3 is strong in high-sensitivity pyroelectric detectors for thermal imaging used in smart buildings, industrial monitoring, and premium vehicle ADAS systems. Research institutions in Germany and the UK are also prominent in developing LiTaO3 components for high-speed fiber-optic communication networks.

- Emerging Opportunities in Latin America and MEA: While currently smaller in market volume, Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions exhibiting potential growth tied directly to expanding cellular network infrastructure, particularly the rollout of 4G and 5G networks in urban centers. As mobile penetration increases and local governments invest in modernizing telecommunications infrastructure, the demand for RF filtering components, sourced internationally from APAC manufacturers, will inevitably increase, thereby stimulating indirect demand for LiTaO3 precursors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Tantalate Crystal Market.- Sumitomo Metal Mining Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Gooch & Housego PLC

- Advantest Corporation

- Wavelength Opto-Electronic (S) Pte Ltd

- Oxide Corporation

- Beijing Opto-Electronics Technology Co., Ltd.

- CASTECH INC.

- Advanced Crystal Technology Inc.

- Crystech Inc.

- Schott AG

- Fujian Castech Crystals Inc.

- RIKEN CRYSTAL

- Coherent Corp.

- Photonic Solutions PLC

- Roditi International

- Korth Kristalle GmbH

- Alkor Technologies

- Hellma GmbH & Co. KG

- Mitsui Kinzoku

Frequently Asked Questions

Analyze common user questions about the Lithium Tantalate Crystal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Lithium Tantalate crystals in modern technology?

The primary applications are in Surface Acoustic Wave (SAW) filters, essential for 5G and high-frequency wireless communication systems; electro-optical modulators for high-speed fiber optics and photonics integration; and high-sensitivity pyroelectric sensors for uncooled infrared detection in industrial and defense systems.

How does 5G technology specifically influence the demand for LiTaO3?

5G requires robust, thermally stable RF filters capable of handling complex frequency band combinations. Lithium Tantalate’s high electromechanical coupling and stability make it the preferred substrate for high-performance TC-SAW filters, dramatically increasing the number of LiTaO3 components required per device and base station.

What major technological challenges restrict the scalability of the Lithium Tantalate Crystal market?

The main technological challenges include the high complexity and capital costs associated with the Czochralski crystal growth method, the difficulty in consistently achieving large-diameter (8-inch) wafers without defects, and volatility in the supply chain of high-purity Tantalum Oxide precursor materials.

How does the Electronic Grade differ from the Optical Grade of Lithium Tantalate?

Electronic Grade LiTaO3 prioritizes consistent piezoelectric and acoustic properties, mainly used for SAW filters, focusing on high volume production with strict orientation control. Optical Grade demands superior purity, extremely low defect density, and high homogeneity, necessary for electro-optic devices requiring precise light manipulation.

Which geographical region dominates both the production and consumption of Lithium Tantalate crystals?

The Asia Pacific (APAC) region dominates both production, led by advanced manufacturers in Japan, and consumption, driven by the massive concentration of consumer electronics and telecommunications equipment manufacturing industries across China, South Korea, and Taiwan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager