Lithium Thionyl Chloride Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437356 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Lithium Thionyl Chloride Battery Market Size

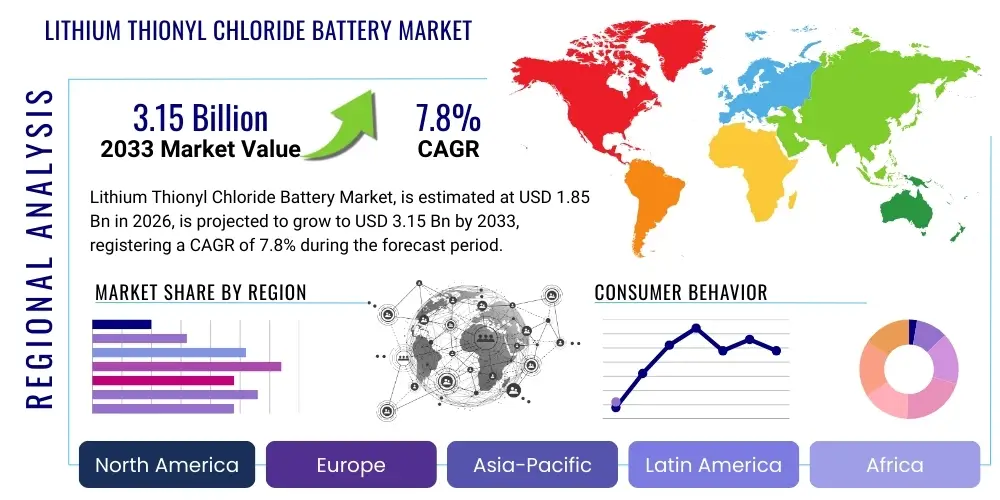

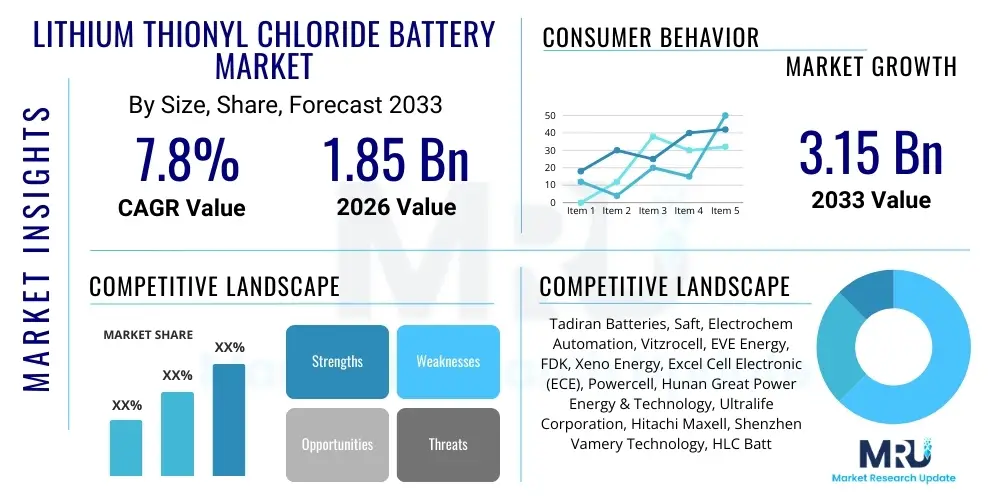

The Lithium Thionyl Chloride Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.15 Billion by the end of the forecast period in 2033.

Lithium Thionyl Chloride Battery Market introduction

The Lithium Thionyl Chloride (Li-SOCl2) battery market encompasses the manufacturing and distribution of non-rechargeable, high-energy-density power sources known for their exceptionally long shelf life and reliable performance under extreme conditions, including wide temperature ranges and high shock/vibration environments. These primary batteries utilize lithium metal as the anode and liquid thionyl chloride as the cathode and electrolyte solvent, providing an unparalleled combination of voltage stability and volumetric energy density compared to other primary lithium chemistries. Key advantages driving their demand include their high cell voltage (typically 3.6V), low self-discharge rate crucial for long-term deployment, and robust construction necessary for critical applications in industrial monitoring, military electronics, and remote telemetry systems. The unique electrochemical properties, specifically the formation of a stable passivation layer on the lithium anode, enable storage lives often exceeding 10 years, making them the preferred choice for 'set-and-forget' devices requiring minimal maintenance and assured operational readiness over extended periods.

Major applications of Li-SOCl2 batteries span across utility metering (smart gas, water, and electric meters), where longevity is paramount; medical devices such as implantable pacemakers and external monitors, demanding high reliability and safety; industrial automation sensors, often deployed in hazardous or inaccessible locations; and specialized military and aerospace equipment, which requires consistent power output across extreme climatic variations. Furthermore, the oil and gas industry utilizes these batteries heavily in downhole logging tools and seismic equipment due to their ability to function effectively at high temperatures and pressures. The product's inherent safety features, when manufactured to strict standards, along with advancements in spirally wound and bobbin constructions to optimize current delivery and energy storage, respectively, continue to solidify its irreplaceable position in niche markets where performance cannot be compromised by size or environmental constraints.

Driving factors for sustained market growth include the global expansion of IoT infrastructure, necessitating reliable long-term power for wireless sensors; increasing adoption of smart utility grids (Smart Grids) in both developed and developing economies; and continuous modernization of defense technologies, requiring compact, high-power-density sources for portable communication and targeting systems. The technological evolution in maximizing discharge efficiency and mitigating the voltage delay phenomenon (associated with the initial breakdown of the passivation layer) through sophisticated cell design and chemical additives further enhances their suitability for high-pulse applications. However, regulatory landscapes surrounding the transport and disposal of primary lithium batteries, coupled with pricing pressures from competing chemistries in less demanding applications, require continuous innovation and optimization within the manufacturing supply chain to maintain competitive advantage.

Lithium Thionyl Chloride Battery Market Executive Summary

The Lithium Thionyl Chloride Battery Market is characterized by robust growth, primarily propelled by burgeoning demand from the Internet of Things (IoT) ecosystem and critical infrastructure monitoring systems requiring extended operational lifespan and zero maintenance. Business trends indicate a strong emphasis on developing high-rate discharge variants (spiral construction) to cater to applications demanding immediate high current pulses, such as automated meter reading (AMR) modules and asset tracking devices, while maintaining the traditional bobbin type dominance in low-current, high-capacity utility metering. Key stakeholders are investing heavily in improving manufacturing processes to enhance safety profiles, specifically focusing on advanced hermetic sealing techniques (glass-to-metal seals) and incorporating non-pressurized cell designs to address historical safety concerns associated with certain thermal or mechanical abuses, thus appealing to risk-averse end-users in medical and defense sectors. The market structure remains moderately concentrated, with leading global manufacturers competing primarily on quality, certification standards, and supply chain reliability, particularly concerning the sourcing and management of lithium and thionyl chloride.

Regional trends reveal that North America and Europe currently hold the largest market shares due to established smart grid infrastructure, stringent regulatory requirements favoring highly reliable components, and significant defense spending incorporating advanced telemetry and communication systems. The Asia Pacific (APAC) region, however, is projected to exhibit the highest CAGR, driven by massive urbanization projects, rapid deployment of wireless sensor networks (WSNs) for industrial monitoring, and government initiatives promoting smart city development, particularly in countries like China, India, and South Korea, where the uptake of advanced utility metering solutions is escalating. Furthermore, the specialized industrial sectors in the Middle East, particularly oil and gas exploration, provide a consistent, high-value demand base for high-temperature Li-SOCl2 variants used in downhole applications. Manufacturers are strategically expanding their distribution networks and local production capabilities within APAC to capitalize on localized regulatory support and reduce logistical complexities associated with hazardous materials transport.

Segmentation trends highlight the bobbin construction type retaining its volumetric dominance owing to its superior energy density and long service life, essential for the dominant utility metering sector, which values capacity over instantaneous power. Concurrently, the spiral wound segment is experiencing accelerated growth as IoT and asset tracking applications proliferate, requiring greater power output capabilities for periodic data transmission bursts. Application-wise, utility metering remains the foundational segment, but significant expansion is noted in the medical and defense segments, driven by advancements in miniaturization and the necessity for batteries that can guarantee operational integrity over implantable device lifetimes or in demanding tactical environments. This dual-track segmentation growth—stable demand from traditional high-capacity sectors and dynamic growth from high-power specialized niches—necessitates manufacturers maintain diverse product portfolios capable of meeting varying power delivery profiles and thermal specifications, ensuring market resilience across different industrial cycles and technological maturity levels.

AI Impact Analysis on Lithium Thionyl Chloride Battery Market

Analysis of common user questions regarding AI's impact on the Li-SOCl2 market reveals dominant themes centered on predictive maintenance optimization, enhanced quality control, and potential applications in smart battery management systems (BMS) for hybrid primary/secondary power systems. Users frequently inquire about how AI can predict the end-of-life (EOL) with greater accuracy, especially given the complex discharge characteristics and passivation layer dynamics unique to Li-SOCl2 chemistry, thereby maximizing operational lifespan in critical, remote sensors. Another major concern relates to using machine learning (ML) algorithms to detect and classify manufacturing defects in real-time during cell assembly, specifically focusing on micro-leaks or sealing inconsistencies that compromise the cell's 10-20 year shelf life, a crucial factor in high-reliability markets. Furthermore, interest exists in leveraging AI to optimize the initial activation and voltage delay mitigation process for bobbin cells, ensuring rapid deployment and stable initial performance without sacrificing long-term capacity, suggesting a need for AI-driven solutions to manage the trade-offs inherent in this chemistry.

The application of Artificial Intelligence within the Lithium Thionyl Chloride battery domain is primarily focused on enhancing manufacturing precision and optimizing deployment reliability across massive sensor networks. By utilizing deep learning models on historical manufacturing data, including electrolyte composition variability, electrode loading consistency, and sealing integrity measurements, manufacturers can achieve tighter tolerances and significantly reduce variance in cell performance and longevity. This level of predictive quality control is particularly valuable for Li-SOCl2 batteries, where catastrophic failure or premature capacity fade is highly detrimental in inaccessible or mission-critical applications. Furthermore, AI-driven simulations allow for rapid prototyping and optimization of cell designs tailored for specific environmental stresses (e.g., high heat in downhole applications or extreme cold in arctic sensors), accelerating the development cycle for customized, high-reliability products.

Beyond manufacturing, AI significantly contributes to the operational efficiency of end-user applications, especially within large-scale IoT deployments. Sophisticated AI algorithms integrated into central monitoring systems analyze the nuanced discharge curves and voltage profiles transmitted by remote Li-SOCl2 powered sensors. These algorithms can differentiate between normal capacity depletion and anomalies caused by environmental stress or unexpected load profiles, providing highly accurate remaining useful life (RUL) estimates. This predictive capability transforms scheduled maintenance into condition-based maintenance, minimizing unnecessary replacements and ensuring that critical sensor networks, such as those used in infrastructure monitoring or defense surveillance, maintain maximum uptime. Although Li-SOCl2 batteries are primary (non-rechargeable), AI's role in optimizing their performance centers on maximizing the life of the installed asset through superior diagnostics and resource management across vast dispersed networks.

- AI optimizes manufacturing processes by identifying minute assembly defects, leading to improved consistency and extended 10+ year shelf life.

- Machine learning models accurately predict the Remaining Useful Life (RUL) of deployed Li-SOCl2 cells based on real-time voltage and temperature data, crucial for critical infrastructure monitoring.

- AI-driven analysis helps mitigate the voltage delay effect by optimizing cell activation protocols and initial load testing sequences.

- Predictive maintenance schedules for large IoT networks are enhanced, maximizing asset uptime and reducing unnecessary field replacements of remote sensors.

- Advanced simulation platforms use AI to design custom cells for extreme temperature and pressure environments (e.g., downhole oil and gas).

- Data analytics assist in optimizing raw material utilization and supply chain risk management for key components like high-purity lithium and thionyl chloride.

DRO & Impact Forces Of Lithium Thionyl Chloride Battery Market

The Lithium Thionyl Chloride battery market is subject to a complex interplay of drivers, restraints, and opportunities that collectively shape its growth trajectory, influenced heavily by global technological shifts and regulatory environments. The primary driver is the unparalleled combination of high energy density, 3.6V output, and the longest shelf life (over 10 years) among commercially available primary batteries, which makes them indispensable for applications where battery replacement is difficult, costly, or impossible, such as deep-sea exploration, medical implants, and inaccessible industrial monitoring sites. This long-term reliability aligns perfectly with the burgeoning growth of massive, low-power-consumption IoT sensor networks being deployed globally. However, the market faces significant restraints, notably the regulatory challenges associated with the transport and disposal of primary lithium metal batteries due to their classification as hazardous materials, requiring stringent packaging and handling protocols which increase logistical costs. Furthermore, the inherent safety risk associated with high-pressure internal buildup if the cell is abused, coupled with the voltage delay phenomenon upon initial discharge, requires specialized engineering and limits penetration in highly consumer-facing applications, although continuous advancements in manufacturing mitigate these risks.

Opportunities for market expansion are largely concentrated within the specialized high-value segments, particularly the transition towards smart infrastructure and the ongoing modernization of defense and security systems worldwide. The increasing complexity and power demands of advanced military communication and surveillance gear necessitate compact, reliable power sources that Li-SOCl2 batteries uniquely provide. Moreover, the opportunity exists in developing hybrid solutions—combining Li-SOCl2 for primary power capacity with high-rate capacitors or secondary batteries for pulse power delivery—to address the demanding dual requirements of modern wireless transmitters (long life and high instantaneous power). The rising global emphasis on renewable energy infrastructure monitoring (wind farms, solar installations) in remote locations also presents a substantial, untapped market requiring the long-duration, maintenance-free power that this chemistry offers. Manufacturers focused on achieving ultra-low self-discharge rates (below 1% per year) and higher temperature ratings (up to 150°C) will be best positioned to capitalize on these specialized, high-margin opportunities.

The impact forces within this market structure are characterized by technology push from manufacturers continually improving safety and performance metrics, and a strong pull from critical infrastructure sectors requiring unwavering reliability. Competitive pressure from alternative primary lithium chemistries, such as Lithium Manganese Dioxide (Li-MnO2) and Lithium Iron Disulfide (Li-FeS2), while significant in consumer electronics and moderate-rate industrial applications, is less impactful in the extreme-endurance niches where Li-SOCl2 dominates. The supply chain stability for key raw materials, especially thionyl chloride, acts as a pivotal force; any disruption or price volatility directly impacts manufacturing costs and market prices. Ultimately, the market is driven by functional superiority in specific mission-critical environments, making performance specifications and regulatory compliance the dominant competitive factors, rather than simple cost leadership, resulting in a premium pricing structure reflective of the high reliability and technical complexity inherent in Li-SOCl2 cell production.

Segmentation Analysis

The Lithium Thionyl Chloride Battery market is strategically segmented based on construction type, application, and end-user vertical, reflecting the diverse performance requirements mandated by various critical sectors. The key differentiating factor in segmentation lies between the high-capacity, low-rate bobbin cell structure and the high-rate, high-power spiral wound structure. Bobbin cells dominate in utility metering and slow data logging where maximum energy density and decades-long endurance are prioritized, whereas spiral wound cells cater to communication burst devices, asset tracking, and defense applications requiring robust power delivery over short intervals. The analysis across these segments confirms that while the volume may be driven by bobbin types in smart metering, the fastest growth and highest profitability are often found in specialized spiral wound cells tailored for demanding military and aerospace specifications, requiring significant investment in R&D to manage thermal performance and safety under extreme discharge conditions.

Furthermore, segmentation by application reveals a dependence on utility metering (gas, water, electricity) as the foundational revenue stream, providing consistent, large-volume contracts. However, the fastest emerging application segments include the medical industry, specifically implantable devices and monitoring systems where reliability is non-negotiable, and the defense sector, driven by geopolitical instability and military modernization requiring secure, high-density power for smart munitions and battlefield communications. The industrial segment, encompassing SCADA systems, remote sensing, and oil and gas exploration, remains robust due to the necessity of enduring harsh environments. This diverse application portfolio insulates the market from slowdowns in any single sector, encouraging manufacturers to maintain specialized production lines capable of meeting the rigorous quality standards demanded by each distinct end-user vertical, such as ISO 13485 for medical devices or MIL-SPEC standards for defense contracts.

Geographically, market growth is segmented by the maturity level of smart infrastructure deployment. Mature markets like North America and Western Europe focus on replacement cycles and technology upgrades (e.g., migrating from 2G to 5G network support in meters), driving demand for next-generation, high-pulse cells. Conversely, emerging economies in APAC and Latin America represent greenfield opportunities for initial smart grid deployment and industrial automation, leading to exponential demand for high-capacity, low-cost bobbin cells. Strategic segmentation is thus vital for market players, requiring a global approach that balances high-volume, stable contracts in emerging regions with high-margin, technologically advanced sales in established markets, ensuring sustained revenue generation across the entire product lifecycle and geographical spectrum.

- By Construction Type:

- Bobbin Type (High Capacity, Low Rate Discharge, Extremely Long Life)

- Spiral Wound Type (Lower Capacity, High Rate Discharge, Pulse Capability)

- By Application:

- Utility Metering (Smart Gas, Water, Electric Meters)

- Medical Devices (Implantable Devices, External Monitoring)

- Defense and Aerospace (Tactical Communication, Munitions, Telemetry)

- Industrial IoT and Sensing (Remote Monitoring, SCADA, Asset Tracking)

- Oil and Gas (Downhole Logging Tools, Seismic Equipment)

- Automotive Electronics (Tire Pressure Monitoring Systems - TPMS backup)

- By End-User:

- Government and Defense

- Utilities and Energy Sector

- Healthcare

- Industrial Manufacturing

- Telecommunications

Value Chain Analysis For Lithium Thionyl Chloride Battery Market

The value chain for the Lithium Thionyl Chloride battery market is highly specialized, beginning with the meticulous procurement of ultra-high-purity raw materials and extending through specialized manufacturing, distribution, and critical end-user integration. Upstream analysis focuses intensely on securing stable supplies of lithium metal foil (the anode), thionyl chloride (the cathode/solvent), and carbon black (cathode current collector), along with specialized non-woven separators and glass-to-metal seals crucial for hermeticity. The quality and purity of thionyl chloride are paramount, as slight impurities can severely compromise cell performance and safety characteristics, necessitating long-term relationships with certified chemical suppliers. Raw material costs and availability are significant determinants of the final product price, placing substantial emphasis on efficient inventory management and minimizing waste in the highly complex chemical processing required for electrolyte preparation.

The manufacturing stage is the core value-add, involving highly automated, cleanroom fabrication processes to minimize contamination and ensure consistent cell construction, whether bobbin or spiral wound. Key manufacturing processes include electrode preparation, careful layering of components, laser welding, and the critical electrolyte filling and sealing process, often performed under extremely dry conditions. Due to the inherent complexity and potential risks associated with lithium metal and thionyl chloride, manufacturers invest heavily in safety infrastructure, specialized equipment, and intellectual property surrounding internal cell structure and safety mechanisms (e.g., thermal fuses or vents). Direct manufacturing expertise in hermetic sealing, particularly glass-to-metal seals, is a major barrier to entry, distinguishing top-tier suppliers who can guarantee decade-long reliability from smaller competitors.

The downstream distribution channels are bifurcated, serving both direct original equipment manufacturers (OEMs) and indirect industrial distributors. Direct sales dominate in large, highly regulated segments such as defense and medical devices, where strict quality audits, custom cell specifications, and guaranteed traceability necessitate close collaboration between the battery producer and the OEM integrator. Indirect channels, utilizing specialized industrial and electronic component distributors, service the fragmented IoT, general industrial sensing, and low-volume utility metering markets. Given the status of Li-SOCl2 batteries as hazardous goods, distribution networks must comply with rigorous international transport regulations (e.g., UN 3090, IATA), adding layers of complexity and cost. Successful market penetration relies on establishing certified, reliable distribution partners capable of managing hazardous logistics and providing localized technical support for integration into customer devices, ensuring both compliance and customer satisfaction across the highly specialized end-user base.

Lithium Thionyl Chloride Battery Market Potential Customers

Potential customers for Lithium Thionyl Chloride batteries are primarily concentrated in sectors requiring non-interruptible, long-duration power sources in remote, harsh, or mission-critical environments where the cost of battery replacement vastly exceeds the initial cost of the cell. The largest consumer base resides within the utility sector, specifically gas, water, and electricity providers worldwide who are implementing Advanced Metering Infrastructure (AMI) and Advanced Meter Reading (AMR) systems. These utilities demand bobbin-type cells capable of powering communication modules and sensors for 10 to 20 years without intervention, making Li-SOCl2 batteries the default choice due to their extremely low self-discharge rates and high capacity.

The defense and security industries represent another significant, high-value customer segment, utilizing these batteries in specialized communication equipment, passive monitoring systems, smart munitions, and remote telemetry units. These customers prioritize high-rate discharge capability (spiral wound), reliability under extreme thermal shock, and adherence to military specifications (MIL-SPEC). The reliability of the power source is directly linked to operational success and soldier safety, resulting in highly inelastic demand where performance and certification outweigh minor price considerations. Manufacturers must achieve complex certifications and demonstrate robust quality assurance protocols to successfully penetrate and sustain business relationships within this specialized government contracting sphere.

Furthermore, the medical device sector, encompassing manufacturers of implantable cardiac rhythm management devices (pacemakers, defibrillators) and external patient monitoring equipment, constitutes a highly sensitive and regulatory-intensive customer base. These applications require the ultimate level of electrochemical stability, bio-compatibility of external materials, and predictable discharge profiles over several years, making Li-SOCl2 an essential component. Lastly, the industrial sector, including oil and gas exploration companies (for high-temperature downhole equipment), aerospace manufacturers (for onboard telemetry), and logistics firms (for long-term asset trackers), represents diverse customer groups united by the need for maintenance-free power in demanding, inaccessible settings. Targeting these customers requires a portfolio of cells specifically rated for high temperature, high pressure, or high vibration tolerances.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.15 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tadiran Batteries, Saft, Electrochem Automation, Vitzrocell, EVE Energy, FDK, Xeno Energy, Excel Cell Electronic (ECE), Powercell, Hunan Great Power Energy & Technology, Ultralife Corporation, Hitachi Maxell, Shenzhen Vamery Technology, HLC Battery, Minamoto Battery |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Thionyl Chloride Battery Market Key Technology Landscape

The technological landscape of the Lithium Thionyl Chloride battery market is centered on enhancing performance metrics such as energy density, minimizing the notorious voltage delay phenomenon, and drastically improving the inherent safety profile and reliability over decades of service. A core technological focus involves optimizing the internal cell geometry, specifically the distinction between the high-capacity, low-surface-area bobbin design and the high-power, high-surface-area spiral wound design. Continuous material science research targets improving the passivation layer formed on the lithium anode, seeking additives or surface treatments that allow for a highly stable but easily broken layer upon discharge, effectively reducing the undesirable voltage delay which can temporarily impede functionality in pulse-heavy applications like wireless data transmission bursts. Furthermore, advanced laser welding and manufacturing precision are critical technologies ensuring the integrity of the anode/cathode interface and the overall structural stability necessary for extreme environmental operation.

Safety technology represents another pivotal area of innovation, particularly crucial given the highly reactive nature of thionyl chloride. Manufacturers utilize robust engineering techniques, including specialized vents, current interrupt devices (CIDs), and sophisticated hermetic sealing, often achieved through precision glass-to-metal seals, which are critical for preventing electrolyte leakage and ingress of moisture over a 20-year operational window. Research efforts are also dedicated to developing non-pressurized cell designs and incorporating internal thermal fuses to manage potential thermal runaway events, thereby ensuring compliance with increasingly strict regulatory demands from sectors like medical and defense. The successful application of these safety mechanisms, integrated through highly specialized and proprietary processes, differentiates premium products and allows them to address the most sensitive market applications where failure is unacceptable.

Looking forward, key technological advancements include the development of high-temperature Li-SOCl2 variants (operating efficiently up to 150°C) specifically tailored for geothermal and deep-well oil and gas logging applications, which requires specialized electrolyte formulations and construction materials to maintain stability under extreme thermal stress and hydrostatic pressure. The integration of advanced battery management algorithms, often enabled by integrated microcontrollers and sophisticated sensors, is becoming standard even in primary batteries to provide accurate state-of-health (SOH) monitoring, crucial for predictive maintenance in large-scale deployments. This technological push is transforming the Li-SOCl2 cell from a simple power source into an intelligent component, capable of communicating its status and maximizing its operational life within complex networked systems, ultimately extending the boundaries of its traditional utility and industrial applications.

Regional Highlights

- North America: This region holds a significant market share, driven by extensive adoption of smart metering infrastructure across the US and Canada, requiring high-capacity Li-SOCl2 batteries for long-term utility deployment. Furthermore, North America is a critical hub for the defense and aerospace industries, demanding spiral wound, high-rate versions for advanced military electronics, tactical communications, and unmanned aerial vehicles (UAVs). Stringent quality requirements and adherence to certifications in the medical and defense sectors ensure stable, high-value demand, focusing competition on reliability and technical performance rather than price.

- Europe: Europe represents a mature market characterized by early smart grid implementation and strong regulatory push for energy efficiency. Countries in Western Europe, such as Germany, France, and the UK, maintain consistent demand for long-life bobbin cells for utilities and advanced industrial automation sensors, particularly in petrochemical and manufacturing plants. The presence of major battery manufacturers and specialized chemical suppliers contributes to a robust supply chain, though compliance with strict environmental directives and WEEE (Waste Electrical and Electronic Equipment) regulations influences disposal strategies and product design.

- Asia Pacific (APAC): APAC is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) globally, largely fueled by rapid industrialization, massive investments in smart city projects, and the explosive growth of the Industrial IoT (IIoT) ecosystem in countries like China, India, and Southeast Asia. The demand here is dual-natured: high-volume, cost-effective bobbin cells for initial mass utility meter deployment and increasingly sophisticated high-power spiral cells to support burgeoning localized defense capabilities and advanced industrial sensing applications across remote areas.

- Latin America: This region is an emerging market for Li-SOCl2 technology, primarily driven by expanding telecommunications infrastructure and initial phases of smart grid modernization, particularly in Brazil and Mexico. Market growth is stable, though slower than APAC, characterized by fluctuating economic conditions and a focus on cost-effective, durable solutions necessary for operation in remote geographical locations with challenging climate variability.

- Middle East and Africa (MEA): MEA presents strong demand in specialized niches, predominantly the oil and gas sector in the Middle East, where high-temperature Li-SOCl2 batteries are essential for downhole drilling and monitoring equipment. Additionally, growing defense spending and investment in large-scale infrastructure projects across the GCC nations and South Africa provide consistent requirements for high-reliability, long-duration power sources for security and monitoring applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Thionyl Chloride Battery Market.- Tadiran Batteries

- Saft

- Electrochem Automation (A subsidiary of Greatbatch, now Integer Holdings)

- Vitzrocell

- EVE Energy

- FDK

- Xeno Energy

- Excel Cell Electronic (ECE)

- Powercell

- Hunan Great Power Energy & Technology

- Ultralife Corporation

- Hitachi Maxell

- Shenzhen Vamery Technology

- HLC Battery

- Minamoto Battery

- Jiangsu Tianyi Battery

- Wuhan Fanso Technology

- Shandong Huifeng Energy Technology

- EnerSys (formerly Hawker Powersource)

- Chloride Power Protection

Frequently Asked Questions

Analyze common user questions about the Lithium Thionyl Chloride battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Lithium Thionyl Chloride batteries over other battery chemistries?

The primary advantage is their superior energy density combined with an extremely low self-discharge rate, allowing them to provide reliable power for over 10 to 20 years, making them ideal for critical, remote, and long-term utility metering and IoT applications.

How do Bobbin and Spiral Wound Li-SOCl2 batteries differ in application?

Bobbin type batteries offer the highest capacity and longest life for low-current applications (like basic utility metering), while Spiral Wound batteries provide higher surface area, enabling high-rate pulse discharge capability essential for wireless transmission bursts in asset tracking and defense systems.

What is the 'voltage delay' phenomenon in Li-SOCl2 batteries and how is it addressed?

Voltage delay refers to a temporary dip in voltage upon initial discharge after prolonged storage, caused by the buildup of a stable lithium chloride passivation layer. Manufacturers mitigate this using proprietary electrolyte additives and optimized cell construction to ensure rapid depolarization and immediate stable voltage output.

Which industry segment drives the largest demand for Lithium Thionyl Chloride batteries?

The Utility Metering segment (Smart Gas, Water, and Electric Meters) currently drives the largest volume demand globally, relying on the chemistry's guaranteed longevity and maintenance-free operation for large-scale infrastructure projects.

Are Li-SOCl2 batteries considered safe, given they contain highly reactive components?

When manufactured to strict industry standards (utilizing hermetic glass-to-metal seals and internal safety mechanisms like CIDs and vents), they are highly reliable and safe for intended use. However, they are classified as hazardous materials requiring specialized handling and transport due to the reactive nature of lithium and thionyl chloride.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager