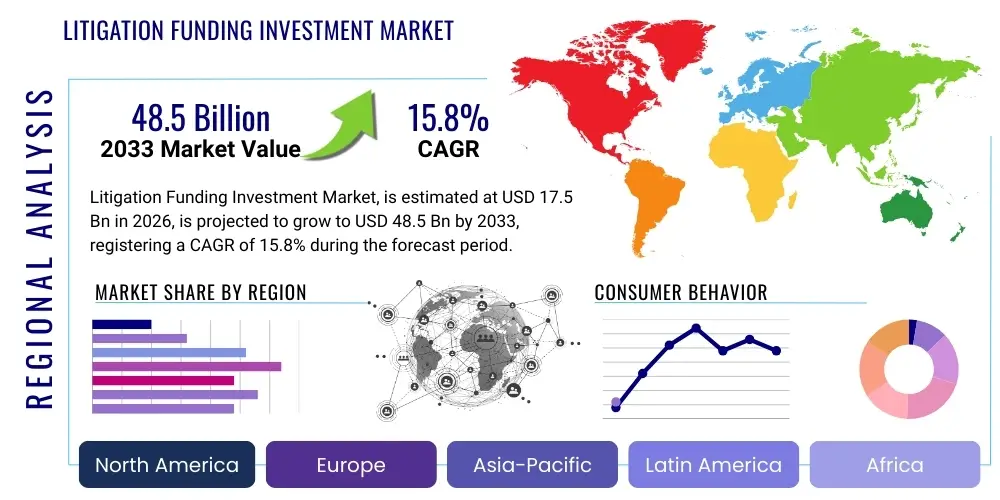

Litigation Funding Investment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438114 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Litigation Funding Investment Market Size

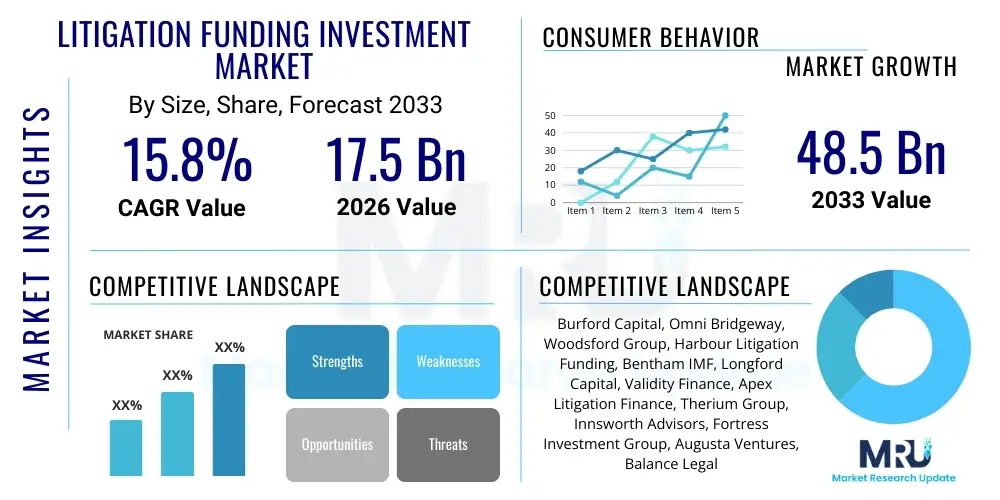

The Litigation Funding Investment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $17.5 Billion in 2026 and is projected to reach $48.5 Billion by the end of the forecast period in 2033.

Litigation Funding Investment Market introduction

The Litigation Funding Investment Market involves the financial backing of legal claims and arbitration by third-party funders who are not directly involved in the dispute. This specialized financial product, often referred to as Third-Party Funding (TPF), allows claimants—ranging from large corporations and small businesses to individuals—to pursue meritorious legal actions without incurring the upfront and ongoing costs associated with litigation. In return for bearing the financial risk, the funder receives an agreed-upon share of the final settlement or award if the case is successful. This mechanism fundamentally democratizes access to justice and acts as a sophisticated risk management tool for businesses, enabling them to convert potentially high-cost legal liabilities into off-balance-sheet expenditures.

Major applications for litigation funding span a wide array of legal practice areas, most notably high-stakes commercial litigation, international arbitration (especially ICSID and ICC cases), intellectual property disputes (patent infringement being a primary driver), and insolvency claims. The product description can be segmented based on the funding structure, including single-case funding, which addresses individual high-value disputes, and portfolio funding, which allows funders to manage a basket of claims, thereby diversifying risk and offering more predictable returns to investors. The increasing complexity and duration of global commercial disputes have solidified the necessity of external capital for legal pursuits, transforming litigation from a cost center into a potential asset.

Key driving factors for market expansion include the increasing acceptance and regulatory clarity of TPF across major jurisdictions, particularly in common law regions like the UK, Australia, and the US. Furthermore, institutional investors, such as pension funds and sovereign wealth funds, are increasingly drawn to litigation finance due to its non-correlated returns relative to traditional asset classes like equities and bonds. The benefits derived from this funding model extend beyond mere cost coverage, encompassing strategic advantages such as independent case valuation, enhanced due diligence provided by funders, and the ability for claimants to maintain operational capital instead of earmarking it for prolonged legal battles.

Litigation Funding Investment Market Executive Summary

The Litigation Funding Investment Market is experiencing a paradigm shift characterized by rapid institutionalization, strategic technological adoption, and evolving regulatory landscapes that are paving the way for sustained double-digit growth. Business trends indicate a movement away from bespoke, single-case funding toward standardized portfolio funding structures, which are preferred by large institutional investors seeking scalable investment products. This institutionalization is driving increased transparency, professionalization of fund management, and greater focus on standardized metrics for risk assessment and due diligence. Funders are leveraging sophisticated data analytics and legal tech platforms to enhance predictive modeling for case selection and duration, maximizing return profiles and optimizing capital deployment efficiency.

Regionally, while North America and Europe remain the dominant markets, growth momentum is accelerating significantly in the Asia Pacific (APAC) region, driven primarily by the rising use of international arbitration centers in Singapore and Hong Kong and increasing regulatory acknowledgment in emerging economies. The US market continues to mature with greater adoption among corporate General Counsels who view litigation finance not as a tool of last resort but as a core component of enterprise risk management. European expansion is centered around the UK, which serves as a global hub, and increased exploration in civil law jurisdictions attempting to adapt their frameworks to accommodate TPF structures, albeit with varied degrees of success and regulatory complexity.

Segment trends show significant differentiation in investment focus. Commercial litigation and international arbitration remain the largest segments, but there is explosive growth observed in highly specialized areas like environmental, social, and governance (ESG) related claims and mass tort litigation, particularly in jurisdictions allowing collective redress. The segmentation by funding type indicates a clear trend where portfolio funding is outstripping single-case funding growth, appealing to both sophisticated corporate claimants and institutional limited partners (LPs). Furthermore, the role of insurance products, such as adverse cost insurance, is becoming deeply integrated with funding arrangements, further mitigating risk for both the claimant and the funder and stabilizing the market structure.

AI Impact Analysis on Litigation Funding Investment Market

Common user questions regarding AI’s impact on litigation funding revolve around its ability to transform due diligence, predict case outcomes, and potentially automate parts of the funding evaluation process. Users frequently ask if AI will displace the need for human legal expertise in case selection, what specific algorithms are used for calculating risk-adjusted returns (RAROC), and how ethical considerations regarding data privacy and algorithmic bias are being addressed, especially when accessing sensitive case files. Key concerns center on the 'black box' nature of advanced AI models and the regulatory challenges associated with using predictive analytics to influence judicial processes or settlement negotiations. Conversely, the high expectation is that AI will dramatically reduce the time and cost associated with initial case screening, leading to higher efficiency and more accurate financial modeling for investors.

The integration of AI and machine learning (ML) is fundamentally redefining the operational architecture of litigation funding. AI-driven platforms are being deployed to analyze vast datasets of past litigation outcomes, judicial tendencies, and opposing counsel strategies, providing funders with a quantitative edge in assessing the merit and potential value of a claim. This shifts the due diligence process from purely qualitative expert judgment to a data-backed, probabilistic assessment, allowing funders to price risk more accurately. Furthermore, AI tools are enhancing document review speed and relevance in the e-discovery phase, reducing the overall litigation costs which directly impacts the profitability of the funded case, thereby attracting more sophisticated capital to the market.

- AI enables highly accurate predictive modeling for case duration, settlement probability, and potential damages, optimizing investment returns.

- Machine Learning algorithms expedite the initial screening of claims, allowing funders to process a significantly higher volume of applications efficiently.

- Natural Language Processing (NLP) tools automate the analysis of legal documents, contracts, and transcripts, improving due diligence speed and depth.

- AI assists in identifying optimal exit strategies and critical negotiation points by benchmarking current case attributes against historical settlement data.

- The use of AI introduces regulatory scrutiny concerning data governance and proprietary algorithms used for valuation, demanding standardized ethical frameworks.

- Automation of routine administrative tasks (e.g., portfolio tracking and reporting) frees up legal experts to focus solely on complex strategic decision-making.

DRO & Impact Forces Of Litigation Funding Investment Market

The dynamics of the Litigation Funding Investment Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces influencing market trajectory. The primary drivers center on the global trend towards risk mitigation for corporations, which are increasingly seeking non-recourse financing solutions to manage large legal expenses while preserving shareholder value and liquidity. Concurrently, the proliferation of global commercial disputes, often crossing multiple jurisdictions and requiring specialized legal expertise, increases the demand for deep-pocketed, specialized funding solutions. Opportunities are emerging primarily through regulatory adaptation in new geographical areas, particularly across Asia and specific European Union member states, as well as the expansion into novel legal sectors like international tax disputes and consumer class actions.

Restraints, however, pose significant hurdles to unrestrained growth. The most prominent restraint is the inconsistent and often ambiguous regulatory environment across various key jurisdictions. In the US, debates persist regarding attorney-client privilege and the discoverability of funding agreements, which creates uncertainty. Furthermore, the high capital requirement and the illiquid nature of the investment—where capital can be locked up for three to five years, or even longer—detract smaller investors and increase the internal hurdle rate for funds. Ethical concerns surrounding potential conflicts of interest between the funder's financial goals and the claimant's best interest also periodically result in calls for stricter governmental oversight, potentially slowing market innovation.

The impact forces driving the market forward include the increasing acceptance by global law firms, which now actively incorporate funding options into their client advisories, shifting the perception of TPF from niche service to mainstream financial strategy. The professionalization of the industry, marked by the entry of publicly listed funding companies and large institutional capital, necessitates robust due diligence and governance standards, increasing investor confidence. Opportunities are amplified by the development of secondary markets for litigation assets, which promise to enhance liquidity, potentially reducing the duration risk and broadening the investor base beyond specialized fund structures to mainstream alternative asset managers.

Segmentation Analysis

The Litigation Funding Investment Market is structurally diverse, segmented primarily based on the type of funding deployed, the application area of the dispute, and the end-user profile. Analyzing these segments provides critical insights into capital flow and risk appetite within the industry. By funding type, the distinction between single-case funding (high-risk, high-reward, specific to one dispute) and portfolio funding (lower risk, diversified across multiple cases) dictates capital allocation strategies. Portfolio funding is growing faster, reflecting institutional preference for risk diversification and predictable returns. Understanding these segment dynamics is crucial for both fund managers seeking optimized deployment and investors targeting specific return profiles.

- By Funding Type:

- Single-Case Funding

- Portfolio Funding

- Defense-Side Funding

- By Application Area:

- Commercial Litigation

- International Arbitration (Investor-State and Commercial)

- Intellectual Property Disputes (Patent, Trademark, Copyright)

- Insolvency and Bankruptcy Claims

- Mass Torts and Class Actions

- By End-User:

- Corporations and Businesses

- Law Firms (as a financing tool)

- Individuals and Small Entities

Value Chain Analysis For Litigation Funding Investment Market

The value chain in litigation funding is intricate, involving several highly specialized stages that transform raw legal claims into financial assets. Upstream activities focus on sourcing and rigorous due diligence. This involves claim origination, where fund managers assess the legal merit, jurisdiction, quantum of damages, and enforceability of potential awards. This phase requires significant internal legal expertise, often supported by external advisory counsel and forensic accountants. The quality of upstream assessment—heavily reliant on data analytics—is the most crucial determinant of investment success, establishing the contractual terms and pricing the non-recourse risk accurately.

Midstream activities encompass the actual deployment and management of capital. Once a case is selected, the funder enters into the funding agreement, providing capital for legal fees, disbursements, and often adverse cost insurance. During the active litigation phase, the funder maintains oversight, monitoring key milestones, advising on settlement offers, and managing stakeholder communications. Although funders do not control legal strategy, they act as strategic partners, influencing crucial financial decisions. The efficient and compliant management of active portfolios is critical, requiring robust technological platforms for tracking legal spend against budget and reporting performance metrics to LPs.

Downstream analysis focuses on the monetization and distribution channels. The primary monetization event occurs upon a successful resolution, either through settlement or a favorable court judgment. The returns are calculated based on the investment principal and the agreed-upon multiple or percentage share of the recovery. Distribution channels involve the complex legal procedures for transferring funds and settling costs. Direct distribution often goes back to the claimant and the funder. Indirectly, the successful conclusion of a case validates the funder's model, attracting further institutional capital. The transparency and efficiency of the payout structure, often overseen by Escrow agents, are vital for maintaining the integrity and trust in the TPF ecosystem.

Litigation Funding Investment Market Potential Customers

Potential customers, or end-users/buyers of litigation funding services, primarily fall into three categories: large corporations, law firms, and high-net-worth individuals or small to mid-sized enterprises (SMEs). For large multinational corporations, TPF serves not merely as a financing tool but as a sophisticated treasury and risk management strategy. Companies use funding to remove substantial legal expenses from their Profit and Loss statements, freeing up working capital for core business investments. This shift from an expense model to an asset management model is driving corporate adoption, particularly among general counsel facing pressure to optimize departmental budgets and deliver predictable financial performance.

Law firms represent a secondary, yet extremely powerful, customer segment. While they are not the ultimate recipients of the funds (the claimants are), they act as critical gatekeepers and advocates for TPF. Law firms utilize funding to offer alternative fee arrangements (AFAs) to their clients, such as hybrid contingency or fixed fee models, which would otherwise strain the firm's capital base. For smaller or boutique firms, securing funding allows them to compete for large, complex cases that require resources previously accessible only to the largest global firms, democratizing the legal services market and ensuring firms get paid consistently.

SMEs and individuals involved in significant commercial or complex personal injury claims constitute the third key segment. For these claimants, litigation funding often represents the only viable pathway to justice, as they lack the financial depth to withstand lengthy and expensive legal proceedings against well-resourced opponents. The availability of non-recourse funding ensures that meritocratic claims are not abandoned due to financial necessity. The increasing specialization in areas like international arbitration and securities litigation expands the scope of potential customers who require external expertise and capital to effectively enforce contractual rights or seek damages.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $17.5 Billion |

| Market Forecast in 2033 | $48.5 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Burford Capital, Omni Bridgeway, Woodsford Group, Harbour Litigation Funding, Bentham IMF, Longford Capital, Validity Finance, Apex Litigation Finance, Therium Group, Innsworth Advisors, Fortress Investment Group, Augusta Ventures, Balance Legal Capital, Curiam Capital, Calunius Capital, Lanthorn Capital, Rembrandt, Parabellum Capital, LCM, Vinson & Elkins |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Litigation Funding Investment Market Key Technology Landscape

The technological landscape supporting the litigation funding market is rapidly maturing, moving beyond simple data management to predictive analytics and portfolio optimization platforms. Key technologies utilized include proprietary risk modeling software and data aggregation tools that synthesize vast amounts of public and non-public legal data. These sophisticated platforms leverage artificial intelligence (AI) and machine learning (ML) to perform automated assessments of case viability, assigning probabilistic scores to outcomes based on jurisdiction, judge history, legal precedent, and the historical performance of opposing counsel. This technology is critical for high-volume portfolio funders who require scalable and objective metrics for investment decisions, fundamentally enhancing the quality of initial due diligence.

Furthermore, LegalTech solutions, specifically those focused on e-discovery and secure document management (often leveraging blockchain for immutable record-keeping), are becoming integral to the funder’s operational infrastructure. By reducing the cost and time associated with the discovery phase—historically a major cost driver in litigation—funders improve the net return on investment. The efficient transfer and secure storage of highly sensitive legal documentation require advanced cybersecurity measures and compliance with stringent data privacy regulations (such as GDPR), pushing funders to invest heavily in robust, compliant technological architectures. The competitive advantage increasingly lies in the proprietary data models and the speed at which claims can be vetted and funded.

Beyond due diligence and document management, technology is transforming investor relations and capital raising. Funders utilize advanced reporting platforms to provide institutional investors with real-time portfolio performance tracking, liquidity projections, and risk exposure analysis. This transparency, facilitated by secure online portals and API integration, is essential for attracting large institutional capital seeking detailed financial oversight. The future landscape will likely involve greater use of smart contracts for automating funding disbursements and return calculations upon case resolution, reducing administrative friction and further standardizing the complex legal financial transactions inherent in the TPF ecosystem.

Regional Highlights

- North America (Dominant Market, Maturation, and Corporate Adoption): North America, particularly the United States, holds the largest share of the global litigation funding market, characterized by large dispute values, a favorable common law system, and widespread corporate adoption. The US market is maturing, with key focus shifting toward multi-jurisdictional patent litigation, complex commercial disputes, and class action lawsuits. Corporate general counsels are driving demand by treating funding as a financial tool for balance sheet management, further normalizing the practice across industries. Regulatory discussions often focus on transparency requirements at the federal and state levels, but the overall operational environment remains highly accommodating for TPF.

- Europe (UK Hub, Continental Expansion, and Regulatory Divergence): Europe is the second-largest market, primarily anchored by the United Kingdom, which has been a pioneering jurisdiction due to clear pro-funding case law and a sophisticated legal market. The UK acts as a hub for international arbitration funding globally. Continental Europe presents a more fragmented landscape, with significant opportunities in civil law jurisdictions adapting to collective redress mechanisms and arbitration. Germany and the Netherlands are key expansion targets, although local regulatory frameworks remain complex and variable, requiring tailored funding structures and deeper legal analysis to navigate jurisdictional subtleties.

- Asia Pacific (APAC) (High Growth Potential, Arbitration Focus): The APAC region is projected to exhibit the highest Compound Annual Growth Rate, driven by the increasing use of international arbitration centers in key financial hubs like Singapore, Hong Kong, and Australia. Australia remains a globally significant market, particularly for class actions. Singapore has proactively adapted its legislation to explicitly permit and regulate TPF in international arbitration and related mediation proceedings, positioning itself as a central gateway for regional funding. Economic growth and complex cross-border trade disputes are fueling the demand for non-recourse capital.

- Latin America (Emerging Opportunities and Infrastructure Disputes): The Latin American market remains nascent but offers significant long-term potential, particularly in infrastructure, energy, and investor-state disputes. Jurisdictional risks and currency volatility necessitate specialized funding structures, but the need for capital to pursue complex, high-value claims against state entities is substantial. Institutional investors are cautious but increasingly exploring opportunities in key economies like Brazil and Mexico where legal reforms are slowly improving contract enforceability.

- Middle East and Africa (MEA) (Niche Growth, Regulatory Clarity Needed): MEA represents a niche market focused predominantly on international arbitration proceedings hosted in regional financial zones (e.g., Dubai International Financial Centre and Abu Dhabi Global Market). These free zones have adopted common law principles and specific TPF regulations, creating localized clusters of activity. Broader regional adoption is constrained by less mature legal systems and limited regulatory precedent regarding third-party involvement in domestic litigation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Litigation Funding Investment Market.- Burford Capital

- Omni Bridgeway

- Woodsford Group

- Harbour Litigation Funding

- Bentham IMF

- Longford Capital

- Validity Finance

- Apex Litigation Finance

- Therium Group

- Innsworth Advisors

- Fortress Investment Group

- Augusta Ventures

- Balance Legal Capital

- Curiam Capital

- Calunius Capital

- Lanthorn Capital

- Rembrandt

- Parabellum Capital

- LCM

- Vinson & Elkins (Strategic Funding Arm)

Frequently Asked Questions

Analyze common user questions about the Litigation Funding Investment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Litigation Funding Market?

The primary driver is the increasing demand from large corporations for risk transfer and balance sheet optimization, allowing them to pursue meritorious claims without incurring significant upfront legal costs, coupled with the interest from institutional investors seeking non-correlated, high-yield assets.

How does litigation funding manage investment risk?

Risk is managed through rigorous upfront due diligence, often using advanced AI analytics, and increasingly through portfolio funding models that diversify capital across multiple, unrelated cases to mitigate the risk associated with any single claim failing to achieve a favorable outcome.

What is the difference between single-case funding and portfolio funding?

Single-case funding finances one specific legal dispute, offering potentially high returns but higher risk. Portfolio funding finances a group of claims, providing diversification, lower volatility, and is typically preferred by large corporations and institutional investors.

Which geographical region shows the fastest growth potential for litigation funding?

The Asia Pacific (APAC) region, driven by progressive regulatory changes in jurisdictions like Singapore and Hong Kong, particularly concerning international arbitration, is forecast to exhibit the highest CAGR in the coming years.

Is litigation funding regulated, and if so, where?

Regulation varies significantly globally. Jurisdictions like the UK and Australia have established common law precedents and specific regulatory frameworks, while in the US, regulation often falls under state bar rules and ongoing judicial scrutiny regarding transparency and ethical standards.

What role does Artificial Intelligence (AI) play in the funding process?

AI is crucial for enhancing due diligence by analyzing vast amounts of legal data to predict case outcomes, estimate litigation duration, and accurately price the non-recourse risk, leading to more efficient capital allocation by funders.

Who are the typical investors providing capital to litigation funding firms?

The capital predominantly comes from sophisticated institutional investors, including pension funds, sovereign wealth funds, university endowments, and specialized alternative asset managers seeking returns that are independent of traditional market cycles.

What types of legal disputes are most commonly funded?

The most common disputes funded are high-value commercial litigation, international arbitration (both commercial and investor-state), complex intellectual property (IP) disputes, and specialized insolvency and bankruptcy claims.

Does funding lead to conflicts of interest between the funder and the claimant?

Potential conflicts of interest are a key ethical concern. Reputable funding contracts explicitly state that the funder cannot control the legal strategy or dictate settlement decisions, ensuring the claimant and their counsel maintain control over the legal aspects of the case.

What are the typical financial terms of a litigation funding agreement?

Funding is non-recourse, meaning the funder only receives payment if the case is successful. Returns are usually calculated as a multiple of the invested capital or a percentage of the final recovery, whichever is higher, structured to reflect the duration and risk of the case.

How does the Litigation Funding Market benefit small and medium-sized enterprises (SMEs)?

For SMEs, litigation funding levels the playing field, providing the necessary capital to pursue valid claims against larger, well-resourced corporate defendants, thereby ensuring access to justice that might otherwise be financially prohibitive.

What impact does the lack of liquidity have on the litigation funding industry?

The inherent illiquidity—investments often require capital lock-up for several years—restrains market growth by limiting the investor base. However, the emerging secondary market for litigation assets is actively working to address this liquidity constraint.

What is defense-side funding, and is it a growing segment?

Defense-side funding is where capital is provided to a defendant to cover the costs of defending a claim. While niche, it is a growing segment, often structured to offer insurance solutions or capital to manage extensive defense costs without depleting corporate reserves.

How is the enforceability of a judgment factored into funding decisions?

The enforceability of a potential judgment is a critical element of due diligence. Funders invest significant resources to assess the ability of the claimant to recover funds, especially in international disputes where asset tracing and multi-jurisdictional enforcement can be complex and costly.

What are the ethical considerations for law firms utilizing TPF?

Law firms must ensure that using TPF does not violate professional conduct rules, especially regarding fee splitting, maintaining independent professional judgment, and ensuring complete transparency with the client about the non-recourse nature and terms of the funding agreement.

Is there a trend toward consolidation among key litigation funding players?

Yes, as the market matures and attracts larger institutional capital, there is a trend toward consolidation, with major players acquiring smaller, specialized funds to gain access to niche expertise, expand geographic reach, and acquire sophisticated proprietary data models.

How do ESG factors influence litigation funding investment today?

ESG factors are becoming a significant segment driver. Funders are increasingly targeting claims related to climate change litigation, corporate governance failures, and social accountability, aligning investment strategies with sustainability and ethical mandates preferred by institutional LPs.

What differentiates international arbitration funding from domestic litigation funding?

Arbitration funding often involves higher value claims, specific rules set by institutions (like ICC or ICSID), and involves a reduced risk of adverse cost orders compared to common law jurisdictions, requiring funders to possess specialized expertise in international law and treaties.

How does technology help funders in calculating Return on Investment (ROI)?

Technology platforms use historical data to simulate various outcomes and associated legal costs, allowing funders to calculate a statistically driven, risk-adjusted ROI (RAROC) for each case or portfolio, replacing anecdotal evidence with objective financial metrics.

What impact has the COVID-19 pandemic had on the market?

The pandemic initially caused delays in court systems, extending case duration. However, it ultimately drove increased demand for funding, as corporations faced liquidity pressures and sought external financing to pursue breaches of contract and supply chain disruption claims resulting from the economic downturn.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager