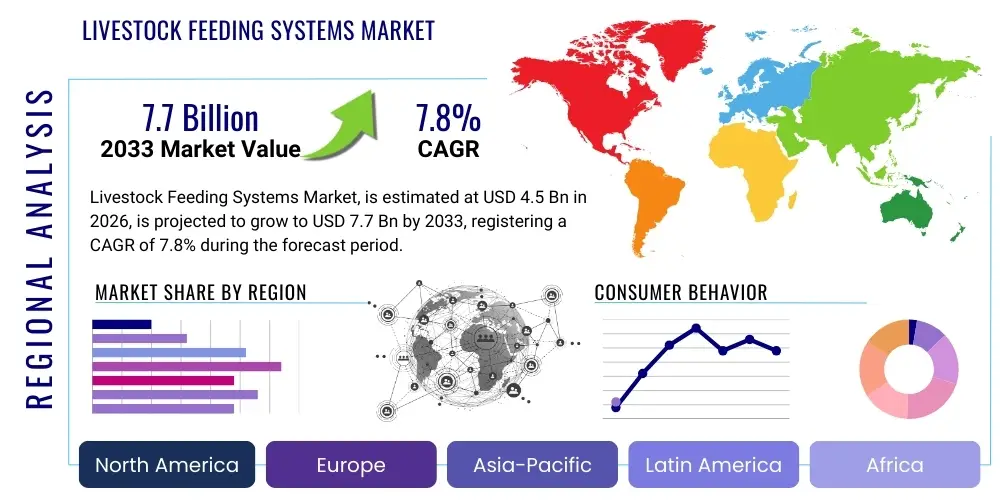

Livestock Feeding Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436595 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Livestock Feeding Systems Market Size

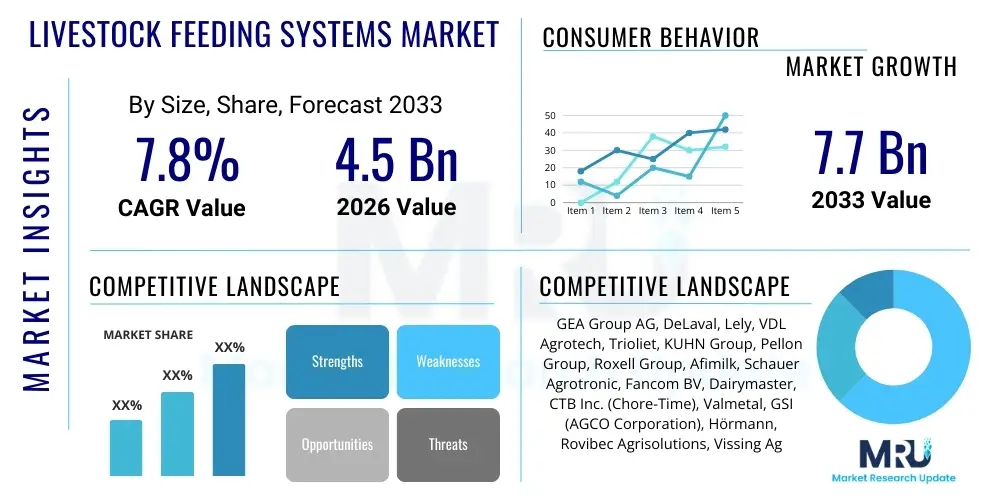

The Livestock Feeding Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the increasing global demand for high-quality protein, necessitating enhanced efficiency in livestock farming operations. The adoption of automation technologies, particularly in developed economies, plays a critical role in optimizing feed conversion ratios (FCR) and minimizing labor costs associated with traditional feeding practices.

Market valuation reflects significant investments being made across the dairy and swine industries where precision feeding yields immediate economic returns. The transition from manual dispensing methods to sophisticated, sensor-driven systems allows farmers to monitor individual animal consumption patterns, leading to proactive health management and reducing feed wastage. Furthermore, favorable regulatory environments promoting sustainable agriculture and animal welfare standards contribute substantially to the market’s positive trajectory, pushing producers towards integrated, technology-enabled feeding solutions that ensure nutritional consistency and traceability.

Livestock Feeding Systems Market introduction

The Livestock Feeding Systems Market encompasses a wide range of specialized equipment and integrated solutions designed for the automatic and semi-automatic preparation, storage, conveyance, and dispensing of feed to various types of livestock, including cattle, poultry, swine, and aquaculture species. These systems are crucial components of modern smart farming initiatives, aiming to maximize productivity, improve animal health, and reduce operational expenses associated with manual labor and feed waste. Products range from basic conveyors and storage silos to highly sophisticated Total Mixed Ration (TMR) robotic feeders and individualized precision feeding stations utilizing sensors, cameras, and data analytics platforms to tailor dietary intake.

Major applications of these systems span large-scale commercial dairy farms, intensive swine production facilities, and vertically integrated poultry operations where consistency and scale are paramount. Key benefits derived from the adoption of these technologies include enhanced feed efficiency, better control over nutrient delivery, reduction in feed costs due to minimized spoilage and wastage, and significant labor savings. Furthermore, precision feeding mitigates environmental impacts by optimizing nutrient utilization and reducing excess excretion.

Driving factors for market growth include the escalating global population, leading to increased demand for animal protein; continuous technological advancements such as the integration of IoT, AI, and robotics into feeding equipment; and the persistent challenge of labor shortages in agricultural sectors globally. The focus on improving animal welfare standards, often linked to automatic and controlled feeding schedules, also serves as a strong market impetus, particularly in stringent regulatory regions like Europe and North America.

Livestock Feeding Systems Market Executive Summary

The Livestock Feeding Systems Market is experiencing rapid commercialization driven by globalization and the imperative for agricultural sustainability. Key business trends include strategic collaborations between technology providers and traditional agricultural equipment manufacturers, focusing on developing integrated farm management platforms that link feeding data with overall herd performance metrics. Mergers and acquisitions are common as established players seek to acquire niche technological expertise, especially in sensor technology, machine vision, and sophisticated data analytics for personalized animal feeding. Regional trends highlight North America and Europe as leaders in automated system adoption due to higher labor costs and regulatory pressure for efficiency, while Asia Pacific, particularly China and India, represents the fastest-growing market owing to the modernization of large-scale industrial farms.

Segment trends underscore the dominance of automated/robotic feeding systems over conventional methods, reflecting the industry's shift towards precision agriculture. Within livestock segments, the dairy sector maintains the largest share, characterized by high investment in TMR mixers and robotic pushers aimed at optimizing milk production efficiency and reducing the incidence of metabolic disorders. The swine and poultry sectors show high potential, driven by the need for tight control over growth rates and feed conversion ratios in high-density environments. Component-wise, monitoring and control units, which include advanced sensors and software, are projected to witness the highest CAGR as farmers prioritize real-time data for decision-making.

Overall market dynamics suggest a transition from bulk feeding to highly personalized, demand-driven feeding protocols. The market is competitive, characterized by continuous product innovation centered on maximizing feed intake accuracy, minimizing energy consumption, and ensuring robust system reliability in harsh farming environments. Future growth will be dictated by the penetration of IoT and cloud-based systems allowing for remote monitoring and predictive maintenance capabilities, ensuring operational continuity for livestock producers globally.

AI Impact Analysis on Livestock Feeding Systems Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Livestock Feeding Systems Market primarily revolve around themes of real-time optimization, predictive modeling for resource management, and the potential for individualized animal nutrition. Common concerns include the cost of implementing AI-driven sensors and software, data privacy and security, and the need for simplified, user-friendly interfaces suitable for farm personnel. Users frequently ask about AI's ability to diagnose subclinical health issues based on feeding pattern anomalies and its role in maximizing Feed Conversion Ratio (FCR) by dynamically adjusting feed formulations based on current environmental conditions, animal age, weight, and specific production goals.

AI is fundamentally transforming livestock feeding from scheduled dispensing into an adaptive, hyper-personalized nutritional strategy. Machine learning algorithms analyze vast datasets generated by sensors—including feed intake cameras, weight scales integrated into feeding stations, and environmental monitors—to create highly accurate models of individual animal or group requirements. This allows automated systems to adjust feed quantity, composition, and mixing ratio instantaneously, ensuring optimal nutritional delivery necessary for peak performance, whether for milk yield, weight gain, or reproductive health. This predictive capability significantly reduces the guesswork involved in traditional farming.

The integration of deep learning networks enables automated visual analysis of feed bunks to detect spoilage or refusal patterns, allowing systems to autonomously trigger cleaning cycles or adjust feeding times, thereby minimizing waste and maintaining feed quality. Furthermore, AI-driven predictive maintenance optimizes the operational longevity of the feeding equipment itself, anticipating component failures and scheduling maintenance before costly downtime occurs. This transition towards prescriptive analytics underscores AI's growing importance not just in animal management but in overall farm resilience and profitability, driving the next wave of technological adoption across commercial livestock operations worldwide.

- AI optimizes feed formulation based on real-time biometric and environmental data, maximizing FCR.

- Machine learning algorithms enable predictive health monitoring through analysis of deviations in individual feeding behavior.

- Deep learning facilitates precise visual feed bunk management, detecting spoilage and minimizing waste autonomously.

- AI drives prescriptive maintenance scheduling for automated feeders, reducing system downtime and operational costs.

- Natural Language Processing (NLP) enhances user interfaces, making complex data insights accessible to farm operators.

DRO & Impact Forces Of Livestock Feeding Systems Market

The dynamics of the Livestock Feeding Systems Market are shaped by powerful Drivers, Restraints, and Opportunities, collectively forming the core Impact Forces that govern investment and technological adoption. Primary drivers include the global imperative for food security and the resultant need to enhance livestock productivity and profitability through automation. Restraints largely center on the high initial capital investment required for sophisticated automated systems, particularly prohibitive for small and medium-sized farms, coupled with the necessity for specialized technical skills to operate and maintain advanced equipment. Opportunities abound in emerging markets where agricultural modernization is rapidly accelerating and in the continued development of modular, scalable, and affordable precision feeding technologies, particularly leveraging cloud connectivity and subscription-based software models.

The convergence of these forces creates a high-pressure environment for innovation. Impact forces driving the market expansion include demographic shifts, such as urbanization and rising disposable incomes globally, which translate directly into increased demand for premium meat and dairy products, necessitating highly efficient, quality-controlled production systems. Conversely, intense regulatory scrutiny over environmental sustainability, specifically concerning nitrogen and phosphorus excretion, acts as a restraining force against inefficient practices, compelling farmers towards precision feeding solutions that minimize nutrient leakage into the environment. The pervasive influence of digitalization across the agricultural value chain acts as a powerful enabling factor, transforming market potential.

The overall impact force leans strongly towards technological adoption, driven by the undeniable long-term economic benefits and labor efficiencies offered by automated systems. While initial costs remain a significant hurdle, the ongoing reduction in sensor prices, combined with modular equipment design, is gradually lowering the barrier to entry. Successful companies are those that can effectively monetize the data generated by their feeding systems, offering farm optimization services that provide a substantial return on investment (ROI) beyond mere labor savings. This shift from hardware sales to integrated service models is critical in shaping the future competitive landscape and addressing the fundamental restraints faced by the industry.

Segmentation Analysis

The Livestock Feeding Systems Market is highly segmented, allowing for granular analysis across various dimensions including system type, livestock type, component, and operational function. Segmentation is vital for identifying specific market needs and tailoring technological solutions, particularly as producers move toward species-specific and personalized nutrition protocols. The core segmentation reflects the shift from basic mechanical equipment to integrated, smart, and fully automated robotic solutions designed for high precision and continuous operation in demanding agricultural settings. Understanding these segments provides clarity on where the highest growth potential resides and which technological advancements are most critical for market penetration.

The market is predominantly influenced by the dairy sector, which demands complex TMR preparation and continuous feed delivery to maximize yield, contrasting with the poultry sector, which relies on high-throughput conveyance and dispensing lines tailored for mass production. Component segmentation reveals a significant focus on the software and data analytics layers, demonstrating the market's maturity beyond mere mechanical automation toward data-driven decision-making. Geographically, segmentation highlights disparities in technological maturity and adoption rates, with established markets focusing on replacement and upgrade cycles, while developing markets prioritize first-time automation installations.

These defined segments dictate product development strategies and investment priorities for key market players. For instance, companies focusing on the swine segment must emphasize robust, easy-to-clean dispensing units to adhere to stringent hygiene standards, whereas companies targeting beef cattle may prioritize durable, large-capacity mobile TMR mixers. The inherent diversity across livestock types ensures that the market remains fragmented but robust, requiring manufacturers to maintain a diversified portfolio of specialized equipment to address the varied needs of modern livestock production globally.

- By System Type:

- Automated Feeding Systems (Robotic Feeders, Automated Rail Systems)

- Conventional Feeding Systems (Mobile Feeders, Stationary Mixers)

- By Livestock Type:

- Ruminants (Dairy Cattle, Beef Cattle)

- Swine (Pigs and Hogs)

- Poultry (Broilers, Layers)

- Aquaculture and Others

- By Component:

- Feed Storage & Delivery Systems (Silos, Conveyors, Augers)

- Feed Dispensing & Spreading Equipment (TMR Mixers, Dosing Units)

- Monitoring & Control Systems (Sensors, Software, Cameras, Data Analytics)

- By Operation Mode:

- Fixed/Stationary Systems

- Mobile/Self-Propelled Systems

Value Chain Analysis For Livestock Feeding Systems Market

The value chain for the Livestock Feeding Systems Market is complex, encompassing raw material procurement, specialized equipment manufacturing, sophisticated software integration, distribution, installation, and post-sales servicing. The upstream segment involves the sourcing of critical materials such as industrial-grade steel, complex polymers, high-precision electronic components, and advanced sensor technology necessary for building durable and accurate feeding machinery. Key upstream activities include ensuring supply chain resilience, managing fluctuating commodity prices, and maintaining rigorous quality control over sensor reliability and electronic control units, which are foundational to system performance and longevity.

Midstream activities are dominated by Original Equipment Manufacturers (OEMs) who focus on R&D, design, and assembly. This stage is characterized by intense focus on technological innovation, specifically integrating IoT capabilities, robotic arms, and complex mixing mechanisms (like those used in TMR mixers) to meet precise nutritional demands. Manufacturing efficiency and scalable production capabilities are crucial midstream success factors. The distribution channel involves a dual approach: direct sales for highly complex, customized robotic systems often requiring manufacturer installation teams, and indirect sales through a network of specialized agricultural equipment dealers and distributors who handle standard mixers, conveyors, and replacement parts.

The downstream analysis focuses on the end-users—large commercial farms, cooperative farms, and smaller independent producers—who require robust installation, calibration, and long-term technical support. Post-installation services, including software updates, predictive maintenance contracts, and operational training, constitute a growing and crucial revenue stream. The trend is moving towards integrated solution providers who offer not just the physical machinery but also the associated software subscription services (SaaS), facilitating seamless data flow and maximizing equipment utility throughout its lifecycle, thus enhancing the overall value proposition for the end-user.

Livestock Feeding Systems Market Potential Customers

Potential customers for Livestock Feeding Systems are predominantly large-scale commercial agricultural enterprises across the globe that prioritize efficiency, consistency, and scale in animal production. The primary end-users or buyers include commercial dairy operations, particularly those with herd sizes exceeding 500 cows, where automation is essential to manage high milk yields and reduce labor intensity. Intensive Swine Production Units (SPUs) and large-scale Poultry Farms (both broiler and layer operations) are also significant buyers, requiring highly automated feeding lines to manage rapid growth cycles and massive volumes of animals while maintaining strict biosecurity protocols.

Beyond traditional livestock sectors, the emerging aquaculture industry, specializing in fish and crustacean farming, represents a growing segment requiring specialized automated submerged and floating feeders designed for precise dosage and wide distribution across ponds or containment tanks. Furthermore, feed processing plants and cooperative feed mills often invest in advanced stationary mixing and dispensing systems that are later transported to multiple farm sites. These customers seek equipment that integrates seamlessly with their existing inventory management and data systems, allowing for comprehensive performance tracking and quality control across the production chain.

The driving factor for these end-users is the desire to achieve optimal Feed Conversion Ratios (FCR) and minimize operational labor expenses. Therefore, customers are actively seeking systems that offer guaranteed reliability, precision, and integration capabilities, often prioritizing solutions that incorporate AI and IoT for proactive management. Investment decisions are heavily influenced by the system's ability to demonstrate a clear return on investment (ROI) within a short timeframe, typically through reduced feed wastage and verifiable increases in animal output (e.g., higher milk solids or faster weight gain).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GEA Group AG, DeLaval, Lely, VDL Agrotech, Trioliet, KUHN Group, Pellon Group, Roxell Group, Afimilk, Schauer Agrotronic, Fancom BV, Dairymaster, CTB Inc. (Chore-Time), Valmetal, GSI (AGCO Corporation), Hörmann, Rovibec Agrisolutions, Vissing Agro, Steyr Landtechnik, Nedap N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Livestock Feeding Systems Market Key Technology Landscape

The technology landscape of the Livestock Feeding Systems Market is rapidly evolving, driven by the principles of Industry 4.0 and the integration of sophisticated digital tools. The core technologies include advanced Total Mixed Ration (TMR) preparation systems, which utilize high-precision weighing scales and automated mixing algorithms to ensure nutritional uniformity, crucial for dairy and beef operations. Beyond basic mechanics, the critical technological differentiator is the application of the Internet of Things (IoT) sensors, including RFID tags, ultrasonic sensors, and computer vision systems, which capture real-time data on feed inventory, animal location, consumption rates, and body condition scoring. This sensor network forms the foundation for data-driven feeding strategies.

Robotics represents a fundamental shift in the market, particularly in the dairy sector with autonomous feed pushers and self-propelled robotic TMR mixers that operate continuously, minimizing human intervention and ensuring consistent feed availability. Furthermore, sophisticated variable frequency drives (VFDs) and energy-efficient motors are being deployed across conveyors and dispensing equipment to reduce electricity consumption, addressing sustainability concerns and lowering operational costs. The increasing complexity of feed formulation and delivery necessitates highly developed Control Systems, often operating on cloud platforms, allowing farmers to monitor and adjust system parameters remotely via mobile interfaces.

The most transformative technology remains the integration of AI and Machine Learning (ML) for prescriptive analytics. These algorithms analyze historical performance data combined with current feeding parameters to predict optimal feed delivery times and quantities, moving beyond mere descriptive data. Precision dosing technology, especially critical in swine and poultry operations, uses electro-mechanical valves and complex algorithms to dispense micro-doses of supplements or medication directly into the feed line based on individual or group need, ensuring high accuracy and minimizing waste of expensive inputs. Technology convergence—combining advanced hardware with intelligent software—is the defining trend shaping modern livestock feeding infrastructure.

Regional Highlights

- North America: This region holds a significant share of the global market, primarily due to the presence of large commercial farms, high labor costs necessitating automation, and strong governmental support for technological adoption in agriculture. The U.S. and Canada are early adopters of robotic TMR systems and advanced monitoring solutions (IoT). Investment is heavily skewed towards maximizing efficiency in dairy and beef production, with a mature market focused on system upgrades and data integration services.

- Europe: Europe is characterized by stringent animal welfare regulations and high standards for food quality and traceability, driving demand for precision feeding systems that ensure consistent nutrition and minimize environmental impact. Countries like the Netherlands, Germany, and France are leaders in robotic feeding system deployment, particularly for swine and dairy. The regional market growth is supported by favorable policies promoting smart farming and nutrient management technologies.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid industrialization of the livestock sector, particularly in China, India, and Southeast Asian nations. The transition from small, traditional farms to large, centralized commercial operations is creating immense demand for imported and locally manufactured automated feeding solutions. Government initiatives to modernize agriculture and secure domestic food supply are key accelerators, though initial capital affordability remains a challenge for widespread adoption.

- Latin America: This region, led by Brazil and Argentina, represents a major global hub for beef and poultry production. The market growth is driven by the expansion of large agricultural export businesses that require automated systems to maintain competitive pricing and international quality standards. Focus is placed on robust, high-throughput systems capable of operating efficiently in diverse climatic conditions, particularly mobile feeders and large-scale feed preparation units.

- Middle East and Africa (MEA): The MEA market is emerging, driven by significant investments in domestic food security projects, especially in the Gulf Cooperation Council (GCC) countries which rely on imported feed and often utilize controlled-environment farming. Adoption is concentrated in large, government-backed poultry and dairy projects, focusing on highly optimized and climate-resilient automated systems to overcome harsh environmental challenges like extreme heat and water scarcity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Livestock Feeding Systems Market.- GEA Group AG

- DeLaval

- Lely

- VDL Agrotech

- Trioliet

- KUHN Group

- Pellon Group

- Roxell Group

- Afimilk

- Schauer Agrotronic

- Fancom BV

- Dairymaster

- CTB Inc. (Chore-Time)

- Valmetal

- GSI (AGCO Corporation)

- Hörmann

- Rovibec Agrisolutions

- Vissing Agro

- Nedap N.V.

- Fullwood Packo

Frequently Asked Questions

Analyze common user questions about the Livestock Feeding Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Livestock Feeding Systems Market?

The Livestock Feeding Systems Market is projected to experience a Compound Annual Growth Rate (CAGR) of 7.8% between the forecast period of 2026 and 2033, driven primarily by technological adoption and efficiency mandates in the agricultural sector.

Which livestock segment accounts for the largest market share in feeding systems?

The Ruminants segment, predominantly comprising dairy and beef cattle, currently holds the largest market share due to the high necessity for Total Mixed Ration (TMR) systems and continuous robotic feeding to optimize milk yield and animal health in large commercial operations.

How does AI technology benefit precision livestock feeding?

AI technology benefits precision feeding by utilizing machine learning algorithms to analyze real-time data from sensors (IoT), enabling dynamic adjustment of feed formulation and dispensing schedules, thereby maximizing the Feed Conversion Ratio (FCR) and detecting early signs of animal distress.

What are the primary restraints affecting the adoption of automated feeding systems?

The major restraints are the high initial capital investment required for implementing sophisticated automated and robotic systems, and the subsequent demand for highly skilled technical personnel for system operation, maintenance, and complex data interpretation.

Which geographical region exhibits the fastest growth in the automated feeding market?

The Asia Pacific (APAC) region is projected to register the fastest market growth, fueled by rapid industrialization, large-scale farm modernization initiatives, and increasing governmental focus on achieving self-sufficiency in animal protein production across key economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager