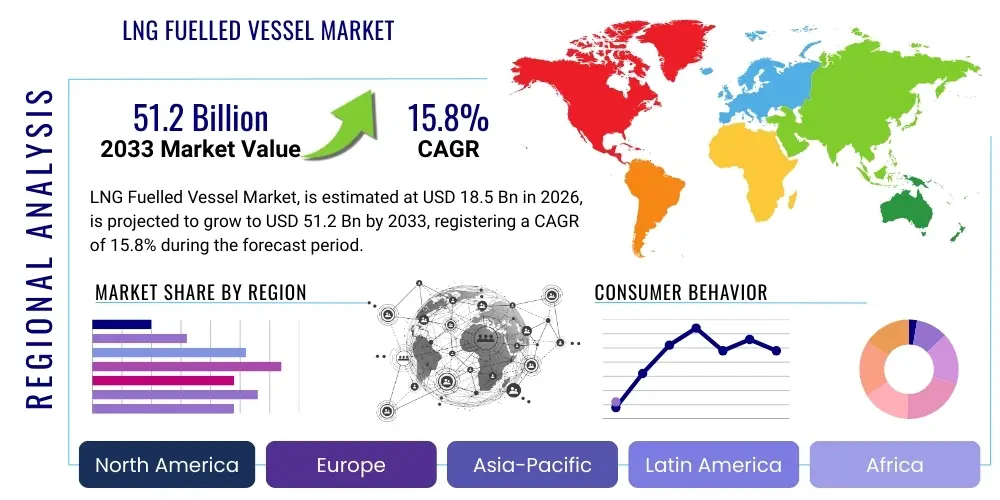

LNG Fuelled Vessel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438607 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

LNG Fuelled Vessel Market Size

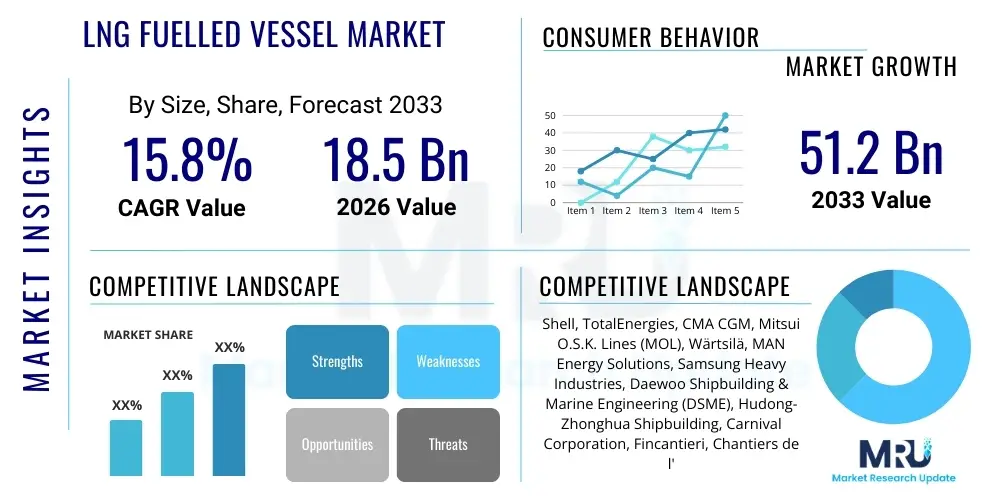

The LNG Fuelled Vessel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $51.2 Billion by the end of the forecast period in 2033.

LNG Fuelled Vessel Market introduction

The LNG Fuelled Vessel Market encompasses the design, construction, operation, and retrofitting of ships utilizing Liquefied Natural Gas (LNG) as their primary propulsion fuel. This market is fundamentally driven by the global imperative to decarbonize the maritime sector and comply with increasingly stringent environmental regulations set forth by the International Maritime Organization (IMO), particularly the 2020 sulfur cap and the Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII). LNG is considered a crucial transitional fuel, offering substantial reductions in sulfur oxides (SOx) and nitrogen oxides (NOx) emissions, virtually eliminating particulate matter, and providing a significant pathway toward meeting future net-zero targets when combined with bio-LNG or synthetic methane.

Product description within this segment primarily revolves around advanced dual-fuel engine technologies (both low-pressure and high-pressure injection systems), sophisticated cryogenic fuel storage tanks (Type A, B, C, and membrane tanks), and integrated fuel gas supply systems (FGSS). Major applications span the entire commercial maritime landscape, including large container ships, crude oil tankers, bulk carriers, cruise ships, ferries, and specialized offshore vessels. The immediate benefit for vessel operators is regulatory compliance and reduced operational costs in Emission Control Areas (ECAs), coupled with long-term advantages related to future-proofing their assets against even stricter environmental mandates.

The primary driving factors fueling market expansion include sustained pressure from shippers and charterers demanding greener supply chains, the ongoing cost-effectiveness of LNG compared to compliant marine gas oil (MGO) or very low sulfur fuel oil (VLSFO), and continuous advancements in bunkering infrastructure globally. Furthermore, government subsidies and incentives, particularly in Europe and Asia-Pacific, aimed at promoting sustainable shipping and the development of supporting logistics, have solidified LNG's position as a preferred interim solution. The market’s resilience is also attributed to its scalability and the relative maturity of dual-fuel engine technology, offering operational flexibility between LNG and traditional fuels.

LNG Fuelled Vessel Market Executive Summary

The LNG Fuelled Vessel Market is experiencing unprecedented momentum characterized by rapid order book expansion and substantial investment across the value chain. Business trends indicate a structural shift away from traditional heavy fuel oil (HFO) towards dual-fuel capabilities, primarily driven by the need for compliance with IMO's EEXI and CII frameworks, which penalize inefficient vessel operations. New shipbuilding orders for LNG-capable vessels now account for a significant percentage of the global order book, signaling long-term industry commitment. Key commercial strategies focus on building out robust LNG bunkering networks, establishing standardized safety protocols, and developing specialized small-scale LNG carriers to facilitate last-mile fuel delivery, transforming LNG from a niche fuel into a mainstream option for global trade routes.

Regional trends highlight Europe and Asia Pacific (APAC) as the central growth hubs. Europe, spearheaded by stringent EU regulations and major port initiatives (e.g., Rotterdam, Hamburg), leads in adopting LNG across ferry, cruise, and specialized vessel segments. APAC, driven by shipbuilding powerhouses like South Korea and China, dominates the construction of large LNG-fueled vessels, particularly massive container ships and bulk carriers, supported by growing bunkering infrastructure in Singapore, Shanghai, and other key trading hubs. North America is accelerating adoption, particularly in coastal shipping and Great Lakes regions, focusing on regulatory pressure related to the U.S. EPA and Canada's environmental standards, although infrastructure remains more concentrated on major coastline ports.

Segment trends underscore the dominance of container ships and tankers in terms of aggregated LNG fuel consumption capacity, owing to their size and frequent global voyages. The cruise ship segment demonstrates high growth in luxury liners adopting LNG to meet strict port-of-call emission requirements. Technological segmentation shows a clear preference for high-pressure two-stroke engines in larger vessels due to their higher efficiency and minimal methane slip, while low-pressure engines remain popular for smaller vessels requiring simpler installations. The market’s segmentation reveals a maturing industry where technology choice is closely aligned with operational profile and vessel size, maximizing both economic efficiency and environmental performance targets.

AI Impact Analysis on LNG Fuelled Vessel Market

Users frequently inquire about how artificial intelligence (AI) and machine learning (ML) can optimize the use of LNG, particularly concerning efficiency gains, safety, and addressing the technical challenge of methane slip. Common questions center on predictive maintenance schedules for complex dual-fuel engines, dynamic route planning to maximize energy efficiency against fluctuating LNG prices, and the role of AI in real-time boil-off gas (BOG) management to prevent fuel wastage. There is significant interest in understanding how AI-driven systems integrate fuel consumption data with meteorological and navigational inputs to achieve the best possible Carbon Intensity Indicator (CII) rating, thereby optimizing vessel performance and securing operational profitability.

The application of AI in the LNG fuelled vessel market is transformative, enabling operators to move beyond static performance metrics toward predictive and adaptive operational models. AI algorithms are crucial for sophisticated energy management systems (EMS) that precisely control the air-to-fuel ratio in dual-fuel engines, a critical function for minimizing methane slip—the emission of uncombusted methane, a potent greenhouse gas. Furthermore, AI-driven digital twins of vessels allow for continuous simulation and optimization of fuel handling, loading, and consumption under varying operational loads and environmental conditions, ensuring that the vessel operates within its optimal efficiency window. This capability significantly enhances the economic viability of LNG adoption, offsetting concerns related to initial capital expenditure.

Beyond technical performance, AI enhances safety and maintenance protocols. By analyzing vast streams of sensor data from cryogenic storage systems, pumps, compressors, and engines, AI identifies subtle deviations indicative of potential equipment failure long before conventional monitoring tools. This predictive maintenance minimizes downtime, reduces the risk of hazardous situations related to high-pressure LNG handling, and lowers lifecycle costs. The integration of ML into route optimization software allows vessels to dynamically adjust speed and course based on real-time factors such as congestion, weather severity, and bunkering availability, ensuring timely arrival while maximizing fuel savings, thereby delivering substantial competitive advantages in a cost-sensitive industry.

- AI optimizes engine control units (ECUs) to minimize methane slip in dual-fuel engines.

- Machine learning algorithms enable predictive maintenance for cryogenic tanks and fuel gas supply systems (FGSS), increasing reliability.

- AI-powered Energy Management Systems (EMS) integrate weather and navigational data for dynamic route optimization, maximizing fuel efficiency.

- Digital twin technology simulates vessel performance and LNG consumption under various loads, aiding operational planning.

- Automated monitoring of bunkering operations enhances safety and accuracy in LNG transfer procedures.

DRO & Impact Forces Of LNG Fuelled Vessel Market

The growth trajectory of the LNG Fuelled Vessel Market is sculpted by a confluence of powerful drivers (D), structural restraints (R), and compelling opportunities (O), collectively forming the market's impact forces. The dominant driver is the strict global regulatory landscape, spearheaded by IMO mandates for emissions reduction, pushing shipowners to adopt cleaner fuels like LNG to avoid hefty penalties and ensure market access in ECAs. Counterbalancing this growth are significant restraints, notably the high upfront capital cost associated with dual-fuel engine retrofits or new builds, the complexity of establishing a comprehensive global bunkering infrastructure, and persistent concerns regarding methane slip. However, the opportunities presented by the eventual adoption of bio-LNG and synthetic LNG (e-methane) offer a zero-carbon pathway, solidifying LNG's role beyond a transitional fuel.

Key drivers include the favorable economic equation when comparing LNG to compliant low-sulfur fuels over the life cycle of a vessel, especially when factoring in the cost avoidance related to scrubbers and environmental taxes. The growing acceptance of LNG by major charterers, who increasingly prioritize sustainability scores, also provides commercial impetus. The impact forces are further amplified by technological maturity; dual-fuel engine designs are now highly reliable and offer competitive power outputs. Restraints, however, pose structural challenges. The geographic limitations of existing bunkering facilities necessitate careful route planning, and the energy density difference requires larger fuel tanks, potentially reducing cargo space—a critical constraint for high-volume vessels like container ships. Furthermore, market uncertainty surrounding future carbon pricing mechanisms affects long-term investment decisions.

Opportunities center on diversification and innovation. The expansion into small-scale LNG bunkering solutions, including barge-to-ship and truck-to-ship services, is resolving infrastructure bottlenecks, particularly in secondary ports. The utilization of Boil-Off Gas (BOG) management technologies, such as re-liquefaction and advanced gas combustion units, addresses the efficiency concerns related to cryogenic storage, improving the overall energy balance. Finally, the synergy between LNG adoption and the future transition to ammonia or hydrogen is an influential factor. LNG vessels represent a crucial step in preparing the maritime supply chain, crew expertise, and regulatory environment for subsequent low-carbon fuels, ensuring the market remains dynamic and technologically evolving, thereby maximizing the positive impact forces on market expansion.

Segmentation Analysis

The LNG Fuelled Vessel Market is meticulously segmented based on key operational and technical characteristics, including Vessel Type, Engine Type, and Operation. This segmentation provides a granular view of adoption patterns, investment priorities, and technological preferences across the diverse maritime industry. Container ships and tankers represent the largest volume segments due to their sheer size and global operational footprint, requiring high power output and long-range capabilities, making LNG an economically viable option for fuel cost hedging and regulatory compliance. The differentiation between engine types is critical; two-stroke engines are favored for large, long-haul vessels requiring high efficiency, while four-stroke engines are typically used in smaller vessels, ferries, and auxiliary power applications.

Segmentation by operation clarifies the operational contexts where LNG offers the most immediate benefits. Deep-sea shipping dominates the market value due to the high fuel consumption involved in transoceanic voyages, making fuel price arbitrage and emission compliance paramount. Coastal and inland water shipping, while smaller in volume, show high growth rates driven by strict regional environmental regulations and the comparative ease of establishing localized bunkering infrastructure within defined corridors. Furthermore, specialized vessels, such as offshore service vessels (OSVs) and governmental ships, often adopt LNG to demonstrate environmental leadership and comply with specific operational mandates.

The structure of segmentation highlights the current maturity of LNG technology adoption. As LNG bunkering infrastructure expands beyond major global hubs, segmentation by operational profile is expected to shift, with more general cargo and bulk carriers entering the market. Analyzing engine segmentation reveals ongoing innovation focused on minimizing methane slip, pushing the industry towards highly optimized high-pressure injection systems. This detailed segmentation analysis is vital for stakeholders assessing market entry points, product development strategies, and infrastructure investment decisions across various vessel and engine classes.

- Vessel Type:

- Container Ships

- Tankers (Crude, Product, Chemical)

- Bulk Carriers

- Cruise Ships and Ferries

- Offshore Support Vessels (OSVs) and Specialized Vessels

- Engine Type:

- Two-Stroke Engines (High Pressure and Low Pressure)

- Four-Stroke Engines (High Pressure and Low Pressure)

- Operation:

- Deep-Sea Shipping

- Coastal and Inland Shipping

Value Chain Analysis For LNG Fuelled Vessel Market

The LNG Fuelled Vessel Market value chain is complex, spanning energy production, logistics, infrastructure development, shipbuilding, and end-user operation. Upstream activities begin with the exploration, extraction, and liquefaction of natural gas, a highly capital-intensive process requiring large-scale plants. Key players in this segment are major international energy companies and national oil companies (NOCs) responsible for converting pipeline gas into cryogenic LNG suitable for marine transport. Efficiency and cost structure at the liquefaction stage directly influence the final delivered price of LNG marine fuel, making upstream relationships crucial for long-term supply stability and hedging against volatility.

The midstream component focuses on the crucial logistics and distribution channels necessary to move LNG from liquefaction terminals to the vessels. This segment involves specialized transportation via large LNG carriers and the critical development of LNG bunkering infrastructure, which includes floating storage units (FSUs), dedicated LNG bunkering vessels (LNGBVs), and shore-side terminals. Distribution channels are rapidly diversifying, involving port authorities, specialized bunkering service providers (both direct and indirect services), and third-party logistics firms that manage the complex process of ship-to-ship, truck-to-ship, or terminal-to-ship refueling operations. The efficiency and geographic reach of the distribution network are primary determinants of market adoption rates.

Downstream involves the shipbuilding industry, engine manufacturers, system integrators (cryogenic storage and FGSS), and the end-users—shipowners and operators. Direct distribution occurs when major energy suppliers contract directly with large fleet operators. Indirect distribution relies on established marine fuel traders and brokering firms. Shipowners are positioned at the consumer end, making investment decisions based on total cost of ownership (TCO), regulatory compliance needs, and the availability of maintenance and repair services for specialized dual-fuel systems. The final stage involves maintenance, repair, and overhaul (MRO) services, often requiring specialized expertise in handling cryogenic components and complex gas systems, ensuring the long-term operational viability of the fleet.

LNG Fuelled Vessel Market Potential Customers

The primary potential customers and end-users of LNG fuelled vessels are commercial shipping companies and fleet operators across various maritime sectors who face immediate regulatory pressure to reduce their environmental footprint and secure long-term operational cost advantages. This encompasses major global shipping lines operating container feeder vessels and mega-max container carriers, international tanker organizations transporting crude oil and refined products, and large dry bulk operators moving iron ore and coal. These entities prioritize vessels with high fuel efficiency, long range, and guaranteed access to bunkering facilities on major trade routes, viewing LNG as a necessity for maintaining competitiveness and market access in environmentally sensitive areas.

Another significant segment of potential buyers includes cruise line corporations and ferry operators, particularly those servicing highly regulated coastal zones, such as the Baltic Sea, North Sea, and North American coasts. For these passenger-focused operators, the reduction of SOx and particulate matter is critical not only for compliance but also for public health perception and enhancing the passenger experience, especially when operating near urban ports. Their purchasing decisions are heavily influenced by the need for quiet operation and zero local emissions capabilities while maneuvering, making dual-fuel technology highly attractive despite the operational complexities of frequent port calls.

Finally, governmental agencies, naval fleets, and specialized maritime service providers (e.g., offshore supply vessel operators, ice-class vessel owners, dredging companies) constitute niche but high-value customer segments. These organizations often lead in adopting advanced environmental technologies to comply with public procurement mandates or specific operational requirements in environmentally fragile zones (e.g., Arctic exploration). Their demand focuses on reliability, redundancy, and specialized tank designs suitable for harsh operating conditions, demonstrating a willingness to absorb higher capital expenditure for long-term strategic and environmental benefits. The collective shift in demand across these groups confirms the mainstreaming of LNG as a foundational marine energy source.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $51.2 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shell, TotalEnergies, CMA CGM, Mitsui O.S.K. Lines (MOL), Wärtsilä, MAN Energy Solutions, Samsung Heavy Industries, Daewoo Shipbuilding & Marine Engineering (DSME), Hudong-Zhonghua Shipbuilding, Carnival Corporation, Fincantieri, Chantiers de l'Atlantique, Kawasaki Heavy Industries, Viking Line, TOTE Maritime, Korea Shipbuilding & Offshore Engineering (KSOE), ExxonMobil, Crowley Maritime Corporation, Pasha Group, GasLog Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LNG Fuelled Vessel Market Key Technology Landscape

The technological landscape of the LNG Fuelled Vessel market is dominated by advancements in dual-fuel engine systems, cryogenic containment solutions, and sophisticated fuel gas supply systems (FGSS). Dual-fuel engine technology is segmented primarily into two-stroke and four-stroke variants, each optimizing for different vessel types. Two-stroke engines, predominantly used in large vessels like container ships and bulk carriers, feature high power density and fuel efficiency. A critical technological distinction lies between low-pressure (LP) and high-pressure (HP) injection systems. HP systems (like MAN’s ME-GI) offer superior efficiency and near-zero methane slip but require more complex, higher-pressure infrastructure. LP systems (like Wärtsilä's offerings) are simpler but may suffer from higher methane slip, pushing R&D efforts towards LP engine optimization technologies.

Cryogenic fuel storage technology is equally pivotal. Vessels utilize specialized tanks, most commonly Type C tanks (pressure vessels used for smaller volumes and ferries) or the highly integrated membrane tanks (used extensively on large LNG carriers and container ships). Technological focus here is on insulation efficiency, structural integrity, and managing thermal stratification to maintain the LNG in its liquid state (-162°C). Innovations such as vacuum-insulated systems and advanced thermal management materials are reducing the heat ingress, thereby minimizing the rate of Boil-Off Gas (BOG). Effective BOG management is essential, involving technologies like re-liquefaction plants installed onboard or advanced gas combustion units that utilize the BOG in the engine or auxiliary boilers, ensuring minimal wasted fuel and maximizing operational safety.

The integration and control systems, collectively known as the Fuel Gas Supply System (FGSS), represent a core technological challenge. The FGSS must reliably deliver LNG to the engines while ensuring compliance with stringent safety codes (such as the IMO IGF Code). Modern FGSS solutions incorporate automated purging and inerting systems, leak detection sensors, and highly precise pressure and temperature controls. Ongoing technological development focuses on system modularization for easier installation during retrofits, improved standardization across different engine manufacturers, and integrating these systems with vessel-wide digitalization platforms. The continuous evolution of these core technologies is critical for addressing industry concerns regarding safety, efficiency, and environmental performance, reinforcing LNG's role as a technologically mature alternative fuel.

Regional Highlights

The LNG Fuelled Vessel market demonstrates distinct adoption patterns across global regions, heavily influenced by local regulatory stringency, existing bunkering infrastructure maturity, and dominant shipbuilding capacity.

- Asia Pacific (APAC): APAC is the engine room of the global LNG-fueled vessel market, primarily due to its dominance in shipbuilding (South Korea, China, Japan) and its strategic control over major maritime trade routes. South Korea leads in constructing large, complex LNG-fueled container ships and LNG carriers, benefiting from robust government support and high technological expertise. Singapore acts as the leading global LNG bunkering hub, solidifying the fuel's supply reliability in the region. The increasing adoption of LNG by domestic shipping fleets in China and India further drives regional demand, propelled by national air quality targets and port emission regulations.

- Europe: Europe exhibits the highest regulatory drive and operational penetration, particularly in the ferry, cruise, and specialized coastal shipping sectors. Regulations from the European Union (EU Fit for 55 package) and the existence of established Emission Control Areas (ECAs) in the Baltic and North Seas mandate the use of cleaner fuels. Major ports like Rotterdam, Antwerp, and Hamburg have invested heavily in robust shore-side and ship-to-ship bunkering infrastructure, creating a mature ecosystem. Scandinavian countries, in particular, lead in small-scale LNG adoption and utilizing bio-LNG, positioning Europe as a frontrunner in transitioning to net-zero maritime operations.

- North America: North America presents a growing, albeit segmented, market. Adoption is strong in coastal trade (e.g., TOTE Maritime) and inland waterways, driven by specific EPA regulations and the availability of abundant, competitively priced natural gas derived from shale resources. Infrastructure development is concentrated along the US Gulf Coast, which facilitates bunkering for crude and product tankers, and the East Coast. However, the regulatory patchwork and the comparative geographical spread of ports pose challenges, necessitating continuous investment in flexible bunkering solutions like truck-to-ship operations to cover less central locations.

- Middle East and Africa (MEA) & Latin America (LATAM): These regions are emerging markets, primarily focused on supporting their large hydrocarbon export operations and specific localized trade routes. MEA, leveraging its position as a major LNG exporter (Qatar, UAE), is strategically developing bunkering facilities to capture transit traffic through the Suez Canal and major oil routes. LATAM’s growth is nascent, focused on regional ferry services and offshore support vessels operating in energy exploration fields, relying primarily on truck-to-ship transfer until large-scale LNG bunkering infrastructure becomes widespread.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LNG Fuelled Vessel Market.- Wärtsilä

- MAN Energy Solutions

- Shell

- TotalEnergies

- CMA CGM

- Mitsui O.S.K. Lines (MOL)

- Samsung Heavy Industries

- Daewoo Shipbuilding & Marine Engineering (DSME)

- Hudong-Zhonghua Shipbuilding

- Carnival Corporation

- Fincantieri

- Chantiers de l'Atlantique

- Kawasaki Heavy Industries

- Viking Line

- TOTE Maritime

- Korea Shipbuilding & Offshore Engineering (KSOE)

- ExxonMobil

- Crowley Maritime Corporation

- Pasha Group

- GasLog Ltd.

- Höegh LNG

- Siemens Energy

- ABS (American Bureau of Shipping)

- DNV (Det Norske Veritas)

- Bureau Veritas

Frequently Asked Questions

Analyze common user questions about the LNG Fuelled Vessel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for adopting LNG as a marine fuel?

The primary driver is the stringent emission regulations imposed by the IMO, specifically the 2020 sulfur cap and the Energy Efficiency Existing Ship Index (EEXI), which mandate significant reductions in SOx, NOx, and particulate matter, pushing operators toward cleaner alternatives like LNG.

What are the main drawbacks associated with LNG-fueled vessels?

Key drawbacks include the high initial capital expenditure for vessel construction or retrofit, the complexity of developing sufficient global bunkering infrastructure, and the challenge of methane slip, where uncombusted methane (a potent greenhouse gas) is emitted.

How do high-pressure and low-pressure dual-fuel engines compare in terms of efficiency?

High-pressure injection two-stroke engines generally offer superior fuel efficiency and significantly lower methane slip compared to low-pressure systems, making them preferred for large, long-haul vessels, although they require more complex fuel handling systems.

Which regions are leading in the development of LNG bunkering infrastructure?

Europe (led by the Netherlands and Germany) and Asia Pacific (led by Singapore and South Korea) are the global leaders in developing and operating comprehensive LNG bunkering infrastructure, including dedicated bunkering vessels and shore-side terminals.

Will LNG remain viable as the shipping industry transitions toward net-zero targets?

Yes, LNG is considered a crucial transitional fuel. Its infrastructure and engine technology are compatible with bio-LNG (from sustainable sources) and synthetic e-methane, offering a viable, near-zero carbon pathway that ensures the long-term utility of current LNG investments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager