LNG Insulation Panel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432234 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

LNG Insulation Panel Market Size

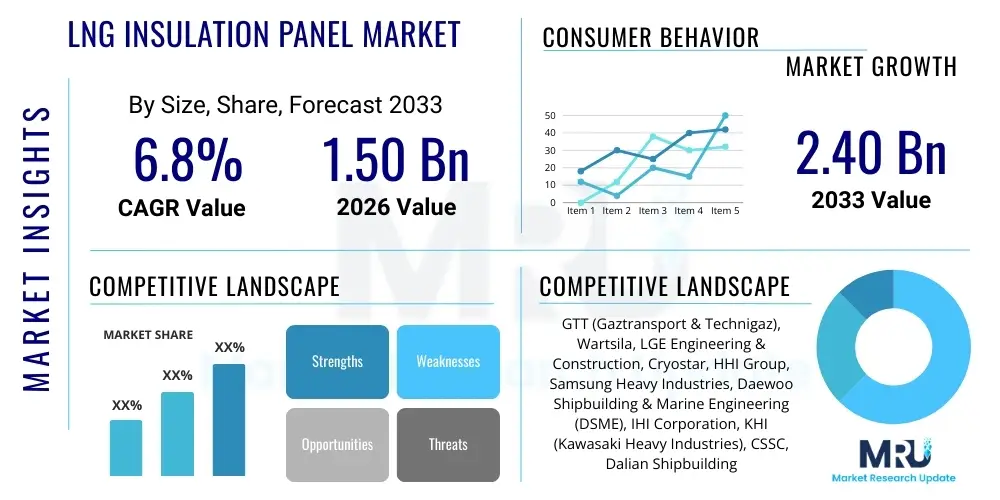

The LNG Insulation Panel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.50 billion in 2026 and is projected to reach USD 2.40 billion by the end of the forecast period in 2033.

LNG Insulation Panel Market introduction

The Liquefied Natural Gas (LNG) Insulation Panel Market encompasses highly specialized thermal management systems designed to maintain cryogenic temperatures, typically around -162°C (-260°F), required for transporting and storing LNG efficiently and safely. These panels are critical components in minimizing boil-off gas (BOG) losses, which represent significant economic and operational inefficiencies. The primary function of these insulation systems is to provide exceptional thermal resistance, mechanical stability, and fire resistance, crucial for the long service life of LNG infrastructure, especially in dynamic marine environments. The complexity of LNG insulation is driven by the stringent regulatory requirements from maritime bodies and energy safety organizations, demanding materials that can withstand extreme temperature gradients and structural stresses.

Product descriptions within this market vary primarily based on the underlying technology, predominantly falling into membrane-type containment systems (such as those developed by GTT, utilizing specialized plywood and high-density foam) and spherical tank systems (Moss type). Common insulation materials utilized include high-density polyurethane foam (PUF), fiberglass reinforced plastics (FRP), and more recently, advanced materials like vacuum insulated panels (VIPs) and aerogels for enhanced performance in thinner profiles. Major applications span the entire LNG value chain, including insulation for large LNG carriers (LNGCs), Floating Storage and Regasification Units (FSRUs), onshore liquefaction plants, storage tanks, and smaller LNG bunkering vessels and terminals.

The market is predominantly driven by the global energy transition favoring cleaner fuels, leading to increased demand for LNG trade and infrastructure development. Key benefits derived from high-performance LNG insulation panels include reduced operating costs due to minimized cargo loss, enhanced safety profiles by preventing cold spots and structural damage, and compliance with increasingly strict environmental regulations regarding methane emissions. Furthermore, the push towards smaller-scale LNG facilities and the growth of LNG as a marine fuel (bunkering) are expanding the application scope for these specialized panels, fostering innovation in materials science and installation techniques to improve efficiency and reduce construction time.

LNG Insulation Panel Market Executive Summary

The LNG Insulation Panel Market is experiencing robust growth fueled by geopolitical shifts emphasizing energy security and the ongoing global transition towards gas as a bridge fuel, particularly in Asia Pacific and Europe. Business trends indicate a strong focus on large-scale shipbuilding, primarily for ultra-large LNG carriers (ULNGCs) and FSRUs, which require massive volumes of specialized containment system components. Technology providers are increasingly focusing on materials innovation, specifically the integration of composite materials and advanced insulation technologies like cryogenic vacuum insulation to improve thermal efficiency beyond traditional PUF/FRP systems, addressing the industry demand for lower boil-off rates (BORs). Consolidation among shipyards and strategic partnerships between insulation material suppliers and containment system licensors are defining the competitive landscape, aiming for standardization and cost optimization in complex cryogenic projects.

Regional trends highlight the Asia Pacific region, particularly China, South Korea, and Japan, as the dominant hubs for both LNG carrier construction and demand, driving substantial growth in panel consumption. South Korean shipyards hold a near-monopoly on high-specification LNGC construction, creating a localized demand cluster for advanced insulation systems. Europe is also emerging as a critical market, driven by the rapid development of import terminals and FSRU deployments following regional energy supply disruptions, focusing on quick construction times and proven technology. Meanwhile, the North American market sees steady demand associated with expansion projects for LNG export terminals along the Gulf Coast, necessitating large volumes of insulation for onshore storage tanks and associated piping.

Segmentation trends reveal that the Membrane Containment System segment, dominated by GTT technologies (Mark III and NO96), maintains the largest market share due to its flexibility, high volume capacity, and proven track record in maritime transport. Within material types, Polyurethane Foam (PUF) remains the volume leader due to its cost-effectiveness and favorable thermal properties, though there is increasing penetration by advanced materials like aerogels in niche applications requiring maximum space efficiency. Furthermore, the application segment of LNG Carriers (LNGCs) dictates the majority of market revenue, but the Bunkering and Small-Scale LNG segment is showing the highest growth trajectory, spurred by stricter IMO environmental regulations pushing marine operators towards LNG fuel usage.

AI Impact Analysis on LNG Insulation Panel Market

User inquiries regarding AI's influence in the LNG Insulation Panel market often center on three key themes: predictive maintenance for insulation integrity, optimization of manufacturing processes, and design phase material selection. Users are concerned about the longevity and performance degradation of panels over the typical 40-year lifespan of LNG assets. They frequently ask how AI can detect micro-cracks or insulation failure points before they lead to catastrophic boil-off increases or structural issues. Furthermore, there is significant user interest in leveraging AI/Machine Learning (ML) to optimize the complex nesting and cutting patterns of custom insulation panels (especially in membrane systems) to minimize material waste, a high cost factor in production. The expectation is that AI will provide real-time performance monitoring, vastly improving asset reliability and operational safety while simultaneously reducing manufacturing costs through algorithmic optimization of production lines.

AI and ML technologies are poised to transform the lifecycle management of LNG insulation. By integrating sensor data from temperature monitoring systems, acoustic emission sensors, and visual inspection robots, AI algorithms can establish performance baselines and identify anomalies indicative of insulation breaches or structural movement. This shift from time-based maintenance to condition-based and predictive maintenance ensures that repair or replacement interventions are executed precisely when needed, extending asset life and maintaining optimal thermal efficiency. Moreover, in the design and engineering phase, Generative Design AI can rapidly evaluate thousands of material combinations and geometrical configurations to optimize panel thickness, density, and placement, balancing thermal performance requirements against weight and cost constraints, leading to superior final product specifications.

- AI-driven Predictive Maintenance: Utilizing ML models on acoustic and thermal sensor data to forecast potential insulation failure points (e.g., cold spots, water ingress) in LNG tanks and carriers, optimizing inspection schedules.

- Manufacturing Optimization: Implementation of AI-powered computer vision systems for quality control in PUF spraying and panel lamination, ensuring material uniformity and reducing defects.

- Supply Chain Efficiency: Applying predictive analytics to forecast demand for specific insulation materials (e.g., PUF vs. VIPs) based on global shipbuilding backlogs and regional energy projects, optimizing inventory management.

- Generative Design: AI assisting in the computational fluid dynamics (CFD) modeling of cargo tanks to simulate heat transfer and mechanically stress, optimizing panel dimensions and material layering for minimum boil-off gas rates (BOR).

- Autonomous Inspection Systems: Deployment of AI-guided drones and robots equipped with specialized sensors (e.g., infrared cameras) for automated, high-resolution inspection of large storage tank exteriors and difficult-to-access areas.

DRO & Impact Forces Of LNG Insulation Panel Market

The dynamics of the LNG Insulation Panel market are dictated by a confluence of robust drivers stemming from global energy demand and strict regulatory restraints related to safety and environmental performance, balanced against significant opportunities arising from technological advancements and emerging applications. The primary driver is the accelerating international trade of LNG, necessitating continuous investment in new LNGCs and storage terminals worldwide. Concurrently, the stringent safety standards imposed by organizations such as the International Maritime Organization (IMO) and classification societies (e.g., DNV, Lloyd's Register) mandate the use of certified, high-performance, and fire-resistant cryogenic insulation, maintaining a high entry barrier for suppliers and ensuring premium pricing for specialized products. These powerful forces collectively shape market growth by pushing innovation toward higher efficiency and greater operational reliability in extremely demanding cryogenic environments.

Key drivers include the substantial demand surge for LNG bunkering infrastructure as maritime emissions regulations tighten (IMO 2020), prompting vessel operators to switch to LNG fuel, requiring small-scale, high-efficiency storage solutions. Furthermore, the push for energy independence and diversification, especially in Europe and parts of Asia, accelerates the construction of new FSRUs and onshore regasification facilities, all heavily reliant on specialized insulation for their storage components. However, significant restraints impede faster growth, primarily the high capital expenditure associated with materials and installation, especially for advanced systems like Vacuum Insulated Panels (VIPs) or bespoke membrane systems. The complex, highly regulated, and long lead times in the shipbuilding industry also create cyclical market dependence, making planning and investment challenging for insulation suppliers.

Opportunities within the market are abundant, notably the development and commercialization of next-generation insulation materials, such as aerogels and composite structures, offering superior thermal performance with reduced thickness and weight, potentially lowering overall vessel construction costs and improving cargo capacity. There is also a substantial opportunity in the maintenance, repair, and overhaul (MRO) sector, as the aging global fleet of LNG carriers requires periodic inspection and replacement of insulation components to maintain efficiency. Furthermore, the expanding utilization of small-scale LNG applications, including remote power generation and regional distribution networks, opens up new customer bases beyond traditional large-scale shipping and storage projects, offering diversification for manufacturers skilled in cryogenic material handling.

Segmentation Analysis

The LNG Insulation Panel market is broadly segmented based on Material Type, Insulation Technology, and Application, reflecting the diverse requirements of the LNG value chain from production to end-use. Material type segmentation reveals the technological hierarchy, ranging from conventional, cost-effective polyurethane foam (PUF) to high-performance, higher-cost materials like aerogel-based composites and specialized Vacuum Insulated Panels (VIPs). This segmentation is critical as material choice directly impacts the resultant Boil-Off Rate (BOR) and the mechanical robustness of the containment system. The dominance of foam-based systems is challenged by the need for ultra-low BORs in long-distance transportation and FSRUs, driving interest in hybrid solutions combining traditional materials with advanced cryogenic barriers.

Insulation Technology segmentation focuses on the structural approach used in cargo containment. Membrane containment systems, largely proprietary technologies like GTT’s Mark III and NO96, hold the majority market share, especially in LNGCs, due to their efficiency in maximizing cargo space. The alternative, the Moss-type spherical tank, uses specialized rigid panel systems, maintaining relevance for specific vessel designs and capacity requirements. Understanding this segmentation is vital for suppliers, as material specifications and panel geometries differ drastically between membrane and Moss systems, requiring specialized manufacturing and installation expertise tailored to each patented technology.

Application segmentation illustrates where the primary demand originates, with LNG Carriers being the dominant segment, consuming the largest volume of specialized panels. However, strategic growth is anticipated in the Onshore Storage Tanks segment, particularly as large liquefaction and regasification terminals expand, and in the burgeoning LNG Bunkering segment, which requires compact, highly robust insulation for smaller fuel tanks used in marine propulsion. The segmentation structure provides a clear roadmap for market participants to tailor their material offerings and design services to the specific operational and regulatory needs of each end-user category.

- Material Type:

- Polyurethane Foam (PUF)

- Phenolic Foam

- Fiber Reinforced Plastic (FRP)

- Polyisocyanurate (PIR)

- Cryogenic Vacuum Insulated Panels (VIPs)

- Aerogels and Composite Materials

- Mineral Wool and Perlite

- Insulation Technology:

- Membrane Containment Systems (e.g., GTT Mark III, NO96)

- Spherical Tank Systems (Moss Type)

- Prismatic Tank Systems (Type B, Type C)

- Application:

- LNG Carriers (LNGCs)

- Floating Storage and Regasification Units (FSRUs)

- Onshore Storage Tanks (Liquefaction/Regasification Terminals)

- Offshore Platforms and FLNG (Floating LNG)

- LNG Bunkering Facilities and Small-Scale LNG

Value Chain Analysis For LNG Insulation Panel Market

The value chain for the LNG Insulation Panel market is highly specialized and capital-intensive, starting with the upstream sourcing of crucial raw materials, primarily petrochemical derivatives and specialized composites. Upstream analysis involves major chemical companies supplying basic components like isocyanates and polyols for Polyurethane Foam (PUF) production, as well as suppliers of high-performance materials like fiberglass, aluminum foil, and aerogel precursors. Supply security and price volatility of these chemical inputs significantly impact the final cost structure of the insulation panels. Due to the requirement for specific mechanical and thermal certifications, material sourcing is often highly regulated and restricted to approved suppliers by licensors such as GTT, maintaining stringent quality control throughout the foundational stages.

The midstream involves specialized manufacturing and assembly, where raw materials are converted into finished insulation panels, blocks, or blankets. This stage is dominated by specialized insulation manufacturers who work closely with containment system licensors (GTT being paramount) and major shipyards. The manufacturing processes—including foaming, lamination, and precision cutting—are complex, requiring high investment in customized machinery and cleanroom environments to maintain cryogenic performance integrity. The downstream distribution channel is largely direct and project-specific. Insulation panels are typically supplied directly from the manufacturer to the major shipbuilding yards (in the case of LNGCs) or to EPC contractors (for onshore storage tanks) under long-term supply agreements tailored to massive infrastructure projects.

Direct channels involve manufacturers delivering finished goods to large, specific, end-user projects, such as a South Korean shipyard constructing a fleet of LNG carriers. Indirect channels are less common but may involve specialized distributors or system integrators handling smaller, ancillary cryogenic systems or regional repair and retrofit projects, particularly in the emerging LNG bunkering segment. The success of the value chain is highly dependent on close collaboration between material suppliers, panel manufacturers, containment system designers, and the final integrators (shipyards/EPCs) to ensure seamless integration and adherence to the required low-temperature performance specifications. Patent and licensing agreements, particularly those related to membrane technology, heavily influence market participation and profit distribution across the value chain.

LNG Insulation Panel Market Potential Customers

Potential customers for LNG Insulation Panels are defined by their engagement in the construction, ownership, or operation of assets requiring cryogenic containment systems for LNG. The primary customer segment comprises global shipbuilding giants, predominantly those located in South Korea, China, and Japan, responsible for constructing high-capacity LNG carriers (LNGCs), FSRUs, and other specialized marine vessels. These shipyards act as the direct procurement point, integrating the insulation systems into the cargo containment structures according to classification society rules and client specifications. Since LNGC projects are multi-billion dollar contracts, insulation suppliers must demonstrate financial stability, scalability, and strict adherence to quality assurance protocols over extended delivery periods.

The second critical customer group includes Engineering, Procurement, and Construction (EPC) companies specializing in large-scale energy infrastructure development, such as onshore liquefaction terminals, receiving terminals, and large storage tanks. These customers purchase massive volumes of insulation panels (often rigid blocks or customized cladding systems) and materials for site installation. For EPCs, key purchasing criteria include ease of installation, longevity, fire safety ratings, and the overall system’s ability to meet stringent thermal performance guarantees to minimize boil-off gas during long-term storage. This segment often favors suppliers capable of providing turnkey solutions, including technical consulting and on-site support.

Finally, a growing segment consists of specialized marine operators and fleet owners involved in LNG bunkering and small-scale LNG distribution. As more commercial vessels switch to LNG fuel, there is increasing demand for robust, compact, and highly efficient insulation systems for onboard fuel tanks. Furthermore, industrial gas companies and regional energy distributors utilizing micro-LNG plants or ISO tanks for remote supply represent niche but high-growth customers. For these buyers, flexibility in panel size, quick delivery times, and robust performance under cyclical loading conditions are primary factors influencing purchasing decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.50 billion |

| Market Forecast in 2033 | USD 2.40 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GTT (Gaztransport & Technigaz), Wartsila, LGE Engineering & Construction, Cryostar, HHI Group, Samsung Heavy Industries, Daewoo Shipbuilding & Marine Engineering (DSME), IHI Corporation, KHI (Kawasaki Heavy Industries), CSSC, Dalian Shipbuilding Industry Co. (DSIC), Aspen Aerogels, Owens Corning, Armacell, Rockwool International, Kingspan Group, BASF SE, Dow Inc., Mitsui E&S, Sumitomo Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LNG Insulation Panel Market Key Technology Landscape

The technology landscape of the LNG Insulation Panel market is highly concentrated around achieving superior thermal performance, mechanical stability, and adherence to extreme fire safety standards, primarily driven by the evolution of containment system designs. The dominant technology remains the membrane containment system, championed by Gaztransport & Technigaz (GTT). These systems, specifically Mark III and NO96, rely on layered insulation structures built directly into the inner hull of the vessel. Mark III utilizes reinforced polyurethane foam panels affixed to the inner hull, layered with a primary and secondary membrane. The NO96 system uses a plywood-foam structure. Technological advancements in this area focus on refining the polyurethane foam composition—increasing density, improving closed-cell content, and ensuring optimal adhesion between layers to withstand the continuous contraction and expansion cycles caused by cryogenic temperature changes.

The innovation trajectory is heavily leaning towards the integration of advanced materials to push down the boil-off rate (BOR) below 0.1% per day, which is increasingly demanded by shipowners for enhanced operational efficiency. Key emerging technologies include Vacuum Insulated Panels (VIPs) and high-performance aerogel-based composites. VIPs offer significantly reduced thermal conductivity compared to standard foam, allowing for thinner insulation profiles, thus maximizing cargo volume. While VIPs face challenges related to potential vacuum degradation over time, they are finding specialized application in specific areas of the cargo tanks and in small-scale LNG applications where space optimization is critical. Aerogels, known for their ultra-low thermal conductivity, are being incorporated into blankets or hybrid panel structures to boost the performance of traditional PUF/FRP systems without drastically altering the installation process.

Furthermore, technology development is also concentrating on installation and monitoring. Automated robotic welding and inspection systems are being developed to ensure the flawless construction of the primary and secondary barriers in membrane tanks, where even minor defects can compromise the integrity of the insulation space. Integration of fiber optic sensors and embedded temperature probes within the insulation layers represents a key technological frontier, allowing for real-time monitoring of thermal gradients and early detection of potential leaks or cold spots. This shift toward smart insulation systems not only improves operational safety but also facilitates the implementation of AI-driven predictive maintenance strategies, ensuring optimal performance throughout the vessel's lifetime.

Regional Highlights

- Asia Pacific (APAC): Dominance in Shipbuilding and Consumption The Asia Pacific region is the unequivocal global powerhouse for the LNG Insulation Panel market, driven by both supply-side manufacturing capacity and robust demand for LNG imports. South Korea, specifically its 'Big Three' shipyards (HHI, Samsung Heavy Industries, DSME), commands over 80% of the global order book for large LNGCs, making it the largest concentrated demand center for insulation panels tied to GTT membrane technology. China is rapidly catching up, increasing its shipbuilding capacity and contributing significantly to the demand for insulation materials for both domestic use and export projects. Japan remains a steady buyer, focusing on maintenance and highly reliable insulation systems for its vast fleet and regasification terminals. The region’s massive energy requirements and long-term commitment to LNG necessitate continuous expansion of both maritime and onshore cryogenic infrastructure, ensuring sustained, high-volume demand.

- Europe: Focus on Energy Security and FSRU Deployment Europe has emerged as a high-growth, high-value region, particularly following geopolitical shifts that necessitated rapid diversification of gas supply. This has triggered an unprecedented surge in demand for Floating Storage and Regasification Units (FSRUs) and associated onshore terminal expansions. European projects prioritize speed of deployment and adherence to stringent EU environmental standards, often requiring premium insulation materials and specialized installation expertise. While European shipyards contribute less to LNGC construction than APAC, the focus on complex FSRU conversion projects and the rapid development of LNG bunkering hubs along major shipping routes ensures substantial demand for high-performance, complex insulation solutions for small-to-mid-scale applications.

- North America: Export Terminal Expansion and Onshore Storage North America, primarily the United States, is positioned as a major LNG exporter, driving substantial demand for insulation panels used in onshore liquefaction facilities, storage tanks, and associated pipelines, particularly along the Gulf Coast. The insulation requirements here focus heavily on rigid, large-scale panel systems suitable for land-based storage tanks (often Type A prismatic tanks or flat-bottomed tanks), which require superior structural integrity and longevity in diverse climatic conditions. The regulatory framework, governed by entities like the Federal Energy Regulatory Commission (FERC), dictates robust insulation specifications. Growth is tied directly to the approval and construction pace of new multi-billion dollar export terminals, requiring multi-year supply contracts for materials.

- Middle East and Africa (MEA): Production Capacity Growth and Localized Demand MEA represents a critical region primarily from a production and export standpoint. Major producers like Qatar, Australia (often grouped with APAC data but serving global markets), and emerging African nations are expanding liquefaction capacity. This drives localized demand for insulation panels for massive onshore storage facilities supporting these export projects. Demand in this region is characterized by very large-scale, long-duration projects demanding the highest quality, durable insulation capable of withstanding harsh desert or high-humidity coastal environments. As bunkering operations expand in strategic locations like the UAE and South Africa, a secondary market for small-scale cryogenic insulation is also developing.

- Latin America: Emerging Market for Imports and Regional Supply Latin America remains a developing market characterized by import requirements and specific regional projects. Countries like Brazil, Chile, and Argentina utilize FSRUs and onshore terminals for energy needs, generating demand for related insulation maintenance and installation services. Market growth is sporadic but tied to national energy policies and infrastructure financing. While not a major shipbuilding hub, the region presents opportunities for suppliers of retrofit services and specialized insulation for regional distribution infrastructure, especially concerning small-scale LNG used for industrial or remote power applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LNG Insulation Panel Market.- GTT (Gaztransport & Technigaz)

- HHI Group (Hyundai Heavy Industries)

- Samsung Heavy Industries

- Daewoo Shipbuilding & Marine Engineering (DSME)

- Aspen Aerogels

- Wartsila

- LGE Engineering & Construction

- Cryostar

- IHI Corporation

- KHI (Kawasaki Heavy Industries)

- CSSC (China State Shipbuilding Corporation)

- Dalian Shipbuilding Industry Co. (DSIC)

- Owens Corning

- Armacell

- Rockwool International

- Kingspan Group

- BASF SE

- Dow Inc.

- Mitsui E&S

- Sumitomo Chemical

Frequently Asked Questions

Analyze common user questions about the LNG Insulation Panel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of LNG insulation panels and what materials are commonly used?

The primary function of LNG insulation panels is to maintain the cryogenic temperature of Liquefied Natural Gas (approximately -162°C) to prevent excessive boil-off gas (BOG) and ensure structural integrity of containment systems. Commonly used materials include high-density polyurethane foam (PUF), Fiber Reinforced Plastic (FRP), and advanced options like aerogels and Vacuum Insulated Panels (VIPs), selected based on required thermal performance and mechanical strength specific to maritime or onshore applications.

How does the choice of insulation technology affect LNG carrier efficiency?

Insulation technology, predominantly defined by Membrane Systems (GTT Mark III/NO96) versus Moss Spherical Tanks, critically impacts cargo capacity and boil-off rate (BOR). Membrane systems maximize cargo volume utilization and rely on highly efficient layered insulation panels to achieve ultra-low BORs, typically below 0.1% per day. Superior insulation performance directly translates to reduced cargo loss during transit and lower operational costs for ship owners.

Which geographical region dominates the demand for LNG insulation panels?

The Asia Pacific region, specifically South Korea, China, and Japan, dominates the demand for LNG insulation panels. This dominance is driven by South Korea's near-monopoly on high-specification LNG carrier (LNGC) construction, coupled with the immense regional energy demand necessitating continuous expansion of LNG import and storage infrastructure across APAC.

What impact are stricter environmental regulations having on LNG insulation material development?

Stricter environmental regulations, particularly those promoting LNG as a marine fuel (bunkering), are driving demand for highly efficient, compact insulation materials with zero ozone depletion potential (ODP) and low global warming potential (GWP). This encourages the development of advanced solutions like aerogels and hybrid panels that minimize boil-off and enhance fuel efficiency, supporting the industry's compliance goals related to greenhouse gas reduction.

Are Vacuum Insulated Panels (VIPs) becoming a standard alternative to traditional PUF panels?

While traditional Polyurethane Foam (PUF) remains the industry standard due to cost and proven reliability, Vacuum Insulated Panels (VIPs) are increasingly being adopted in niche and high-performance applications, such as small-scale LNG tanks and specific segments of FSRUs, where maximizing space and achieving exceptionally low thermal conductivity are paramount. VIPs are not yet a standard replacement due to higher cost and long-term vacuum integrity concerns, but they are a key technological growth area.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager