LNG Liquefaction Equipment Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437344 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

LNG Liquefaction Equipment Sales Market Size

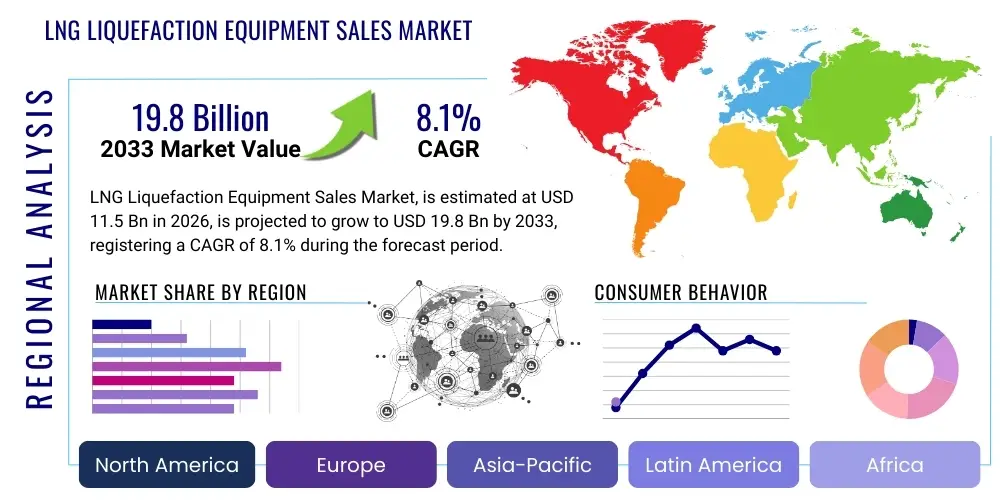

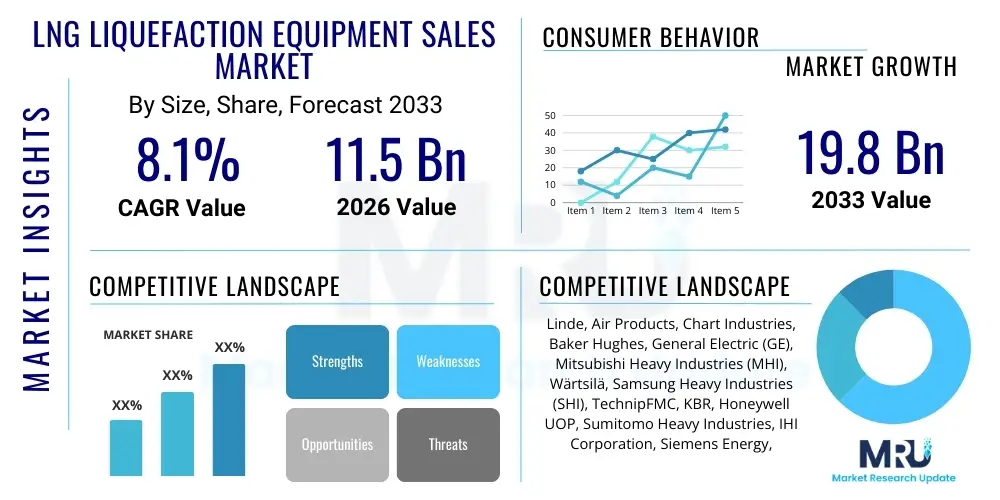

The LNG Liquefaction Equipment Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 19.8 Billion by the end of the forecast period in 2033.

LNG Liquefaction Equipment Sales Market introduction

The LNG Liquefaction Equipment Sales Market encompasses the manufacturing, distribution, and deployment of specialized machinery and systems essential for cooling natural gas below -162°C (-260°F), transforming it into Liquefied Natural Gas (LNG). This critical equipment includes main cryogenic heat exchangers, compressors, turbines, purification systems, storage tanks, and associated modules necessary for efficient energy transformation and volume reduction. The primary objective of liquefaction is to significantly reduce the volume of natural gas, enabling its safe and economical transport across vast distances via specialized LNG carriers, particularly where pipeline infrastructure is infeasible or impractical. The demand for these sophisticated systems is directly tied to global natural gas consumption patterns and the ongoing strategic shift towards cleaner fossil fuels as transitional energy sources.

Major applications of LNG liquefaction equipment span large-scale export terminals, floating liquefaction facilities (FLNG), mid-scale modular plants, and small-scale operations catering to local bunkering or peak-shaving needs. The continuous development of more efficient liquefaction cycles, such as the mixed refrigerant process and optimized cascade cycles, drives equipment innovation and replacement cycles. Benefits derived from advanced liquefaction technologies include enhanced energy efficiency, reduced operational expenditure (OPEX), higher throughput capacity, and decreased environmental footprint compared to older generation technologies. Furthermore, the strategic deployment of modular and standardized equipment reduces construction time and mitigates project risks, accelerating the global proliferation of LNG supply chains.

Driving factors propelling market expansion are fundamentally linked to global energy security concerns, the increasing adoption of natural gas as a substitute for coal in power generation, and the burgeoning demand for LNG in marine fuel applications (bunkering). The robust pipeline of approved and pending liquefaction projects, particularly in North America, Qatar, and Australia, provides a consistent demand floor for high-specification machinery. Regulatory frameworks promoting decarbonization, while potentially challenging for all fossil fuels, simultaneously favor the use of gas over coal, thus necessitating continuous investment in the infrastructure required to move gas efficiently, making liquefaction equipment indispensable.

LNG Liquefaction Equipment Sales Market Executive Summary

The LNG Liquefaction Equipment Sales Market exhibits robust growth driven primarily by long-term structural shifts in global energy markets favoring gas utilization and trade globalization. Business trends are characterized by a strong emphasis on modularization, standardization of component design to reduce construction timelines and costs, and increased integration of digital twin technology for predictive maintenance and operational optimization. Strategic alliances between equipment manufacturers and Engineering, Procurement, and Construction (EPC) firms are crucial for securing large-scale project contracts. Furthermore, the rising adoption of Floating Liquefied Natural Gas (FLNG) technology represents a significant business opportunity, demanding highly compact and specialized equipment designed for demanding offshore environments, stimulating research and development investments in lightweight cryogenic solutions and enhanced reliability mechanisms.

Regional trends indicate that North America, particularly the U.S. Gulf Coast, remains the dominant hub for liquefaction capacity expansion, necessitated by vast shale gas reserves and robust export demand, making it the largest market for core components like turbomachinery and heat exchangers. Asia Pacific, led by China, Japan, and South Korea, is the primary demand region for imported LNG, subsequently fueling investment in new and replacement equipment for liquefaction projects globally to secure supply. Emerging markets in Africa and Latin America are increasingly focusing on small-scale and regional LNG supply chains, promoting the deployment of smaller, often containerized, liquefaction units. This geographic diversification mitigates concentration risk and ensures stable, long-term equipment sales trajectories across various geopolitical and economic environments.

Segmentation trends highlight the increasing prominence of small-scale and mid-scale liquefaction plants, moving away solely from mega-projects. This shift is driven by the necessity for decentralized supply options, especially in regions with limited pipeline access or for specific industrial, transport, and remote power generation applications. Equipment sales are heavily segmented by technology, with efficient, closed-loop processes dominating new installations due to their superior performance metrics and environmental compliance. Crucially, the market for retrofit and upgrade components within existing facilities remains strong, particularly focused on enhancing energy efficiency (e.g., replacing older compressors with high-efficiency models) and expanding debottlenecking capacity, ensuring sustained demand even outside major new project cycles.

AI Impact Analysis on LNG Liquefaction Equipment Sales Market

User queries regarding the impact of Artificial Intelligence (AI) on the LNG Liquefaction Equipment Sales Market generally revolve around three core themes: operational efficiency, predictive maintenance for high-value equipment, and optimization of liquefaction processes. Users are keenly interested in how AI can extend the lifespan of critical components like compressors and heat exchangers, thereby impacting replacement cycle timing and sales volumes. There is also significant curiosity about AI’s role in automating plant start-up/shutdown sequences and dynamically adjusting cooling parameters to maximize throughput under varying feed gas compositions and ambient temperatures. A common concern is the cybersecurity risk associated with integrating sophisticated AI platforms into critical infrastructure, balanced by the expectation that AI integration will lead to substantially lower operational expenditures (OPEX) and higher asset utilization rates.

The integration of AI and machine learning (ML) algorithms is fundamentally shifting the value proposition of LNG liquefaction equipment, moving it beyond purely physical assets towards an integrated smart solution. Equipment manufacturers are leveraging AI to embed self-diagnostic capabilities within turbomachinery and cryogenic heat exchangers, generating continuous data streams that inform maintenance strategies. This shift impacts sales by emphasizing equipment differentiation based on "smart" features and guaranteed uptime, potentially favoring manufacturers who offer superior digital service packages alongside hardware. The application of AI in modeling complex thermodynamic processes allows for real-time optimization, minimizing energy consumption per unit of LNG produced, a crucial competitive advantage in the high-energy-cost sector.

While AI may temporarily reduce the need for premature equipment replacement by extending asset life, the overarching effect is an acceleration in demand for new, advanced equipment designed specifically to be "AI-ready"—equipped with the necessary sensors, connectivity, and digital infrastructure. Furthermore, AI tools are revolutionizing the design phase, enabling manufacturers to rapidly simulate various equipment configurations (e.g., modular units) to meet specific project demands, thereby speeding up the sales cycle for customized solutions. The long-term impact suggests a focus shift from sheer volume of equipment sales to the bundled sale of high-efficiency hardware combined with perpetually licensed software and maintenance services, redefining revenue models for key market participants.

- AI-driven predictive maintenance reduces unplanned downtime, optimizing equipment utilization.

- Machine learning algorithms enhance liquefaction cycle efficiency, reducing energy intensity and OPEX.

- AI facilitates the use of digital twins for simulating plant performance and optimizing equipment specifications during the design phase.

- Improved sensor technology and data analytics, essential for AI, drive demand for highly instrumented, next-generation equipment.

- Automated fault detection in compressors and turbines extends equipment operational life and dictates specialized service contracts.

- AI optimizes supply chain logistics and manufacturing processes for equipment providers, improving delivery times.

DRO & Impact Forces Of LNG Liquefaction Equipment Sales Market

The market dynamics for LNG liquefaction equipment are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form significant Impact Forces. Key drivers include the global energy transition, which positions natural gas as a vital bridge fuel due to its lower carbon intensity compared to coal and oil, stimulating significant capacity expansion in export regions. Simultaneously, restraints, particularly the high upfront capital investment required for liquefaction terminals and the protracted regulatory approval processes, often slow down project execution and equipment procurement timelines. However, these challenges are countered by substantial opportunities arising from the trend towards modularization and small-scale LNG (SSLNG), which opens up new localized markets and reduces financing barriers, offering substantial potential for equipment diversification and sales growth outside traditional mega-projects. These countervailing forces ensure a dynamic, yet generally upward, market trajectory.

One primary driver involves the global energy security paradigm, emphasized by geopolitical uncertainties, which mandates diversification of energy sources and supply routes, heavily favoring seaborne LNG trade. This necessitates continuous investment in liquefaction infrastructure to meet growing demand from Europe and Asia. Furthermore, the marine fuel sector is emerging as a critical driver; increasing regulatory pressure on maritime emissions (IMO 2020) is pushing shipowners toward LNG as a preferred clean fuel, creating an exponential demand for LNG bunkering infrastructure, including small-scale liquefaction units near ports. These drivers generate immediate and sustained large-volume orders for cryogenic heat exchangers, complex piping systems, and specialized vacuum-insulated storage tanks, underpinning market stability and growth projections throughout the forecast period.

Conversely, significant restraints pose challenges to market momentum. The extreme capital expenditure (CAPEX) associated with constructing a typical multi-train liquefaction facility (often exceeding $10 billion) results in prolonged financing and decision-making cycles, causing market volatility. Moreover, public and political scrutiny regarding long-term fossil fuel investments and evolving climate policies introduce regulatory uncertainty, potentially leading to project delays or cancellations. Another technical restraint is the complexity and sensitivity of the liquefaction process, requiring ultra-reliable, specialized equipment, which limits the competitive landscape to a few highly experienced vendors, potentially leading to supply bottlenecks during periods of high demand. Mitigating these restraints requires innovative financing models and faster regulatory streamlining.

Opportunities center on technological advancements and strategic market penetration. The trend toward floating liquefaction (FLNG) and gas monetization in stranded offshore fields offers lucrative opportunities for manufacturers specializing in highly compact, durable, and space-efficient equipment suitable for marine applications. Additionally, the increasing focus on carbon capture and storage (CCS) integration within liquefaction plants presents a niche opportunity for suppliers capable of providing equipment that improves the overall environmental performance of the facility, aligning projects with emerging low-carbon standards. The adoption of modular construction techniques, where major components are built off-site, also streamlines logistics, reduces risk, and accelerates deployment, making LNG projects viable in more locations and further capitalizing on SSLNG demand.

- Drivers: Growing global natural gas demand, increasing use of LNG as marine fuel, strategic focus on energy security, advancements in modularization.

- Restraints: High capital expenditure requirements, volatile natural gas prices impacting Final Investment Decisions (FIDs), complex regulatory environment and lengthy approval processes, technological complexity limiting vendor competition.

- Opportunity: Expansion of Floating LNG (FLNG) projects, proliferation of small-scale LNG (SSLNG) facilities for regional distribution, integration of digital solutions (AI/IoT) for operational efficiency, market expansion in developing regions (Africa, Southeast Asia).

- Impact Forces: Geopolitical tensions (accelerating supply diversification), decarbonization mandates (favoring gas over coal but requiring efficiency improvements), commodity price fluctuations (directly affecting project FIDs), technological breakthroughs (lowering CAPEX through standardization).

Segmentation Analysis

The LNG Liquefaction Equipment Sales Market is comprehensively segmented based on the scale of the facility, the type of technology employed, and the specific application sector, reflecting the diverse requirements of the global LNG supply chain. Segmentation by facility size—ranging from multi-train mega-projects to micro-scale units—is crucial as it directly dictates the necessary equipment specifications, size, power rating of compressors, and complexity of cryogenic heat exchangers. Furthermore, technological segmentation focuses on the distinct liquefaction cycles utilized, such as the established C3/MR (Propane Pre-cooled Mixed Refrigerant) process and the newer, highly efficient single mixed refrigerant (SMR) or nitrogen expansion cycles, each requiring unique component designs and materials engineering. Analyzing these segments provides a clear understanding of where growth capital is being allocated and which equipment types are experiencing peak demand.

The segmentation structure is highly informative for equipment manufacturers, allowing them to tailor their production capabilities and R&D efforts. For instance, the large-scale segment, primarily serving major export markets, demands custom-engineered, high-capacity turbomachinery, often procured through long-term contracts. Conversely, the small-scale segment requires standardized, containerized, and readily deployable units, prioritizing ease of installation and operational simplicity over maximum capacity. Application-based segmentation differentiates equipment used in fixed onshore terminals (which prioritize efficiency and longevity) from those used in floating or mobile offshore facilities (which emphasize compactness, vibration tolerance, and durability in harsh marine environments). This granular view of the market needs ensures accurate forecasting and strategic alignment for market players.

- By Scale (Capacity):

- Large Scale (over 5 MTPA)

- Mid Scale (0.5 MTPA to 5 MTPA)

- Small Scale (below 0.5 MTPA)

- Micro Scale (for localized use and vehicle fueling)

- By Equipment Type:

- Cryogenic Heat Exchangers (Plate-Fin, Coil Wound)

- Compressors and Turbines

- Pre-treatment and Purification Skids (Acid Gas Removal, Dehydration)

- Pumps and Valves (Cryogenic Grade)

- Storage Tanks and Insulated Piping

- By Application:

- Onshore Export Terminals

- Floating Liquefaction (FLNG) Vessels

- LNG Bunkering and Distribution Hubs

- Peak Shaving and Storage Facilities

- By Technology/Process:

- Propane Pre-cooled Mixed Refrigerant (C3/MR)

- Single Mixed Refrigerant (SMR)

- Dual Mixed Refrigerant (DMR)

- Nitrogen Expansion Cycle

Value Chain Analysis For LNG Liquefaction Equipment Sales Market

The value chain for LNG liquefaction equipment is complex, beginning with upstream raw material extraction and processing, moving through highly specialized manufacturing, and culminating in downstream deployment and aftermarket services. The upstream analysis focuses on sourcing high-grade alloys (e.g., aluminum, stainless steel) necessary for cryogenic applications, alongside securing high-power components such as industrial gas turbines and compressors from specialized vendors. Delays or price volatility in these primary raw materials and components directly influence the production cost and lead time for final liquefaction equipment. The integration and reliability of upstream suppliers are critical, as the tolerance for material defects in cryogenic environments is extremely low, demanding stringent quality control and certified material sourcing.

The midstream and core manufacturing phase is dominated by a few global engineering firms and equipment specialists who perform complex design, fabrication, and modular assembly of the liquefaction trains, heat exchangers, and associated skids. Distribution channels are predominantly direct, involving direct sales and long-term contracts between the Original Equipment Manufacturers (OEMs) and the final project owner/developer (often major oil and gas companies or utility providers), typically facilitated through a large Engineering, Procurement, and Construction (EPC) contractor. Indirect sales are less common but occur through specialized distributors or system integrators focusing on smaller, standardized liquefaction units (SSLNG). This high degree of direct engagement emphasizes long-term relationships and technical support as core competitive advantages over simple transactional sales.

The downstream segment involves the installation, commissioning, operation, and maintenance (O&M) of the equipment at the liquefaction site. Long-term profitability for OEMs is increasingly linked to providing sophisticated aftermarket services, including spare parts supply, performance monitoring, and system upgrades. The downstream demand dictates the need for durable and serviceable equipment designs. Moreover, the feedback loop from downstream operations (e.g., performance data, failure analysis) is vital for improving future equipment design and maintaining technological leadership. The success of the entire value chain hinges on the effective coordination between equipment providers and EPC firms to ensure timely project delivery and compliance with rigorous international safety and environmental standards.

LNG Liquefaction Equipment Sales Market Potential Customers

Potential customers for LNG liquefaction equipment are concentrated among entities possessing significant natural gas resources or those requiring strategic gas supply for long-term power generation and industrial applications. The primary end-users are International Oil Companies (IOCs), National Oil Companies (NOCs), and major Independent Energy Developers (IEDs) who initiate and finance large-scale export terminal projects. These customers require robust, customized, multi-billion dollar liquefaction trains and are focused on maximizing efficiency, throughput, and asset longevity to ensure decades of reliable operation and return on investment. The decision-making process for these customers is lengthy, often spanning multiple years and involving competitive bidding processes among top-tier equipment suppliers and EPC contractors, prioritizing reliability and proven track records.

A rapidly growing segment of potential customers includes specialized midstream companies and utility providers focusing on regional energy security and transportation fueling infrastructure. These customers typically invest in mid-scale or small-scale liquefaction plants, either fixed onshore or near port facilities. Their requirements prioritize modularity, standardization, and faster deployment times to meet localized demand rapidly. Furthermore, maritime and logistics companies are emerging as customers for small, specialized equipment used in LNG bunkering barges or specific industrial applications like remote power generation in isolated areas. These diverse customer profiles necessitate that equipment suppliers maintain a flexible product portfolio ranging from bespoke mega-project solutions to off-the-shelf modular units.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 19.8 Billion |

| Growth Rate | 8.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde, Air Products, Chart Industries, Baker Hughes, General Electric (GE), Mitsubishi Heavy Industries (MHI), Wärtsilä, Samsung Heavy Industries (SHI), TechnipFMC, KBR, Honeywell UOP, Sumitomo Heavy Industries, IHI Corporation, Siemens Energy, NOV, Wood, ENI, Shell Global, ExxonMobil, CNOOC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LNG Liquefaction Equipment Sales Market Key Technology Landscape

The technology landscape in the LNG Liquefaction Equipment Sales Market is defined by continuous innovation focused on improving thermodynamic efficiency, minimizing energy consumption, and reducing the footprint of liquefaction trains. The core technologies revolve around the refrigeration cycles used to achieve the necessary cryogenic temperatures. The Propane Pre-cooled Mixed Refrigerant (C3/MR) cycle remains the benchmark for large-scale facilities due to its proven reliability and high throughput. However, its dominance is being challenged by proprietary technologies like the Dual Mixed Refrigerant (DMR) and various Single Mixed Refrigerant (SMR) variations, which offer advantages in terms of process simplicity and reduced equipment complexity, making them highly suitable for mid-scale and floating applications. Equipment manufacturers are heavily invested in optimizing the design of main cryogenic heat exchangers (MCHEs)—the heart of the liquefaction plant—to enhance heat transfer efficiency while minimizing pressure drop, driving specialized sales in compact, highly complex coil-wound and plate-fin exchangers.

A second major technological area involves turbomachinery—specifically the large compressor trains and associated drivers (gas turbines or electric motors). The trend is moving towards larger, more powerful, and highly efficient compression systems capable of handling varying feed gas conditions and maintaining stable operations across a broad turndown range. The adoption of electric motor-driven compression (e-compressor trains) is gaining traction, particularly in regions where environmental regulations are stringent or where abundant renewable energy sources are available, as this reduces local emissions and potentially lowers operational costs compared to traditional gas turbine drivers. Suppliers of these high-specification compressors, often operating under strict licensing agreements, form a significant, high-value segment of the equipment market.

Furthermore, technology enabling modularization and standardization is rapidly influencing equipment sales. Modular equipment, where entire sections of the plant are built, tested, and shipped as self-contained units (skids), reduces on-site construction risk, accelerates commissioning, and lowers overall CAPEX. This modular approach is vital for the growth of FLNG and SSLNG projects. Advanced materials science is also critical, focusing on developing lighter, more durable, and cost-effective cryogenic materials for piping, valves, and storage systems, ensuring operational integrity at extreme temperatures. The integration of digital technologies, including advanced sensor networks and digital twins, is now considered a standard technological requirement, dictating the specifications for new equipment procurement.

Regional Highlights

Regional dynamics dictate significant variations in the demand and specification requirements for LNG liquefaction equipment globally, reflecting geopolitical energy strategies and resource availability.

- North America (U.S. and Canada): This region dominates current and projected market growth, driven by substantial, low-cost shale gas production and immense export capacity expansion along the Gulf Coast and in Canada. Demand here is characterized by extremely large-scale, multi-train facilities requiring peak-efficiency, high-throughput turbomachinery and customized cryogenic equipment. U.S. FIDs (Final Investment Decisions) remain the single most important metric for global equipment sales. The shift toward electric-driven compressors to reduce emissions is also a growing regional trend.

- Asia Pacific (APAC, including China, Australia, Qatar, and Southeast Asia): While Qatar and Australia are major exporters and equipment buyers (with Qatar driving mega-project expansion), the broader APAC region acts as the primary end-user market for LNG, necessitating continuous liquefaction equipment sales in exporting nations to meet Asian demand. China's growing reliance on gas for power generation and domestic distribution fuels substantial SSLNG projects and virtual pipeline systems, driving high demand for small-scale, standardized equipment and related transportation components.

- Europe: Equipment sales are less focused on large new export facilities (except specific projects like in Norway) but are highly centered on replacement, upgrade, and efficiency improvement equipment for existing import terminals (regasification units often requiring specialized cold energy recovery systems) and significant investment in small-scale liquefaction for LNG bunkering and heavy-duty transport fuel supply, driven by strict maritime emission regulations.

- Middle East and Africa (MEA): This region is pivotal due to major capacity expansions led by Qatar and emerging projects in Mozambique and potentially Nigeria. Sales are characterized by large, custom-engineered equipment for flagship projects where government-backed financing supports massive, long-lifecycle installations. FLNG is also gaining traction, particularly for monetizing stranded offshore gas reserves in West Africa, demanding specialized compact marine equipment.

- Latin America: This market is primarily driven by smaller, regional monetization projects and domestic market development. The focus is on small-to-mid-scale modular solutions that can be rapidly deployed to serve local power generation needs, often bypassing expensive pipeline infrastructure, making standardization and ease of transport key equipment requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LNG Liquefaction Equipment Sales Market.- Linde PLC

- Air Products and Chemicals, Inc.

- Chart Industries

- Baker Hughes Company

- General Electric (GE) Oil & Gas

- Mitsubishi Heavy Industries (MHI) Group

- Wärtsilä Corporation

- Samsung Heavy Industries (SHI)

- TechnipFMC PLC

- KBR, Inc.

- Honeywell UOP

- Sumitomo Heavy Industries, Ltd.

- IHI Corporation

- Siemens Energy AG

- NOV Inc.

- Wood Group PLC

- JGC Holdings Corporation

- Bechtel Corporation

- Kawasaki Heavy Industries, Ltd.

- Cryostar (A member of Linde)

Frequently Asked Questions

Analyze common user questions about the LNG Liquefaction Equipment Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary growth drivers for the LNG Liquefaction Equipment market?

The market is primarily driven by the increasing global demand for natural gas as a cleaner transitional fuel in power generation, heightened focus on energy security requiring diverse supply routes (seaborne LNG), and rapid adoption of LNG as a compliant marine fuel (bunkering), necessitating new liquefaction and distribution infrastructure globally.

How does the shift towards modularization impact equipment sales?

Modularization significantly boosts equipment sales in the small-scale (SSLNG) and Floating LNG (FLNG) segments. It allows manufacturers to standardize production, reduce on-site construction time and risk, lower project CAPEX, and accelerate deployment, thereby making LNG projects viable for a wider range of customers and smaller resource pools.

Which technological innovation is most crucial for competitiveness in this market?

Optimization of cryogenic heat exchangers (MCHEs) and high-efficiency turbomachinery remains the most crucial technological focus. Advances in liquefaction cycles, such as proprietary mixed refrigerant processes and the integration of highly efficient electric-motor driven compressors, determine operational performance, energy consumption, and ultimately, project viability and equipment sales success.

Which region dominates the current demand for large-scale liquefaction equipment?

North America, particularly the United States Gulf Coast, currently dominates the demand for large-scale, high-capacity liquefaction equipment. This dominance is sustained by vast, low-cost shale gas resources and aggressive export capacity build-out, requiring numerous multi-billion-dollar liquefaction trains and associated high-power components like gas turbines and large compressors.

What is the main financial restraint affecting new liquefaction project FIDs?

The main financial restraint is the extremely high upfront capital expenditure (CAPEX) required for large-scale liquefaction terminals, often involving multi-billion dollar investments. This massive cost necessitates long-term gas sales agreements (GSAs) and strong financial backing, leading to extended decision-making processes and susceptibility to fluctuations in global commodity prices and interest rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager