Load Binders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432259 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Load Binders Market Size

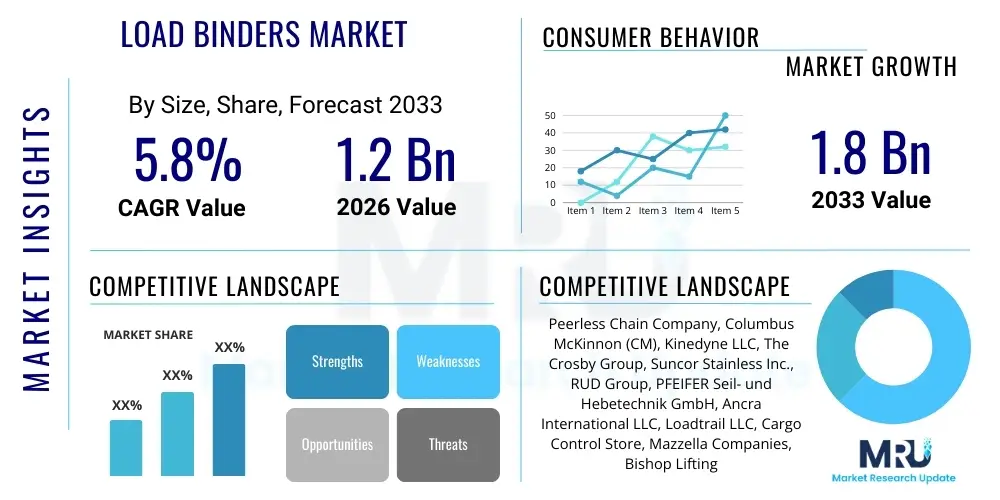

The Load Binders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.8 Billion by the end of the forecast period in 2033.

Load Binders Market introduction

The Load Binders Market encompasses the manufacturing, distribution, and sale of mechanical devices essential for tensioning tie-down materials such as chains or webbing, primarily utilized in the transportation and logistics sectors for cargo securement. These critical tools ensure the safety and integrity of transported goods, ranging from heavy construction equipment and agricultural machinery to industrial commodities and structural steel. Load binders are broadly classified into lever binders (snap binders) and ratchet binders, each offering distinct advantages in terms of leverage, ease of release, and safety protocols, catering to specific regulatory requirements and operational preferences across various industries.

The primary product description centers on high-tensile strength alloys and robust mechanical mechanisms designed to withstand extreme forces, vibration, and environmental exposure during transit. Major applications span over-the-road trucking, rail freight, marine shipping, construction sites, and specialized heavy haulage. Key benefits derived from the effective use of certified load binders include reduced risk of freight damage, enhanced worker safety through controlled load release, and mandatory compliance with international and regional cargo securement standards, notably those enforced by governmental bodies like the Federal Motor Carrier Safety Administration (FMCSA) in North America.

Market expansion is fundamentally driven by the escalating volume of global trade, robust infrastructural investments in developing economies, and the continuous growth of the third-party logistics (3PL) sector which demands reliable and high-quality cargo securing solutions. Furthermore, increasing regulatory scrutiny requiring stricter adherence to certified load securement procedures, coupled with technological advancements focused on ergonomic and safer binder designs, consistently propels demand. These factors collectively establish load binders as indispensable components of the modern logistics ecosystem, positioning the market for sustained expansion throughout the forecast period.

Load Binders Market Executive Summary

The global Load Binders Market is characterized by steady, recession-resistant demand, underpinned by continuous activity in core industries such as construction, mining, and intermodal shipping. Current business trends indicate a strong shift towards ratchet binders due to their enhanced safety features, offering greater leverage and a controlled release mechanism compared to traditional lever binders, mitigating risks associated with recoiling forces. Consolidation within the supply chain, driven by mergers and acquisitions among key manufacturers, is leading to standardized product offerings and a heightened focus on high-durability, certified products that meet global testing standards. Moreover, manufacturers are increasingly integrating features such as corrosion resistance and ergonomic handles to improve operational efficiency and prolong product lifespan, catering directly to professional fleet operators seeking lower total cost of ownership.

Regionally, the market dynamics are heavily influenced by infrastructure spending and regulatory maturity. North America remains the dominant market, primarily due to stringent federal safety mandates (e.g., DOT regulations) governing heavy haulage and well-established trucking logistics. The Asia Pacific region, however, is projected to exhibit the fastest growth, propelled by massive infrastructure projects in China, India, and Southeast Asia, coupled with rapid urbanization and the expansion of domestic and cross-border logistics capabilities. European markets maintain high stability, emphasizing quality control and certified manufacturing processes, often leading innovation in smart load securement technologies and material science applications.

Segment trends reveal that the Application segment of Transportation and Logistics continues to hold the largest market share, directly correlating with commercial vehicle sales and freight volume. Within the Product Type segmentation, while lever binders offer a cost-effective solution for short hauls or lighter loads, the ratchet binder segment is accelerating its market penetration due to increasing focus on driver safety and liability reduction across major fleets. The material science trend emphasizes the use of lighter, high-strength alloys to reduce overall equipment weight without compromising securing capacity, a critical factor for maximizing payload efficiency in modern transport operations.

AI Impact Analysis on Load Binders Market

Common user inquiries regarding AI's influence on the Load Binders Market frequently revolve around predictive maintenance, automated load securement verification, and integration within smart logistics platforms. Users seek to understand how AI can minimize human error in the securing process, ensuring compliance and preventing load failures which often lead to significant financial loss and liability. Key themes center on leveraging machine learning (ML) for real-time risk assessment based on route conditions, cargo type, and tension data, and whether future load binders will incorporate integrated sensors capable of communicating directly with fleet management systems. The expectation is that AI will transform the traditionally manual process into a data-driven, verifiable safety protocol, significantly improving operational safety and efficiency for large-scale logistics providers.

While the physical load binder remains a mechanical tool, AI primarily influences the ecosystems surrounding its use. Specifically, the integration of vision systems and IoT sensors in cargo decks, analyzed by machine learning algorithms, can automatically verify if the correct number of binders is applied and if the tension levels meet regulatory requirements before a vehicle departs. This shift from manual inspection to automated, verifiable checks drastically reduces the incidence of non-compliance and ensures loads are secured optimally for the intended journey profile (e.g., factoring in expected road vibration or sharp turns). This data-centric approach enhances preventative safety protocols, minimizing the risk of accidents caused by load shift.

Furthermore, AI-driven analytics are beginning to impact inventory management and material selection for load binders within large fleet operations. ML models can analyze usage patterns, failure rates, environmental factors, and maintenance logs to predict the optimal replacement cycle for specific binder types, ensuring that fleets replace worn-out equipment proactively rather than reactively. This predictive maintenance capability ensures consistent securement quality and reduces unexpected equipment failure during critical hauling operations, translating directly into enhanced supply chain reliability and reduced insurance claims related to insecure cargo incidents.

- AI enables automated verification of load securement tension and compliance via integrated IoT sensors.

- Machine learning algorithms optimize fleet inventory management, predicting binder wear and optimal replacement schedules.

- Integration with fleet management systems provides real-time alerts for load shift or insufficient tension during transit.

- Vision systems utilize AI to confirm the physical presence and correct application of required load securement devices pre-departure.

- Data analytics improve ergonomic design by identifying stress points and failure modes in current binder models based on operational use data.

DRO & Impact Forces Of Load Binders Market

The market is predominantly influenced by robust drivers related to regulatory mandates and infrastructural development, offset by significant restraints such as reliance on volatile raw material pricing and the inherent risks associated with manual operation. Opportunities emerge strongly from the increasing adoption of automated and smart securement systems, alongside geographical expansion into rapidly industrializing regions. The collective impact of these forces dictates market velocity and shapes strategic investments in product design and material sourcing. The balance between regulatory compliance push (Drivers) and the challenge of high-quality material sourcing (Restraints) defines the competitive landscape for manufacturers operating globally, urging continual innovation in product durability and user safety features.

Drivers: A primary driver is the global standardization and stringent enforcement of cargo securement regulations, which necessitates the compulsory use of certified load binders for professional transport operations, thereby creating consistent replacement and new purchase cycles. Rapid urbanization, coupled with significant public and private sector investment in infrastructure projects—such as road networks, bridges, and energy facilities—boosts demand for heavy haulage services, consequently increasing the requirement for high-capacity, durable load securement tools. The continuous expansion of global trade and the complex nature of intermodal freight movement further amplify the need for reliable securing mechanisms to handle diverse and sometimes unconventional loads across rail, road, and sea transportation.

Restraints: The market faces considerable challenges, notably the volatility and price increases of key raw materials, primarily high-strength steel and specialty alloys, which directly impact manufacturing costs and retail pricing elasticity. Furthermore, the inherent safety hazards associated with certain load binder types, particularly the forceful release mechanism of traditional lever binders, pose significant occupational safety risks, leading to potential liability issues and worker preference for safer alternatives. The lifespan of load binders is also finite, and despite being durable, the necessity for frequent replacement due to wear and tear or loss creates a constant pressure point on fleet budgets, sometimes leading operators to defer necessary replacements, which poses a safety risk.

Opportunity: Significant opportunities lie in the development and commercialization of next-generation ergonomic and technologically enhanced load binders, including those featuring integrated digital tension gauges or anti-vibration locking systems, positioning manufacturers ahead of emerging safety trends. Furthermore, exploring untapped potential in specialized markets, such as wind energy component transportation (requiring customized heavy-duty systems) and high-precision logistics (demanding zero-tolerance securement), offers avenues for high-margin growth. Expanding distribution networks into emerging markets in Africa and Latin America, where infrastructural investment is accelerating, provides a substantial opportunity for increasing market penetration outside of established economic regions.

Impact Forces: The overarching impact force is safety regulation compliance, which acts as a non-negotiable threshold for entry and sustained operation in the market; any failure to meet current DOT or equivalent standards immediately excludes a product. Another powerful force is the competitive intensity driven by both domestic and international low-cost manufacturers, which pressures established brands on pricing while simultaneously elevating the importance of quality certification and brand trust. Environmental, Social, and Governance (ESG) mandates are also emerging as an indirect force, pushing manufacturers to adopt sustainable materials and resource-efficient production processes, particularly in highly regulated Western markets.

Segmentation Analysis

The Load Binders Market is systematically segmented based on Product Type, Application, Material, and Load Capacity, allowing for a granular analysis of demand drivers and competitive positioning within specific operational niches. Understanding these segmentations is crucial for manufacturers to tailor their product lines, marketing strategies, and distribution channels to meet the specialized needs of different end-user industries, such as heavy construction versus long-haul logistics. The dominance of a particular segment often reflects regional regulatory preferences and the prevailing type of industrial activity—for instance, regions with significant mining operations heavily prioritize extreme load capacity binders, while general logistics favors high-volume, standardized models.

The segmentation by Product Type, notably Ratchet Binders versus Lever Binders, is perhaps the most defining characteristic of the market, reflecting the trade-off between speed/cost and safety/precision. Application segmentation provides insights into vertical market saturation and growth potential, highlighting sectors like heavy machinery haulage as key expansion areas. Material segmentation (e.g., steel alloy vs. specialized coatings) reflects ongoing efforts to enhance product durability, corrosion resistance, and achieve optimal strength-to-weight ratios, directly responding to end-user demands for equipment longevity under harsh conditions. Analyzing these variables collectively offers a detailed roadmap for strategic market development and product innovation focused on maximizing safety and operational reliability.

- By Product Type:

- Ratchet Load Binders

- Lever Load Binders (Snap Binders)

- Over-Center Binders

- By Application:

- Transportation and Logistics (Trucking, Rail, Intermodal)

- Construction and Infrastructure

- Agriculture and Forestry

- Mining and Quarrying

- Marine and Ship Building

- Heavy Machinery Haulage

- By Material:

- Standard Steel Alloy

- High-Strength Steel Alloy

- Stainless Steel (for corrosive environments)

- By Capacity:

- Light Duty (e.g., less than 5,000 lbs WLL)

- Medium Duty (e.g., 5,000 lbs to 10,000 lbs WLL)

- Heavy Duty (e.g., over 10,000 lbs WLL)

Value Chain Analysis For Load Binders Market

The value chain for the Load Binders Market begins with upstream activities focused heavily on raw material sourcing and primary manufacturing processes, extending through complex distribution channels before reaching the diverse downstream end-users. Upstream analysis highlights the critical reliance on suppliers of high-grade steel and specialized alloys (e.g., drop-forged steel for hooks and handle mechanisms). Price fluctuations and quality consistency in these materials directly dictate the cost structure and final quality of the load binders, requiring strong long-term relationships with material vendors. Manufacturing processes involve precision forging, heat treatment, and surface finishing to ensure the final product meets stringent working load limit (WLL) and regulatory requirements, where cost efficiency in production scale is paramount for profitability.

Downstream activities involve specialized logistics providers, wholesale industrial suppliers, and direct sales channels targeting large fleet operators and governmental agencies. The distribution channel is characterized by a mix of direct sales to large, recurring customers (such as major trucking companies or equipment rental firms) and indirect sales through industrial distributors, hardware wholesalers, and increasingly, specialized e-commerce platforms focused on cargo control equipment. Distributors play a crucial role in providing local stock, immediate availability, and application expertise to smaller independent operators and construction businesses. The efficacy of the distribution network, particularly its ability to navigate complex global shipping regulations and customs, is a key determinant of market reach and success.

The distinction between direct and indirect distribution significantly impacts margin realization and customer relationship depth. Direct sales allow manufacturers to capture higher margins and maintain tight control over brand messaging and technical support, often preferred for custom or high-value heavy-duty orders. Conversely, the indirect channel offers expansive geographical reach and exposure to smaller, localized buyers who prefer a one-stop-shop for industrial supplies, albeit with reduced pricing control. Furthermore, certification and compliance testing (often outsourced to third-party labs) constitute a vital step in the value chain, adding essential value by validating the product’s safety standards, thereby facilitating market acceptance and minimizing manufacturer liability risk across all distribution routes.

Load Binders Market Potential Customers

The primary end-users and buyers in the Load Binders Market are organizations and professionals engaged in the regular movement of heavy or bulky goods, where securement failure poses substantial risks to public safety, infrastructure, and financial viability. The largest cohort of potential customers resides within the Transportation and Logistics sector, particularly long-haul trucking companies, specialized heavy haul carriers, and intermodal freight operators managing the transfer of goods between road, rail, and maritime vessels. These customers prioritize high durability, minimal maintenance requirements, and mandatory WLL certification compliance, often purchasing in high volumes to equip their entire fleet and maintain inventory for replacements.

Another major segment consists of the Construction and Infrastructure industries, including civil engineering firms, heavy equipment rental companies, and specialized contractors involved in moving cranes, excavators, pre-fabricated materials, and structural elements to job sites. For this customer base, the demand is frequently driven by project timelines and the need for reliable securing devices that can operate effectively in harsh, often muddy or abrasive, environments. Specialized applications within this sector, such as the transport of oversized wind turbine components, demand customized load binders that can handle unique geometric challenges and extremely high load requirements, representing a niche but lucrative customer focus.

Secondary, yet significant, potential customers include the Agricultural sector (farmers and agricultural machinery dealers needing to secure tractors and implements), the Mining and Quarrying industry (transporting specialized rock processing equipment and raw materials), and government bodies such as military logistics divisions or departments of transportation requiring durable, tested equipment for their fleets. These diverse end-users necessitate a varied product portfolio from manufacturers, ranging from simple, rugged lever binders for agricultural use to highly engineered, ergonomic ratchet binders favored by sophisticated, risk-averse commercial fleet operators focused on maximizing driver safety and minimizing potential accident costs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Peerless Chain Company, Columbus McKinnon (CM), Kinedyne LLC, The Crosby Group, Suncor Stainless Inc., RUD Group, PFEIFER Seil- und Hebetechnik GmbH, Ancra International LLC, Loadtrail LLC, Cargo Control Store, Mazzella Companies, Bishop Lifting Products Inc., WESCO Industrial Products, Erickson Manufacturing, Secure-A-Load, Dixie Industries, Kenlee Heavy Duty, Vulcan Off-Road, Durbin-Durco Inc., B/A Products Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Load Binders Market Key Technology Landscape

The technology landscape in the Load Binders Market, traditionally viewed as low-tech, is evolving rapidly, driven primarily by material science innovations and the integration of digital monitoring capabilities. Key technological advancements focus on achieving superior strength-to-weight ratios using specialized heat-treated steel and proprietary alloy formulations, ensuring that the binders can handle higher working load limits (WLL) while minimizing the overall weight carried by the transport vehicle. Furthermore, anti-corrosion coatings and specialized plating techniques (such as zinc dichromate or powder coating) are continually being refined to enhance product longevity, especially in corrosive marine or perpetually wet construction environments, thereby reducing replacement frequency and maintenance costs for end-users.

Ergonomics and safety design represent another significant area of technological focus, particularly in ratchet binder mechanisms. Manufacturers are investing heavily in design modifications that reduce the effort required to achieve maximum tension and, critically, ensure a smoother, more controlled release process, directly addressing workplace safety concerns associated with snap-back or sudden release injuries. Novel handle designs incorporating cushioned grips and optimized gear ratios are becoming standard features in premium product lines. This continuous refinement in mechanical engineering aims not only to improve driver satisfaction and speed up the securement process but also to establish higher safety benchmarks that exceed minimum regulatory requirements, positioning certain brands as market leaders in operational safety.

The nascent integration of smart technology marks the most forward-looking aspect of the technology landscape. This involves incorporating miniature, durable sensors (IoT technology) into the load binder mechanism or the attached chain/webbing. These sensors are designed to monitor tension levels in real-time, providing digital feedback that confirms the load is secured to the required WLL. Data collected from these smart load binders can be wirelessly transmitted to the truck cab or a centralized fleet management system, alerting drivers or dispatchers immediately if tension drops due to shifting cargo or faulty equipment. This technological leap enables proactive intervention, significantly mitigating the risk of catastrophic load failure and paving the way for data-driven compliance reporting, aligning the market with the broader digital transformation occurring across the logistics industry.

Regional Highlights

Regional analysis of the Load Binders Market reveals distinct market maturity and growth dynamics driven by infrastructure investment cycles, regulatory environments, and the prevalence of heavy industrial activity. North America is characterized by high demand for certified, heavy-duty ratchet binders, fueled by stringent Department of Transportation (DOT) regulations and a massive, well-established trucking industry that relies on standardized, high-quality securing equipment. The continuous requirement for freight movement across vast distances ensures a steady market for replacement parts and sophisticated securement solutions, making it a critical region for product testing and premium product sales. The United States and Canada dominate regional consumption due to robust energy and manufacturing sectors.

Europe demonstrates a strong focus on quality, precision engineering, and adherence to sophisticated European Union safety standards. While the overall volume of freight transport is high, the market growth is often slower but extremely stable, emphasizing durable, long-life products and ergonomic designs to comply with strict occupational safety guidelines. Germany, France, and the UK are primary consumers, driven by advanced manufacturing and high-value supply chains. The region is often at the forefront of implementing new materials and environmentally conscious manufacturing practices within the cargo control sphere.

The Asia Pacific (APAC) region is projected to be the engine of future market growth, underpinned by unprecedented infrastructural spending, rapid industrialization, and the exponential growth of local and intra-regional logistics networks, particularly in emerging economies like India and Indonesia. While the demand for cost-effective solutions remains high, there is a rapidly increasing adoption rate of high-quality, certified load binders as global safety standards begin to permeate local supply chains. China, as a global manufacturing and export hub, drives immense volume demand across all segments, necessitating localized manufacturing and distribution hubs for key market players.

Latin America and the Middle East & Africa (MEA) regions present substantial potential, though their markets are currently less mature and often fragmented. Latin America’s growth is tied closely to commodity exports (mining and agriculture) and improving road networks, driving demand for medium to heavy-duty equipment. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, sees market activity driven by massive oil and gas infrastructure projects and logistics hubs, demanding highly specialized, corrosion-resistant load binders suitable for extreme desert and marine conditions. Regulatory frameworks in these regions are tightening, which will accelerate the demand for certified, compliant products over the forecast period.

- North America: Dominant market share due to stringent DOT regulations, high volume of cross-border trade, and large fleet operations requiring frequent replacement of heavy-duty ratchet binders.

- Asia Pacific (APAC): Fastest growing region, driven by massive infrastructure investments (roads, ports) in China and India, and the subsequent expansion of third-party logistics services.

- Europe: Stable growth characterized by high quality standards, focus on ergonomic design, and adherence to specific EU safety and environmental directives in manufacturing.

- Latin America: Emerging market growth linked to resource extraction industries (mining, agriculture) and improving regional logistics connectivity.

- Middle East & Africa (MEA): Growth centered around oil, gas, and major construction projects, driving demand for specialized, environmentally resilient securing equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Load Binders Market.- Peerless Chain Company

- Columbus McKinnon (CM)

- Kinedyne LLC

- The Crosby Group

- Suncor Stainless Inc.

- RUD Group

- PFEIFER Seil- und Hebetechnik GmbH

- Ancra International LLC

- Loadtrail LLC

- Cargo Control Store

- Mazzella Companies

- Bishop Lifting Products Inc.

- WESCO Industrial Products

- Erickson Manufacturing

- Secure-A-Load

- Dixie Industries

- Kenlee Heavy Duty

- Vulcan Off-Road

- Durbin-Durco Inc.

- B/A Products Co.

Frequently Asked Questions

Analyze common user questions about the Load Binders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between ratchet and lever load binders in terms of safety?

Ratchet load binders are generally considered safer due to their controlled tensioning and release mechanism. They require less physical force and eliminate the sudden, forceful snap-back associated with traditional lever binders, significantly reducing the risk of operator injury during load securement and release operations.

How do regulatory standards, such as those by the DOT, influence the purchase of load binders?

Regulatory bodies, including the US Department of Transportation (DOT) and equivalent international agencies, mandate specific working load limits (WLL) and material quality standards for all cargo securement devices. Compliance is non-negotiable for commercial carriers, directly driving demand towards certified, high-WLL load binders that meet or exceed published safety specifications to avoid severe fines and operational shutdowns.

Which application segment drives the highest volume demand for load binders globally?

The Transportation and Logistics segment, encompassing long-haul trucking, rail freight, and intermodal shipping, consistently drives the highest volume demand. The continuous movement of raw materials and finished goods, combined with mandatory replacement cycles due to wear and tear, ensures this sector remains the largest consumer base for standardized and heavy-duty load securement tools.

What technological innovations are currently impacting the efficiency and reliability of load binders?

Key technological advancements include the use of advanced, lighter-weight steel alloys to enhance strength without adding bulk, and the increasing incorporation of smart technology, such as integrated sensors, for real-time digital monitoring of tension levels. These innovations improve securement verification and enable predictive maintenance capabilities for fleet operators.

Is the high cost volatility of raw materials a significant restraint in the Load Binders Market?

Yes, the high cost volatility of high-grade steel and specialized alloys required for manufacturing durable, high-capacity load binders represents a significant restraint. These fluctuations directly impact production costs, often necessitating price adjustments and careful inventory management strategies to maintain profitability and competitive pricing in the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager