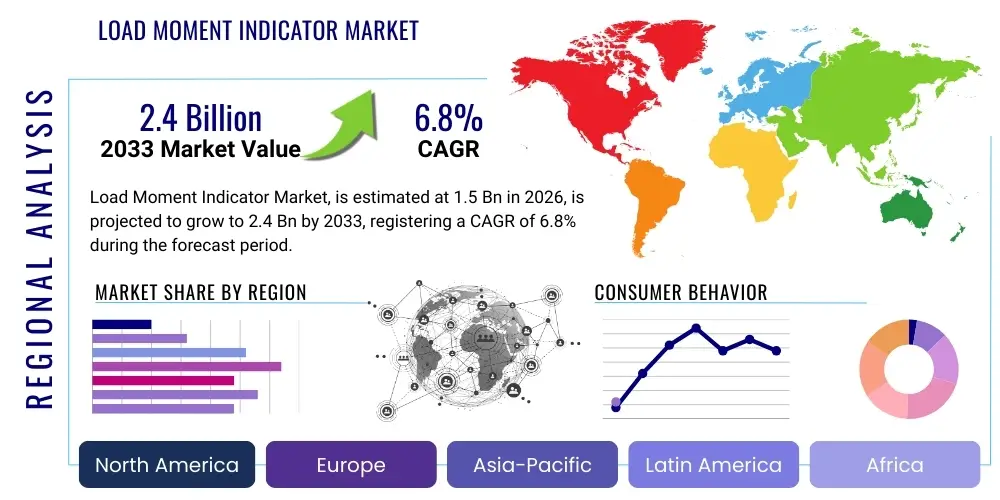

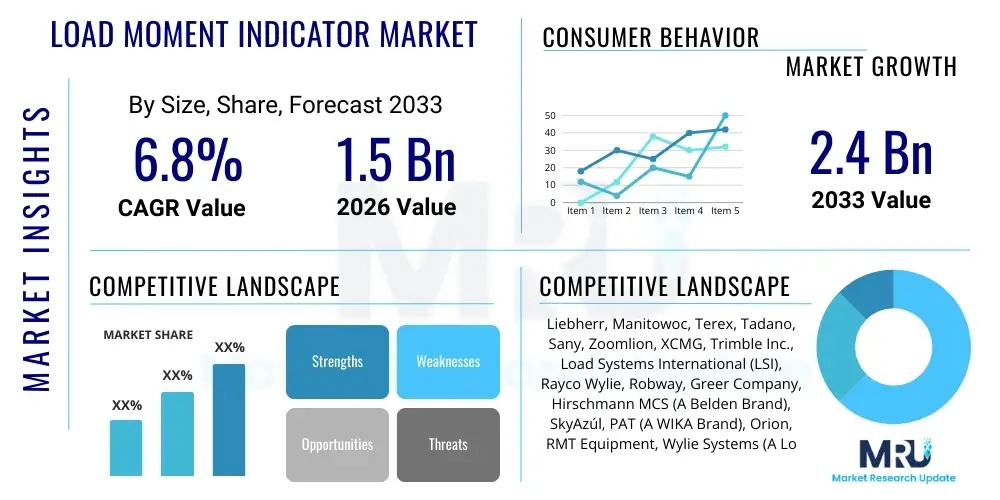

Load Moment Indicator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440682 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Load Moment Indicator Market Size

The Load Moment Indicator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by several critical factors, including the increasing emphasis on construction site safety, stringent regulatory mandates across various industries, and the continuous expansion of infrastructure development projects globally. The rising demand for heavy lifting equipment in sectors such as energy, manufacturing, and logistics further propels the adoption of Load Moment Indicators (LMIs), which are essential for preventing crane overloads and ensuring operational integrity.

The market's expansion is not merely a reflection of increased equipment sales but also the ongoing trend of retrofitting existing crane fleets with advanced safety systems. As older machinery is updated to comply with modern safety standards and operational efficiency requirements, the demand for sophisticated LMI solutions experiences a significant boost. Furthermore, technological advancements, such as the integration of wireless communication, real-time data analytics, and user-friendly interfaces, are enhancing the appeal and functionality of LMIs, making them indispensable tools for crane operators and site managers alike. The inherent value proposition of LMIs, in terms of reducing accident risks, minimizing equipment damage, and optimizing project timelines, firmly establishes their position as a high-growth segment within the broader industrial safety equipment market.

Load Moment Indicator Market introduction

The Load Moment Indicator (LMI) market encompasses the design, manufacturing, distribution, and servicing of electronic safety systems vital for the safe operation of cranes and other heavy lifting machinery. An LMI system is a crucial device that monitors the load being lifted, the crane's radius, boom angle, and other critical parameters to calculate the load moment and compare it against the crane's rated capacity. Its primary function is to alert the operator if the crane approaches an overload condition, thereby preventing structural damage, tip-overs, and potential accidents. The product typically comprises a central processing unit, various sensors (pressure transducers, length and angle sensors), and an in-cab display unit that provides real-time operational data and warnings to the operator. These sophisticated systems are fundamental in ensuring compliance with international safety standards and operational best practices across a multitude of industries where heavy lifting is routinely performed.

Major applications for Load Moment Indicators span across diverse sectors, including commercial and residential construction, oil and gas exploration and production, marine and offshore operations, mining, shipping and logistics, and renewable energy infrastructure development, particularly wind turbine installation and maintenance. In construction, LMIs are indispensable for tower cranes, mobile cranes, and crawler cranes operating on dynamic and challenging job sites, ensuring the structural integrity of both the crane and the lifted materials. Within the oil and gas industry, LMIs are critical for offshore platforms and onshore drilling rigs, where heavy lifting operations in hazardous environments demand the highest levels of safety and precision. The benefits of deploying LMI systems are multifaceted: they significantly enhance workplace safety by preventing catastrophic failures, reduce operational costs by minimizing equipment downtime and repair expenses, improve productivity through optimized lifting operations, and ensure regulatory compliance, thereby mitigating legal and financial risks for companies. These systems act as an intelligent co-pilot, empowering operators with real-time insights to make informed decisions and maintain safe working limits.

The driving factors behind the robust expansion of the Load Moment Indicator market are primarily centered on the escalating global focus on industrial safety, driven by increasingly stringent government regulations and industry standards designed to protect personnel and assets. Regulatory bodies worldwide are continuously updating and enforcing directives that mandate the use of advanced safety systems on lifting equipment, compelling operators to adopt LMI technology. Furthermore, the rapid pace of urbanization and industrialization, particularly in emerging economies, fuels significant investments in infrastructure projects, manufacturing facilities, and energy installations, all of which heavily rely on cranes and lifting equipment. This surge in demand for heavy machinery inherently translates into a heightened need for sophisticated safety solutions like LMIs. Economic growth and technological advancements also play pivotal roles; as new crane models emerge with higher lifting capacities and complex operational parameters, the integration of advanced LMI systems becomes even more critical. The increasing awareness among end-users regarding the long-term benefits of safety investments, including reduced insurance premiums, enhanced corporate reputation, and improved operational efficiency, further accelerates market growth. Finally, the retrofitting market, driven by the need to upgrade older crane fleets to meet contemporary safety benchmarks, provides a consistent revenue stream, ensuring sustained market momentum.

Load Moment Indicator Market Executive Summary

The Load Moment Indicator (LMI) market is experiencing dynamic shifts, characterized by a confluence of evolving business trends, distinct regional growth patterns, and significant segmentation developments. In terms of business trends, a major shift is observed towards integrated smart safety solutions, where LMIs are not standalone devices but are networked with telematics, IoT sensors, and cloud-based platforms for real-time data monitoring, predictive maintenance, and remote diagnostics. This integration allows for a more holistic approach to crane management, enabling fleet owners to track operational performance, identify potential issues before they become critical, and ensure compliance across distributed assets. There is also a growing emphasis on user-friendly interfaces and intuitive control systems, making advanced LMI technology accessible to a broader range of operators. The aftermarket segment, focusing on retrofitting existing cranes with modern LMI systems, continues to be a robust revenue stream, driven by the economic viability of upgrading rather than replacing entire fleets. Furthermore, strategic partnerships and collaborations between LMI manufacturers and crane OEMs are becoming more prevalent, aiming to provide factory-installed, seamlessly integrated safety solutions that enhance performance and reliability from the outset. The drive for operational efficiency and accident prevention remains the paramount business objective, guiding product innovation and market penetration strategies.

Regionally, the market exhibits varied growth rates and adoption patterns, with Asia Pacific emerging as a dominant force due to massive infrastructure investments, rapid urbanization, and a burgeoning construction sector, particularly in countries like China and India. Government initiatives promoting smart city development and sustainable infrastructure further fuel the demand for safe lifting solutions in this region. North America and Europe, while mature markets, continue to demonstrate steady growth, primarily driven by stringent safety regulations, a strong focus on worker protection, and the ongoing modernization of existing crane fleets. These regions are also at the forefront of adopting advanced LMI technologies, including AI-enhanced systems and wireless integration. Latin America, the Middle East, and Africa are experiencing increasing LMI adoption, spurred by growing construction activities, oil and gas exploration, and investments in port infrastructure. However, these regions often face challenges related to regulatory enforcement and the availability of skilled technicians, which can influence the pace of market expansion. The global push for renewable energy projects, such as wind farms, also contributes significantly to LMI demand across all regions, as these installations require specialized heavy lifting equipment operating under strict safety protocols.

Segmentation trends within the LMI market highlight key areas of innovation and demand. By type, wireless LMI systems are gaining significant traction over traditional wired systems due to their ease of installation, flexibility, and reduced maintenance requirements, offering enhanced mobility and less cable management complexity on busy construction sites. In terms of components, the market for advanced sensors (e.g., high-precision load cells, inclinometers, and wind speed sensors) and rugged, high-resolution displays is experiencing rapid growth, driven by the need for greater accuracy and real-time data visualization. Application-wise, the construction sector remains the largest consumer, but significant growth is also observed in the marine and offshore segment, where specialized LMIs designed for harsh environments and dynamic loading conditions are in high demand. The mining industry, with its heavy-duty lifting requirements and emphasis on worker safety, also represents a growing end-user segment. Furthermore, the market is seeing a trend towards modular LMI systems that can be easily customized and scaled to fit various crane types and operational needs, offering greater versatility to end-users. This granular understanding of segmentation allows manufacturers to tailor their product offerings and marketing strategies to meet specific industry requirements and capitalize on emerging opportunities.

AI Impact Analysis on Load Moment Indicator Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Load Moment Indicator (LMI) market frequently revolve around enhanced safety capabilities, predictive maintenance, operational efficiency, and the potential for autonomous crane operations. Users are keen to understand how AI algorithms can process complex sensor data more effectively than traditional systems, leading to more accurate risk assessments and proactive safety interventions. Concerns often include the reliability of AI in critical safety applications, data security, the cost of integration, and the need for skilled personnel to manage and maintain these advanced systems. Expectations are high for AI to transform LMIs from reactive warning systems into proactive, intelligent decision-making tools, capable of optimizing lift plans, minimizing human error, and ultimately creating safer and more efficient construction and industrial environments. The underlying theme is a desire for LMIs to move beyond simple load calculations to become comprehensive, intelligent assistants for crane operators and site managers, leveraging machine learning to adapt to dynamic conditions and learn from past operational data.

- AI-driven predictive analytics enable LMIs to forecast potential overload situations or component failures based on operational patterns and environmental factors, shifting from reactive warnings to proactive hazard prevention.

- Enhanced decision support for crane operators through AI algorithms that process multiple data streams (load, wind speed, ground conditions) to recommend optimal lifting parameters and identify potential risks in real-time.

- Integration of machine learning models for anomaly detection, allowing LMIs to identify unusual operational behaviors that could indicate mechanical issues or unsafe practices, thus improving overall fleet health monitoring.

- AI facilitates the development of intelligent load management systems that can dynamically adjust crane limits based on real-time environmental conditions (e.g., gusts of wind, ground instability), significantly boosting safety margins.

- The advent of AI contributes to the progression towards autonomous or semi-autonomous crane operations, where LMIs provide critical real-time data for automated control systems, reducing reliance on human intervention in hazardous tasks.

- Improved data analysis and reporting capabilities, as AI can sift through vast amounts of LMI operational data to identify trends, optimize resource allocation, and enhance compliance auditing, offering deeper operational insights.

- Development of AI-powered vision systems that complement traditional LMI sensors, offering object detection, collision avoidance, and precise positioning capabilities, particularly beneficial in complex or confined workspaces.

- AI supports adaptive learning in LMI systems, allowing them to refine their calibration and performance over time by analyzing historical operational data and environmental feedback, leading to higher accuracy and reliability.

DRO & Impact Forces Of Load Moment Indicator Market

The Load Moment Indicator (LMI) market is significantly influenced by a complex interplay of drivers, restraints, and opportunities, each exerting a distinct impact on its growth trajectory. Key drivers include the ever-increasing emphasis on workplace safety across global industries, driven by a humanitarian imperative and the economic repercussions of accidents. Governments and regulatory bodies worldwide are continuously updating and enforcing stringent safety standards and mandates for lifting equipment, compelling operators to invest in sophisticated LMI systems to ensure compliance and avoid hefty penalties. The rapid growth in construction and infrastructure development, particularly in emerging economies, fuels a robust demand for cranes and, consequently, for integrated safety devices like LMIs. Furthermore, the economic benefits associated with LMI adoption, such as reduced equipment damage, minimized downtime, lower insurance premiums, and enhanced operational efficiency, strongly incentivize companies to integrate these systems into their fleets. Technological advancements, leading to more accurate, reliable, and user-friendly LMI systems with features like wireless connectivity and real-time data logging, also act as a significant market driver, expanding their applicability and appeal.

Conversely, several restraints impede the market's full potential. The high initial investment cost associated with purchasing and installing advanced LMI systems can be a significant barrier, particularly for small and medium-sized enterprises (SMEs) with limited capital budgets. This is compounded by the perception that LMIs are an added expense rather than a critical safety investment, especially in regions with lax regulatory enforcement. The complexity of integrating LMI systems with diverse crane types and models, along with the need for specialized training for operators and maintenance personnel, also presents a challenge. A lack of awareness regarding the full benefits of modern LMI technology in some regions, coupled with the slow adoption rates of new safety standards, further acts as a restraint. Additionally, economic downturns or fluctuations in the construction and industrial sectors can temporarily dampen demand for new equipment and safety upgrades, impacting market growth. The maintenance and calibration requirements of LMIs also add to operational costs, which can be a deterrent for some end-users.

Opportunities within the LMI market are vast and promising. The retrofitting market offers substantial growth potential, as a large installed base of older cranes worldwide needs to be upgraded to meet contemporary safety standards without the prohibitive cost of full replacement. This creates a continuous demand for advanced LMI systems adaptable to existing machinery. Emerging markets, with their burgeoning infrastructure projects and industrialization efforts, present untapped opportunities for LMI manufacturers to expand their geographic footprint and capitalize on new construction booms. The ongoing integration of LMIs with advanced technologies such as telematics, the Internet of Things (IoT), and Artificial Intelligence (AI) for enhanced data analytics, predictive maintenance, and remote monitoring creates new value propositions and drives innovation. Moreover, the increasing focus on customized LMI solutions tailored for specific applications, such as wind turbine installation, port logistics, or specialized marine operations, allows manufacturers to cater to niche markets with unique safety requirements. Educational initiatives to raise awareness about the long-term benefits and regulatory necessity of LMIs can also unlock significant market potential by overcoming the perception of high initial cost and promoting wider adoption across all operational scales. These opportunities, when strategically pursued, can significantly accelerate market expansion.

Segmentation Analysis

The Load Moment Indicator (LMI) market is broadly segmented to provide a comprehensive understanding of its diverse landscape, enabling stakeholders to identify specific growth areas and tailor strategies effectively. This segmentation typically considers various parameters such as the type of LMI system, the components involved, the specific crane type it is integrated with, and the end-use application industries. Analyzing these segments helps in understanding demand patterns, technological preferences, and the competitive environment across different market niches. The market's structural integrity is defined by how these individual segments perform, influenced by regulatory frameworks, technological advancements, and regional industrial growth. Understanding these segments is crucial for accurate market forecasting, product development, and strategic market entry.

- By Type:

- Wired LMI Systems: Traditional systems relying on physical cable connections for data transmission, often robust and reliable in stable environments but requiring more complex installation and maintenance.

- Wireless LMI Systems: Increasingly popular systems utilizing radio frequencies or other wireless protocols for data communication, offering easier installation, greater flexibility, and reduced cable management challenges.

- By Component:

- Sensors: Includes load cells (pressure transducers), length sensors, angle sensors (inclinometers), wind speed sensors, and anti-two block switches, which gather critical operational data.

- Displays: In-cab monitor units that provide real-time data, warnings, and graphical interfaces to the crane operator.

- Processors/Controllers: The central computing unit that receives sensor data, performs calculations, and manages the LMI system's overall functions, including alarm triggers.

- Software: Firmware and application software running on the LMI system, responsible for calculations, data logging, diagnostics, and user interface functionalities.

- By Crane Type:

- Mobile Cranes: Includes rough terrain cranes, all-terrain cranes, truck-mounted cranes, and carry deck cranes, which are highly versatile and widely used in construction and industrial applications.

- Tower Cranes: Stationary cranes primarily used in high-rise construction projects, requiring precise load monitoring due to their height and reach.

- Crawler Cranes: Track-mounted cranes known for their high lifting capacities and stability on uneven terrain, common in heavy construction, infrastructure, and energy projects.

- Marine Cranes: Specialized cranes used on barges, ships, and offshore platforms, designed to operate in dynamic marine environments with unique stability and load-sensing requirements.

- Overhead Cranes: Cranes found in factories and warehouses for material handling, where LMIs ensure safe internal logistics and production processes.

- By Application/End-Use Industry:

- Construction: The largest segment, encompassing residential, commercial, and infrastructure development, including roads, bridges, and tunnels.

- Oil & Gas: Operations in exploration, drilling, production, and refining, both onshore and offshore, where safety is paramount due to hazardous environments.

- Shipping & Logistics: Port operations, shipbuilding, container handling, and freight movement, requiring efficient and safe lifting of heavy cargo.

- Mining: Extraction and processing of minerals, involving heavy machinery and continuous lifting operations in challenging conditions.

- Utilities & Energy: Power generation (including wind farms and nuclear), transmission, and distribution, with a growing demand for LMIs in renewable energy infrastructure.

- Manufacturing: Industrial facilities using cranes for assembly, material handling, and equipment installation within controlled environments.

Value Chain Analysis For Load Moment Indicator Market

The value chain for the Load Moment Indicator (LMI) market is a complex ecosystem involving multiple stages, from raw material sourcing to the final deployment and aftermarket services, illustrating the interconnectedness of various participants. The upstream analysis begins with the procurement of critical raw materials and components necessary for LMI system manufacturing. This includes electronic components such as microprocessors, memory chips, displays, wiring, and specialized sensors like load cells, length sensors, and angle sensors. Suppliers in this segment provide high-quality, often customized, electronic and mechanical parts that meet stringent industrial standards. Furthermore, the development of proprietary software and firmware, which forms the core intelligence of LMI systems, is a significant upstream activity, often involving specialized software developers and embedded systems engineers. Strong relationships with reliable component suppliers are crucial for ensuring the quality, cost-effectiveness, and uninterrupted supply of LMI systems. Research and development activities also sit firmly upstream, focusing on innovation in sensor technology, processing capabilities, and user interface design to enhance system accuracy, reliability, and user experience, driving future market competitiveness.

Moving downstream, the value chain encompasses the manufacturing, assembly, and distribution channels that bring the LMI systems to end-users. LMI manufacturers typically design and assemble the various components into a complete, integrated system, involving rigorous testing and calibration to meet industry standards and regulatory requirements. This manufacturing phase often includes both mass production for standard LMI models and custom engineering for specialized applications. Once manufactured, the products are moved through distribution channels, which can be direct or indirect. Direct channels involve LMI manufacturers selling directly to large crane OEMs (Original Equipment Manufacturers) who integrate the LMIs as factory-installed features, or directly to large fleet owners and government agencies for retrofitting. Indirect channels involve a network of authorized distributors, dealers, and value-added resellers (VARs) who provide sales, installation, and often local support services to a broader range of end-users, including smaller construction firms, rental companies, and individual crane operators. These distributors play a crucial role in market penetration, especially in geographically diverse or emerging markets, leveraging their local presence and customer relationships to offer tailored solutions and support. The effectiveness of these distribution networks is paramount for timely delivery and efficient market reach.

The downstream analysis also extends to post-sales services, which are critical for customer satisfaction and long-term market presence. This includes installation services, calibration, operator training, maintenance, repair, and ongoing technical support. Many LMI manufacturers and their authorized service partners provide these essential services, ensuring the continuous, safe, and optimal functioning of the LMI systems throughout their operational life. Direct and indirect distribution channels also encompass the sales of spare parts and software updates, which contribute significantly to the aftermarket revenue. The feedback loop from end-users through these channels is invaluable for product improvement and innovation. Effective service provision not only ensures product longevity but also builds strong customer loyalty and brand reputation. The entire value chain is driven by the imperative of safety and efficiency in heavy lifting operations, with each participant contributing to the ultimate goal of preventing accidents and optimizing crane performance. The efficiency and integration across this value chain directly impact the cost, quality, and accessibility of LMI solutions for the global market.

Load Moment Indicator Market Potential Customers

The potential customers for Load Moment Indicator (LMI) systems are diverse and span across numerous heavy industries where the safe and efficient operation of lifting equipment is paramount. Primarily, these include crane operators, construction companies, infrastructure development firms, and heavy equipment rental agencies that own and operate a wide range of cranes, from mobile and tower cranes to crawler and marine cranes. For these end-users, LMIs are not just an optional accessory but a critical safety component mandated by regulations and essential for preventing costly accidents, equipment damage, and project delays. Construction companies, regardless of their size, are continuous buyers as they seek to comply with evolving safety standards, protect their workforce, and enhance operational efficiency on dynamic job sites. Large infrastructure projects, such as bridge construction, dam building, and large-scale industrial plant installations, demand multiple LMI-equipped cranes, making these projects significant consumption hubs.

Beyond the core construction sector, the oil and gas industry represents a substantial customer base, particularly for offshore drilling platforms, refineries, and pipeline construction. The hazardous and often remote environments in which these operations occur necessitate the highest levels of safety and precision in lifting, making advanced LMI systems indispensable. Similarly, the shipping and logistics sector, encompassing port authorities, terminal operators, and shipbuilding companies, relies heavily on cranes for cargo handling, container stacking, and vessel construction and repair. The need for rapid, high-volume material movement under strict safety protocols drives demand for robust LMI solutions in this segment. The mining industry, with its heavy-duty lifting requirements for ore extraction, equipment maintenance, and material transport within challenging terrains, also constitutes a significant market for LMIs, prioritizing ruggedness and reliability.

Furthermore, the rapidly expanding renewable energy sector, especially wind farm development and maintenance, creates a specialized demand for LMIs tailored to extremely tall and heavy lifts. Utility companies involved in power grid maintenance and the installation of large-scale electrical infrastructure also represent key buyers. Original Equipment Manufacturers (OEMs) of cranes are indirect but pivotal customers, as they integrate LMI systems into new cranes as factory-installed features, making them a primary channel for LMI technology adoption. Finally, government agencies and military organizations, which operate their own fleets of heavy lifting equipment for various public works and defense applications, are also significant purchasers, often prioritizing advanced features and compliance with strict government specifications. The overarching driver for all these customer segments is the imperative to enhance safety, reduce operational risks, comply with regulations, and ultimately improve productivity and profitability through reliable lifting operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Liebherr, Manitowoc, Terex, Tadano, Sany, Zoomlion, XCMG, Trimble Inc., Load Systems International (LSI), Rayco Wylie, Robway, Greer Company, Hirschmann MCS (A Belden Brand), SkyAzúl, PAT (A WIKA Brand), Orion, RMT Equipment, Wylie Systems (A Load Systems International Company), GS Global Resources, FWF Load Monitoring Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Load Moment Indicator Market Key Technology Landscape

The technology landscape of the Load Moment Indicator (LMI) market is characterized by continuous innovation aimed at enhancing safety, accuracy, and operational efficiency of heavy lifting equipment. At its core, LMI technology relies on sophisticated sensor integration. This includes high-precision load cells or pressure transducers that measure the actual weight being lifted, robust length and angle sensors (often inclinometers or encoders) that determine the boom's configuration, and anti-two-block switches that prevent hoist ropes from being pulled into the boom tip. The advancement in these sensor technologies, providing higher accuracy and durability in harsh operating environments, forms the fundamental backbone of modern LMI systems. Furthermore, the development of intelligent microprocessors and advanced digital signal processing (DSP) techniques has significantly improved the ability of LMIs to rapidly and accurately process multiple data inputs in real-time, performing complex calculations to determine the crane's load moment relative to its rated capacity. This computational power is crucial for dynamic risk assessment and immediate operator feedback.

A significant technological shift in the LMI market is the widespread adoption of wireless communication protocols. Traditional wired systems, while reliable, can be cumbersome to install, prone to cable damage, and limit operational flexibility. Wireless LMIs, utilizing technologies such as Wi-Fi, Bluetooth, or proprietary radio frequencies, offer easier installation, reduced maintenance, and greater adaptability to various crane configurations. This wireless integration also facilitates seamless data transfer between sensors, the central processing unit, and the in-cab display. Concurrently, the evolution of display technology plays a critical role. Modern LMI systems feature high-resolution, sunlight-readable, and ruggedized LCD or LED displays that provide clear, intuitive graphical interfaces for operators. These displays often present real-time data on load weight, radius, boom angle, rated capacity, and warning indicators, making it easier for operators to stay within safe working limits. The user interface design often incorporates touchscreens and customizable layouts, enhancing usability and reducing cognitive load on operators, especially during critical lifting operations.

Beyond core hardware, software innovation is a vital differentiator. Advanced LMI systems are increasingly leveraging sophisticated algorithms for real-time load chart management, dynamic stability calculations, and compensation for environmental factors like wind speed. The integration of telematics and cloud-based platforms is revolutionizing how LMI data is utilized, allowing for remote monitoring of crane operations, comprehensive fleet management, and predictive maintenance scheduling. This capability enables companies to gather invaluable operational data, analyze performance trends, identify potential issues before they escalate, and ensure regulatory compliance across an entire fleet. The convergence of LMI technology with the Internet of Things (IoT) allows sensors to communicate directly with cloud platforms, fostering a connected ecosystem of smart cranes. Looking ahead, the nascent integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms promises to further enhance LMI capabilities, enabling predictive safety warnings, autonomous operational assistance, and adaptive load management based on historical data and real-time environmental inputs, pushing the boundaries of crane safety and efficiency.

Regional Highlights

- North America: This region maintains a mature and technologically advanced LMI market, driven by stringent safety regulations imposed by bodies like OSHA and ASME, ensuring widespread adoption across construction, oil & gas, and manufacturing sectors. The focus here is heavily on modernization and retrofitting existing crane fleets with cutting-edge, often wireless and IoT-integrated, LMI systems. Investments in infrastructure upgrades and robust residential and commercial construction activities further stimulate demand. The presence of major LMI manufacturers and a strong emphasis on worker safety contribute to steady growth, with significant demand coming from both new equipment sales and the aftermarket.

- Europe: Europe represents another highly regulated and safety-conscious market, with directives from the European Union (EU) mandating high safety standards for lifting equipment. Countries like Germany, the UK, and France are key contributors, driven by a strong manufacturing base, significant investments in renewable energy (especially wind farms), and ongoing infrastructure projects. The market here emphasizes precision, reliability, and the integration of LMIs with advanced telematics for fleet management and compliance. Innovations in smart construction and digital twins also influence LMI adoption, pushing for highly interconnected and data-rich safety solutions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the LMI market, fueled by unprecedented infrastructure development, rapid urbanization, and industrialization in countries like China, India, and Southeast Asian nations. Massive government investments in smart cities, transportation networks, and manufacturing hubs are driving a colossal demand for heavy lifting equipment, consequently boosting LMI adoption. While price sensitivity can be a factor, the increasing awareness of international safety standards and the desire to reduce accident rates are accelerating the integration of advanced LMI systems. The sheer scale of construction and industrial activity makes APAC a critical growth engine.

- Latin America: This region is experiencing steady growth in the LMI market, primarily driven by increasing investments in infrastructure, mining, and oil & gas sectors. Countries like Brazil, Mexico, and Chile are witnessing significant construction and industrial expansion, leading to a rising demand for cranes and associated safety systems. Regulatory frameworks are gradually strengthening, pushing for greater adoption of LMI technology to improve workplace safety. The market often seeks cost-effective yet reliable LMI solutions, and there's a growing trend towards upgrading older equipment to meet international operational standards.

- Middle East and Africa (MEA): The MEA region presents significant opportunities, particularly in the Middle East with its ambitious mega-projects, urban development initiatives, and ongoing investments in the oil & gas sector. Countries like UAE, Saudi Arabia, and Qatar are key markets, characterized by large-scale construction activities requiring sophisticated and robust LMI systems for diverse crane types. In Africa, growing infrastructure development, particularly in sub-Saharan Africa, and expansion in mining and resource extraction industries are driving LMI demand. However, challenges related to regulatory enforcement and the availability of skilled technicians can influence market maturity and adoption rates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Load Moment Indicator Market.- Liebherr

- Manitowoc

- Terex

- Tadano

- Sany

- Zoomlion

- XCMG

- Trimble Inc.

- Load Systems International (LSI)

- Rayco Wylie

- Robway

- Greer Company

- Hirschmann MCS (A Belden Brand)

- SkyAzúl

- PAT (A WIKA Brand)

- Orion

- RMT Equipment

- Wylie Systems (A Load Systems International Company)

- GS Global Resources

- FWF Load Monitoring Systems

- Transco Industries Inc.

Frequently Asked Questions

What is a Load Moment Indicator (LMI) and why is it important?

A Load Moment Indicator (LMI) is an electronic safety system for cranes that monitors critical operational parameters such as load weight, boom length, boom angle, and radius. It calculates the crane's load moment and compares it against the rated capacity, providing real-time warnings to the operator if an overload condition is approached or exceeded. Its importance lies in significantly enhancing workplace safety by preventing crane overloads, tip-overs, and structural failures, thereby reducing accidents, protecting personnel, minimizing equipment damage, and ensuring compliance with stringent safety regulations. LMIs are crucial for optimizing crane operations and maintaining safe working limits on construction sites and in heavy industries.

How do Load Moment Indicators contribute to site safety and operational efficiency?

Load Moment Indicators contribute to site safety by providing continuous, real-time data and audible/visual alarms to operators, allowing them to prevent dangerous overload situations that could lead to catastrophic failures. By ensuring the crane operates within its safe working limits, LMIs protect personnel and valuable assets. In terms of operational efficiency, LMIs provide precise load information, which helps operators optimize lifting plans and execute tasks more confidently. They reduce downtime caused by accidents or equipment repairs, streamline operations by providing clear operational parameters, and contribute to faster project completion times. Additionally, data logged by LMIs can be used for post-operation analysis, improving future planning and training protocols, leading to overall safer and more efficient lifting practices.

What are the key technological advancements shaping the LMI market?

The LMI market is being shaped by several key technological advancements. The shift from traditional wired systems to advanced wireless LMIs offers easier installation, greater flexibility, and reduced maintenance. Integration with telematics and cloud-based platforms enables remote monitoring, predictive maintenance, and comprehensive fleet management, providing valuable operational insights. High-precision sensors (load cells, angle sensors) and robust, intuitive in-cab displays enhance accuracy and user experience. Furthermore, the nascent integration of Artificial Intelligence (AI) and Machine Learning (ML) is paving the way for predictive safety warnings, adaptive load management, and ultimately, smarter, more autonomous crane operations. These innovations collectively improve accuracy, reliability, and the overall intelligence of LMI systems.

Which industries are the primary end-users for Load Moment Indicators?

The primary end-users for Load Moment Indicators span a wide array of heavy industries where lifting operations are fundamental. The construction sector, encompassing residential, commercial, and infrastructure projects (e.g., roads, bridges, high-rises), is the largest consumer. Other significant industries include oil & gas (onshore and offshore exploration/production), shipping & logistics (port operations, container handling, shipbuilding), mining (heavy equipment handling, material extraction), and utilities & energy (power generation, wind turbine installation, grid maintenance). Manufacturing facilities also utilize LMIs for material handling and assembly. Each industry relies on LMIs to ensure safety, regulatory compliance, and efficient execution of critical lifting tasks, adapted to their specific operational challenges.

What is the significance of the retrofitting market for LMIs?

The retrofitting market for Load Moment Indicators holds significant importance due to the large installed base of older cranes globally that may not have advanced safety systems or need upgrades to meet contemporary safety standards. Retrofitting allows crane owners to enhance the safety and compliance of their existing machinery without incurring the substantial cost of purchasing new equipment. This segment is driven by evolving regulatory mandates and the economic benefits of extending the operational life of cranes while improving safety performance. It provides a continuous revenue stream for LMI manufacturers and installers, enabling wider adoption of advanced LMI technology and contributing significantly to overall market growth and safety improvements across the industry, particularly for small and medium-sized enterprises.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager