Lock Washers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434950 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Lock Washers Market Size

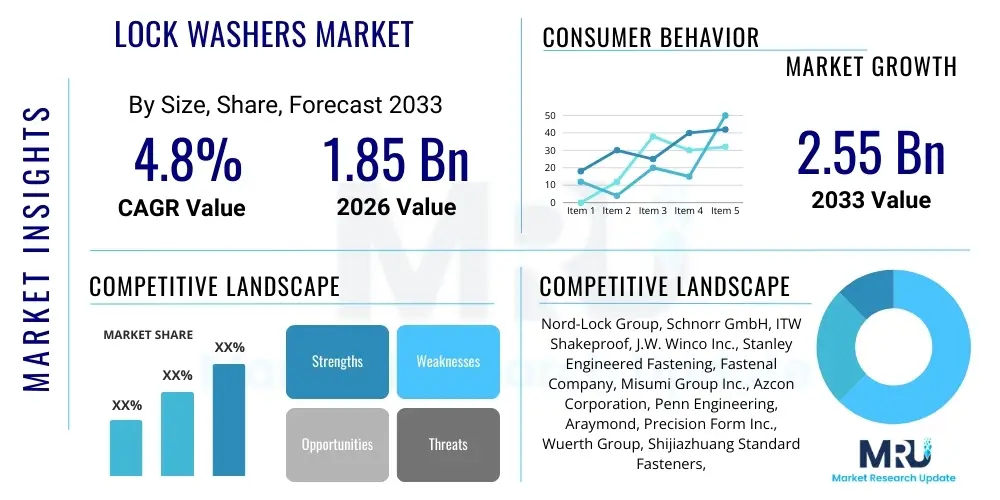

The Lock Washers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

Lock Washers Market introduction

The Lock Washers Market encompasses the global trade and utilization of specialized fastening components designed to prevent nuts and bolts from loosening due to vibration, thermal expansion, and mechanical shock. Lock washers, sometimes referred to as locking washers or anti-vibration washers, are critical components in maintaining the structural integrity and long-term reliability of assemblies across diverse industrial sectors. These products are fundamentally defined by their ability to provide friction, tension, or mechanical interference when compressed, thereby ensuring that the bolted joint retains its pre-load tension under dynamic operational conditions. The importance of maintaining precise clamping force cannot be overstated, particularly in critical applications where fastener failure leads to catastrophic equipment malfunction or safety hazards. The effectiveness of a lock washer is quantified by its ability to resist the rotational movement between the nut and the bearing surface, a performance metric often validated using standardized testing protocols such as the Junker test (DIN 65151). The fundamental mechanical objective is to create sufficient counter-force to overcome the torque required for loosening, effectively raising the joint’s resistance to self-unscrewing under operational stress.

Key product categories within this market include spring lock washers (split), which rely on spring tension to maintain friction; toothed lock washers (internal and external), which bite into the mating surfaces to create a mechanical lock; and specialized high-security washers like wedge-locking systems, which use opposing cam geometry to dynamically increase clamping force when loosening occurs. The selection of material is paramount, dictating the component’s suitability for a given environment. Standard offerings include carbon steel (often plated with zinc or cadmium for corrosion resistance), stainless steel (304, 316, 410 for enhanced environmental durability), brass, and exotic high-performance alloys such as Inconel or Hastelloy used in high-temperature or highly corrosive environments like aerospace engines and deep-sea drilling equipment. The constant drive for higher performance is pushing manufacturers toward developing unique surface treatments and specialized geometries that maximize grip and minimize material loss during installation and operation. Furthermore, the rising complexity of modern machinery, which operates at higher speeds and temperatures, necessitates lock washer solutions that can handle increased dynamic loading and thermal expansion differentials with guaranteed reliability.

Major applications of lock washers span crucial heavy industries, including automotive manufacturing, where they are essential for securing critical engine parts, chassis components, and wheel assemblies. In the infrastructure sector, they are vital for long-term stabilization of bridges, communication towers, and high-speed rail tracks, environments where structural failure is intolerable. The burgeoning renewable energy sector, particularly utility-scale wind turbine installations, represents a high-growth application area, demanding advanced anti-vibration technology due to continuous oscillating loads. Driving factors for market growth include stringent global safety regulations, the massive capital expenditure allocated to infrastructure projects in emerging economies, and the continuous replacement and maintenance demand generated by aging industrial assets globally. The benefits derived from utilizing certified lock washers—including extended equipment service life, substantial reduction in unscheduled downtime, increased operational safety, and adherence to rigorous industry standards—solidify their status as indispensable components in modern mechanical and structural engineering.

Lock Washers Market Executive Summary

The Lock Washers Market trajectory confirms sustained, moderate growth, underpinned by fundamental demand drivers related to infrastructure renewal and advanced manufacturing requirements across key industrial verticals. Current business trends indicate a definitive shift away from commodity-grade fasteners toward specialized, value-added locking solutions. This transition is being catalyzed by end-user industries demanding guaranteed pre-load retention performance, driven by zero-defect requirements in assembly. Key manufacturers are differentiating themselves through proprietary locking mechanisms (like cam-based designs) and specialized materials, moving the competitive focus from simple cost reduction to total life-cycle reliability. Supply chain resilience, following recent global disruptions, has become a strategic priority, leading to greater vertical integration among top-tier suppliers and increased reliance on regional manufacturing hubs to ensure prompt delivery of high-volume and custom parts. Furthermore, environmental, social, and governance (ESG) pressures are influencing material choices and coating processes, with a growing preference for solutions that avoid restricted substances like cadmium.

Regionally, the market dynamism is most pronounced in Asia Pacific (APAC), which not only accounts for the largest production volume globally but is also experiencing the fastest demand growth, fuelled by rapid industrialization in Southeast Asia and continued heavy investment in China's automotive and rail networks. North America and Europe, while growing at a slower pace, dominate the high-value segment. These regions exhibit strong demand for highly engineered products catering to aerospace, defense, and offshore applications, where product certification and traceability are paramount, commanding significant price premiums. European market strategy is heavily focused on innovation in fatigue resistance and compliance with strict EU directives on material content and recycling. Emerging economies in Latin America and MEA are seeing substantial, project-specific demand, particularly related to oil and gas exploration and large-scale public works, creating opportunities for suppliers who can manage complex logistics and local regulatory compliance effectively.

Segmentation analysis highlights that while Carbon Steel remains the dominant material by volume due to its cost-efficiency in construction and general industrial use, Stainless Steel grades are rapidly gaining share due to their longevity and performance in corrosive environments, particularly in water treatment and renewable energy projects. Based on Type, the growth is disproportionately favoring specialized designs: Wedge-Locking Washers and high-tension Conical Spring Washers are experiencing accelerated adoption rates as engineers seek verifiable anti-loosening solutions for dynamic loads. The Automotive industry retains its leadership in the Application segment, closely followed by the increasing requirements of the General Industrial and Power Generation (including nuclear, thermal, and wind) sectors. The executive view concludes that future success depends on anticipating highly specific engineering needs, investing in smart manufacturing for quality control, and securing supply chains to manage the increasing complexity of specialized fastener portfolios globally.

AI Impact Analysis on Lock Washers Market

Analyzing user queries reveals a deep interest in how AI and machine learning are revolutionizing the traditional, mechanical field of fastening technology. Common questions center on the ability of AI algorithms to optimize lock washer design for specific applications, especially where complex dynamic loads are present. Users frequently ask about the implementation of AI-driven quality assurance systems to detect minute material flaws or dimensional inconsistencies during high-volume production, recognizing that even minor defects can compromise joint integrity. A significant area of concern and inquiry is the potential for AI integration into maintenance regimes: specifically, leveraging ML models to process vast amounts of sensor data from IIoT-enabled machinery to predict the precise moment a bolted joint might lose its pre-load tension, thereby allowing maintenance teams to intervene proactively before operational failure. These thematic queries suggest a market moving towards quantifiable reliability, where the physical component is increasingly supported and validated by intelligent data analytics throughout its lifecycle, from conception to in-service monitoring. The consensus expectation is that AI will minimize human error in manufacturing and vastly extend the predictable lifespan of critical bolted assemblies, fundamentally shifting the emphasis from component replacement to condition-based monitoring, particularly for proprietary high-end locking systems.

- AI-powered Predictive Maintenance: Utilization of machine learning models to analyze vibration and stress data from bolted joints, predicting the pre-load decay or potential loosening of lock washers in critical machinery (e.g., wind turbines, rail bogies), enabling preemptive replacement. This moves the industry beyond time-based maintenance to condition-based servicing, drastically reducing downtime and preventing costly structural failures.

- Optimized Manufacturing Processes: Implementing AI for real-time monitoring of stamping and forming machinery, utilizing sensors and acoustic analysis to immediately detect wear on tooling, ensuring tighter tolerances, identifying microscopic defects, and drastically reducing material waste in the high-speed production of complex washer types, thus improving overall yield rates and consistency.

- Generative Design of Fasteners: Using advanced AI algorithms to explore and optimize complex lock washer geometries that maximize friction and mechanical resistance for specific load and vibration profiles, allowing engineers to quickly iterate on thousands of designs far surpassing the limitations of traditional, manual engineering methods, leading to patented, highly efficient locking solutions.

- Enhanced Quality Control (QC): Deployment of computer vision and deep learning models for high-speed, automated inspection of surface finish, material integrity, and dimensional accuracy. These systems can process images from multiple angles instantaneously, checking for cracks, burrs, or inconsistent plating thickness with sensitivity far exceeding traditional manual or mechanical gauging, guaranteeing zero-defect output for sensitive applications.

- Intelligent Supply Chain and Inventory Management: Leveraging AI to forecast demand accurately based on industrial output trends, geopolitical factors, and seasonal cycles, optimizing stock levels for thousands of specialized lock washer variants across global distribution centers. This sophisticated forecasting minimizes holding costs, prevents critical stock-outs for key industrial clients, and streamlines logistics in complex global networks.

DRO & Impact Forces Of Lock Washers Market

The Lock Washers Market’s growth trajectory is intricately defined by powerful intrinsic Drivers, persistent operational Restraints, and transformative technological Opportunities. The market is fundamentally buoyant, propelled by the relentless global push toward enhanced safety standards in infrastructure and manufacturing, making high-integrity fastening solutions mandatory, not optional. The primary driver is the accelerating volume and velocity of heavy industrial activity globally. Restraints are primarily tied to external economic volatility, specifically the erratic pricing of steel and nickel, which pressures the cost structure of high-volume producers, coupled with the persistent challenge of distinguishing high-quality, certified products from low-cost, unverified alternatives. Opportunities reside squarely in the sphere of specialization—creating highly durable, maintenance-free fastening systems tailored for emerging, high-stress sectors like deep-sea energy installations and high-speed aerospace applications, where performance guarantees justify premium pricing models. This delicate balance of forces underscores the necessity for manufacturers to heavily invest in process efficiency and material science to maintain a competitive edge, ensuring that innovation translates directly into quantifiable long-term reliability for end-users operating critical systems.

Drivers: A paramount driver is the exponential growth in global infrastructure investment, particularly concentrated in massive transportation (rail, highway networks) and urban development projects across APAC and MEA, requiring vast quantities of structurally reliable fasteners. Furthermore, the global shift towards renewable energy sources mandates robust fastening systems; the constant, high-frequency fatigue loading experienced by utility-scale wind turbine towers and blades dictates the mandatory use of specialized, certified lock washers with verified performance longevity. The regulatory environment also plays a crucial, reinforcing role: increasingly stringent government mandates concerning workplace safety and product liability (particularly in North America and Europe) compel OEMs across all sectors—from mining machinery to medical devices—to specify and use only proven anti-loosening mechanisms. The inevitable life cycle of machinery generates a substantial, recession-resistant aftermarket demand for replacement and upgrade parts (MRO), which consistently supports market volume. The complexity and power of modern machinery means joint failure risks are higher, making reliable fastening an absolute prerequisite for operational sustainability and insurance compliance.

Restraints: The market faces significant headwinds from the extreme volatility in the global prices of primary raw materials, specifically high-grade carbon steel, stainless steel, and nickel, which are essential for manufacturing quality lock washers. Since the cost of raw metal constitutes a major portion of the final product price in high-volume segments, sudden material cost spikes can severely impact profitability and necessitate frequent price adjustments, complicating long-term contracting. A persistent competitive restraint is the widespread availability and acceptance of low-cost, uncertified lock washers, particularly the traditional split washer type, often sourced from highly decentralized Asian suppliers. These low-quality products not only depress average market prices but also pose significant safety risks when used inappropriately in critical applications, potentially damaging the reputation of the entire fastener category. Moreover, technological substitutes, notably advanced chemical thread lockers (adhesives) and specialized captive bolts/nuts, continuously evolve, posing a competitive threat by eliminating the need for a separate lock washer component in specific assemblies, forcing traditional manufacturers to innovate or lose market share in lower load environments.

Opportunities: Significant future growth opportunities are rooted in technological differentiation and market niche exploitation. The rapidly expanding sector of electrification (EVs and industrial electrification) requires highly specialized non-magnetic, lightweight, and heat-resistant lock washers, presenting a high-value customization opportunity. Developing and marketing "smart fasteners" that integrate miniature wireless sensors capable of monitoring pre-load tension in real-time offers a premium market segment serving the Industrial Internet of Things (IIoT) trend, appealing directly to large asset owners focused on predictive maintenance. Geographically, untapped potential exists in regions undergoing rapid, regulated industrialization, such as specific corridors in Southeast Asia and Africa, where standardization efforts are creating demand for certified, European or American-standard fasteners for the first time. Finally, the growing corporate emphasis on sustainability is an opportunity for manufacturers who can develop green fasteners using recycled materials, minimize production waste, or implement highly durable coatings that extend component lifespan, appealing to corporations with strong ESG procurement mandates. The capacity to offer advanced technical consultation and validated performance testing to engineers serves as a high-barrier-to-entry opportunity for premium suppliers.

- Drivers: Global infrastructure investment surge; implementation of stricter international safety and reliability standards (ISO, EN); escalating demand from renewable energy sectors (wind, solar); continuous replacement cycle driven by MRO needs; rapid expansion and electrification of the automotive sector.

- Restraints: Acute vulnerability to global steel and alloy price volatility; proliferation of low-quality, non-certified commodity products; market encroachment by alternative thread-locking adhesives and self-locking nuts; high capital expenditure required for tooling and precision manufacturing.

- Opportunity: Specialization in IIoT-integrated smart fasteners for predictive maintenance; targeting high-growth niche markets like aerospace and offshore wind; developing advanced non-metallic or lightweight alloy washers for EVs; geographical expansion into developing regulatory environments; offering customized fastener solutions with validated performance data.

- Impact Forces: Safety regulations significantly uplift demand for certified products (High); Raw material cost fluctuations profoundly affect smaller competitors (High); Technological innovation (wedge-locking, smart sensing) accelerates premium segment growth (High-Medium); Global manufacturing health directly correlates with volume demand (Medium).

Segmentation Analysis

The Lock Washers Market segmentation provides a critical view of the diverse product engineering, material applications, and industrial adoption patterns that characterize the industry. Segmenting by Type illuminates the functional evolution of the market, distinguishing between friction-dependent mechanisms (like standard split washers) and mechanically secure systems (like cam-based wedge-locking washers). This division clearly shows that while standard types maintain high volume, specialized, high-performance types are capturing disproportionately high value and demonstrating superior growth rates, reflecting engineering mandates for enhanced joint security under dynamic loading conditions. The performance characteristics demanded by modern machinery—higher speeds, greater power, and enhanced vibration—are fundamentally reshaping the product mix, favoring products that offer guaranteed pre-load retention and maintain tension over extended operational periods. This necessitates ongoing investment in precision tooling and proprietary design patents to secure market differentiation.

Material segmentation dictates the operational envelope and longevity of the lock washer. Carbon steel, due to its favorable strength-to-cost ratio, remains the workhorse for general industrial and construction applications, often requiring specialized plating like zinc flake or galvanization for basic corrosion protection. However, the rapidly expanding need for durability in extreme environments—such as saltwater spray, chemical exposure, or high heat—is driving robust growth in the Stainless Steel segment (specifically 316 grade) and specialized alloys. Manufacturers focusing on premium markets (aerospace, medical, chemical processing) prioritize these higher-cost materials, emphasizing certifications and traceability documentation. Furthermore, niche requirements, such as electrical isolation in electronics or weight reduction in aerospace, spur the small but technologically advanced segment of polymer or titanium lock washers. Understanding these material preferences is crucial for supply chain planning and compliance with industry-specific material restrictions.

Analysis by Application confirms the strong reliance of the lock washer market on the health of the heavy industrial sectors. The Automotive Industry, particularly with the rapid global adoption of complex powertrain systems and the transition to EVs, requires an enormous variety of customized washers for safety-critical assemblies (brakes, steering, battery enclosures). The Construction and Infrastructure segment demands large-diameter, high-tensile components for structural security in long-life assets. Meanwhile, the Energy sector, especially in the context of large-scale power generation and oil & gas extraction, requires the highest performance fasteners to minimize maintenance cycles in inaccessible or hazardous locations. Strategic market participants focus on vertical integration and developing specific application expertise, allowing them to provide comprehensive fastening solutions rather than just components. This includes offering engineering consultation on joint design and providing specialized coating processes to meet the unique longevity and safety requirements of each distinct industrial end-user.

- By Type:

- Split Lock Washers (Spring Washers) – High volume, general use, friction-based.

- Toothed Lock Washers (Internal and External) – Provide mechanical locking bite, suitable for electrical grounding applications.

- Wedge-Locking Washers (e.g., Double Stack Design) – Superior resistance to vibration, cam-based mechanical locking, high growth segment.

- Conical Spring Washers (Belleville Washers) – Designed to maintain pre-load tension and compensate for relaxation or thermal expansion, high precision required.

- Serrated Flange Washers – Integrated design combining washer and nut/bolt flange, gaining traction in simplified assemblies.

- Heavy Duty Structural Washers – Used in large construction and infrastructure projects, focusing on high tensile strength and thickness.

- By Material:

- Carbon Steel – High volume, cost-effective, standard industrial use.

- Stainless Steel (304, 316, 410 Grades) – Essential for corrosion resistance in chemical, marine, and food processing.

- Non-Ferrous Metals (Brass, Copper) – Used primarily for specific electrical conductivity or non-sparking requirements.

- High-Performance Alloys (e.g., Titanium, Inconel) – Reserved for extreme environments (high temperature, high stress) in aerospace and specialized energy.

- Polymer/Plastic – Niche applications requiring electrical insulation or lightweight non-metallic solutions.

- By Application/End-Use Industry:

- Automotive (Passenger vehicles, Commercial trucks, EVs) – Largest volume consumer, focused on anti-vibration performance.

- Aerospace and Defense – Highest quality standards, demanding strict traceability and lightweight, specialized alloys.

- Construction and Infrastructure (Bridges, Buildings, Rail) – Requires large, high-tensile, high-durability washers for structural integrity.

- General Industrial Machinery and Equipment – Consistent MRO and OEM demand across multiple sectors (agriculture, textile, mining).

- Energy (Oil & Gas, Power Generation, Renewable Energy) – Critical demand for corrosion-resistant, high-reliability fasteners in exposed and dynamic environments.

- Electrical and Electronics – Focus on specific materials for grounding or insulation, requiring high precision and small dimensions.

- Marine and Shipbuilding – Mandates fasteners capable of withstanding severe saltwater corrosion and constant dynamic loading.

Value Chain Analysis For Lock Washers Market

The Lock Washers Market value chain initiates with the upstream sourcing of high-purity metal alloys and wire rod, a segment dominated by global steel giants. The cost dynamics at this stage are dictated by global commodity markets and geopolitical factors, rendering the entire chain vulnerable to input price volatility. Procurement for high-performance lock washers requires stringent quality control on the incoming material, including certified chemical composition and mechanical properties, which necessitates strong, often long-term, relationships with reputable metals suppliers. This stage also includes the sourcing of specialized coatings, plating chemicals, and heat treatment inputs, all of which directly affect the final component’s performance and adherence to international standards (e.g., RoHS compliance, anti-corrosion specifications). Efficient negotiation and hedging strategies are essential at the upstream level to stabilize production costs for the midstream manufacturers.

The midstream manufacturing phase is where value addition is maximized, involving highly specialized processes such as precision cold forging, high-speed stamping, complex heat treatment (to achieve specific hardness and spring characteristics), and surface finishing. Leading manufacturers invest heavily in automated machinery and proprietary tooling to achieve micron-level tolerances and replicate complex geometries like the opposing cam faces in wedge-locking systems. The complexity of manufacturing determines the barrier to entry; while standard split washers can be mass-produced with moderate capital, high-security washers require specialized metallurgical knowledge and capital-intensive equipment. Quality assurance within this stage is paramount, involving extensive testing (Junker vibration tests, torque-tension testing, microscopic analysis) to ensure compliance with end-user performance specifications, particularly for safety-critical applications in aerospace and rail, where traceability of every batch is mandatory.

The downstream segment encompasses the distribution and sales network, which is bifurcated into direct and indirect channels. Direct sales cater to major Original Equipment Manufacturers (OEMs)—such as large automotive assembly plants, major aerospace firms, and Tier 1 suppliers—where bespoke specifications, Just-In-Time (JIT) delivery, and vendor managed inventory (VMI) systems are required. This channel emphasizes deep technical partnership and consultative sales. The indirect channel, serving the vast and highly fragmented Maintenance, Repair, and Operations (MRO) market and smaller OEMs, is facilitated by powerful global and regional industrial distributors (e.g., Fastenal, Wuerth). These distributors manage enormous catalogs of SKUs, provide local inventory access, and offer crucial logistics support. The growth of B2B e-commerce platforms is optimizing the indirect channel, allowing for greater transparency in pricing and availability, enabling smaller firms to access specialized lock washers previously limited to large industrial procurement teams. The efficiency of the total value chain is often measured by the speed and reliability of this final mile delivery to the installation site, making sophisticated warehouse management and logistics software critical tools for major market players.

Lock Washers Market Potential Customers

Potential customers and end-users of lock washers span the entire spectrum of heavy and precision manufacturing industries where bolted joints are subject to dynamic stress, vibration, or thermal cycling. The largest volume consumers are Original Equipment Manufacturers (OEMs) within the automotive sector, including manufacturers of passenger vehicles, commercial trucks, and off-road equipment, where the washers are integrated into engine mounts, braking systems, and structural components. The construction and infrastructure sector, encompassing developers and contractors building high-rise structures, bridges, and tunnels, represents massive, though often project-based, demand for high-tensile, large-diameter lock washers to secure steel frameworks. The need for safety and long-term durability in these applications makes certified products indispensable.

A high-value customer segment is the Energy sector, encompassing both traditional (oil, gas, nuclear) and renewable (wind, solar) power generation firms. For offshore wind turbines, the customer requirement is for fasteners that offer extreme longevity (25+ years) and superior corrosion resistance, minimizing the need for expensive maintenance in remote, hostile environments. Similarly, nuclear power facilities demand fasteners manufactured under highly controlled conditions with full material traceability and documented lifespan performance. These customers prioritize reliability and safety above all else, making them prime targets for premium, proprietary locking systems and specialized alloy materials, where the initial cost is secondary to the assured prevention of catastrophic failure and compliance with international standards like ASME and API.

The third major customer segment involves the vast network of Maintenance, Repair, and Operations (MRO) buyers and small-to-medium-sized machinery manufacturers. While MRO demand is typically lower volume per transaction, it is constant and widespread, driven by the need to service and maintain the existing global installed base of industrial equipment—from printing presses to agricultural machinery. These customers often rely on the expertise of industrial distributors for immediate supply of standard sizes and materials. Other critical niche customers include companies in aerospace (demanding lightweight, high-temperature alloys and zero-defect quality), medical device manufacturing (requiring extremely small, precision-engineered components), and heavy construction (large structural bolts for infrastructure). Successfully serving this diverse base requires manufacturers to maintain a comprehensive product catalog while demonstrating the capacity for bespoke technical engineering and certification.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nord-Lock Group, Schnorr GmbH, ITW Shakeproof, J.W. Winco Inc., Stanley Engineered Fastening, Fastenal Company, Misumi Group Inc., Azcon Corporation, Penn Engineering, Araymond, Precision Form Inc., Wuerth Group, Shijiazhuang Standard Fasteners, NIPPON FRUEHAUF Co., Ltd., Bollhoff Group, ND Industries, Superbolt (A Nord-Lock Group Company), TFC Plc, EJOT SE & Co. KG, G&G Manufacturing Co., Bulten AB, Nucor Fastener Division. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lock Washers Market Key Technology Landscape

The technological evolution of the Lock Washers Market is marked by three primary pillars: advanced locking geometries, sophisticated material science, and the integration of digital monitoring capabilities. The most significant advancement lies in the mechanical design realm, spearheaded by highly engineered, non-frictional locking systems such as wedge-locking washers. These designs fundamentally transform the locking principle; instead of relying on friction against the bearing surface, they use a pair of washers with opposing cams on one side and radial serrations on the reverse. When the bolt attempts to loosen due to vibration, movement can only occur across the cams, generating a locking effect where the axial force increases faster than the loosening rotation, dynamically locking the joint. This reliance on geometry, rather than maintained friction, offers verifiable performance superior to traditional spring washers, particularly in high-shear, dynamic load environments, and has become a de facto standard in critical applications like wind turbines and railways. Furthermore, specialized spring elements, such as conical spring washers, are precision-engineered to provide elastic compensation, effectively mitigating joint relaxation and compression set often encountered in gasketed or composite joints, demanding extremely precise load-deflection curve management during manufacturing.

In material science, technological progress is focused on maximizing durability, environmental resistance, and strength-to-weight ratios. The adoption of high-strength stainless steels (e.g., Duplex and Super Duplex alloys) is accelerating in offshore and infrastructure projects where traditional plated carbon steel washers fail prematurely due to corrosion. Manufacturers are investing in advanced surface treatments and protective coatings, moving beyond standard galvanization to high-performance zinc flake and ceramic coatings (like Geomet or Dacromet), which provide superior salt spray resistance and consistent friction characteristics required for accurate torque tensioning. The challenge lies in ensuring that these protective coatings do not compromise the essential hardness and biting efficacy of the washer's serrations. Furthermore, the development of specialty alloys and composites for weight-sensitive applications (aerospace, high-performance racing) and non-metallic options for electrical insulation demonstrates the breadth of material innovation required to meet highly diverse industrial requirements. This technological thrust requires substantial internal metallurgical expertise and certified production environments.

The emerging technological frontier is the integration of digital intelligence into the fastening process and the fastener itself. While still expensive, the concept of "smart fastening" is gaining traction, using technologies such as embedded ultrasonic sensors or micro-strain gauges to non-invasively monitor the pre-load tension of the bolt joint in real-time. This provides actionable data to facility managers via IIoT platforms, allowing for predictive maintenance scheduling based on actual joint condition rather than arbitrary time intervals. This shift from a passive mechanical component to an active data source represents a potentially transformative technology, particularly for remote or inaccessible equipment. Moreover, advances in automated optical inspection (AOI) utilizing high-resolution cameras and AI deep learning models are fundamentally improving quality control during production, ensuring that every manufactured washer meets stringent dimensional and material integrity standards at high throughput speeds, reducing the likelihood of field failure attributable to manufacturing defects. These technological investments are critical for suppliers aiming to secure lucrative contracts in the premium, high-reliability segment.

Regional Highlights

The Lock Washers Market exhibits distinct regional performance profiles, strongly correlated with local industrial maturity, regulatory stringency, and prevailing economic investment cycles. Asia Pacific (APAC) commands the largest market share in terms of volume due to its unparalleled scale of manufacturing, particularly in China and India, which serve as global production hubs for automotive components, general machinery, and consumer electronics. The region's growth is accelerating fastest, driven by significant government expenditure on massive infrastructure projects (e.g., high-speed rail, urban metro systems) and robust private investment in manufacturing capacity expansion. While APAC encompasses a broad quality spectrum, there is a clear rising demand for high-quality, certified European and North American standard lock washers for critical applications, reflecting increasing industrial maturity and the adoption of stricter local safety codes. Local manufacturers are increasingly competitive, focusing on high-volume production with improving quality controls to capture domestic and regional MRO demand, alongside their primary role as global OEM suppliers.

North America (NA) represents a mature, high-value market segment characterized by stringent regulatory environments and a strong presence of advanced, high-tech industries. Demand is heavily concentrated in specialized sectors such as aerospace and defense, where regulatory mandates require certified, fully traceable, and highly reliable fastening systems, resulting in high average selling prices (ASPs). The energy sector, particularly oil and gas drilling and pipeline construction, is another major consumer, requiring advanced anti-corrosion and high-temperature lock washers made from specialized alloys. The automotive sector in NA is also undergoing significant transition, with demand shifting towards lightweight and high-performance washers required for the rapidly expanding electric vehicle production lines. Market players in this region prioritize technical consulting, guaranteed performance testing (such as Junker results), and sophisticated supply chain logistics to meet the demands of large industrial OEMs who require zero-defect supply chain management.

The European market is defined by its deep commitment to precision engineering, sustainability, and adherence to unified standards (e.g., CE marking requirements). Europe is a technological leader in specialized lock washer design, notably in complex conical spring washers and proprietary cam-based systems, driven by demanding end-users in Germany’s precision machinery and the Nordic countries' leadership in offshore wind energy. The continuous dynamic loading and harsh environments encountered by European wind turbines necessitate the highest quality, fatigue-resistant fasteners, often leading to proprietary long-term contracts for specialized suppliers. Furthermore, environmental regulations push manufacturers towards sustainable production methods and the elimination of hazardous substances in coatings. Europe’s robust MRO segment, supported by a dense network of highly specialized technical distributors, ensures consistent demand for certified replacement parts across its long-established industrial base. Finally, Latin America and the Middle East & Africa (MEA) are emerging as critical markets, with demand spikes correlated directly to large capital projects in mining, petrochemicals, and national infrastructure development. These regions often import premium, certified products for critical applications while relying on more localized sourcing for general construction, indicating significant future growth potential as standardization takes root.

- Asia Pacific (APAC): Highest volume market; characterized by rapid growth in automotive, infrastructure, and electronics manufacturing; driven by urbanization and government investment; increasing demand for certified, high-performance European-standard fasteners, especially in fast-growing economies like Vietnam and Indonesia.

- North America: High-value market focused on precision and traceability; dominant sectors include aerospace, defense, high-performance automotive, and pipeline infrastructure; strong regulatory environment necessitates certified, high-end specialized alloys and anti-corrosion coatings.

- Europe: Technology-driven market leading in complex locking geometries (wedge, conical); emphasis on sustainability and durability; major demand from wind energy (offshore), high-end machinery, and rail systems; mature MRO network supports steady aftermarket demand.

- Latin America & MEA: Project-based growth markets; demand heavily influenced by resource extraction (mining, oil & gas) and large public infrastructure programs; increasing adoption of international standards is boosting the need for certified imported fasteners in critical applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lock Washers Market.- Nord-Lock Group (Sweden)

- Schnorr GmbH (Germany)

- ITW Shakeproof (USA)

- J.W. Winco Inc. (USA)

- Stanley Engineered Fastening (USA)

- Fastenal Company (USA - Distributor/Manufacturer)

- Misumi Group Inc. (Japan)

- Azcon Corporation (USA)

- Penn Engineering (USA)

- Araymond (France)

- Precision Form Inc. (USA)

- Wuerth Group (Germany - Distributor/Manufacturer)

- Shijiazhuang Standard Fasteners Co., Ltd. (China)

- NIPPON FRUEHAUF Co., Ltd. (Japan)

- Bollhoff Group (Germany)

- ND Industries (USA)

- Superbolt (A Nord-Lock Group Company) (USA)

- TFC Plc (UK)

- EJOT SE & Co. KG (Germany)

- G&G Manufacturing Co. (USA)

- Bulten AB (Sweden)

- Nucor Fastener Division (USA)

Frequently Asked Questions

Analyze common user questions about the Lock Washers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of lock washers offer the best resistance against loosening due to extreme vibration?

Wedge-locking washers are generally considered the most effective against extreme vibration and dynamic loads. They utilize geometric locking rather than friction, ensuring that any movement attempting to loosen the bolt automatically increases the clamping force, thereby providing superior joint reliability compared to traditional split or toothed washers in high-stress applications, proven by Junker vibration testing.

How does the volatile price of raw materials impact the profitability of lock washer manufacturers?

Volatility in steel and alloy prices, the primary raw materials, significantly compresses profit margins, especially for standard washers where competition is fierce and pricing elasticity is low. Manufacturers mitigate this by securing long-term supply contracts, utilizing sophisticated commodity hedging, and focusing heavily on high-margin, specialized washers where material cost constitutes a smaller percentage of the total engineered value.

Which industry segment drives the highest demand volume for lock washers globally?

The Automotive Industry consistently drives the highest volume demand for lock washers globally, requiring reliable fastening systems for high-speed assembly and safety-critical vehicle components, including chassis and engine mounts. This is closely followed by the high-volume requirements of the Construction and General Industrial Machinery sectors, particularly in infrastructure projects across Asia Pacific.

What role does corrosion resistance play in the selection of lock washers for energy applications?

In energy applications, especially offshore wind and oil & gas, corrosion resistance is paramount for preventing material degradation and ensuring joint integrity over decades in hostile environments. High-grade stainless steel (316) and specialized zinc-nickel or ceramic coatings are mandatory to withstand severe saltwater spray, chemical exposure, and high temperatures, protecting against catastrophic failure and minimizing expensive remote maintenance.

Are conventional split lock washers still relevant in modern engineering, or are they being replaced entirely?

While high-performance mechanical washers are rapidly replacing split washers in critical, dynamic assemblies, conventional split lock washers remain relevant and cost-effective. They are widely used in low-load, non-critical applications, or where space constraints limit the use of larger, specialized types. Their simplicity and low cost ensure they retain a substantial volume share, particularly in general MRO and light manufacturing sectors globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Stainless Steel Lock Washers Market Statistics 2025 Analysis By Application (Automotive, Machinery & Equipment, Airplane, Structural Applications), By Type (Split Lock Washers, External & Internal Star Lock Washers), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Lock Washers Market Statistics 2025 Analysis By Application (Automotive, Machinery & Equipment, Airplane, Structural Applications), By Type (External & Internal Star, Split), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Lock Washers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Internal& External Star, Split, Others), By Application (Automotive, Machinery & Equipment, Airplane, Structural applications, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager