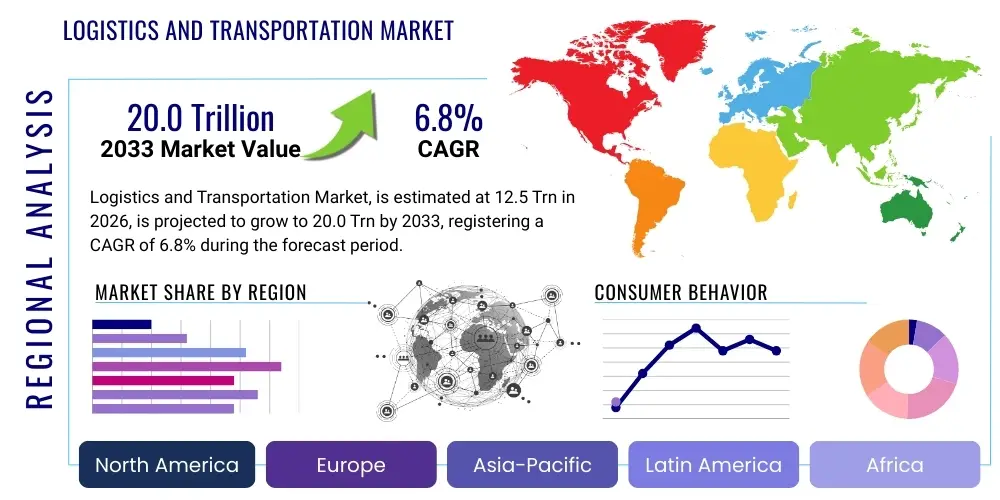

Logistics and Transportation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440520 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Logistics and Transportation Market Size

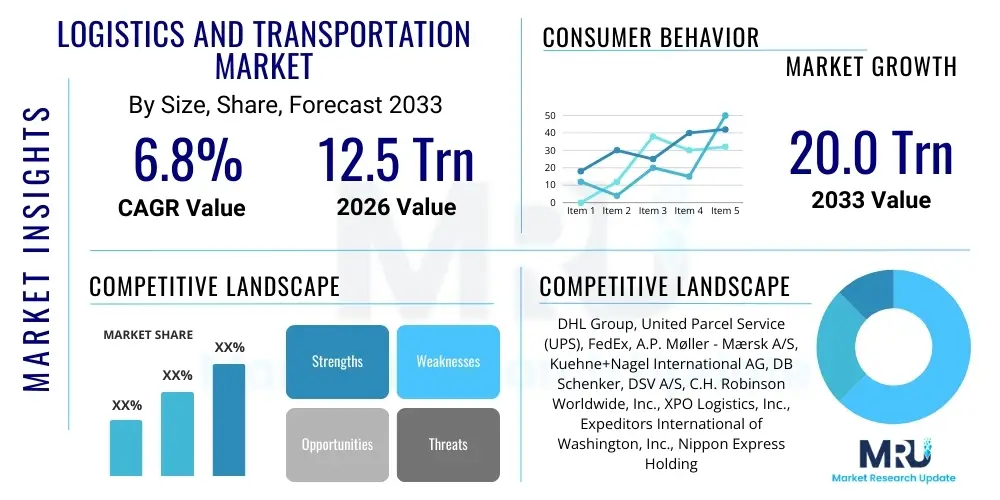

The Logistics and Transportation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 12.5 trillion in 2026 and is projected to reach USD 20.0 trillion by the end of the forecast period in 2033.

Logistics and Transportation Market introduction

The global Logistics and Transportation Market encompasses a vast ecosystem of services and solutions critical for the efficient movement of goods, people, and information across supply chains. It includes a wide array of activities such as freight forwarding, warehousing, express delivery services, supply chain management, and various modes of transportation including road, rail, air, and maritime. This intricate network serves as the backbone of global commerce, facilitating trade, manufacturing, and consumption by ensuring products reach their intended destinations reliably and cost-effectively. The market is characterized by its dynamic nature, influenced by technological advancements, geopolitical shifts, economic fluctuations, and evolving consumer demands, particularly the exponential growth in e-commerce.

The core offerings within this market range from standard shipping and storage solutions to highly specialized services like cold chain logistics for pharmaceuticals and perishables, or intricate project logistics for oversized industrial components. Major applications span nearly every industry sector, including manufacturing, retail, e-commerce, healthcare, automotive, food and beverage, and energy. The primary benefits derived from robust logistics and transportation infrastructure include enhanced supply chain efficiency, reduced operational costs, improved inventory management, greater market reach for businesses, and accelerated delivery times for end-consumers. Furthermore, a well-developed logistics sector is pivotal for economic development, job creation, and fostering international trade relationships, contributing significantly to global GDP.

Key driving factors propelling the market's expansion include the relentless growth of e-commerce, which necessitates advanced last-mile delivery solutions and efficient warehousing; increasing globalization of trade, leading to longer and more complex supply chains; rapid urbanization, which intensifies demand for efficient urban logistics; and continuous technological advancements in areas like automation, artificial intelligence, and data analytics. Additionally, government investments in infrastructure development, such as improved road networks, ports, and railways, along with supportive trade policies, further stimulate market growth. The increasing complexity of global supply chains, coupled with demands for greater transparency and sustainability, also drives innovation and investment in this vital sector.

Logistics and Transportation Market Executive Summary

The Logistics and Transportation Market is currently undergoing a transformative period, driven by a confluence of evolving business trends, significant regional dynamics, and intricate segment-specific shifts. Business trends are largely characterized by an accelerated adoption of digital technologies, including Artificial Intelligence (AI), Internet of Things (IoT), and blockchain, aimed at enhancing operational efficiency, optimizing routes, and improving supply chain visibility. There is also a pronounced shift towards sustainable logistics practices, with companies investing in electric vehicles, optimizing fuel consumption, and developing greener warehousing solutions to meet growing environmental regulations and consumer demand for eco-friendly operations. Furthermore, the rise of omni-channel retailing and direct-to-consumer (D2C) models is reshaping fulfillment strategies, demanding more agile and flexible logistics services.

Regional trends highlight the Asia-Pacific region as the primary growth engine, fueled by its burgeoning e-commerce markets, rapidly expanding manufacturing bases, and significant infrastructure investments, particularly in China and India. North America demonstrates strong technological adoption, focusing on automation in warehouses and sophisticated supply chain management software to enhance competitiveness. Europe, while mature, is at the forefront of sustainable logistics initiatives and intermodal transport solutions, driven by stringent environmental policies and a robust network of trade corridors. Latin America and the Middle East & Africa regions are experiencing substantial growth, albeit from a lower base, propelled by urbanization, increasing consumer spending, and diversification efforts beyond traditional resource economies, leading to greater demand for modern logistics infrastructure and services.

Segmentation trends indicate robust performance across various categories. The freight forwarding segment continues to expand due to increasing international trade volumes, with a growing emphasis on multimodal solutions. Warehousing and storage services are witnessing significant innovation, particularly with the advent of automated warehouses and fulfillment centers designed to handle the surge in e-commerce orders. The Courier, Express, and Parcel (CEP) segment is experiencing exponential growth, primarily driven by the last-mile delivery demands of online retail. Value-added logistics services, such as inventory management, packaging, and reverse logistics, are also gaining traction as businesses seek to outsource complex supply chain functions to specialized third-party logistics (3PL) providers to optimize costs and enhance service quality, reflecting a broader trend towards end-to-end supply chain solutions.

AI Impact Analysis on Logistics and Transportation Market

Common user questions regarding the impact of AI on the Logistics and Transportation Market frequently revolve around themes of operational efficiency, cost reduction, predictive capabilities, and the future of human labor. Users are keen to understand how AI can optimize complex logistical challenges like route planning, inventory management, and demand forecasting, questioning its potential to significantly reduce transit times and operational expenditures. Concerns also often surface regarding the initial investment required for AI implementation, data security, the ethical implications of autonomous systems, and the potential for job displacement, particularly for roles like truck drivers and warehouse operatives. Conversely, there is a strong expectation that AI will enhance decision-making through advanced analytics, improve safety protocols, and unlock new levels of supply chain resilience and responsiveness, allowing for proactive adjustments to disruptions and personalized customer experiences.

- Enhanced Route Optimization: AI algorithms analyze real-time traffic, weather, and delivery data to determine the most efficient routes, reducing fuel consumption and transit times.

- Predictive Maintenance: AI monitors vehicle and equipment performance, predicting potential failures before they occur, thereby minimizing downtime and maintenance costs.

- Demand Forecasting: Machine learning models process vast datasets to predict future demand with high accuracy, optimizing inventory levels and preventing stockouts or overstocking.

- Warehouse Automation: AI-powered robots and autonomous guided vehicles (AGVs) automate tasks such as picking, packing, and sorting, significantly increasing throughput and reducing labor costs.

- Intelligent Inventory Management: AI optimizes storage space utilization, tracks inventory movements, and recommends reorder points, improving stock accuracy and reducing waste.

- Autonomous Vehicles: Development of self-driving trucks, drones, and delivery robots promises to revolutionize last-mile delivery and long-haul transportation, addressing labor shortages and enhancing safety.

- Customer Service Automation: AI-powered chatbots and virtual assistants handle customer inquiries, track shipments, and resolve issues, improving service efficiency and availability.

- Supply Chain Risk Management: AI identifies potential disruptions (e.g., weather events, geopolitical instability) by analyzing global data, enabling proactive mitigation strategies.

- Fraud Detection and Security: AI algorithms can detect anomalies in shipping patterns or financial transactions, enhancing security and reducing fraud within the supply chain.

- Dynamic Pricing and Capacity Management: AI allows carriers to optimize pricing strategies and manage cargo capacity more effectively based on real-time market conditions.

- Personalized Logistics Services: AI can tailor logistics solutions to individual customer needs, offering customized delivery options and enhancing overall customer satisfaction.

- Enhanced Transparency and Traceability: AI integrates with IoT devices and blockchain to provide end-to-end visibility of goods in transit, improving trust and accountability.

DRO & Impact Forces Of Logistics and Transportation Market

The Logistics and Transportation Market is shaped by a complex interplay of internal and external forces, categorized as Drivers, Restraints, and Opportunities (DRO), alongside broader Impact Forces. Key drivers include the exponential growth of e-commerce, which continuously generates demand for rapid and flexible delivery solutions, transforming last-mile logistics and warehousing requirements. Concurrently, the increasing globalization of supply chains necessitates sophisticated international freight management and customs clearance services. Technological advancements, particularly in areas like IoT, AI, and big data analytics, serve as powerful enablers, offering solutions for enhanced efficiency, transparency, and cost optimization. Furthermore, ongoing infrastructure development in emerging economies and developed nations alike, such as improved road networks, port expansions, and digital connectivity, provides the foundational support for market expansion, facilitating smoother and faster movement of goods across vast geographies. The increasing demand for efficient and resilient supply chains, driven by past disruptions, further accelerates investment and innovation in this sector.

Conversely, several significant restraints challenge sustained market growth and profitability. High operational costs, encompassing fuel prices, labor expenses, and maintenance of fleets and infrastructure, persistently squeeze profit margins. The complex regulatory landscape, varying significantly across countries and regions, poses hurdles related to compliance, licensing, and environmental standards, adding layers of complexity to international operations. Infrastructure bottlenecks, especially in rapidly urbanizing areas and developing regions, lead to congestion, delays, and increased transit times. A persistent shortage of skilled labor, particularly truck drivers, warehouse personnel, and logistics specialists, impacts operational capacity and drives up wage costs. Moreover, cybersecurity risks associated with increasingly digitalized supply chains present a constant threat to data integrity and operational continuity, while geopolitical uncertainties and trade protectionism can disrupt established routes and relationships, making long-term planning challenging. The inherent capital-intensive nature of the industry also acts as a barrier to entry for new players, limiting competition.

Despite these challenges, numerous opportunities for innovation and growth exist within the market. The burgeoning field of green logistics and sustainable supply chain practices offers significant potential for companies to differentiate themselves, attract environmentally conscious consumers, and comply with evolving regulations through investments in electric vehicles, optimized routing, and sustainable packaging. The continuous innovation in last-mile delivery solutions, including drone delivery, autonomous vehicles, and crowd-sourced models, promises to address urban congestion and enhance delivery speed. The monetization of data analytics derived from logistics operations provides opportunities for optimized planning, predictive insights, and value-added services. The integration of advanced automation technologies in warehouses and distribution centers represents a pathway to overcome labor shortages and boost efficiency. Furthermore, expansion into untapped emerging markets, particularly in Africa and Southeast Asia, presents substantial long-term growth prospects as these economies develop and demand for logistics services escalates, creating new trade corridors and consumption hubs. The increasing adoption of 3PL and 4PL models by businesses seeking to outsource logistics functions also represents a growing opportunity for specialized service providers.

Impact forces on the Logistics and Transportation Market extend beyond the immediate drivers and restraints, representing broader macro-environmental factors that shape the industry's trajectory. Regulatory changes, such as new emissions standards, trade tariffs, or data privacy laws, can profoundly alter operational requirements and cost structures. Geopolitical shifts, including international trade agreements, political instability, or major conflicts, have direct impacts on global supply chains, often leading to re-routing, increased costs, or reshoring strategies. Technological disruption, spanning from revolutionary AI applications to advancements in material science for packaging or vehicle design, constantly pushes the boundaries of what is possible, demanding continuous adaptation and investment from market participants. Economic cycles, including recessions or boom periods, directly influence consumer spending and industrial production, thereby dictating freight volumes and logistics demand. Environmental concerns, driven by climate change and public pressure, mandate a shift towards more sustainable practices, influencing investment in green technologies and carbon-neutral operations. Finally, evolving consumer expectations, particularly for faster, cheaper, and more transparent deliveries, compel logistics providers to innovate constantly in service delivery and customer experience, directly impacting service models and operational priorities across the entire value chain.

Segmentation Analysis

The Logistics and Transportation Market is meticulously segmented to provide a granular understanding of its diverse components and dynamics. This multi-faceted segmentation allows for targeted market analysis, highlighting growth areas, competitive landscapes, and specific industry needs across various service types, end-use sectors, operational models, and geographical regions. A comprehensive segmentation provides stakeholders with actionable insights into market structure, demand patterns, and strategic opportunities, enabling more effective decision-making and resource allocation within this complex global industry.

- By Service Type:

- Freight Forwarding:

- Air Freight

- Ocean Freight

- Road Freight

- Rail Freight

- Multimodal Freight

- Warehousing and Storage:

- General Warehousing

- Bonded Warehousing

- Automated Warehousing

- Temperature-Controlled Warehousing (Cold Chain)

- Distribution Centers

- Fulfillment Centers

- Courier, Express, and Parcel (CEP):

- Domestic Express

- International Express

- Standard Parcel

- Same-Day Delivery

- Last-Mile Delivery

- Value-Added Logistics Services:

- Inventory Management

- Packaging and Labeling

- Cross-Docking

- Customs Brokerage

- Reverse Logistics

- Supply Chain Consulting

- Order Fulfillment

- Other Logistics Services (e.g., Lead Logistics Provider (LLP)/4PL, Project Logistics)

- Freight Forwarding:

- By End-Use Industry:

- Manufacturing (Automotive, Electronics, Heavy Industry)

- Retail and E-commerce

- Healthcare and Pharmaceuticals

- Food and Beverage

- Automotive

- Chemicals and Petrochemicals

- Consumer Goods

- Energy and Utilities

- Aerospace and Defense

- Agriculture

- Other Industries

- By Model:

- Asset-based Logistics (own vehicles, warehouses)

- Non-asset-based Logistics (brokerage, freight forwarding without owning assets)

- By Mode of Transport:

- Road Transport (Trucking, Vans)

- Rail Transport

- Maritime Transport (Ocean Shipping, Inland Waterways)

- Air Transport

- Intermodal Transport

- By Solution:

- Supply Chain Management (SCM) Solutions

- Transportation Management Systems (TMS)

- Warehouse Management Systems (WMS)

- Fleet Management Solutions

- Inventory Management Solutions

- Order Management Solutions

- E-commerce Logistics Platforms

Value Chain Analysis For Logistics and Transportation Market

The value chain of the Logistics and Transportation Market is a complex network involving multiple stakeholders, from initial raw material suppliers to the final consumer. It begins with upstream activities focused on the provision of essential resources and infrastructure. This includes manufacturers of transportation equipment such as trucks, ships, aircraft, and rail cars, as well as suppliers of critical components like engines, tires, and navigation systems. Technology providers specializing in logistics software, telematics, IoT devices, and automation solutions also form a crucial part of the upstream segment, enabling efficiency and innovation further down the chain. Additionally, providers of fuel and energy resources, as well as construction companies involved in building and maintaining logistics infrastructure like roads, ports, airports, and warehouses, represent significant upstream contributors whose capabilities directly influence the operational efficiency and cost structure of the entire logistics process. Robust upstream collaboration is vital for maintaining a competitive edge and ensuring the availability of advanced, sustainable resources for the core logistics operations.

The core processes within the value chain involve the execution of actual logistics and transportation services. This midstream segment is dominated by freight carriers (road, rail, air, ocean), warehousing and storage operators, freight forwarders, customs brokers, and third-party logistics (3PL) providers. These entities are responsible for the physical movement, handling, and temporary storage of goods, often coordinating complex multimodal transport solutions. Key activities include route planning, load optimization, cargo handling, inventory management, order fulfillment, and compliance with national and international shipping regulations. The efficiency and reliability of these core services are paramount, directly impacting delivery times, product integrity, and overall customer satisfaction. Integrated logistics providers, offering end-to-end solutions, play a pivotal role in streamlining these processes, leveraging economies of scale and specialized expertise to manage intricate supply chains on behalf of their clients, thereby adding significant value.

Downstream activities focus on the final delivery and customer-facing aspects of the logistics process. This includes last-mile delivery services, parcel delivery, installation, and after-sales support. The rise of e-commerce has significantly amplified the importance of efficient and customer-centric last-mile solutions, making it a critical differentiator in consumer markets. Distribution channels within the market are highly diversified, encompassing direct channels where manufacturers or retailers manage their own logistics (insourcing), and indirect channels involving a wide array of intermediaries. Indirect channels include third-party logistics (3PL) providers who offer outsourced logistics functions, fourth-party logistics (4PL) providers who manage the entire supply chain, freight brokers who connect shippers with carriers, and online digital freight platforms that streamline booking and tracking. The choice of distribution channel often depends on factors like scale, complexity of operations, cost considerations, and the desired level of control. The increasing sophistication of these downstream services and distribution models reflects the market’s continuous adaptation to evolving business demands and consumer expectations for speed, convenience, and transparency.

Logistics and Transportation Market Potential Customers

The Logistics and Transportation Market serves an incredibly diverse range of end-users and buyers, spanning virtually every sector of the global economy. These customers seek efficient, reliable, and cost-effective solutions for moving raw materials, semi-finished goods, and finished products across various distances, from local deliveries to intricate international shipments. Manufacturers across industries such as automotive, electronics, heavy machinery, and consumer goods represent a significant customer segment, relying heavily on logistics providers for inbound supply of components, inter-plant transfers, and outbound distribution of their finished products to retailers or direct to consumers. Their primary needs revolve around just-in-time delivery, supply chain visibility, and the ability to handle specialized cargo requirements, driving demand for optimized warehousing and freight services to maintain production schedules and meet market demands efficiently.

The retail and e-commerce sectors are arguably the most dynamic customer segments, with their escalating demands for rapid, flexible, and last-mile delivery solutions fundamentally reshaping logistics operations. E-commerce businesses, in particular, require sophisticated fulfillment centers, efficient parcel delivery networks, and robust reverse logistics capabilities to manage returns. Traditional retailers also depend on logistics for inventory replenishment, store distribution, and adapting to omni-channel strategies that blend online and physical storefronts. Additionally, the healthcare and pharmaceutical industry is a critical end-user, requiring highly specialized cold chain logistics for temperature-sensitive drugs and medical devices, along with stringent compliance with regulatory standards for transportation and storage. This sector prioritizes reliability, security, and traceability to ensure product integrity and patient safety throughout the supply chain, often demanding bespoke, high-value logistics services.

Beyond these major segments, the food and beverage industry relies on complex logistics for perishable goods, demanding temperature-controlled transport and warehousing from farm to table. The energy and utilities sector requires specialized project logistics for oversized equipment and remote site deliveries, while the chemicals and petrochemicals industry necessitates hazardous material handling expertise and strict safety protocols. Furthermore, government agencies, construction companies, and even individual consumers (through parcel services) represent significant customer bases. Each customer segment presents unique logistical challenges and demands, driving continuous innovation in service offerings, technology integration, and customized solutions from logistics and transportation providers. The overarching goal for all these buyers is to optimize their supply chains, reduce operational costs, enhance efficiency, and ultimately deliver superior value to their own customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 trillion |

| Market Forecast in 2033 | USD 20.0 trillion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DHL Group, United Parcel Service (UPS), FedEx, A.P. Møller - Mærsk A/S, Kuehne+Nagel International AG, DB Schenker, DSV A/S, C.H. Robinson Worldwide, Inc., XPO Logistics, Inc., Expeditors International of Washington, Inc., Nippon Express Holdings, Inc., Bolloré Logistics, Sinotrans Limited, Geodis, Ryder System, Inc., Penske Logistics, J.B. Hunt Transport Services, Inc., Schneider National, Inc., Coyote Logistics (a UPS Company), Panalpina World Transport (now part of DSV). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Logistics and Transportation Market Key Technology Landscape

The Logistics and Transportation Market is undergoing a profound technological transformation, driven by innovations aimed at enhancing efficiency, visibility, and sustainability across the entire supply chain. One of the most impactful technologies is the Internet of Things (IoT), which enables real-time tracking of goods, vehicles, and assets through sensors, providing crucial data on location, temperature, humidity, and other environmental conditions. This granular data empowers logistics providers with unprecedented visibility, facilitating proactive decision-making, optimizing routes, and ensuring product integrity, particularly for sensitive cargo. Alongside IoT, advanced data analytics and Artificial Intelligence (AI) are rapidly becoming indispensable, processing the massive amounts of data generated to predict demand, identify potential disruptions, optimize warehouse operations, and automate complex planning tasks. AI-powered algorithms are revolutionizing areas such as predictive maintenance for fleets, dynamic route optimization, and intelligent inventory management, leading to significant cost reductions and service improvements.

Automation and robotics represent another critical pillar of the evolving technology landscape, particularly in warehousing and material handling. Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), and robotic picking systems are increasingly deployed in fulfillment centers to speed up processing, reduce labor dependency, and enhance accuracy. These technologies are crucial for handling the surge in e-commerce volumes and addressing labor shortages. Furthermore, blockchain technology is gaining traction for its potential to enhance transparency, security, and traceability within complex supply chains. By creating immutable, distributed ledgers, blockchain can verify the authenticity of products, streamline documentation, and reduce fraud, fostering greater trust among participants and simplifying cross-border transactions. While still in its early adoption phases for many applications, its potential for secure data sharing and contract automation is significant, promising to revolutionize how supply chain data is managed and accessed, contributing to a more resilient and verifiable logistics ecosystem.

Beyond these, cloud computing platforms provide the scalable infrastructure necessary for housing and processing vast quantities of logistics data, enabling seamless integration of various systems and applications, from Transportation Management Systems (TMS) to Warehouse Management Systems (WMS). These platforms facilitate collaboration across geographically dispersed teams and partners, enhancing overall supply chain coordination. Telematics systems, leveraging GPS and on-board diagnostics, offer real-time insights into fleet performance, driver behavior, and vehicle health, contributing to operational efficiency, safety, and regulatory compliance. Digital freight platforms are also disrupting traditional brokerage models by connecting shippers and carriers directly, offering greater transparency, competitive pricing, and streamlined booking processes. Finally, the development and integration of autonomous vehicles, including self-driving trucks, drones, and delivery robots, are on the horizon, promising to revolutionize last-mile delivery and long-haul transportation by addressing labor costs, improving safety, and enabling 24/7 operations, ultimately pushing the boundaries of what is possible in logistics and transportation.

Regional Highlights

- North America: This region stands as a powerhouse for logistics and transportation, characterized by its mature infrastructure, high adoption rates of advanced technologies, and a robust e-commerce market. The U.S. leads in innovative logistics solutions, particularly in warehouse automation, AI-driven analytics, and last-mile delivery. The demand for expedited shipping and resilient supply chains, partly fueled by geopolitical shifts and natural disasters, drives significant investment in digital platforms and sustainable practices. Trade flows within NAFTA (now USMCA) further bolster regional freight volumes, with a strong focus on intermodal transport to optimize efficiency across vast distances.

- Europe: Europe showcases a highly integrated and sophisticated logistics market, emphasizing sustainability, regulatory compliance, and intermodal connectivity. Strict environmental regulations are driving investments in green logistics, electric fleets, and optimized rail and inland waterway transport. The region benefits from a well-developed network of ports, railways, and highways, facilitating efficient cross-border trade within the EU. Technological adoption, particularly in areas like real-time tracking, predictive analytics, and smart warehousing, is significant, aimed at overcoming labor shortages and enhancing operational efficiency amidst a diverse and often complex regulatory environment.

- Asia Pacific (APAC): APAC is the fastest-growing region in the logistics and transportation market, primarily propelled by its burgeoning e-commerce sector, rapid industrialization, and significant infrastructure development, especially in China, India, and Southeast Asian countries. The sheer volume of manufacturing output and consumer base drives immense demand for both domestic and international freight services. Investment in port expansion, new trade routes (like the Belt and Road Initiative), and modern logistics parks is immense. While technology adoption is varied, there's a strong push towards automation, digitalization, and cold chain logistics to serve diverse and expanding markets.

- Latin America: This region presents a market with significant growth potential, although often challenged by infrastructure deficits, economic volatility, and regulatory complexities. E-commerce growth and increasing urbanization are key drivers, particularly in Brazil, Mexico, and Argentina, leading to a rising demand for improved warehousing and last-mile delivery solutions. Investments are focusing on modernizing port facilities, improving road networks, and adopting digital logistics platforms to enhance efficiency and connectivity. Overcoming existing logistical bottlenecks and improving supply chain resilience remain critical areas of focus for regional development.

- Middle East and Africa (MEA): The MEA region is emerging as a critical logistics hub, strategically positioned between Europe, Asia, and Africa. Driven by economic diversification efforts beyond oil, significant investments in logistics infrastructure, particularly in the UAE and Saudi Arabia, are transforming the landscape. Major port developments, free trade zones, and air cargo expansion are facilitating greater international trade flows. Africa, with its vast untapped potential, is seeing increased interest in last-mile solutions, e-commerce logistics, and infrastructure development to connect rapidly growing urban centers and improve regional trade links, despite persistent challenges in connectivity and political stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Logistics and Transportation Market.- DHL Group

- United Parcel Service (UPS)

- FedEx

- A.P. Møller - Mærsk A/S

- Kuehne+Nagel International AG

- DB Schenker

- DSV A/S

- C.H. Robinson Worldwide, Inc.

- XPO Logistics, Inc.

- Expeditors International of Washington, Inc.

- Nippon Express Holdings, Inc.

- Bolloré Logistics

- Sinotrans Limited

- Geodis

- Ryder System, Inc.

- Penske Logistics

- J.B. Hunt Transport Services, Inc.

- Schneider National, Inc.

- Coyote Logistics (a UPS Company)

- Panalpina World Transport (now part of DSV)

Frequently Asked Questions

What are the primary drivers for growth in the Logistics and Transportation Market?

The market's growth is primarily driven by the exponential expansion of e-commerce, increasing globalization of trade, continuous technological advancements (such as AI, IoT, and automation), and significant infrastructure development globally. Growing demand for efficient and resilient supply chains also plays a crucial role.

How is Artificial Intelligence (AI) transforming the Logistics and Transportation Market?

AI is revolutionizing the market by enabling advanced route optimization, predictive maintenance for fleets, highly accurate demand forecasting, intelligent warehouse automation, and enhanced supply chain risk management. It drives efficiency, reduces costs, and improves service reliability.

What are the biggest challenges faced by the Logistics and Transportation Market?

Key challenges include high operational costs, complex regulatory landscapes, persistent infrastructure bottlenecks, a growing shortage of skilled labor, and increasing cybersecurity risks. Geopolitical uncertainties and the need for sustainable practices also present significant hurdles.

Which geographical region is expected to lead market growth and why?

The Asia Pacific (APAC) region is projected to lead market growth, primarily due to its booming e-commerce sector, rapid industrialization, substantial investments in logistics infrastructure, and a vast consumer base across countries like China and India.

What is 'green logistics' and its importance in the market?

Green logistics refers to sustainable practices aimed at minimizing the environmental impact of logistics activities, such as using electric vehicles, optimizing routes to reduce emissions, sustainable packaging, and efficient waste management. It is crucial for regulatory compliance, corporate social responsibility, and meeting consumer demand for eco-friendly operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager