Logistics Real Estate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434040 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Logistics Real Estate Market Size

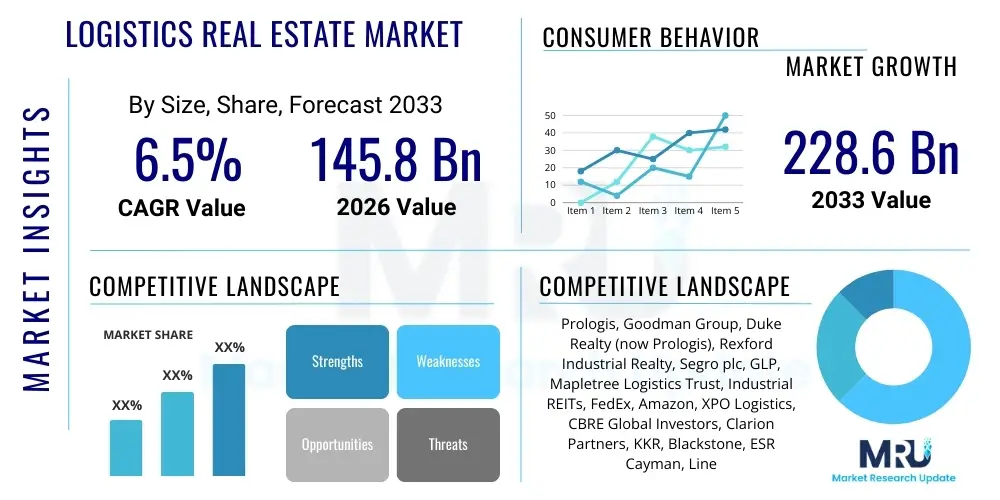

The Logistics Real Estate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 145.8 billion in 2026 and is projected to reach USD 228.6 billion by the end of the forecast period in 2033.

Logistics Real Estate Market introduction

The Logistics Real Estate Market encompasses the physical assets crucial for modern supply chain operations, including distribution centers, fulfillment centers, warehouses, and specialized storage facilities such as cold chain and intermodal terminals. These properties serve as the foundational infrastructure enabling the movement, storage, and processing of goods across local, national, and global networks. Historically driven by manufacturing and traditional retail, the market has undergone a profound transformation, primarily catalyzed by the explosive growth of e-commerce, which demands faster delivery times, higher inventory throughput, and complex sorting capabilities, necessitating high-specification, technologically integrated facilities. The strategic importance of logistics real estate has elevated it from a mere cost center to a critical component of competitive advantage for retailers, third-party logistics (3PL) providers, and manufacturers globally.

The core product offerings within this sector are evolving rapidly, moving beyond basic storage to incorporate features such as high clear heights, expansive truck courts, abundant docking capacity, and specialized handling zones optimized for automation and robotics. Major applications span across e-commerce fulfillment, supporting both last-mile delivery and large-scale regional distribution; third-party logistics, which manages complex supply chains for multiple clients; and dedicated corporate logistics for manufacturing and traditional retail chains. The increasing consumer expectation for immediate delivery has placed immense pressure on proximity to urban centers, driving demand for innovative, vertical storage solutions and multi-story warehousing in land-constrained, high-density areas.

The primary benefits of a robust logistics real estate portfolio include enhanced supply chain resilience, optimized inventory management through centralization, and significant operational efficiencies derived from modern facility design. Key driving factors include continued global economic growth, which fuels trade volumes; the accelerating digitalization of retail, pushing distribution networks closer to consumers; and significant technological advancements in material handling and warehouse management systems (WMS). Furthermore, global geopolitical shifts and the focus on inventory buffering post-pandemic have led corporations to adopt 'just-in-case' inventory strategies, bolstering the demand for large-scale, flexible warehousing space across all major regions, reinforcing the long-term positive outlook for market expansion and sophisticated facility development.

Logistics Real Estate Market Executive Summary

The Logistics Real Estate Market is defined by intense investor interest, spurred by resilient fundamentals, favorable macro trends, and compelling operational shifts. Business trends indicate a continued flow of institutional capital into the sector, viewing logistics properties as stable assets that offer inflation-hedging qualities due to predictable income streams derived from long-term leases and robust occupancy rates, which often exceed 95% in prime metropolitan areas. This influx of capital is driving yield compression in core markets, prompting investors to increasingly pursue value-add opportunities, such as developing specialized facilities (e.g., cold storage or data centers) or converting older, underutilized industrial assets into modern, high-throughput distribution hubs that meet stringent environmental, social, and governance (ESG) standards required by large corporate tenants and investors.

Regional trends are highly divergent yet uniformly characterized by rapid growth. The Asia Pacific (APAC) region is projected to register the fastest growth, largely driven by surging domestic consumption, massive infrastructure investments (particularly in emerging economies like India and Southeast Asia), and the rapid expansion of cross-border e-commerce networks. North America and Europe, while more mature, are experiencing modernization waves; North America is focused on expanding automated 'mega-box' facilities in inland port regions, while Europe is optimizing its extensive logistics corridors for efficient cross-border transport, especially concerning shifts brought about by geopolitical events and new trade agreements. The focus in all mature markets is shifting toward high-barrier-to-entry urban logistics, addressing the critical need for last-mile capabilities near densely populated consumer bases.

Segmentation trends highlight the increasing specialization within the sector. The e-commerce segment remains the dominant application driver, continuously demanding highly automated fulfillment centers capable of supporting complex sorting and rapid delivery schedules. Concurrently, the Cold Storage segment is exhibiting disproportionately high growth, fueled by the rising consumer demand for fresh and frozen foods and the proliferation of temperature-sensitive pharmaceuticals, necessitating sophisticated temperature-controlled warehouse infrastructure. In terms of facility type, there is a clear bifurcation: demand for massive, efficient regional distribution centers (RDCs) located outside cities coexists with intense demand for smaller, strategically located last-mile facilities within urban rings. This dichotomy underscores the evolving nature of logistics networks, which are becoming multi-nodal and highly responsive, requiring diverse real estate solutions tailored to specific supply chain functions.

AI Impact Analysis on Logistics Real Estate Market

User inquiries regarding AI's impact on logistics real estate frequently revolve around efficiency gains, predictive site selection, automation integration, and the potential displacement of traditional labor, specifically asking how AI-driven optimization will alter space requirements and facility design. Key user concerns focus on whether smarter inventory management and route optimization will reduce the overall square footage needed, or if the requirement for complex, highly technical automated sorting equipment will instead drive demand for more specialized, higher-value space. There is a clear expectation that AI will revolutionize the planning, construction, and operation of facilities, enabling predictive maintenance, optimizing energy consumption, and providing real-time inventory visibility. The analysis indicates that while AI may reduce the need for certain types of manual labor space, it significantly increases the need for high-specification facilities capable of housing complex robotic and automated infrastructure, ensuring the continued viability and increased technological sophistication of logistics real estate assets.

Artificial Intelligence fundamentally transforms how logistics real estate is utilized and managed by introducing unprecedented levels of operational efficiency and predictive capability. AI algorithms are now deployed in advanced Warehouse Management Systems (WMS) to optimize inventory slotting, maximize storage density, and minimize travel time for autonomous vehicles and human pickers within the facility. This optimization allows operators to handle higher throughput in the same or even smaller physical footprint, increasing the effective utilization rate of the asset. Moreover, AI facilitates predictive maintenance on sophisticated mechanical handling equipment, reducing downtime, extending asset lifespans, and ensuring continuous operational capacity—a critical factor for high-volume e-commerce fulfillment centers where every hour of downtime translates directly to lost revenue and customer dissatisfaction. This shift requires real estate owners and developers to partner closely with technology providers to ensure buildings are 'AI-ready', featuring robust power infrastructure, seamless connectivity, and adequate floor loading capacity.

Beyond internal operations, AI’s impact extends to strategic real estate decisions. Machine learning models analyze vast datasets encompassing consumer demographics, traffic patterns, regulatory environments, and historical sales data to identify optimal locations for new distribution centers, maximizing service area reach while minimizing transportation costs. This predictive analytics approach allows developers to justify premium pricing for strategically located parcels by demonstrating superior long-term ROI based on optimized logistical efficiencies. Furthermore, AI is central to sustainability efforts within the sector, regulating building systems (HVAC, lighting) to drastically reduce energy consumption and manage peak load demand, which is increasingly important as developers strive to meet stringent ESG targets mandated by investors and regulatory bodies. The integration of AI thus elevates logistics properties into high-performance, resilient assets critical to modern supply chain continuity.

- AI optimizes warehouse layout and inventory slotting, maximizing cubic utilization and throughput capacity.

- Predictive analytics enhance site selection by modeling demand density, transport costs, and labor availability.

- AI-powered WMS facilitates real-time monitoring and routing for autonomous mobile robots (AMRs) and automated storage and retrieval systems (AS/RS).

- Implementation of predictive maintenance reduces equipment downtime and extends the operational life of highly mechanized facilities.

- AI algorithms manage building energy systems, achieving significant reductions in operational utility costs and improving ESG compliance.

- Enhanced security systems utilize AI for perimeter monitoring, access control, and anomaly detection within high-value facilities.

DRO & Impact Forces Of Logistics Real Estate Market

The Logistics Real Estate Market is fundamentally shaped by powerful drivers such as the relentless expansion of global e-commerce, which necessitates dense, proximate distribution networks, and the critical need for supply chain resiliency following recent global disruptions, leading companies to prioritize inventory safety stock and localized manufacturing (reshoring or nearshoring). Restraints primarily involve the critical scarcity and escalating cost of developable land, particularly near major urban cores, coupled with increasing construction costs driven by material shortages and labor constraints, which compress development yields. Opportunities are vast, centered on technological adoption—such as specialized cold chain infrastructure and multi-story warehousing to overcome land constraints—and the strategic redevelopment of aging industrial stock into modern, high-efficiency assets. These factors collectively constitute the impact forces, which drive continuous modernization, push investment towards complex, specialized assets, and increase the geographic footprint of robust logistics hubs worldwide.

The core drivers sustaining the market’s robust growth include technological integration and changing consumer behavior. The expectation of next-day or same-day delivery mandates a denser network of logistics hubs, pushing demand for urban infill sites suitable for last-mile operations. This structural shift requires significant capital expenditure on sophisticated automation, making modern facilities inherently more valuable and resistant to economic downturns. Additionally, globalization, despite recent protectionist pressures, continues to rely heavily on efficient warehousing near major transport nodes like ports and rail terminals. Furthermore, the burgeoning demand for specialized storage, particularly temperature-controlled logistics driven by the pharmaceutical and grocery sectors, introduces a high-barrier-to-entry niche that commands premium rents and offers insulation from general warehousing fluctuations, further accelerating investment.

Conversely, significant impediments threaten the market’s expansion velocity. Regulatory hurdles, complex permitting processes, and substantial local opposition to industrial development in increasingly sensitive urban fringe areas pose persistent challenges to new project timelines. The cost of labor, particularly specialized technical staff required to maintain complex automated systems, is rising, increasing operating expenses for tenants. Environmental regulations and the pressure to achieve net-zero carbon footprints require substantial upfront investment in sustainable building technologies, which, while beneficial long-term, increase immediate development costs. Navigating the delicate balance between sustainable development and economic viability remains a major hurdle, requiring innovative financing and construction methodologies.

Segmentation Analysis

The Logistics Real Estate Market is segmented primarily by Facility Type, Application, and Size. Facility types range from massive, multi-modal distribution centers handling regional throughput to smaller, strategically located last-mile urban fulfillment centers. The application segmentation defines the user base, dominated by the rapidly expanding e-commerce sector, followed closely by resilient Third-Party Logistics (3PL) providers and traditional manufacturing and retail distribution channels. Size segmentation often divides properties into Big Box (over 400,000 sq ft), Mid-Box (100,000 to 400,000 sq ft), and Small Box/Urban Infill (under 100,000 sq ft), each serving distinct roles in the overall supply chain architecture. Understanding these segmentations is vital for investors seeking tailored risk-return profiles, as last-mile facilities generally command higher rents per square foot but face greater operational complexity and regulatory scrutiny compared to large-scale, out-of-town distribution centers.

- By Facility Type:

- Distribution Centers (RDCs, National Hubs)

- Fulfillment Centers (E-commerce optimized)

- Warehouses (General Purpose Storage)

- Specialized Facilities (Cold Storage, Hazardous Materials, Intermodal Terminals)

- Last-Mile/Urban Infill Facilities

- By Application:

- E-commerce & Retail Distribution

- Third-Party Logistics (3PL)

- Manufacturing & Industrial

- Food & Beverage (Including Cold Chain)

- Pharmaceutical & Healthcare

- By Size:

- Big Box (400,000 sq ft and above)

- Mid Box (100,000 to 400,000 sq ft)

- Small Box/Urban Logistics (Under 100,000 sq ft)

Value Chain Analysis For Logistics Real Estate Market

The value chain in the Logistics Real Estate Market begins with Upstream activities, dominated by land acquisition, which requires specialized local knowledge and political acumen, followed by construction and development. This stage involves securing financing, procuring high-quality building materials (steel, concrete, specialized roofing), and deploying sophisticated engineering and construction management services focused on sustainability and rapid construction timelines. Key upstream dependencies include reliable suppliers for pre-engineered building components and access to skilled labor for complex automated system installation. The efficiency and cost-effectiveness of this upstream phase directly impact the long-term profitability and competitiveness of the final logistics asset, emphasizing the crucial need for developers to manage supply chain volatility.

The core of the value chain involves Midstream activities—the actual leasing, property management, and operation of the completed facilities. This phase involves sophisticated asset management, focused on maintaining high occupancy rates, maximizing rental income through value-add services, and ensuring the facility remains technologically relevant. Property managers play a vital role in negotiating complex leases, often involving extensive fit-out clauses related to automation equipment, and managing tenant relationships, particularly with demanding 3PLs and major e-commerce players. The value proposition here is optimizing the building's performance, minimizing operating expenses (OpEx), and adapting to evolving tenant needs, such as installing enhanced power grids for robotics and electric vehicle charging infrastructure.

Downstream activities involve the ultimate customers—the end-users who occupy and utilize the space—and the various distribution channels through which the real estate is traded and financed. Distribution is primarily handled through direct relationships between developers/owners (like REITs and large funds) and major corporate tenants. Indirect distribution includes brokerage services that facilitate transactions and connect smaller regional operators with suitable properties. The final output is the delivery of a seamless, resilient, and optimized physical platform that allows end-users to execute their supply chain strategies effectively, ranging from high-speed e-commerce fulfillment to controlled pharmaceutical distribution. The end-users’ operational success fundamentally validates the value generated throughout the logistics real estate value chain.

Logistics Real Estate Market Potential Customers

The primary customers and buyers of logistics real estate assets or leased space are categorized into three major groups: Third-Party Logistics (3PL) providers, who require flexible, strategically located space to serve their diverse client base; large-scale E-commerce and Retail entities, which demand high-throughput fulfillment centers close to consumer populations; and Manufacturing/Industrial companies, needing space for inventory buffering, raw material storage, and finished goods distribution. 3PLs represent a significant demand source, often signing large, long-term leases that stabilize cash flows for asset owners, acting as intermediaries between property investors and countless smaller businesses. E-commerce giants are the critical demand accelerators, driving the need for advanced automation and premium urban logistics sites to meet stringent delivery deadlines, thus underpinning the market's high growth potential and valuation metrics across the globe.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 145.8 Billion |

| Market Forecast in 2033 | USD 228.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prologis, Goodman Group, Duke Realty (now Prologis), Rexford Industrial Realty, Segro plc, GLP, Mapletree Logistics Trust, Industrial REITs, FedEx, Amazon, XPO Logistics, CBRE Global Investors, Clarion Partners, KKR, Blackstone, ESR Cayman, Lineage Logistics, Americold, NFI Industries, Cushman & Wakefield |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Logistics Real Estate Market Key Technology Landscape

The technology landscape governing logistics real estate is characterized by the convergence of operational efficiencies and structural building innovation, moving assets toward becoming 'smart warehouses.' The primary technological integration revolves around advanced Warehouse Management Systems (WMS) and the deployment of Autonomous Mobile Robots (AMRs) and Automated Storage and Retrieval Systems (AS/RS). These technologies require substantial IT infrastructure within the physical building, including high-density Wi-Fi networks, robust fiber connectivity, and significantly increased power capacity to run robotics fleets and specialized sorting machinery. Developers are increasingly designing facilities with higher clear heights (up to 40 feet or more) and reinforced floor slabs to accommodate vertical storage systems and heavier automated equipment loads, directly influencing the construction specifications and capital expenditure required for new projects.

Beyond operational automation, technology is fundamentally transforming building design and sustainability. Building Information Modeling (BIM) software is standard practice for modern construction, allowing for precise engineering, minimizing material waste, and optimizing system placement before groundbreaking. Furthermore, the imperative for Environmental, Social, and Governance (ESG) compliance has driven widespread adoption of technologies such as solar panel arrays (converting vast roofscapes into energy generation sources), smart metering, and advanced HVAC systems optimized for energy efficiency. These sustainable technologies not only reduce the operational footprint but also enhance the asset's long-term value and attractiveness to institutional investors who prioritize green certifications like LEED and BREEAM, making them critical differentiators in competitive leasing markets.

The integration of the Internet of Things (IoT) sensors is pervasive, providing real-time data on everything from temperature, humidity, and energy usage to structural integrity and security breaches. This data, often processed by AI, enables proactive facility management and predictive maintenance, minimizing unplanned outages and maximizing uptime. For specialized segments like cold storage, highly precise IoT monitoring systems ensure strict compliance with regulatory standards for temperature-sensitive goods. The overall technological trend points toward highly connected, data-driven, and flexible real estate assets capable of adapting rapidly to tenant turnover and evolving logistical needs, positioning technology as a non-negotiable component of modern logistics real estate value creation.

Regional Highlights

- North America: The market, dominated by the United States, is characterized by exceptionally strong investor demand, driven by the maturity of the e-commerce sector and the focus on modernizing aging facilities. Demand is concentrated in major logistics hubs like the Inland Empire (Southern California), Dallas-Fort Worth, and the New Jersey ports. The region leads in the adoption of large-scale automation, resulting in higher ceiling requirements and specialized tenant fit-outs. Nearshoring trends from Mexico and Canada are also fueling demand for cross-border distribution centers, particularly in border regions and key inland ports, leading to continued rent growth despite economic volatility.

- Europe: Europe’s market structure is highly fragmented yet unified by regulatory frameworks and dense cross-border trade. Key markets like Germany, the UK, France, and the Netherlands benefit from central geographical positioning and robust manufacturing bases. The primary growth drivers are optimization of Pan-European supply chains and intensified pressure for urban logistics solutions in capital cities such as London, Paris, and Berlin. ESG compliance is paramount in Europe, with institutional funds strictly prioritizing properties that meet high sustainability standards, pushing developers toward green building certifications and renewable energy integration.

- Asia Pacific (APAC): APAC represents the fastest-growing region globally, fueled by massive population growth, expanding middle-class consumption, and surging domestic e-commerce markets, notably in China, India, and Southeast Asia. Infrastructure development, including major port expansions and regional connectivity projects, is unlocking new logistics corridors. Due to extreme land scarcity in dense urban centers (e.g., Singapore, Hong Kong, Tokyo), the region is pioneering high-tech, multi-story logistics facilities designed for high-density storage and vertical automation, maximizing cubic space utilization and commanding premium rents.

- Latin America (LATAM): The LATAM logistics real estate market is maturing, driven by increasing foreign direct investment and the structural shift toward modern retail and e-commerce, replacing traditional supply chain methods. Mexico and Brazil are the core growth engines. Demand is focused on high-quality, Class A warehouses located near major consumption centers like São Paulo and Mexico City. Challenges remain regarding infrastructure consistency and political stability, but the underlying demographic and consumption trends provide significant long-term growth potential for institutional investors willing to navigate market complexities.

- Middle East and Africa (MEA): Growth in the MEA region is often concentrated around key economic zones and maritime trade hubs, such as the UAE (Dubai), Saudi Arabia, and South Africa. Government-led diversification initiatives, focusing on logistics and trade as economic pillars, are major drivers. Development focuses on specialized cold chain facilities and temperature-controlled storage to support pharmaceutical and food import sectors, with significant future potential driven by developing economies and increased regional trade agreements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Logistics Real Estate Market.- Prologis

- Goodman Group

- Segro plc

- GLP (Global Logistics Properties)

- Mapletree Logistics Trust

- Rexford Industrial Realty

- Duke Realty (acquired by Prologis)

- Blackstone Real Estate

- KKR

- ESR Group

- Cain International

- Lineage Logistics (Specialized Cold Storage)

- Americold Realty Trust (Specialized Cold Storage)

- NFI Industries

- XPO Logistics

- CBRE Global Investors

- Clarion Partners

- JLL (Advisory & Transaction Services)

- Cushman & Wakefield (Advisory Services)

- Amazon (Internal Logistics Network Development)

Frequently Asked Questions

Analyze common user questions about the Logistics Real Estate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving current investment interest in Logistics Real Estate?

Investment interest is driven primarily by the structural demand created by accelerated e-commerce penetration, which ensures high occupancy rates and resilient rental growth. Furthermore, logistics properties offer superior inflation hedging compared to other real estate sectors due to long lease terms, low capital expenditure volatility, and the critical nature of warehousing to modern supply chains. Institutional investors value the sector’s stable, yield-producing performance and its alignment with global consumer trends.

How is the growth of automation and robotics affecting the design and value of modern warehouses?

Automation significantly increases the value of logistics real estate by boosting throughput efficiency. It mandates specific design changes, including higher clear heights (40+ feet), stronger floor slabs to support heavy automated systems, enhanced power infrastructure, and larger truck courts for autonomous vehicle charging. Facilities designed for automation command premium rents and possess higher long-term relevance than standard, non-automated warehouses.

What role does the 'Last-Mile' segment play, and why is it so competitive?

The Last-Mile segment involves small, strategically located facilities near urban populations necessary for fulfilling same-day and next-day delivery promises. It is competitive because land scarcity near urban cores is acute, leading to fierce competition for infill sites and high property values. This segment is critical for supply chain performance but faces high operational and regulatory barriers, often leading to innovative solutions like multi-story warehousing.

What are the key Environmental, Social, and Governance (ESG) compliance trends impacting logistics developers?

ESG compliance is rapidly becoming a fundamental requirement, not just a preference. Key trends include achieving high green building certifications (LEED, BREEAM), integrating solar power and energy-efficient building systems, and adopting sustainable construction materials to minimize embodied carbon. Compliance is crucial because institutional investors and large corporate tenants increasingly mandate strict sustainability criteria, tying ESG performance directly to asset valuation and leasing viability.

Which geographical region is expected to lead market growth over the forecast period?

The Asia Pacific (APAC) region, particularly emerging economies like India and Southeast Asia, is projected to lead market growth. This rapid expansion is driven by robust demographic shifts, explosive growth in domestic e-commerce consumption, and vast government investments in infrastructure development, which collectively accelerate the demand for high-quality, modern logistics real estate assets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager