Logistics Robots Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435120 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Logistics Robots Sales Market Size

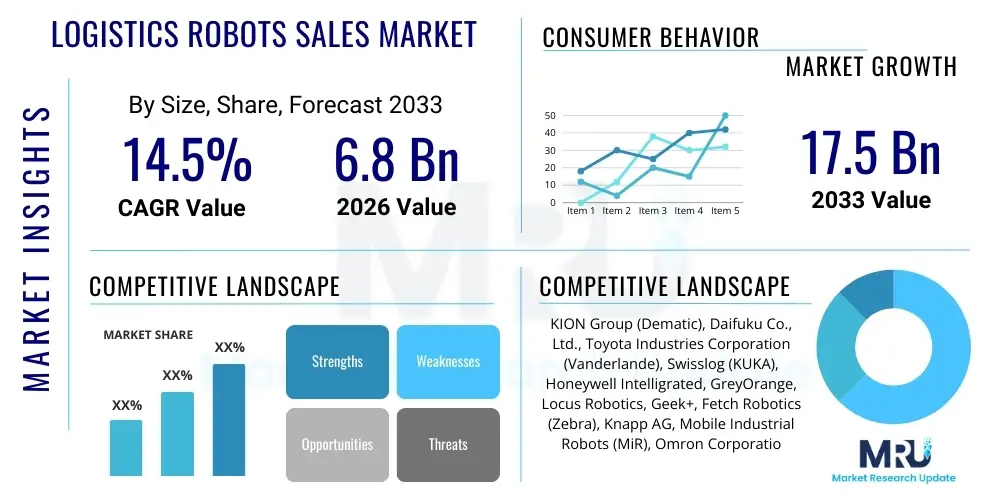

The Logistics Robots Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 6.8 Billion in 2026 and is projected to reach USD 17.5 Billion by the end of the forecast period in 2033.

Logistics Robots Sales Market introduction

The Logistics Robots Sales Market encompasses the manufacturing, distribution, and implementation of automated systems designed to optimize material handling, transportation, storage, and fulfillment within warehousing, distribution centers, and manufacturing environments. These robotic systems include Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), automated sorting systems, robotic arms for picking and packing, and drone delivery systems. The fundamental purpose of these technologies is to enhance operational efficiency, reduce labor costs, improve accuracy, and accelerate throughput in increasingly complex supply chains. The market addresses the global necessity for speed and precision driven by the proliferation of e-commerce and rising consumer expectations for fast delivery.

The core product offerings span various degrees of autonomy and function. AGVs are guided by physical markers or predefined paths, primarily used for large-volume, repetitive material transfer. Conversely, AMRs use advanced sensors, machine learning, and onboard computing to navigate dynamic environments independently, offering flexibility in modern, flexible warehouse layouts. Major applications include internal logistics, inventory management, cross-docking, and order fulfillment. Key benefits realized by adopting these systems include significant reduction in human error, 24/7 operational capability, enhanced safety by handling heavy or repetitive tasks, and scalable automation capabilities crucial for peak season demands.

Driving factors propelling market expansion include the critical shortage of manual labor in developed economies, necessitating automation investments. Furthermore, the exponential growth of e-commerce, particularly accelerated by global shifts towards online purchasing, mandates highly efficient and automated fulfillment infrastructure. Technological advancements in sensor technology, battery life, and integrated software platforms (like warehouse management systems – WMS) are simultaneously lowering the total cost of ownership (TCO) and increasing the functional capability of these robots, making them economically viable for a broader range of logistics operations.

Logistics Robots Sales Market Executive Summary

The Logistics Robots Sales Market exhibits robust expansion driven primarily by global e-commerce maturation and persistent supply chain pressure for optimization and resilience. Business trends indicate a shift from traditional, fixed automation (like conventional conveyors) towards flexible, software-driven robotic solutions, with Autonomous Mobile Robots (AMRs) gaining significant traction over older AGV technology due to their adaptability and faster deployment cycles. Mergers, acquisitions, and strategic partnerships are highly prevalent as technology providers seek to integrate specialized software capabilities, such as vision systems and AI-powered route optimization, solidifying comprehensive end-to-end solutions for enterprise clients. Investment remains concentrated in areas addressing the "last mile" and complex piece-picking tasks, which are historically bottlenecks in automation.

Regionally, Asia Pacific (APAC) currently dominates the sales volume, propelled by massive manufacturing bases and aggressive automation mandates in countries like China, Japan, and South Korea, which are responding to rapid domestic e-commerce growth and aging workforces. North America and Europe, while possessing higher average investment per robot, focus heavily on quality and complexity of automation, driven by high labor costs and demands for quick Return on Investment (ROI). The market structure is moving towards a hybrid model, where robots are increasingly deployed alongside human workers in collaborative environments (cobotics), requiring specialized safety certifications and seamless integration capabilities.

Segment trends highlight the dominance of material handling solutions, particularly AMRs for transport and conveyance, representing the largest revenue segment. However, the fastest growth is observed in the picking and packing robot segment, driven by technological breakthroughs in grasping capability and object recognition necessary for handling diverse product SKUs. Software and services surrounding the robot hardware (fleet management, simulation, maintenance contracts) are rapidly expanding, indicating that operational excellence and system longevity are becoming critical differentiators alongside hardware price and performance. Cloud-based robot management platforms are emerging as standard offerings, enabling centralized control and predictive maintenance across vast fleets.

AI Impact Analysis on Logistics Robots Sales Market

User questions concerning AI integration in logistics robots frequently revolve around autonomy, efficiency gains, and necessary infrastructure upgrades. Common queries include: "How does AI improve robot navigation and pathfinding in dynamic warehouses?", "What is the true ROI of AI-powered picking versus traditional automation?", and "How will AI affect the need for human supervision and intervention?". Users are keenly interested in the operational advantages derived from Machine Learning (ML), such as enhanced predictive maintenance, optimized fleet coordination (swarm robotics), and improved computer vision systems crucial for handling variable inventory (the "Grasping Problem").

The consensus themes suggest that AI transforms logistics robots from simple programmed machines into intelligent, adaptive agents. Concerns often center on data privacy, the required expertise to maintain AI models, and the initial investment in high-fidelity sensors and computing power necessary to run sophisticated algorithms. Users expect AI to reduce operational friction points, ensuring robots can handle exceptions autonomously—such as unexpected obstacles or damaged goods—without halting the entire workflow. This shift is critical for achieving true lights-out automation in fulfillment centers.

Ultimately, AI integration is viewed not just as an enhancement but as a foundational necessity for future logistics robots, enabling them to operate effectively in increasingly complex, unstructured, and human-dense environments. This technological progression is driving demand for advanced sensors and embedded processing units, influencing the purchasing decisions of major e-commerce platforms and third-party logistics (3PL) providers who prioritize scalable, resilient, and adaptive automation solutions for their global networks.

- AI enhances route optimization and dynamic path planning for AMRs, significantly reducing travel time.

- Machine learning improves computer vision systems, dramatically boosting accuracy and speed in complex piece-picking and sorting tasks.

- Predictive maintenance algorithms powered by AI reduce unexpected downtime and extend the operational lifespan of robotic fleets.

- AI facilitates complex fleet management (swarm intelligence), enabling large numbers of robots to coordinate effectively in shared workspaces.

- Natural Language Processing (NLP) is increasingly used in human-robot interfaces for easier programming and troubleshooting.

DRO & Impact Forces Of Logistics Robots Sales Market

The Logistics Robots Sales Market is primarily driven by persistent global labor shortages and the unrelenting demands imposed by e-commerce expansion, pushing enterprises to prioritize capital investment in automation over rising operational labor costs. However, market adoption is constrained by high initial capital expenditures, which can be prohibitive for small and medium-sized enterprises (SMEs), and challenges related to integrating heterogeneous robot fleets with legacy IT infrastructure. Significant opportunities arise from the increasing feasibility of robotic-as-a-Service (RaaS) models, which lower the entry barrier, alongside the untapped potential in non-traditional logistics segments such as micro-fulfillment centers and cold chain operations. These forces collectively dictate the pace and direction of market growth.

Impact forces are heavily skewed toward technological advancements, specifically in battery longevity and simultaneous localization and mapping (SLAM) capabilities, which continually enhance robot utility and deployment speed. Regulatory frameworks related to worker safety and shared automation spaces also exert influence, requiring manufacturers to meet increasingly stringent global standards. Economically, the market's trajectory is sensitive to global supply chain volatility, influencing the cost and availability of critical components like semiconductors and high-precision sensors, thereby affecting overall robot pricing and lead times.

The overarching impact is a positive feedback loop: as robots become smarter, cheaper, and easier to integrate, their adoption accelerates, further stimulating investment in R&D to solve remaining logistical bottlenecks, such as true generalization in grasping and rapid task re-configuration. The necessity for supply chain resilience following recent global disruptions also acts as a powerful catalyst, positioning automated logistics infrastructure as a critical competitive asset rather than a discretionary expense.

Segmentation Analysis

The Logistics Robots Sales Market is meticulously segmented across multiple dimensions, including type of robot, function, application, and end-user industry, reflecting the diverse requirements of the modern supply chain. This multi-layered segmentation allows for precise market targeting and product development, addressing needs ranging from bulk material transport to high-precision item fulfillment. The primary division relies on mobility and autonomy, distinguishing fixed-base systems from autonomous mobile solutions. Functional segmentation highlights the specialization necessary for various tasks, such as handling, sorting, assembly, or guided transport, each requiring specialized hardware and software integration to maximize efficiency and accuracy within specific operational constraints.

- By Type:

- Automated Guided Vehicles (AGVs)

- Autonomous Mobile Robots (AMRs)

- Articulated Robotic Arms

- Automated Storage and Retrieval Systems (AS/RS)

- Gantry Robots

- Drones and UAVs

- By Function:

- Picking and Placing (Piece Picking, Case Picking)

- Sorting and Conveying

- Palletizing and Depalletizing

- Tugging and Loading/Unloading

- Inspection and Inventory Management

- By Application:

- Warehouse and Distribution Management

- Assembly and Production Lines

- Outdoor Logistics (Yard Management)

- Last-Mile Delivery

- By End User:

- E-commerce and Retail

- Automotive

- Food and Beverage

- Healthcare and Pharmaceuticals

- Electronics and Electricals

- Manufacturing (General)

- 3PL and Logistics Providers

Value Chain Analysis For Logistics Robots Sales Market

The value chain for the Logistics Robots Sales Market is complex, involving highly specialized technological components and extensive integration services. The upstream segment is dominated by critical component suppliers, including manufacturers of high-fidelity sensors (LiDAR, 3D vision systems), specialized motors and actuators, advanced microprocessors, and long-life industrial batteries. Innovation and pricing in this upstream tier significantly dictate the final capabilities and cost structure of the robotic systems. Supply chain resilience and access to proprietary sensor technology are major competitive factors at this stage. Manufacturers often engage in vertical integration or strategic sourcing to secure consistent supply of crucial components, particularly in the current climate of semiconductor shortages.

The midstream phase involves the core robot manufacturers who design, assemble, and integrate hardware with proprietary operating systems and fleet management software. This stage is crucial for differentiation, focusing on features like reliability, payload capacity, speed, and safety certifications. Software development, including advanced AI algorithms for pathfinding and task execution, constitutes a rapidly increasing share of the value added. Direct distribution channels are often preferred for major enterprise clients, enabling manufacturers to offer comprehensive planning, customization, and after-sales support directly. However, for regional deployment or specialized integration, indirect channels involving certified system integrators play a vital role.

Downstream analysis centers on deployment, integration, and long-term maintenance. System integrators and third-party logistics (3PLs) act as key partners, ensuring seamless integration of robotic fleets with existing Warehouse Management Systems (WMS) and Enterprise Resource Planning (ERP) tools. The shift toward RaaS models has introduced recurring revenue streams based on usage and service contracts, making ongoing support and software updates a critical profit center. Customer relationships are strengthened through reliable technical support and the continuous improvement of operational software, ensuring maximum uptime and efficiency for the end-user's logistics operations.

Logistics Robots Sales Market Potential Customers

Potential customers for logistics robots span a wide spectrum of industries characterized by high throughput requirements, repetitive material handling tasks, and critical needs for inventory accuracy. The dominant end-users are large-scale e-commerce retailers and dedicated 3PL providers who handle massive volumes of diverse SKUs across expansive distribution networks. These entities require scalable, flexible automation to manage extreme peak demands (e.g., holiday seasons) and navigate complex global supply chain constraints, making investments in AMRs and high-speed sortation systems essential for competitive advantage.

Another major segment includes the Automotive and Electronics manufacturing sectors. These industries utilize logistics robots for precise material delivery to assembly lines (just-in-time logistics), handling sensitive components, and performing quality inspection tasks. The controlled and standardized nature of manufacturing environments makes AGV and gantry robot implementations highly effective. Furthermore, the Food and Beverage industry, facing stringent hygiene regulations and the complexities of temperature-controlled storage, is increasingly adopting specialized robots for palletizing, case picking, and internal transport within cold storage facilities.

The growing appeal of RaaS models is unlocking smaller market segments, including conventional retail chains, regional food distributors, and smaller manufacturing operations that previously lacked the capital expenditure budgets for automation. These potential buyers prioritize ease of deployment, minimal infrastructure disruption, and predictable operational costs, favoring scalable AMR solutions managed via cloud-based platforms over heavily customized, fixed automation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 17.5 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KION Group (Dematic), Daifuku Co., Ltd., Toyota Industries Corporation (Vanderlande), Swisslog (KUKA), Honeywell Intelligrated, GreyOrange, Locus Robotics, Geek+, Fetch Robotics (Zebra), Knapp AG, Mobile Industrial Robots (MiR), Omron Corporation, Balyo, Fanuc Corporation, ABB, Amazon Robotics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Logistics Robots Sales Market Key Technology Landscape

The technological landscape of logistics robots is defined by the convergence of advanced hardware and sophisticated artificial intelligence, prioritizing adaptability and collaboration within existing infrastructure. A key enabling technology is Simultaneous Localization and Mapping (SLAM), which allows AMRs to navigate and operate effectively in dynamic, human-centric environments without the need for pre-installed physical infrastructure (like wires or magnetic tape). The rapid evolution of LiDAR and 3D vision sensors is instrumental in enhancing SLAM accuracy and object detection, ensuring safety and precision in tasks such as autonomous fork lifting and dense inventory navigation.

Furthermore, battery technology—specifically the adoption of high-density lithium iron phosphate (LFP) cells—is crucial, enabling longer operational cycles and faster charging times, thereby maximizing robot uptime and reducing the fleet size needed for continuous operation. On the software front, the move towards modular, cloud-based fleet management systems is transforming deployment. These systems use algorithms to dynamically allocate tasks, manage charging queues, and optimize traffic flow for thousands of robots concurrently, often employing predictive analytics to prevent bottlenecks before they occur, leading to significant efficiency gains across large fulfillment centers.

The integration of deep learning and computer vision represents the third major pillar, specifically solving the "pick and place" challenge for variable items. Advanced robotic arms now utilize convolutional neural networks (CNNs) to recognize, classify, and determine the optimal grasp point for countless unique SKUs, ranging from fragile consumer goods to irregularly shaped packaged foods. This technological capability is unlocking automation in previously manual-intensive areas, particularly in e-commerce fulfillment and personalized order packing.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in terms of volume deployment and manufacturing capacity, primarily fueled by robust investments in large-scale automation projects in China, Japan, and South Korea. China, driven by domestic e-commerce giants and a government focus on manufacturing digitization (Made in China 2025), represents the largest and fastest-growing single market for both AGVs and AMRs. Japanese and South Korean markets focus heavily on high-precision, reliable automation solutions due to severely aging workforces and high quality control standards in electronics and automotive manufacturing. The region benefits from lower manufacturing costs for robot hardware, enabling aggressive pricing and rapid market penetration.

- North America (NA): North America commands the highest average expenditure per robotic system, driven by acute labor shortages and high labor costs, making the ROI on automation immediate and compelling. The focus here is heavily on software intelligence, flexible automation (AMRs), and robust integration into sophisticated WMS/ERP systems, particularly within the 3PL and large-scale e-commerce distribution center segments. The market is highly receptive to innovative business models like RaaS, reducing the initial financial barrier for adopting advanced picking and fulfillment robots.

- Europe: The European market demonstrates mature adoption, characterized by a strong emphasis on safety standards (CE marking) and collaboration (cobotics). Western Europe, particularly Germany, the UK, and the Benelux countries, shows high uptake in manufacturing and logistics, valuing reliability and energy efficiency. There is a concerted effort across the EU to harmonize robotics standards, which accelerates cross-border deployment. Eastern Europe is emerging as a significant growth area due to the influx of manufacturing and logistics hub investments requiring modern, automated solutions to handle increased regional trade volumes.

- Latin America (LATAM): The LATAM region is an emerging market, currently showing lower penetration rates compared to developed economies. Adoption is concentrated in major economies like Brazil and Mexico, driven by large, multinational companies setting up advanced distribution centers. The market is highly price-sensitive, often favoring low-cost AGVs initially, though the increasing need for efficiency in urban last-mile logistics is starting to drive interest in flexible AMR solutions, particularly those offered under financially accessible RaaS arrangements.

- Middle East and Africa (MEA): Growth in MEA is primarily localized within the Gulf Cooperation Council (GCC) states, propelled by national visions for economic diversification (e.g., Saudi Vision 2030, UAE Centennial 2071) that emphasize the development of world-class logistics infrastructure, ports, and smart cities. Significant government investment in mega-projects and the establishment of vast, automated logistics zones require cutting-edge robotic systems. The rest of Africa remains nascent, with adoption focused on specialized applications in mining, major ports, and pharmaceutical logistics centers in South Africa and Nigeria.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Logistics Robots Sales Market.- KION Group (Dematic)

- Daifuku Co., Ltd.

- Toyota Industries Corporation (Vanderlande)

- Swisslog (KUKA)

- Honeywell Intelligrated

- GreyOrange

- Locus Robotics

- Geek+

- Fetch Robotics (Zebra Technologies)

- Knapp AG

- Mobile Industrial Robots (MiR - Teradyne)

- Omron Corporation

- Balyo

- Fanuc Corporation

- ABB

- Amazon Robotics

- RightHand Robotics

- Exotec Solutions

- Seegrid Corporation

- Invia Robotics

Frequently Asked Questions

Analyze common user questions about the Logistics Robots Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) in logistics?

The primary distinction lies in navigation and flexibility. AGVs follow fixed paths (wires, tape, or magnets) and require significant infrastructure changes, offering lower operational flexibility. AMRs navigate intelligently using sensors and SLAM technology, adapting to dynamic obstacles and optimizing routes in real-time without physical guidance, making them ideal for agile warehouse environments.

How does the Robotic-as-a-Service (RaaS) model impact market entry for smaller businesses?

RaaS significantly lowers the barrier to entry by transforming high upfront capital expenditure (CAPEX) into predictable operational expenditure (OPEX). This subscription model allows smaller businesses to access advanced robotic fleets, scaling automation capacity up or down based on seasonal demands without incurring the full cost and risk of ownership.

Which industry segment is driving the highest demand for advanced piece-picking robots?

The E-commerce and Retail fulfillment segment drives the highest demand for advanced piece-picking robots. This necessity stems from the requirement to handle vast inventories of single items (eaches) for individual customer orders, a task demanding highly accurate computer vision and grasping algorithms to manage diverse product shapes and sizes.

What major challenges currently restrain the widespread adoption of logistics robots?

Key restraints include the complexity and cost of integrating robotic systems with existing legacy Warehouse Management Systems (WMS) and IT infrastructure. Furthermore, a shortage of specialized technical talent needed to program, maintain, and optimize sophisticated robot fleets presents a significant adoption hurdle for many organizations.

What role does Artificial Intelligence (AI) play in enhancing logistics robot performance?

AI is crucial for enhancing robot autonomy and efficiency. It enables advanced capabilities such as dynamic path optimization, predictive failure analysis (maintenance), intelligent object recognition for sorting and picking, and centralized fleet coordination (swarm robotics) to maximize throughput and minimize human intervention in complex operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager