Long Glass Fiber Reinforced Polypropylene Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432464 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Long Glass Fiber Reinforced Polypropylene Market Size

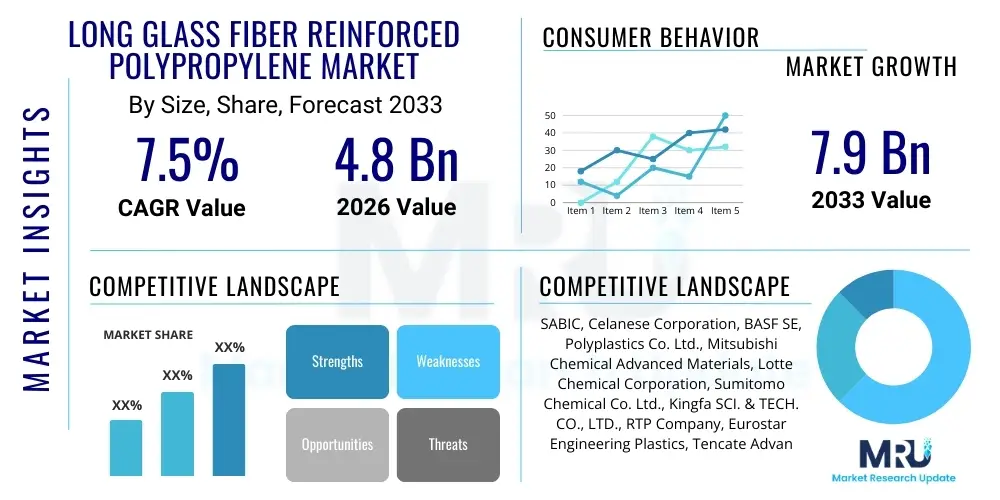

The Long Glass Fiber Reinforced Polypropylene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Long Glass Fiber Reinforced Polypropylene Market introduction

The Long Glass Fiber Reinforced Polypropylene (LGFRPP) Market encompasses the production, distribution, and utilization of thermoplastic composites that integrate long glass fibers (typically 10-25 mm in length) into a polypropylene matrix. This reinforcement significantly enhances the mechanical properties of standard PP, offering superior stiffness, strength, impact resistance, and dimensional stability, particularly at elevated temperatures. These characteristics make LGFRPP an ideal material for replacing traditional metal components and short fiber-reinforced plastics across numerous industries, primarily driven by the need for lightweighting and increased performance in demanding applications. The material's balanced performance profile, coupled with its cost-effectiveness and excellent recyclability, positions it as a key enabling technology for sustainable manufacturing practices.

LGFRPP is a high-performance material used extensively in structural and semi-structural applications where high specific strength and rigidity are critical. The primary sectors utilizing this material include automotive, aerospace, industrial equipment, and consumer goods. In the automotive sector, LGFRPP is crucial for components like front-end modules, instrument panel carriers, door modules, and bumper beams, directly contributing to vehicle weight reduction, which in turn improves fuel efficiency and reduces emissions. The material’s ability to withstand complex injection molding processes while maintaining fiber integrity ensures consistent mechanical performance across intricate geometries, providing design flexibility for engineers.

The burgeoning demand for electric vehicles (EVs) is a major catalyst driving LGFRPP adoption. As automakers seek to offset the weight of heavy battery packs, lightweighting body and chassis components becomes paramount. LGFRPP provides the necessary structural integrity for battery housings and underbody protection, offering excellent chemical resistance and thermal stability. Furthermore, its inherent benefits—such as excellent creep resistance, low warpage, and superior noise, vibration, and harshness (NVH) characteristics—cement its position as the material of choice for demanding structural applications where durability and safety standards are non-negotiable.

Long Glass Fiber Reinforced Polypropylene Market Executive Summary

The Long Glass Fiber Reinforced Polypropylene (LGFRPP) Market is poised for substantial growth, fundamentally driven by the global imperative toward lightweighting in the transportation sector and the increasing sophistication of material science in industrial applications. Key business trends indicate a strong focus on developing advanced compounding technologies, such as pultrusion and direct long fiber injection (D-LFT), to improve fiber dispersion and composite performance consistency. Strategic collaborations between material suppliers and Tier 1 automotive manufacturers are accelerating the qualification and adoption of new LGFRPP grades, specifically tailored for EV battery components and structural chassis parts. The market dynamics are characterized by intense competition among major players striving for proprietary compounding patents and vertically integrated supply chains to secure cost advantages.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, primarily due to the massive scale of automotive manufacturing in China, Japan, and South Korea, coupled with robust infrastructure development initiatives. Europe remains a strong market, driven by stringent emission regulations (Euro 7 standards) and the region’s leadership in sustainable material utilization and circular economy principles, favoring LGFRPP’s recyclability. North America is experiencing steady growth, largely fueled by renewed investments in domestic electric vehicle production and the demand for high-strength, durable materials in industrial and heavy-duty transportation applications.

Segment trends emphasize the automotive application segment maintaining the largest market share, with significant acceleration expected in EV-related components. By manufacturing process, the injection molding segment is projected to hold the majority share due to its efficiency and ability to produce complex, high-volume parts, although D-LFT processes are gaining traction for large structural parts. Furthermore, there is a clear trend towards specialty LGFRPP grades offering enhanced fire retardancy (FR), improved UV resistance, and specific thermal management properties necessary for sophisticated electronics enclosures and high-heat under-the-hood components, diversifying the material's utility beyond traditional automotive applications.

AI Impact Analysis on Long Glass Fiber Reinforced Polypropylene Market

User queries regarding AI's influence on the LGFRPP market frequently revolve around its role in optimizing material formulation, accelerating compound discovery, and improving manufacturing efficiency. Key themes include how AI can predict the performance of novel LGFRPP composites under varied stress conditions, the use of machine learning for defect detection in compounding and molding processes, and the optimization of supply chain logistics for raw materials (PP resin and long glass fibers). Users are concerned about the implementation costs of AI-driven quality control systems but anticipate significant long-term benefits in terms of material consistency, reduced waste, and faster time-to-market for specialized high-performance grades. The expectation is that AI will move LGFRPP development from empirical testing to predictive modeling, enabling rapid material customization for specific customer requirements, particularly in the highly complex realm of lightweight automotive design.

- AI optimizes compounding processes by analyzing real-time sensor data, ensuring superior fiber length and dispersion consistency.

- Machine learning algorithms predict mechanical properties (strength, stiffness, impact resistance) based on formulation inputs, dramatically reducing physical prototyping cycles.

- Predictive maintenance uses AI to monitor injection molding equipment, minimizing downtime and ensuring continuous high-quality production of LGFRPP components.

- AI-driven simulation tools accelerate the design and validation of complex LGFRPP parts, especially for crash safety components in EVs.

- Supply chain management benefits from AI forecasting, optimizing inventory levels of PP resin and glass fiber rovings to mitigate material cost volatility.

DRO & Impact Forces Of Long Glass Fiber Reinforced Polypropylene Market

The LGFRPP market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The primary driver remains the stringent regulatory environment pushing for vehicular lightweighting to meet global fuel efficiency and emission targets. This is compounded by the rapid expansion of the Electric Vehicle (EV) market, where LGFRPP offers a critical solution for minimizing curb weight and enhancing battery protection. Conversely, the market faces restraints rooted in the high initial cost associated with specialized compounding equipment necessary to preserve the long fiber length, alongside the technical challenge of ensuring perfect fiber-matrix adhesion for consistent mechanical integrity. Opportunities emerge from the potential for LGFRPP expansion into high-growth, non-traditional sectors such as renewable energy (wind turbine components) and medical devices, coupled with the ongoing development of bio-based PP matrices to enhance sustainability credentials.

Impact forces acting upon the market are largely centered on technological disruption and material substitution threats. The availability of high-performance long carbon fiber (LCF) composites, although more expensive, poses a competitive threat in ultra-high-performance applications. However, LGFRPP's significantly lower cost profile and inherent recyclability provide a strong counter-advantage. Porter's Five Forces analysis suggests that the bargaining power of buyers, particularly large automotive OEMs, is high, compelling manufacturers to continually improve cost efficiency and material performance. The threat of new entrants is moderate, given the high capital investment required for specialized compounding technology and the necessity of establishing a validated supply history with major end-users. Overall, market growth is primarily dictated by technological advancement in fiber-matrix coupling agents and processing techniques that maximize fiber length retention during injection molding.

Segmentation Analysis

The Long Glass Fiber Reinforced Polypropylene (LGFRPP) market is comprehensively segmented based on its core components, manufacturing process, and diverse end-use applications. This segmentation provides a granular view of market dynamics, revealing varying growth rates across different composite types and regional demands. Key segmentation analysis focuses on the types of long glass fibers used, such as continuous or chopped rovings, and how these fibers are integrated into the PP matrix via different methods like pultrusion, direct long fiber compounding (D-LFT), or pre-pelletized techniques. Understanding these segments is crucial for manufacturers tailoring product offerings to meet specific performance requirements, such as high impact resistance needed for automotive bumpers versus high stiffness required for structural supports. The versatility of PP as a base resin allows for diverse compound formulations, addressing specialized needs across industries ranging from recreational to heavy industrial machinery, thereby maximizing the market reach of LGFRPP products.

- By Product Type:

- LGFRPP Pellets (Pre-compounds)

- Direct Long Fiber Thermoplastic (D-LFT) Compounds

- By Manufacturing Process:

- Injection Molding

- Compression Molding

- Extrusion

- By End-Use Application:

- Automotive (Interior, Exterior, Structural Components, EV Battery Housing)

- Aerospace

- Consumer Goods

- Industrial Equipment (Pumps, Housings, Fans)

- Electrical and Electronics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Long Glass Fiber Reinforced Polypropylene Market

The value chain for LGFRPP is characterized by a high degree of integration and specialization, starting from upstream raw material production. Upstream activities involve the sourcing and manufacturing of critical components: polypropylene resin producers (often petrochemical giants) and long glass fiber manufacturers (specializing in high-tenacity rovings). The quality of the coupling agents applied to the glass fibers, which ensures robust adhesion to the non-polar PP matrix, is a crucial determinant of the final composite performance. This upstream phase requires significant capital expenditure and adherence to strict quality control standards to ensure the consistency of the final composite material.

The core midstream activity involves compounding, where the PP resin and long glass fibers are melt-processed, typically using pultrusion or twin-screw extrusion methods, to create LGFRPP pellets or direct-feed materials. This stage is proprietary, with leading companies developing specialized technology to minimize fiber breakage and maintain maximum length, which directly correlates to mechanical performance. Downstream activities encompass molders and final part fabricators, who utilize injection molding or compression molding to produce the finished components for end-user industries. The efficiency of the molding process is highly dependent on the quality of the LGFRPP compound and the precise control of processing parameters.

Distribution channels for LGFRPP are bifurcated into direct and indirect routes. Direct sales are common for large-volume purchases by major automotive Tier 1 suppliers, facilitating technical support and customized material formulations tailored to specific OEM specifications. Indirect channels utilize specialized distributors and regional agents who cater to smaller industrial, consumer goods, and electrical component manufacturers. The consultative nature of the sales process, requiring in-depth material expertise, means that the relationship between the compounder and the end-user remains highly critical across both distribution methods, driving the need for strong technical marketing and application development support.

Long Glass Fiber Reinforced Polypropylene Market Potential Customers

The primary consumers and end-users of Long Glass Fiber Reinforced Polypropylene are large-scale manufacturers operating within sectors where material performance, weight reduction, and cost-efficiency are critical design parameters. Automotive OEMs and their Tier 1 suppliers constitute the largest customer base, utilizing LGFRPP for crucial structural and semi-structural parts like instrument panels, seat structures, front-end carriers, and increasingly, EV battery module enclosures and cooling system components. These customers demand highly consistent materials that meet stringent safety, thermal, and dimensional stability standards, often requiring custom color matching and specialized grades with flame retardancy (FR) properties.

Beyond the automotive industry, significant potential customers reside in the industrial and consumer durable goods sectors. Industrial equipment manufacturers, including producers of major appliances, HVAC systems, and power tools, seek LGFRPP for internal components that require superior stiffness and fatigue resistance, such as pump housings, fan blades, and motor mounts. The inherent resistance of PP to chemicals and moisture, combined with the structural benefits of long glass fibers, makes it suitable for harsh operating environments, attracting customers in the fluid handling and infrastructure sectors. Furthermore, the electrical and electronics sector uses LGFRPP for durable, high-stiffness enclosures and structural parts where material creep must be minimized under continuous load.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SABIC, Celanese Corporation, BASF SE, Polyplastics Co. Ltd., Mitsubishi Chemical Advanced Materials, Lotte Chemical Corporation, Sumitomo Chemical Co. Ltd., Kingfa SCI. & TECH. CO., LTD., RTP Company, Eurostar Engineering Plastics, Tencate Advanced Composites, Daicel Polymer Ltd., Trinseo, Envalior, Wuxi Lead Advanced Material Co., Ltd., Ravago Group, Toray Industries, Inc., Asahi Kasei Corporation, Lanxess AG, DuPont de Nemours, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Long Glass Fiber Reinforced Polypropylene Market Key Technology Landscape

The technological landscape of the LGFRPP market is continuously evolving, focused primarily on refining the compounding and processing methods to maximize fiber length retention and optimize fiber-matrix interface adhesion. The predominant technologies employed include Pultrusion Compounding, which is highly effective in producing pellets with long, consistent fiber lengths, thereby ensuring high mechanical integrity in the final molded part. Another critical technology is Direct Long Fiber Thermoplastic (D-LFT) processing, which integrates the compounding and molding stages, allowing fibers to be chopped and mixed directly into the polymer melt immediately before injection or compression molding. This process significantly reduces costs and minimizes fiber attrition compared to pre-compounded pellets, making it highly attractive for producing large, structural automotive components.

Recent technological advancements are centered on specialized coupling agents and surface treatments for glass fibers. These chemical treatments are essential to overcome the inherent incompatibility between hydrophilic glass fibers and the hydrophobic polypropylene matrix. Advanced coupling technologies, often based on maleic anhydride grafted polypropylene (MAPP), are being refined to create stronger chemical bonds, leading to superior stress transfer and, consequently, higher strength and stiffness in the final product. Furthermore, sophisticated process control systems incorporating rheological modeling and infrared scanning are being developed to monitor the melt flow and fiber orientation during injection molding in real-time. This level of precision is vital for guaranteeing the consistent anisotropic performance required for critical structural applications.

The increasing focus on sustainable materials is driving technological innovation towards incorporating recycled PP (rPP) and bio-based PP feedstocks into LGFRPP compounds without compromising performance. Challenges associated with using rPP, such as degraded molecular weight and reduced mechanical properties, necessitate the development of highly effective stabilization and homogenization technologies. Companies are investing heavily in closed-loop recycling processes for LGFRPP parts, aiming to recover the valuable long fibers and reintroduce them into new composite formulations. This sustainable technological push aligns with global corporate environmental goals and positions LGFRPP favorably against less recyclable materials.

Regional Highlights

Geographic analysis reveals distinct consumption patterns and growth drivers across major global regions, reflecting local manufacturing dynamics and regulatory pressures.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily fueled by China and India's massive automotive production bases, particularly in the EV segment. Government initiatives supporting domestic manufacturing and robust growth in infrastructure and consumer electronics contribute significantly to LGFRPP demand.

- Europe: This region is characterized by high demand for premium and sustainable LGFRPP grades. Stringent EU regulations regarding vehicle emissions and the push towards circular economy models necessitate high-performance, lightweight, and easily recyclable materials, driving adoption in luxury and specialized automotive segments.

- North America: Steady growth is observed, driven by the resurgence of the domestic manufacturing sector and substantial investments in electric vehicle production facilities. LGFRPP is critical for meeting stringent North American safety standards while achieving weight reduction targets in trucks and large SUVs.

- Latin America (LATAM): Growth is moderate but accelerating, focused mainly on automotive assembly plants in Brazil and Mexico. The market is primarily driven by local demand for economical yet performance-enhancing components in entry-level and mid-range vehicles.

- Middle East and Africa (MEA): This region offers emerging opportunities, primarily linked to infrastructure projects, industrial machinery requirements in the oil and gas sector, and localized manufacturing expansions in countries like Saudi Arabia and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Long Glass Fiber Reinforced Polypropylene Market.- SABIC

- Celanese Corporation

- BASF SE

- Polyplastics Co. Ltd.

- Mitsubishi Chemical Advanced Materials

- Lotte Chemical Corporation

- Sumitomo Chemical Co. Ltd.

- Kingfa SCI. & TECH. CO., LTD.

- RTP Company

- Eurostar Engineering Plastics

- Tencate Advanced Composites

- Daicel Polymer Ltd.

- Trinseo

- Envalior

- Wuxi Lead Advanced Material Co., Ltd.

- Ravago Group

- Toray Industries, Inc.

- Asahi Kasei Corporation

- Lanxess AG

- DuPont de Nemours, Inc.

Frequently Asked Questions

Analyze common user questions about the Long Glass Fiber Reinforced Polypropylene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of Long Glass Fiber Reinforced Polypropylene (LGFRPP) over traditional materials?

LGFRPP offers significantly enhanced mechanical properties, including superior stiffness, higher impact strength, and excellent dimensional stability compared to standard PP or short glass fiber composites. Its major advantage is maintaining high strength even at elevated temperatures, making it a critical substitute for metals in lightweight structural applications.

Which end-use application dominates the LGFRPP market share globally?

The automotive industry is the dominant end-use application, primarily utilizing LGFRPP for internal structural components, front-end modules, instrument panels, and increasingly, critical battery housing components in Electric Vehicles (EVs) due to the material's excellent strength-to-weight ratio and cost-effectiveness.

What is the main manufacturing challenge in producing high-quality LGFRPP parts?

The main challenge is maintaining the integrity and maximum length of the glass fibers during the compounding and injection molding processes. Fiber attrition must be minimized, and optimal fiber dispersion and orientation must be achieved to ensure consistent, predictable mechanical performance in the final molded component.

How do sustainability trends affect the growth of the LGFRPP market?

Sustainability is a major driver, as LGFRPP is fully recyclable within the PP waste stream, unlike many thermoset composites. The increasing use of recycled polypropylene (rPP) as a base resin for LGFRPP further enhances its sustainable profile, meeting corporate mandates for reduced environmental impact and circular economy participation.

How does the cost of LGFRPP compare to that of Long Carbon Fiber Reinforced Polypropylene (LCFRPP)?

LGFRPP is significantly more cost-effective than LCFRPP. While LCFRPP offers superior strength and lightweighting capabilities, LGFRPP provides an optimal balance of cost, performance, and processability, making it the preferred material for high-volume, cost-sensitive structural applications where ultra-high modulus is not strictly necessary.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager