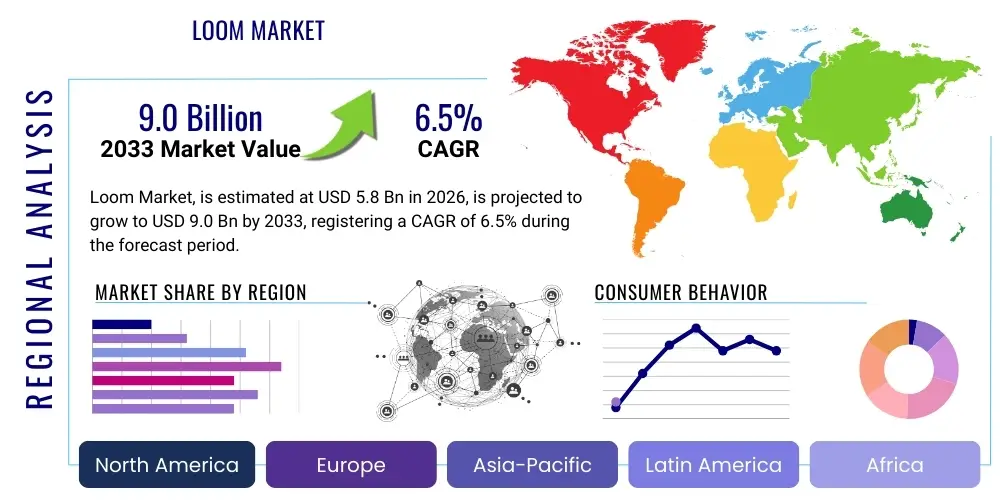

Loom Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436238 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Loom Market Size

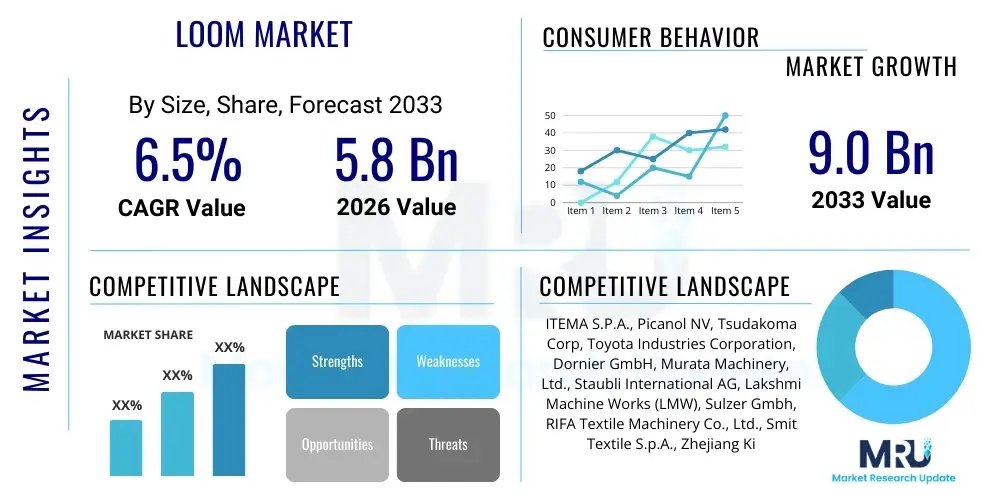

The Loom Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $9.0 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally underpinned by the global shift towards high-speed automated textile manufacturing, driven primarily by cost reduction imperatives, increasing demand for complex fabric structures, and the rapid expansion of the technical textiles sector across emerging economies.

Loom Market introduction

The Loom Market encompasses the manufacturing, distribution, and utilization of machinery designed for weaving, ranging from traditional shuttle looms to advanced shuttleless technologies like air-jet, water-jet, and rapier looms. These machines are essential infrastructure for the global textile industry, converting prepared yarn into finished fabric. Product descriptions highlight technological sophistication, focusing on weaving speed (Picks Per Minute – PPM), automation level, energy efficiency, and versatility in handling diverse fiber types, including cotton, synthetics, and specialized technical fibers. The evolution of loom technology is characterized by a sustained focus on increasing productivity while minimizing operational downtime and optimizing fabric quality control through integrated electronics.

Major applications of looms span the entire spectrum of textile production, dominated by the apparel sector (fashion textiles, denim, shirting) and the home textiles segment (bedding, upholstery, towels). However, significant growth is concentrated in industrial applications, specifically technical textiles used in automotive components, medical implants, geotextiles, and protective wear. The primary benefit derived from modern weaving machinery is unparalleled efficiency, allowing manufacturers to meet stringent production quotas required by global supply chains. Furthermore, the precision offered by computerized control systems enables the creation of intricate patterns and high-density weaves previously unattainable, thus opening new avenues for innovation in material science.

Driving factors propelling the market include persistent global population growth increasing the demand for clothing and consumer goods, the necessity for textile manufacturers to upgrade aging machinery to remain competitive, and governmental policies promoting textile industry modernization in countries like China, India, and Vietnam. The integration of Industry 4.0 principles, particularly IoT connectivity and real-time data monitoring, is accelerating the adoption rate of sophisticated, high-capital-cost looms, enabling manufacturers to reduce labor dependency and material waste, thereby justifying the initial investment through long-term operational savings.

Loom Market Executive Summary

The Loom Market Executive Summary indicates robust future growth, largely dominated by the adoption of shuttleless looms, particularly in the Asia Pacific region which currently serves as the epicenter for global textile manufacturing and capacity expansion. Business trends are heavily focused on sustainable manufacturing practices, leading to increased demand for energy-efficient water-jet and air-jet technologies that reduce water and power consumption. Furthermore, customization and quick response manufacturing (QRM) are dictating the need for highly flexible looms capable of rapid pattern changes with minimal adjustment time, pushing manufacturers towards advanced rapier and electronic jacquard systems capable of handling complex orders efficiently. The competitive landscape is characterized by intense technological rivalry among leading global manufacturers, concentrating on speed benchmarks, reduced vibration, and enhanced user interfaces for remote operation and diagnostics.

Regional trends clearly show the dominance of the Asia Pacific (APAC) region, driven by substantial capacity additions, favorable labor costs, and governmental support for the domestic textile industry, making it the largest producer and consumer of looms globally. North America and Europe, while having lower production volumes, exhibit high demand for advanced, specialized looms targeting niche markets such as high-performance technical textiles, aerospace materials, and luxury apparel, focusing more on quality and innovation rather than sheer volume. Latin America and MEA are emerging as key markets, primarily for mid-range, versatile machinery suitable for local consumer markets, undergoing significant modernization efforts replacing older, inefficient shuttle equipment.

Segmentation trends highlight that by technology type, air-jet looms maintain a leading position due to their high speed, making them ideal for standard and wide fabric production. However, water-jet looms are gaining traction in specific synthetic and filament weaving applications where water availability is not a concern, owing to their cost-effectiveness and relatively higher speed compared to rapier systems. By application, the technical textiles segment is anticipated to register the highest CAGR, spurred by the growing requirements of the medical, construction, and automotive industries for specialized non-apparel fabrics. This shift necessitates investment in heavy-duty looms capable of handling rigid and unconventional yarn materials effectively.

AI Impact Analysis on Loom Market

User queries regarding AI's impact on the Loom Market frequently revolve around automation capabilities, predictive maintenance accuracy, and the potential for displacing skilled weaving operators. Users seek clarification on how AI can integrate seamlessly into legacy machinery, what the return on investment (ROI) is for AI-driven quality control systems, and whether AI can genuinely optimize complex scheduling and material flow in large weaving mills. The consensus emerging from these inquiries is a blend of caution regarding initial implementation costs and excitement over the potential for unprecedented efficiency gains. The core expectation is that AI will move loom operation from reactive maintenance to fully predictive, minimizing catastrophic failures and maximizing uptime, thereby revolutionizing the historically labor-intensive quality assurance process.

AI is fundamentally transforming loom operation by enabling systems to learn from massive datasets generated by integrated sensors (IoT). This allows for dynamic adjustments to weaving parameters—such as warp tension, weft insertion timing, and shedding motion—in real-time, based on material characteristics and ambient conditions. Such proactive control ensures consistent fabric quality even when facing minor material inconsistencies, a critical improvement over traditional fixed-parameter weaving. Furthermore, AI algorithms are being deployed in vision systems to perform complex defect detection tasks faster and more accurately than human inspectors, classifying faults (e.g., broken picks, smash faults) and instantly flagging them for correction, significantly reducing waste and rework.

Beyond the operational floor, AI is influencing the entire product lifecycle from design to delivery. Generative AI tools are assisting textile designers in creating novel fabric structures and patterns optimized for specific loom types, drastically reducing the time required for sample creation and prototyping. In supply chain management, machine learning models optimize yarn inventory levels and predict future machine part failures, ensuring that necessary components are stocked precisely when required, thus avoiding delays related to sourcing specialized parts. This holistic integration of AI tools promises to enhance the competitiveness of weaving mills globally, making textile manufacturing a highly data-driven and responsive industry segment.

- AI-driven Predictive Maintenance: Anticipating mechanical failures of critical components (e.g., grippers, nozzles, cams) to schedule maintenance preemptively, maximizing machine uptime and minimizing unplanned shutdowns.

- Automated Quality Control (AQC): Utilizing computer vision and deep learning models to identify and categorize fabric defects in real-time on the loom, ensuring compliance with stringent quality standards.

- Dynamic Weaving Optimization: Adjusting operational parameters (speed, tension, insertion force) based on real-time material feedback and environmental variables to maintain consistent fabric properties.

- Supply Chain & Inventory Forecasting: Machine learning models predicting optimal yarn procurement and spare parts stocking levels to reduce working capital and inventory costs.

- Energy Consumption Optimization: AI algorithms managing loom power cycles and motor speeds to reduce overall energy footprint, especially crucial for air-jet and water-jet systems.

- Design and Prototyping Acceleration: Use of generative AI for rapid visualization and simulation of complex textile patterns before physical production begins.

DRO & Impact Forces Of Loom Market

The market dynamics are governed by a complex interplay of strong drivers centered around automation and efficiency, significant restraints relating to high investment costs and technological complexity, and substantial opportunities emerging from sustainable and smart textile applications. The primary drivers include the escalating global demand for high-quality fabrics, the continuous pressure on manufacturers to reduce unit production costs, and the necessity to counter rising labor wages through enhanced automation. Restraints involve the substantial initial capital expenditure required for modern shuttleless looms, which acts as a barrier to entry for smaller manufacturers, coupled with the need for specialized technical expertise to operate and maintain these complex machines effectively. Opportunities lie in the burgeoning market for smart fabrics, technical textiles, and the development of highly customized, short-run textile production capabilities enabled by digital technologies.

Impact forces within the Loom Market are characterized by high bargaining power of large buyers (major global apparel brands and integrated textile corporations) who demand lower prices and faster turnaround times, pressuring loom manufacturers to innovate rapidly while maintaining competitive pricing. Threat of new entrants is moderate due to the extremely high capital investment required for manufacturing sophisticated weaving machinery and the need for established intellectual property (IP) regarding high-speed mechanical design. However, substitute products pose a low threat, as looms remain fundamental for woven fabric production, although non-woven fabric technologies compete in specific industrial applications. Intensity of competitive rivalry among existing players is very high, driven by the global dominance of a few major European and Asian OEMs constantly striving to exceed performance benchmarks, particularly in speed and energy efficiency, leading to continuous investment in R&D and aggressive market share acquisition strategies.

The market is further impacted by evolving environmental regulations globally, particularly in developed markets, which favor technologies that minimize water usage, chemical use, and energy consumption. This regulatory environment acts as both a driver, compelling the adoption of new, cleaner technologies (like water-jet looms with closed-loop water systems), and a restraint, increasing the compliance costs for legacy machinery. Furthermore, geopolitical stability and global trade agreements significantly affect the supply chain for raw materials (steel, components) and the accessibility of key export markets for textile products, directly influencing demand for new weaving capacity in various regions. Thus, technological innovation, economic stability, and regulatory adherence form the tripod upon which the long-term success of the Loom Market rests.

Segmentation Analysis

The Loom Market is segmented based primarily on technology (type), end-use application, and level of automation, providing a granular view of market dynamics and investment pockets. Segmentation by type differentiates between shuttle looms (now largely obsolete for mass production but still used for niche, hand-crafted textiles), and shuttleless looms, which are categorized into Air-Jet, Water-Jet, Rapier, and Projectile systems. Each technology caters to specific production requirements: Air-Jet for high speed and light to medium weight fabrics, Water-Jet for synthetic/filament yarns requiring high efficiency, and Rapier for maximum versatility in complex patterns and yarn types. Analyzing these segments helps stakeholders understand where future capital investments and technological breakthroughs are most likely to occur, currently favoring automated air-jet and rapier systems due to their balance of speed and versatility.

- By Technology Type:

- Air-Jet Looms

- Water-Jet Looms

- Rapier Looms

- Projectile Looms

- Other (Shuttle Looms, Knitting Machines, etc.)

- By Application:

- Apparel & Clothing

- Home Textiles

- Technical Textiles (Automotive, Medical, Geotextiles)

- Industrial Textiles

- By Automation Level:

- Fully Automatic Looms

- Semi-Automatic Looms

- By End-use Sector:

- Integrated Mills

- Specialized Weaving Units

- Small and Medium Enterprises (SMEs)

Value Chain Analysis For Loom Market

The Loom Market value chain begins with upstream activities involving the sourcing of highly specialized raw materials, primarily precision engineering components such as high-grade steel alloys, electronic control systems (PLCs, sensors, drives), and specialized mechanical assemblies (cams, grippers, nozzles). Key upstream suppliers hold significant leverage due to the need for components meeting extremely tight tolerances required for high-speed operation. The manufacturing stage itself is highly capital-intensive, focusing on sophisticated CNC machining, assembly, testing, and quality assurance. Research and Development (R&D) is a continuous process, focused on incremental improvements in speed, noise reduction, and energy efficiency, representing a critical value addition point for established OEMs.

Distribution channels for looms are predominantly direct, especially for high-value shuttleless machinery sold to large integrated textile mills. Direct sales allow manufacturers to offer comprehensive installation, training, and long-term maintenance contracts, crucial for sophisticated equipment. Indirect distribution involves regional distributors and agents who manage sales, spare parts inventory, and first-level technical support in geographically dispersed markets, particularly serving Small and Medium Enterprises (SMEs). The decision to use direct versus indirect channels is heavily dependent on the market maturity and the size of the end-user, with North America and Europe seeing more direct interaction, while APAC often utilizes robust distributor networks due to the volume of sales.

Downstream activities center on the end-users—textile manufacturers—who utilize the looms to produce woven goods. The efficiency and quality of the finished fabric directly reflect the capabilities of the loom. Further downstream, these fabrics enter secondary value chains for finishing, dyeing, apparel cutting, and final sale. The close relationship between loom manufacturers and large downstream textile players is vital, as manufacturers often customize loom specifications (e.g., width, yarn count capacity) to meet the specific requirements of the fabric produced. This integration allows for optimization of the entire production process, from yarn cone to finished roll of fabric, ensuring maximum profitability for the end-user.

Loom Market Potential Customers

The primary customers in the Loom Market are textile manufacturers categorized by scale, specialization, and production focus. Large integrated textile mills, which manage the entire process from spinning to finishing, represent the most significant potential customers. These mills require large volumes of highly efficient, automated looms (primarily Air-Jet and high-end Rapier systems) and prioritize factors such as production speed, long-term reliability, and integration with existing factory automation systems. Their purchasing decisions are often centralized, involve significant capital budgeting, and are focused on achieving economies of scale to supply global fashion and retail brands with high-volume standardized fabrics.

A second major customer segment includes specialized weaving units, often found in developed economies, that focus exclusively on high-value, niche products such as technical textiles (e.g., carbon fiber weaving, specialized medical implants, protective ballistic materials) or luxury/designer fabrics. These customers prioritize machine versatility, precision, and the ability to handle unconventional materials. They often opt for highly customized Rapier looms or specialized broad looms capable of extreme widths and densities. For this segment, the unique technical capability of the loom is more critical than the absolute speed, driving demand for premium European and Japanese manufacturers known for engineering excellence and adaptability.

Finally, Small and Medium-sized Enterprises (SMEs) in emerging markets constitute a large segment of potential customers, typically seeking cost-effective, durable, and easily maintainable semi-automatic or older generation shuttleless looms. Their purchasing power is limited, and they rely heavily on local distributors for financing and immediate technical support. The trend among these SMEs is often the acquisition of slightly older, refurbished models or new equipment from cost-competitive Chinese and Indian manufacturers. Their primary product focus is usually domestic or regional apparel and basic home textile products, where high volume and low cost are paramount competitive factors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $9.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ITEMA S.P.A., Picanol NV, Tsudakoma Corp, Toyota Industries Corporation, Dornier GmbH, Murata Machinery, Ltd., Staubli International AG, Lakshmi Machine Works (LMW), Sulzer Gmbh, RIFA Textile Machinery Co., Ltd., Smit Textile S.p.A., Zhejiang Kingdom Machine Co., Ltd., Saurer AG, Van de Wiele, Wuxi Jingwei Textile Machinery |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Loom Market Key Technology Landscape

The technology landscape of the Loom Market is defined by the integration of mechanical precision with advanced digital control systems, fundamentally transitioning weaving from a manual skill to a data-driven process. The core technological advancements are centered around increasing the Picks Per Minute (PPM) while simultaneously managing vibration and energy consumption. Key technologies include optimized weft insertion mechanisms (e.g., multi-phase air-jet systems), sophisticated electronic let-off and take-up mechanisms that ensure uniform warp tension throughout the process, and advanced shedding motions (electronic jacquards and dobby machines) that allow for nearly instantaneous pattern changes, crucial for short-run customization orders and complex technical weaves.

A significant trend dominating the landscape is the implementation of Industry 4.0 paradigms through the Internet of Things (IoT). Modern looms are equipped with hundreds of sensors monitoring variables like yarn tension, temperature, humidity, and motor performance. This data is collected and processed locally or sent to cloud platforms for real-time diagnostics and overall equipment effectiveness (OEE) analysis. The use of specialized servo motors and direct drives has replaced traditional mechanical linkage systems, offering greater precision, higher speeds, and significantly reduced maintenance requirements compared to older cam-based systems. These digital advancements are essential for maintaining the stringent quality requirements of high-performance fabrics, particularly in the automotive and medical sectors.

Furthermore, research into material science is influencing the development of loom components, focusing on lighter, stronger materials for moving parts to allow for higher acceleration and deceleration rates without compromising structural integrity. This allows for faster weft insertion cycles. The integration of advanced human-machine interfaces (HMIs) and remote monitoring capabilities facilitates decentralized management of weaving operations, allowing technicians to diagnose and troubleshoot issues from anywhere, improving response times and efficiency. The ongoing technological arms race is thus focused not merely on speed, but on the seamless amalgamation of mechanical robustness, electronic intelligence, and user-friendly operability to maximize return on investment for end-users.

Regional Highlights

The Loom Market exhibits distinct regional consumption and production characteristics, heavily weighted towards Asia Pacific (APAC) due to the region's massive manufacturing base and continuous industrial expansion. APAC, led by China, India, and Vietnam, dominates both the supply (through domestic manufacturing of cost-effective equipment) and the demand (through large-scale capacity additions in textile mills). The region benefits from lower labor costs, robust governmental support through subsidies, and proximity to major yarn suppliers, making it the globally preferred hub for mass textile production, driving high demand for Air-Jet and Water-Jet looms focused on volume and efficiency. Rapid urbanization and the resultant surge in domestic consumer spending also contribute significantly to textile demand within these nations.

Europe and North America represent mature markets characterized by replacement demand rather than new capacity expansion, focusing primarily on high-end specialized machinery. These regions prioritize investment in sophisticated Rapier looms and specialized broad looms suitable for weaving highly technical textiles (e.g., aerospace composites, non-flammable fabrics) and high-value designer apparel. European manufacturers, in particular, lead technological innovation, focusing on sustainability, reduced noise levels, energy conservation, and advanced automation features. The core market driver here is the requirement for flexibility and innovation in fabric structure rather than sheer throughput, justifying the high price point of European-manufactured equipment.

Latin America (LATAM) and the Middle East & Africa (MEA) are characterized as emerging markets experiencing moderate growth driven by industrialization and the need to modernize existing weaving infrastructure. Countries like Brazil, Turkey, and Egypt are investing in mid-range shuttleless looms to improve domestic textile quality and competitiveness, reducing reliance on imported fabrics. Growth in these regions is often supported by foreign direct investment and government initiatives aimed at building local manufacturing self-sufficiency. However, market adoption can be slower due to financial constraints and geopolitical instability in certain sub-regions, favoring durable, versatile, and moderately priced machinery capable of handling diverse local demand.

- Asia Pacific (APAC): Dominates consumption and production; driven by mass textile manufacturing, capacity expansion, governmental subsidies, and high adoption of air-jet and water-jet technologies in China, India, and Vietnam.

- Europe: Characterized by high-value, replacement demand; focus on technical textiles, luxury fabrics, sustainability, and technological leadership in advanced rapier systems (Germany, Italy, Belgium).

- North America: Stable market with emphasis on automation and specialty weaving; demand centered around niche, high-performance industrial fabrics and textiles for automotive and medical applications.

- Latin America (LATAM): Emerging market modernization; moderate growth fueled by local consumption, investment in semi-automatic and basic shuttleless looms for domestic apparel needs (Brazil, Mexico).

- Middle East and Africa (MEA): Growth driven by industrial diversification; efforts to build self-sufficient textile industries, particularly in Turkey and Egypt, focusing on versatile and durable machinery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Loom Market.- ITEMA S.P.A.

- Picanol NV

- Tsudakoma Corp

- Toyota Industries Corporation

- Dornier GmbH

- Murata Machinery, Ltd.

- Staubli International AG

- Lakshmi Machine Works (LMW)

- Sulzer Gmbh

- RIFA Textile Machinery Co., Ltd.

- Smit Textile S.p.A.

- Zhejiang Kingdom Machine Co., Ltd.

- Saurer AG

- Van de Wiele

- Wuxi Jingwei Textile Machinery

- CHTC Fong's International Company Limited

- CCI Corporation

- Teijin Seiki Co., Ltd.

- Nisshinbo Holdings Inc.

- Kroyer-Becker KG

Frequently Asked Questions

Analyze common user questions about the Loom market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the adoption of shuttleless looms globally?

The primary driver is the need for high-speed automated production, translating directly into reduced labor costs and significantly higher output efficiency compared to traditional shuttle systems, crucial for meeting global mass market demand.

Which loom technology offers the highest versatility for diverse fabric types?

Rapier looms generally offer the highest versatility. They can handle a wide range of yarn counts, complex fabric structures, and different fiber types, making them ideal for customized, high-value, short-run production and technical textiles.

How is the integration of Industry 4.0 influencing loom maintenance?

Industry 4.0, primarily through IoT sensors and AI analytics, is enabling a shift from reactive to predictive maintenance. Looms can now anticipate component failures and schedule necessary repairs automatically, maximizing machine uptime (OEE).

Which geographical region dominates the demand and supply of new looms?

The Asia Pacific (APAC) region, driven by continuous expansion in China and India, dominates both the manufacturing capacity and the total consumption of new looms due to mass textile production and favorable government policies.

What is the major constraint facing smaller textile manufacturers in adopting modern looms?

The major constraint is the substantial initial capital expenditure required for high-speed, automated shuttleless looms. This high entry cost often necessitates long-term financing or reliance on older/refurbished machinery for smaller enterprises.

Are Air-Jet or Water-Jet looms more energy efficient?

While both are highly efficient, Air-Jet looms consume significantly more energy per pick due to high air compression requirements. Water-Jet looms are typically more energy-efficient in terms of power consumption, although their use is restricted to water-resistant synthetic filament yarns.

What role do technical textiles play in future loom market growth?

Technical textiles represent the fastest-growing application segment. Increased demand from the automotive, construction, and medical sectors for specialized woven materials necessitates investment in highly precise and durable looms capable of handling heavy and complex fibers, ensuring future market expansion.

What is the significance of the electronic let-off and take-up mechanisms in modern weaving?

These electronic mechanisms ensure precise, uniform warp tension throughout the weaving process, regardless of warp beam diameter changes. This precision is critical for maintaining consistent fabric quality, minimizing yarn breaks, and enabling high-speed operation on modern looms.

How do global trade policies affect demand for loom machinery?

Global trade policies, such as tariffs and free trade agreements, directly influence the competitiveness of textile exporting nations. Favorable policies encourage manufacturers to invest in new loom capacity to scale up production, while punitive tariffs can suppress demand in targeted regions.

What is the expected long-term impact of sustainability initiatives on loom design?

Sustainability drives manufacturers to develop looms with lower energy consumption (optimized drives, intelligent motors) and reduced water usage (advanced filtration and closed-loop systems for Water-Jet looms). Furthermore, machinery must be capable of weaving recycled and sustainable fibers effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Loom Machine Market Statistics 2025 Analysis By Application (Natural Fibers Industry, Chemical Fiber Industry), By Type (Floor Looms, Table Looms, Rigid Heddle Looms, Inkle Looms, Tapestry Looms, Card Weaving, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Sweater Knitting Machines Market Statistics 2025 Analysis By Application (Men, Women, Kids), By Type (Hand Loom Flatbed Knitting Machine, Computerized Flatbed Knitting Machine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Shuttleless Loom Market Statistics 2025 Analysis By Application (Natural Fibers Industry, Chemical Fiber Industry), By Type (Rapier (Single and Double Type), Air Jet Loom, Water Jet Loom, Gripper or Projectile Loom), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager