Low Dielectric Glass Fibre Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431456 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Low Dielectric Glass Fibre Market Size

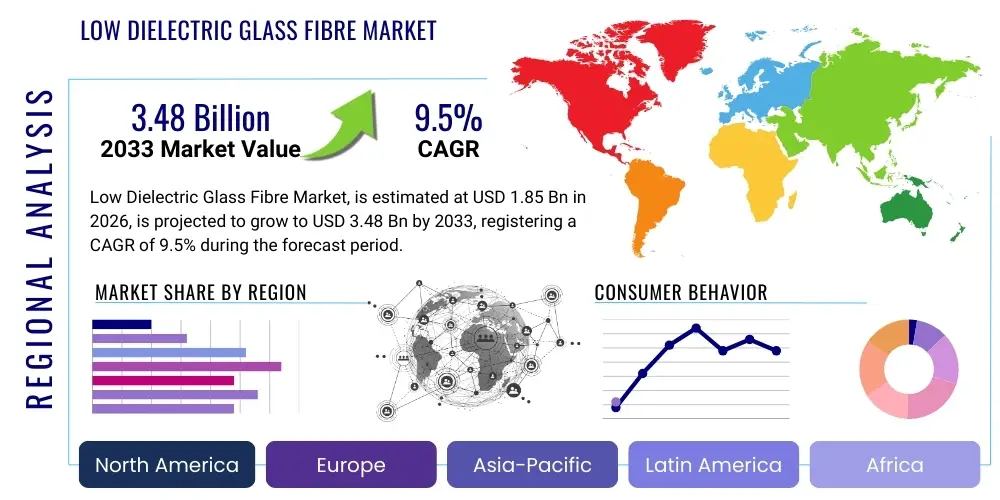

The Low Dielectric Glass Fibre Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.48 Billion by the end of the forecast period in 2033.

Low Dielectric Glass Fibre Market introduction

Low Dielectric Glass Fibre (LDGF) represents a critical class of advanced materials specifically engineered for high-frequency and high-speed electronic applications, offering superior signal integrity compared to standard E-glass fibers. These specialty fibers are characterized by a low dielectric constant (Dk) and low dissipation factor (Df), properties essential for minimizing signal loss and ensuring reliable performance in demanding communication environments. The primary product differentiation in this market revolves around modifying the glass composition—often reducing alkali metal content and incorporating specialized oxides—to achieve optimal electrical performance while maintaining desirable mechanical strength and thermal stability. Major applications include high-frequency printed circuit boards (PCBs), substrates for 5G telecommunication infrastructure, advanced driver-assistance systems (ADAS) in the automotive sector, and specialized military and aerospace components requiring stringent signal transmission fidelity. The overarching driving factor for this market’s expansion is the relentless global deployment of 5G networks, the proliferation of data centers, and the exponential growth of connected devices within the Internet of Things (IoT) ecosystem, all of which necessitate materials capable of handling extremely high data rates with minimal energy loss.

Low Dielectric Glass Fibre materials are crucial enablers for next-generation electronics, serving as the backbone for high-performance laminates used in multilayer PCBs. Their enhanced electrical characteristics directly translate into faster processing speeds and reduced latency in end products, making them indispensable for applications like millimeter-wave technology and high-performance computing. The product’s benefits extend beyond just electrical properties; LDGF also offers excellent dimensional stability and resistance to chemicals and moisture, crucial for the longevity and reliability of advanced electronic assemblies. The market dynamics are heavily influenced by the speed of technology adoption in key regions, particularly in Asia Pacific where the manufacturing of consumer electronics and telecommunication equipment is concentrated. As electronic devices become smaller, more complex, and operate at higher frequencies, the demand for high-performance insulating materials like LDGF will continue its upward trajectory, pushing manufacturers towards continuous innovation in fiber chemistry and processing techniques to meet increasingly stringent technical specifications required by the electronics industry.

Low Dielectric Glass Fibre Market Executive Summary

The Low Dielectric Glass Fibre Market is characterized by robust growth driven primarily by macro-level business trends centered on global digitalization and connectivity mandates. Key business trends include significant capital expenditure by telecommunication firms on 5G infrastructure rollout, increased electrification and autonomy in the automotive sector necessitating radar and sensor integration, and sustained demand from defense and aerospace industries for lightweight, high-reliability electronic components. Regionally, Asia Pacific maintains its dominance, serving as both the largest consumer and the principal manufacturing hub for LDGF products, fueled by massive production scale in China, Taiwan, South Korea, and Japan, specifically catering to PCB and consumer electronics production. North America and Europe are significant consumers, driven by high-value applications such as data centers and specialized defense electronics. Segment-wise, the High-Frequency PCB application segment holds the largest share due to the proliferation of high-speed data transmission requirements, while the D-Glass and modified E-Glass segments are experiencing rapid technological adoption as manufacturers strive to balance cost efficiency with superior dielectric performance. The overall market trajectory is highly dependent on technological advancements in glass composition and the successful mitigation of material substitution threats posed by high-performance polymer alternatives like PTFE and specialized hydrocarbons, compelling manufacturers to continually optimize the cost-performance ratio of glass fiber products.

Operational efficiency and supply chain resilience remain paramount in this specialized market. The Executive Summary highlights a competitive landscape where vertical integration, from raw material processing to final laminate manufacturing, provides a distinct advantage, allowing major players to maintain tight quality control over critical dielectric properties. Furthermore, environmental, social, and governance (ESG) factors are increasingly influencing market decisions, pushing companies towards developing energy-efficient melting processes and recyclable materials, which provides a long-term strategic advantage. The market is witnessing a trend towards customization, where LDGF producers collaborate directly with laminate manufacturers to develop proprietary fabric constructions and sizing agents optimized for specific resin systems (e.g., high-Tg epoxy, BT/Epoxy, Polyimide). Investment in R&D focusing on ultra-low Dk/Df fibers is escalating, particularly in response to the emerging requirements of 6G communication technologies and advanced quantum computing interfaces, ensuring that LDGF remains a foundational material for future electronic advancements.

AI Impact Analysis on Low Dielectric Glass Fibre Market

Common user questions regarding AI's impact on the Low Dielectric Glass Fibre market center on optimizing the complex manufacturing process, predicting end-use performance under various environmental stresses, and accelerating the design of new fiber formulations required for ultra-high-frequency applications. Users are primarily concerned with how AI can minimize variability in Dk and Df values across large production batches, which is critical for signal integrity in advanced PCBs. They also inquire about AI-driven demand forecasting, especially concerning the highly cyclical nature of the consumer electronics segment, and the use of machine learning algorithms to simulate and test new glass compositions without extensive, time-consuming laboratory trials. The key themes summarized from user queries are efficiency enhancement, defect reduction, predictive quality control, and faster material discovery cycles, all aimed at lowering production costs while maintaining the stringent quality standards demanded by 5G and radar technologies.

- AI-driven optimization of glass batch compositions to achieve target dielectric properties with higher precision and reduced raw material waste.

- Predictive maintenance analytics applied to melting furnaces and fiber drawing machines, ensuring consistent filament diameter and minimizing processing defects, thereby improving yield.

- Machine learning algorithms utilized for simulating electromagnetic performance of LDGF-based laminates, accelerating the design cycle for high-frequency PCBs.

- Enhanced quality control systems employing computer vision for real-time defect detection (e.g., sizing irregularities, fiber breakage) during the weaving and fabric finishing stages.

- AI-powered demand forecasting models integrating global semiconductor cycles and 5G deployment schedules to optimize production planning and inventory management for LDGF producers.

- Automated analysis of complex operational parameters (temperature, pull speed, tension) during fiber drawing to maintain ultra-low variability in critical physical and electrical characteristics.

- Robotics and AI integration in material handling and packaging to ensure the pristine condition of delicate glass fiber fabrics before shipment to laminators.

DRO & Impact Forces Of Low Dielectric Glass Fibre Market

The Low Dielectric Glass Fibre market is significantly influenced by a confluence of driving factors, structural restraints, and emerging opportunities, collectively shaping the market's trajectory and profitability. The primary drivers include the mandatory global shift towards 5G and anticipated 6G networks, which demand materials with superior electrical performance to minimize signal loss at higher frequencies, coupled with the rapid expansion of data centers requiring high-speed interconnects. Restraints largely involve the highly complex and capital-intensive nature of specialty glass fiber manufacturing, which limits new market entrants, alongside the constant competitive threat from alternative materials such as specialized fluoropolymers (e.g., PTFE-based laminates) and thermoset hydrocarbon resins that sometimes offer lower Dk/Df values, albeit at a higher cost. Opportunities are present in the burgeoning Advanced Driver-Assistance Systems (ADAS) market, especially radar systems operating in the 77 GHz range, and in the growing aerospace sector where requirements for lightweight and high-temperature resistant dielectric materials are paramount. The impact forces are generally high, reflecting the market’s reliance on rapid technological cycles and the substantial investment required to maintain manufacturing competitiveness and adhere to increasingly rigorous performance specifications.

The high cost associated with producing specialty LDGF compositions, particularly D-Glass or modified versions, acts as a barrier, challenging manufacturers to achieve economies of scale without compromising material integrity. However, this is partially offset by the high willingness-to-pay among high-performance electronics manufacturers who cannot compromise on signal reliability. Furthermore, stringent regulatory requirements, particularly concerning halogen-free and environmentally sustainable materials, act as an indirect impact force, pushing innovation towards greener manufacturing processes and cleaner glass compositions. The market benefits from strong bargaining power of suppliers for highly refined raw materials (like high-purity silica), yet this is counterbalanced by intense competition among the glass fiber producers themselves. Overall, the market remains technologically driven, with the balance of forces favoring specialized players capable of rapid material formulation iteration and consistent quality control, positioning the LDGF market for sustained, albeit technically challenging, growth.

Segmentation Analysis

The Low Dielectric Glass Fibre Market segmentation provides a granular view of demand across various product types and end-use applications, crucial for strategic market positioning. The market is primarily bifurcated by Type, focusing on the chemical composition and resultant electrical properties, encompassing standard E-Glass, which serves as a baseline, and specialized D-Glass, S-Glass, and Q-Glass variants designed for high-performance requirements. D-Glass (or low dielectric E-glass substitutes) currently dominates the high-frequency PCB segment due to its favorable balance between cost and performance (low Dk/Df). Application segmentation highlights the critical role of LDGF in key growth areas, with High-Frequency PCBs for 5G telecommunications and data processing serving as the leading segment. This segmentation reflects the core technical requirements of modern electronics, where signal integrity at high speeds dictates material selection, driving specialization within both the material composition and the final application.

- By Type:

- E-Glass (Standard/Modified)

- D-Glass (Low Dielectric Constant Glass)

- S-Glass (High Strength Glass used in specific high-reliability applications)

- Q-Glass (Quartz-based Glass Fiber)

- Other Specialty Glass Types (e.g., NE-Glass, T-Glass)

- By Application:

- High-Frequency PCBs (5G Base Stations, Routers, Switches)

- Communication Equipment (Antennas, Repeaters)

- Automotive Radars and Sensors (ADAS Systems, 77 GHz Radar)

- Aerospace and Defense Electronics (Guidance Systems, Satellite Communication)

- Consumer Electronics (High-End Smartphones, Gaming Consoles, Wearables)

- Data Centers and Server Infrastructure

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Low Dielectric Glass Fibre Market

The value chain for the Low Dielectric Glass Fibre market is complex, beginning with highly specialized upstream raw material sourcing and culminating in the final integration into advanced electronic systems. Upstream analysis involves the procurement and preparation of high-purity raw materials, including specific grades of silica, alumina, and specialized oxides (like boron or lithium oxides) which dictate the final dielectric properties. The manufacturing process is highly capital-intensive, involving the precise melting of batch materials, platinum bushing technology for fiber drawing, and the crucial application of proprietary sizing agents optimized for compatibility with high-performance resin systems. The sizing step is particularly critical as it ensures the bond strength between the glass fiber and the resin matrix. Distribution channels are typically direct for large volume contracts, where LDGF manufacturers supply woven fabrics directly to specialized laminate producers (downstream processors). Indirect channels, utilizing highly technical distributors or agents, are used for smaller, specialized orders or for penetrating specific regional markets. The quality and consistency of the glass fiber significantly influence the subsequent laminate quality, placing immense pressure on upstream suppliers to maintain ultra-tight tolerances on Dk and Df.

The downstream analysis focuses on the transformation of the LDGF fabric into rigid or flexible copper-clad laminates (CCL). Laminate manufacturers use high-temperature, high-pressure processes to impregnate the fabric with resin and bond it with copper foil. These laminates are then sold to Printed Circuit Board (PCB) fabricators. The performance requirements set by PCB designers, particularly in the telecommunications and automotive sectors, directly dictate the demand for specific LDGF types. For instance, 5G infrastructure requires extremely low loss materials, driving the demand for D-glass and specialized polymer-compatible sizings. The integration stage involves the PCB assembly houses, which use the finished boards in final electronic devices. The efficiency of the entire value chain is determined by seamless technical collaboration between the glass fiber producer, the laminate manufacturer, and the end-use PCB designer, emphasizing a highly relationship-driven market structure where technical expertise and material consistency are prized over mere commodity pricing.

Low Dielectric Glass Fibre Market Potential Customers

The core potential customers in the Low Dielectric Glass Fibre Market are specialized laminate manufacturers and high-performance Printed Circuit Board (PCB) fabricators who serve high-reliability and high-frequency end markets. These customers require materials that guarantee minimal signal loss and exceptional thermal stability. Specific end-users/buyers include major telecommunication equipment manufacturers (e.g., those producing 5G base stations, antennas, and networking gear), Tier 1 automotive suppliers focusing on advanced driver-assistance systems (ADAS) modules, and defense and aerospace contractors developing radar, electronic warfare, and satellite communication systems. The key characteristic of these buyers is their need for customized material specifications, often requiring LDGF products to meet military-grade reliability standards (e.g., MIL-SPEC) or specific industry certifications (e.g., automotive AEC-Q standards). The purchasing decision is heavily weighted toward proven material performance, supplier consistency, and technical support, rather than being purely cost-driven, reflecting the mission-critical nature of their final electronic products.

Secondary but rapidly growing customer segments include specialized manufacturers of high-performance computing (HPC) and data center infrastructure. These entities require LDGF for server backplanes and high-speed interconnects that manage massive volumes of data transfer. Furthermore, specialized scientific instrumentation manufacturers, particularly those in medical imaging and high-energy physics research, represent niche buyers seeking extremely stable dielectric properties in unique operating environments. The ongoing miniaturization trend in consumer electronics also brings high-end smartphone and tablet manufacturers into the customer base, specifically those designing components that operate at elevated frequencies within confined spaces. As technology evolves towards 6G and increasingly complex integrated circuits, the customer base will continue to shift towards those entities focused on maximizing data throughput and minimizing latency, making LDGF producers strategic partners rather than simple material suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.48 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PPG Industries, Owens Corning, Johns Manville (a Berkshire Hathaway company), China Jushi Co. Ltd., Chongqing Polycomp International Corp. (CPIC), Taishan Fiberglass Inc., Nippon Electric Glass Co., Ltd. (NEG), AGY Holding Corp., Saint-Gobain, Binani 3B-Fibreglass, TEIJIN Limited, Nittobo Co., Ltd., BASF SE, Toray Industries, Inc., Gurit Holding AG, Mitsubishi Chemical Corporation, Sichuan Xingwen Glass Fiber Co., Ltd., Fujian Longking Fiberglass Co., Ltd., Advanced Glassfiber Yarns LLC, Hexcel Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Low Dielectric Glass Fibre Market Key Technology Landscape

The technological landscape of the Low Dielectric Glass Fibre market is characterized by continuous innovation focused on optimizing glass composition, enhancing manufacturing precision, and perfecting the interface between fiber and resin. A primary focus is on advanced melting techniques, specifically the use of oxy-fuel furnaces and electrical boosting, which ensure higher temperature stability and better homogeneity of the molten glass, crucial for achieving ultra-low alkali content necessary for superior dielectric properties. Precision fiber drawing technology is another cornerstone; this involves multi-bushing platinum/rhodium alloy systems that allow for extremely thin, consistent filaments (often less than 5 microns) to be drawn at high speeds, minimizing defects that could compromise the fabric structure and electrical consistency. Furthermore, the development of highly specialized sizing chemistry is critical. New sizing agents are being formulated to ensure optimal compatibility and adhesion with advanced resin systems like polyphenylene ether (PPE) and hydrocarbon resins, maximizing the overall laminate performance in high-frequency environments and minimizing moisture absorption, a major factor contributing to dielectric loss.

A significant technological advancement involves the integration of high-throughput screening and analytical tools used to rapidly test new glass formulations. Manufacturers employ sophisticated methods like X-ray photoelectron spectroscopy (XPS) and electron microscopy to analyze the surface chemistry and internal structure of the fibers, ensuring that the desired low Dk/Df properties are consistently achieved across production runs. There is a growing trend toward surface functionalization, where fibers are treated with nanoscale coatings or plasma etching to further optimize the chemical bonding with advanced resin matrices, thereby improving the overall mechanical and electrical performance of the resulting laminate. Finally, digital manufacturing and Industry 4.0 principles are being applied to manage the entire process, utilizing sensor data and predictive modeling to maintain stringent quality control, especially concerning the uniformity of the weave and the tension applied during fabric preparation, ensuring the final material meets the demanding specifications required for millimeter-wave frequency applications.

Regional Highlights

The geographical distribution of demand and manufacturing capacity critically shapes the global Low Dielectric Glass Fibre market, with significant disparities in technological maturity and application focus across regions. Asia Pacific (APAC) dominates the market, largely due to its unparalleled position as the global hub for electronics manufacturing, including the mass production of consumer devices, networking equipment, and the fastest adoption rate of 5G infrastructure, particularly in China, South Korea, and Taiwan. The presence of major PCB and laminate manufacturers in this region drives high volume demand for D-glass and other specialty LDGF materials. This region is characterized by high operational intensity and competitive pricing, necessitating continuous cost optimization by local and international suppliers.

North America and Europe represent mature markets focused heavily on high-value, low-volume applications. North America's demand is driven significantly by the aerospace, defense, and data center sectors, which require ultra-high reliability and often demand materials meeting stringent military specifications, thereby favoring specialized, premium-priced LDGF products like S-Glass or Q-Glass variants. Europe is strongly influenced by the automotive sector, particularly the rapid integration of ADAS technologies requiring 77 GHz radar sensors, demanding reliable LDGF substrates. Regulatory pressures regarding environmental compliance (e.g., REACH) also influence material selection and manufacturing processes in the European market. Latin America and the Middle East & Africa (MEA) are emerging markets, with growth linked to localized telecom infrastructure upgrades and increasing foreign investment in advanced manufacturing capabilities.

- Asia Pacific (APAC): Market leader by volume, driven by mass production of consumer electronics, 5G infrastructure deployment (China, Korea), and the presence of major CCL and PCB manufacturing firms. Focus on cost-effective, high-performance D-Glass and modified E-Glass.

- North America: High-value market focused on defense, aerospace, and advanced data communication equipment. Demand for specialized, high-reliability fibers (e.g., Q-Glass) for mission-critical applications and high-speed server backplanes.

- Europe: Driven by strict automotive standards for ADAS and radar systems, along with industrial automation requirements. Strong emphasis on sustainable manufacturing and adherence to environmental regulations.

- Latin America: Emerging market characterized by increasing investment in telecom network expansion and slow but steady growth in local electronics assembly, leading to moderate demand for standard LDGF types.

- Middle East and Africa (MEA): Growth tied to strategic infrastructure projects, including smart city development and military spending, focusing on niche, high-performance applications but generally smaller market size.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Low Dielectric Glass Fibre Market.- PPG Industries

- Owens Corning

- Johns Manville (a Berkshire Hathaway company)

- China Jushi Co. Ltd.

- Chongqing Polycomp International Corp. (CPIC)

- Taishan Fiberglass Inc.

- Nippon Electric Glass Co., Ltd. (NEG)

- AGY Holding Corp.

- Saint-Gobain

- Binani 3B-Fibreglass

- TEIJIN Limited

- Nittobo Co., Ltd.

- BASF SE (Specialty Chemicals/Sizing Agents)

- Toray Industries, Inc. (Advanced Materials)

- Gurit Holding AG (Composite Materials Focus)

- Mitsubishi Chemical Corporation

- Sichuan Xingwen Glass Fiber Co., Ltd.

- Fujian Longking Fiberglass Co., Ltd.

- Advanced Glassfiber Yarns LLC

- Hexcel Corporation

Frequently Asked Questions

What is the primary technical advantage of Low Dielectric Glass Fibre (LDGF) over standard E-Glass in high-frequency applications?

The primary advantage of LDGF is its significantly lower dielectric constant (Dk) and dissipation factor (Df). These properties minimize signal attenuation and energy loss, ensuring superior signal integrity and faster data transmission speeds, which is essential for 5G, radar, and high-performance computing operating at frequencies above 10 GHz.

Which application segment drives the highest volume demand for Low Dielectric Glass Fibre globally?

The High-Frequency Printed Circuit Boards (PCBs) segment, primarily used in 5G telecommunication base stations, data center infrastructure, and advanced networking equipment, drives the highest volume demand for LDGF. This segment requires large quantities of laminates specifically designed to handle high data rates with minimal latency.

How does the rollout of 5G technology specifically impact the demand outlook for D-Glass fibers?

The 5G rollout critically boosts demand for D-Glass and modified low-Dk E-Glass because these materials offer an optimal balance of cost and electrical performance necessary for mass-market high-frequency circuit boards. They enable signal transmission in the 28 GHz and 39 GHz spectrums (and higher) required for 5G millimeter-wave applications, ensuring reduced insertion loss.

What are the key manufacturing challenges faced by producers in the Low Dielectric Glass Fibre market?

Key challenges include maintaining precise control over the glass composition to ensure consistent Dk/Df values across large batches, managing the high capital expenditure required for advanced melting and fiber drawing technology, and developing proprietary sizing agents compatible with evolving high-performance resin systems to ensure optimal laminate adhesion.

Which geographical region is expected to exhibit the fastest growth in the LDGF market during the forecast period?

Asia Pacific (APAC) is projected to exhibit the fastest growth due to its status as the global manufacturing center for electronics, aggressive investment in 5G infrastructure, and rapid adoption of advanced automotive electronics and IoT devices, particularly driven by scaling production in countries like China, Taiwan, and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager