Low Soda Alumina Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432825 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Low Soda Alumina Market Size

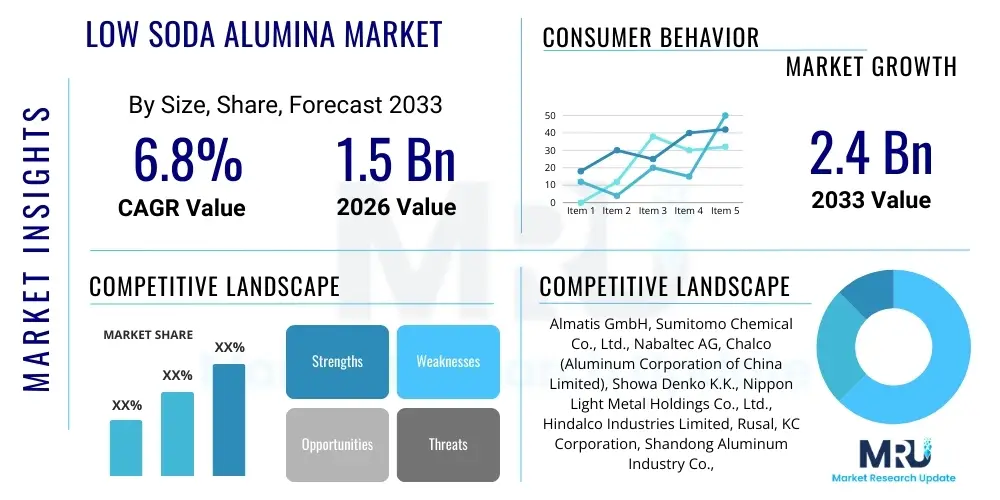

The Low Soda Alumina Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Low Soda Alumina Market introduction

Low Soda Alumina (LSA) refers to high-purity aluminum oxide characterized by extremely low sodium oxide (Na₂O) content, typically maintained below 0.1%. This stringent purity requirement is critical because sodium acts as an impurity, significantly degrading the electrical, mechanical, and thermal properties of final ceramic and refractory products. The primary methods for producing LSA involve advanced modifications to the conventional Bayer process, often incorporating selective leaching, acid washing, or the use of proprietary additives during the calcination phase to volatilize or neutralize sodium compounds. Due to its superior dielectric strength, high melting point, and excellent chemical resistance, LSA serves as a foundational material in high-performance applications where standard alumina is insufficient.

The product portfolio of the LSA market encompasses various grades defined by their soda content, ranging from standard LSA (0.05% to 0.1% Na₂O) to Ultra-Low Soda Alumina (ULSA), which mandates levels below 0.01%. Major applications include the production of electronic substrates, sapphire crystal growth, advanced refractories for specialized industrial furnaces, and technical ceramics utilized in medical and aerospace sectors. The demand for LSA is intricately linked to the rapid expansion of electronics industries, particularly in high-frequency communications (5G infrastructure) and energy storage solutions (lithium-ion battery components), which require materials capable of operating under extreme conditions with minimal electrical loss.

Key benefits driving market adoption include enhanced thermal shock resistance, superior electrical insulation properties at high temperatures, and improved sintered density and mechanical strength in final ceramic parts. Driving factors center on the relentless miniaturization of electronic devices, requiring smaller, more efficient components made from high-purity materials, and the increasing global investment in high-temperature industrial processes, especially glass melting and specialty steel production, where LSA-based refractories offer extended service life and reliability compared to traditional materials.

Low Soda Alumina Market Executive Summary

The Low Soda Alumina market is experiencing robust growth, primarily propelled by transformative trends in the electronics and energy sectors. Business trends highlight a strong focus on vertical integration among key manufacturers, seeking to control the supply chain from raw bauxite sourcing through specialized calcination processes to final product customization. Furthermore, there is a pronounced shift towards Ultra-Low Soda Alumina (ULSA) grades, driven by stringent quality mandates from semiconductor and sapphire substrate manufacturers. Regional trends underscore Asia Pacific's (APAC) undisputed dominance, accounting for the largest share of consumption and production, owing to concentrated manufacturing hubs for consumer electronics, flat panel displays, and advanced refractories in countries such as China, Japan, and South Korea. This region also serves as a crucial hub for lithium-ion battery production, further stimulating LSA demand.

Segmentation trends reveal that the Electronics application segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period, overshadowing traditional Refractory applications, although the latter remains a substantial volume driver. Within the type segmentation, alumina with Na₂O content between 0.05% and 0.1% holds the majority market share, balancing high performance with manageable production costs. However, the market structure is increasingly bifurcating, with specialized players focusing exclusively on the niche, high-margin ULSA sector (less than 0.01% Na₂O) essential for high-end optical and semiconductor applications, while established chemical giants cater to the bulk refractory and general ceramic segments. Pricing dynamics are heavily influenced by energy costs, as LSA production is an energy-intensive process requiring extremely high calcination temperatures, resulting in fluctuating material costs passed onto end-users.

Geographically, while APAC dictates volume, North America and Europe continue to lead in technological innovation and demand for highly specialized, custom LSA grades used in aerospace components, medical implants, and advanced R&D projects. The competitive landscape is characterized by a balance between global chemical conglomerates that benefit from economies of scale and niche specialty chemical producers offering tailored solutions and superior purity levels. Strategic collaborations focusing on sustainable sourcing and waste reduction in the energy-intensive purification process are becoming prevalent to address environmental concerns and optimize operational expenditures, thus shaping the long-term viability and growth trajectory of the LSA market.

AI Impact Analysis on Low Soda Alumina Market

User inquiries regarding AI's influence on the Low Soda Alumina market often revolve around optimizing the complex production parameters, particularly the high-temperature calcination and impurity removal stages. Users are concerned with how machine learning can enhance quality control (QC) consistency, given the critical nature of maintaining low soda content, and predict equipment failure in energy-intensive furnaces. The consensus theme centers on leveraging AI and predictive analytics to achieve unprecedented levels of material consistency and minimize waste in a manufacturing process historically reliant on empirical adjustments. Expectations include the integration of AI-driven sensor networks to monitor and fine-tune calcination curves in real-time, thereby reducing energy consumption and material variability across different production batches, leading to higher yields of premium-grade Ultra-Low Soda Alumina necessary for advanced electronics.

- AI-driven optimization of calcination furnace energy consumption, resulting in significant operational cost reductions.

- Predictive maintenance analytics for high-temperature processing equipment, minimizing unplanned downtime and enhancing asset utilization.

- Machine learning algorithms applied to real-time spectral analysis for instant, highly accurate quality control of Na₂O content, ensuring batch consistency.

- Enhanced R&D capabilities through AI simulation of new purification routes and additive formulations for ultra-low soda requirements.

- Optimization of complex global supply chains, leveraging AI to forecast demand fluctuations from semiconductor and refractory customers.

DRO & Impact Forces Of Low Soda Alumina Market

The Low Soda Alumina market is fundamentally driven by the explosive demand from high-technology sectors, while simultaneously constrained by significant production complexities and cost structures. The primary driver is the pervasive adoption of advanced ceramics in mission-critical electronic components, 5G infrastructure, and Electric Vehicle (EV) battery separators, where conventional materials fail to meet thermal and electrical performance specifications. Restraints principally involve the extremely high energy required for the extensive purification and high-temperature calcination processes, leading to volatile production costs and a notable carbon footprint, alongside the technical difficulty of consistently achieving ultra-low soda levels (<0.01% Na₂O) at commercial scale. Opportunities are substantial, particularly in emerging energy storage applications, where LSA serves as a crucial component for solid-state batteries and next-generation fuel cells, offering manufacturers avenues for high-value product differentiation.

The impact forces influencing this market operate across economic, technological, and regulatory dimensions. Economically, global industrial output and capital expenditure in the electronics and metals industries directly dictate LSA consumption volumes. Technologically, innovations in material science that allow for alternative, lower-cost soda reduction methods or the development of entirely new, non-alumina ceramic formulations pose a future disruptive threat, though LSA currently maintains a competitive edge based on performance history. Regulatory impact primarily stems from environmental standards concerning energy consumption and emissions associated with high-temperature processing, pushing manufacturers towards sustainable and efficient production technologies, which subsequently influences market pricing and competitive advantage.

Overall, the market dynamic exhibits strong positive forces exerted by technological advancement and application expansion, which significantly outweigh the inherent complexities of high-purity production. The scarcity of high-quality, reliable LSA suppliers capable of meeting stringent specifications further solidifies the market's high-value status. The equilibrium point is constantly shifting, favoring manufacturers who can consistently deliver superior purity grades while effectively managing escalating energy and raw material costs, ensuring that the market's fundamental reliance on high-performance materials sustains its upward trajectory.

Segmentation Analysis

The Low Soda Alumina market is segmented primarily by Type, based on the residual sodium oxide content, and by Application, reflecting the diverse end-use industries requiring high-purity material properties. This segmentation allows for precise market targeting, as the required purity level dictates both the complexity of manufacturing and the resultant price point. Type segmentation distinguishes between grades suitable for bulk industrial use (slightly higher Na₂O) and highly specialized grades necessary for sensitive electronic or optical applications (Ultra-Low Na₂O). The Application segmentation reveals the foundational demand originating from traditional refractory and structural ceramics markets, contrasted with the rapid, high-growth demand originating from advanced electronics and medical sectors. Understanding these segments is crucial for strategic pricing and capacity planning, as the required processing technology differs substantially across purity levels.

- By Type:

- Low Soda Alumina (Na₂O Content 0.05% - 0.1%)

- Ultra-Low Soda Alumina (Na₂O Content less than 0.05%)

- By Application:

- Refractories (e.g., kiln linings, specialized bricks)

- Ceramics (e.g., technical ceramics, structural components, grinding media)

- Electronics (e.g., substrates, insulators, LED components, sapphire crystal growth)

- Others (e.g., medical implants, catalyst carriers, abrasives)

- By End-User Industry:

- Metal and Foundry

- Chemical and Petrochemical

- Glass Manufacturing

- Electronics and Semiconductors

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, Japan, South Korea, India)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA) (Saudi Arabia, UAE)

Value Chain Analysis For Low Soda Alumina Market

The Value Chain for the Low Soda Alumina market is highly capital-intensive and characterized by complex, energy-heavy processing steps, beginning with the sourcing of high-quality raw materials. Upstream analysis focuses on the extraction and refining of bauxite ore. While standard bauxite is the starting point, the quality required for LSA necessitates careful selection or pre-treatment, as subsequent purification steps are costly. Key upstream activities involve the standard Bayer process to produce aluminum hydrate, followed by specialized processing stages designed specifically to minimize sodium contamination. Control over high-grade bauxite reserves offers a significant competitive advantage, reducing variability in the feed material and simplifying downstream purification.

Midstream activities represent the core value addition, encompassing the proprietary purification and calcination techniques. This stage is dominated by specialized chemical manufacturers. Low soda content is achieved through intensive processes such as acid leaching, proprietary additive incorporation during precipitation, or controlled high-temperature calcination (sintering) that volatilizes sodium impurities. The success of LSA production hinges on stringent particle size control and crystal structure management during calcination, as these properties directly influence the final performance of the ceramic or refractory product. Investment in advanced thermal processing technology is mandatory at this stage.

Downstream analysis involves the distribution channel and the utilization by end-users. Distribution is typically direct for large volume orders targeting major refractory or glass manufacturers. For specialized, high-purity Ultra-Low Soda Alumina (ULSA) used in electronics and medical devices, distribution often involves highly technical sales teams and specialized distributors who can manage small, customized lot sizes and provide technical support to R&D departments. Indirect channels (distributors) manage smaller customers across diverse geographic regions. The final utilization involves incorporating LSA into highly specialized products like transparent armor, high-frequency antenna substrates, or specialized refractory linings in aluminum smelting, demonstrating the high-value integration of this material into critical infrastructure and advanced technology components.

Low Soda Alumina Market Potential Customers

The potential customer base for Low Soda Alumina spans multiple high-performance industries, requiring materials that offer superior mechanical, thermal, and dielectric properties compared to conventional alumina grades. The primary end-users are material procurement managers and R&D scientists within companies specializing in advanced manufacturing. In the refractory sector, customers include integrated steel mills, glass manufacturers, and cement producers seeking extended life cycles and reduced maintenance costs for their high-temperature furnaces and kilns. These buyers prioritize thermal stability and resistance to chemical attack, opting for LSA with moderate purity levels.

The fastest-growing segment of potential customers resides within the electronics and semiconductor industry. This includes manufacturers of high-power LEDs, sapphire substrates for optical windows and robust displays, and producers of insulating components used in power electronics and 5G base stations. These customers demand Ultra-Low Soda Alumina (ULSA) grades, as sodium impurities drastically affect dielectric constant and signal loss, making purity the absolute critical purchasing criterion. Furthermore, manufacturers of cutting-edge lithium-ion and solid-state battery separators represent a significant emerging customer group, focusing on the material's chemical inertness and high-temperature performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Almatis GmbH, Sumitomo Chemical Co., Ltd., Nabaltec AG, Chalco (Aluminum Corporation of China Limited), Showa Denko K.K., Nippon Light Metal Holdings Co., Ltd., Hindalco Industries Limited, Rusal, KC Corporation, Shandong Aluminum Industry Co., Ltd., Huber Advanced Materials, Saint-Gobain Ceramic Materials, Washington Mills, Baikowski SAS, Zibo Honghe Chemical Co., Ltd., Luoyang Jalon Micro-nano New Material Co., Ltd., Minco, Axens, CoorsTek Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Low Soda Alumina Market Key Technology Landscape

The technological landscape of the Low Soda Alumina market is dominated by advancements focused on highly controlled purification, calcination, and surface modification techniques, all designed to minimize residual sodium content (Na₂O) to parts per million (ppm) levels. The conventional Bayer process, while fundamental, is insufficient for LSA production; therefore, manufacturers employ secondary, proprietary purification steps. Key technologies include acid leaching and washing processes, where aluminum hydroxide is treated with mild acids to dissolve and remove soluble sodium salts before the final calcination stage. The efficacy of this treatment depends critically on particle morphology and surface area control, requiring specialized precipitation reactors.

A second crucial area is controlled high-temperature calcination and sintering. This process involves heating the purified alumina hydrate to temperatures exceeding 1,200°C, often approaching 1,600°C, under carefully managed atmospheric conditions. Advanced rotary kilns and shaft furnaces are employed, sometimes incorporating specialized volatile additives that react with sodium compounds, facilitating their removal via vaporization. Technological innovation here focuses on improving thermal efficiency, reducing energy consumption, and achieving uniform particle size distribution (PSD) and crystalline structure (alpha alumina) simultaneously, which are essential for superior densification in the final ceramic product.

Furthermore, post-processing technologies, such as advanced milling, classification, and surface coating, contribute significantly to the functional performance of LSA powders. Fine milling techniques, including jet milling, are necessary to achieve the sub-micron particle sizes required for high-density ceramics used in electronics. The integration of advanced sensor technology and process control systems (often leveraging AI, as noted previously) ensures batch-to-batch consistency in purity, particle size, and morphology—a non-negotiable requirement for critical applications like sapphire crystal growth and semiconductor substrates, making continuous process optimization the cornerstone of technological competition.

Regional Highlights

The Low Soda Alumina market exhibits significant regional disparities, driven by concentrated manufacturing activities and technological leadership in specific geographical areas.

- Asia Pacific (APAC): APAC holds the dominant share in both production capacity and market consumption, driven primarily by China, Japan, and South Korea. This dominance is attributed to the region’s massive electronics and semiconductor manufacturing base, coupled with extensive operations in high-temperature refractories and glass production. China serves as a major global supplier, capitalizing on large production volumes and favorable cost structures, while Japan and South Korea lead in the consumption of Ultra-Low Soda Alumina for advanced electronics, including high-definition displays, 5G components, and specialized ceramics.

- North America: North America represents a mature, high-value market characterized by demand for highly specialized, custom LSA grades. Consumption is focused on cutting-edge applications in aerospace, defense, medical implants, and advanced R&D into solid-state battery technology. Although production volume is lower than in APAC, the region commands premium pricing due to stringent quality control and innovation, particularly in the development of next-generation ceramic matrix composites (CMCs).

- Europe: Europe is a key consumer, driven by established industries such as advanced glass manufacturing (e.g., flat panel displays), specialized automotive components, and high-performance industrial ceramics. Germany, France, and the UK are primary hubs. European manufacturers emphasize sustainability and circular economy principles, driving research into energy-efficient purification methods and high-purity recycling routes, ensuring high technical standards across the supply chain.

- Latin America and Middle East & Africa (MEA): These regions represent emerging markets for LSA. Latin America's demand is tied to local metal and petrochemical industries requiring LSA-based refractories. MEA, particularly the Gulf nations, shows growth potential driven by planned industrial diversification and large-scale infrastructure projects requiring specialized high-temperature materials, although the market remains smaller compared to major economic zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Low Soda Alumina Market.- Almatis GmbH

- Sumitomo Chemical Co., Ltd.

- Nabaltec AG

- Chalco (Aluminum Corporation of China Limited)

- Showa Denko K.K.

- Nippon Light Metal Holdings Co., Ltd.

- Hindalco Industries Limited

- Rusal

- KC Corporation

- Shandong Aluminum Industry Co., Ltd.

- Huber Advanced Materials

- Saint-Gobain Ceramic Materials

- Washington Mills

- Baikowski SAS

- Zibo Honghe Chemical Co., Ltd.

- Luoyang Jalon Micro-nano New Material Co., Ltd.

- Minco

- Axens

- CoorsTek Inc.

- Aditya Birla Group

Frequently Asked Questions

Analyze common user questions about the Low Soda Alumina market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Low Soda Alumina and standard alumina?

Low Soda Alumina (LSA) possesses a significantly reduced content of sodium oxide (Na₂O), typically below 0.1%, compared to standard calcined alumina. This high purity is essential as sodium impurities severely degrade the electrical insulation and thermal stability required for advanced ceramics and electronic applications.

Which end-user application is driving the highest growth in the LSA market?

The Electronics segment, specifically the manufacturing of substrates for semiconductors, components for 5G infrastructure, and sapphire crystal growth for advanced optical applications, is exhibiting the highest growth rate, due to strict material purity requirements in these high-performance sectors.

How is Ultra-Low Soda Alumina (ULSA) produced?

ULSA (Na₂O < 0.05%) production involves specialized, energy-intensive purification stages, such as proprietary acid leaching and highly controlled, high-temperature calcination processes, following the initial Bayer refining to ensure residual sodium contaminants are minimized to parts per million levels.

What are the main constraints impacting the profitability of LSA manufacturers?

The primary constraints are the extraordinarily high energy consumption required for the high-temperature calcination and purification steps, leading to high operational expenditures, alongside the volatility of raw bauxite and natural gas prices.

Which geographic region dominates the global Low Soda Alumina market?

The Asia Pacific (APAC) region, spearheaded by China, Japan, and South Korea, dominates the LSA market in terms of both production capacity and consumption, driven by the concentration of global electronics and specialized refractory manufacturing industries.

The strategic outlook for the Low Soda Alumina market remains strongly positive, anchored by irreversible trends in technological advancement across global high-tech industries. The inherent material properties of LSA—superior thermal stability, excellent dielectric performance, and high mechanical strength—secure its position as an irreplaceable resource in the fabrication of critical components across multiple sectors. Manufacturers are continuously investing in advanced processing technologies, such as plasma calcination and specialized chemical washing, to push the boundaries of purity, aiming to meet the escalating demand for Ultra-Low Soda Alumina (ULSA) grades, particularly from the semiconductor and advanced optical industries. This technological arms race focuses heavily on achieving particle size uniformity and crystal structure perfection at a commercially viable scale, dictating the competitive hierarchy within the specialized chemicals sector.

Furthermore, the market's reliance on stringent quality control procedures is intensifying, particularly as LSA moves into safety-critical and high-reliability applications, such as medical ceramics and aerospace components. This necessitates greater integration of digital tools, including AI and machine learning, throughout the manufacturing process—from predictive modeling of impurity distribution in raw materials to real-time adjustment of furnace temperatures. Supply chain resiliency is also a growing focus, with companies seeking dual sourcing strategies for high-quality bauxite and hedging against geopolitical risks that could affect energy supply, given the energy-intensive nature of LSA production. This pursuit of operational resilience ensures consistent supply to critical end-users and stabilizes pricing structures against external market shocks.

Looking forward, the synergistic expansion of the Electric Vehicle (EV) battery sector, especially the push toward solid-state battery technology requiring highly stable ceramic separators, presents the most significant long-term growth opportunity. LSA and its derivatives are perfectly positioned to meet the chemical inertness and high-temperature tolerance required by these next-generation energy solutions. The market is therefore shifting from a focus on high-volume refractory materials towards high-margin, highly customized functional materials for electronics and energy storage, compelling market players to invest heavily in application-specific R&D and forge deeper, collaborative relationships with technological pioneers in the downstream segments to secure future market penetration and differentiation.

The environmental considerations surrounding LSA production, particularly concerning the vast energy expenditure associated with high-temperature processing, are simultaneously driving innovation toward more sustainable manufacturing practices. Companies are exploring cleaner energy sources for calcination and optimizing kiln designs to maximize heat recovery and minimize CO2 emissions. Regulatory pressures in Europe and North America incentivize these sustainable shifts, gradually reshaping the competitive landscape where environmental responsibility is becoming a crucial differentiating factor, complementing traditional performance metrics like purity and particle morphology. This dual imperative—maximizing purity while minimizing environmental impact—will define the capital investment strategies and technological roadmap for the Low Soda Alumina market through 2033.

The strategic implication for market stakeholders is clear: sustained profitability requires a move away from bulk LSA production towards high-specification ULSA grades, coupled with aggressive investment in process automation and data analytics to optimize complex production parameters. Manufacturers who can master the art of producing sub-0.01% soda content materials consistently and cost-effectively, while securing stable energy contracts, will capture the most lucrative segments of the future LSA market, especially those linked to 6G technology development, specialized photonics, and advanced medical diagnostics equipment. The market dynamics dictate a shift toward specialization, high-tech customization, and robust operational efficiency to maintain relevance in this highly technical specialty chemicals domain.

The refractory industry, while seeing slower relative growth compared to electronics, remains a foundational pillar of LSA demand. The material's superior refractoriness and resistance to alkali attack make it indispensable in applications like high-purity glass melting furnaces and aluminum smelting pot linings. Innovations within this segment focus less on purity levels (compared to electronics) and more on enhancing thermal cycling resistance and mechanical stability through proprietary blending and binding agents. This ensures that LSA-based refractories offer prolonged service intervals, thereby reducing operational costs for industrial end-users, guaranteeing a sustained, though mature, revenue stream for LSA producers that cater to industrial bulk demands.

In summary, the Low Soda Alumina market is poised for significant expansion, driven by megatrends in digitalization and electrification. Success in this market is directly correlated with a firm's ability to navigate the complex challenges of high-purity manufacturing, manage volatile energy costs, and align product portfolios with the hyper-specific technical demands of the fastest-growing end-user sectors, especially semiconductors and advanced battery technology, ensuring a technologically sophisticated and economically robust outlook for the entire forecast period.

The integration of advanced materials into critical infrastructure projects globally, particularly in energy transmission and specialized defense applications, further strengthens the market foundation. LSA-based composites and structural ceramics are increasingly specified in high-performance military and aerospace programs due to their lightweight properties combined with extreme temperature resistance. This demand segment, characterized by rigorous certification processes and long procurement cycles, provides stability and sustained, high-value orders, albeit at lower volumes than mass-market electronics. The need for materials that can withstand hypersonic speeds or extreme operational environments ensures that innovation in LSA manufacturing is continuously funded and prioritized.

Technological barriers to entry in the ULSA segment remain exceptionally high, primarily due to the proprietary nature of the purification chemistry and the massive capital investment required for high-precision thermal equipment. This limits the competitive field to established multinational chemical corporations and a few highly specialized niche players. This high barrier to entry helps maintain healthy profit margins for premium grades, shielding leading producers from the price pressures often associated with commodity chemicals. Strategic mergers and acquisitions are anticipated as large players seek to acquire specialized purification know-how or secure long-term contracts with emerging technology providers, further consolidating the high-purity sector of the market.

Environmental, Social, and Governance (ESG) criteria are exerting increasing pressure on the market. Stakeholders, including investors and end-users (especially in Europe), are demanding transparency regarding the energy sourcing and waste disposal practices associated with LSA production. Manufacturers are responding by investing in carbon capture technologies and transitioning to renewable energy sources for powering their calcination facilities. Compliance with global environmental regulations is becoming a prerequisite for market access in sensitive regions, transforming operational sustainability from a secondary concern into a central strategic imperative for competitive advantage in the Low Soda Alumina industry moving forward.

The development of alternative technologies, such as novel methods for producing high-purity non-oxide ceramics, poses a moderate risk to the long-term dominance of LSA, particularly in electronics. However, the proven track record, cost efficiency, and versatility of alumina, when produced to low-soda specifications, ensure its continued relevance. The industry is proactive in mitigating this risk by continuously enhancing LSA performance through surface modifications and doping, ensuring LSA ceramics remain the material of choice for demanding applications where cost-performance optimization is critical. The market intelligence indicates a strong resilience against substitution, supported by decades of application engineering and standardization.

Finally, the interplay between particle morphology and final product performance dictates intense specialization. Producers are segmenting their offerings not just by soda content, but also by average particle size, specific surface area, and crystal phase (e.g., highly reactive gamma-alumina vs. dense alpha-alumina). This level of micro-segmentation allows LSA suppliers to perfectly match material specifications to highly technical end-user requirements, such as optimizing powder flowability for thermal spraying or maximizing density for transparent ceramic armor, ensuring that the market continues to evolve towards highly customized, value-added products rather than homogenized commodities. The expertise in particle engineering is thus a paramount asset in the competitive landscape of the Low Soda Alumina market.

The ongoing global investment in infrastructure, particularly in high-voltage power grids and renewable energy generation (solar panels), further sustains the demand for LSA. High-purity alumina ceramics are vital insulators and structural components in these systems, where reliability under fluctuating environmental conditions is non-negotiable. Governments and private entities globally are prioritizing grid modernization and energy transition, creating a durable demand floor for LSA in specialized electrical components. This steady, non-cyclical demand acts as a stabilizing force against potential volatility in the consumer electronics sector, providing market participants with balanced revenue streams across both industrial and high-tech applications, underpinning the projected growth trajectory of 6.8% CAGR.

Innovation extends significantly into the realm of composite materials leveraging LSA. The use of low soda alumina as a matrix or reinforcement phase in advanced ceramic-matrix composites (CMCs) and metal-matrix composites (MMCs) is gaining traction, particularly in automotive engine components and industrial wear parts. These composites offer superior hardness, wear resistance, and thermal stability compared to monolithic ceramics or metals. Market penetration in these composite applications is fueled by the pursuit of lightweighting in transportation and improving the service life of machinery in harsh operating environments, adding another diversified revenue stream to the LSA market ecosystem.

The regulatory environment in different regions poses varied challenges. In the European Union, the REACH regulation mandates complex registration and compliance for specialty chemicals, often favoring manufacturers who demonstrate transparency and adherence to strict safety standards, indirectly increasing the barriers for non-compliant global suppliers. Conversely, rapid expansion in Asian markets, while offering high volume, requires producers to adapt swiftly to localized supply chain demands and competitive pricing pressures. Navigating this heterogeneous regulatory landscape demands specialized expertise in global trade compliance and product stewardship, differentiating leading firms based on their global operational agility and regulatory sophistication.

Finally, the long-term success of stakeholders in the Low Soda Alumina market will be defined by their capacity for strategic capital expenditure and R&D focused on yield improvement. Since the raw material cost is substantial and the processing highly energy-intensive, any incremental improvement in refining yield or reduction in energy per ton of final product directly translates to significant competitive advantage and higher margin capture, especially in the tight-margin bulk refractory segment. Thus, technological prowess in process efficiency, rather than just market size, is the ultimate determinant of profitability and market leadership in this technically demanding sector.

The continuous evolution in sapphire growth technology, essential for smartphone display covers, camera lenses, and high-power LED substrates, directly correlates with the demand for the purest grades of LSA. Sapphire crystal growth processes are extremely sensitive to impurities; even minor traces of sodium can lead to crystallographic defects, resulting in unusable material. Therefore, sapphire manufacturers act as stringent gatekeepers for ULSA quality, driving suppliers to achieve purity levels that were technically unfeasible just a decade ago. This specific high-value application segment commands substantial price premiums, making it a critical focus area for specialized LSA producers looking to maximize return on their high-tech manufacturing investments.

Furthermore, the LSA market is indirectly influenced by macroeconomic shifts in global construction and infrastructure. While LSA’s primary applications are high-tech, the refractory segment is strongly correlated with the output of the steel and cement industries. Although cyclical, these industrial demands ensure a baseline level of consumption. Any significant global stimulus package or infrastructure spending initiative results in a sustained increase in demand for high-quality, durable refractories, which increasingly utilize LSA for enhanced performance and longevity in corrosive and high-temperature environments, providing a crucial stabilizing element for overall market health.

The market also benefits from technological diffusion, as purification technologies initially developed for ULSA used in electronics trickle down to improve the quality and consistency of standard LSA grades used in general technical ceramics. This diffusion elevates the overall standard of products available across the market spectrum. Improved material consistency at lower price points expands the applicability of LSA into areas previously dominated by lower-performance materials, such as high-wear mechanical seals and basic automotive components, broadening the potential customer base and supporting stable market volume growth over the forecast period.

Ultimately, the competitive structure of the Low Soda Alumina market favors companies with deep vertical integration—from bauxite processing to final micronization and customization. Integration provides better control over impurity levels throughout the complex manufacturing chain and hedges against raw material price fluctuations. Companies that maintain dedicated R&D facilities focusing on advanced material synthesis and characterization, capable of rapid prototyping and adjusting specifications for highly demanding customers, are best positioned to capitalize on the sustained shift toward higher purity, specialized applications that characterize the current and future market dynamics.

The emergence of additive manufacturing (3D printing) for ceramics represents a nascent yet potentially transformative factor for the LSA market. LSA powders customized for specific 3D printing techniques (like stereolithography or binder jetting) require precise particle size distribution and rheological properties. While currently a small market segment, 3D printing enables the production of complex geometries for aerospace and medical devices that are impossible to fabricate using traditional methods, opening up new, high-growth niche markets for specialized LSA powder manufacturers willing to adapt their micronization processes to meet the exacting specifications of additive manufacturing technologies.

The continued strong performance projected for the Low Soda Alumina market, achieving an expected value of USD 2.4 Billion by 2033, underscores its foundational role in the global transition towards high-performance and electrically efficient materials. Market players are strategically realigning operations to focus on the high-margin ULSA segment, demonstrating confidence in the sustained demand from the semiconductor and advanced battery industries, which prioritize material integrity above cost considerations. This dynamic specialization, coupled with ongoing efforts to mitigate high energy costs through process optimization, solidifies the market's trajectory towards sustained expansion and technological maturity over the defined forecast period.

The high investment in renewable energy infrastructure, specifically photovoltaic solar cells and wind turbine components, is a powerful secondary driver. LSA-based ceramics are used in essential structural and insulating parts within these systems, demanding exceptional reliability and longevity in outdoor conditions. The global pivot towards decarbonization guarantees persistent governmental and corporate spending on these technologies, thereby securing long-term, non-cyclical demand for high-purity ceramic raw materials like Low Soda Alumina, insulating the market from temporary slowdowns in consumer electronics expenditure.

Market analysts are closely monitoring shifts in global aluminum production capacity, as LSA is a byproduct of high-purity aluminum production processes. While LSA purification is complex, the availability and cost of the initial aluminum hydrate feedstock influence overall market economics. Any significant capacity expansion or contraction in the primary aluminum industry, particularly in regions like China or Russia, has ripple effects on the supply chain and pricing stability of specialty derivatives like Low Soda Alumina, necessitating careful global monitoring by procurement and strategy teams within LSA manufacturing firms.

The competitive differentiation among key players is increasingly focused on intellectual property related to proprietary soda removal agents and advanced calcination protocols. Firms that hold patents on efficient, low-energy purification methods gain a substantial cost advantage, enabling them to offer competitive pricing while maintaining high purity standards. This emphasis on technical innovation over sheer scale suggests that specialized knowledge and patented processes are becoming more valuable assets than raw capacity, positioning R&D-intensive companies favorably for future market dominance.

The successful integration of automation and robotics in LSA handling and quality inspection processes is another developing trend. Since contamination control is paramount, minimizing human contact and standardizing sampling procedures through automated systems ensures greater batch-to-batch homogeneity and reduces the risk of trace impurities being introduced during packaging or transport. These investments in clean manufacturing environments and advanced process control systems are vital expenditures that support the premium pricing structure associated with Ultra-Low Soda Alumina grades required by sensitive end-users.

In conclusion, the Low Soda Alumina market is characterized by high technical barriers, robust demand from cutting-edge industries, and a persistent focus on cost-effective purity enhancement. The synthesis of superior material science, operational excellence, and strategic alignment with high-growth applications like 5G and solid-state batteries ensures that LSA remains a strategically important specialty chemical with compelling growth prospects through 2033.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager