Low Temperature Bearing Grease Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439124 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Low Temperature Bearing Grease Market Size

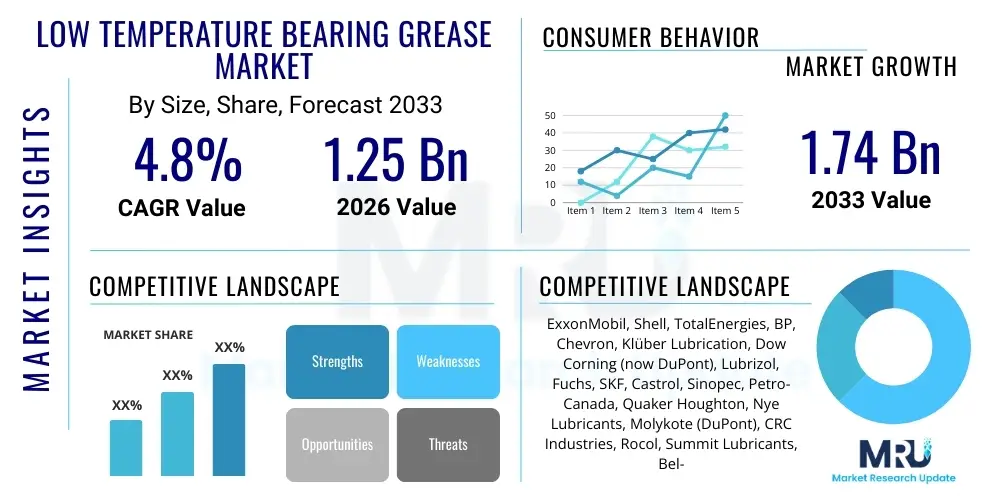

The Low Temperature Bearing Grease Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.74 Billion by the end of the forecast period in 2033.

Low Temperature Bearing Grease Market introduction

Low Temperature Bearing Grease is a specialized lubricating compound engineered to maintain optimal consistency and performance in extremely cold environments, typically below 0°C, where conventional greases fail due to thickening or crystallization. These greases are predominantly formulated using synthetic base oils, such as Polyalphaolefins (PAOs), Esters, or Silicones, combined with specific thickeners like Lithium, Polyurea, or PTFE, and performance-enhancing additives. The primary function is to minimize friction, reduce wear, and ensure smooth operation of critical mechanical components, particularly bearings, gear systems, and sliding mechanisms operating in sub-zero conditions, preventing operational failures and high energy consumption associated with stiffened lubricants.

Major applications of low temperature bearing greases span across industries that require reliability in harsh climatic conditions or specialized processes like cryogenics. Key sectors include aerospace (aircraft controls and landing gear), automotive (electric vehicle components and cold-weather starting systems), industrial machinery (refrigeration compressors, wind turbines, and outdoor power generation equipment), and food processing (freezing tunnels and cold storage facilities). These greases offer superior low-temperature torque properties, excellent shear stability, and resistance to oxidation, making them indispensable for maintaining efficiency and longevity of assets exposed to severe cold.

The market growth is primarily driven by the increasing deployment of renewable energy infrastructure, particularly wind turbines in cold climates, and the rapid expansion of the cold chain logistics sector globally. Furthermore, the stringent operational requirements in the aerospace and defense industries, coupled with the rising adoption of specialized industrial robotics in low-temperature manufacturing environments, contribute significantly to the demand for advanced, synthetic low-temperature lubricants. Benefits of utilizing these specialized greases include enhanced equipment lifespan, reduced maintenance frequency, minimized cold-starting torque, and improved energy efficiency, solidifying their critical role in specialized industrial applications.

Low Temperature Bearing Grease Market Executive Summary

The Low Temperature Bearing Grease Market is poised for stable growth, fueled by crucial advancements in synthetic lubricant technology and escalating demand from cold-climate industries. Business trends indicate a strong shift towards high-performance synthetic base oils, such as PAOs and Esters, offering superior thermal stability and lower pour points compared to traditional mineral oil-based greases. Key market players are intensely focusing on developing bio-based and environmentally friendly low-temperature greases to align with sustainability goals, creating new product differentiation opportunities. Mergers, acquisitions, and strategic collaborations, especially between lubricant manufacturers and major industrial bearing producers, are common strategies employed to consolidate market share and ensure optimized product integration and supply chain efficiency across specialized sectors like aerospace and cryogenics.

Regionally, North America and Europe currently dominate the market due to the presence of mature industrial infrastructure, stringent performance standards for outdoor and cold-weather equipment, and significant investments in Arctic exploration and wind energy projects. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily driven by rapid industrialization, expanding cold chain infrastructure in developing economies like China and India, and increasing manufacturing complexity that requires precision lubrication. Latin America and the Middle East & Africa (MEA) are also seeing rising demand, particularly in mining operations and remote oil and gas infrastructure exposed to intermittent severe cold conditions, necessitating robust lubricant solutions that ensure operational continuity.

Segmentation analysis highlights the dominance of synthetic greases, particularly those based on PAO and Ester formulations, due to their superior performance characteristics in extreme cold. The application segment sees robust demand from the Automotive sector, largely driven by the specific lubrication needs of high-speed electric vehicle (EV) components, which must maintain functionality regardless of ambient temperature. Furthermore, the burgeoning demand from the Industrial Machinery segment, covering applications such as industrial freezers and specialized Arctic-grade equipment, remains a significant revenue stream. Key segments demonstrate resilience against economic fluctuations as low-temperature greases are often non-negotiable safety and reliability components in critical industrial systems, ensuring consistent market traction throughout the forecast period.

AI Impact Analysis on Low Temperature Bearing Grease Market

Common user questions regarding AI's impact on the Low Temperature Bearing Grease Market center around predictive maintenance, automated formulation development, supply chain optimization, and quality control. Users frequently inquire how AI can enhance the precision of grease application schedules, predict bearing failure based on real-time lubrication analysis (condition monitoring), and accelerate the R&D cycle for novel synthetic formulations tailored for specific extreme cold applications. The prevailing concerns relate to data integration challenges in older industrial machinery and the necessary sensor infrastructure required to feed data into AI algorithms for effective analysis. Overall, users expect AI to transition the lubrication management process from reactive maintenance to proactive, data-driven reliability engineering, significantly reducing unplanned downtime in cold environments where maintenance access is difficult and costly.

- AI-Powered Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data (temperature, vibration, acoustic emission) from bearings to determine optimal relubrication intervals, minimizing grease waste and preventing premature failure in low-temperature settings.

- Optimized Formulation R&D: AI models can simulate molecular interactions and predict the rheological properties of new base oils and thickener combinations under cryogenic or sub-zero conditions, drastically speeding up the development of specialized synthetic greases.

- Supply Chain Forecasting: Implementing AI tools to forecast regional demand fluctuations based on seasonal climate trends and industrial project timelines, ensuring timely delivery of specialized low-temperature greases to remote or harsh locations.

- Automated Quality Control: Employing computer vision and advanced data analytics in manufacturing to monitor grease consistency, purity, and additive dispersion during production, guaranteeing compliance with stringent low-temperature performance specifications.

- Digital Twin Simulation: Creating virtual models of complex machinery operating in cold environments to test the performance and durability of various low-temperature greases before real-world deployment, reducing physical testing costs and time.

- Enhanced Condition Monitoring: AI aids in analyzing used grease samples (oil analysis) to identify microscopic wear debris or contamination patterns indicative of impending bearing stress specifically linked to cold weather operation, allowing proactive intervention.

- Inventory Management: Utilizing AI to manage complex inventory requirements for a diverse range of specialized greases (e.g., PAO, PFPE, Ester-based), optimizing stock levels based on application severity and lead times for synthetic components.

DRO & Impact Forces Of Low Temperature Bearing Grease Market

The dynamics of the Low Temperature Bearing Grease Market are characterized by strong drivers related to global infrastructural development in cold regions, while facing challenges associated with high raw material costs and stringent environmental regulations. Opportunities are emerging through technological specialization and expansion into nascent high-growth sectors like sustainable cold chain logistics and deep-sea exploration. These internal and external forces collectively shape investment decisions, R&D priorities, and competitive strategies within the specialized lubricant industry, influencing overall market trajectory.

Key drivers include the rapid expansion of wind energy projects, particularly offshore and in high-altitude or northern locations, which mandate lubricants capable of enduring extreme temperature swings and high load conditions. The increasing complexity and speed of specialized machinery, such as high-performance spindle bearings in cold-weather manufacturing and advanced components in aerospace, necessitate lubricants with exceptional thermal and shear stability at low temperatures. Furthermore, the critical need for energy efficiency and reduced maintenance costs pushes end-users toward premium synthetic greases that offer extended operational life and lower cold-starting torque, directly impacting industrial profitability and sustainability goals.

Restraints primarily revolve around the high initial cost of synthetic base oils (like PAO and PFPE) compared to mineral oils, which can limit adoption in cost-sensitive industrial sectors. The market also faces regulatory challenges concerning the disposal and environmental impact of certain non-biodegradable synthetic thickeners and additives. Another significant constraint is the technical complexity involved in formulating specialized greases; manufacturers must carefully balance low-temperature performance with factors like compatibility, load-carrying capacity, and sealant swelling across diverse application spectrums, requiring extensive R&D investment and specialized expertise. However, the consistent demand from safety-critical sectors outweighs these restraints, highlighting the necessity of these specialized products.

Opportunities are abundant in the development of biodegradable and environmentally acceptable lubricants (EALs) suitable for low-temperature operation, particularly in marine and outdoor applications where leakage is a concern. The electrification of the automotive sector, specifically the need for thermal management and high-reliability lubrication in EV transmissions and motor bearings exposed to cold, presents a lucrative niche. Moreover, strategic market penetration in emerging economies focusing on cold storage infrastructure and remote mining activities offers substantial growth prospects. The overarching impact forces dictate that innovation in synthesis and formulation must remain a priority, driving product evolution toward higher performance, sustainability, and application-specific customization to maintain competitive advantage.

Segmentation Analysis

The Low Temperature Bearing Grease Market is primarily segmented based on the type of base oil utilized, the chemical nature of the thickener, and the specific end-use application. Understanding these segments is crucial as the performance requirements vary significantly; for instance, aerospace applications require chemically inert, high-reliability greases (often PFPE/PTFE), while industrial machinery may prioritize cost-effectiveness and shear stability (often PAO/Lithium). The formulation constituents, especially the base oil, directly determine the minimum operating temperature, viscosity index, and overall service life of the lubricant, thereby segmenting the market based on technical capability and intended use environment.

The Base Oil segment is dominated by synthetic variants due to their inherent ability to perform reliably across vast temperature ranges. Polyalphaolefins (PAO) represent a cost-effective synthetic choice, widely used in automotive and general industrial applications. Esters offer superior solvency and thermal stability, often favored for high-performance and high-speed bearings. For ultra-low temperature, chemically harsh, or cryogenic environments, Perfluoropolyethers (PFPE) combined with PTFE thickeners provide unmatched inertness and stability, albeit at a higher cost. The Thickener segment is largely influenced by lithium complexes and polyurea, which provide excellent mechanical stability, while specialty thickeners like silica or clay are used in specific high-load or non-soap applications.

Application-wise, the market sees robust demand from the Industrial sector, including specialized equipment like chillers, food processing freezers, and robotics operating in severe cold conditions. The Automotive segment is growing rapidly, specifically driven by the lubrication needs of modern EV components, requiring greases that minimize parasitic drag and ensure battery efficiency in freezing climates. Aerospace and defense applications, requiring absolute reliability in high-altitude, sub-zero conditions, constitute a high-value, stringent specification segment. This highly segmented nature of the market necessitates tailored product development and targeted marketing strategies by leading manufacturers.

- By Base Oil Type:

- Polyalphaolefins (PAO)

- Esters (Synthetic Esters, Diesters)

- Silicone-Based

- Perfluoropolyethers (PFPE)

- Mineral Oil (Limited low-temp use)

- By Thickener Type:

- Lithium Complex

- Polyurea

- Calcium Sulfonate

- PTFE (Polytetrafluoroethylene)

- Bentonite/Clay

- By Application:

- Automotive (EVs, Suspension Systems, Starter Motors)

- Aerospace and Defense (Actuators, Control Systems, Landing Gear)

- Industrial Machinery (Freezing Tunnels, Compressors, Robotics)

- Wind Energy (Pitch and Yaw Bearings, Main Shaft Bearings)

- Cold Chain Logistics (Refrigeration Units, Conveyor Systems)

- HVAC and Refrigeration

Value Chain Analysis For Low Temperature Bearing Grease Market

The value chain for the Low Temperature Bearing Grease Market starts with the sourcing and manufacturing of highly specialized raw materials, primarily synthetic base oils (such as PAO, Esters, and PFPE) and performance additives (antioxidants, rust inhibitors). The upstream phase is characterized by a limited number of specialized chemical companies dominating the supply of high-purity synthetic fluids, often requiring complex chemical synthesis. Price volatility and supply chain stability in this phase are critical, as the cost of these components accounts for a significant portion of the final product cost. Manufacturers often engage in long-term contracts with key chemical suppliers to mitigate risks associated with raw material availability and quality consistency.

The midstream phase involves the core activities of formulation, blending, and manufacturing. Leading lubricant companies utilize sophisticated blending plants and stringent quality control processes to ensure the grease meets specific low-temperature performance metrics, such as low starting torque and long service life. This phase requires significant technical expertise in tribology and chemistry to achieve the delicate balance between base oil, thickener, and additive package necessary for extreme cold environments. Certifications, especially in high-stakes sectors like aerospace and food grade applications (H1 certification), add complexity and value at this manufacturing stage.

The downstream distribution channel involves specialized supply routes to various industrial end-users. Direct sales are common for large industrial original equipment manufacturers (OEMs) and major bearing companies, allowing for customized formulation consulting and direct technical support. Indirect channels utilize networks of authorized industrial distributors, specialized lubricant resellers, and technical service providers who handle smaller volumes, regional stocking, and local application support. Due to the technical nature of the product, both direct and indirect sales channels emphasize technical training and application knowledge, ensuring the correct grease is applied to prevent costly equipment failures in critical low-temperature operations, thus concluding the specialized value delivery system.

Low Temperature Bearing Grease Market Potential Customers

Potential customers for low temperature bearing greases are concentrated within sectors where operational reliability in severe cold is non-negotiable, or where mechanical systems generate high internal temperatures but are situated within a freezing ambient environment. These end-users are primarily focused on reducing energy consumption associated with high starting torque in cold conditions and extending the Mean Time Between Failures (MTBF) for critical rotating assets. The buyers are often maintenance managers, reliability engineers, and procurement specialists within specialized manufacturing, energy, and logistics companies who prioritize performance specifications over initial purchase price due to the high costs associated with cold-weather failure and downtime.

The largest volume buyers include manufacturers and operators of large-scale renewable energy facilities, specifically wind farms located in northern latitudes or offshore areas, who require greases for pitch, yaw, and main shaft bearings that operate remotely and demand long service intervals. Another major customer base is the aerospace industry, where stringent performance and safety standards dictate the use of highly specialized synthetic and chemically inert greases for critical flight control systems and actuators that face cryogenic temperatures at high altitudes. Automotive OEMs, particularly those designing components for electric vehicles intended for global cold markets, represent a rapidly growing segment, driven by the need for lubricants that maintain efficiency without sacrificing battery range in freezing weather.

Furthermore, specialized industrial facilities such as large meat processing plants, commercial cold storage warehouses, and manufacturers of cryogenic equipment (e.g., medical devices, superconducting magnets) are crucial customers. These buyers require lubricants resistant to moisture ingress, chemical degradation, and oxidation, while maintaining fluid properties at temperatures often below -40°C. The purchasing decision in these critical application segments is heavily influenced by technical data, OEM approvals, case studies demonstrating extended life, and the supplier's ability to provide reliable technical support and rapid regional supply, cementing the importance of specialized service in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.74 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Shell, TotalEnergies, BP, Chevron, Klüber Lubrication, Dow Corning (now DuPont), Lubrizol, Fuchs, SKF, Castrol, Sinopec, Petro-Canada, Quaker Houghton, Nye Lubricants, Molykote (DuPont), CRC Industries, Rocol, Summit Lubricants, Bel-Ray. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Low Temperature Bearing Grease Market Key Technology Landscape

The technology landscape for Low Temperature Bearing Grease is characterized by continuous refinement in synthetic chemistry and formulation techniques aimed at pushing the lower boundary of operating temperature while maintaining mechanical stability and load-carrying capacity. A critical technological trend involves the development of high-performance synthetic base oils, particularly advanced Polyalphaolefins (PAO) and complex Esters, which exhibit naturally low pour points and high viscosity indices, ensuring minimal viscosity change across broad temperature ranges. Furthermore, the use of Perfluoropolyethers (PFPE) is vital for ultra-low temperature and oxygen-rich environments like aerospace, where chemical inertness is paramount. Innovation in this area focuses on improving the compatibility and cost-effectiveness of these high-end synthetic bases.

Additive technology represents another crucial pillar. Manufacturers are investing heavily in customized additive packages that enhance anti-wear (AW), extreme pressure (EP), and anti-corrosion properties without compromising the low-temperature torque requirements. For instance, specialized non-sulfurized EP additives are often preferred to avoid potential incompatibility or undesirable reactions at low temperatures. A key focus area is the development of micro-fine solid lubricants, such as PTFE powder or specialized molybdenum disulfide (MoS2), which are carefully dispersed to provide a low coefficient of friction at startup in extremely cold conditions, crucial for reducing battery drain in EV applications or easing the initial load on industrial motors.

Moreover, the adoption of nanotechnology, although nascent, holds significant potential. Incorporating engineered nanoparticles, such as specific carbon nanotubes or ceramic materials, into grease formulations aims to enhance thermal conductivity and tribological performance under mixed lubrication regimes at sub-zero temperatures. Finally, advanced manufacturing technologies, including highly controlled continuous blending processes and sophisticated filtering, are essential to ensure the homogeneity and purity of the grease, preventing component separation or gelling that could lead to catastrophic bearing failure in cold environments. These technological advancements ensure the lubricants meet the rapidly evolving demands of modern, high-precision machinery operating in increasingly challenging environments.

Regional Highlights

- North America: The region is a dominant market due to extensive industrial infrastructure in northern states (e.g., Alaska, Canada) and high investment in offshore oil & gas, Arctic exploration, and severe cold-weather wind farms. Demand is driven by stringent specifications in the aerospace industry (due to key military and commercial aircraft manufacturers) and the increasing production of electric vehicles requiring optimized cold-weather component lubrication. The adoption rate of premium synthetic greases (PAO and PFPE) is exceptionally high.

- Europe: Europe represents a mature market characterized by strict environmental regulations and high adoption of synthetic EALs (Environmentally Acceptable Lubricants), particularly for marine and wind energy applications in the North Sea and Nordic regions. Germany, France, and the UK are major consumers, driven by high-tech manufacturing, robust automotive production, and substantial investments in cold chain logistics. Regulatory pressure often steers technological development toward sustainable, high-performance formulations.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid industrial expansion in China, India, and Japan, coupled with massive infrastructure development, including specialized cold storage facilities and high-speed rail networks operating in diverse climatic zones. While price sensitivity exists, the increasing influx of precision machinery from global manufacturers demands specialized low-temperature greases, transitioning the market from mineral to synthetic bases, particularly in high-volume industrial machinery and automotive components.

- Latin America: This region presents localized demand concentrated in high-altitude mining operations (Andes region) and specific manufacturing hubs in Southern Brazil and Chile, where cold temperatures necessitate reliable lubrication for heavy machinery and conveyor systems. The market tends to be project-specific, relying on imported high-quality synthetic greases for crucial operational assets where downtime cost is prohibitively high.

- Middle East and Africa (MEA): Demand in MEA is highly specialized, focused on oil and gas infrastructure in remote, high-desert areas that experience significant diurnal temperature variation, sometimes dipping below freezing overnight, and high-altitude exploration projects. Specialized demand also comes from local cold chain logistics expansion and the nascent high-tech manufacturing sector, typically relying on global suppliers to meet international performance standards for critical equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Low Temperature Bearing Grease Market.- ExxonMobil (Mobilgrease brand leader in synthetic formulations)

- Shell (Shell Gadus specialized low-temperature series)

- TotalEnergies (Accelerating R&D in synthetic EALs)

- BP (Focus on industrial and heavy-duty cold climate greases)

- Chevron (Strong presence in North American industrial applications)

- Klüber Lubrication (Specialist in high-end, custom synthetic greases)

- Dow Corning (now DuPont) (Leading producer of Silicone and PFPE greases under the Molykote brand)

- Lubrizol (Key supplier of advanced additive technologies for low-temp formulations)

- Fuchs (Broad portfolio covering automotive, industrial, and specialized applications)

- SKF (Major bearing manufacturer offering integrated lubrication solutions)

- Castrol (Leveraging strong automotive sector connections)

- Sinopec (Dominant player in the massive Chinese industrial market)

- Petro-Canada Lubricants (Expertise in arctic grade formulations)

- Quaker Houghton (Specializing in metalworking and industrial lubrication)

- Nye Lubricants (Highly specialized in synthetic and fluorinated lubricants for niche markets like aerospace and medical devices)

- Rocol (Offering advanced industrial and food-grade low-temperature products)

- Summit Lubricants (Focusing on specialized grease compounding and private labeling)

- Bel-Ray Company (Strong in high-performance, severe-duty environments)

- Chemours (Key supplier of specialty fluorochemicals and PFPE base oils)

- Vickers Oil (Focus on specialized marine and environmental lubricants)

Frequently Asked Questions

Analyze common user questions about the Low Temperature Bearing Grease market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between low temperature grease and standard industrial grease?

The core difference lies in the base oil type and viscosity index. Low temperature greases utilize synthetic base oils (like PAO or Ester) which maintain stable viscosity and fluidity well below 0°C, preventing excessive shear stress and high starting torque that causes failure in standard mineral oil-based greases in cold conditions. They are specifically formulated to prevent solidification and channeling.

Why are Polyalphaolefins (PAO) base oils preferred for low temperature bearing grease formulations?

PAOs are favored because they are synthetically engineered hydrocarbons offering exceptional thermal stability, a high viscosity index, and naturally low pour points (often below -50°C). This allows the grease to provide excellent boundary lubrication at extremely low temperatures while remaining cost-effective compared to ultra-high-performance options like PFPE.

What is the significance of low starting torque in cold-weather lubricant selection?

Low starting torque is a critical performance metric, particularly in battery-operated systems like electric vehicles or remote, unmanned machinery. A grease that thickens excessively in the cold requires significantly more force (torque) to initiate rotation, leading to increased energy consumption, potential motor overload, and delayed operational readiness. Low-temperature greases minimize this resistive force.

In which applications are PFPE/PTFE greases mandatory, despite their high cost?

PFPE (Perfluoropolyether) greases thickened with PTFE (Teflon) are mandatory in highly critical, extreme environments such as aerospace flight control systems, vacuum applications, and cryogenic equipment (liquid nitrogen/oxygen environments). Their necessity stems from their unparalleled chemical inertness, non-flammability, and ability to perform reliably across the widest temperature ranges (-70°C to over 200°C) without degradation or chemical reaction.

How do environmental regulations impact the development of low temperature bearing greases?

Environmental regulations, particularly in Europe, drive manufacturers to develop Environmentally Acceptable Lubricants (EALs) that are biodegradable and non-toxic. This pressure mandates the use of specialized synthetic esters or certain natural oils as base fluids, coupled with environmentally benign thickeners and additives, to ensure performance in cold, sensitive outdoor environments like marine or remote wind farms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager