Low Voltage Electronic Circuit Breaker Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435655 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Low Voltage Electronic Circuit Breaker Market Size

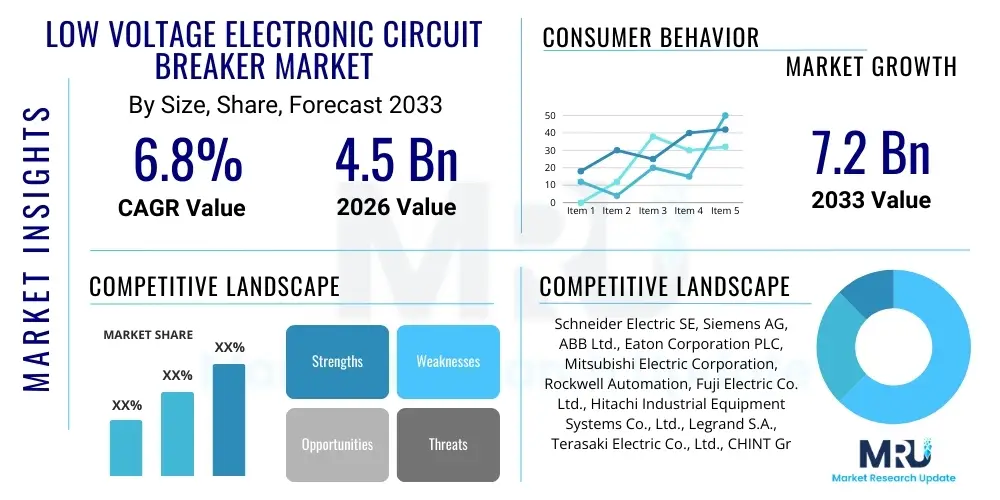

The Low Voltage Electronic Circuit Breaker Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Low Voltage Electronic Circuit Breaker Market introduction

The Low Voltage Electronic Circuit Breaker Market encompasses devices designed to protect electrical circuits from damage caused by overcurrent, primarily resulting from an overload or short circuit, operating within voltages typically below 1000V AC or 1500V DC. These modern electronic versions utilize sophisticated digital trip units, replacing traditional thermal-magnetic mechanisms in high-end applications. The primary product description focuses on their enhanced accuracy, selectivity, and communication capabilities, which are crucial for integration into modern building management systems and industrial control networks. Electronic circuit breakers offer highly precise protection curves and diagnostic feedback, significantly improving system reliability and reducing downtime compared to their mechanical predecessors.

Major applications of these advanced devices span critical infrastructure sectors including industrial manufacturing, commercial buildings, data centers, and renewable energy installations (solar and wind power systems). In industrial settings, they ensure the safety and longevity of complex machinery and automation systems. For commercial real estate, electronic breakers are vital components of smart power distribution panels, enabling remote monitoring and energy management. The core benefits include superior fault discrimination, faster reaction times, reduced maintenance requirements, and the ability to integrate seamlessly with supervisory control and data acquisition (SCADA) systems, enhancing overall electrical safety and operational efficiency.

The driving factors propelling this market growth include the accelerated pace of global urbanization and industrialization, leading to increased demand for reliable and smart power protection solutions. Furthermore, stringent governmental regulations mandating higher safety standards for electrical installations, coupled with the rapid adoption of smart grid technologies and the integration of distributed energy resources (DERs), necessitate the deployment of advanced electronic circuit protection devices. The continuous advancement in semiconductor technology also allows manufacturers to embed more intelligence and diagnostic capabilities into smaller, more efficient electronic trip units.

Low Voltage Electronic Circuit Breaker Market Executive Summary

The Low Voltage Electronic Circuit Breaker Market is experiencing robust expansion driven primarily by global digitalization and the surging demand for predictive maintenance solutions across industrial and commercial sectors. Key business trends indicate a strong shift towards intelligent circuit protection devices equipped with communication protocols (like Modbus, Profibus, and Ethernet/IP) that facilitate real-time monitoring and integration into the Industrial Internet of Things (IIoT) ecosystem. Manufacturers are focusing heavily on developing modular designs and highly configurable electronic trip units that offer enhanced flexibility for diverse application needs. Mergers and acquisitions focusing on software and connectivity expertise are becoming common as companies aim to provide complete digital power management solutions, positioning these breakers not merely as protective devices but as essential data points within the electrical infrastructure.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, largely due to massive investments in infrastructure development, rapid industrial automation adoption in countries like China and India, and the expansion of residential and commercial construction activities. North America and Europe, characterized by established grids, are primarily focused on modernization and replacement cycles, emphasizing the adoption of smart electronic circuit breakers to support grid stability, renewable energy integration, and compliance with stringent energy efficiency standards (such as IEC and UL certifications). The Middle East and Africa (MEA) are also showing promising growth, spurred by large-scale smart city projects and essential oil & gas sector investments requiring resilient electrical infrastructure.

Segment trends underscore the dominance of Molded Case Circuit Breakers (MCCBs) utilizing electronic trip units, particularly in commercial and light industrial applications, due to their balance of cost, performance, and flexibility. However, the Miniature Circuit Breaker (MCB) segment is witnessing significant innovation with the introduction of electronic versions for residential and small commercial settings, offering features like arc fault detection (AFDD) and ground fault protection (GFPD). The technology segment is heavily biased towards 'Smart' breakers, where integrated sensors and communication chips enable advanced analytics, load shedding capabilities, and remote diagnostic functions, ultimately driving higher average selling prices (ASPs) and creating value beyond basic protection.

AI Impact Analysis on Low Voltage Electronic Circuit Breaker Market

User queries regarding the integration of Artificial Intelligence (AI) into the Low Voltage Electronic Circuit Breaker Market commonly revolve around achieving truly predictive maintenance, enhancing system self-diagnosis, and optimizing grid load management in real-time. Users are seeking clarity on how AI algorithms can leverage the massive data streams generated by smart electronic trip units—data covering load profiles, fault history, ambient conditions, and operational parameters—to foresee potential equipment failures before they manifest. Key concerns frequently raised involve the cybersecurity implications of connecting safety-critical devices to AI-driven networks, the standardization required for effective data exchange between different vendor systems, and the actual return on investment (ROI) derived from implementing AI-enhanced monitoring solutions over traditional maintenance schedules. Expectations are high regarding AI's ability to minimize unplanned downtime and significantly extend the operational lifespan of electrical assets.

AI's primary influence is transforming low-voltage protection from a reactive function into a proactive, intelligent management system. By applying machine learning models to analyze subtle changes in circuit behavior—such as minor current fluctuations or temperature anomalies that predate a major fault—AI enables the transition from time-based or condition-based maintenance to true predictive maintenance. This capability allows facility managers to schedule interventions precisely when needed, optimizing resource allocation and dramatically improving system reliability. Moreover, AI aids in complex fault discrimination in intricate electrical networks, ensuring that only the specific affected segment is isolated, thereby maintaining continuity of power supply to unaffected loads.

Furthermore, AI algorithms are critical for supporting advanced features in smart grids, particularly related to distributed energy resources (DERs) like solar and battery storage. In these dynamic environments, electronic circuit breakers need to adapt rapidly to bidirectional power flows and momentary voltage dips. AI optimizes the breaker settings (trip curves, delay times) dynamically based on real-time grid conditions, load forecasting, and established operational priorities, something conventional electronic settings cannot achieve. This high level of adaptive intelligence makes AI integration an inevitable evolutionary step for high-performance low voltage protection devices serving critical infrastructure and smart building applications.

- AI enhances predictive maintenance by analyzing circuit signatures and operational anomalies to forecast impending failures.

- Optimized load shedding and power distribution management through machine learning models that dynamically adjust breaker settings.

- Improved fault discrimination and selectivity in complex, meshed low-voltage networks, minimizing nuisance tripping.

- Automated self-diagnosis and anomaly detection, reducing the reliance on manual inspection and simplifying compliance checks.

- Facilitation of seamless integration of intermittent Distributed Energy Resources (DERs) by dynamically adapting protection parameters.

DRO & Impact Forces Of Low Voltage Electronic Circuit Breaker Market

The Low Voltage Electronic Circuit Breaker Market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping its trajectory. The dominant drivers stem from global regulatory pressures for enhanced electrical safety, particularly the adoption of advanced protection standards (e.g., specific requirements for arc flash reduction and selective coordination). Simultaneously, the ongoing global trend of industrial automation, marked by the deployment of IIoT devices and advanced manufacturing systems (Industry 4.0), necessitates highly reliable and communicable circuit protection, directly boosting demand for electronic models capable of integration and remote telemetry. These drivers collectively push original equipment manufacturers (OEMs) and end-users toward investing in more advanced, albeit higher-cost, electronic solutions to safeguard expensive capital equipment and ensure continuous operations.

Restraints primarily revolve around the initial investment cost associated with advanced electronic circuit breakers, which are substantially higher than traditional thermal-magnetic alternatives. This cost factor poses a barrier to entry, especially in developing regions or for small and medium-sized enterprises (SMEs) with tighter capital expenditure budgets. Furthermore, the complexity inherent in configuring, commissioning, and maintaining these sophisticated electronic trip units requires specialized technical expertise, which can be scarce, leading to slower adoption rates in some markets. Standardization challenges, particularly concerning the interoperability of communication protocols across different vendor platforms, also act as a drag on widespread market acceptance, requiring complex integration efforts.

The key opportunities lie in the exponential growth of Electric Vehicle (EV) charging infrastructure and large-scale data center construction globally, both of which require robust, high-performance low voltage DC and AC protection solutions. The transition towards smart cities and sustainable energy systems, which involve deploying microgrids and integrating significant amounts of renewable energy, presents a substantial market for electronic breakers capable of managing complex bi-directional power flows and providing granular energy consumption data. The impact forces indicate a clear market trajectory favoring intelligence, connectivity, and customization, forcing market players to continually innovate on digital features and data services rather than focusing solely on physical protection capabilities.

Segmentation Analysis

The Low Voltage Electronic Circuit Breaker Market is highly fragmented and segmented across various parameters, including the type of breaker, the current rating, the final application sector, and the level of technology integration. Segmentation provides a granular view of market dynamics, highlighting areas of high growth such as smart circuit breakers and segments servicing critical infrastructure like data centers. Understanding these segments is crucial as different end-user industries prioritize distinct features, such as high interrupting capacity in industrial settings versus communication and monitoring capabilities in commercial buildings. The fundamental segmentation by Type (MCCB, ACB, MCB) remains critical, but the differentiation based on 'Technology' (Conventional vs. Smart/Electronic) is increasingly driving market value.

The segment analysis reveals that the industrial sector is the largest revenue contributor due to its reliance on heavy machinery and continuous processes, demanding superior protection and selectivity. However, the commercial segment, propelled by investments in energy-efficient smart buildings, is anticipated to record the highest growth rate, fueled by the mandate for detailed energy monitoring and robust fire safety features (like AFCI/GFCI integration). Geographically, APAC dominates, but specialized niche segments, such as electronic DC breakers for high-power battery systems, are witnessing rapid growth globally, reflecting the broader transition toward electrification and battery storage solutions.

Segmentation is vital for strategic market positioning. For instance, companies focusing on the high-end industrial segment emphasize features such as customized trip curves, high short-circuit breaking capacity, and integration with high-level automation systems. Conversely, players targeting the residential and small commercial sectors prioritize ease of installation, compact design, and compliance with residential safety standards (like AFCI and GFCI requirements), often incorporating basic communication features for remote diagnostics. This divergence in requirements ensures sustained diversification in product offerings across the market landscape.

- By Type:

- Molded Case Circuit Breakers (MCCBs)

- Air Circuit Breakers (ACBs)

- Miniature Circuit Breakers (MCBs)

- Residual Current Devices (RCDs) / Ground Fault Circuit Interrupters (GFCIs)

- Specialty Breakers (e.g., DC Breakers for PV and EV)

- By Application/End-Use:

- Industrial (Manufacturing, Oil & Gas, Mining)

- Commercial (Offices, Hospitals, Data Centers, Retail)

- Residential (Housing, Multi-family Units)

- Infrastructure & Utility (Grid Stations, Public Transport, Water Treatment)

- By Rated Current:

- Low Ampere (Up to 100A)

- Medium Ampere (101A to 400A)

- High Ampere (Above 400A)

- By Technology:

- Conventional (Thermal-Magnetic units with basic electronic trip)

- Smart/Advanced Electronic (Integrated communication, diagnostic, and metering features)

Value Chain Analysis For Low Voltage Electronic Circuit Breaker Market

The value chain for the Low Voltage Electronic Circuit Breaker Market is characterized by several distinct stages, starting from upstream raw material procurement and complex electronic component manufacturing, through to downstream distribution and final installation services. Upstream analysis focuses on the sourcing of key materials, including specialized plastics (for casings), copper (for contacts and busbars), and complex semiconductor components (for the electronic trip units and communication modules). The manufacturing of the core electronic components, such particularly the specialized microcontrollers and sensors required for accurate current measurement and fault analysis, represents a high-value creation step. Strategic supplier relationships and vertical integration capabilities in microelectronics are crucial for manufacturers to maintain control over quality and cost, especially given the strict safety standards.

The midstream segment involves the design, assembly, testing, and final packaging of the circuit breakers. Given the high-reliability requirements, rigorous testing (including short-circuit, endurance, and environmental tests) is a major cost driver and value differentiator. The sophistication of electronic breakers demands advanced calibration processes to ensure precise trip characteristics. Furthermore, the integration of software and firmware for communication and diagnostics is performed at this stage. Value is added through product certification (UL, IEC, CCC) and the development of proprietary communication platforms that offer seamless integration with other power management devices.

Downstream analysis focuses on the distribution channels, which include direct sales to large industrial OEMs, indirect sales through electrical distributors, wholesalers, and specialized system integrators. Direct channels are commonly used for high-volume, customized projects (like data center construction or power utility upgrades), where technical consultation is required. Indirect channels, relying on established electrical supply houses, manage the majority of sales for standard MCBs and MCCBs. System integrators play a critical role by embedding these breakers into larger power distribution boards and control panels. Post-sale services, including maintenance, calibration, and software updates for smart breakers, represent a growing segment of value capture.

Low Voltage Electronic Circuit Breaker Market Potential Customers

The potential customer base for Low Voltage Electronic Circuit Breakers is expansive, encompassing any entity requiring reliable electrical protection and advanced power management capabilities below 1000V. Primary end-users fall into three major categories: industrial, commercial, and infrastructure. In the industrial sector, the primary buyers are Original Equipment Manufacturers (OEMs) of control panels and switchgear, as well as end-user facility maintenance and engineering departments in automotive, petrochemical, pharmaceutical, and heavy manufacturing. These customers prioritize high selectivity, short circuit interruption capacity, and seamless integration with industrial control systems (PLCs and SCADA).

The commercial sector includes owners and developers of large commercial buildings, data centers, hospitals, and educational institutions. Data centers, in particular, represent a high-growth segment, demanding specialized DC and high-amperage electronic breakers for critical redundancy and high-density power distribution. Commercial customers focus heavily on energy metering capabilities, remote monitoring, and compliance with stringent energy efficiency and fire safety codes, making smart electronic breakers highly desirable for sophisticated building management systems (BMS). Purchasing decisions are often influenced by system integrators and electrical engineering consultants who specify products based on efficiency and compliance.

Finally, the infrastructure and utility sector includes public utilities responsible for power generation and distribution, as well as operators of critical transport systems (railways, metros) and large public works projects. These buyers prioritize long-term reliability, extreme operational resilience, and the capacity of the breakers to manage and withstand harsh environmental conditions. With the global push towards microgrids and distributed generation, utility buyers are increasingly purchasing advanced electronic breakers designed for protection within bidirectional power flow environments, necessitating digital connectivity for centralized grid management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric SE, Siemens AG, ABB Ltd., Eaton Corporation PLC, Mitsubishi Electric Corporation, Rockwell Automation, Fuji Electric Co. Ltd., Hitachi Industrial Equipment Systems Co., Ltd., Legrand S.A., Terasaki Electric Co., Ltd., CHINT Group, Huayi Electric Co., Ltd., Noark Electric, E-T-A Elektrotechnische Apparate GmbH, Nader Electric, Socomec, Hager Group, GE Industrial Solutions (now part of ABB), Sensata Technologies, TE Connectivity. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Low Voltage Electronic Circuit Breaker Market Key Technology Landscape

The technological landscape of the Low Voltage Electronic Circuit Breaker Market is rapidly advancing, moving beyond simple overcurrent protection towards comprehensive digital power management. The most significant shift is the replacement of basic thermal-magnetic release mechanisms with sophisticated microprocessor-based electronic trip units. These units utilize precise digital signal processing (DSP) to analyze current waveform characteristics, allowing for highly selective coordination, advanced diagnostics, and superior protection against complex faults, such as high-impedance faults and low-level arcing faults. The use of semiconductor technology allows for greater customization of trip curves and faster reaction times than mechanical releases, leading to substantial improvements in system reliability and asset protection.

A crucial technological trend is the pervasive integration of communication capabilities, making these breakers key components of the IIoT. Modern electronic circuit breakers are equipped with standardized communication protocols (e.g., Modbus TCP/IP, Profinet, EtherNet/IP) enabling real-time monitoring of energy consumption, load profiling, and remote setting adjustment. This connectivity is essential for implementing smart grid features, microgrid controls, and sophisticated energy management software within large industrial and commercial complexes. Furthermore, the integration of advanced metering capabilities (power quality analysis, harmonic distortion measurement) directly into the breaker unit adds significant value, reducing the need for separate metering devices.

The ongoing development of specialized electronic circuit breakers for DC applications is another major technological frontier, driven by the proliferation of photovoltaic (PV) systems, battery energy storage systems (BESS), and EV charging networks. DC electronic breakers face unique challenges, primarily the difficulty of extinguishing a DC arc. Innovations in magnetic blow-out technology and rapid solid-state switching are central to addressing these challenges, providing robust protection solutions for high-voltage DC systems. Further research and development are concentrated on enhancing arc fault detection capabilities (AFDD) to meet increasingly rigorous safety standards in residential and commercial environments, utilizing proprietary algorithms to reliably distinguish dangerous arcs from normal operational noise.

Regional Highlights

The regional market for Low Voltage Electronic Circuit Breakers shows distinct growth patterns and technology adoption rates influenced by local regulatory environments, infrastructure investment levels, and industrial maturity.

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, driven by massive investments in residential, commercial, and utility infrastructure, particularly in emerging economies like China, India, and Southeast Asian countries. The rapid expansion of the manufacturing sector (Industry 4.0 adoption) and substantial governmental pushes for smart city development necessitate reliable, high-performance circuit protection. Adoption of electronic circuit breakers is accelerating due to the need for advanced power monitoring in new industrial parks and the swift integration of renewable energy projects.

- North America: North America is characterized by high replacement demand and significant expenditure on modernizing aging electrical infrastructure. Regulatory compliance, particularly with UL standards and NFPA requirements (including arc flash safety), mandates the use of highly selective and electronically monitored breakers. The market is heavily influenced by investment in large data center complexes, which require premium electronic and digital protection for continuous operation and energy efficiency optimization.

- Europe: Europe exhibits mature market characteristics with stringent regulations focused on energy efficiency and safety (IEC standards). The push for decarbonization and the extensive integration of decentralized energy sources (microgrids, solar installations) drive the demand for smart, communicable electronic breakers capable of handling complex power flows. Germany, France, and the UK are key markets, emphasizing high-quality, long-life products integrated into advanced building automation systems (BAS).

- Latin America (LATAM): Growth in LATAM is steady, fueled by urbanization and necessary investment in modernizing existing industrial plants, particularly in Brazil and Mexico. The market is moderately price-sensitive, leading to a balanced adoption of standard and advanced electronic MCCBs. Infrastructure projects and increased foreign direct investment in manufacturing are key growth catalysts.

- Middle East and Africa (MEA): The MEA region, specifically the GCC nations, shows significant potential driven by large-scale public and private construction projects (e.g., smart cities like NEOM) and expansion in the oil & gas sector. These critical applications require high reliability and robust electronic breakers capable of operating in harsh climatic conditions. South Africa is a key regional hub for industrial adoption in the African continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Low Voltage Electronic Circuit Breaker Market.- Schneider Electric SE

- Siemens AG

- ABB Ltd.

- Eaton Corporation PLC

- Mitsubishi Electric Corporation

- Rockwell Automation

- Fuji Electric Co. Ltd.

- Hitachi Industrial Equipment Systems Co., Ltd.

- Legrand S.A.

- Terasaki Electric Co., Ltd.

- CHINT Group

- Huayi Electric Co., Ltd.

- Noark Electric

- E-T-A Elektrotechnische Apparate GmbH

- Nader Electric

- Socomec

- Hager Group

- GE Industrial Solutions (now part of ABB)

- Sensata Technologies

- TE Connectivity

Frequently Asked Questions

Analyze common user questions about the Low Voltage Electronic Circuit Breaker market and generate a concise list of summarized FAQs reflecting key topics and concerns.What differentiates an electronic circuit breaker from a traditional thermal-magnetic breaker?

Electronic circuit breakers use microprocessor-based trip units and current sensors (like Rogowski coils) for highly accurate fault detection and customizable trip curves, offering superior selectivity and diagnostics. Traditional thermal-magnetic breakers rely on slower bimetallic strips (thermal) and electromagnetic coils (magnetic) for fixed or less adjustable protection characteristics.

How does the integration of IoT impact the performance of low voltage electronic breakers?

IoT integration transforms breakers into smart devices capable of real-time communication, providing data on load profiles, energy consumption, and operational status. This enables predictive maintenance, remote management of trip settings, and seamless integration with Building Management Systems (BMS) and SCADA platforms for optimized power distribution.

Which end-use sector is currently driving the highest demand for advanced electronic circuit breakers?

The Industrial sector remains the largest revenue generator due to the protection needs of expensive machinery and complex automation systems. However, the Commercial sector, specifically Data Centers and Smart Buildings, is exhibiting the highest growth rate due to the requirement for critical redundancy, advanced metering, and enhanced fire safety compliance (AFDD/GFCI).

What are the primary challenges restricting the widespread adoption of electronic circuit breakers?

The key challenge is the significantly higher initial capital expenditure compared to conventional alternatives. Additionally, the complexity of configuration, commissioning, and maintaining these intelligent devices requires specialized technical training, posing a barrier for smaller enterprises or regions with limited specialized labor.

What role does Artificial Intelligence play in future Low Voltage Circuit Breaker design?

AI is crucial for enabling true predictive maintenance by analyzing circuit data to forecast equipment degradation. It also allows dynamic adjustment of protection settings based on real-time grid conditions and load patterns, optimizing fault discrimination and supporting the stability of complex microgrids and DER integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager