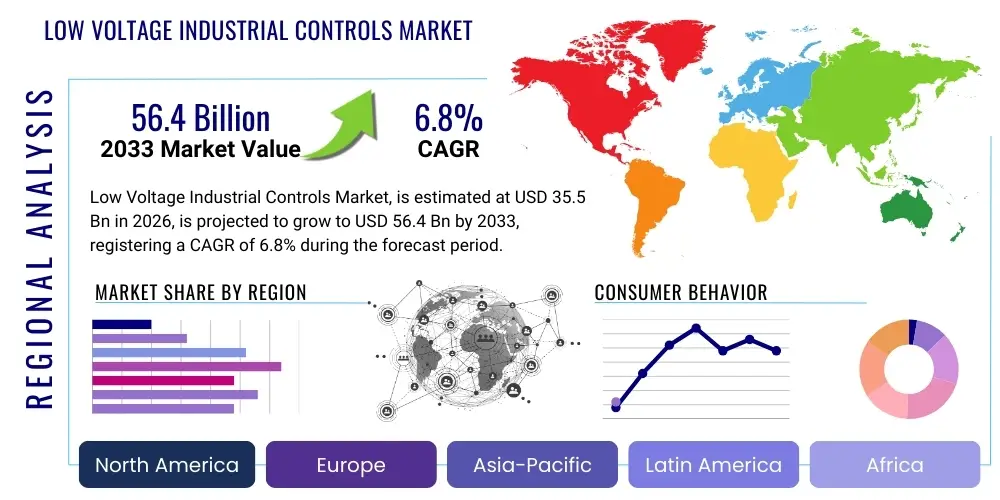

Low Voltage Industrial Controls Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435855 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Low Voltage Industrial Controls Market Size

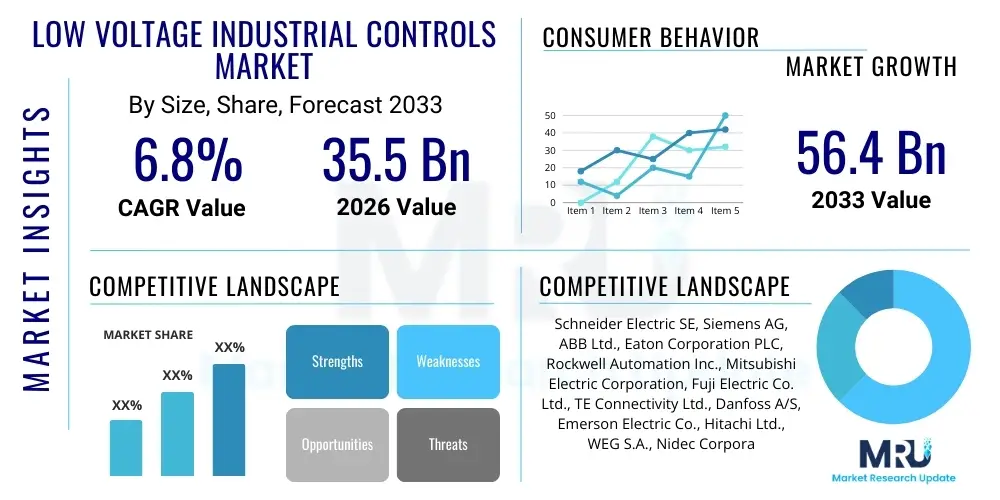

The Low Voltage Industrial Controls Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 56.4 Billion by the end of the forecast period in 2033.

Low Voltage Industrial Controls Market introduction

The Low Voltage Industrial Controls (LVIC) market encompasses critical electrical components designed to manage, protect, and regulate power flow and machine operation within industrial environments. These controls are foundational elements of nearly all automation systems, ensuring safe and efficient operation of motors, heating elements, and general machinery. Key products include circuit breakers, motor starters, contactors, control relays, push buttons, and signaling devices, all operating below 1000V AC or 1500V DC. The fundamental utility of LVIC lies in providing reliable overload protection, short-circuit protection, and seamless integration with higher-level Supervisory Control and Data Acquisition (SCADA) and Distributed Control Systems (DCS). Demand for these components is intrinsically linked to global industrial output, infrastructure development, and the ongoing modernization of existing manufacturing facilities, particularly in rapidly industrializing economies.

A major evolution defining the contemporary LVIC landscape is the integration of digital capabilities and networking features, moving traditional electromechanical devices toward smart, connected components. This shift is driven by the requirements of Industry 4.0, which mandates real-time data collection, predictive maintenance, and remote monitoring capabilities. Smart LVIC components are now equipped with communication protocols such as Modbus, EtherNet/IP, and PROFINET, allowing seamless vertical integration from the sensor/actuator level up to the enterprise resource planning (ERP) systems. This enhanced connectivity significantly improves operational transparency, minimizes unscheduled downtime, and allows industrial operators to optimize energy consumption and overall equipment effectiveness (OEE).

The primary applications of low voltage industrial controls span across heavy industries such as oil and gas, metals and mining, power generation, and utilities, as well as discrete manufacturing sectors like automotive, food and beverage, and packaging. Benefits derived from deploying advanced LVIC include enhanced personnel and equipment safety, improved process stability, and increased operational flexibility. Driving factors include stringent safety regulations requiring modern protection mechanisms, massive investments in renewable energy infrastructure (which requires specialized control and switching gear), and the imperative for energy efficiency mandated by global climate goals. The ongoing replacement cycle of aging infrastructure in mature economies further solidifies the steady demand for reliable and modern low voltage control solutions.

Low Voltage Industrial Controls Market Executive Summary

The global Low Voltage Industrial Controls (LVIC) market is experiencing robust growth fueled primarily by accelerating industrial automation and significant capital expenditures in smart factory initiatives worldwide. Business trends indicate a strong move toward modular and flexible control solutions that facilitate rapid reconfiguration and integration into existing systems without extensive downtime. Key manufacturers are focusing heavily on developing intelligent Motor Control Centers (MCCs) and integrated control panels that offer pre-configured diagnostics and remote asset management capabilities, effectively blurring the lines between traditional hardware and sophisticated software services. Furthermore, market competition is intensifying, leading to innovation in miniaturization, component durability, and cybersecurity features embedded directly within control devices, addressing the critical vulnerability points introduced by increased networking.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, India, and Southeast Asian nations, continues to dominate market volume and exhibits the highest growth rate, driven by expansive manufacturing bases and extensive investments in critical infrastructure projects, including smart grids and electrified public transport systems. North America and Europe, while growing at a more moderate pace, focus on technological sophistication, emphasizing the adoption of premium, high-reliability components compliant with rigorous standards like UL and IEC. Regulatory compliance, particularly related to energy efficiency standards (e.g., IE4 motor efficiency), mandates the integration of advanced variable frequency drives (VFDs) and specialized contactors, driving high-value growth in these mature markets.

Segmentation trends reveal that Motor Control Centers (MCCs) and circuit breakers remain the largest revenue-generating component segments due to their indispensable role in protecting industrial power circuits and managing heavy motor loads. Control switches and relays are anticipated to witness accelerated demand growth, particularly those featuring electronic and solid-state designs, offering faster switching times and significantly longer operational lifespans compared to traditional electromechanical counterparts. End-user analysis highlights the machinery and equipment sector, alongside the automotive industry, as major consumers, capitalizing on LVIC solutions to enable highly automated assembly lines and specialized tooling processes. The increasing focus on predictive maintenance and condition monitoring is transforming the aftermarket services segment, creating lucrative opportunities for providers specializing in data analytics and remote diagnostics platforms layered upon the control hardware.

AI Impact Analysis on Low Voltage Industrial Controls Market

Common user inquiries regarding the intersection of Artificial Intelligence (AI) and the Low Voltage Industrial Controls (LVIC) market frequently revolve around how AI can enhance predictive maintenance, optimize energy consumption, and manage complex system faults autonomously. Users are primarily concerned with the feasibility of integrating AI algorithms into edge devices or cloud platforms to interpret data streams generated by smart LVIC components (such as connected circuit breakers and VFDs). The core expectations center on moving beyond simple threshold-based alerts to genuine anomaly detection, predicting component failure before it impacts operations, and automating control logic adjustments based on real-time environmental or operational variability. There is significant interest in AI's role in improving system reliability and reducing the total cost of ownership (TCO) by minimizing unexpected downtime and streamlining maintenance schedules. Users also question the necessary data infrastructure and cybersecurity measures required to support AI-driven industrial control systems.

The influence of AI is profoundly reshaping the operational utility of LVIC by moving them from passive protection devices to active, intelligent assets contributing actionable insights to the overall factory ecosystem. AI algorithms, leveraging data collected from smart contactors and overload relays regarding current draw, temperature profiles, and switching cycles, can establish precise operational baselines. Deviations from these baselines, often too subtle for human observation or traditional monitoring systems, trigger detailed alerts for impending issues like contact erosion or coil degradation. This shift enables manufacturers to adopt true condition-based monitoring, optimizing asset utilization and extending the lifespan of expensive motor and control systems. The ability of AI to process multivariate sensor data enhances fault isolation capabilities, drastically reducing troubleshooting time, which is crucial in complex, high-throughput manufacturing environments.

- AI-driven Predictive Maintenance: Reduces unscheduled downtime by forecasting component failure based on operational data analysis.

- Energy Optimization: AI algorithms fine-tune VFD and motor control schedules to minimize power usage during peak demand periods.

- Automated Fault Diagnosis: Utilizes machine learning to rapidly identify root causes of tripping events and recommend remediation steps.

- Edge Computing Integration: Deployment of lightweight AI models directly onto smart LVIC devices for immediate, localized decision-making.

- Process Optimization: Enables dynamic adjustment of control parameters (e.g., motor speed, current limits) based on changing load requirements or material properties.

- Cybersecurity Enhancement: AI monitors network traffic and behavioral patterns of connected controls to detect and flag unauthorized access attempts or operational deviations indicative of a cyber threat.

DRO & Impact Forces Of Low Voltage Industrial Controls Market

The market for Low Voltage Industrial Controls (LVIC) is governed by a robust confluence of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that shape its trajectory. Key drivers include the global push for industrial automation, driven by wage inflation and the need for higher precision and quality in manufacturing processes. The proliferation of the Industrial Internet of Things (IIoT) mandates the replacement of legacy analog controls with digitally enabled components capable of generating and transmitting large volumes of data. However, the market faces significant restraints, primarily high initial investment costs associated with upgrading to smart, connected control systems and the substantial challenge of integrating diverse communication protocols from various vendors into a unified system. Opportunities arise from emerging markets, the growth of renewable energy projects requiring specialized switchgear, and the increasing focus on customized, high-reliability solutions for mission-critical applications.

Drivers: The most significant driver is the widespread adoption of Industry 4.0 principles, necessitating end-to-end connectivity and intelligent asset management across all operational levels. This transition demands smart motor starters, intelligent protection relays, and networked circuit breakers that offer diagnostic capabilities and remote operability. Furthermore, increasingly stringent international safety standards (e.g., IEC 61439, UL 508) enforce the use of certified and modern control gear, stimulating the replacement market. The rapid development of infrastructure in developing nations—specifically investments in utilities, transportation, and construction—creates a foundational demand for standardized, reliable low voltage distribution and control equipment. Energy efficiency mandates, such as those promoting high-efficiency motors, inherently drive demand for compatible, advanced motor control devices like Variable Frequency Drives (VFDs) and soft starters, which optimize motor performance and reduce energy wastage.

Restraints: Despite the benefits of digitalization, the steep learning curve and capital expenditure required for integrating complex, modern LVIC systems act as a significant restraint, particularly for small and medium-sized enterprises (SMEs). System interoperability remains a persistent challenge; the lack of universal standards for industrial communication protocols necessitates specialized integration expertise and costly gateways. Additionally, the long operational lifespan of traditional LVIC components means that manufacturers often defer upgrades until major equipment failure, slowing the pace of modernization. The growing threat of cyberattacks targeting industrial control systems introduces reluctance among some operators to fully network their critical controls, leading to slower adoption rates for fully cloud-integrated solutions.

Opportunity: Major opportunities lie in the rapidly expanding green economy, including electric vehicle (EV) manufacturing facilities and battery production gigafactories, which require specialized, high-current LVIC solutions. The development of modular and plug-and-play control solutions simplifies integration and reduces installation time, appealing to retrofit projects. Furthermore, the expansion of renewable energy sources, such as solar farms and wind power plants, necessitates highly reliable and robust low voltage switchgear capable of handling intermittent power flows and harsh environmental conditions. The service segment—including remote monitoring, data analytics, and subscription-based maintenance services built around the installed smart LVIC base—represents a substantial, high-margin opportunity for market players.

Segmentation Analysis

The Low Voltage Industrial Controls market is comprehensively segmented based on product type, application, end-use industry, and geography, reflecting the highly diverse nature of industrial electrical infrastructure. Product segmentation is crucial as it differentiates between core protection devices, switching mechanisms, and specialized motor control equipment. Application segmentation helps in understanding where the most complex and mission-critical controls are deployed, often distinguishing between power distribution and machine control tasks. End-use analysis provides insight into sectoral demand fluctuations, with heavy industries requiring rugged, high-reliability controls, while discrete manufacturing seeks speed, connectivity, and compactness.

Analyzing these segments allows vendors to tailor their offerings—for example, developing corrosion-resistant controls for the oil and gas sector or highly networked, fast-acting components for high-speed robotic assembly lines in the automotive industry. The dominance of certain segments, such as motor control and circuit protection, underscores the foundational necessity of these components in maintaining operational continuity and safety. Future growth will be significantly driven by the electronics and automation component segments, benefiting from the global digitalization trend and the transition to smart controls capable of advanced diagnostics and remote management, providing a clear path for strategic investment and product diversification.

- By Product Type:

- Circuit Breakers (Moulded Case Circuit Breakers - MCCB, Miniature Circuit Breakers - MCB)

- Motor Control Centers (MCC)

- Contactors and Relays (Control Relays, Overload Relays)

- Control Switches (Pushbuttons, Selector Switches, Pilot Devices)

- Other Components (Timers, Limit Switches, Sensors)

- By Application:

- Power Distribution

- Machine Control and Automation

- Process Control

- By End-Use Industry:

- Oil and Gas

- Power Generation and Utilities

- Chemical and Petrochemical

- Metals and Mining

- Automotive

- Food and Beverage

- Machinery and Equipment

- Infrastructure and Construction

- By Technology:

- Conventional (Electromechanical)

- Smart/Connected (Digital, IoT-enabled)

Value Chain Analysis For Low Voltage Industrial Controls Market

The value chain for the Low Voltage Industrial Controls market begins with the raw material suppliers, predominantly providing copper, plastics, electrical steel, and specialized electronic components necessary for manufacturing robust electrical gear. Upstream activities involve highly specialized manufacturing and assembly processes, requiring precision engineering to ensure component reliability and adherence to strict safety standards (e.g., thermal and short-circuit tolerance). Core manufacturers invest heavily in R&D to integrate connectivity features (IIoT compatibility) and develop advanced protective algorithms for relays and circuit breakers, differentiating themselves through quality and performance certification.

The distribution phase is multifaceted, leveraging both direct and indirect channels. Direct distribution often targets large OEMs and major infrastructure projects where complex customization, technical consultation, and long-term service agreements are required. Indirect channels, primarily electrical wholesale distributors, stock and supply standard components to SMEs, maintenance contractors, and system integrators. System integrators play a crucial role as intermediaries, taking standardized LVIC components and assembling them into custom control panels and integrated automation solutions tailored to specific end-user requirements, thereby adding significant functional value.

Downstream analysis focuses on installation, commissioning, and subsequent maintenance activities. Post-sale services, including software updates, remote diagnostics, and lifecycle management of smart controls, are increasingly contributing to revenue streams. The demand for digitalized controls has expanded the downstream value chain to include IT service providers and data analytics specialists who manage the operational technology (OT) data generated by LVIC components. Effective supply chain management, particularly regarding the sourcing of semiconductors for smart devices and specialized materials, is vital for maintaining competitive pricing and ensuring timely delivery amidst global logistical challenges.

Low Voltage Industrial Controls Market Potential Customers

Potential customers for Low Voltage Industrial Controls are broadly defined as any industrial, commercial, or infrastructural entity requiring reliable management and protection of electrical power circuits and motorized assets. The primary end-users include machinery manufacturers (OEMs) who integrate these controls into their equipment before sale, and system integrators who design and build customized control panels for factories and facilities. Furthermore, asset owners and operators across heavy industries constitute a massive ongoing market for maintenance, upgrades, and replacement cycles, driven by equipment obsolescence or operational expansion requirements.

Within the utility sector, power generation companies (both conventional and renewable) and transmission and distribution operators are critical customers, utilizing high-reliability circuit breakers and switchgear for managing power flow and protecting critical grid assets. In the manufacturing sector, key buyers include automotive production facilities, chemical processing plants, and food and beverage producers, all requiring high volumes of reliable motor controls and protective devices to maintain complex, continuous production lines. The decision-makers often include plant engineers, electrical maintenance managers, procurement specialists, and automation project managers, all prioritizing product reliability, certification compliance, and integration capability with existing automation platforms.

The rapidly growing infrastructure sector, encompassing large commercial building complexes, data centers, and public works projects (like rail and water treatment facilities), represents an expanding customer base. These entities require robust, standardized LVIC equipment for safety and energy management within building automation systems and critical utility processes. The trend toward decentralized and smart infrastructure further means that smaller, specialized customers, such as local municipalities managing smart city projects or localized microgrids, are becoming increasingly important buyers, demanding components that are easily scalable and offer advanced communication features for remote management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 56.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric SE, Siemens AG, ABB Ltd., Eaton Corporation PLC, Rockwell Automation Inc., Mitsubishi Electric Corporation, Fuji Electric Co. Ltd., TE Connectivity Ltd., Danfoss A/S, Emerson Electric Co., Hitachi Ltd., WEG S.A., Nidec Corporation, Legrand S.A., Hyosung Heavy Industries, LS Electric Co. Ltd., Chint Group, Hubbell Incorporated, Phoenix Contact GmbH & Co. KG, Littelfuse Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Low Voltage Industrial Controls Market Key Technology Landscape

The Low Voltage Industrial Controls (LVIC) market is fundamentally being redefined by the convergence of traditional electrical engineering with advanced digital technology, encapsulated by the Industrial Internet of Things (IIoT). Key technological advancements focus on miniaturization and enhancing the protective capabilities and lifespan of components while embedding communication features. Solid-state switching technology, replacing traditional electromechanical contactors and relays, offers vastly improved longevity, faster response times, and zero-maintenance requirements, appealing heavily to industries requiring high cycle counts and exceptional reliability. Furthermore, integrated diagnostic capabilities are now standard, providing detailed data on current harmonics, voltage sag, and thermal stress, allowing operators to proactively manage system health.

The development of standardized and secure industrial communication protocols, essential for AEO and GEO compatibility in smart factories, is paramount. Technologies like OPC UA (Open Platform Communications United Architecture) and various industrial Ethernet standards (EtherCAT, PROFINET, EtherNet/IP) are being universally adopted to ensure seamless, vendor-agnostic data exchange between LVIC components and higher-level SCADA or cloud-based analytics platforms. Cybersecurity features are increasingly becoming critical components of the technology landscape, with manufacturers incorporating secure boot mechanisms, hardware-based encryption, and role-based access control directly into smart circuit breakers and protective relays to defend against remote tampering or unauthorized configuration changes, mitigating the primary risk of connecting operational technology to the internet.

Another transformative technology is the use of modular Motor Control Centers (MCCs) designed for high scalability and rapid replacement. These modern MCCs are often implemented using plug-and-play technologies that minimize wiring errors and reduce commissioning time dramatically. Variable Frequency Drives (VFDs) represent a crucial technological segment, continually evolving to offer higher efficiency (e.g., compatibility with IE5 motors) and incorporating advanced control algorithms for complex motor types, such as permanent magnet synchronous motors (PMSMs). The integration of Human-Machine Interface (HMI) screens and augmented reality (AR) tools for maintenance and troubleshooting directly with LVIC cabinets further streamlines operational workflow, allowing technicians to access real-time diagnostic information and schematics instantly.

Regional Highlights

Regional dynamics within the Low Voltage Industrial Controls market are diverse, reflecting varying industrial maturity, regulatory landscapes, and rates of technological adoption. The Asia Pacific (APAC) region stands out as the primary engine of global market growth. This dominance is attributed to rapid urbanization, massive government investments in infrastructure development (including smart cities and high-speed rail networks), and the positioning of countries like China, India, and Vietnam as global manufacturing hubs. The robust expansion of the automotive, electronics, and power generation sectors in APAC ensures a continuous, high-volume demand for foundational LVIC components and increasingly, sophisticated motor control solutions to modernize factory floors.

North America and Europe represent mature markets characterized by high technological sophistication and stringent safety standards. Growth in these regions is driven less by capacity expansion and more by digitalization, replacement cycles, and compliance requirements. European market expansion is tightly linked to the implementation of the European Green Deal, necessitating extensive upgrades to electricity grids and industrial processes to improve energy efficiency. Key focus areas include intelligent power distribution systems and LVIC with embedded diagnostic capabilities that align with advanced predictive maintenance protocols. North American demand is particularly strong in the oil and gas sector, data centers, and advanced manufacturing (aerospace and pharmaceuticals), prioritizing high reliability, compliance with UL standards, and robust cybersecurity features in connected controls.

Latin America (LATAM) and the Middle East & Africa (MEA) offer high potential, primarily driven by investments in resource extraction (mining, oil, and gas) and large-scale utility and infrastructure projects. MEA’s market growth is highly dependent on national diversification strategies, particularly in the Gulf Cooperation Council (GCC) countries, focusing on developing non-oil industrial sectors and smart city projects like NEOM. While LATAM faces economic volatility, sustained investment in mining and energy infrastructure ensures a stable, albeit cyclical, demand for rugged and reliable LVIC components capable of operating in demanding environments. The adoption rate of advanced IIoT-enabled controls is slower in these regions compared to APAC or North America, but increasing foreign direct investment is accelerating the move toward modern automation standards.

- Asia Pacific (APAC): Highest growth rate fueled by massive manufacturing base expansion, infrastructure development, and accelerated adoption of Industry 4.0 in China and India.

- North America: Driven by technological upgrades, replacement of aging infrastructure, and high demand from data centers and sophisticated manufacturing (e.g., aerospace, pharmaceuticals).

- Europe: Growth propelled by energy efficiency mandates, rigorous safety regulations, and the transition toward smart grids and renewable energy integration.

- Latin America (LATAM): Steady demand from core sectors including mining, oil and gas, and increasing investment in regional manufacturing modernization.

- Middle East and Africa (MEA): Growth tied to diversification projects, large-scale infrastructural initiatives, and heavy reliance on the oil and gas sector requiring durable controls.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Low Voltage Industrial Controls Market.- Schneider Electric SE

- Siemens AG

- ABB Ltd.

- Eaton Corporation PLC

- Rockwell Automation Inc.

- Mitsubishi Electric Corporation

- Fuji Electric Co. Ltd.

- TE Connectivity Ltd.

- Danfoss A/S

- Emerson Electric Co.

- Hitachi Ltd.

- WEG S.A.

- Nidec Corporation

- Legrand S.A.

- Hyosung Heavy Industries

- LS Electric Co. Ltd.

- Chint Group

- Hubbell Incorporated

- Phoenix Contact GmbH & Co. KG

- Littelfuse Inc.

Frequently Asked Questions

Analyze common user questions about the Low Voltage Industrial Controls market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Low Voltage Industrial Controls market?

The primary drivers are the global mandate for industrial automation (Industry 4.0), stringent safety and energy efficiency regulations (e.g., IE4/IE5 motor standards), and significant capital investment in infrastructure projects and smart factory retrofitting, particularly in Asia Pacific.

How is the integration of IIoT impacting traditional Low Voltage Industrial Controls?

IIoT is transforming LVIC from simple protective hardware into smart, connected devices that provide real-time diagnostic data, enabling predictive maintenance, remote monitoring, and optimizing energy consumption across industrial power systems.

Which product segment holds the largest market share in Low Voltage Industrial Controls?

Motor Control Centers (MCCs) and circuit protection devices, including moulded case circuit breakers (MCCBs), typically hold the largest market share due to their indispensable role in protecting and managing the majority of motorized assets and power distribution lines in industrial environments.

What is the main challenge faced by manufacturers in the LVIC sector?

A key challenge is ensuring seamless interoperability and standardization across diverse industrial communication protocols (e.g., Modbus, PROFINET) while simultaneously addressing rising cybersecurity threats inherent in connecting critical operational technology (OT) to the enterprise network.

Which end-use industries are the fastest growing consumers of advanced LVIC solutions?

The fastest growing consumer sectors are the automotive industry (driven by EV production and advanced robotics), the data center segment, and the renewable energy generation sector, all requiring high reliability, speed, and advanced protective features.

What role does Artificial Intelligence (AI) play in modern Low Voltage Industrial Controls?

AI is utilized to analyze the operational data generated by smart controls for advanced predictive maintenance, anomaly detection, automated fault diagnosis, and dynamic optimization of motor control parameters to maximize efficiency and reliability.

How does regional market maturity affect LVIC purchasing patterns?

In mature markets (North America, Europe), purchasing focuses on premium, smart, and highly compliant components for modernization and replacement. In emerging markets (APAC), purchasing prioritizes volume, scalability, and cost-effectiveness for new capacity installation and foundational infrastructure build-out.

What certifications are essential for Low Voltage Industrial Controls?

Essential certifications include international standards like IEC 60947 (low-voltage switchgear and controlgear), regional safety standards such as UL (Underwriters Laboratories) for North America, and specific compliance for hazardous environments (e.g., ATEX/IECEx).

Are solid-state components replacing traditional electromechanical contactors entirely?

Solid-state components are increasingly preferred in high-cycle, critical applications due to their longevity and speed, but electromechanical contactors remain prevalent and cost-effective for high-current, general-purpose applications where switching frequency is lower and simplicity is preferred.

How important are energy efficiency considerations in the design of new LVIC products?

Energy efficiency is critically important. Manufacturers are focusing on developing advanced Variable Frequency Drives (VFDs), soft starters, and power quality components that minimize losses and ensure optimal performance, aligning with global regulatory pressures to reduce industrial energy consumption.

What is the forecasted CAGR for the Low Voltage Industrial Controls market?

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, reflecting stable demand driven by mandatory industrial upgrades and ongoing global automation efforts.

Explain the significance of modularity in current LVIC system design.

Modularity allows for rapid scalability, simplified maintenance, and reduced installation time. Modern Motor Control Centers (MCCs) are designed with plug-and-play modules, enabling quick component replacement and system reconfiguration without extensive rewiring or prolonged downtime.

In the value chain, what is the role of system integrators?

System integrators act as crucial intermediaries, purchasing standard LVIC components and assembling them into custom, application-specific control panels and integrated automation solutions, adding programming and technical expertise tailored to the end-user’s facility needs.

How does digitalization affect product differentiation among major LVIC suppliers?

Digitalization allows suppliers to differentiate through embedded software features, data analytics platforms, cybersecurity safeguards, and proprietary communication protocols that offer superior diagnostics and seamless integration into specific digital ecosystems (e.g., proprietary automation suites).

What are the key opportunities in the LVIC market related to renewable energy?

Opportunities include supplying specialized protective switchgear for solar and wind farms, developing controls for energy storage systems (BESS), and providing high-reliability components capable of managing intermittent power flows and grid synchronization requirements.

What defines the upstream segment of the LVIC value chain?

The upstream segment involves the sourcing of critical raw materials (copper, silver, specialty polymers), the production of complex sub-components like coils and molded housings, and highly technical R&D efforts focused on protective algorithms and advanced material science.

What segment of LVIC is crucial for managing high-speed production lines?

Control relays and specialized solid-state contactors are crucial for high-speed lines, offering the necessary fast switching cycles, extended mechanical life, and compatibility with precise PLC/DCS timing required for high-throughput robotic and assembly applications.

How is the adoption of electric vehicles influencing the LVIC market?

The production of electric vehicles (EVs) and battery gigafactories necessitates vast numbers of specialized, high-current low voltage controls and advanced protective devices to manage automated assembly, cell testing, and the high-power charging infrastructure within these facilities.

What does AEO stand for in the context of industrial market reports?

AEO stands for Answer Engine Optimization, which involves structuring content (like this report) to directly and concisely answer anticipated user questions, making the information easily digestible and relevant for generative AI models and search engine features.

How do global supply chain disruptions affect the LVIC market?

Supply chain disruptions, particularly related to semiconductors and specialized electronic components, increase manufacturing lead times for smart LVIC devices, potentially delaying major automation projects and driving up the total component cost for end-users.

What is the significance of the "Base Year" in this market report?

The Base Year (2025) provides the foundational data point, representing the fully analyzed and verified market size from which the forecasted growth rates (CAGR) and future market projections (up to 2033) are calculated and extrapolated.

Which region is exhibiting the highest growth rate for LVIC adoption?

The Asia Pacific (APAC) region is exhibiting the highest growth rate, propelled by rapid industrialization, large-scale infrastructural investments, and government mandates supporting local manufacturing capabilities across key economies.

What is the role of the low voltage circuit breaker?

The low voltage circuit breaker's primary role is to automatically interrupt the electrical current flow when a fault occurs, such as an overload or short circuit, protecting equipment, wiring, and personnel operating below 1000V AC or 1500V DC.

Define the distinction between Machine Control and Process Control applications for LVIC.

Machine Control applications involve discrete, often high-speed, operations (like assembly lines or robotic cells), requiring rapid-response LVIC. Process Control applications involve continuous, often slow-moving, flows (like refining or chemical mixing), demanding highly reliable, robust controls with redundancy.

Why are customization and service contracts increasingly important in the LVIC market?

Customization ensures LVIC solutions meet unique operational requirements and regulatory compliance for complex industrial sites. Service contracts, especially for smart controls, provide crucial revenue through remote monitoring, data analysis, software updates, and lifecycle management, ensuring system reliability long after installation.

How do smart grids impact the demand for low voltage switchgear?

Smart grids require highly intelligent, network-enabled low voltage switchgear capable of bidirectional communication, rapid fault isolation, and integration with distributed energy resources (DERs), significantly increasing the demand for advanced, digitally capable LVIC components.

What is the relationship between VFDs and energy efficiency regulations?

Variable Frequency Drives (VFDs) are essential for complying with modern energy efficiency regulations (like IE4/IE5 standards) by precisely controlling motor speed and torque, thereby reducing wasted energy compared to fixed-speed operations, making them a high-demand LVIC component.

Which LVIC components are most affected by miniaturization trends?

Control relays, miniature circuit breakers (MCBs), and power supplies are most affected by miniaturization, allowing control panel manufacturers to reduce cabinet footprint, increase component density, and lower material costs, optimizing space utilization in factory environments.

What distinguishes a conventional LVIC component from a smart/connected component?

A smart/connected LVIC component includes embedded microprocessors, sensors, and communication interfaces (e.g., Ethernet ports) that allow it to transmit operational data and receive remote commands, whereas a conventional component relies solely on electromechanical operation.

How is the petrochemical industry influencing LVIC product requirements?

The petrochemical industry demands LVIC products that meet extremely high safety standards, are certified for use in potentially explosive atmospheres (Hazardous Locations), and exhibit superior resistance to corrosion and harsh chemicals for long-term reliability.

What opportunities does the refurbishment of legacy industrial infrastructure present?

Refurbishment presents a strong opportunity for the sale of smart LVIC components used in retrofit projects, allowing older machinery to gain IIoT capabilities and improved safety features without requiring a full, costly machine replacement.

Explain the concept of lifecycle management services in LVIC.

Lifecycle management services involve providing support from initial installation through eventual decommissioning, including scheduled maintenance, remote monitoring, software updates for smart controls, and proactive component replacement planning based on predictive analytics data.

How does the shift towards modular control panels benefit end-users?

Modular control panels offer end-users benefits such as faster assembly and commissioning, easier expansion, standardized internal layouts, and simplified troubleshooting, leading to lower engineering costs and reduced downtime during modifications.

What is the significance of the voltage level (low voltage) in this market segment?

Low voltage (generally defined as below 1000V AC or 1500V DC) signifies the portion of the electrical system that interfaces directly with motors, control circuitry, and standard facility wiring, making these components the most numerous and critical for machine-level operation and safety.

What are the typical Restraints affecting market growth in Latin America?

Restraints in Latin America often include economic volatility, currency fluctuations, reliance on imported technology leading to higher costs, and slower governmental adoption of advanced industrial standards compared to globally leading regions.

In the context of GEO, what market data points are critical?

For Generative Engine Optimization (GEO), critical data points include specific market size values, CAGR, key drivers, restraints, and detailed segmentation data, as these provide structured, high-value content favored by large language models for synthesized reports.

How do competitive dynamics in the LVIC market influence pricing?

Intense competition, especially from Asian manufacturers offering cost-effective, standard components, puts continuous pressure on the pricing of basic electromechanical LVIC. However, specialized, high-performance smart controls maintain premium pricing due to R&D and intellectual property.

What is the role of the Historical Year period (2019 to 2024) in the report?

The Historical Year period provides the baseline for trend analysis, allowing analysts to examine past market performance, identify cyclical patterns, and validate the growth assumptions used for the subsequent forecast period (2026-2033).

Which LVIC product segment is expected to show the highest CAGR during the forecast period?

Digitally enabled components, such as smart contactors, networked protective relays, and integrated motor control units, are expected to show the highest CAGR due to the overwhelming global demand for IIoT connectivity and condition monitoring capabilities.

How does the construction industry use Low Voltage Industrial Controls?

The construction industry uses LVIC for managing power distribution on site, controlling HVAC systems in large commercial buildings, and operating heavy machinery like cranes and pumps, relying on robust circuit breakers and control switches for safety and reliability.

Why is adherence to IEC 61439 standards crucial for LVIC manufacturers?

Adherence to IEC 61439 is crucial because it sets the fundamental requirements for low-voltage switchgear and controlgear assemblies (control panels), ensuring safety, operational performance, and interchangeability across international markets, confirming fitness for industrial purpose.

What is a key downstream activity related to smart LVIC devices?

A key downstream activity is the provision of data integration and cloud analytics services, translating the operational data transmitted by smart controls into actionable business intelligence for optimizing production schedules and reducing energy consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager