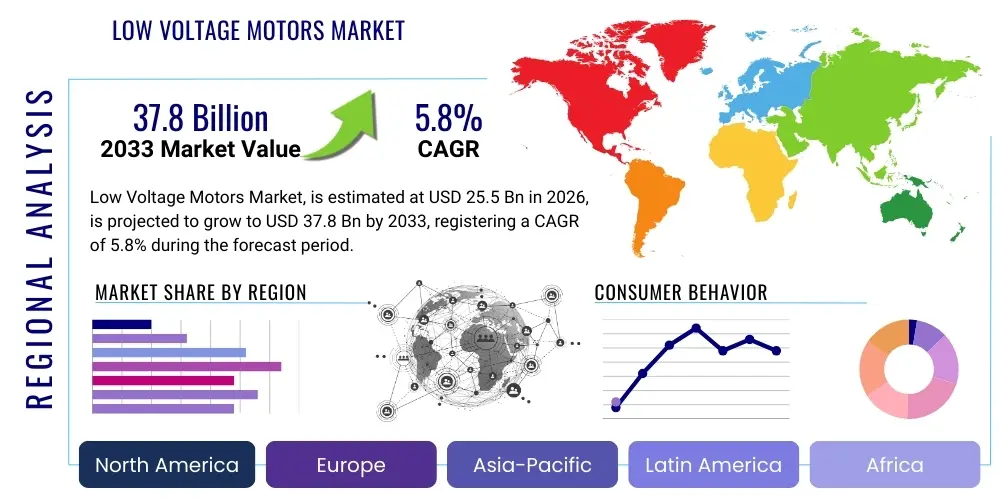

Low Voltage Motors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437686 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Low Voltage Motors Market Size

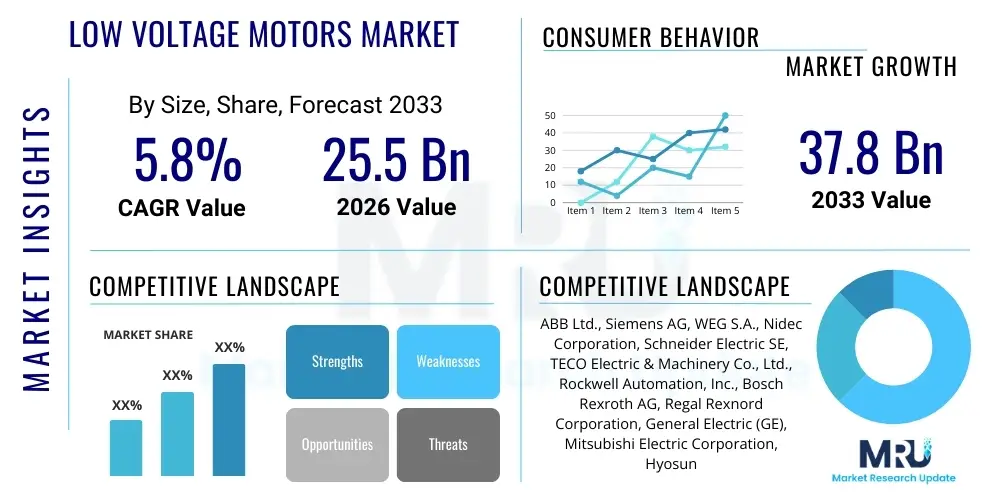

The Low Voltage Motors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 37.8 Billion by the end of the forecast period in 2033.

Low Voltage Motors Market introduction

The Low Voltage (LV) Motors Market encompasses electrical motors designed to operate at voltages typically below 1,000 volts AC (Alternating Current) or 1,500 volts DC (Direct Current). These motors are fundamental components in virtually all industrial, commercial, and residential applications, serving as the workhorse for various processes requiring rotational motion, such as pumping, ventilation, compression, and material handling. LV motors are crucial for driving machinery in sectors like oil and gas, manufacturing, water and wastewater treatment, power generation, and HVAC systems. The increasing focus on energy efficiency, driven by stringent regulatory standards (like IE3 and IE4 efficiency ratings), is a primary factor accelerating the adoption of premium and super-premium efficiency LV motors, particularly in replacement and modernization projects across developed economies.

Major applications of LV motors span across diverse industries. In manufacturing, they power conveyor belts, machine tools, and robotics. Within the utility sector, they are essential for pumps and fans used in power plants and water facilities. Benefits derived from modern LV motor technology include reduced operational costs due to lower energy consumption, increased reliability and extended service life, and minimized maintenance requirements. Furthermore, the integration of LV motors with Variable Speed Drives (VSDs) allows for precise control over speed and torque, leading to optimal process management and additional energy savings, cementing their necessity in smart industrial infrastructure.

The market is predominantly driven by global industrialization, especially rapid infrastructural development in emerging economies, alongside the persistent trend of replacing older, less efficient motors with high-efficiency counterparts to comply with energy conservation mandates. Demand is also bolstered by technological advancements, including the incorporation of smart monitoring capabilities (IoT integration) that enable predictive maintenance and optimized performance. The robust growth observed in the food and beverage, chemical, and pharmaceutical sectors, which rely heavily on continuous process operations powered by reliable LV motors, further underpins the overall market expansion.

Low Voltage Motors Market Executive Summary

The Low Voltage Motors Market is poised for stable expansion, underpinned by strong business trends centered on sustainability and digitalization. Key business trends indicate a definitive shift toward synchronous reluctance motors (SynRM) and permanent magnet synchronous motors (PMSM) over traditional induction motors, owing to their superior efficiency profiles which align with global energy transition goals. Furthermore, consolidation among major global players and increased investment in localized manufacturing facilities in Asia Pacific demonstrate strategies aimed at optimizing supply chains and addressing regional demand volatility. The integration of motors with advanced sensor technology for condition monitoring (Industry 4.0 readiness) is becoming a standard expectation rather than a competitive differentiator.

Regionally, Asia Pacific (APAC) continues to dominate the market, driven by massive infrastructure projects, rapid expansion of the industrial base, particularly in China and India, and increasing governmental focus on domestic manufacturing capacity (e.g., 'Make in India'). North America and Europe, while representing mature markets, exhibit consistent growth fueled primarily by regulatory mandates necessitating the replacement of installed motor bases with IE3/IE4-compliant models and ongoing automation in mature industries. The Middle East and Africa (MEA) region shows accelerating demand, largely correlated with investments in oil and gas infrastructure and burgeoning water treatment projects.

In terms of segment trends, the AC LV Motors segment maintains the largest market share, driven by their ruggedness and widespread applicability across industrial settings. Within the application segments, the Heating, Ventilation, and Air Conditioning (HVAC) sector is projected to register the fastest growth due to global urbanization and climate control requirements. The IE3 efficiency class currently forms the core of market sales volume globally, although the IE4 and IE5 segments are expected to show accelerated value growth, reflecting the premiumization of energy-efficient motor solutions globally.

AI Impact Analysis on Low Voltage Motors Market

Common user questions regarding AI's impact on the Low Voltage Motors Market primarily revolve around how Artificial Intelligence can optimize motor lifespan, predict failures, and improve energy consumption profiles in industrial settings. Users often seek clarity on the feasibility and return on investment (ROI) of implementing AI-driven predictive maintenance platforms that utilize motor data (vibration, temperature, current draw). Concerns also focus on the standardization of data collection protocols, the cost of integrating AI-capable sensors, and the skill gap required to interpret complex algorithms that determine optimal motor usage and preventative action. Users expect AI to move beyond simple monitoring to active, real-time optimization of motor duty cycles.

AI's primary influence is manifesting in enhancing the intelligence quotient of the entire electric drivetrain. By leveraging machine learning models trained on vast datasets of operational parameters, manufacturers can offer "Motor as a Service" (MaaS) solutions, shifting the focus from product sales to performance delivery. This involves deploying edge computing capabilities within VSDs and motors themselves, allowing for immediate analysis of anomalies and potential faults before they escalate into critical failures, thereby significantly boosting asset utilization rates and reducing unexpected downtime, a major operational expenditure in continuous process industries.

Furthermore, AI algorithms are crucial in developing next-generation motor designs by simulating complex electromagnetic fields and thermal stress distribution, reducing the time and cost associated with prototyping and physical testing. Predictive analytics also empowers users to dynamically adjust motor speed and torque based on real-time process demands and energy pricing, moving beyond fixed optimization schedules to truly responsive energy management systems that maximize savings and sustainability goals across the industrial value chain.

- AI-driven Predictive Maintenance (PdM) algorithms minimize unplanned downtime by forecasting component failure based on vibration and thermal signatures.

- Optimized Energy Management systems utilize machine learning to dynamically adjust motor speeds (via VSDs) based on real-time production loads and energy tariffs.

- AI facilitates advanced motor design simulations, accelerating the development of higher efficiency IE4 and IE5 motors.

- Enhanced Motor Control capabilities through AI improve torque ripple reduction and precision control in demanding applications like robotics and high-speed CNC machinery.

- Integration of AI at the edge allows for immediate, decentralized data processing and anomaly detection, reducing reliance on constant cloud connectivity.

DRO & Impact Forces Of Low Voltage Motors Market

The Low Voltage Motors Market dynamics are defined by a robust set of drivers centered on energy efficiency mandates, balanced by restraints such as high initial capital expenditure for premium efficiency models and counterbalanced by significant opportunities stemming from industrial IoT integration. Key drivers include government regulations (e.g., EU Ecodesign directive, US DOE standards) that enforce minimum energy performance standards (MEPS), compelling industries to adopt high-efficiency motors (IE3 and above). Additionally, the global drive towards decarbonization and corporate sustainability initiatives strongly supports market expansion, as motors consume a significant portion of industrial electricity. The rapid pace of automation across manufacturing sectors globally further solidifies the demand base.

Restraints primarily revolve around the reluctance of small and medium enterprises (SMEs) in emerging markets to undertake the higher initial investment required for premium efficiency motors (IE4/IE5), despite the proven long-term operational savings. Other limiting factors include fluctuating raw material prices, particularly for copper, aluminum, and permanent magnets, which impact manufacturing costs and final product pricing. The lengthy replacement cycles typical of durable industrial equipment also slow down the penetration rate of newer technologies in existing operational plants.

Opportunities for growth are vast, including the burgeoning market for explosion-proof (Ex) motors required in hazardous environments (Oil & Gas, Chemical), and the significant potential derived from retrofitting older, inefficient motor populations in established industries across Europe and North America. The convergence of LV motor technology with sophisticated digital services, particularly the integration with cloud platforms for comprehensive asset management and predictive analytics, presents a high-growth avenue. The resultant impact forces strongly favor market acceleration, with the pressure from regulatory compliance being the most acute and non-negotiable force driving short-term demand for high-efficiency replacements, while long-term growth is secured by technological integration (IoT).

Segmentation Analysis

The Low Voltage Motors market is extensively segmented based on critical technical and application parameters, providing a granular view of demand distribution and technological preferences. Key segmentation includes motor technology (AC vs. DC), efficiency ratings (Standard, High, Premium, Super Premium), motor type (Induction, Synchronous, DC), output power (Fractional vs. Integral HP), and crucial end-user industry applications. The dominance of AC induction motors is gradually being challenged by highly efficient synchronous alternatives, particularly in applications where precise control and maximum energy savings are paramount. The market analysis across these segments is essential for understanding the shifting competitive landscape and identifying niche high-growth opportunities within the diverse industrial ecosystem.

- By Type:

- AC Motors (Induction Motors, Synchronous Motors)

- DC Motors (Brushed DC Motors, Brushless DC Motors)

- By Efficiency Class:

- IE1 (Standard Efficiency)

- IE2 (High Efficiency)

- IE3 (Premium Efficiency)

- IE4 (Super Premium Efficiency)

- IE5 (Ultra Premium Efficiency)

- By Output Power:

- Fractional Horsepower (FHP)

- Integral Horsepower (IHP)

- By Application:

- Pumps

- Fans and Blowers

- Compressors

- Extruders

- Material Handling

- HVAC (Heating, Ventilation, and Air Conditioning)

- Others (Machine Tools, Robotics)

- By End-User Industry:

- Oil & Gas

- Chemical, Petrochemical, and Pharmaceutical

- Metals and Mining

- Power Generation

- Water and Wastewater Treatment

- Pulp and Paper

- Food and Beverage

- Automotive

- Textiles

Value Chain Analysis For Low Voltage Motors Market

The value chain for the Low Voltage Motors market is complex, beginning with raw material extraction and moving through highly specialized manufacturing processes before reaching diverse industrial end-users. The upstream segment is dominated by suppliers of critical raw materials, including electrical steel laminations, copper wiring, aluminum castings, and increasingly, rare earth permanent magnets (essential for PMSMs). Fluctuations in commodity prices significantly affect production costs and are a major point of negotiation and risk management for core motor manufacturers. This stage is crucial for determining the magnetic and thermal properties, which directly influence the motor's eventual efficiency rating.

Midstream activities involve core manufacturing, including stamping and winding, assembly, quality control testing, and integration of digital components such as sensors and communication modules. Major motor OEMs typically control this stage, often integrating backward to secure key component supplies or forward to offer packaged solutions (motor + drive). Distribution channels are critical in bridging the gap between manufacturers and the geographically dispersed industrial consumers. Distribution is primarily handled through a mix of direct sales forces for large, custom projects (particularly in Oil & Gas and Power Generation) and extensive indirect channels, including authorized distributors, system integrators, and independent aftermarket service providers, who handle smaller volume sales, spare parts, and localized maintenance services.

The downstream segment involves installation, commissioning, maintenance, and eventual replacement/recycling. System integrators play a vital role here, integrating motors with VSDs, PLCs (Programmable Logic Controllers), and SCADA systems to deliver complete automation solutions. The shift towards IoT and condition monitoring has heightened the importance of service providers who can offer digital maintenance contracts, ensuring optimal operational performance. The success of a manufacturer is increasingly tied to the efficiency and responsiveness of their distribution and service network, particularly the robust indirect channel which offers accessibility and localized technical support globally.

Low Voltage Motors Market Potential Customers

Potential customers for Low Voltage Motors are ubiquitous across the industrial and commercial landscape, defined by any entity requiring robust, reliable, and efficient rotational power to execute core operations. These customers range from massive multinational corporations operating continuous production processes (e.g., petrochemical plants and integrated steel mills) to small municipal utilities and independent HVAC contractors. The highest volume customers are concentrated in industries characterized by continuous operation cycles where minimizing energy consumption and maximizing uptime directly translates to profitability, such as Water and Wastewater Treatment and the Oil & Gas sector.

The replacement market forms a substantial portion of the customer base, comprising end-users in mature economies (North America, Europe) compelled to upgrade their aging installed base of IE1/IE2 motors to comply with mandatory efficiency standards (IE3 and above). New installation customers include large infrastructure developers, EPC (Engineering, Procurement, and Construction) firms, and OEMs who integrate LV motors directly into their machinery (e.g., compressor manufacturers, pump manufacturers, and robotic system builders). These customers prioritize factors such as motor efficiency, integration ease (connectivity), durability, and compliance with specific regional safety standards (e.g., ATEX or IECEx certifications for hazardous environments).

Furthermore, the rapid expansion of data centers globally represents an emerging, high-value customer segment. Data centers require vast numbers of highly reliable, energy-efficient LV motors for cooling systems (fans, chillers) and backup power generation accessories. These buyers often demand advanced connectivity and remote diagnostic capabilities to manage thousands of distributed assets effectively. Consequently, the focus shifts to motors optimized for VSD operation, high reliability, and minimal vibration, ensuring continuous, stable operational conditions critical for IT infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 37.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, WEG S.A., Nidec Corporation, Schneider Electric SE, TECO Electric & Machinery Co., Ltd., Rockwell Automation, Inc., Bosch Rexroth AG, Regal Rexnord Corporation, General Electric (GE), Mitsubishi Electric Corporation, Hyosung Heavy Industries, Crompton Greaves Consumer Electricals Ltd., Johnson Electric Holdings Limited, Toshiba Corporation, VEM Group, Kirloskar Electric Company, Lafert Group, Lenze SE, Yaskawa Electric Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Low Voltage Motors Market Key Technology Landscape

The Low Voltage Motors technology landscape is defined by continuous innovation aimed at maximizing energy efficiency and integrating smart functionalities. The fundamental technology shift involves moving away from standard squirrel-cage induction motors towards high-efficiency alternatives like Permanent Magnet Synchronous Motors (PMSM) and Synchronous Reluctance Motors (SynRM). PMSMs offer superior power density and efficiency (often achieving IE5 levels), making them ideal for specialized applications requiring compact designs and high torque, although their reliance on rare earth magnets poses supply chain risks. SynRMs, conversely, achieve high efficiency comparable to PMSMs without relying on magnets, appealing to manufacturers seeking sustainable design alternatives.

A secondary, but equally critical, technological trend is the pervasive integration of digital capabilities. This includes advanced sensor arrays (accelerometers, temperature sensors, current transducers) embedded directly within the motor housing to facilitate Condition Monitoring (CM). These sensors communicate wirelessly via industrial protocols (e.g., OPC UA, Modbus TCP) to Variable Speed Drives (VSDs) or cloud-based analytical platforms. This digitalization supports the transition to predictive maintenance models, dramatically reducing unexpected motor failures and optimizing motor performance in real-time by linking operational data with process control systems.

Further innovation involves advancements in material science, particularly in developing improved electrical steel grades with lower core losses and enhanced insulation systems capable of withstanding the high switching frequencies and voltage peaks associated with VSD operation. Modular motor designs are also gaining traction, allowing for easier maintenance, faster assembly, and customization of cooling arrangements (e.g., forced ventilation or water cooling). This focus on modularity and robustness ensures that modern LV motors can handle the increasingly complex and harsh operating conditions typical of modern industrial environments while maintaining high efficiency over their entire lifespan.

Regional Highlights

- Asia Pacific (APAC): Dominance and High Growth Potential

- North America: Focus on Replacement and Regulatory Compliance

- Europe: Strict Efficiency Mandates and Decarbonization

- Latin America (LATAM): Industrial Recovery and Modernization

- Middle East and Africa (MEA): Infrastructure Investment and Energy Projects

APAC is the largest and fastest-growing market globally for Low Voltage Motors, primarily driven by expansive industrialization and robust infrastructure spending, particularly in China, India, and Southeast Asian nations. Governments in this region are actively promoting domestic manufacturing through initiatives (like 'Made in China 2025' and 'Make in India'), significantly boosting the demand for automation and associated LV motors. While price sensitivity remains higher here than in Western markets, regulatory compliance regarding efficiency standards is gradually strengthening, ensuring consistent demand for IE3 motors and a growing uptake of IE4 models in high-value industries like electronics and automotive manufacturing. The sheer scale of population and urbanization further drives massive demand in HVAC and water infrastructure projects.

The North American market, characterized by mature industrial sectors (Oil & Gas, Chemicals, Mining), primarily centers on the replacement of aging infrastructure. Demand is strongly enforced by federal and state regulations, such as the DOE standards, which effectively prohibit the sale of motors below the Premium Efficiency (IE3) class in many applications. High labor costs and the criticality of uptime drive strong interest in smart motors integrated with IoT platforms for predictive maintenance and remote monitoring. The region is a key early adopter of advanced technologies like PMSM and SynRM, prioritizing total cost of ownership (TCO) over initial investment.

Europe represents a highly regulated market where the Ecodesign Directive mandates the use of IE3 or IE4 motors across a wide range of power outputs, effectively dictating market evolution. The strong commitment to energy transition and decarbonization across the European Union fuels consistent demand for the highest efficiency class motors (IE4 and IE5). Key growth drivers include the massive retrofitting requirements in process industries (Germany, Italy) and the accelerating development of renewable energy infrastructure (wind, solar), which utilize specialized LV motors and drives. Sustainability concerns also push manufacturers towards motors utilizing non-rare earth magnet technologies.

The LATAM market is marked by moderate growth, primarily tied to the recovery and modernization of key industries like mining, agriculture, and oil production in countries such as Brazil and Mexico. While adoption of premium efficiency motors is slower due to economic challenges and less rigid regulatory frameworks compared to Europe, the need to reduce operational costs and enhance competitiveness is gradually driving investment in newer LV motor technology. Local manufacturing presence and efficient distribution networks are crucial success factors in this region.

The MEA region demonstrates robust demand linked heavily to significant government investments in diversification, large-scale infrastructure development, and energy projects. The oil and gas sector remains a primary consumer, requiring vast quantities of robust, specialized (often hazardous area certified) LV motors. Growing populations and arid climates necessitate substantial investment in desalination, water treatment, and extensive HVAC systems, fueling high demand for specific motor types. Energy efficiency is becoming increasingly important, especially in GCC countries aiming to reduce reliance on subsidized electricity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Low Voltage Motors Market.- ABB Ltd.

- Siemens AG

- WEG S.A.

- Nidec Corporation

- Schneider Electric SE

- TECO Electric & Machinery Co., Ltd.

- Rockwell Automation, Inc.

- Bosch Rexroth AG

- Regal Rexnord Corporation

- General Electric (GE)

- Mitsubishi Electric Corporation

- Hyosung Heavy Industries

- Crompton Greaves Consumer Electricals Ltd.

- Johnson Electric Holdings Limited

- Toshiba Corporation

- VEM Group

- Kirloskar Electric Company

- Lafert Group

- Lenze SE

- Yaskawa Electric Corporation

Frequently Asked Questions

Analyze common user questions about the Low Voltage Motors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Low Voltage Motors?

The primary factor driving demand is the implementation of global energy efficiency regulations and minimum energy performance standards (MEPS), which necessitate the replacement of older, inefficient motors (IE1/IE2) with modern, high-efficiency models (IE3, IE4, and IE5) across major industrial sectors to minimize energy consumption and reduce operational costs.

How does the integration of IoT affect the Low Voltage Motors market?

IoT integration enables smart motors equipped with embedded sensors and communication capabilities. This allows for real-time condition monitoring, predictive maintenance scheduling, and remote diagnostics, significantly increasing uptime, extending motor lifespan, and providing operational data necessary for advanced industrial automation (Industry 4.0).

Which motor technology is expected to see the fastest growth rate?

Permanent Magnet Synchronous Motors (PMSM) and Synchronous Reluctance Motors (SynRM) are expected to exhibit the fastest growth in value terms. These technologies offer superior energy efficiency (often reaching IE4/IE5 classes) and better power density compared to conventional AC induction motors, aligning perfectly with strict environmental and efficiency mandates globally.

What is the dominant regional market for Low Voltage Motors?

The Asia Pacific (APAC) region currently dominates the global Low Voltage Motors market share, driven by rapid urbanization, massive government investment in manufacturing and infrastructure, and continuous capacity expansion across key industrial sectors, particularly in China and India.

What are the key differences between IE3 and IE4 efficiency classes?

IE4 (Super Premium Efficiency) motors offer substantially lower energy losses compared to IE3 (Premium Efficiency) motors. While IE3 is the minimum standard in many developed markets today for mandatory replacement, IE4 motors provide greater energy savings over their lifespan, making them preferred choices in applications with high running hours or where TCO (Total Cost of Ownership) optimization is critical.

Which industrial application utilizes the most Low Voltage Motors?

Pumps, fans, and compressors collectively represent the largest application segments for Low Voltage Motors. These fluid handling systems are essential across virtually all end-user industries, including water treatment, HVAC, oil & gas, and manufacturing, ensuring their sustained dominance in terms of motor volume usage.

What is the role of Variable Speed Drives (VSDs) in the LV Motor market?

VSDs are crucial for achieving optimal energy efficiency, as they allow motors to operate precisely at the speed required for the load, preventing wasted energy when running at full speed unnecessarily. The increasing adoption of VSDs is intrinsically linked to the demand for modern LV motors optimized for inverter duty, driving the market for integrated motor and drive packages.

What impact does the automotive sector have on the LV Motor market?

The automotive sector drives demand for LV motors in two ways: first, for the industrial machinery (robotics, conveyance systems) used in car manufacturing plants; and second, through the burgeoning market for smaller, specialized LV motors used within the vehicles themselves (e.g., electronic power steering, HVAC blowers, fuel pumps), particularly driven by the shift towards electric vehicles (EVs).

How do raw material price fluctuations affect the market?

Fluctuations in the prices of key raw materials—especially copper, electrical steel, and rare earth elements used in PMSMs—significantly impact the manufacturing costs of LV motors. This volatility can lead to higher average selling prices, potentially slowing down adoption in price-sensitive markets, or compressing manufacturer profit margins.

What are Fractional Horsepower (FHP) motors and where are they used?

Fractional Horsepower (FHP) motors are those with an output of less than one horsepower. They are typically used in smaller, residential, and light commercial equipment such as household appliances, small fans, portable tools, office machinery, and minor automation components, representing a high-volume segment of the overall LV motor market.

What is 'Motor as a Service' (MaaS) and how is it related to LV motors?

MaaS is a business model enabled by digitalization and IoT, where users pay for the performance and reliability delivered by the motor system rather than purchasing the hardware outright. Providers use smart LV motors and AI-driven predictive maintenance to guarantee uptime and optimized energy use, appealing to industrial customers focused purely on operational output.

What challenges exist in adopting IE5 Ultra Premium Efficiency motors?

Challenges include the extremely high initial capital cost compared to IE3/IE4 models, the requirement for highly specialized control systems (VSDs), and in some designs, reliance on complex materials like rare earth magnets, leading to supply chain concerns and resistance in non-critical applications.

How important is the water and wastewater treatment sector to the market?

The Water and Wastewater Treatment (WWT) sector is highly critical. It operates 24/7 and relies extensively on pumps and aerators, making energy efficiency paramount. WWT facilities are rapidly adopting IE3 and IE4 LV motors integrated with VSDs to manage peak flow requirements efficiently and minimize massive continuous energy expenditures.

What is the expected long-term impact of Industry 4.0 on LV motors?

Industry 4.0 is transitioning LV motors from simple mechanical components into intelligent, interconnected assets. This means motors will increasingly feature integrated diagnostics, self-optimization capabilities, and seamless communication with other factory systems, facilitating fully automated and adaptive manufacturing processes.

What is the key differentiator for LV motor manufacturers in highly competitive markets?

Beyond price and efficiency, the key differentiators are reliability (mean time between failures), warranty duration, and the quality of digital service offerings, including ease of integration with industrial IoT platforms and the availability of responsive, localized technical support and replacement services.

Why are explosion-proof (Ex) motors critical in certain industries?

Ex motors are designed to operate safely in hazardous environments (e.g., Oil & Gas, Chemical, Mining) where explosive gases, dust, or vapors may be present. These specialized LV motors prevent ignition by containing any sparks or ensuring surface temperatures remain below the ignition point of the surrounding atmosphere, adhering strictly to standards like ATEX or IECEx.

Does the pulp and paper industry have specific LV motor requirements?

Yes. The pulp and paper industry requires LV motors that are highly resistant to moisture, corrosive chemicals, and high humidity, demanding robust enclosures and advanced insulation systems. Continuous operation cycles also necessitate high efficiency and strong reliability for drives used in conveyor systems, mixers, and refiners.

How does government incentive impact the replacement market?

Government incentives, often provided through subsidies or tax credits for installing certified high-efficiency equipment (IE3/IE4), significantly accelerate the replacement cycle in mature economies. These financial supports help overcome the high initial investment barrier, especially for SMEs, encouraging quicker adoption of superior technology.

What is the significance of the IE Code system?

The International Efficiency (IE) code system provides a standardized, globally recognized classification (IE1 to IE5) for the energy efficiency levels of electric motors. This standardization allows end-users and regulators to easily compare motor performance and enforce minimum efficiency standards uniformly across different markets, driving global market quality improvements.

What is the current trend regarding Permanent Magnet Synchronous Motors (PMSM) supply chain?

The trend is towards mitigating supply chain risks associated with rare earth magnets, primarily sourced from specific geographic regions. Manufacturers are exploring alternatives, such as Synchronous Reluctance Motors (SynRM), or investing in diversified magnet sourcing and alternative magnet compositions to stabilize production and pricing for high-efficiency PMSMs.

What role do system integrators play in the LV Motor distribution channel?

System integrators are crucial intermediaries who purchase motors and drives and incorporate them into complex, customized automation systems (e.g., large machinery, assembly lines). They provide specialized technical expertise, ensuring the motor system is correctly sized, programmed, and integrated with the customer's overall control architecture.

Why is the Food and Beverage industry a strong growth area for LV motors?

The Food and Beverage sector requires motors that meet stringent hygiene standards (washdown duty, stainless steel enclosures) and high reliability for continuous operations (mixing, conveying, packaging). As automation increases in this sector, demand grows for specific, efficient, and sanitary LV motor designs.

How are advancements in electrical steel affecting motor performance?

Improvements in the quality and processing of electrical steel laminations (using thinner gauges and advanced alloys) result in significantly lower core losses within the motor. This directly contributes to higher efficiency ratings (IE4, IE5) and reduced motor heating, enhancing both performance and lifespan.

What are the primary challenges faced by manufacturers in emerging markets?

Manufacturers in emerging markets often face challenges related to intense price competition from local players offering low-cost, lower-efficiency motors, inconsistent regulatory enforcement of efficiency standards, and deficiencies in local supply chain infrastructure and skilled technical labor.

What is the significance of the TCO (Total Cost of Ownership) concept in motor purchasing?

TCO is highly significant, especially in developed markets. It emphasizes that while high-efficiency motors have a greater initial cost, the massive savings generated over the motor’s 10-15 year lifespan through reduced energy consumption (which typically accounts for over 95% of the motor’s lifetime cost) result in a lower overall financial outlay compared to cheaper, inefficient alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager