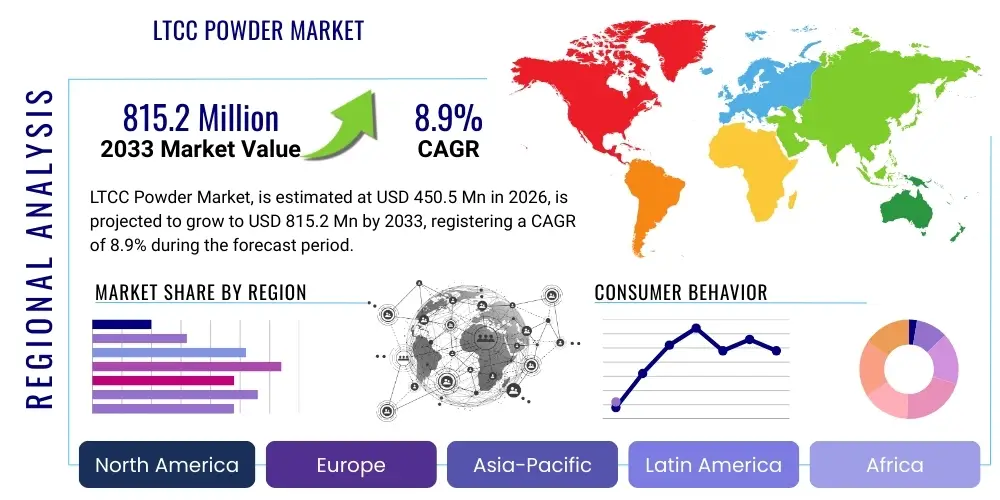

LTCC Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436076 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

LTCC Powder Market Size

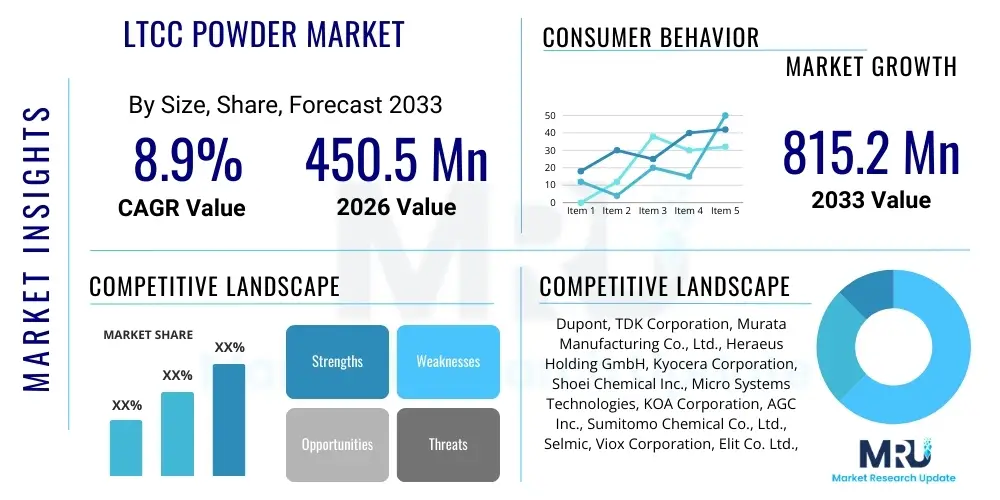

The LTCC Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at $450.5 Million in 2026 and is projected to reach $815.2 Million by the end of the forecast period in 2033.

LTCC Powder Market introduction

Low-Temperature Co-fired Ceramic (LTCC) powder constitutes the foundational material for manufacturing multilayer ceramic substrates and components. This sophisticated material system typically comprises glass-ceramic composite powders combined with various additives and sintering aids, designed to allow firing at relatively low temperatures (typically below 900°C), which is crucial for compatibility with high-conductivity metals like silver (Ag) and gold (Au). The resulting LTCC substrates exhibit superior characteristics including excellent high-frequency performance, high thermal stability, high-Q factors, and robust mechanical integrity, making them indispensable in modern electronic packaging. The ability to integrate passive components (such as resistors, capacitors, and inductors) directly into the substrate layers provides significant advantages in miniaturization and enhanced system performance.

The primary applications of LTCC technology span critical sectors such as wireless communication modules, automotive electronics (especially radar systems and sensors), aerospace and defense applications requiring robust performance under extreme conditions, and high-speed networking infrastructure. The unique blend of electrical and thermal properties inherent to LTCC materials, particularly low dielectric loss and tunable thermal expansion coefficients, positions them as the material of choice for demanding radio frequency (RF) and microwave components. As digital transformation accelerates globally, the demand for highly integrated, compact, and reliable electronic components that can operate efficiently at higher frequencies drives the underlying growth trajectory of the LTCC powder market.

Key driving factors supporting market expansion include the global deployment of 5G infrastructure, which necessitates high-performance filters, antennas, and front-end modules, all benefiting from LTCC substrates due to their dimensional stability and low signal attenuation. Furthermore, the proliferation of Internet of Things (IoT) devices, coupled with advancements in autonomous vehicle technology requiring complex millimeter-wave radar systems (e.g., 77 GHz modules), fuels the adoption of these specialized powders. The continuous push toward electronic component miniaturization and functional integration, addressing the increasing complexity and density requirements in portable electronics, solidifies the market's robust long-term potential.

LTCC Powder Market Executive Summary

The LTCC Powder Market is characterized by intense technological evolution driven by the convergence of 5G rollout and sophisticated automotive electronics. Business trends indicate a shift towards customized powder formulations that offer ultra-low loss tangents and precise dielectric constants, catering specifically to millimeter-wave applications. Leading manufacturers are investing heavily in process optimization and advanced mixing technologies to ensure highly homogeneous powder distribution, critical for consistent performance in complex multi-layer structures. Strategic partnerships between powder suppliers and electronics manufacturing service (EMS) providers are becoming vital to streamline the supply chain and accelerate the commercialization of new LTCC-based modules, particularly in the densely competitive Asian electronics manufacturing hub. Consolidation among smaller regional players is also observed, aimed at leveraging economies of scale and gaining access to specialized material science expertise.

Regionally, Asia Pacific (APAC) dominates the market, primarily due to the overwhelming concentration of consumer electronics manufacturing, robust automotive production bases in China, Japan, and South Korea, and aggressive deployment of 5G networks, especially in countries like China and India. North America and Europe, while exhibiting slower growth in manufacturing volume, represent key markets for high-value LTCC applications in aerospace, defense, and high-reliability industrial control systems, where stringent quality and performance standards necessitate premium LTCC materials. Latin America and MEA are emerging markets, expected to show higher CAGRs driven by infrastructure development and increasing automotive radar adoption, albeit starting from a smaller base.

Segment-wise, the market is broadly segmented by composition (glass-ceramic, ceramic-only), application (automotive, telecommunications, defense), and dielectric constant. The telecommunications segment, spurred by filters and duplexers for 5G, remains the largest revenue contributor. However, the automotive segment, fueled by advanced driver-assistance systems (ADAS) and electric vehicle (EV) battery management systems utilizing high-reliability components, is projected to register the fastest growth. There is an increasing demand for environmentally friendly, lead-free LTCC formulations, aligning with global regulatory pressures and sustainability goals, influencing product development across all segmentation layers.

AI Impact Analysis on LTCC Powder Market

User inquiries regarding AI's influence on the LTCC Powder Market predominantly revolve around optimizing material properties, predicting manufacturing yield, and automating quality control processes in LTCC fabrication. Users are keenly interested in how Artificial Intelligence can accelerate the discovery of novel glass-ceramic compositions and refine sintering profiles to achieve desired dielectric performance with greater precision and reduced development cycle time. Key themes emerging from common questions include the application of machine learning for defect detection in green tapes, predictive maintenance for high-cost co-firing furnaces, and the use of AI algorithms to tailor powder characteristics based on specific end-application frequency requirements. These questions reflect an expectation that AI will transition LTCC manufacturing from empirical, trial-and-error methodologies to data-driven, highly optimized processes, thus improving throughput and material utilization rates for specialized powders.

- AI-driven Material Discovery: Accelerating the identification and validation of optimal glass-ceramic formulations and sintering aids required for high-frequency or high-power applications, significantly reducing R&D timelines.

- Predictive Quality Control (QC): Utilizing machine learning models to analyze real-time data from powder mixing, tape casting, and co-firing processes, predicting potential defects (e.g., porosity, delamination) before they occur, thereby enhancing yield.

- Manufacturing Process Optimization: Employing AI algorithms to fine-tune firing temperature profiles and atmospheric conditions within furnaces, ensuring consistent density and dielectric performance across large production batches of LTCC substrates.

- Supply Chain Resilience: Using AI tools for demand forecasting and inventory management of specialized raw materials (e.g., precious metals for electrodes and specific oxide powders), mitigating supply chain risks associated with volatile material costs.

- Automated Inspection Systems: Implementing deep learning-based visual inspection systems for high-speed, accurate detection of microscopic flaws in LTCC green sheets and sintered components, replacing manual inspection processes.

- Custom Formulation Matching: Developing AI tools that match a customer’s specific electrical performance criteria (e.g., desired dielectric constant, loss tangent) to the optimal existing or novel LTCC powder composition.

- Enhanced Thermal Management Design: Leveraging AI simulations to design LTCC structures with optimized thermal dissipation paths, which is crucial for high-power density RF modules used in 5G base stations.

DRO & Impact Forces Of LTCC Powder Market

The LTCC Powder Market growth is fundamentally driven by the escalating demand for compact, high-performance electronic modules necessitated by advancements in wireless communications (5G/6G) and the integration of sophisticated sensor technologies in transportation. However, this growth is significantly constrained by the high initial manufacturing costs and the inherent complexity associated with co-firing processes, demanding extremely tight material tolerances and precise temperature control. Opportunities for market expansion reside in the development of novel, low-cost, lead-free powder compositions and the increasing necessity for reliable electronic packaging in harsh environments, such as deep-sea exploration and high-altitude aerospace applications. The interplay of these factors—high-frequency technology adoption as a driver, process complexity as a restraint, and material innovation as an opportunity—dictates the market trajectory, compelling manufacturers to focus on cost reduction through automation and material science breakthroughs.

Drivers: The global rollout of 5G and subsequent development towards 6G requires highly integrated passive devices (IPDs) and efficient RF front-end modules, where LTCC's superior high-frequency characteristics (low dielectric loss) are critical. Furthermore, the rapid growth of the automotive radar market (24 GHz and 77 GHz) for ADAS and autonomous driving heavily relies on LTCC substrates for robust sensor performance. The continual push for miniaturization in consumer electronics, reducing system weight and size while increasing functionality, also propels LTCC adoption over traditional PCBs or HTCC (High-Temperature Co-fired Ceramics). The proven long-term reliability of LTCC under severe thermal and mechanical stress makes it irreplaceable in mission-critical applications.

Restraints: The primary constraint is the significantly high cost associated with LTCC manufacturing, stemming from the raw materials (often precious metals like Ag and Au for internal electrodes) and the stringent process control required during green tape fabrication and co-firing. The market also faces competition from alternative low-loss materials, such as specific organic substrates or sophisticated ceramic-filled polymers, which are often cheaper to process for certain applications. Technical barriers related to achieving perfect dimensional stability and flatness during sintering, especially for large area substrates, pose manufacturing yield challenges that limit wider adoption in high-volume, low-cost electronics.

Opportunities: Major opportunities lie in emerging applications such as high-density interconnection (HDI) solutions for semiconductor packaging and highly reliable power electronics modules in electric vehicles. The development of advanced, environmentally sustainable LTCC formulations, particularly those eliminating lead oxides while maintaining optimal sintering temperatures and dielectric properties, opens up new market segments. Furthermore, the integration of LTCC technology with other fabrication methods, like 3D printing of ceramic structures, offers potential pathways for creating highly complex, three-dimensional RF circuits, unlocking specialized niche markets.

Impact Forces: The market is heavily impacted by technological cycles in telecommunications (e.g., 5G upgrade cycles), which cause large, periodic surges in demand for specialized LTCC powders. Regulatory forces related to lead-free requirements (RoHS compliance) push the industry towards complex material reformulation. Competitive pressure from alternative packaging technologies (e.g., redistribution layer - RDL, or thin-film processing) forces LTCC providers to continually innovate on cost and performance. Lastly, macroeconomic volatility affects the price of key input materials (metals and oxides), influencing overall component pricing and market profitability.

Segmentation Analysis

The LTCC Powder Market is intricately segmented based on material composition, which determines the final electrical and thermal performance; dielectric constant, critical for different frequency applications; and the ultimate end-user application sector, reflecting divergent reliability and volume requirements. Understanding these segments is crucial as material manufacturers increasingly tailor their powder formulations to meet the stringent demands of high-growth areas like 5G infrastructure and advanced automotive electronics. The market structure emphasizes the specialized nature of LTCC production, where small variations in composition, particle size distribution, or binder systems can drastically alter the final substrate performance, necessitating high degrees of specialization across the supply chain.

Segmentation by composition focuses mainly on the type of glass utilized (borosilicate, zinc borosilicate, or other low-melting glasses) combined with ceramic fillers (e.g., Alumina, Forsterite, or specific dielectric oxides). Segmentation by dielectric constant (Dk) directly correlates with the operational frequency; low Dk materials are preferred for high-speed digital and RF applications above 30 GHz to minimize signal delay and cross-talk, while medium Dk materials serve general RF and integrated passive applications. The application segment drives volume and reliability specifications, with Telecom and Automotive being the fastest-growing and most technically demanding sectors.

- By Composition:

- Glass-Ceramic Composites (Dominant segment due to tunable properties)

- Ceramic-only LTCC Powders (Used when higher mechanical strength is required)

- Lead-containing LTCC Powders (Declining due to regulation)

- Lead-free LTCC Powders (Fastest growing segment)

- By Dielectric Constant (Dk):

- Low Dk (< 6)

- Medium Dk (6 - 10)

- High Dk (> 10)

- By Application:

- Telecommunications (5G filters, antennas, duplexers, RF modules)

- Automotive Electronics (ADAS radar sensors, power management, lighting modules)

- Aerospace and Defense (Satellite communications, radar systems, high-reliability modules)

- Consumer Electronics (Wearables, mobile devices, complex modules)

- Industrial and Medical Electronics (Sensors, high-reliability control systems)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For LTCC Powder Market

The LTCC Powder value chain begins with the sourcing and processing of high-purity raw materials, including specific metal oxides (like Alumina, Titania, Zinc Oxide) and glass precursors (silicates, borates). This upstream segment is characterized by specialized chemical companies that manage the purification and initial mixing necessary to create the base powder components. The middle segment involves the core LTCC powder manufacturers who blend, calcine, mill, and functionally grade these raw materials to produce tailored glass-ceramic composite powders. This stage requires significant intellectual property related to particle size distribution control, chemical homogeneity, and the introduction of proprietary sintering aids to achieve low-temperature co-firing capability and desired dielectric properties. Quality assurance at this stage is paramount, as inconsistencies propagate severe defects during the downstream sintering process.

The downstream segment includes LTCC substrate fabricators and module manufacturers. Fabricators utilize the powder to create green tapes via tape casting, screen print conductive pastes (Ag, Au) onto these layers, stack them, laminate them under pressure, and finally co-fire the stack in highly controlled furnaces. These finished substrates are then sold directly to Original Equipment Manufacturers (OEMs) or specialized Electronic Manufacturing Services (EMS) providers who integrate active components (ICs) onto the substrate, creating complex RF modules or sensor packages. The distribution channel is predominantly direct for high-volume, established relationships between powder suppliers and substrate manufacturers, but indirect channels through specialized chemical distributors exist for smaller fabricators or R&D institutions seeking specific custom formulations.

Direct distribution ensures stringent quality control and allows for immediate technical feedback regarding powder performance during the demanding co-firing stage, which is crucial in this high-reliability sector. Indirect channels offer geographical reach and specialized logistics for smaller quantities or specific regional markets where local presence is necessary. The complexity of the LTCC material dictates that technical support and collaboration remain a central element of the value chain, ensuring that the powder performance translates optimally into the final integrated electronic package, especially given the continuous performance demands driven by 5G and high-frequency radar technology adoption.

LTCC Powder Market Potential Customers

Potential customers for LTCC powder are predominantly large-scale manufacturers of advanced electronic components and integrated modules where high reliability, excellent thermal management, and superior high-frequency performance are non-negotiable prerequisites. The largest segment of buyers includes multinational corporations specializing in wireless infrastructure and mobile communications, such as those manufacturing base station components, advanced smartphone antennas, and complex filter arrays necessary for efficient spectrum utilization in 5G networks. These customers require massive volumes of standardized, high-quality powder that consistently delivers low dielectric loss and high Q-factors necessary for optimal RF signal integrity.

Another rapidly expanding customer base is found within the automotive sector, specifically manufacturers of ADAS systems, including Lidar and Radar modules (e.g., 77 GHz systems). These buyers demand LTCC materials that offer exceptional stability under extreme temperature fluctuations and mechanical vibration, ensuring the safety-critical functions of autonomous vehicles remain uncompromised throughout the vehicle's lifespan. Furthermore, defense and aerospace contractors represent a high-value customer segment, focusing on customized, often smaller-volume purchases of powders suitable for military radar, electronic warfare systems, and specialized satellite communication transceivers where performance in extreme environments and adherence to strict military specifications override cost considerations.

The continuous trend toward electronic system miniaturization also drives demand from contract manufacturers and fabless design houses that specialize in complex System-in-Package (SiP) solutions for consumer electronics and medical devices. These buyers utilize LTCC substrates to integrate multiple heterogeneous components into a single, compact package, leveraging the material's ability to incorporate buried passive components. The buying decision for all potential customers is heavily influenced by the powder supplier's technical support capabilities, the consistency of the material batch-to-batch, and adherence to crucial environmental standards, such as the avoidance of regulated heavy metals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450.5 Million |

| Market Forecast in 2033 | $815.2 Million |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dupont, TDK Corporation, Murata Manufacturing Co., Ltd., Heraeus Holding GmbH, Kyocera Corporation, Shoei Chemical Inc., Micro Systems Technologies, KOA Corporation, AGC Inc., Sumitomo Chemical Co., Ltd., Selmic, Viox Corporation, Elit Co. Ltd., CETC, Nippon Electric Glass Co., Ltd., AEM Inc., NeoCera Materials, CoorsTek, Inc., Advanced Glass Industries, Saint-Gobain Ceramic Materials. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LTCC Powder Market Key Technology Landscape

The technological landscape of the LTCC powder market is primarily defined by material science innovation focused on achieving superior electrical performance, reducing sintering temperatures, and ensuring environmental compliance. Core technology centers on the precise formulation of the glass-ceramic system. Modern advancements involve shifting from traditional lead-containing glasses to complex, multi-component, lead-free systems (often based on Barium, Boron, or Zinc oxides combined with silicates) that provide the necessary viscosity for sintering below 900°C while maintaining critical dielectric properties, such as low loss tangents (tan < 0.001 at high frequencies). The ability to consistently control the crystallization behavior of the glass phase during co-firing is a key technological differentiator, ensuring the formation of a stable, dense ceramic matrix with reproducible electrical characteristics, which is vital for high-volume manufacturing.

Another crucial technological development involves powder processing techniques, specifically the advanced milling and classification methods used to control the particle size distribution (PSD) and morphology of the constituent powders. Uniform PSD is essential for creating high-quality, defect-free green tapes during the tape casting process, minimizing porosity, and preventing warping or delamination during the co-firing stage. Manufacturers are increasingly utilizing sophisticated mixing technologies, including mechanical alloying and spray drying, to create highly homogeneous composite particles where the ceramic filler is uniformly encapsulated or distributed within the glass phase, resulting in improved dielectric uniformity across large substrates and stacked layers.

Furthermore, technology related to metallization and interfacing is critical. While the powder itself is dielectric, its functionality relies on successful co-firing compatibility with conductive pastes, typically made of silver (Ag) or occasionally gold (Au) for ultra-high reliability. Technological advancements are focused on developing new conductor paste formulations that have thermal shrinkage kinetics precisely matched to the LTCC powder system during sintering, minimizing internal stresses that could lead to cracking or poor adhesion. This technological synergy between material science (powder) and process engineering (metallization and firing profiles) defines the frontier of performance in high-density LTCC circuit integration, supporting the demands of millimeter-wave applications that require extremely tight layer-to-layer registration tolerances and high-quality buried passive components.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for the LTCC Powder Market, driven by its massive concentration of consumer electronics manufacturing, particularly in China, South Korea, and Taiwan. The region is characterized by aggressive deployment of 5G infrastructure, leading to soaring demand for high-performance RF modules, filters, and antenna components. Japan and South Korea remain key centers for material science innovation and high-reliability LTCC production, catering to both domestic and international markets, particularly in automotive and high-end industrial sectors. Government initiatives supporting semiconductor and electronic component localization in countries like China further solidify APAC's dominance and expected growth leadership.

- North America: This region maintains a strong presence, primarily focusing on high-value, specialized applications in the aerospace, defense, and telecommunications sectors. Demand is driven by stringent performance requirements for military radar systems, space-based communication payloads, and advanced 5G/6G R&D. The focus here is less on high volume and more on customized, ultra-reliable LTCC formulations with specific dielectric and thermal characteristics required for extreme operating conditions. Technical leadership in design and advanced electronic packaging continues to fuel steady demand for premium LTCC materials.

- Europe: Europe is a significant market, heavily influenced by its robust automotive industry, particularly in Germany, which drives demand for LTCC materials used in highly sophisticated ADAS, safety systems, and sensor modules (e.g., 24 GHz and 77 GHz radar). The region also maintains strong research activities in high-frequency communications and industrial controls, demanding materials that comply rigorously with environmental standards, accelerating the shift towards lead-free LTCC formulations. Regulatory pressure concerning materials mandates continuous innovation within the European supply chain.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets for LTCC applications. Growth is primarily tied to increasing investments in regional telecommunications infrastructure, especially the adoption of 4G/5G networks, and the gradual modernization of automotive fleets, which incorporates more electronic safety features. While manufacturing capabilities are limited compared to APAC, the regions serve as growing consumption hubs, increasing the indirect demand for LTCC components imported from dominant manufacturing centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LTCC Powder Market.- Dupont

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- Heraeus Holding GmbH

- Kyocera Corporation

- Shoei Chemical Inc.

- Micro Systems Technologies

- KOA Corporation

- AGC Inc.

- Sumitomo Chemical Co., Ltd.

- Selmic

- Viox Corporation

- Elit Co. Ltd.

- CETC (China Electronics Technology Group Corporation)

- Nippon Electric Glass Co., Ltd.

- AEM Inc.

- NeoCera Materials

- CoorsTek, Inc.

- Advanced Glass Industries

- Saint-Gobain Ceramic Materials

Frequently Asked Questions

Analyze common user questions about the LTCC Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of LTCC powder over traditional PCB materials?

LTCC powder enables the creation of multilayer ceramic substrates that offer significantly superior performance at high frequencies (millimeter-wave), lower dielectric loss, exceptional thermal stability, and the ability to embed passive components internally, leading to greater component integration and miniaturization compared to organic Printed Circuit Boards (PCBs).

How is the demand for LTCC powder influenced by the 5G rollout?

The 5G rollout is a major growth driver, necessitating high-performance filters, duplexers, and front-end modules that operate efficiently above 30 GHz. LTCC substrates are ideal for these applications due to their high Q-factors and low signal attenuation, crucial for maintaining signal integrity and power efficiency in 5G base stations and user equipment.

Which application segment drives the highest future growth rate for LTCC powder?

The Automotive Electronics segment, specifically driven by the rapid adoption of Advanced Driver-Assistance Systems (ADAS) utilizing 77 GHz radar modules and complex battery management systems in Electric Vehicles (EVs), is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to stringent reliability requirements.

What are the main challenges restraining the wider adoption of LTCC technology?

Key challenges include the high overall manufacturing cost compared to organic alternatives, primarily due to expensive raw materials (like precious metal conductors) and the technical complexity involved in achieving high yield during the co-firing process, which requires precise control over shrinkage and dimensional stability.

Are lead-free LTCC formulations dominating the market, and why?

Yes, lead-free LTCC formulations, typically based on complex barium or zinc glass-ceramic systems, are becoming dominant, particularly in Europe and APAC, driven by global environmental regulations such as the Restriction of Hazardous Substances (RoHS) directives and the increasing demand from major consumer electronics manufacturers for sustainable component solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager