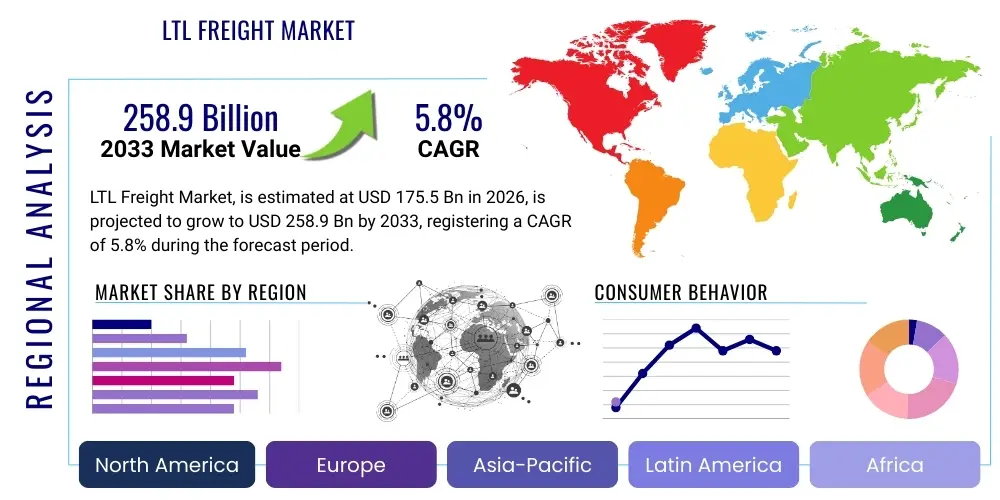

LTL Freight Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437026 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

LTL Freight Market Size

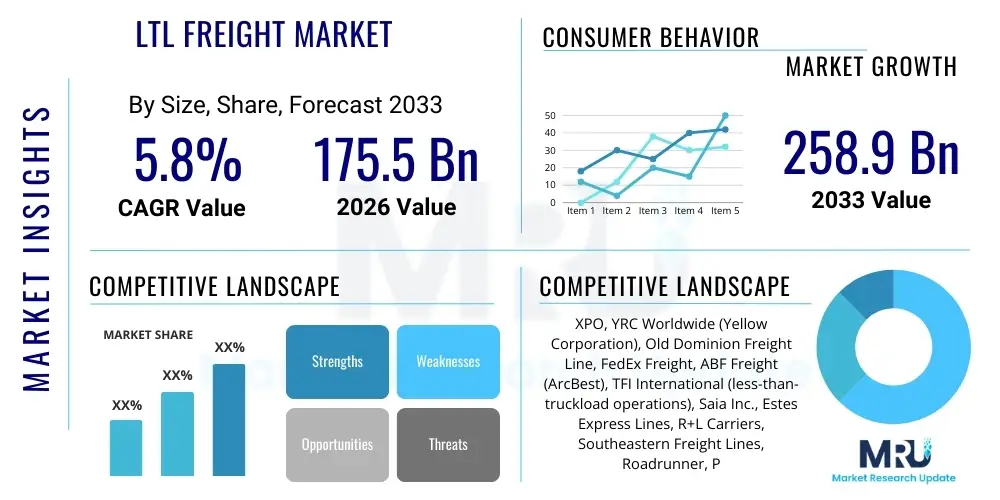

The LTL Freight Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $175.5 Billion in 2026 and is projected to reach $258.9 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the continuous fragmentation of supply chains globally and the escalating demand for expedited, partial-load shipments across various industrial sectors. The shift in consumer purchasing habits towards e-commerce, necessitating efficient movement of smaller, frequent consignments, directly contributes to the robust growth trajectory of the LTL segment. Furthermore, strategic capacity investments by major carriers, focusing on network optimization and technological integration, are positioning the market for sustained high-value growth.

LTL Freight Market introduction

The Less-Than-Truckload (LTL) Freight Market encompasses the transportation of relatively small freight shipments, typically weighing between 150 pounds and 15,000 pounds, requiring consolidation with other shipments for efficient movement. Unlike full truckload (FTL) services, LTL carriers utilize a hub-and-spoke network model, collecting freight from multiple shippers, consolidating it at regional terminals (hubs), transporting the consolidated loads over long distances, and then breaking down the loads at destination terminals for final delivery. This complex operational framework allows shippers to move smaller volumes of cargo cost-effectively, bridging the gap between parcel services and FTL transportation, making it critical for small to medium-sized businesses and distributors managing inventory volatility. The primary products moved within this market include manufactured goods, retail inventory replenishment, e-commerce fulfillment components, and industrial equipment parts, serving almost every sector of the modern economy.

Major applications of LTL services are prevalent in retail logistics, automotive parts distribution, manufacturing supply chains, and increasingly, specialized cold chain logistics and hazardous materials transport requiring precise handling. The core benefit of LTL lies in its ability to offer economies of scale, allowing shippers to pay only for the space occupied by their freight, thereby significantly reducing transportation costs compared to underutilized FTL capacity. This segment also provides higher service frequency and enhanced security through specialized handling and tracking at terminal checkpoints. The inherent flexibility and scalability of LTL networks are proving indispensable in today's unpredictable logistics environment, allowing businesses to maintain lean inventory strategies and respond quickly to demand fluctuations without substantial capital investment in private fleets.

Driving factors for the sustained market expansion include accelerated growth in cross-border e-commerce, which necessitates efficient consolidation of small international shipments; ongoing improvements in digital tracking and visibility tools that enhance shipper confidence; and structural pressures on FTL capacity, which often pushes marginal shipments into the LTL network. Furthermore, regulatory environments demanding greater safety and environmental compliance favor large, technologically advanced LTL carriers capable of investing in modern, eco-friendly fleets and sophisticated route optimization software. The increasing complexity of global supply chains and the pervasive need for precise, time-definite delivery schedules solidify the LTL market's pivotal role in global trade infrastructure.

LTL Freight Market Executive Summary

The LTL Freight Market is characterized by intense competition, ongoing technological disruption, and robust underlying demand driven by retail inventory adjustments and e-commerce penetration. Key business trends include aggressive investment in terminal expansion and automation to improve cross-dock efficiency and labor productivity. Carriers are prioritizing yield management through sophisticated pricing algorithms, moving away from simple weight-based tariffs towards density and dimensional measurement (dimming) to maximize trailer utilization and profitability. Furthermore, there is a pronounced industry consolidation trend, where larger carriers are acquiring regional players to expand their network density and service coverage, ensuring greater control over pricing and service reliability across broader geographic regions. This strategic focus on network fluidity and operational excellence is central to maintaining competitive advantage in a market increasingly sensitive to transit times and damages.

Regionally, North America remains the dominant market, particularly due to the extensive road infrastructure and the high volume of manufacturing and retail trade between the US, Canada, and Mexico. Asia Pacific, however, represents the fastest-growing region, fueled by rapid industrialization, massive investments in logistics infrastructure, and burgeoning intra-regional trade, especially within China and India. European LTL markets, constrained by diverse regulatory environments and cross-border complexity, are emphasizing intermodal solutions and standardized digital platforms to harmonize operations. Middle Eastern and African markets are slowly maturing, primarily driven by investments in port development and diversification away from reliance on commodity exports, leading to increased demand for domestic distribution networks and specialized LTL services.

Segmentation analysis highlights the dominance of the Non-hazardous Goods segment by cargo type, reflecting the substantial movement of general merchandise, machinery, and automotive components. However, the Specialized LTL segment, particularly refrigerated and temperature-controlled transport, is exhibiting higher growth due to stringent pharmaceutical and food safety regulations. By service type, the Standard LTL offering holds the largest market share, but expedited and guaranteed services are growing disproportionately, driven by e-commerce demands for shorter lead times. The Manufacturing sector remains the largest end-user, though the Retail & E-commerce segment shows the most aggressive growth rate, underscoring the shift in B2C logistics needs that rely heavily on frequent, smaller LTL movements for fulfillment centers and last-mile operations coordination.

AI Impact Analysis on LTL Freight Market

User questions regarding AI's influence in the LTL sector primarily focus on how autonomous operations will redefine labor needs, the reliability of AI-driven optimization tools, and the security implications of highly digitized networks. Users are intensely interested in AI's capacity to solve the chronic issues of empty miles, terminal congestion, and dynamic pricing accuracy. The consensus among market stakeholders is that AI will fundamentally transition LTL from a historically static operational model to a highly agile, predictive, and data-driven environment. Key themes include achieving instantaneous network recalibration based on real-time demand signals, minimizing freight damage through automated handling systems, and leveraging predictive maintenance on assets to maximize uptime. Overall, the expectation is that AI will dramatically enhance efficiency and yield, transforming the carrier selection and service delivery process.

- AI-Powered Dynamic Pricing: Utilization of machine learning algorithms to assess real-time capacity, demand, and competitive tariffs, enabling precise yield management and optimizing lane profitability instantaneously.

- Predictive Terminal Operations: AI models forecasting incoming freight volumes and optimal cross-docking labor allocation, reducing dwell times and improving terminal throughput efficiency by minimizing bottlenecks.

- Route and Load Optimization: Advanced algorithms determining the most efficient pickup/delivery routes and mathematically optimal consolidation strategies (cube utilization), reducing fuel consumption and operational costs.

- Autonomous Fleet Management: Implementation of AI for predictive maintenance, monitoring vehicle health parameters, scheduling repairs proactively, and potentially managing semi-autonomous vehicle platooning on major lanes.

- Enhanced Damage Reduction: Computer vision systems and AI analyzing packaging integrity and handling procedures during loading and unloading, identifying high-risk areas and reducing cargo claims rates.

- Demand Forecasting: Machine learning models using historical data, seasonal trends, and macroeconomic indicators to predict future LTL demand, enabling proactive capacity adjustments and resource planning.

DRO & Impact Forces Of LTL Freight Market

The LTL Freight Market is simultaneously propelled by powerful structural drivers and constrained by inherent operational challenges, while significant opportunities remain for those leveraging technological advancements. Key drivers include the accelerated shift to e-commerce fulfillment models requiring decentralized inventory management and frequent replenishment cycles, the necessity for cost efficiency driving shippers toward shared capacity models, and continuous globalization leading to complex intermodal requirements. These driving forces compel carriers to invest heavily in robust, scalable terminal networks and sophisticated IT infrastructure. However, the market faces acute restraints such as chronic driver shortages globally, exacerbated by stringent licensing and working hour regulations, substantial capital investment required for terminal construction and automation, and inherent complexity in managing network fluidity across varied geographical regulatory landscapes. Furthermore, the persistent threat of economic downturns impacting manufacturing output and inventory levels remains a significant short-term restraint.

Opportunities within the LTL sector are primarily centered around digitalization and vertical specialization. The implementation of IoT sensors, advanced telematics, and blockchain technology offers opportunities for unprecedented visibility, security, and supply chain transparency, attracting high-value shippers. Furthermore, specializing in niche segments such as temperature-controlled LTL (pharma, perishable goods) or white-glove delivery services allows carriers to command higher margins and differentiate their offerings. The movement toward sustainability presents another strategic opportunity, with carriers investing in electric vehicles (EVs) for final-mile LTL delivery and optimizing routes to reduce carbon footprints, appealing to environmentally conscious corporate clients. Successful carriers are those that skillfully navigate the capital intensity of infrastructure upgrades while exploiting digital tools to improve network predictability and service reliability.

The impact forces within the LTL market are shaped by the interplay of economic cycles, regulatory scrutiny, and technological innovation. Economic growth directly correlates with LTL volumes, acting as a primary external force. Internally, the critical impact force is the balance between capacity utilization (network density) and labor availability, which dictate operating ratios and profitability. The regulatory landscape, particularly regarding emissions standards and safety protocols, mandates continual operational adjustments, often requiring significant investment. Lastly, disruptive technology, notably AI in optimization and automation in handling, serves as a transformative force, rewarding early adopters with significant competitive advantages in speed, accuracy, and operational cost reduction, fundamentally reshaping the carrier competitive hierarchy and service standards.

Segmentation Analysis

The LTL Freight Market is meticulously segmented based on cargo type, service type, and end-user application, allowing for granular analysis of demand patterns and carrier specialization. The segmentation reflects the diverse needs of shippers, ranging from high-volume general merchandise to highly regulated specialized freight like pharmaceuticals or hazardous materials. Analyzing these segments provides critical insights into which operational capabilities—such as specialized equipment, cold chain management, or guaranteed delivery windows—are driving growth and commanding premium pricing across the value chain. The dominant segments often dictate the network design and investment priorities of major carriers, while high-growth niche segments signal potential areas for strategic market entry or targeted acquisitions, ensuring that market resources are allocated efficiently based on specific logistical requirements.

- By Cargo Type:

- Non-hazardous Goods (General Merchandise, Retail Inventory, Standard Industrials)

- Hazardous Materials (Chemicals, Flammable Liquids, Waste)

- Temperature-Controlled Goods (Food & Beverage, Pharmaceuticals, Biotechnology Products)

- Specialized Freight (High-Value Electronics, Oversized/Dimensional Freight)

- By Service Type:

- Standard LTL

- Guaranteed/Expedited LTL (Time-Critical Shipments)

- Cross-Border LTL

- Integrated LTL (Incorporating warehousing and fulfillment)

- Final Mile LTL (Residential and commercial B2B deliveries)

- By End User:

- Retail and E-commerce (Inventory replenishment, DC transfers)

- Manufacturing (Automotive, Heavy Machinery, Components)

- Automotive Industry (Parts distribution, Aftermarket sales)

- Food and Beverage

- Healthcare and Pharmaceuticals

- Chemical and Petrochemical

- Others (Construction, Energy, Government)

Value Chain Analysis For LTL Freight Market

The LTL freight value chain is complex and integrated, starting with upstream activities involving equipment manufacturers, technology providers, and labor supply, and extending downstream through consolidation, linehaul, and final delivery. Upstream suppliers are crucial, providing essential resources such as Class 8 trucks, specialized trailers (e.g., liftgate equipped), terminal handling equipment, and sophisticated WMS/TMS platforms. The efficiency of the entire network is heavily dependent on the quality and availability of labor, including drivers, dockworkers, and IT specialists. Strong relationships with reliable equipment suppliers ensure fleet modernity and regulatory compliance, while technology vendors drive competitive differentiation through optimization software and predictive analytics capabilities, significantly impacting operational expenses and service quality throughout the cycle.

The core intermediate phase involves freight collection, consolidation at originating terminals, long-haul movement (linehaul) to destination terminals, and final break-bulk and delivery. Direct channels in LTL involve shippers contracting directly with large national carriers who manage the entire process through their proprietary terminal network. This provides maximum control and consistent service levels but may not always be the most cost-effective option for sporadic volumes. Indirect channels involve using Third-Party Logistics Providers (3PLs) or freight brokers. 3PLs aggregate volume from multiple smaller shippers, providing leverage to secure favorable rates and capacity from carriers, and often manage ancillary services like documentation and customs clearance, offering greater flexibility and accessibility to a wider range of services for smaller enterprises.

Downstream activities focus on reaching the end-user, often involving specialized final-mile delivery requirements, proof of delivery (POD) validation, and returns management. The distribution channel dynamics are rapidly evolving, with indirect channels (3PLs and digital freight marketplaces) capturing increasing market share by offering advanced digital integration and instant quoting capabilities. These platforms simplify the complex LTL pricing structure for shippers, providing transparency and efficient procurement. The interplay between direct carrier sales and indirect brokerage remains a constant feature of the competitive landscape, with carriers balancing network yield maximization against the volume consistency provided by major 3PL partners. The ultimate value proposition resides in providing high reliability and transparency, irrespective of the channel utilized.

LTL Freight Market Potential Customers

Potential customers for LTL freight services span across virtually every industry that requires frequent, smaller shipments that do not justify dedicated truckload service. The primary buyers are companies engaged in Just-In-Time (JIT) manufacturing and retail inventory replenishment, where precise, smaller-volume shipments are crucial for maintaining lean operations and minimizing warehousing costs. This includes automotive manufacturers requiring daily deliveries of components, electronics producers relying on timely sub-assembly transport, and machinery companies shipping replacement parts. These customers prioritize network reliability, damage reduction protocols, and sophisticated tracking capabilities, often seeking carriers that can provide integrated supply chain solutions beyond basic transportation, such as warehousing and light assembly.

The retail and rapidly expanding e-commerce sector represents another major segment of potential customers. Retailers utilize LTL for transferring inventory between Distribution Centers (DCs) and for delivering goods to individual store locations for shelf replenishment. E-commerce businesses leverage LTL, particularly specialized residential LTL, for shipping large items like furniture, appliances, and fitness equipment that cannot be handled by parcel carriers. These customers place high value on guaranteed delivery windows, residential delivery expertise (including liftgate services and inside delivery), and streamlined digital communication tools. Their demand often peaks seasonally, requiring carriers with flexible capacity and strong labor resources to handle fluctuating volumes efficiently.

Furthermore, specialized industries such as pharmaceuticals, healthcare, and chemicals are significant, high-value customers. These sectors demand carriers capable of handling temperature-sensitive goods, hazardous materials, and complying with rigorous regulatory standards, often necessitating specialized equipment (reefers, ventilated trailers) and highly trained personnel. For these segments, compliance, security, and proven quality management systems are paramount, overriding simple price competition. The ideal LTL carrier for these potential customers offers not just transportation but a comprehensive, compliant logistics partnership that minimizes liability and ensures product integrity throughout the entire transit process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $175.5 Billion |

| Market Forecast in 2033 | $258.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | XPO, YRC Worldwide (Yellow Corporation), Old Dominion Freight Line, FedEx Freight, ABF Freight (ArcBest), TFI International (less-than-truckload operations), Saia Inc., Estes Express Lines, R+L Carriers, Southeastern Freight Lines, Roadrunner, Pitt Ohio, Averitt Express, Central Freight Lines, Dayton Freight Lines, AAA Cooper Transportation (Now part of Knight-Swift), UPS Freight (Now TFI International), Reddaway, New Penn, Holland. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LTL Freight Market Key Technology Landscape

The technological evolution of the LTL Freight Market is centered on optimizing the hub-and-spoke network, improving asset utilization, and enhancing customer visibility, driven by investments in sophisticated Transportation Management Systems (TMS) and real-time data collection tools. Key technologies include advanced Dimensioning and Weighing (D&W) systems, often utilizing laser or vision technology, deployed at terminals to accurately capture the dimensions, weight, and sometimes density of every shipment. This precision is vital for yield management, ensuring accurate billing, optimal trailer loading (cubing), and minimizing unexpected capacity constraints. Furthermore, the adoption of proprietary or third-party TMS platforms integrated with complex pricing engines allows carriers to dynamically quote rates, manage capacity across multiple lanes simultaneously, and automate the routing and dispatch process, moving away from manual, spreadsheet-based management systems.

Telematics and the Internet of Things (IoT) are pervasive across the fleet and terminal operations. IoT sensors are embedded in trailers and handling equipment to monitor location, temperature, shock, and unauthorized openings, providing granular data crucial for regulatory compliance and proactive maintenance. Fleet telematics provide real-time data on driver behavior (e.g., harsh braking, excessive idling), fuel consumption, and engine diagnostics, supporting both safety initiatives and operational efficiency improvements. This real-time data feed is instrumental in enabling predictive maintenance programs, significantly reducing unexpected roadside breakdowns and improving overall fleet reliability, a critical differentiator in service quality for LTL carriers.

Looking forward, the technology landscape is being reshaped by the implementation of Artificial Intelligence (AI) and Machine Learning (ML). These advanced computational tools are being applied to complex problems like network optimization, where hundreds of variables (terminal capacity, delivery time windows, labor availability, fuel prices) are dynamically modeled to determine the most profitable daily operational plan. Additionally, AI is powering sophisticated customer interaction tools, including intelligent chatbots for tracking queries and automated claims processing systems, substantially reducing administrative overhead. Blockchain technology is also being explored for secure, tamper-proof management of freight documentation, bills of lading, and payment processes, promising higher transparency and reduced opportunities for fraud in the complex LTL interchange environment.

Regional Highlights

- North America: North America, particularly the United States, holds the largest market share in the global LTL freight market, driven by a highly mature logistics infrastructure, extensive highway networks, and a massive consumer base driving retail and manufacturing activity. The market here is dominated by large, national carriers focused on density and high operating ratios. The regional strategy emphasizes technological superiority in yield management and cross-border capabilities, especially catering to trade flows between the US, Canada, and Mexico. The US LTL sector is characterized by intense price competition and continuous investment in terminal automation to combat rising labor costs.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to rapid urbanization, exponential growth in e-commerce (particularly China and India), and governmental initiatives investing heavily in modernizing transportation infrastructure. The LTL segment in APAC is more fragmented than in North America, often relying on complex regional partnerships. Growth is concentrated in improving last-mile density and developing integrated logistics parks that facilitate efficient consolidation and distribution, addressing the high volume of goods moving between manufacturing hubs and consumption centers.

- Europe: The European LTL market is highly complex, segmented by national borders, varying labor laws, and stringent environmental regulations. While cross-border LTL is challenging, the market is addressing these issues through standardized digital interfaces and increased reliance on intermodal transport (road and rail combinations). Sustainability is a key focus, pushing carriers toward lower-emission vehicles and optimized city logistics schemes. The primary market focus is harmonization of standards and efficient customs procedures within the European Union framework to enable smoother LTL flow.

- Latin America: This region presents significant opportunity, though hampered by infrastructure deficits, geopolitical instability, and regulatory inconsistency. LTL market growth is localized, focusing heavily on major economies like Brazil and Mexico. The demand is strong from the automotive and consumer goods sectors. Carriers often prioritize security and specialized handling due to risks associated with transport, emphasizing GPS tracking, convoy security, and high-value cargo protocols.

- Middle East and Africa (MEA): The MEA region is developing rapidly, particularly driven by large-scale infrastructure projects in the GCC countries and increasing consumer wealth. The LTL market is nascent but expanding, supported by investments in major port gateways (e.g., Jebel Ali) that serve as regional transshipment hubs. The focus is on building efficient domestic distribution networks and overcoming logistical challenges related to harsh climate and long transit distances, leveraging modern, digitally controlled fleets to ensure service integrity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LTL Freight Market.- XPO

- YRC Worldwide (Yellow Corporation)

- Old Dominion Freight Line

- FedEx Freight

- ABF Freight (ArcBest)

- TFI International (less-than-truckload operations)

- Saia Inc.

- Estes Express Lines

- R+L Carriers

- Southeastern Freight Lines

- Roadrunner

- Pitt Ohio

- Averitt Express

- Central Freight Lines

- Dayton Freight Lines

- AAA Cooper Transportation (Now part of Knight-Swift)

- Herman Express (TFI International)

- New Penn (TFI International)

- Holland (TFI International)

- CEVA Logistics (LTL services)

Frequently Asked Questions

Analyze common user questions about the LTL Freight market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between LTL and FTL freight services?

LTL (Less-Than-Truckload) involves consolidating multiple smaller shipments from various customers onto one truck, optimizing space and reducing costs for freight typically under 15,000 lbs. FTL (Full Truckload) dedicates the entire truck space to a single shipper, offering faster transit times and direct routes, typically used for larger, high-volume shipments.

How is LTL freight pricing determined, and what is the role of 'dimming'?

LTL pricing is complex, based primarily on freight class (density and handling difficulty), weight, distance (lane), and any accessorial services required (e.g., liftgate, guaranteed delivery). 'Dimming' (dimensional weighing) uses technology to accurately measure the shipment’s volume and weight, ensuring the carrier charges based on the actual cube and density used, thus maximizing trailer yield.

Which technological trends are currently most disruptive in the LTL market?

The most disruptive trends are the application of AI and Machine Learning for dynamic pricing and highly sophisticated network optimization, automating complex decision-making processes regarding terminal routing and capacity allocation, thereby improving operating efficiency and overall profitability.

Why is the North American region dominant in the LTL market size?

North America is dominant due to its vast, interconnected highway infrastructure, the maturity and scale of its logistics network, high levels of industrial and retail activity, and the presence of highly structured, consolidated national LTL carriers with large proprietary terminal networks.

What are the greatest operational challenges facing LTL carriers today?

The key operational challenges include the persistent shortage of qualified commercial drivers and skilled terminal labor, the significant capital investment required for terminal automation and expansion, and maintaining network fluidity and delivery integrity amid fluctuating e-commerce driven demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager